Professional Documents

Culture Documents

76887cajournal Nov2023 9

Uploaded by

tejveersingh7137Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

76887cajournal Nov2023 9

Uploaded by

tejveersingh7137Copyright:

Available Formats

565

THE CHARTERED ACCOUNTANT

THEME

Augmenting Economic Governance

through Accountancy Excellence

The corporate governance framework is linked to ‘transparency’

either directly or by implications. The public demand for greater

‘transparency’ became shriller with every corporate fraud

around the globe. As the corporate frauds centred around the

financial statements containing material misstatements, without

audit qualifications, the accounting practices and the auditors’

independence naturally came under deeper scrutiny. For the

corporate structure to exist and grow it is imperative that the

users of the financial statements must have confidence and

trust in the financial performance and the financial position

being reported to them. The current market capitalization on the

NSE1 is Rs 30,899,396.78 crores or US $3.72 Trillion. With so

much at stake, the financial and increasingly, the non-financial

information contained in the financial statements need to be not

CA. Manoj Fadnis only timely and relevant but also meet the expectation of the

Past President ICAI and CAPA large universe of the users.

T

he legal and the regulatory global accounting benchmarks. the use of the entity’s economic

response followed the With the exception of the US, the resources.

corporate frauds. The major economies have accepted

US introduced the Sarbanes The neutrality of the financial

the International Financial

Oxley Act in 2002 to improve the reporting between the existing

Reporting Standards (IFRS)

auditing and public disclosure in and the future stakeholders is

as issued by the International an important characteristic.

response to several accounting Accounting Standards Board

scandals in the early 2000s. Given the quarterly reporting

(IASB) as the basis for the by the listed enterprises,

In UK the Financial Reporting financial reporting. the management is likely to

Council was established with

The objective2 of the general be in pressure to show the

the objective of restoring trust in

purpose financial reporting is performance on a quarter-to-

audit and corporate governance.

to provide financial information quarter basis. The concept

In Australia, the Corporate Law

about the reporting entity that is of continuous disclosures of

Economic Reform Program (Audit

useful to existing and potential material events to the stock

Reform & Corporate Disclosure)

investors, lenders and other exchanges only adds to this

Act 2004 came into effect from pressure. However, the uniformity

1st July 2004. Several regulatory creditors in making decisions

relating to providing resources and the consistency in selection

reforms took place in India which of the accounting policies

culminated in The Companies to the entity. Those decisions

involve decisions about (a) ensures that the management

Act, 2013 being implemented with discretion does not override

effect from 1st April 2014. buying, selling or holding

equity and debt instruments; the long-term objectives and

One common thread amongst (b) providing or settling loans succumb to the short-term

pressures.

all these reforms has been the and other forms of credit; or

emphasis on transparency in (c) exercising rights to vote The financial statements are

the financial statements and on, or otherwise influence, required to describe how

adherence to the accepted management’s actions that affect efficiently and effectively the

1

As on 23rd October 2023 -NSE website

2

Objectives, usefulness and limitations of general purpose financial reporting as per the Conceptual Framework of Financial Reporting

under Indian Accounting Standards (Ind AS) issued by the ICAI.

www.icai.org NOVEMBER 2023 21

566

THEME THE CHARTERED ACCOUNTANT

entity’s management and Tax Act for the purpose of As against this the Accounting

governing board have discharged computation of taxable income. Standard 18 Related Parties

their responsibilities in using the The revision of Schedule VI in defines it as those persons

economic resources available 2011 and presently the Schedule who have the authority and

to the entity. The claims against III to the Companies Act 2013 responsibility for planning,

the entity is also an important permit the Accounting Standards directing and controlling the

information sought for by the to become the basis for the activities of the reporting

stakeholders to evaluate the preparation and presentation of enterprise. Similarly, Ind

performance and therefore, the financial statements. As a AS 24 defines it as those

requires to be properly reported. result, the principles enunciated persons having authority and

in AS 26/Ind AS 38 will not responsibility for planning,

The accounting frauds exploit

permit capitalization of revenue directing and controlling the

the grey areas in accounting.

