Professional Documents

Culture Documents

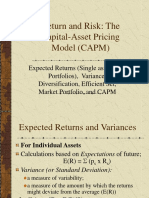

BF2 Lecture1 ORP

Uploaded by

Duc Tao ManhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BF2 Lecture1 ORP

Uploaded by

Duc Tao ManhCopyright:

Available Formats

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Lecture 1

Chapter 7. Optimal Risky Portfolios

Associate Professor Dr. Phan Dinh Khoi

Faculty of Finance and Banking

School of Economics

Can Tho University

Oct 16 2023

Phan Dinh Khoi Business Finance 2 - Lecture 1 1 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Outline

1 The investment Decision

2 Portfolio of Risky Assets

3 Asset Allocation

4 The Markowitz Portfolio Optimization

5 Summary

Phan Dinh Khoi Business Finance 2 - Lecture 1 2 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

A top-down process with 3 steps:

Step 1. Capital allocation between the risky portfolio and

the risk-free asset

Step 2. Asset allocation across broad asset classes

Step 3. Security selection of individual assets within each

asset class

Phan Dinh Khoi Business Finance 2 - Lecture 1 3 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

The Optimal Risky Portfolio is the portfolio on the efficient

frontier that offers the highest return per unit of risk

measured by the Sharpe ratio.

The Optimal Risky Portfolio can be obtained through the

diversification principle in which additional risky assets are

selectively added to the existing risky portfolio based on

Markowitz’s minimum-variance idea.

This is the third step of the investment decision.

The power of diversification shall be explained in this lecture

Phan Dinh Khoi Business Finance 2 - Lecture 1 4 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Diversification Principles

Suppose your portfolio currently consists of one stock VFS.

What would be the source of risk associated with this

investment?

How can you likely reduce the risk of your investment?

Phan Dinh Khoi Business Finance 2 - Lecture 1 5 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Diversification Principles

Consider a portfolio of n risky assets of which the portfolio risk is

expressed as a function of the number of risky assets in the

portfolio.

Figure: A: All risk is firm-specific Figure: B: Some risk is systematic

Phan Dinh Khoi Business Finance 2 - Lecture 1 6 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Market Risk and Firm-specific Risk

Firm-specific risk

- Risk that can be eliminated by diversification

- So-called: Non-systematic or diversifiable

- For example: EV industry, fuel cell technology, CEO leaders,

etc.

Market risk

- Market-wide risk sources

- Remains even after diversification

- So-called: Systematic or non-diversifiable

- For example: economic growth, inflation, interest rate, etc.

Phan Dinh Khoi Business Finance 2 - Lecture 1 7 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Portfolio risk and number of stocks

The average standard deviation of returns of portfolios

composed of only one stock was 49.2%. The average portfolio

risk fell rapidly as the number of stocks included in the

portfolio increased.

The portfolio risk could be reduced to only 19.2%

Figure: C: The power of diversification

Phan Dinh Khoi Business Finance 2 - Lecture 1 8 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Covariance and Correlation

Two important concepts underpin the diversification idea.

Portfolio risk depends on the correlation and covariance

between the returns of the assets in the portfolio.

Covariance and the correlation coefficients provide a

measure of the way the returns of two assets vary.

Phan Dinh Khoi Business Finance 2 - Lecture 1 9 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Portfolio of Risky Assets

Given a portfolio of two risky assets (P) that includes a corporate

bond (D) and a stock (E), an investor would like to know the

parameters of the portfolio as follows:

Expected return

Portfolio risk

Portfolio covariance

These parameters are the starting point of the efficient

diversification problem.

This is also called the two-security portfolio case of the portfolio

selection problem.

