Professional Documents

Culture Documents

CH 13-Pages-4

Uploaded by

rehan0 ratings0% found this document useful (0 votes)

2 views1 pageThis document summarizes stock transactions and dividend entries for a corporation over the course of a year. In February, the corporation purchased 40,000 shares of treasury stock for $1,120,000. In May and July, cash dividends were declared and paid to shareholders. In September, 30,000 shares of treasury stock were sold for $1,020,000. In October, a stock dividend was declared and issued to shareholders, increasing the number of outstanding shares. In December, remaining cash dividends were paid and the stock dividend distribution was closed to paid-in capital.

Original Description:

4

Original Title

ch 13-pages-4

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes stock transactions and dividend entries for a corporation over the course of a year. In February, the corporation purchased 40,000 shares of treasury stock for $1,120,000. In May and July, cash dividends were declared and paid to shareholders. In September, 30,000 shares of treasury stock were sold for $1,020,000. In October, a stock dividend was declared and issued to shareholders, increasing the number of outstanding shares. In December, remaining cash dividends were paid and the stock dividend distribution was closed to paid-in capital.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageCH 13-Pages-4

Uploaded by

rehanThis document summarizes stock transactions and dividend entries for a corporation over the course of a year. In February, the corporation purchased 40,000 shares of treasury stock for $1,120,000. In May and July, cash dividends were declared and paid to shareholders. In September, 30,000 shares of treasury stock were sold for $1,020,000. In October, a stock dividend was declared and issued to shareholders, increasing the number of outstanding shares. In December, remaining cash dividends were paid and the stock dividend distribution was closed to paid-in capital.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

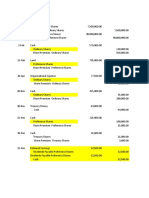

CHAPTER 13 Corporations: Organization, Stock Transactions, and Dividends

Prob. 13–5A

Jan. 9 No entry required. The stockholders’ ledger would be revised to

record the increased number of shares held by each stockholder

and new par value.

Feb. 28 Treasury Stock (40,000 shares × $28) 1,120,000

Cash 1,120,000

May 1 Cash Dividends {(75,000 shares × $0.80) + 199,200

[(1,200,000 shares – 40,000 shares) × $0.12]}

Cash Dividends Payable 199,200

July 10 Cash Dividends Payable 199,200

Cash 199,200

Sept. 7 Cash (30,000 shares × $34) 1,020,000

Treasury Stock (30,000 shares × $28) 840,000

Paid-In Capital from Sale of Treasury

Stock [30,000 shares × ($34 – $28)] 180,000

Oct. 1 Cash Dividends {(75,000 shares × $0.80) – 202,800

[(1,200,000 shares – 10,000 shares) × $0.12]}

Cash Dividends Payable 202,800

1 Stock Dividends (23,800 shares × $36) 856,800

Stock Dividends Distributable 595,000

(23,800 shares × $25)

Paid-In Capital in Excess of Par—

Common Stock (23,800 shares × $11) 261,800

Dec. 1 Cash Dividends Payable 202,800

Cash 202,800

1 Stock Dividends Distributable 595,000

Common Stock 595,000

13-28

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

You might also like

- Sol. Man. - Chapter 16 - Accounting For DividendsDocument16 pagesSol. Man. - Chapter 16 - Accounting For DividendspehikNo ratings yet

- The Set School Computer Class Vii Chapter:Cyber SecurityDocument9 pagesThe Set School Computer Class Vii Chapter:Cyber SecurityAisha Anwar100% (1)

- TikTok - Make Your Day 8-8 3Document49 pagesTikTok - Make Your Day 8-8 3Lakotre 129No ratings yet

- Solman Chap10 Shareholders Equity - CompressDocument18 pagesSolman Chap10 Shareholders Equity - CompressDump DumpNo ratings yet

- Ptosis Definition of Eyelid Ptosis: Abnormally Low Position of The Upper Eyelid Margin Caused by PoorDocument6 pagesPtosis Definition of Eyelid Ptosis: Abnormally Low Position of The Upper Eyelid Margin Caused by PoortiamaharaniNo ratings yet

