Professional Documents

Culture Documents

E Potrait 07112022-2

Uploaded by

marketbus12Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

E Potrait 07112022-2

Uploaded by

marketbus12Copyright:

Available Formats

3 STEP ALL-IN-ONE INVESTMENT

ACCOUNT 2.0 OPENING DECK

Strictly for internal use only.

ADDITIONAL FEATURES OF

ALL-IN-1 INVESTMENT ACCOUNT 2.0

Easy and smooth Powered by best in Enablement of STP

account opening class FinTech API for fast and easy

process. integrations with IDfy, account opening.

Digio and Signzy.

Options of opening Derivatives privilege Promo-codes and

account through activation in the referral programs.

Digilocker, KRA account opening

validation and journey.

manual journeys.

Upfront option

available to the

customers back-

track the journey.

Strictly for internal use only.

3 EASY STEP TO PROCESS

VERIFY

KYC

E-SIGN

Strictly for internal use only.

VERIFY | Mobile verification

Enter mobile

number

and press

continue

CUSTOMER CAN

TRACK APPLICATION

BY CLICKING ON

“HERE”

Strictly for internal use only.

VERIFY | Verify Mobile Number

Enter OTP

sent on

given mobile Click on

number. verify

SELECT RELATIONSHIP OF

GIVEN MOBILE NUMBER.

Strictly for internal use only.

VERIFY | Enter Email ID

Enter email

ID

Option to

enter Promo

code if any.

SELECT RELATIONSHIP

OF GIVEN EMAIL ID.

Strictly for internal use only.

VERIFY | Verify Email OTP

Enter OTP

sent on given

email-id so as

to authenticate

the same.

Strictly for internal use only.

VERIFY | PAN Verification

Enter PAN

and DOB

DOB should

be as per

PAN card

If customer’s PAN is KRA verified then customer will

automatically proceed with KRA journey

Strictly for internal use only.

VERIFY | Confirm PAN CARD details

Name as per

ITD will be

displayed on

screen.

Click on

confirm to

continue

IF PAN IS INCORRECT, THEN CLICK

ON “RE-ENTER PAN”

Strictly for internal use only.

VERIFY | Search Branch Details

Enter IFSC

Search by IFSC if you know the IFSC code else search by bank to

find the IFSC

Strictly for internal use only.

VERIFY | Choose IFSC code

Select bank

branch

details

Strictly for internal use only.

VERIFY | Verify Bank Account

Enter bank

account

number and

Penny drop customer ID

will be done (incase HDFC

to customer’s bank)

mentioned

account to

verify bank

details.

Incase if

customer

bank detail

do not match

customer has

to upload

bank proof

Strictly for internal use only.

VERIFY | Personal Details And

Documents Proofs

(Connect to DigiLocker)

Proceed

through

Digilocker

Make sure your Aadhaar card is linked to mobile number

Strictly for internal use only.

KYC | Enter Security Code

Enter

security

code sent

on mobile

number

Authenticate

Aadhaar

Strictly for internal use only.

KYC | Enter Aadhar card number

Enter Aadhar

card number,

Capture &

click on next

button

Strictly for internal use only.

KYC | Digilocker

Enter OTP

sent on

given mobile

number.

Strictly for internal use only.

KYC | Digilocker

Allow

permission

to fetched

documents

Strictly for internal use only.

KYC | Upload Bank Proof

Upload Bank

Proof

Upload Bank Proof only if penny drop has failed

As per exchange circular only cancel cheque copy where

Customer signature & Name available is accepted as bank proof

Note: Photo of photo is not accepted

Strictly for internal use only.

KYC | Upload PAN Card Image

Upload PAN

card photo

Note: Photo of photo is not accepted

If customer is KRA verify, in this sinario we have to upload PAN

card image

Strictly for internal use only.

KYC | Upload Signature

Upload a valid

wet

signature

within

the whitespace

Note: Photo of photo is not accepted

Strictly for internal use only.

KYC | Upload Selfie

Upload Selfie

Make sure to allow camera permission and

Upload a front face clear selfie

Note: Photo of photo is not accepted

Strictly for internal use only.

KYC | KYC Details

Enter

company

name to

avail special

corporate

schemes

To avail special corporate offers select company name

from the drop down

Strictly for internal use only.

KYC | Nominee Addition

Click on

“ADD” to

proceed

with

nominee

addition

Incase nomination selected as Yes

Strictly for internal use only.