Phan Dinh Khoi Business Finance 2 - Lecture 1 10 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Two-security Portfolio: Return

Definition: Given a portfolio (P) that consists of a bond (D)

and an equity (E)

Notations:

rP : Portfolio return

wD : Bond weight

rD : Bond return

wE : Equity weight

rE : Equity return

E (rP ) = wD E (rD ) + wE E (rE ) (1)

Phan Dinh Khoi Business Finance 2 - Lecture 1 11 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Two-security Portfolio: Risk

Notations:

2 = Variance of Security D

σD

σE2 = Variance of Security E

σD = Standard deviation of Security D

σE = Standard deviation of Security E

Cov (rD , rE )= Covariance of returns of D and E

Cov (rD , rE ) = ρDE σD σE

σP2 = wD2 σD

2 + w 2 σ 2 + 2w w Cov (r , r )

E E D E D E (2)

Phan Dinh Khoi Business Finance 2 - Lecture 1 12 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Two-security Portfolio: Risk

Range of values for ρDE

−1.0 ≤ ρ ≤ +1.0

If ρ = +1.0 i.e., D and E are perfectly positively correlated

If ρ = 0.0 i.e., D and E are uncorrelated

If ρ = −1.0 i.e., D and E are perfectly negatively correlated

How does ρ affect the portfolio risk in Eq(2)?

σP2 = wD2 σD

2 + w 2 σ 2 + 2w w ρ

E E D E DE σD σE (3)

Phan Dinh Khoi Business Finance 2 - Lecture 1 13 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Two-security Portfolio: Risk

When ρDE = +1.0, there is no diversification

σP = wD σD + wE σE (4)

When ρDE = −1.0, a perfect hedge is possible

σP = wD σD − wE σE (5)

Hence, we have a special case to obtain weights that drive the

standard deviation σP of the portfolio to zero.

σD

wE =

σD + σE

wD = 1 − wE

Phan Dinh Khoi Business Finance 2 - Lecture 1 14 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Three-security Portfolio: Return & Risk

Definition: A portfolio (P) of three equities (E1 , E2 , E3 )

Notations:

rP : Portfolio return

w1 : Bond weight, and r1 : Bond return

w2 : Equity weight, and r2 : Equity return

w3 : Equity weight, and r3 : Equity return

Portfolio return

E (rP ) = w1 E (r1 ) + w2 E (r2 ) + w3 E (r3 ) (6)

Portfolio variance

σP2 =w12 σ12 + w22 σ22 + w32 σ32

(7)

+ 2w1 w2 σ1 ,2 +2w1 w3 σ1 ,3 +2w2 w3 σ2 ,3

Phan Dinh Khoi Business Finance 2 - Lecture 1 15 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

N-security Portfolio: Return & Risk

Portfolio return

n

X

E (rP ) = w1 E (r1 ) + w2 E (r2 ) + ... + wn E (rn ) = wi E (ri ) (8)

i=1

Portfolio variance

n X

X n

σP2 = wi wj Cov (ri , rj ) (9)

i=1 j=1

Phan Dinh Khoi Business Finance 2 - Lecture 1 16 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Portfolio weights, returns, and standard deviations

How do weights of risky assets affect the portfolio

expected returns?

Figure: 7.3 Expected return and standard deviation with various

correlation coefficients

Phan Dinh Khoi Business Finance 2 - Lecture 1 17 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Portfolio weights, returns, and standard deviations

How do weights of risky assets affect the portfolio

expected returns?

Figure: 7.3 Portfolio expected return as a function of investment

proportion

Phan Dinh Khoi Business Finance 2 - Lecture 1 18 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Portfolio weights, returns, and standard deviations

How do weights and correlation coefficients of risky

assets affect the portfolio standard deviations?

Figure: 7.4 Portfolio standard deviation as a function of investment

proportion

Phan Dinh Khoi Business Finance 2 - Lecture 1 19 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Portfolio weights, returns, and standard deviations

How do weights and correlation coefficients of risky

assets affect the portfolio standard deviations?

Figure: 7.5 Portfolio expected returns as a function of standard deviation

Phan Dinh Khoi Business Finance 2 - Lecture 1 20 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Asset Allocation with Stocks, Bonds, and Bills

Generally, investors want to invest in risky portfolios that offer the

highest reward-to-volatility. That means they seek the risky

portfolio that results in the greatest expected return corresponding

to any level of volatility. This is known as Sharpe ratio.

The Sharpe ratio is defined as the portfolio’s risk premium in

excess of the risk-free rate, divided by the standard deviation.

When choosing their capital allocation between risky and risk-free

assets, the steepest Sharpe ratio, which is the slope of the capital

allocation line (CAL).

E (rp )−rf

Sp = σp (10)

How do we find the highest possible Sharpe ratio or the

steepest CAL?

