Professional Documents

Culture Documents

CH 13-Pages-2

Uploaded by

rehan0 ratings0% found this document useful (0 votes)

6 views1 pageThis document outlines various stock transactions and dividend payments made by a corporation throughout the year. It records the corporation issuing new stock shares and selling treasury stock, as well as paying cash and stock dividends on its common stock. The transactions affect the corporation's accounts for cash, common stock, paid-in capital, treasury stock, dividends payable, retained earnings, and income summary.

Original Description:

2

Original Title

ch 13-pages-2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines various stock transactions and dividend payments made by a corporation throughout the year. It records the corporation issuing new stock shares and selling treasury stock, as well as paying cash and stock dividends on its common stock. The transactions affect the corporation's accounts for cash, common stock, paid-in capital, treasury stock, dividends payable, retained earnings, and income summary.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageCH 13-Pages-2

Uploaded by

rehanThis document outlines various stock transactions and dividend payments made by a corporation throughout the year. It records the corporation issuing new stock shares and selling treasury stock, as well as paying cash and stock dividends on its common stock. The transactions affect the corporation's accounts for cash, common stock, paid-in capital, treasury stock, dividends payable, retained earnings, and income summary.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

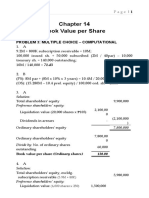

CHAPTER 13 Corporations: Organization, Stock Transactions, and Dividends

Prob. 13–4A (Continued)

2.

Jan. 22 Cash Dividends Payable 28,000

[(375,000 shares – 25,000 shares) × $0.08]

Cash 28,000

Apr. 10 Cash 1,800,000

Common Stock (75,000 shares × $20) 1,500,000

Paid-In Capital in Excess of Stated Value— 300,000

Common Stock [75,000 shares × ($24 – $20)]

June 6 Cash (25,000 shares × $26) 650,000

Treasury Stock (25,000 shares × $18) 450,000

Paid-In Capital from Sale of Treasury Stock 200,000

[25,000 shares × ($26 – $18)]

July 5 Stock Dividends [(375,000 shares + 450,000

75,000 shares) × 4% × $25]

Stock Dividends Distributable 360,000

(18,000 shares × $20)

Paid-In Capital in Excess of Stated Value— 90,000

Common Stock [18,000 shares × ($25 – $20)]

Aug. 15 Stock Dividends Distributable 360,000

Common Stock 360,000

Nov. 23 Treasury Stock (30,000 shares × $19) 570,000

Cash 570,000

Dec. 28 Cash Dividends [(375,000 shares + 75,000 shares + 43,800

18,000 shares – 30,000 shares) × $0.10]

Cash Dividends Payable 43,800

31 Income Summary 1,125,000

Retained Earnings 1,125,000

31 Retained Earnings 493,800

Stock Dividends 450,000

Cash Dividends 43,800

13-26

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

You might also like

- Problem SolvingDocument10 pagesProblem SolvingRegina De LunaNo ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 16Document89 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 16Mckenzie100% (1)

- 05 - Task Performance - 1-InterAcctng2Document2 pages05 - Task Performance - 1-InterAcctng2Jomari EscarillaNo ratings yet

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-16Document82 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-16Kate Alvarez75% (4)

- CH 13-Pages-4Document1 pageCH 13-Pages-4rehanNo ratings yet

- WRD 27e SM 13 FinalDocument38 pagesWRD 27e SM 13 FinalRafli HananNo ratings yet

- Chapter 13Document42 pagesChapter 13Peo PaoNo ratings yet

- Solution Chapter 16Document90 pagesSolution Chapter 16Frances Chariz YbioNo ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 16Document90 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 16MckenzieNo ratings yet

- Danica Reign C. Figueroa Financial Accounting and Reporting Bsa 1C Problem 14Document4 pagesDanica Reign C. Figueroa Financial Accounting and Reporting Bsa 1C Problem 14Danica Reign FigueroaNo ratings yet

- SHE Classroom DiscussionDocument3 pagesSHE Classroom DiscussionBrod Lee SantosNo ratings yet

- A. Goodwill, 12/31/20x6 (P330,000 - P19,300) P 310,700 B. FV of NCI, 12/31/20x6Document10 pagesA. Goodwill, 12/31/20x6 (P330,000 - P19,300) P 310,700 B. FV of NCI, 12/31/20x6Love FreddyNo ratings yet

- Kunci AP2 Kuis2Document7 pagesKunci AP2 Kuis2Firdha AsshiddiqiNo ratings yet

- Date Account Title Debit Credit: Cost Method Equity MethodDocument4 pagesDate Account Title Debit Credit: Cost Method Equity MethodFriska AvriliaNo ratings yet

- Bab 3 - Kunci JawabanDocument6 pagesBab 3 - Kunci JawabanVanni LimNo ratings yet

- Answers To Final Exam Revision Practice QDocument5 pagesAnswers To Final Exam Revision Practice QMinSu YangNo ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 3 (2022)Document76 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 3 (2022)Mazikeen DeckerNo ratings yet