- CTM400 JD 6090 Engine Service Manual PDFDocument420 pagesCTM400 JD 6090 Engine Service Manual PDFDaniel Ostapovich100% (6)

- Problem SolvingDocument10 pagesProblem SolvingRegina De LunaNo ratings yet

- Concrete Masonry - Free Standing WallsDocument42 pagesConcrete Masonry - Free Standing WallsDaniel Liew100% (7)

- Quiz Chapter-10 She-Part-1 2021Document4 pagesQuiz Chapter-10 She-Part-1 2021Hafsah Amod DisomangcopNo ratings yet

- VisArt10E SampleEbookDocument76 pagesVisArt10E SampleEbookFuture Managers Pty Ltd83% (6)

- Assignment Bsma 1a May 27Document14 pagesAssignment Bsma 1a May 27Maeca Angela Serrano100% (1)

- Chapter 13 Akun Keuangan TugasDocument2 pagesChapter 13 Akun Keuangan Tugassegeri kec0% (1)

- Individual Assignments 2Document8 pagesIndividual Assignments 2Arista Yuliana SariNo ratings yet

- Lesson 09 - Gas Turbines IDocument25 pagesLesson 09 - Gas Turbines ISohaib Arshad100% (3)

- Quizzes - Chapter 15 - Accounting For CorporationsDocument6 pagesQuizzes - Chapter 15 - Accounting For CorporationsAmie Jane Miranda100% (3)

- Marketing Plan For Madge Café: Caro, Marie Joy Casiple, Koleen Estebal, Honey Faye Longno, JosieDocument15 pagesMarketing Plan For Madge Café: Caro, Marie Joy Casiple, Koleen Estebal, Honey Faye Longno, JosieJoyNo ratings yet

- Solution For Chapter 16 Investments (13 E)Document8 pagesSolution For Chapter 16 Investments (13 E)RaaNo ratings yet

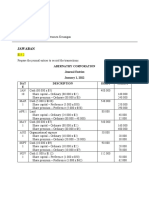

- Jawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditDocument6 pagesJawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditChupa HesNo ratings yet

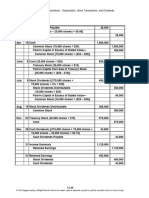

- Danica Reign C. Figueroa Financial Accounting and Reporting Bsa 1C Problem 14Document4 pagesDanica Reign C. Figueroa Financial Accounting and Reporting Bsa 1C Problem 14Danica Reign FigueroaNo ratings yet

- Problem: Andres Adi Putra S 43220110067 AKM2-Forum 6Document17 pagesProblem: Andres Adi Putra S 43220110067 AKM2-Forum 6tes doangNo ratings yet

- Ats 01 - ATS 01E 2Document25 pagesAts 01 - ATS 01E 2Omoi CamillusNo ratings yet

- Financial Accounting - Tugas 2 - 9 Oktober 2019Document3 pagesFinancial Accounting - Tugas 2 - 9 Oktober 2019AlfiyanNo ratings yet

- CH 13-Pages-2Document1 pageCH 13-Pages-2rehanNo ratings yet

- WRD 27e SM 13 FinalDocument38 pagesWRD 27e SM 13 FinalRafli HananNo ratings yet

- Chapter 13Document42 pagesChapter 13Peo PaoNo ratings yet

- SHE Classroom DiscussionDocument3 pagesSHE Classroom DiscussionBrod Lee SantosNo ratings yet

- JAWABAN SOAL 2.01 Dan 2.02Document2 pagesJAWABAN SOAL 2.01 Dan 2.02Vanni Lim100% (1)

- Tugas Sesi 8Document3 pagesTugas Sesi 8mutmainnahNo ratings yet

- QuizDocument5 pagesQuizQasim KhanNo ratings yet

- Bab 3 - Kunci JawabanDocument6 pagesBab 3 - Kunci JawabanVanni LimNo ratings yet

- 2024 MGB Group 06 v1Document5 pages2024 MGB Group 06 v1sakshisingh0712No ratings yet

- 04 Case Problem - SheDocument13 pages04 Case Problem - SheJen DeloyNo ratings yet