KYC | Nominee Addition

Add

nominee

PAN number

Incase nomination selected as Yes

Strictly for internal use only.

KYC | Nominee Addition

Name is

fetched as

per KRA

records

Enter

Nominee’s

personal

details

Incase nomination selected as Yes

Strictly for internal use only.

KYC | Nominee Addition

Preview and

proceed

User can add maximum 3 nominees

Incase nomination selected as Yes

Strictly for internal use only.

KYC | Personal Details

Name is

fetched as

per KRA

records

Enter father

name as

per PAN/

Aadhaar &

Enter correct

mother

name

Enter

details as

required

Name is fetched as per KRA records

Strictly for internal use only.

KYC | Correspondence Address

Enter

correspondence

details

Strictly for internal use only.

KYC | Trading Segments

Based on the company name selected, special offer will be

reflected on the plan page.

Select the segment as Cash + MF + Derivative to avail special

benefits

Strictly for internal use only.

KYC | Plan Selection

Accept

derivate T&C

Incase derivative paln selected as Yes

Strictly for internal use only.

KYC | Plan Selection

Latest salary

slip

If customer upload bank statement, there should be credit

balance of rupees 10,000 in last six month

Strictly for internal use only.

KYC | Plan Selection

Select any

one

document

If customer select derivate plan, Upload income proof

Note: Screenshot is not accepted

Strictly for internal use only.

KYC | KRA KYC Esign

Strictly for internal use only.

E-SIGN | KRA KYC Esign

Proceed to

KRA KYC

Esign

Strictly for internal use only.

E-SIGN | KRA KYC Esign

Preview the

pre-signed

KRA KYC

form and

click on sign

now

Strictly for internal use only.

E-SIGN | KRA KYC Esign

Enter

Aadhaar

number and

OTP for

e-sign

Strictly for internal use only.

E-SIGN | Submit Application

Enter LG/LC

and Source

code

Strictly for internal use only.

E-SIGN | Submit Application

Click on

e-sign now

to proceed

ahead

Strictly for internal use only.

E-SIGN | Submit Application

Click to

proceed

e-sign

Strictly for internal use only.

E-SIGN | Submit Application

Pre-view the

pre-signed

AOF and

click on sign

now

Strictly for internal use only.

E-SIGN | Submit Application

Enter

Aadhaar

number and

OTP for

e-sign

Strictly for internal use only.

E-SIGN | Submit Application

Click here to

download

e-signed AOF

Strictly for internal use only.

E-SIGN | Submit Application

INSTRUCTIONS AFTER SUBMITTING

APPLICATION

Account gets activated within 10-15 minutes.

Customers will be provided trading account details over

SMS and Email.

duly signed ddpi document should be send by the customer

for seamless trading experience (ddpi sent to customer

registered mail address after account opening)

If the account is rejected due to any reason, the link to

rectify and re-submit application will be sent over email

and SMS along with the rejection reason.

Strictly for internal use only.

THANK YOU!

Investment in securities market are subject to market risks, read all the related documents

carefully before investing.

SEBI registration & disclaimers: https://www.hdfcsec.com/article/disclaimer-1795

You might also like

- Veri5Digital Master BrochureDocument15 pagesVeri5Digital Master Brochureveri5digitaNo ratings yet

- Digital Onboarding Guide PDFDocument2 pagesDigital Onboarding Guide PDFrahulNo ratings yet

- SBi NotesDocument12 pagesSBi Notesganesh reddyNo ratings yet

- Digital Account Flow-Corporate SalaryDocument22 pagesDigital Account Flow-Corporate SalaryAejaz PatelNo ratings yet

- OKYC Brochure - Veri5Digital (Khosla Labs)Document1 pageOKYC Brochure - Veri5Digital (Khosla Labs)veri5digitaNo ratings yet

- Httpsmyaadhaar Uidai Gov inDocument1 pageHttpsmyaadhaar Uidai Gov inprathameshtawate00No ratings yet

- User Manual For ZED Registration 20.04.2022 2022Document32 pagesUser Manual For ZED Registration 20.04.2022 2022Aneesh AneeshNo ratings yet

- Process For Online EPF Transfer Process For Online EPF TransferDocument13 pagesProcess For Online EPF Transfer Process For Online EPF Transfermayank.mgguptaNo ratings yet