- SHE PART 1 QuizDocument9 pagesSHE PART 1 QuizZhane KimNo ratings yet

- JAWABAN SOAL 2.01 Dan 2.02Document2 pagesJAWABAN SOAL 2.01 Dan 2.02Vanni Lim100% (1)

- 3.business Plan Divident and Grought ABDocument26 pages3.business Plan Divident and Grought ABmiradvance studyNo ratings yet

- Ia2 Ia2 Millan Solution - CompressDocument6 pagesIa2 Ia2 Millan Solution - CompressWynne RamosNo ratings yet

- Fair Value of Net AssetsDocument8 pagesFair Value of Net AssetsGanbilegBatnasanNo ratings yet

- Audit of Owner's EquityDocument9 pagesAudit of Owner's EquityHira IdaceiNo ratings yet

- Problem 16Document11 pagesProblem 16Anjan kunduNo ratings yet

- P13.3 General Journal A Date Account Titles Ref Dr. Cr. Aug-01 Cash (2.000 X 0,70) Sep-01 Cash (2.000 X 8)Document3 pagesP13.3 General Journal A Date Account Titles Ref Dr. Cr. Aug-01 Cash (2.000 X 0,70) Sep-01 Cash (2.000 X 8)Friska AvriliaNo ratings yet

- Chapter 14Document5 pagesChapter 14Kiminosunoo LelNo ratings yet

- Sol. Man. Chapter 14 Bvps 2021Document6 pagesSol. Man. Chapter 14 Bvps 2021Nikky Bless LeonarNo ratings yet

- Chapter 8Document10 pagesChapter 8Vip BigbangNo ratings yet

- Assignment Bsma 1a May 27Document14 pagesAssignment Bsma 1a May 27Maeca Angela Serrano100% (1)

- Lecture 7, 8, and 9Document3 pagesLecture 7, 8, and 9paullawrencepizzarramarasiganNo ratings yet

- Chapter 12 Akun Keuangan TugasDocument1 pageChapter 12 Akun Keuangan Tugassegeri kecNo ratings yet

- Corporate Finance Week 3 Slide SolutionsDocument6 pagesCorporate Finance Week 3 Slide SolutionsKate BNo ratings yet

- Chapter 16 Advanced Accounting Solution ManualDocument94 pagesChapter 16 Advanced Accounting Solution ManualVanessa DozonNo ratings yet

- Ias 32Document3 pagesIas 32Yến Hoàng HảiNo ratings yet

- Akuntansi Menengah 2Document5 pagesAkuntansi Menengah 2ANGELOXAK202No ratings yet

- S 5.8-5.13 Limited CompaniesDocument11 pagesS 5.8-5.13 Limited CompaniesIlovejjcNo ratings yet

- Poa, Chapter 8 AnswersDocument21 pagesPoa, Chapter 8 Answersselena hussainNo ratings yet

- Sol. Man. - Chapter 10 - She (Part 1) - 2021Document18 pagesSol. Man. - Chapter 10 - She (Part 1) - 2021Ventilacion, Jayson M.No ratings yet

- FAR Final Exam Answer Key and Solutions For StudentsDocument8 pagesFAR Final Exam Answer Key and Solutions For StudentsAli IsaacNo ratings yet

- Jawaban Review Uts Inter 2 - FixDocument8 pagesJawaban Review Uts Inter 2 - FixCaratmelonaNo ratings yet

- Sol. Man. - Chapter 16 - Accounting For DividendsDocument14 pagesSol. Man. - Chapter 16 - Accounting For DividendscpawannabeNo ratings yet

- Solution To Problems - Chapter 10Document14 pagesSolution To Problems - Chapter 10GFGSHSNo ratings yet

- SET C AnswersDocument6 pagesSET C AnswersJohnrick VallenteNo ratings yet

- Corporate Finance Week 4 Slide SolutionsDocument4 pagesCorporate Finance Week 4 Slide SolutionsKate BNo ratings yet

- Santos - Solution FinalsDocument3 pagesSantos - Solution FinalsIan SantosNo ratings yet

- Operations Exercise 6Document2 pagesOperations Exercise 6Alleya. Jane AliNo ratings yet

- Lecture 5Document3 pagesLecture 5paullawrencepizzarramarasiganNo ratings yet

- 04 Case Problem - SheDocument13 pages04 Case Problem - SheJen DeloyNo ratings yet

- Sol. Man. - Chapter 16 - Accounting For DividendsDocument16 pagesSol. Man. - Chapter 16 - Accounting For DividendspehikNo ratings yet

- Corporation Problems-1Document18 pagesCorporation Problems-1Avia Chelsy DeangNo ratings yet

- Sol. Man. - Chapter 15 - Eps - 2021Document20 pagesSol. Man. - Chapter 15 - Eps - 2021Crystal Rose TenerifeNo ratings yet

- Consolidated Financial Statements (Part 3) : XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsDocument4 pagesConsolidated Financial Statements (Part 3) : XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsMaryjoy Sarzadilla Juanata100% (1)