- Kunci AP2 Kuis2Document7 pagesKunci AP2 Kuis2Firdha AsshiddiqiNo ratings yet

- P16-3A Journalize Transactions and Adjusting Entry For Stock InvestmentsDocument3 pagesP16-3A Journalize Transactions and Adjusting Entry For Stock InvestmentsRisky FernandoNo ratings yet

- Accounting Chap 11Document3 pagesAccounting Chap 11Khanh KimNo ratings yet

- Problem 16Document11 pagesProblem 16Anjan kunduNo ratings yet

- CFAS - M3P2 AssignmentDocument12 pagesCFAS - M3P2 AssignmentMay OriaNo ratings yet

- P13.3 General Journal A Date Account Titles Ref Dr. Cr. Aug-01 Cash (2.000 X 0,70) Sep-01 Cash (2.000 X 8)Document3 pagesP13.3 General Journal A Date Account Titles Ref Dr. Cr. Aug-01 Cash (2.000 X 0,70) Sep-01 Cash (2.000 X 8)Friska AvriliaNo ratings yet

- Sol. Man. - Chapter 16 - Accounting For DividendsDocument14 pagesSol. Man. - Chapter 16 - Accounting For DividendscpawannabeNo ratings yet

- Poblem and SolutionDocument8 pagesPoblem and SolutionshajiNo ratings yet

- Akuntansi Menengah 2Document5 pagesAkuntansi Menengah 2ANGELOXAK202No ratings yet

- Chapter 12 Akun Keuangan TugasDocument1 pageChapter 12 Akun Keuangan Tugassegeri kecNo ratings yet

- Problem 2-1: Current LiabilityDocument3 pagesProblem 2-1: Current LiabilityDanica RamosNo ratings yet

- Ia2 Ia2 Millan Solution - CompressDocument6 pagesIa2 Ia2 Millan Solution - CompressWynne RamosNo ratings yet

- Sol. Man. - Chapter 10 - She (Part 1) - 2021Document18 pagesSol. Man. - Chapter 10 - She (Part 1) - 2021Ventilacion, Jayson M.No ratings yet

- Additional Consolidation Reporting IssuesDocument61 pagesAdditional Consolidation Reporting IssuesDifaNo ratings yet

- Poblem and SolutionDocument8 pagesPoblem and SolutionshajiNo ratings yet

- Chapter 16 Problem2 New PDFDocument5 pagesChapter 16 Problem2 New PDFBernadette Joyce ManjaresNo ratings yet

- Aud1 022424 LectureDocument1 pageAud1 022424 LectureJessie PaterezNo ratings yet

- CH 13 Class Practtice SolutionDocument3 pagesCH 13 Class Practtice SolutionZiyad Imad AyadNo ratings yet

- Accounting AnswersDocument3 pagesAccounting AnswersMheg NervidaNo ratings yet

- Chapter 11 Tugas DosenDocument11 pagesChapter 11 Tugas DosenElsa Siregar100% (1)

- Problem 6 (Determination of Earnings and Earnings Per Share)Document8 pagesProblem 6 (Determination of Earnings and Earnings Per Share)TABOCTABOC JOHN PHILIP M.No ratings yet

- Solution Aassignments CH 12Document7 pagesSolution Aassignments CH 12RuturajPatilNo ratings yet

- Chapter 8Document10 pagesChapter 8Vip BigbangNo ratings yet

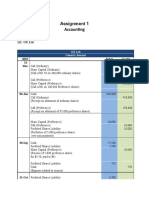

- Assignment 1 Accounting: Q1: OZ LTDDocument3 pagesAssignment 1 Accounting: Q1: OZ LTDFaraz BakhshNo ratings yet

- Answer 4 - "Answers Only For Vaughn Company, Bennett Enterprise"Document3 pagesAnswer 4 - "Answers Only For Vaughn Company, Bennett Enterprise"Rheu ReyesNo ratings yet

- Pa4-Chapter-3.Garcia J John Vincent DDocument5 pagesPa4-Chapter-3.Garcia J John Vincent DJohn Vincent GarciaNo ratings yet