Phan Dinh Khoi Business Finance 2 - Lecture 1 21 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Asset Allocation with Stocks, Bonds, and Bills

To illustrate, we use the optimal risky portfolio given in Table 7.3

for the case of ρ = 0.3 and the risk-free rate T-bills yielding 5%.

Two possible capital allocation lines (CALs) are drawn starting

from the risk-free rate rf to two feasible portfolios.

Portfolio A: 82% in Bond and 18% in Equity, its expected

return is 8.9% and standard deviation is 11.45%.

Sharpe ratio at A:

SA = E (rσA A)−rf = 8.9−5

11.45 = 0.34

Portfolio B: 70% in Bond and 30% in Equity, its expected

return is 9.5% and standard deviation is 11.7%.

Sharpe ratio at B:

SB = E (rσB B)−rf = 9.5−5

11.7 = 0.38

Phan Dinh Khoi Business Finance 2 - Lecture 1 22 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Asset Allocation with Stocks, Bonds, and Bills

How do we find the highest possible Sharpe ratio or the

steepest CAL?

Figure: 7.6 The opportunity set of the debt and equity funds and two

feasible CALs

Phan Dinh Khoi Business Finance 2 - Lecture 1 23 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Asset Allocation with Stocks, Bonds, and Bills

Can we find a steeper CAL? The tangency portfolio, labeled P in

Figure 7.7, is the optimal risky portfolio to combine with T-bills.

Figure: 7.7 The opportunity set of the debt and equity funds and the

optimal CAL

Phan Dinh Khoi Business Finance 2 - Lecture 1 24 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Asset Allocation with Stocks, Bonds, and Bills

We want to maximize the slope SP that is subject to the

constraint WD + WE by solving the optimization problem:

E (rP ) − rf X

MaxSP = subject to wi = 1

σP

The solution for weights of the optimal portfolio P

E (RD )σE2 − E (RE )Cov (RD , RE )

wD =

E (RD )σE2 + E (RE )σD2 − [E (R ) + E (R )]Cov (R , R )

D E D E

and

wE = 1 − wD

Note that R is defined as excess returns, e.g. RE = rE − rf .

Phan Dinh Khoi Business Finance 2 - Lecture 1 25 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Asset Allocation with Stocks, Bonds, and Bills

Given the data in Table 7.1, we can calculate

The Optimal Portfolio’s weights

(8−5)400−(13−5)72

wD = (8−5)400+(13−5)144−(8−5)(1−5)72 = 0.4

wE = 1 − 0.4 = 0.6

Phan Dinh Khoi Business Finance 2 - Lecture 1 26 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Asset Allocation with Stocks, Bonds, and Bills

Portfolio P’s expected return

E (rp ) = (0.4 ∗ 8) + (0.6 ∗ 13) = 11%

Portfolio P’s standard deviation

σp = [(0.42 ∗ 144) + (0.62 ∗ 400) + (2 ∗ 0.4 ∗ 0.6 ∗ 72)]1/2

σp = 14.2%

Sharpe ratio at P:

E (rp )−rf 11−5

Sp = σp = 14.2 = 0.42

Phan Dinh Khoi Business Finance 2 - Lecture 1 27 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Asset Allocation with Stocks, Bonds, and Bills

Given a level of risk aversion e.g. A = 4, how do investors

allocate funds between the risky portfolio and risk-free asset?

E (rp ) − rf 0.11 − 0.05

y= 2

= = 0.7439

Aσp 4 ∗ 0.1422

Figure: 7.8 Determination of the optimal complete portfolio

Phan Dinh Khoi Business Finance 2 - Lecture 1 28 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Asset Allocation with Stocks, Bonds, and Bills

1-0.7439 - rf

The total fraction of wealth in T-Bills: 25.61%

The total fraction of wealth in Bonds:

y ∗ wD = 0.7439 ∗ 0.4 = 29.76%

The total fraction of wealth in Equities:

y ∗ wD = 0.7439 ∗ 0.6 = 44.63%

weight of risk asset and rf

Figure: 7.8 The proportion of the optimal complete portfolio

Phan Dinh Khoi Business Finance 2 - Lecture 1 29 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

The Markowitz Portfolio Optimization

In general, the portfolio construction problem for the case of many

risky assets and a risk-free asset can be established by the

following steps:

First, identify the risky-return combinations available from the

set of risky assets.