expenditure and the subsequent activities of the entity, directly or

It is imperative these areas

amortization over a period indirectly, including any director

are minimised, and the

of time but will require such (whether executive or otherwise)

best accounting practices

expenditure to be charged to the of that entity.

are codified. Intangible

statement of profit and loss.

assets, contingent liabilities, The definition of the ‘manager’

accounting of derivatives The accounting standards are under the Act is very wide. A

are some of the examples principle based. The definitions person may not fall within the

where the improvement in of terms may be more specific definition of the ‘manager’ but

accounting requirements, as under the law but will be broader may be covered as a KMP

per the applicable accounting under the applicable accounting under the applicable accounting

standards, have resulted in standards. The terms used in the standards. Independent

more accountability and better law will apply for the all the legal Directors are not covered within

governance. The disclosures of and regulatory purposes whereas the definition of the KMP under

related party transactions have the definition of the same term the Act and AS 18 whereas

led to more questioning of the as per the accounting standard they are not excluded as per

management on these issues will apply for the purpose of the Ind AS 24. Interestingly Ind AS

and has attracted more attention financial statements. 24 includes ‘domestic partner’

of the regulators. within the definition of close

The term “key managerial

members of the family who are

The differences between the personnel” (KMP) is defined

expected to influence a related

intangible items and intangible in sub-section (51) of section

party. Given the changing

assets are now well settled. (2) of the Companies Act,

social scenario, the importance

While all intangible assets are 2013 (the Act) to mean (i) the

of such inclusions cannot be

intangible items, the reverse Chief Executive Officer or

underestimated.

is not true. Recognising large the managing director or the

expenditure as deferred revenue manager; (ii) the company The disclosures of the

expenditure and amortising secretary; (iii) the whole- transactions with the KMPs, their

it over a few years was a time director; or (iv) the Chief relatives and entities privately

common practice. In fact, the Financial Officer. The term controlled by the KMPs adds

Schedule VI to the Companies ‘manager’ is defined under a lot of value to the financial

Act, 1956 till 2011, permitted sub-section (53) to mean an statements. The requirement

the classification of the individual who, subject to the to disclose these transactions

miscellaneous expenditure to the superintendence, control and results in higher responsibilities

extent not written off or adjusted direction of the Board of on the audit committees while

under the heading of ‘Assets’ Directors, has the management approving and ensuring the same

in the balance sheet. Thus, it of the whole, or substantially to be at arm’s length.

was an accepted position for the whole, of the affairs of

The interpretations of the

the corporates to write off large a company, and includes

Accounting Standards is gaining

revenue expenditure such as a director or any other person

more importance with the

advertisement etc.. over a period occupying the position of a

regulators taking strict action.

of few years but at the same manager, by whatever name

time claim it is an expenditure called, whether under a contract SEBI3 barred a well reputed

under section 37 of the Income of service or not. listed company as well as

3

Order no WTM/AB/CFID/CFID_1/20686/2022-23 dated 21st October 2022

22 NOVEMBER 2023 www.icai.org

567

THE CHARTERED ACCOUNTANT

THEME

its promoters from the stock the principle of control and money and have greater usage of

market for two years, for establishes control as the basis fair value. It is said that fair value

fraudulent misrepresentation for consolidation. It also sets is relevant while the historical

of the company’s statements. out how to apply the principle cost is reliable. The trade-off

However, the order has been of control to identify whether an is thus, between reliability and

stayed by the Securities investor controls an investee and relevance. In case of financial

Appellate Tribunal (SAT). Thus, therefore must consolidate the assets and liabilities, the fair

the matter is sub-judice. The investee. value basis of measurement

issues involve interpretation of is more relevant than the age-

The issue whether an investee

the then applicable accounting old historical cost concept.

should have been consolidated

standards. The said company Derivatives require minimum

as a subsidiary or as an

had real estate revenue as a initial investment but the outcome

associate came before SEBI

significant constituent of the on their settlement can be far

recently. SEBI4 held that the

total revenue. The real estate greater. Measuring the derivatives

company had wrongly classified

business had entered into sale at historical cost will be irrelevant.

