Professional Documents

Culture Documents

Staples - Et - Al-2014-Marketing - Horizons - A - 1980's - Perspective, - Proceedings - of - The - 1980 - Academy - Of...

Staples - Et - Al-2014-Marketing - Horizons - A - 1980's - Perspective, - Proceedings - of - The - 1980 - Academy - Of...

Uploaded by

Alvito FahreziOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Staples - Et - Al-2014-Marketing - Horizons - A - 1980's - Perspective, - Proceedings - of - The - 1980 - Academy - Of...

Staples - Et - Al-2014-Marketing - Horizons - A - 1980's - Perspective, - Proceedings - of - The - 1980 - Academy - Of...

Uploaded by

Alvito FahreziCopyright:

Available Formats

EVALUATION OF POINT-OF-SALE SERVICES:

PROBLEMS AND PROSPECTS FOR RETAILING

William A. "Stapl.es, Univers-ity' of Houston at Clear Lake City

Robert A. Swerdlow, Lamar University

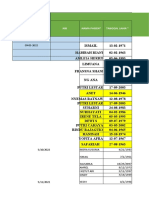

Abstract TABLE 1

Retailer Evaluation Fram-ework

A recent development called electronic funds transfer for Point-of-Sale Banking

(EFT) may move the-· banking community a step closer to

a checkless society. EFT refers to a technological Range of Services Available

and organizational network that enables transactions check· authorization/guarantee

to be initiate& and executed with electronic impulses check cashing

and machine comprehensible data. ·With these charact- direct debit transactions

eristics, EFT is seen as an alternative to the current cash withdrawal· from checking or saving accounts

paper based methods of cash and check payments. The- overdraft privileges

purpose of this paper is to analyze the possible adop- account balance verification

tion of point-of-sale (POS) terminals by retailers. Implementation Cost Considerations

hardware costs

software costs

Retailer Evaluation of degree of cost sharing

Point-of-Sale Services personnel required

break~even point in transactions

Any proposed evaluation system should include a con- break-even point in time required

sideration of available services and their accompany- consumer education costs

ing costs and benefits. Table I presents a retail promotional costs

evaluation framework for point-of-sale banking. An Potential Benefits

initial area for review is the range of POS services reductions of bad debts expense

available. Key factors to consider are the capabil- access to larger consumer base

:tties of each proposed POS system. While a number of increased in-store customer traffic

options are usually available, the retailer should · security of the system

carefully consider the complete.ness of the services reliability of the system

offered. Specifically, services for the retailer to improved management reporting capability

consider include check authorization and guarantee faster checkout of customers

plus direct debit transactions. These two services Other Considerations

are the most common in POS banking. Other service legal environment in state of operation

opt:!,ons include check cashing, cash wi.thdrawal, over- degree of competitor adoption of POS

draft privileges, and account balance verification. availability of POS services from financial firms

proposed hours of operation of the system

Besides the range of available services, retailers ease-of customer use

must pay particular attention to the. costs result-ing projected rates of consumer usage

from implementation of any POS system. The principal

costs are with the computer-related hardware, software

requirements, and costs of shared services. In this Conclusion

regard, the retailer needs to analyze alternative sys-

tems and their possible hookup to existing retail store A retailer is continuously confronted with a changing

equ:!,pment. Due to the high implementation costs, every business environment. Retail institut1ons must be

retailer should determine the degree of cost sharing ever aware of service innovations that will enable

proposed by each financial institution. The afterna:.. them to further satisfy the consumer. The challenge

tives range from total financial institution backing of maintaining or increasing ~~rket ·share is never

to little or none. Other cost factors to consider cen- ending. Similar to the introduction of other products

ter on the increased number of personnel required and and services in retail outlets, the eventual success

the further training for existing personnel. or failure of point-of-sale banking will depend on the

extent of consumer acceptance.

Retailers will also want to estimate the potential ben-

efits of POS services. The most publicized benefit has

been the reductions in bad debts expenses. Along with

this significant factor, retailers also want to deter-

mine if access to a greater number of consumers will

be provided. This is crucial since a single financial

institution may severely limit consumer access as com-

pared to a cooperative arrangement between a number of

financial institutions. Store operation benefits that

may accrue to the retailer include increased in-store

customer traffic, security and reliability of the funds

transfer system, and an improved management information

reporting capability. This last benefit with respect

to management information is of paramount imp0rtance

due to the increasing size of retail operations. Ad-

vanced POS terminals can aid the retailer in monitor-

ing inventory, automating the sales audit, and speed-

ing up the checkout process.