Next, identify the optimal portfolio of risky assets by obtaining

the portfolio weights that result in the steepest CAL.

Finally, determine an appropriate complete portfolio by mixing

the risk-free asset with the optimal risky portfolio.

In 1952, Harry Markowitz published a formal model of portfolio

selection that embodies principles of diversification to the

identification of an efficient set of portfolios, so-called the efficient

frontier of risky assets. Hence, the portfolio construction problem

is so-called the Markowitz portfolio optimization.

Phan Dinh Khoi Business Finance 2 - Lecture 1 30 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Security selection

The first step is to determine the risk-return opportunities

available.

Given the historical data for expected returns, variances, and

co-variances, the minimum-variance frontier is obtained for

any target expected return. This frontier is a line of the lowest

possible variance that can be attained for a given portfolio

expected return.

When short selling is not allowed, all the portfolios that lie on

the minimum-variance portfolio and upward provide the best

risk-return combination, and hence are candidates for the

optimal portfolio.

The part of the frontier that lies above the global

minimum-variance portfolio is called the efficient frontier of

risky assets.

Phan Dinh Khoi Business Finance 2 - Lecture 1 31 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Security selection

The concepts of:

Minimum-variance frontier

Global minimum-variance portfolio

Efficient portfolio

Figure: 7.10 The minimum-variance frontier of risky assets

Phan Dinh Khoi Business Finance 2 - Lecture 1 32 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Security selection

The second step is to identify the optimal portfolio of risky assets

with the highest Sharpe ratio (i.e, the steepest CAL)

Given a risk-free asset, the capital allocation line (CAL)

connects the risk-free asset to any optimal minimum-variance

portfolio on the efficient frontier.

Given P is the tangent point of the efficient frontier to the

CAL, this CAL(P) dominates all alternative feasible lines.

Therefore, portfolio P is the optimal risky portfolio.

Figure: 7.11 The efficient frontier of risky assets with the optimal CAL

Phan Dinh Khoi Business Finance 2 - Lecture 1 33 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Security selection

The final step is to choose an appropriate mix between the optimal

risky portfolio and T-Bills). Given a level of risk aversion, the

investor chooses the appropriate mix between the optimal

risky portfolio P and the risk-free asset T-bills.

E (rp )−rf

y= Aσp2

Figure: 7.12 Determination of the optimal complete portfolio

Phan Dinh Khoi Business Finance 2 - Lecture 1 34 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Capital allocation and the Separation property

Given the efficient frontier, if the risk-free asset is not included in

the investment decision then all investors will arrive at the same

optimal risky portfolio, regardless of their degree of risk aversion.

The investor’s risk aversion involves only capital allocation, and the

selection of the desired point along the CAL. As a result, the

difference between investors’ choices is that the higher risk-averse

client invests more in the risk-free asset and less in the optimal

risky portfolio than does a less risk-averse investor.

This result is called a separation property; it tells us that the

portfolio choice problem may be separated into two tasks:

The first task is to determine the optimal risky portfolio. It is

merely technical. Given the availability of all risky assets, the

best risky portfolio may be the same for all investors,

regardless of risk aversion.

The second task, capital allocation, depends on each

investor’s risk preference.

Phan Dinh Khoi Business Finance 2 - Lecture 1 35 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

The power of diversification

The general formula for the variance of a portfolio of n risky assets

is written as:

n X

X n

σP2 = wi wj Cov (ri , rj ) (11)

i=1 j=1

Given an equally weighted portfolio, we have wi = 1/n and

Cov (ri , ri ) = σi2 , then Eq.(12) is rewriten as:

n n n

1X 2 X X 1

σP2 = σi + Cov (ri , rj ) (12)

n n2

i=1 j=1,j̸=i i=1

Note that there are n variance terms and n(n-1) covariance terms

in Eq.(13).

Phan Dinh Khoi Business Finance 2 - Lecture 1 36 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

The power of diversification

Define the average variance and average covariance as:

n

1X 2

σ 2P = σi (13)

n

i=1

n n

1 X X

Cov = Cov (ri , rj ) (14)

n(n − 1)

j=1,j̸=i i=1

Then the portfolio variance is written as:

1 2 n−1

σP2 = σ + Cov (15)

n n

Now we examine the effect of diversification

If Cov is zero, σP2 can be driven to zero.

