Professional Documents

Culture Documents

Journal Entries: Problem 3: Exercises (Page 88)

Uploaded by

Renny Rose Lingling0 ratings0% found this document useful (0 votes)

6 views2 pagesThe document provides journal entries for a note payable recorded at a discount. On January 1, 20x1, equipment was purchased for ₱1,281,316 through a note payable with a 16% annual interest rate that was discounted by ₱718,684. Interest expense is recorded annually on December 31 for 20x1 through 20x3. The note is settled on December 31, 20x3 for ₱2,000,000 in cash. A solution shows the calculation of the present value of the note on January 1, 20x1.

Original Description:

Original Title

Untitled

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides journal entries for a note payable recorded at a discount. On January 1, 20x1, equipment was purchased for ₱1,281,316 through a note payable with a 16% annual interest rate that was discounted by ₱718,684. Interest expense is recorded annually on December 31 for 20x1 through 20x3. The note is settled on December 31, 20x3 for ₱2,000,000 in cash. A solution shows the calculation of the present value of the note on January 1, 20x1.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesJournal Entries: Problem 3: Exercises (Page 88)

Uploaded by

Renny Rose LinglingThe document provides journal entries for a note payable recorded at a discount. On January 1, 20x1, equipment was purchased for ₱1,281,316 through a note payable with a 16% annual interest rate that was discounted by ₱718,684. Interest expense is recorded annually on December 31 for 20x1 through 20x3. The note is settled on December 31, 20x3 for ₱2,000,000 in cash. A solution shows the calculation of the present value of the note on January 1, 20x1.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

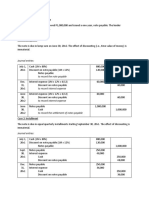

PROBLEM 3: EXERCISES (Page 88)

No. 1 JOURNAL ENTRIES

Date Particulars Debit

20x1 Equipment ₱1,281,316.00

Jan. 1 Discount on Notes Payables 718,684.00

Notes Payable

to record the note payable.

*

Dec. 31 Interest Expense 205,011.00

Discount on Notes Payable

to record interest expense.

*

20x2

Dec. 31 Interest Expense 237,812.00

Discount on Notes Payable

to record interest expense.

*

20x3

Dec. 31 Notes Payable 2,000,000.00

Cash

to record the settlement of notes payable.

*

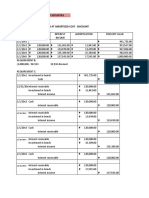

SOLUTION

Lump Sum PV = 1 / (1 + i)ⁿ x FA

= 1 / (1 + 0.16)³ x P 2,000,000.00

= 0.640658

= P 1,281,316

Date Interest Expense Discount on Present Value

Notes Payable

Jan. 1, 20x1 ₱ 718,684.00 ₱ 1,281,316.00

Dec. 31, 20x1 ₱ 205,011.00 513,673.00 1,486,327.00

Dec. 31, 20x2 237,812.00 275,861.00 1,724,139.00

Dec. 31, 20x3 275,861.00 - 2,000,000.00

Credit

₱ 2,000,000.00

205,011.00

237,812.00

2,000,000.00

You might also like

- Chapter 3 Bonds PayableDocument6 pagesChapter 3 Bonds PayableShiela DimaculanganNo ratings yet

- PracticeSet BondsPayableDocument5 pagesPracticeSet BondsPayablearabelle contrerasNo ratings yet

- (Chapter 2) Sol Man of Intermediate Accounting 2 by Zeus MillanDocument17 pages(Chapter 2) Sol Man of Intermediate Accounting 2 by Zeus MillanJonathan Villazon RosalesNo ratings yet

- Banitog - Midterm Assessment 1Document6 pagesBanitog - Midterm Assessment 1Myunimint100% (2)

- Intermediate Accounting 1A Chapter 10 - Investment in Debt Securities Problem 3Document5 pagesIntermediate Accounting 1A Chapter 10 - Investment in Debt Securities Problem 3Yuki BarracaNo ratings yet