- Step Register MyUnifi AppDocument7 pagesStep Register MyUnifi AppElin TanNo ratings yet

- Banco de Oro Online Banking PDFDocument4 pagesBanco de Oro Online Banking PDFalexander o,verdidaNo ratings yet

- Direct Benefit Transfer: ApprenticeDocument5 pagesDirect Benefit Transfer: ApprenticeSourav SinghNo ratings yet

- Existing Investor Login WalkthroughDocument33 pagesExisting Investor Login WalkthroughHonest ReviewsNo ratings yet

- Practical 6Document4 pagesPractical 6ayushNo ratings yet

- SchemaDocument1 pageSchemaWa 13 ExtremeNo ratings yet

- Using Atm/Debit Card Using Account Details Internet Banking CredentialsDocument1 pageUsing Atm/Debit Card Using Account Details Internet Banking CredentialsRCC PGTNo ratings yet

- Panduan Pendaftaran myIOU Coaching 1on1Document30 pagesPanduan Pendaftaran myIOU Coaching 1on1Mohamad HishamNo ratings yet

- BDO Credit Card Online Application Form - Home PDFDocument2 pagesBDO Credit Card Online Application Form - Home PDFalexander o,verdidaNo ratings yet

- EKYCDocument19 pagesEKYCYS TjiaNo ratings yet

- Udyam Registration Annexture Certificate Online in IndiaDocument3 pagesUdyam Registration Annexture Certificate Online in IndiaAjitNo ratings yet

- NSR Registration Process DemoDocument33 pagesNSR Registration Process Demo6535ANURAG ANURAGNo ratings yet

- Smart X Saferoads Student ManualDocument7 pagesSmart X Saferoads Student ManualRafael SaturnoNo ratings yet

- CADian Authorization FlowDocument12 pagesCADian Authorization FlowOldac Viana CamposNo ratings yet

- e-KYC and New Investor Process FlowDocument32 pagese-KYC and New Investor Process FlowSneha Abhash SinghNo ratings yet

- Customer Application Form: Atria Convergence Technologies Ltd. Head OfficeDocument6 pagesCustomer Application Form: Atria Convergence Technologies Ltd. Head OfficevitalengineerNo ratings yet

- Sop VkycDocument5 pagesSop VkycNiteen KumbhareNo ratings yet

- Receipt 542014620Document1 pageReceipt 542014620zainbusmartNo ratings yet

- 1 Personal Details Form 2 OTP Verification Process 3 Loan Details Form 4 Answer Questionnaire 5 Upload Supporting DocumentsDocument2 pages1 Personal Details Form 2 OTP Verification Process 3 Loan Details Form 4 Answer Questionnaire 5 Upload Supporting DocumentsrhenNo ratings yet

- My AIA How To Register 09092021Document16 pagesMy AIA How To Register 09092021angelo agsaulloNo ratings yet

- IDfy Case Studies PDFDocument8 pagesIDfy Case Studies PDFAvishekNNo ratings yet

- Customer Application Form: Regional OfficeDocument6 pagesCustomer Application Form: Regional OfficeVidya RaniNo ratings yet

- ACT Wifi DetailsDocument6 pagesACT Wifi DetailsRiyaz KhanNo ratings yet

- Credit CardDocument1 pageCredit Cardmychannel 360 degreeNo ratings yet

- TIde Merchant Onbaording TrainingDocument49 pagesTIde Merchant Onbaording TrainingMeenakshi RaminaNo ratings yet

- Icici Bank Tcs One Pager - Pan IndiaDocument4 pagesIcici Bank Tcs One Pager - Pan IndiaNikhil SahuNo ratings yet

- DKYC - MKYC PPT (Suresh Sir)Document38 pagesDKYC - MKYC PPT (Suresh Sir)GovindNo ratings yet

- in Order To Register Yourself Kindly Click "Registration" Button On The WebsiteDocument3 pagesin Order To Register Yourself Kindly Click "Registration" Button On The WebsiteDeepak YadavNo ratings yet

- App Form Oap-00000000002749170-ProDocument4 pagesApp Form Oap-00000000002749170-ProPradeep10rNo ratings yet

- Seller Account Identity VerificationDocument43 pagesSeller Account Identity VerificationDeTotNo ratings yet