However, if market risk factors impart a positive correlation

among risky asset returns then all firm-specific risk can be

diversified, and the Cov remains positive.

Phan Dinh Khoi Business Finance 2 - Lecture 1 37 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

The power of diversification

The same intuition is applied when we replace the average

covariance Cov by a common correlation coefficient ρ. The

portfolio variance is written as:

1 2 n−1 2

σP2 = σ + ρσ (16)

n n

The effect of correlation becomes clear.

ρ = 0, diversifiable against firm-specific risk.

ρ > 0, portfolio variance remain positive.

ρ = 1, non-diversifiable any firm-specific risk.

Phan Dinh Khoi Business Finance 2 - Lecture 1 38 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

The power of diversification

Table 7.13 presents portfolio standard deviation as we include more

numbers of securities in the portfolios for two cases, ρ = 0 and

ρ = 0.4.

We can see that the correlation among securities defines the power

of diversification.

Figure: 7.13 Risk reduction of equally weighted portfolios in correlated

and uncorrelated assets

Phan Dinh Khoi Business Finance 2 - Lecture 1 39 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Risk pooling and Risk sharing

Diversification entails spreading the investment budget across

a variety of assets in order to limit overall risk.

The idea is also associated with risk pooling and risk sharing

terminologies.

Risk pooling means spreading your exposure risks across

multiple uncorrelated risky ventures, known as the insurance

principle.

Risk sharing allows other investors to share the risk of a

portfolio of assets, known as the risk sharing strategy.

Phan Dinh Khoi Business Finance 2 - Lecture 1 40 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Risk pooling and Risk sharing

By adding an uncorrelated to the initial portfolio, there are

changes:

the expected risk premium is doubled

the variance is doubled

√

the standard deviation is increased by 2

√

the Sharpe ratio is increased by 2

Phan Dinh Khoi Business Finance 2 - Lecture 1 41 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Take home remarks

The expected return of a portfolio is the weighted average of

the component security expected returns with the investment

proportion as weights

The variance of a portfolio is the weighted sum of the

elements of the covariance matrix with the product of the

investment proportion as weights.

Even if the covariances are positive, the portfolio standard

deviation is less than the weighted average of the component

standard deviations, as long as the assets are not perfectly

positively correlated. Hence, portfolio diversification is of

value as long as assets are less likely perfectly correlated.

An asset that is perfectly negatively correlated with a portfolio

can serve as a perfect hedge. That perfect hedge asset can

reduce the portfolio variance to zero through diversification.

Phan Dinh Khoi Business Finance 2 - Lecture 1 42 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Take home remarks

The efficient frontier is the graphical representation of a set of

portfolios that maximize expected return for each level of

portfolio risk. Rational investors tend to select a portfolio on

the efficient frontier.

If a risk-free asset is and a universal list of assets is available,

all investors will arrive at the same portfolio on the efficient

frontier of risky assets: the portfolio tangent to the CAL.

Differences among investors’ decisions lie in how much fund

each allocates to the optimal portfolio and to the risk-free

asset.

Diversification is based on the allocation of a portfolio of fixed

size across several assets, limiting the exposure to any one

source of risk.

Phan Dinh Khoi Business Finance 2 - Lecture 1 43 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

Final Remarks on Optimal portfolios and Non-normal returns

Non-normal returns indicate that distributions are no longer

solely described by the first two moments’ mean and variance.

Investors are more concerned with ”flat tails”, i.e. the

probability of very large losses.

Modern risk measures such as Value at Risk (VaR) or

Conditional Value at Risk (CVaR) and Expected Shortfall

(ES) should account for flat tails.

If other portfolios provide sufficiently better VaR, CVaR and

ES values than the mean-variance efficient portfolio, one may

prefer these when faced with flat-tailed distributions of assets.