You might also like

- Mutual Fund Insight Jul 2023Document104 pagesMutual Fund Insight Jul 2023Ram Yadav100% (1)

- Payment System HubsDocument27 pagesPayment System HubsgautamojhaNo ratings yet

- Themes - Overview - iOS Human Interface GuidelinesDocument3 pagesThemes - Overview - iOS Human Interface Guidelineskhaled alahmadNo ratings yet

- Revenue AssuranceDocument15 pagesRevenue AssuranceAbhishek ShrivastavaNo ratings yet

- The Real-Time Contact Center: Strategies, Tactics, and Technologies for Building a Profitable Service and Sales OperationFrom EverandThe Real-Time Contact Center: Strategies, Tactics, and Technologies for Building a Profitable Service and Sales OperationNo ratings yet

- Exponentials of Operators - Baker-Campbell-Hausdorff Formula - Physics PagesDocument5 pagesExponentials of Operators - Baker-Campbell-Hausdorff Formula - Physics PagesJuan Camilo Rodríguez PérezNo ratings yet

- AML System Design and Implementation: Aligning Regulatory, Business, and Technological RequirementsDocument16 pagesAML System Design and Implementation: Aligning Regulatory, Business, and Technological RequirementsrajsalgyanNo ratings yet

- Managing Financial Crime Risk in Digital Payments 2022Document5 pagesManaging Financial Crime Risk in Digital Payments 2022Amit RajoriaNo ratings yet

- SM MCQDocument5 pagesSM MCQhello1267No ratings yet

- The National Teachers CollegeDocument7 pagesThe National Teachers CollegeShane BenitezNo ratings yet

- Growing Need For Modest STP in Trade Finance OperationsDocument25 pagesGrowing Need For Modest STP in Trade Finance OperationsGIRINo ratings yet

- Advanced E-Commerce l2Document5 pagesAdvanced E-Commerce l2Emmanuel onwong'aNo ratings yet

- Managing ServiceDocument6 pagesManaging ServiceKarthik MkpNo ratings yet

- Convergent Pre-Paid/ Post-Paid Solutions: WhitepaperDocument9 pagesConvergent Pre-Paid/ Post-Paid Solutions: WhitepaperpoyguyNo ratings yet

- IDRBT Banking Technology Excellence AwardsDocument5 pagesIDRBT Banking Technology Excellence AwardskshitijsaxenaNo ratings yet

- FFIEC ITBooklet RetailPaymentSystemsDocument123 pagesFFIEC ITBooklet RetailPaymentSystemsahong100100% (1)

- Management Science: Measuring The Effect of Queues On Customer PurchasesDocument21 pagesManagement Science: Measuring The Effect of Queues On Customer PurchasesKedong Ken ChenNo ratings yet

- Aml Monitoring System RisksDocument16 pagesAml Monitoring System RisksrajsalgyanNo ratings yet

- Business Dimensions: "What Business Dimensions Suites Better Our Electronic Market?"Document6 pagesBusiness Dimensions: "What Business Dimensions Suites Better Our Electronic Market?"Syed AhmadNo ratings yet

- Branch Transformation:: Getting It RightDocument16 pagesBranch Transformation:: Getting It RightAlex JollyNo ratings yet

- Vendor Managed InventoryDocument3 pagesVendor Managed InventoryHarshal BadheNo ratings yet

- STP STRDocument4 pagesSTP STRapi-313045815No ratings yet

- Way To Manage KYCDocument11 pagesWay To Manage KYCVipul JainNo ratings yet

- GSMA Mobile Money Operational Assessment Version 1.2Document26 pagesGSMA Mobile Money Operational Assessment Version 1.2wahidNo ratings yet

- Assignment 3 Supply ChainDocument2 pagesAssignment 3 Supply ChainTAYYABA AMJAD L1F16MBAM0221No ratings yet

- Payments Hub Redefining Payments InfrastructureDocument10 pagesPayments Hub Redefining Payments InfrastructureRishi SrivastavaNo ratings yet

- Churn ManagementDocument15 pagesChurn ManagementNeelanjan Biswas100% (1)

- Parra-Moyano and Ross - KYC Optimization Using Distributed Ledger TechnologyDocument14 pagesParra-Moyano and Ross - KYC Optimization Using Distributed Ledger TechnologykarthickNo ratings yet