- HDFC BANK Instant Account - DAP Link TutorialDocument22 pagesHDFC BANK Instant Account - DAP Link TutorialManish singh sisodiyaNo ratings yet

- Hyundai Care APP Registration Login ProcessDocument4 pagesHyundai Care APP Registration Login ProcessDhashana MoorthyNo ratings yet

- Change Your Password PDFDocument1 pageChange Your Password PDFMostafa AbdelazeimNo ratings yet

- Digital OnboardingDocument9 pagesDigital OnboardingBuntyNo ratings yet

- 1.jumio IDVerificationDatasheet v7Document2 pages1.jumio IDVerificationDatasheet v7Pedro SanchezNo ratings yet

- eCAFDocument6 pageseCAFmanasa makloorNo ratings yet

- My Aia Member Portal How To RegisterDocument26 pagesMy Aia Member Portal How To RegisterIzarul Aiman TVNo ratings yet

- Esigned Kyc Stock PDFDocument27 pagesEsigned Kyc Stock PDFRajveer KhanguraNo ratings yet

- Restricted Area Identity Card - Form - 2015-09-15Document1 pageRestricted Area Identity Card - Form - 2015-09-15Jay King MindenNo ratings yet

- NGO Darpan How To Signup EnglishDocument10 pagesNGO Darpan How To Signup EnglishSkyhigh GoneNo ratings yet

- Promo Multiple PCS, Macs, Servers and Mobile Devices Into One Account - Sign Up With IDrive®Document1 pagePromo Multiple PCS, Macs, Servers and Mobile Devices Into One Account - Sign Up With IDrive®Wachito VarelaNo ratings yet

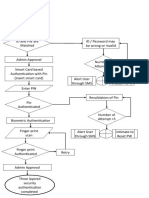

- 3-Layered Authentication - Flow ChartDocument1 page3-Layered Authentication - Flow ChartSANTHOSH KUMARNo ratings yet

- Central Public Works Department (CPWD) User Guide For E-Publishing Process For Auction Dated: 22 July 2022Document24 pagesCentral Public Works Department (CPWD) User Guide For E-Publishing Process For Auction Dated: 22 July 2022Abha CapsNo ratings yet

- Axis Bank FormDocument14 pagesAxis Bank FormTokuto Vitoi ZhimomiNo ratings yet

- I'd MeDocument2 pagesI'd MeIbraheem AkoredeNo ratings yet

- 1.trainer Registration Process - Step by Step GuideDocument44 pages1.trainer Registration Process - Step by Step GuidetanishaNo ratings yet

- Myaadhaar - Unique Identification Authority of India - Government of IndiaDocument2 pagesMyaadhaar - Unique Identification Authority of India - Government of IndiatvNo ratings yet

- Esigned Kyc Stock PDF-1Document27 pagesEsigned Kyc Stock PDF-1lohar8422No ratings yet

- Nextbulk App 2Document34 pagesNextbulk App 2Ayomide EgbaiyeloNo ratings yet

- Checkout QuickPayESuccessDocument1 pageCheckout QuickPayESuccessmonsterballtradingNo ratings yet

- How To Get Registered As A Research Analyst and Instructions For Filling in Form ADocument3 pagesHow To Get Registered As A Research Analyst and Instructions For Filling in Form AnitinakkNo ratings yet

- Brokerage Structure: Skyes & Ray Equities (I) LimitedDocument2 pagesBrokerage Structure: Skyes & Ray Equities (I) Limitedmarketbus12No ratings yet

- Null - 2022-12-14T183756.993Document5 pagesNull - 2022-12-14T183756.993Mayur NagdiveNo ratings yet

- Questionnaire 2Document13 pagesQuestionnaire 2DeepakNo ratings yet

- Njmars Booklet PDFDocument20 pagesNjmars Booklet PDFJuber FarediwalaNo ratings yet

- Null - 2022-12-14T183756.993Document5 pagesNull - 2022-12-14T183756.993Mayur NagdiveNo ratings yet

- Null - 2022-12-14T183756.993Document5 pagesNull - 2022-12-14T183756.993Mayur NagdiveNo ratings yet

- Null - 2022-12-14T183756.993Document5 pagesNull - 2022-12-14T183756.993Mayur NagdiveNo ratings yet

- Max Life Monthly Income Advantage Plan ProspectusDocument13 pagesMax Life Monthly Income Advantage Plan ProspectusAman SaxenaNo ratings yet