Phan Dinh Khoi Business Finance 2 - Lecture 1 44 / 45

The investment Decision Portfolio of Risky Assets Asset Allocation The Markowitz Portfolio Optimization Summary

QUESTIONS AND ANSWERS

Phan Dinh Khoi Business Finance 2 - Lecture 1 45 / 45

You might also like

- VtDA - The Ashen Cults (Vampire Dark Ages) PDFDocument94 pagesVtDA - The Ashen Cults (Vampire Dark Ages) PDFRafãoAraujo100% (1)

- Goats & Sheep: What You Need To KnowDocument74 pagesGoats & Sheep: What You Need To KnowAdrian BAGAYANNo ratings yet

- CH 8Document56 pagesCH 8Sufyan KhanNo ratings yet

- Contents Serbo-Croatian GrammarDocument2 pagesContents Serbo-Croatian GrammarLeo VasilaNo ratings yet

- Chap 3-Corporate FinanceDocument34 pagesChap 3-Corporate FinanceNguyệt Anh NguyễnNo ratings yet

- A Passage To AfricaDocument25 pagesA Passage To AfricaJames Reinz100% (2)

- OglalaDocument6 pagesOglalaNandu RaviNo ratings yet

- CFEA3230 Portfolio Theory Lecture 3Document71 pagesCFEA3230 Portfolio Theory Lecture 3CEA130089 StudentNo ratings yet

- ACCA Advanced Corporate Reporting 2005Document763 pagesACCA Advanced Corporate Reporting 2005Platonic100% (2)

- Markowitz ModelDocument63 pagesMarkowitz ModeldrramaiyaNo ratings yet

- Portfolio TheoryDocument78 pagesPortfolio TheoryAmit PrakashNo ratings yet

- Risk Budgeting: Portfolio Problem Solving with Value-at-RiskFrom EverandRisk Budgeting: Portfolio Problem Solving with Value-at-RiskNo ratings yet

- Unit VII - Portfolio TheoryDocument25 pagesUnit VII - Portfolio TheoryPankul VermaNo ratings yet

- Basic Translation TerminologyDocument7 pagesBasic Translation TerminologyHeidy BarrientosNo ratings yet

- Accounting 110: Acc110Document19 pagesAccounting 110: Acc110ahoffm05100% (1)

- Unit 5 Portfolio Management I. Portfolio Construction:: ApproachDocument18 pagesUnit 5 Portfolio Management I. Portfolio Construction:: ApproachJ. KNo ratings yet

- LECTURE 5b - Advances On Portfolio ManagementDocument36 pagesLECTURE 5b - Advances On Portfolio ManagementKim Hương Hoàng ThịNo ratings yet

- Lecture # 6: Optimal Risky PortfolioDocument36 pagesLecture # 6: Optimal Risky PortfolioNguyễn VânNo ratings yet

- FIN330 Chapter 17Document21 pagesFIN330 Chapter 17NITHYA S MNo ratings yet

- Chapter Six InvestmentDocument34 pagesChapter Six InvestmentJEMAL SEIDNo ratings yet

- Optimal Risky Portfolio (Bodie) PDFDocument20 pagesOptimal Risky Portfolio (Bodie) PDFjoel_kifNo ratings yet

- ECO562-Financial Economics Semester: Spring 2017: Dr. Zulfiqar HyderDocument36 pagesECO562-Financial Economics Semester: Spring 2017: Dr. Zulfiqar HyderHurain ShaikhNo ratings yet

- ch08 Portfolio SelectionDocument24 pagesch08 Portfolio SelectionRamadhani AwwaliaNo ratings yet

- Finanacial ManDocument37 pagesFinanacial ManJayhan PalmonesNo ratings yet

- Lecture 1: Asset Allocation: InvestmentsDocument62 pagesLecture 1: Asset Allocation: Investmentsaranguiz2012No ratings yet

- Sandeep Devabhaktuni: Statement of ParticipationDocument2 pagesSandeep Devabhaktuni: Statement of Participationsandeep devabhaktuniNo ratings yet

- Quantitative Methods: "Crafting Your Cfa Triumph With Effective Summaries."Document10 pagesQuantitative Methods: "Crafting Your Cfa Triumph With Effective Summaries."Huỳnh HuỳnhNo ratings yet

- Invt FM 1 Chapter-3Document56 pagesInvt FM 1 Chapter-3Khalid Muhammad100% (1)

- Portfolio Risk & ReturnDocument50 pagesPortfolio Risk & ReturnSiddhant AggarwalNo ratings yet

