Professional Documents

Culture Documents

Exercise 05 (Individual Graded)

Uploaded by

nininini2923Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise 05 (Individual Graded)

Uploaded by

nininini2923Copyright:

Available Formats

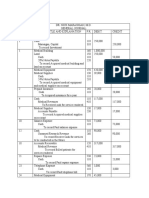

Comprehensive Problem

Dr. Nick Marasigan, upon completing a residency program at Harvard Medical Center, established a

medical practice in San Pablo, Laguna. During October 2023, the first month of operations, the

following transactions occurred:

Oct. 1 Dr. Marasigan transferred P250,000 from his personal checking account to a

bank Account, Dr. Nick Marasigan, M.D.

1 A medical clinic, P1,000,000 and land, P250,000 were acquired by paying P50,000

in cash and issuing a 5-year, 20% note payable (interest is payable every 6

months) for the P1,200,000 balance.

1 Acquired medical equipment costing P420,000 and medical supplies amounting

to P39,000 by paying P59,000 cash and issuing a 24% note payable, maturing in 6

months,for the 400,000 balance.

2 Acquired “all-in-one” insurance for a year, P20,000.

4 Received cash from patients amounting to P117,000.

7 Bought medical supplies on account from San Pablo Supply, P17,000.

10 Paid Salaries of nurses and office staff, P73,000.

12 Received P90,000 from the Laguna Experimental Drug Center for research to be

Conducted by Dr. Marasigan over the next 3 months.

18 Billed patients P317,000 for services rendered.

21 Paid P23,000 for repairs to the medical equipment.

23 Paid the telephone bill, P3,000.

24 Bought medical equipment on account from Dr. De Leon, P45,000.

25 Collected P113,000 from patients billed on the 18th.

27 Paid P13,000 on account to San Pablo Supply.

30 Withdrew P200,000 in cash from the medical practice.

30 Paid P15,000 dues to the Laguna Medical Association.

Required:

1. Establish the following accounts and account numbers in a ledger.

Account No. Account No.

Cash 110 Marasigan, Capital 310

Accounts Receivable 120 Marasigan, Withdrawals 320

Medical Supplies 130 Income Summary 330

Prepaid Insurance 140 Medical Revenues 410

Land 150 Research Revenues 420

Medical Building 160 Salaries Expense 510

Accumulated Depreciation- Insurance Expense 520

Medical Building 165 Repairs Expense 530

Medical Equipment 170 Supplies Expense 540

Accumulated Depreciation- Association Dues Expense 550

Medical Equipment 175 Telephone Expense 560

24% Notes Payable 210 Depreciation Expense-Bldg. 570

20% Notes Payable 220 Depreciation Expense-Equipt. 580

Accounts Payable 230 Interest Expense 590

Salaries Payable 240

Interest Payable 250

Unearned Research Revenues 260

2. Record the transactions for the month of October in a journal (page 1) and post the entries to

the ledger. Use balance sheet accounts to record those transactions that will later require

adjustments.

EXERCISES BEGIN HERE (NOVEMBER 17, 2023)

We have already discussed the correct accounting journal entries last meeting. Now, you have to

prepare the first 6-columns of the worksheet using the attached excel file by following the below

requirements:

3. Prepare the unadjusted trial balance in the worksheet (first 2-columns in the excel file).

4. Record the following adjustments on the worksheet (second 2-columns in the excel file.

a. Insurance for one month has expired.

b. Medical supplies on hand at month-end amounted to P21,000.

c. Depreciation on the medical building and on the medical equipment is P5,000 and P9,000,

respectively.

d. Unearned research revenues in the amount of P30,000 have been earned.

e. Salaries of P51,000 have accrued.

f. Interest on the 20% and 24% notes are P20,000 and P8,000, respectively.