a particular company as an

agreements with an unlisted They have to be measured at

associate and not as a subsidiary

company in which the employees fair value. Keeping pace with the

and accordingly the consolidated

of the listed company were the changing business complexities,

financial statements were not

directors. It was alleged that the Indian Accounting Standards

as per the provisions of Ind AS

the said directors were under are more in line with the needs of

110 resulting in the financial

the control of the management the present times.

statements not showing true and

of the listed company. Also,

fair view. This order is also under The financial reporting too has

another allegation was that the

appeal before the SAT and thus its limitations. They are not

shareholding pattern of the

the case is sub-judice. designed to show the value of a

unlisted company was such that

reporting entity; but they provide

the majority was held by the The ultimate outcome of the

information to help existing and

listed company and its promoters litigation may take time. But such

potential investors, lenders and

indirectly. If so, the transactions cases highlight that governance

other creditors to estimate the

were between the related practices are important in

value of the reporting entity.

parties and should have been selection of the accounting

It is acknowledged that the

disclosed accordingly. Further, policies and aggressive

use of accounting estimates

sale arrangements with the interpretations need to be

is a limitation of the financial

unlisted company were alleged avoided.

statements, but this does not

to be not genuine and the profits

The Accounting Standards have make the financial statements

from such transactions were

evolved over a period of time. less reliable.

unreal. The early outcome of the

Today there are two sets of

litigation will be useful. Markets5 rely on trust. Investors

accounting standards – the first

need to trust the markets, to

With the growth in the corporate set is, the Accounting Standards

trust the companies. And trust,

sector, the corporate groups (AS) which are applicable to

in turn depends on all players

have also increased manifold. smaller entities and the second

communicating transparent

A group includes subsidiary, set is, the Indian Accounting

and useful information. This is

associate and a joint venture. Standards (Ind AS) which are

particularly true and important in

An entity has control over applicable to the listed and

times of heightened uncertainty.

a subsidiary and therefore entities with net worth more than

line by line consolidation is rupees two hundred and fifty Good governance and good

mandated. As against this, in crores. Banks and insurance accounting will always go hand

case of an associate the investor companies are still to migrate to in hand. Corporates following the

has significant influence and Ind AS. accounting principles in letter

therefore, the equity method and spirit will be richly rewarded

The Ind AS are converged with

of accounting is permitted. Ind by the market and those who do

the IFRS, have greater emphasis

AS 110 lays down elaborate not, need rightly to be punished.

of economic substance over legal

principles for the consolidation

form, recognise time value of

of a subsidiary. It defines

4

WTM/ASB/CFID-SEC4/25452/2022-23 dated 31st March 2023

5

IASB Chair Andreas Barckow at the IFRS Foundation Conference: Communicating Author may be reached at

with investors in uncertain times. eboard@icai.in

www.icai.org NOVEMBER 2023 23

You might also like

- Module 1 p1 Development of Financial Reporting FrameworkDocument5 pagesModule 1 p1 Development of Financial Reporting FrameworkluxasuhiNo ratings yet

- Cajournal May2021 9Document3 pagesCajournal May2021 9S M SHEKARNo ratings yet

- F7 notes 2Document4 pagesF7 notes 2Ahmed IqbalNo ratings yet

- Cfas Theories QuizletDocument4 pagesCfas Theories Quizletagm25No ratings yet

- Financial Accounting and Reporting NotesDocument6 pagesFinancial Accounting and Reporting NotesDarlene SarcinoNo ratings yet

- Overview Of: Regulatory FrameworkDocument43 pagesOverview Of: Regulatory FrameworkMohit BoralkarNo ratings yet

- Reviewer for CFAs Chapters 1-7Document17 pagesReviewer for CFAs Chapters 1-7Patrick Jayson VillademosaNo ratings yet

- Financial Statements Review Annual Report 2022.2023 1Document27 pagesFinancial Statements Review Annual Report 2022.2023 1s46856qsxnNo ratings yet

- Chapter 1 - Financial StatementsDocument2 pagesChapter 1 - Financial StatementsclarizaNo ratings yet