- SAPM - Optimal Risky Portfolio - DistributionDocument24 pagesSAPM - Optimal Risky Portfolio - DistributionShubham AgrawalNo ratings yet

- Portfolio Theories-Markowitz Optimization Model and The Sharpe Index ModelDocument18 pagesPortfolio Theories-Markowitz Optimization Model and The Sharpe Index ModelkenarnyNo ratings yet

- Assignment: Submitted To: Mr. Morshed MokhdumDocument6 pagesAssignment: Submitted To: Mr. Morshed MokhdumASHIFA ASHRAFINo ratings yet

- Chapter 17Document21 pagesChapter 17pvaibhyNo ratings yet

- Financial Economics Bocconi Lecture5Document20 pagesFinancial Economics Bocconi Lecture5Elisa CarnevaleNo ratings yet

- 7 2Document37 pages7 2Rahul KadamNo ratings yet

- Portfolio Managemet InternalDocument6 pagesPortfolio Managemet Internalasutoshpradhan36No ratings yet

- Bhavya Mishra: Statement of ParticipationDocument2 pagesBhavya Mishra: Statement of Participationbhavya mishraNo ratings yet

- Chapter 7 Slides FIN 435Document18 pagesChapter 7 Slides FIN 435Wasim HassanNo ratings yet

- And Changes Them According The Risk-Return Profited of The AssetsDocument7 pagesAnd Changes Them According The Risk-Return Profited of The Assetssd5239No ratings yet

- CH 7 Optimal Risky PortfoliosDocument32 pagesCH 7 Optimal Risky PortfoliosShantanu ChoudhuryNo ratings yet

- Chapter 8 PDFDocument211 pagesChapter 8 PDFsalsabila nsNo ratings yet

- FINS5513 Lecture T02B (Pre Lecture)Document24 pagesFINS5513 Lecture T02B (Pre Lecture)adri kusnoNo ratings yet

- Topic 2: Portfolio Theory, Selection & InvestingDocument16 pagesTopic 2: Portfolio Theory, Selection & Investing潘超No ratings yet

- Chapter 08Document23 pagesChapter 08cutemayurNo ratings yet

- 16 International Portfolio Investment: Chapter ObjectivesDocument14 pages16 International Portfolio Investment: Chapter ObjectivesJayant312002 ChhabraNo ratings yet

- The Markowitz ModelDocument4 pagesThe Markowitz ModelSarnalika DasNo ratings yet

- FM 304Document5 pagesFM 304Neil GamerNo ratings yet

- Lecture5 2017-18 UploadDocument48 pagesLecture5 2017-18 Uploadrenwei.visionNo ratings yet

- Fundamentals of Investment: Discipline Specific Elective (DSE-3) Discipline Specific Elective (DSE-4)Document127 pagesFundamentals of Investment: Discipline Specific Elective (DSE-3) Discipline Specific Elective (DSE-4)FROSTOPNo ratings yet

- Separation TheoremDocument21 pagesSeparation TheoremIrfan chohanNo ratings yet

- In Other Words, Given The Choice Between Two Equally Risky Investments, An Investor WillDocument6 pagesIn Other Words, Given The Choice Between Two Equally Risky Investments, An Investor WillOumer ShaffiNo ratings yet

- In Other Words, Given The Choice Between Two Equally Risky Investments, An Investor WillDocument6 pagesIn Other Words, Given The Choice Between Two Equally Risky Investments, An Investor WillOumer ShaffiNo ratings yet

- Risk Measures in Quantitative Finance: by Sovan MitraDocument13 pagesRisk Measures in Quantitative Finance: by Sovan MitraVova KulykNo ratings yet

- 10 Risk and Return - Student VersionDocument59 pages10 Risk and Return - Student VersionKalyani GogoiNo ratings yet

- Portfolio Strategy: Security Analysis & Portfolio ManagementDocument7 pagesPortfolio Strategy: Security Analysis & Portfolio ManagementvaibhavNo ratings yet

- Lecture 5 Credit Risk II Foreign Exchange RiskDocument67 pagesLecture 5 Credit Risk II Foreign Exchange RiskKelvin ChenNo ratings yet

- #01 Session1Document36 pages#01 Session1YisraelaNo ratings yet

- MCQ Iapm Double Final 1Document8 pagesMCQ Iapm Double Final 1moamen BNo ratings yet