5. Prepare the adjusted trial balance (third 2-columns in the excel file).

end

You might also like

- Case QuestionsDocument5 pagesCase Questionsaditi_sharma_65No ratings yet

- Assets Liabilities + Equity + Income - Expenses: Oct. TransactionsDocument4 pagesAssets Liabilities + Equity + Income - Expenses: Oct. Transactionsalford sery Cammayo0% (1)

- Basic Accounting Quiz Part 2Document3 pagesBasic Accounting Quiz Part 2accounting probNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Family Medical Clinic: Chapter 4: Problem 7Document17 pagesFamily Medical Clinic: Chapter 4: Problem 7MilrosePaulinePascuaGuda0% (1)

- Dr. Nick Marasigan, M.D.Document13 pagesDr. Nick Marasigan, M.D.Darlene Perez91% (11)

- ACTG123 (DR Nickmarasigan)Document24 pagesACTG123 (DR Nickmarasigan)Regine BungcalonNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Marasigan TransactionDocument20 pagesMarasigan TransactionE.D.J100% (2)

- Prepare Journal Entries 2Document1 pagePrepare Journal Entries 2Rie CabigonNo ratings yet

- CHAPTER 11 Inventory ModelDocument24 pagesCHAPTER 11 Inventory ModelmulunehNo ratings yet

- Compehensive Problem 8Document19 pagesCompehensive Problem 8Trisha Gaile R. RañosaNo ratings yet

- Quiz 1Document8 pagesQuiz 1Lyca Mae Cubangbang67% (3)

- Prepare Journal Entries, Ledger and Trial Balance For The Following TransactionsDocument1 pagePrepare Journal Entries, Ledger and Trial Balance For The Following TransactionsRie Cabigon0% (1)

- Quiz 1A - Cash and Cash Equivalents, Bank ReconciliationDocument9 pagesQuiz 1A - Cash and Cash Equivalents, Bank ReconciliationLorence Ibañez100% (1)

- Consumer Behaviour AssignmentDocument53 pagesConsumer Behaviour AssignmentKumar Sambhav Singh77% (13)

- Marasigan WorksheetDocument15 pagesMarasigan WorksheetLyca MaeNo ratings yet

- Dr. Nick Marasigan AccountsDocument11 pagesDr. Nick Marasigan AccountsNicole SarmientoNo ratings yet

- ASSIGNMENT 4 Analyses of TransactionsDocument11 pagesASSIGNMENT 4 Analyses of Transactionsaaf100% (2)

- Ebook PDF Corporate Finance A Focused Approach 6th Edition PDFDocument29 pagesEbook PDF Corporate Finance A Focused Approach 6th Edition PDFjennifer.browne345100% (41)

- Journalizing (Doctora) Dr. MarasiganDocument10 pagesJournalizing (Doctora) Dr. Marasigankianna doctoraNo ratings yet

- Quiz NPO Multiple ChoiceDocument4 pagesQuiz NPO Multiple ChoiceLJ Aggabao0% (1)

- Big Ptask - Accounting CycleDocument2 pagesBig Ptask - Accounting CycleAkane HitomiNo ratings yet

- Activity 03 - Recording Business Transactions SADFDFDocument2 pagesActivity 03 - Recording Business Transactions SADFDFAeron RungduenNo ratings yet

- Comprehensive Word Problem 1Document2 pagesComprehensive Word Problem 1AprilNo ratings yet

- PT 4th Quarter Student Copy 2022 2023Document1 pagePT 4th Quarter Student Copy 2022 2023Primi LyNo ratings yet

- Accounting CycleDocument2 pagesAccounting Cyclewonderer mystery60% (5)

- Comprehensive Assessment 1 and 2Document3 pagesComprehensive Assessment 1 and 2Kurt NicolasNo ratings yet

- Review TestDocument1 pageReview TestKristine Joy Mendoza InciongNo ratings yet

- Problem 8 ACCA101Document28 pagesProblem 8 ACCA101Nicole FidelsonNo ratings yet

- 7.1 Completing The Cycle SampleDocument4 pages7.1 Completing The Cycle SampleKena Montes Dela PeñaNo ratings yet