- AKL1C - Soal7 Dan E6-11 - Marhaendra Ihza Pahlevi - 18013010085Document4 pagesAKL1C - Soal7 Dan E6-11 - Marhaendra Ihza Pahlevi - 18013010085mahendra ihzaNo ratings yet

- Chapter 4 - AssigmentDocument2 pagesChapter 4 - AssigmentKryzzel Anne JonNo ratings yet

- Chapter 16 Advanced Accounting Solution ManualDocument119 pagesChapter 16 Advanced Accounting Solution ManualAsuncion BarquerosNo ratings yet

- Assign 4 Natividad BSA 2-13Document5 pagesAssign 4 Natividad BSA 2-13Natividad, Kered ZilyoNo ratings yet

- Additional Consolidation Reporting IssuesDocument61 pagesAdditional Consolidation Reporting IssuesDifaNo ratings yet

- Less: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaDocument16 pagesLess: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaGao YungNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- BB PT SantosaDocument62 pagesBB PT SantosaSiti ZahraNo ratings yet

- ChatgptDocument1 pageChatgptpatrick MuyayaNo ratings yet

- Management and Cost Accounting 10th Edition Drury Solutions Manual Full Chapter PDFDocument38 pagesManagement and Cost Accounting 10th Edition Drury Solutions Manual Full Chapter PDFirisdavid3n8lg100% (10)

- ACCO 014 Principles of AccountingDocument107 pagesACCO 014 Principles of Accountingviolet vinsmokeNo ratings yet

- MC With Answers Partnership Operation CorporationDocument19 pagesMC With Answers Partnership Operation CorporationASHLEY ROLAINE VICENTENo ratings yet

- FIN202Document21 pagesFIN202Thịnh Lưu Thiện HưngNo ratings yet

- Block 2 Final AccountsDocument94 pagesBlock 2 Final Accountssuraj989108No ratings yet

- HKABE 2014-15 Paper2A QuestionDocument11 pagesHKABE 2014-15 Paper2A QuestionChan Wai KuenNo ratings yet

- Solution Manual For Advanced Accounting 11th Edition by HoyleDocument24 pagesSolution Manual For Advanced Accounting 11th Edition by HoyleCherylElliotttfkg100% (42)

- CH6-7 Home QuizDocument5 pagesCH6-7 Home QuizAngel MenodiadoNo ratings yet

- Review Accounting NotesDocument9 pagesReview Accounting NotesJasin LujayaNo ratings yet

- FA2 and FFA - FA Examinable Documents S23-Aug24Document1 pageFA2 and FFA - FA Examinable Documents S23-Aug24NthatiNo ratings yet

- CF2 - Chapter 1 Cost of Capital - SVDocument58 pagesCF2 - Chapter 1 Cost of Capital - SVleducNo ratings yet

- Principles of Accounting - POA - Semester (Spring 2023)Document2 pagesPrinciples of Accounting - POA - Semester (Spring 2023)Umer SiddiquiNo ratings yet

- Shengaf ReconDocument2 pagesShengaf Reconshane bentaib ambiaNo ratings yet

- WORKSHEET Erlinda Seechua AutosavedDocument3 pagesWORKSHEET Erlinda Seechua AutosavedJeraldine DejanNo ratings yet

- Score Financial Spreadsheet TemplateDocument29 pagesScore Financial Spreadsheet TemplateMohamed Shaffaf Ali RasheedNo ratings yet

- HL Basic Savings Ac 062023Document2 pagesHL Basic Savings Ac 062023nurulshariana54No ratings yet

- Ch.13 Accounting StandardsDocument33 pagesCh.13 Accounting StandardsMalayaranjan PanigrahiNo ratings yet

- 01 Quiz On Topic 02 With Answer KeyDocument7 pages01 Quiz On Topic 02 With Answer KeyNye NyeNo ratings yet

- Accountancy PQDocument15 pagesAccountancy PQseema chadhaNo ratings yet

- Unit 10Document20 pagesUnit 10sheetal gudseNo ratings yet

- Statement of Comprehensive Income: Basic Financial Statements IiDocument5 pagesStatement of Comprehensive Income: Basic Financial Statements IiEurica LimNo ratings yet

- Reviewer: Accounting For Partnership Part 1Document22 pagesReviewer: Accounting For Partnership Part 1gab mNo ratings yet

- Test Bank For CH1 - CH2Document15 pagesTest Bank For CH1 - CH2passemmoresNo ratings yet

- Financial Management Economics For Finance 1679035282Document135 pagesFinancial Management Economics For Finance 1679035282Alaka BelkudeNo ratings yet

- AIF NewsDocument3 pagesAIF NewsDiksha DuttaNo ratings yet

- Revised - Ratio Analysis Based On Colgate Palmolive India LTDDocument7 pagesRevised - Ratio Analysis Based On Colgate Palmolive India LTDRaaj Nishanth SNo ratings yet

- Chapter 10 Quiz AnswersDocument12 pagesChapter 10 Quiz AnswersDevanshi PatelNo ratings yet

- MCQS Chapter 1 Company Law 2017Document10 pagesMCQS Chapter 1 Company Law 2017Babloo100% (1)