- 74928bos60524 cp15Document54 pages74928bos60524 cp15Kishan JainNo ratings yet

- Regulatory FrameworkDocument31 pagesRegulatory FrameworkMOHIT BORALKARNo ratings yet

- Guide Internal Control Over Financial Reporting 2019-05Document24 pagesGuide Internal Control Over Financial Reporting 2019-05hanafi prasentiantoNo ratings yet

- KPMG EEFF 2020Document248 pagesKPMG EEFF 2020Jose Martin PerezNo ratings yet

- Accountant July-September 2012Document123 pagesAccountant July-September 2012AviNo ratings yet

- CFASDocument3 pagesCFASMeybilene BernardoNo ratings yet

- Topic 1 To 17Document85 pagesTopic 1 To 17Ava JohnNo ratings yet

- Deloitte Internal Financial Controls Global ScenarioDocument12 pagesDeloitte Internal Financial Controls Global Scenariosarvjeet_kaushalNo ratings yet

- NG Internal Control Overview 18032015Document1 pageNG Internal Control Overview 18032015tunlinoo.067433No ratings yet

- EÝ S Report On IBC's Journey and Next Phase of ReformsDocument64 pagesEÝ S Report On IBC's Journey and Next Phase of ReformsamolrNo ratings yet

- CA Gautam Mitra: Centre For Management StudiesDocument36 pagesCA Gautam Mitra: Centre For Management StudiesRakesh KumarNo ratings yet

- Ssadi NotesDocument6 pagesSsadi NotesYnzon, Elaiza MarieNo ratings yet

- Audit Quick Review PDFDocument41 pagesAudit Quick Review PDFChunnu ChamkilaNo ratings yet

- Lecture 1. The Accountancy ProfessionDocument3 pagesLecture 1. The Accountancy ProfessionTee MendozaNo ratings yet

- Topic 1 - Conceptual Framework & Financial Reporting Environment in MalaysiaDocument58 pagesTopic 1 - Conceptual Framework & Financial Reporting Environment in MalaysiaHazim Badrin100% (1)

- CFAS ReviewerDocument11 pagesCFAS Reviewerbertochristine10No ratings yet

- Financial Reporting: Its Conceptual Framework: HapterDocument44 pagesFinancial Reporting: Its Conceptual Framework: HapterMarym MalikNo ratings yet

- Classification and Factors Influencing Accounting SystemsDocument7 pagesClassification and Factors Influencing Accounting SystemsAreebaNo ratings yet

- Conceptual Framework and Accounting StandardsDocument7 pagesConceptual Framework and Accounting StandardsJumel Alejandre DelunaNo ratings yet

- Topic I - Demand For Auditing and Assurance ServicesDocument7 pagesTopic I - Demand For Auditing and Assurance ServicesaragonkaycyNo ratings yet

- Conceptual Framework - LG Qualitative PDFDocument48 pagesConceptual Framework - LG Qualitative PDFKarl AndresNo ratings yet

- Analysis of Financial Statements: After Studying This Chapter, You Would Be Able ToDocument52 pagesAnalysis of Financial Statements: After Studying This Chapter, You Would Be Able ToDheeraj Turpunati100% (1)

- FAR 001 Conceptual FrameworkDocument4 pagesFAR 001 Conceptual FrameworkdreianyanmaraNo ratings yet

- Conceptual Framework for Financial ReportingDocument11 pagesConceptual Framework for Financial ReportingKimberly NuñezNo ratings yet

- Textual Learning Material - Module 3Document33 pagesTextual Learning Material - Module 3Jerry JohnNo ratings yet

- Financial Accounting Valix Summary 1-7Document13 pagesFinancial Accounting Valix Summary 1-7Noel Guerra94% (65)

- Ias & IfrsDocument6 pagesIas & IfrsIrfan SahirNo ratings yet

- CFAS Reviewer Ch. 1 5Document3 pagesCFAS Reviewer Ch. 1 5Precious AnneNo ratings yet

- 2.1 Concept of Corporate Financial ReportingDocument23 pages2.1 Concept of Corporate Financial ReportingAnilNo ratings yet

- Babe1-4 Conceptual FrameworkDocument7 pagesBabe1-4 Conceptual FrameworkJanelle Lyn MalapitanNo ratings yet