- Notes Payable: Problem 1: True or FalseDocument16 pagesNotes Payable: Problem 1: True or FalseKim HanbinNo ratings yet

- Chapter 3: Bonds Payable and Other ConceptsDocument23 pagesChapter 3: Bonds Payable and Other ConceptsAndrei BernardoNo ratings yet

- Intermediate Accounting Unit4 - Topic2Document12 pagesIntermediate Accounting Unit4 - Topic2Lea Polinar100% (1)

- Intacc2 Chapter 3 Answer KeysDocument24 pagesIntacc2 Chapter 3 Answer KeysATHALIAH LUNA MERCADEJASNo ratings yet

- (Chapter 3) Sol Man Intermediate Accounting 2 by Zeus MillanDocument24 pages(Chapter 3) Sol Man Intermediate Accounting 2 by Zeus MillanJonathan Villazon RosalesNo ratings yet

- Illustration 1 (Notes Payable)Document4 pagesIllustration 1 (Notes Payable)DM MontefalcoNo ratings yet

- Notes PayableDocument10 pagesNotes PayableMia Casas100% (5)

- Camante James G Bsac 1 2 Assignment Acctng1100Document4 pagesCamante James G Bsac 1 2 Assignment Acctng1100James Gliponio CamanteNo ratings yet

- Problem 6-1: Interest Expense Present ValueDocument3 pagesProblem 6-1: Interest Expense Present ValueAngieNo ratings yet

- Interim ReviewerDocument5 pagesInterim ReviewerDarlyn Dalida San PedroNo ratings yet

- Acctg Lab 4Document3 pagesAcctg Lab 4AngieNo ratings yet

- Module 2 - Notes Payable Debt RestructuringDocument39 pagesModule 2 - Notes Payable Debt RestructuringJoshua Cabinas100% (1)

- Solutions Guide: This Is Meant As A Solutions GuideDocument4 pagesSolutions Guide: This Is Meant As A Solutions GuideVivienne Lei BolosNo ratings yet

- Quiz 4 With SolutionDocument5 pagesQuiz 4 With SolutionKarl Lincoln TemporosaNo ratings yet

- Bonds Payable DiscussionDocument6 pagesBonds Payable DiscussionDanica JaneNo ratings yet

- 2a.notes PayableDocument8 pages2a.notes PayableDia rielNo ratings yet

- Chapter 3 - Bonds PayableDocument6 pagesChapter 3 - Bonds PayablePatricia EsplagoNo ratings yet

- Troubled Debt RestructuringDocument3 pagesTroubled Debt RestructuringGiselle MartinezNo ratings yet

- Leases (Part 2) : Problem 1: True or FalseDocument23 pagesLeases (Part 2) : Problem 1: True or FalseKim Hanbin100% (1)

- Chapter 8 Leases Part 2Document9 pagesChapter 8 Leases Part 2Thalia Rhine AberteNo ratings yet

- ACC106 Notes Receivable IllustrationsDocument23 pagesACC106 Notes Receivable IllustrationsJohn MaynardNo ratings yet

- Acc 106 P3 LessonDocument6 pagesAcc 106 P3 LessonRowella Mae VillenaNo ratings yet

- Intermediate AccountingDocument10 pagesIntermediate AccountingJean AmisiNo ratings yet

- 4 - Notes Receivable Problems With Solutions: From The TextbookDocument23 pages4 - Notes Receivable Problems With Solutions: From The TextbookKate BNo ratings yet

- Liabilities Part 2Document43 pagesLiabilities Part 2Luisa Janelle BoquirenNo ratings yet

- Book 1Document2 pagesBook 1Shiela DimaculanganNo ratings yet

- 6TH Notes PayableDocument9 pages6TH Notes PayableAnthony DyNo ratings yet

- Lease Acctg ExerciseDocument12 pagesLease Acctg ExerciseIts meh SushiNo ratings yet

- To Record The Issuance of The Notes: Problem 6-1Document4 pagesTo Record The Issuance of The Notes: Problem 6-1Danica RamosNo ratings yet