- FPC Cross Border White Paper - 06-2021 - FINALDocument28 pagesFPC Cross Border White Paper - 06-2021 - FINALforcetenNo ratings yet

- Literature Review of PaymentDocument8 pagesLiterature Review of Paymentc5p7mv6j100% (1)

- Modern Treasury - Setting Up Your Payment Operations ArchitectureDocument15 pagesModern Treasury - Setting Up Your Payment Operations Architecturefelipeap92No ratings yet

- SBR Managing Privacy Risk Financial ServicesDocument10 pagesSBR Managing Privacy Risk Financial Servicesprakash113779No ratings yet

- Unit 2Document17 pagesUnit 2Maze RunnerNo ratings yet

- WG Payments ReportDocument9 pagesWG Payments ReportAbhiNo ratings yet

- Heavy Reading On Cem With Telecom Italia Case StudyDocument14 pagesHeavy Reading On Cem With Telecom Italia Case Studyrafiq5002No ratings yet

- DTaa SDocument7 pagesDTaa SArun ShekarNo ratings yet

- Pov Aml Transaction Monitoring Customer Segmentation ProtivitiDocument4 pagesPov Aml Transaction Monitoring Customer Segmentation Protivitisimha1177No ratings yet

- Mpel 04 Service EncounterDocument9 pagesMpel 04 Service EncounterHaris KaryadiNo ratings yet

- Saurabh Singh Syssoc Task 1Document4 pagesSaurabh Singh Syssoc Task 1saheb167No ratings yet

- Serving Depositors: Optimising Branch Based BankingDocument21 pagesServing Depositors: Optimising Branch Based BankingkallasanjayNo ratings yet

- BuyersGuide For Fraud Detection in Banking - Guide - For - FR - 756888 - NDXDocument17 pagesBuyersGuide For Fraud Detection in Banking - Guide - For - FR - 756888 - NDXKEEPGEEKNo ratings yet

- Opentext Celent c2b Integration Hybrid Approach ReportDocument28 pagesOpentext Celent c2b Integration Hybrid Approach ReportArpit AgarwalNo ratings yet

- Banks Customer StrategyDocument6 pagesBanks Customer StrategyXenia AndriutaNo ratings yet

- 10.2478 Amns.2022.1.00016Document11 pages10.2478 Amns.2022.1.00016Diana VargheseNo ratings yet

- Accenture Banking ATM Benchmarking 2016Document28 pagesAccenture Banking ATM Benchmarking 2016Marius AngaraNo ratings yet

- Chapter II SampleDocument14 pagesChapter II SampleHoney Sepala JaposNo ratings yet

- Literature Review On Payment SystemDocument5 pagesLiterature Review On Payment Systemfihum1hadej2100% (1)

- Building Business Case For Procure To Pay WP v2 PDFDocument9 pagesBuilding Business Case For Procure To Pay WP v2 PDFsushilk28No ratings yet

- Rais12 SM Ch13Document34 pagesRais12 SM Ch13Ariful Haidar MunnaNo ratings yet

- Literature Review For Supermarket Billing SystemDocument4 pagesLiterature Review For Supermarket Billing Systemaflsnoxor100% (1)

- Recent Developments in The Field of SCMDocument20 pagesRecent Developments in The Field of SCMAysha JalalNo ratings yet

- Mobile Payment Adoption in Korea: Switching From Credit CardDocument22 pagesMobile Payment Adoption in Korea: Switching From Credit CardZenia Shahnaz AnindiatiNo ratings yet

- Swift Payments Whitepaper GuidelinesforthenextgenerationDocument8 pagesSwift Payments Whitepaper Guidelinesforthenextgenerationj-oneillNo ratings yet

- CCCCCCCCCCCCCC: A X in Reality Customer Demand Is Very Rarely Perfectly StableDocument6 pagesCCCCCCCCCCCCCC: A X in Reality Customer Demand Is Very Rarely Perfectly Stablepha_scribdNo ratings yet

- Romney AIS15 SM ch15Document34 pagesRomney AIS15 SM ch15Jonathan SinagaNo ratings yet

- IT in Retail POSDocument20 pagesIT in Retail POSmonicca869581No ratings yet

- Payments For EDocument3 pagesPayments For ELi NaNo ratings yet

- Business ProcessDocument8 pagesBusiness ProcessDebabrat MishraNo ratings yet

- Assignment Operation Management: Submitted By: Siddharth Kr. PathakDocument3 pagesAssignment Operation Management: Submitted By: Siddharth Kr. PathakSiddharth PathakNo ratings yet