- IPSAS presentationDocument8 pagesIPSAS presentationgczdkcvhv5No ratings yet

- Chapter 1 - Introduction To Financial AccountingDocument28 pagesChapter 1 - Introduction To Financial AccountingTaehyung KimNo ratings yet

- Understanding A Financial Statement AuditDocument16 pagesUnderstanding A Financial Statement AuditHarshvardhan Singh ThakurNo ratings yet

- Quick Revision Guide: Auditing and AssuranceDocument29 pagesQuick Revision Guide: Auditing and AssuranceRamNo ratings yet

- Group3. FARR REPORT - SolfDocument8 pagesGroup3. FARR REPORT - SolfAnnguily Sumatra GaidNo ratings yet

- Materi Anung Herlianto - Webinar IAPI-ACCA "Key Audit Matters in The Context of The New Audit Regulation"Document13 pagesMateri Anung Herlianto - Webinar IAPI-ACCA "Key Audit Matters in The Context of The New Audit Regulation"sus antoNo ratings yet

- Financial Reporting Conceptual FrameworkDocument69 pagesFinancial Reporting Conceptual FrameworkAke KevaleeNo ratings yet

- Far 02 Conceptual Framework For Financial Reporting CompressDocument11 pagesFar 02 Conceptual Framework For Financial Reporting CompressDaphnie Loise CalderonNo ratings yet

- CFAS Module 2 - ReviewerDocument4 pagesCFAS Module 2 - ReviewerAthena LedesmaNo ratings yet

- Corporate Insolvency Resolution Procedure Under Indian Insolvency and Bankruptcy Code, 2016: A Comparative PerspectiveDocument8 pagesCorporate Insolvency Resolution Procedure Under Indian Insolvency and Bankruptcy Code, 2016: A Comparative PerspectiveDeva SharmaNo ratings yet

- Paper Test 4Document9 pagesPaper Test 4jokoNo ratings yet

- Article Summary Week 3Document15 pagesArticle Summary Week 3khunaina il khafa ainul NazilatulNo ratings yet

- Referencer For Quick Revision: Intermediate Course Paper-6: Auditing and AssuranceDocument32 pagesReferencer For Quick Revision: Intermediate Course Paper-6: Auditing and AssuranceCutfit HardNo ratings yet

- CFAS Qualifying Exam ReviewerDocument15 pagesCFAS Qualifying Exam ReviewerJoyceNo ratings yet

- Summary of Accounting Standards (B-Ok - Xyz) PDFDocument138 pagesSummary of Accounting Standards (B-Ok - Xyz) PDFFryd PurabNo ratings yet

- ArticlesDocument254 pagesArticlesRiaz IbrahimNo ratings yet

- Introduction To Business FinanceDocument42 pagesIntroduction To Business FinanceKaylie EspinosaNo ratings yet

- Audit CapsuleDocument20 pagesAudit Capsulevishnuverma100% (1)

- CFAS Qualifying Exam ReviewerDocument20 pagesCFAS Qualifying Exam ReviewerCher Na100% (4)

- World Development Report 2022: Finance for an Equitable RecoveryFrom EverandWorld Development Report 2022: Finance for an Equitable RecoveryNo ratings yet

- ISO 22301: 2019 - An introduction to a business continuity management system (BCMS)From EverandISO 22301: 2019 - An introduction to a business continuity management system (BCMS)Rating: 4 out of 5 stars4/5 (1)

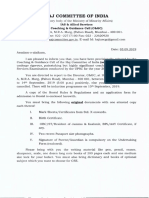

- Haj Committee of India: Tat Tory o Yoft e Ry I yDocument11 pagesHaj Committee of India: Tat Tory o Yoft e Ry I ysayyedarif51No ratings yet

- The Art of Strategic Leadership Chapter 2 - The BusinessDocument6 pagesThe Art of Strategic Leadership Chapter 2 - The BusinessAnnabelle SmythNo ratings yet

- Indian Constitutional Law and Philosophy - Page 9Document32 pagesIndian Constitutional Law and Philosophy - Page 9Prinsu SenNo ratings yet