- Chap 10Document5 pagesChap 10Shiela DimaculanganNo ratings yet

- Solutions-Notes Payable-1 PDFDocument7 pagesSolutions-Notes Payable-1 PDFHerrah Joyce SalinasNo ratings yet

- Due Date Revised Payments PV of 1 @12%, N 0 1 and 2 Present ValueDocument2 pagesDue Date Revised Payments PV of 1 @12%, N 0 1 and 2 Present ValueCamille HornillaNo ratings yet

- Ia 2 Final Exam Answer KeyDocument17 pagesIa 2 Final Exam Answer KeyIrene Grace Edralin AdenaNo ratings yet

- Intacc1A M5Assignment KeyDocument9 pagesIntacc1A M5Assignment KeyGabriel AfricaNo ratings yet

- Lagrimas, Sarah Nicole S. - LeasesDocument9 pagesLagrimas, Sarah Nicole S. - LeasesSarah Nicole S. LagrimasNo ratings yet

- Module 2 - Notes Payable & Debt Restructuring - Rev2Document44 pagesModule 2 - Notes Payable & Debt Restructuring - Rev2Bea Angelle CamongayNo ratings yet

- UntitledDocument2 pagesUntitledJULES RINGGO AGUILARNo ratings yet

- Jackson Kervin Rey G. Intacc 189 Activity 4 Unit 2 1Document4 pagesJackson Kervin Rey G. Intacc 189 Activity 4 Unit 2 1Kervin Rey JacksonNo ratings yet

- Note PayableDocument6 pagesNote PayablemmhNo ratings yet

- Illustration: Bonds Issued at Premium - With Transaction CostsDocument2 pagesIllustration: Bonds Issued at Premium - With Transaction Costselsana philipNo ratings yet

- Chapter 20 CompilationDocument41 pagesChapter 20 CompilationMaria Licuanan0% (1)

- Sol. Man. - Chapter 8 Leases Part 2Document9 pagesSol. Man. - Chapter 8 Leases Part 2Miguel Amihan100% (1)

- Module 5 Note Payable and Debt RestructureDocument15 pagesModule 5 Note Payable and Debt Restructuremmh100% (1)

- Chapter 8Document6 pagesChapter 8swaroopcharmiNo ratings yet

- Part 3 - AnswersDocument4 pagesPart 3 - AnswersFenladen AmbayNo ratings yet

- Exercise 14Document11 pagesExercise 14dwitaNo ratings yet

- Bonds Payable Issued at A PremiumDocument6 pagesBonds Payable Issued at A PremiumCris Ann Marie ESPAnOLANo ratings yet

- Pa4-Chapter-3.Garcia J John Vincent DDocument5 pagesPa4-Chapter-3.Garcia J John Vincent DJohn Vincent GarciaNo ratings yet

- Ia2 Final Exam A Test Bank - CompressDocument32 pagesIa2 Final Exam A Test Bank - CompressFiona MiralpesNo ratings yet

- Sol. Man. - Chapter 13 - Share Based Payments (Part 2) - 2021Document14 pagesSol. Man. - Chapter 13 - Share Based Payments (Part 2) - 2021Crystal Rose TenerifeNo ratings yet

- The Intermediate Accounting Series Volume 2 2016 Empleo Robles SolmanDocument86 pagesThe Intermediate Accounting Series Volume 2 2016 Empleo Robles SolmanSutnek Isly94% (17)

- 2016 Vol 2 CH 1 AnswersDocument11 pages2016 Vol 2 CH 1 AnswersHohohoNo ratings yet

- Problem 4-1: GUILLENA, Isabelle Dynah E. BSA 2-10 Assignment #2: LeasesDocument5 pagesProblem 4-1: GUILLENA, Isabelle Dynah E. BSA 2-10 Assignment #2: LeasesIsabelle GuillenaNo ratings yet

- Problem 10-8 (Banco)Document7 pagesProblem 10-8 (Banco)Roy Mitz Aggabao Bautista VNo ratings yet