- Final 2nd MeetingDocument1 pageFinal 2nd MeetingChristopher CristobalNo ratings yet

- AIS Activity No. 2 Journalizing Using Peachtree and Generation FSDocument2 pagesAIS Activity No. 2 Journalizing Using Peachtree and Generation FSShaira UntalanNo ratings yet

- AIS Journal Entries and Adjusting EntriesDocument2 pagesAIS Journal Entries and Adjusting EntriesIeva Francheska Agustin83% (6)

- FINAL - Accounting - 2016Document1 pageFINAL - Accounting - 2016Jason Yara0% (1)

- Antonio WorksheetDocument7 pagesAntonio WorksheetAntonNo ratings yet

- Additional InformationDocument2 pagesAdditional InformationKailaNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting EntriesAdrianIlaganNo ratings yet

- Week 1 AccountingDocument5 pagesWeek 1 AccountingWawie Cañete50% (2)

- SkillsDocument1 pageSkillsMrsjiNo ratings yet

- Finals 01Document2 pagesFinals 01scarlettNo ratings yet

- Assignment PR 8Document22 pagesAssignment PR 8Margarette Novem T. PaulinNo ratings yet

- Fabm 2 Quiz 1Document2 pagesFabm 2 Quiz 1Jenny HermosadoNo ratings yet

- Activity Sheet 7.problem Set Service Concern-SheldonDocument10 pagesActivity Sheet 7.problem Set Service Concern-SheldonAngela BantayNo ratings yet

- Accounting For Special TransactionsDocument9 pagesAccounting For Special TransactionsHelix HederaNo ratings yet

- Problem Solving No. 3: 75% Passing GradeDocument1 pageProblem Solving No. 3: 75% Passing GradeLizanne GauranaNo ratings yet

- Practice Exercise - Adjusting Entries WorksheetDocument9 pagesPractice Exercise - Adjusting Entries WorksheetRhea Rocha AlfonsoNo ratings yet

- YAWAKADocument24 pagesYAWAKADaniel Gabriel PunoNo ratings yet

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- Answer Keyto CQDocument7 pagesAnswer Keyto CQVivian MonteclaroNo ratings yet

- Illustrative Examples Accounting For Health Care Providers-HospitalsDocument2 pagesIllustrative Examples Accounting For Health Care Providers-HospitalsLa MarieNo ratings yet

- Dr. Marasigan Medical PracticeDocument21 pagesDr. Marasigan Medical PracticeJean FlordelizNo ratings yet

- As 1 Cash and Cash EquivalentsDocument2 pagesAs 1 Cash and Cash EquivalentsRodlyn LajonNo ratings yet

- Week 5 - ACCY111 NotesDocument5 pagesWeek 5 - ACCY111 NotesDarcieNo ratings yet

- Charts of Accounts-The Following Chart of Accounts Should Be Used: 100Document2 pagesCharts of Accounts-The Following Chart of Accounts Should Be Used: 100Jerlmilline JoseNo ratings yet

- DRILLSDocument1 pageDRILLSCristel TomasNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting EntriesCyreniel ClarosNo ratings yet

- BK02CS#2 Portfolio Online Bookkeeping - Mellinia Joyce N. DayegoDocument41 pagesBK02CS#2 Portfolio Online Bookkeeping - Mellinia Joyce N. DayegoMillenia Joyce DayegoNo ratings yet

- Module 4 Post TaskDocument1 pageModule 4 Post TaskSHANE MIJARESNo ratings yet

- Accounting 1 ValeDocument13 pagesAccounting 1 ValeAhmadnur JulNo ratings yet

- AssignmentDocument2 pagesAssignmentjaalataadha46No ratings yet

- Activity 2 ScienceDocument1 pageActivity 2 Sciencemike g.quimnoNo ratings yet

- Practical Accouniting ProblemsDocument3 pagesPractical Accouniting ProblemsMichelle ValeNo ratings yet