- Profile Creation CA2Document15 pagesProfile Creation CA2AarizNo ratings yet

- Macro Solved Ma Econmoics NotesDocument120 pagesMacro Solved Ma Econmoics NotesSaif ali KhanNo ratings yet

- Performance of the Black Nazarene Procession Reveals Pilgrims' ThoughtsDocument7 pagesPerformance of the Black Nazarene Procession Reveals Pilgrims' Thoughtsanon_369627105No ratings yet

- Securing Against The Most Common Vectors of Cyber AttacksDocument30 pagesSecuring Against The Most Common Vectors of Cyber AttacksCandra WidiatmokoNo ratings yet

- BA 6th Sem INFLECTION AND DERIVATION NOTE PDFDocument2 pagesBA 6th Sem INFLECTION AND DERIVATION NOTE PDFRo Lu100% (1)

- Bar Graph Unit MonthDocument2 pagesBar Graph Unit MonthsushantinhbiNo ratings yet

- Forced Removal: The Division, Segregation, and Control of The People of South AfricaDocument96 pagesForced Removal: The Division, Segregation, and Control of The People of South Africas_annaNo ratings yet

- Design & Development ISODocument6 pagesDesign & Development ISOمختار حنفىNo ratings yet

- Framework of Understanding Taxes in The Philippines-1Document9 pagesFramework of Understanding Taxes in The Philippines-1Mergierose DalgoNo ratings yet

- Community Engagement Solidarity and Citizenship 1Document51 pagesCommunity Engagement Solidarity and Citizenship 1arnie rose BalaNo ratings yet

- Rule: National Driver Register Problem Driver Pointer System Participation and Data Receipt ProceduresDocument8 pagesRule: National Driver Register Problem Driver Pointer System Participation and Data Receipt ProceduresJustia.com100% (1)

- Web & Apps PortfolioDocument34 pagesWeb & Apps PortfolioirvingNo ratings yet

- Quality Home AppliancesDocument3 pagesQuality Home AppliancesKevin WillisNo ratings yet

- PSYC 2026 Assignment 1 - Individual Project - 25%Document9 pagesPSYC 2026 Assignment 1 - Individual Project - 25%Carissann ModesteNo ratings yet

- SaharaDocument103 pagesSaharaMahesh TejaniNo ratings yet

- Financial Statement Analysis: Mcgraw-Hill/IrwinDocument32 pagesFinancial Statement Analysis: Mcgraw-Hill/IrwinAnonymous bf1cFDuepPNo ratings yet

- Moises Sanchez-Zaragoza, A077 273 744 (BIA July 14, 2016)Document8 pagesMoises Sanchez-Zaragoza, A077 273 744 (BIA July 14, 2016)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Anckar - On The Applicability of The Most Similar Systems Design and The Most Different Systems Design in Comparative ResearchDocument14 pagesAnckar - On The Applicability of The Most Similar Systems Design and The Most Different Systems Design in Comparative ResearchA0% (1)

- Home Power Magazine - Issue 132 - 2009 08 09Document132 pagesHome Power Magazine - Issue 132 - 2009 08 09Adriana OrtegaNo ratings yet

- Electrical MentorDocument3 pagesElectrical Mentoresk1234No ratings yet

- Encuesta Sesión 6 - Inglés 3 - Septiembre 29 - Prof. Oscar NiquénDocument3 pagesEncuesta Sesión 6 - Inglés 3 - Septiembre 29 - Prof. Oscar NiquénRobacorazones TkmNo ratings yet

- 2nd Summative Test in English 10Document1 page2nd Summative Test in English 10KyohyunNo ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument6 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnSkarlz ZyNo ratings yet

- Inverted SentencesDocument36 pagesInverted SentencesCygfrid Buenviaje100% (1)

- ProCapture-T User Manual V1.1 - 20210903 PDFDocument65 pagesProCapture-T User Manual V1.1 - 20210903 PDFahmad khanNo ratings yet

- National Educational PolicyDocument5 pagesNational Educational Policyarchana vermaNo ratings yet

- HolaDocument5 pagesHolaioritzNo ratings yet