- Pindi YulinarRosita - Chapter 15 IA 2Document10 pagesPindi YulinarRosita - Chapter 15 IA 2Pindi YulinarNo ratings yet

- Pengantar AkuntansiDocument4 pagesPengantar AkuntansiNuraini OktavianthieNo ratings yet

- Midterm ReviewDocument40 pagesMidterm ReviewVanessa BatallaNo ratings yet

- Ias 32Document3 pagesIas 32Yến Hoàng HảiNo ratings yet

- Corporate Finance Assignment Chapter 2 PDFDocument12 pagesCorporate Finance Assignment Chapter 2 PDFAna Carolina Silva100% (1)

- A. General Journal Date Account Title Ref DebitDocument4 pagesA. General Journal Date Account Title Ref DebitFriska AvriliaNo ratings yet

- Journal Entries: Problem 3: Exercises (Page 88)Document2 pagesJournal Entries: Problem 3: Exercises (Page 88)Renny Rose LinglingNo ratings yet

- Akuntansi Pengantar 2Document4 pagesAkuntansi Pengantar 2Lingga ArgianitaNo ratings yet

- SET C AnswersDocument6 pagesSET C AnswersJohnrick VallenteNo ratings yet

- CompReg 4MAY2018Document1,769 pagesCompReg 4MAY2018AbhishekNo ratings yet

- Analysis of Marketing Strategies of Nestle MaggiDocument17 pagesAnalysis of Marketing Strategies of Nestle MaggiPranit Anil Chavan50% (2)

- Digital Signal Processing Lab 4: Figure 3.1: Basic View of Sampling TheoremDocument3 pagesDigital Signal Processing Lab 4: Figure 3.1: Basic View of Sampling Theoremfahadsaeed93No ratings yet

- Grilla PDFDocument8 pagesGrilla PDFLuis TestaNo ratings yet

- Application Baljeet Singh ReadyDocument4 pagesApplication Baljeet Singh ReadyJAGDEEP SINGHNo ratings yet

- SB - 7 SB - 7 WithdrawalDocument1 pageSB - 7 SB - 7 Withdrawal07raghuram5879100% (1)

- Potable Water Tank Repairs in Melbourne - EditedDocument3 pagesPotable Water Tank Repairs in Melbourne - EditedMeshack MateNo ratings yet

- Analysis of The Seismic Coda of Local Earthquakes As Scattered WavesDocument9 pagesAnalysis of The Seismic Coda of Local Earthquakes As Scattered WavesAS LCNo ratings yet

- Couch To 5K Jogging PlanDocument2 pagesCouch To 5K Jogging PlanByzantine PGNo ratings yet

- Gigabyte GA-H81M-S2VDocument32 pagesGigabyte GA-H81M-S2VDan Lucian PopaNo ratings yet

- E-Lock: Digital Signature SolutionsDocument4 pagesE-Lock: Digital Signature SolutionsSuchit KumarNo ratings yet

- Yamaha Yzf r1 99 PartsDocument6 pagesYamaha Yzf r1 99 PartsRalph100% (61)

- 329-Article Text-1006-1-10-20190603Document16 pages329-Article Text-1006-1-10-20190603Jia QuijanoNo ratings yet

- Analog ModulationDocument26 pagesAnalog Modulationmraziff2009No ratings yet

- Carlo Gavazzi EM26-96Document4 pagesCarlo Gavazzi EM26-96dimis trumpasNo ratings yet

- Efficacy and Adverse Events of Oral Isotretinoin For Acne: A Systematic ReviewDocument10 pagesEfficacy and Adverse Events of Oral Isotretinoin For Acne: A Systematic ReviewFerryGoNo ratings yet

- Geography Year 4 TestDocument2 pagesGeography Year 4 TestladeahmagdalyneNo ratings yet

- Depo ProveraDocument3 pagesDepo ProveraNadine Abdel-GhafarNo ratings yet

- Sony CCD-TR67 PDFDocument80 pagesSony CCD-TR67 PDFClemente GuerraNo ratings yet

- Audit Manual LTC Service Etc PDFDocument586 pagesAudit Manual LTC Service Etc PDFsandeepNo ratings yet