- A - REPORT - ON Roles and Responsibility - SUPPLY - CHAIN - MANAGEMENTDocument66 pagesA - REPORT - ON Roles and Responsibility - SUPPLY - CHAIN - MANAGEMENTHEENA GARGNo ratings yet

- Quality Experience Telemetry: How to Effectively Use Telemetry for Improved Customer SuccessFrom EverandQuality Experience Telemetry: How to Effectively Use Telemetry for Improved Customer SuccessNo ratings yet

- Telecom Management for Call Centers: A Practical GuideFrom EverandTelecom Management for Call Centers: A Practical GuideNo ratings yet

- A Short History of Muslim Personal Law in IndiaDocument4 pagesA Short History of Muslim Personal Law in IndiaMASALAMNo ratings yet

- Top-Down Design: Garmin GPS SoftwareDocument25 pagesTop-Down Design: Garmin GPS SoftwareAnthony ScottNo ratings yet

- PTM Mei 2022Document38 pagesPTM Mei 2022lisaNo ratings yet

- Practice Exercises CAEDocument2 pagesPractice Exercises CAENiya PreldjichNo ratings yet

- Capital BudgetingDocument33 pagesCapital BudgetingmoosanipppNo ratings yet

- Indian Maritime University (Imu) : AY 2022-23 Onwards Affiliation Process HandbookDocument202 pagesIndian Maritime University (Imu) : AY 2022-23 Onwards Affiliation Process Handbookazaraero87No ratings yet

- Philippine History During Spanish TimeDocument2 pagesPhilippine History During Spanish Timethegreatman95% (22)

- Revenue Cycle Pimentel-JohnKennethDocument28 pagesRevenue Cycle Pimentel-JohnKennethKenneth PimentelNo ratings yet

- John Stuart MillDocument144 pagesJohn Stuart MillHarold Delos ReyesNo ratings yet

- Avinash Singh: Most Proud of ExperienceDocument2 pagesAvinash Singh: Most Proud of ExperienceAvinash SinghNo ratings yet

- Policy Brief Food Advertising To ChildrenDocument4 pagesPolicy Brief Food Advertising To Childrenapi-267120287No ratings yet

- Bulldog Camera InstructionsDocument16 pagesBulldog Camera Instructionsonur77No ratings yet

- Gas Turbine: Advanced Technology For Decentralized PowerDocument2 pagesGas Turbine: Advanced Technology For Decentralized PowerMarutisinh RajNo ratings yet

- Hasbro ANNUAL REPORT & ACCOUNTS 2019Document192 pagesHasbro ANNUAL REPORT & ACCOUNTS 2019Kumar PranayNo ratings yet

- Balanced Scorecard (BSC)Document11 pagesBalanced Scorecard (BSC)Sendhil KumarNo ratings yet

- Rdsopeskac0206-2019 Sheet 1 To 48 25-04-2019Document48 pagesRdsopeskac0206-2019 Sheet 1 To 48 25-04-2019Arshad AlamNo ratings yet

- Properties of Pure SubstanceDocument26 pagesProperties of Pure SubstanceMahadi HasanNo ratings yet

- Sample StoryDocument2 pagesSample StoryLara Mae Gonzales100% (1)

- Notes On Molecular Orbital CalculationDocument170 pagesNotes On Molecular Orbital CalculationFreeWill100% (1)

- Price Elasticity of DemandDocument5 pagesPrice Elasticity of DemandManoj KNo ratings yet

- Linked ListDocument6 pagesLinked Listdarshancool25No ratings yet

- Catalogo Olson InstrumentsDocument44 pagesCatalogo Olson InstrumentsJuanNo ratings yet

- Terberg Operation Manual: Open Navigation MenuDocument273 pagesTerberg Operation Manual: Open Navigation MenuaustinNo ratings yet

- FerrazDocument168 pagesFerrazCharlie MelloneNo ratings yet

- Appendix: 1. Limp 8. Prolonged Sitting With The Knees FlexedDocument1 pageAppendix: 1. Limp 8. Prolonged Sitting With The Knees Flexedkrissh20No ratings yet

- An Action Research ProposalDocument21 pagesAn Action Research ProposalRICHEL MANGMANGNo ratings yet

- Q2 2nd SUMMATIVE TEST IN SCIENCEDocument3 pagesQ2 2nd SUMMATIVE TEST IN SCIENCEAssyla Segarra OfallaNo ratings yet