- Bonds Equity - Financial Modeling #13Document30 pagesBonds Equity - Financial Modeling #13Yash ShahareNo ratings yet

- OptimalRiskyPortfolios (Chapter7)Document35 pagesOptimalRiskyPortfolios (Chapter7)Joaquin DiazNo ratings yet

- Modern Portfolio TheoryDocument17 pagesModern Portfolio Theorymahbobullah rahmaniNo ratings yet

- Module 3-FM2Document18 pagesModule 3-FM2BeomiNo ratings yet

- 64 - Lec 15Document2 pages64 - Lec 15Waqas Ahmad KhanNo ratings yet

- 0522 Financial Investment UNIT 5Document123 pages0522 Financial Investment UNIT 5fadiismaNo ratings yet

- Chapter 6Document10 pagesChapter 6Seid KassawNo ratings yet

- CoFin - Lecture 6Document62 pagesCoFin - Lecture 6Elliot IseliNo ratings yet

- Daud Kamal and Taufiq Rafaqat PoemsDocument9 pagesDaud Kamal and Taufiq Rafaqat PoemsFatima Ismaeel33% (3)

- Rem - Manila Bankers Vs NG Kok Wei - Noel DomingoDocument3 pagesRem - Manila Bankers Vs NG Kok Wei - Noel DomingoNoel DomingoNo ratings yet

- Barangay Sindalan v. CA G.R. No. 150640, March 22, 2007Document17 pagesBarangay Sindalan v. CA G.R. No. 150640, March 22, 2007FD BalitaNo ratings yet

- Database Management Systems Lab ManualDocument40 pagesDatabase Management Systems Lab ManualBanumathi JayarajNo ratings yet

- Espinosa - 2016 - Martín Ramírez at The Menil CollectionDocument3 pagesEspinosa - 2016 - Martín Ramírez at The Menil CollectionVíctor M. EspinosaNo ratings yet

- Romanian Oil IndustryDocument7 pagesRomanian Oil IndustryEnot SoulaviereNo ratings yet

- Maths Lowersixth ExamsDocument2 pagesMaths Lowersixth ExamsAlphonsius WongNo ratings yet

- Essay EnglishDocument4 pagesEssay Englishkiera.kassellNo ratings yet

- RubricsDocument1 pageRubricsBeaMaeAntoniNo ratings yet

- Syllabus/Course Specifics - Fall 2009: TLT 480: Curricular Design and InnovationDocument12 pagesSyllabus/Course Specifics - Fall 2009: TLT 480: Curricular Design and InnovationJonel BarrugaNo ratings yet

- List of Saturday Opened Branches and Sub BranchesDocument12 pagesList of Saturday Opened Branches and Sub BranchesSarmad SonyalNo ratings yet

- Thermal Systems: Introduction To Heat TransferDocument33 pagesThermal Systems: Introduction To Heat TransferParas SharmaNo ratings yet

- Feline Neonatal IsoerythrolysisDocument18 pagesFeline Neonatal IsoerythrolysisPaunas JoshiNo ratings yet

- Lite Touch. Completo PDFDocument206 pagesLite Touch. Completo PDFkerlystefaniaNo ratings yet

- Approved Chemical ListDocument2 pagesApproved Chemical ListSyed Mansur Alyahya100% (1)

- 2023-Tutorial 02Document6 pages2023-Tutorial 02chyhyhyNo ratings yet

- AdverbsDocument10 pagesAdverbsKarina Ponce RiosNo ratings yet

- Alexander Blok - 'The King in The Square', Slavonic and East European Review, 12 (36), 1934Document25 pagesAlexander Blok - 'The King in The Square', Slavonic and East European Review, 12 (36), 1934scott brodieNo ratings yet

- Goal Ball Lesson PlanDocument4 pagesGoal Ball Lesson Planapi-378557749100% (1)

- 1973 PorbaixM LEC PDFDocument351 pages1973 PorbaixM LEC PDFDana Oboroceanu100% (1)

- Biology - Solved ExamDocument27 pagesBiology - Solved ExamlyliasahiliNo ratings yet

- CRM - Final Project GuidelinesDocument7 pagesCRM - Final Project Guidelinesapi-283320904No ratings yet