- POS Goal Suraksha: Key Feature DocumentDocument6 pagesPOS Goal Suraksha: Key Feature DocumentPiyush VisputeNo ratings yet

- Land Rover Vehicles Price in IndiaDocument2 pagesLand Rover Vehicles Price in IndiaGoodNo ratings yet

- Brokerage Structure: Skyes & Ray Equities (I) LimitedDocument2 pagesBrokerage Structure: Skyes & Ray Equities (I) Limitedmarketbus12No ratings yet

- TYBFM Sem 6 Mutual Fund ManagementDocument53 pagesTYBFM Sem 6 Mutual Fund ManagementHitesh BaneNo ratings yet

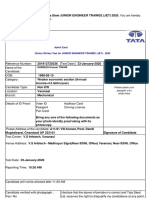

- Army P S TGT Admit CardDocument1 pageArmy P S TGT Admit Cardpraveen0% (1)

- Tata Consultancy Layer FormatDocument21 pagesTata Consultancy Layer FormatChinnu SalimathNo ratings yet

- 63f26d66dc25f23fc3aef5ff All SignDocument25 pages63f26d66dc25f23fc3aef5ff All Signsa3823330No ratings yet

- Icici Claim FormDocument3 pagesIcici Claim FormjspinkuNo ratings yet

- AdmitCard PDFDocument2 pagesAdmitCard PDFSureshJaiswalNo ratings yet

- Appointment Reciept ABDULLAHDocument3 pagesAppointment Reciept ABDULLAHZaibunnisa MalikNo ratings yet

- Admit CardDocument1 pageAdmit Cardchanderp_15No ratings yet

- Unsign PDFDocument30 pagesUnsign PDFLEo GEnji KhunnuNo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- Application For Management of The Consumer Counselling CentersDocument6 pagesApplication For Management of The Consumer Counselling CentersMinatiBindhaniNo ratings yet

- 2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFDocument1 page2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFShankar Rao AsipiNo ratings yet

- Worksmart 026 - Process For Handling Mutilated NotesDocument27 pagesWorksmart 026 - Process For Handling Mutilated NotesJayakrishnaraj AJDNo ratings yet

- Vivad Se Vishwas 1 User Manual - 1681646508Document26 pagesVivad Se Vishwas 1 User Manual - 1681646508Shivam DubeyNo ratings yet

- Loan LetterDocument4 pagesLoan Lettermohd.hadi36No ratings yet

- Neet PG 2022Document7 pagesNeet PG 2022Bharatsinh DabhiNo ratings yet

- Cleartrip Train E Ticket 2Document4 pagesCleartrip Train E Ticket 2Bhushan MadniwaleNo ratings yet

- Tendernotice - 1 - 2022-01-28T103903.252Document72 pagesTendernotice - 1 - 2022-01-28T103903.252Monish MNo ratings yet

- Panp011134 / Py0034116726Document2 pagesPanp011134 / Py0034116726ArumugamPichandiNo ratings yet

- Noc21 cs32Document2 pagesNoc21 cs32Rohit TNo ratings yet

- Chennai Police - Format For Information On TenantsDocument6 pagesChennai Police - Format For Information On TenantsSenthil Kumar50% (4)

- Promokap OfferDocument4 pagesPromokap OfferamitNo ratings yet

- Claim Form PDFDocument5 pagesClaim Form PDFmeghaNo ratings yet

- NJP To SdahDocument2 pagesNJP To SdahAritra BanerjiNo ratings yet

- Case Study On Qualities of Entrepreneurship: Exercise No: 1 DateDocument16 pagesCase Study On Qualities of Entrepreneurship: Exercise No: 1 DateSowfeq AkNo ratings yet

- Test Details: Admit Card-ProvisionalDocument1 pageTest Details: Admit Card-ProvisionalManish KumarNo ratings yet

- Membership Application FormDocument3 pagesMembership Application Formshreenath pandeyNo ratings yet

- 19715/JP GTNR EXP Third Ac (3A)Document3 pages19715/JP GTNR EXP Third Ac (3A)Zubair AnsariNo ratings yet

- TMC Contribution Report 18-19Document15 pagesTMC Contribution Report 18-19arvind667No ratings yet

- HP Fest-O-Mania Offer - August'22Document12 pagesHP Fest-O-Mania Offer - August'22Praful KonjerlaNo ratings yet