- Category Management - A Pervasive, New Vertical/ Horizontal FormatDocument5 pagesCategory Management - A Pervasive, New Vertical/ Horizontal FormatbooklandNo ratings yet

- F2 Past Paper - Question06-2004Document14 pagesF2 Past Paper - Question06-2004ArsalanACCANo ratings yet

- Jacqueline M. GarretaDocument2 pagesJacqueline M. GarretaJacky Garreta ChauvetNo ratings yet

- NIIM BrochureDocument5 pagesNIIM BrochureVikas YNo ratings yet

- Construction Cost ExerciseDocument5 pagesConstruction Cost ExerciseNishant WasadNo ratings yet

- Module 4 - Distribution ManagementDocument30 pagesModule 4 - Distribution ManagementHiroshi OmuraNo ratings yet

- Tax Audit PresentationDocument14 pagesTax Audit PresentationUsama FakharNo ratings yet

- Epcom04 PDFDocument77 pagesEpcom04 PDFCuya JhoannaNo ratings yet

- Accounting Manager or Financial Reporting or Financial ReportingDocument4 pagesAccounting Manager or Financial Reporting or Financial Reportingapi-121650574No ratings yet

- Materials Planning and ForecastingDocument3 pagesMaterials Planning and ForecastingBongYiiNo ratings yet

- Test Bank For MP Service Management 8th EditionDocument10 pagesTest Bank For MP Service Management 8th EditionGlen Wood100% (37)

- CFAP 6 - Audit Procedures (Fin. Reporting) PDFDocument50 pagesCFAP 6 - Audit Procedures (Fin. Reporting) PDFAli HaiderNo ratings yet

- Price DiscriminationDocument3 pagesPrice DiscriminationAng Mei GuiNo ratings yet

- F&B - Retail ManagementDocument50 pagesF&B - Retail ManagementNguyen Thanh SonNo ratings yet

- Title of The Paper: Sales and Distribution ManagementDocument3 pagesTitle of The Paper: Sales and Distribution ManagementAmith MashimadeNo ratings yet

- Updates (Company Update)Document2 pagesUpdates (Company Update)Shyam SunderNo ratings yet

- Accounting Equation & Accounting ClassificationDocument17 pagesAccounting Equation & Accounting ClassificationMuhammad AdibNo ratings yet

- Economics Study Guide Chapter Summary Varian For Midterm 2Document6 pagesEconomics Study Guide Chapter Summary Varian For Midterm 2Josh SatreNo ratings yet

- Marketing Assignment 1 OnDocument3 pagesMarketing Assignment 1 OnSaifi MalikNo ratings yet

- Human Resource Management Gaining A Competitive Advantage 10th Edition Noe Hollenbeck Gerhart Wright ISBN Solution ManualDocument7 pagesHuman Resource Management Gaining A Competitive Advantage 10th Edition Noe Hollenbeck Gerhart Wright ISBN Solution Manualpatricia100% (26)

- Executive SummaryDocument2 pagesExecutive SummaryAmrita PrasadNo ratings yet

- Business Process Re-EngineeringDocument2 pagesBusiness Process Re-EngineeringDonabelle MarimonNo ratings yet

- Delta Signal Corporation: BSC StrategyDocument19 pagesDelta Signal Corporation: BSC StrategySandip ChhettriNo ratings yet

- The Law of Variable ProportionsDocument27 pagesThe Law of Variable ProportionsManraj SinghNo ratings yet

- Basic Accounting Terms l1 Accountancy Class 11 Cbse by Ushank SirDocument11 pagesBasic Accounting Terms l1 Accountancy Class 11 Cbse by Ushank Sirrajput442007No ratings yet

- Supply Chain Management: Supply Chain Performance: Achieving Strategic Fit and ScopeDocument27 pagesSupply Chain Management: Supply Chain Performance: Achieving Strategic Fit and ScopeAsadNo ratings yet