Professional Documents

Culture Documents

CH 1. The Nature of Econometrics and Economic Data

Uploaded by

Fasiko AsmaroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 1. The Nature of Econometrics and Economic Data

Uploaded by

Fasiko AsmaroCopyright:

Available Formats

Econ 3044: Introduction to Econometrics

Chapter-1: The Nature of Econometrics and Economic

Data

Lemi Taye

Addis Ababa University

lemi.taye@aau.edu.et

March 25, 2021

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 1 / 30

Definition and Scope of Econometrics

What is econometrics?

Econometrics = use of statistical methods to analyze economic data

Econometricians typically analyze nonexperimental data

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 2 / 30

Definition and Scope of Econometrics

Typical goals of econometric analysis

Estimating relationships between economic variables

Testing economic theories and hypotheses

Forecasting economic variables

Evaluating and implementing government and business policy

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 3 / 30

Definition and Scope of Econometrics

Steps in an econometric analysis

1 Economic model

2 Econometric model

Economic models

I Maybe micro- or macromodels

I Often use optimizing behaviour, equilibrium modeling, ...

I Establish relationships between economic variables

I Examples: demand equations, pricing equations, ...

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 4 / 30

Definition and Scope of Econometrics

Steps in an econometric analysis

An econometric model consists of a set of behavioral equations

derived from the economic model.

These equations involve some observed variables and some

“disturbances” (which are a catchall for all the variables considered

irrelevant for the purpose of this model).

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 5 / 30

Definition and Scope of Econometrics

Economic vs. Econometric Models

Example

Taking the simplest example of a demand model:

Q = b0 + b1 P + b2 P0 + b3 Y + b4 t

An econometric model would be of the stochastic form:

Q = b0 + b1 P + b2 P0 + b3 Y + b4 t + u

where u stands for the random factors which affect the quantity demanded.

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 6 / 30

Definition and Scope of Econometrics

Economic vs. Econometric Models

Example (Job Training and Worker productivity)

Basic economic understanding is sufficient for realizing that factors such as

education, experience, and training affect worker productivity. This simple

reasoning leads to a model such as

wage = f (educ, exper, training),

A complete econometric model might be

wage = β0 + β1 educ + β2 exper + β3 training + u,

where the term u contains factors such as “innate ability,” quality of

education, family background, and the myriad other factors that can

influence a person’s wage.

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 7 / 30

Methodology of Econometrics

Methodology of Econometrics

Broadly speaking, traditional econometric methodology proceeds along

the following lines:

1 Statement of theory or hypothesis.

2 Specification of the mathematical model of the theory.

3 Specification of the statistical, or econometric, model.

4 Obtaining the data.

5 Estimation of the parameters of the econometric model.

6 Hypothesis testing.

7 Forecasting or prediction.

8 Using the model for control or policy purposes.

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 8 / 30

Methodology of Econometrics

Methodology of Econometrics

To illustrate the preceding steps, let us consider the well-known

Keynesian theory of consumption.

1. Statement of theory or hypothesis

Keynes postulated that the marginal propensity to consume

(MPC),the rate of change of consumption for a unit (say, a dollar)

change in income, is greater than zero but less than 1.

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 9 / 30

Methodology of Econometrics

Methodology of Econometrics

2. Specification of the Mathematical Model of Consumption

For simplicity, a mathematical economist might suggest the following

form of the Keynesian consumption function:

Y = β1 + β2 X 0 < β2 < 1

where Y = consumption expenditure and X = income, and where β1

and β2 , known as the parameters of the model, are, respectively, the

intercept and slope coefficients.

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 10 / 30

Methodology of Econometrics

Methodology of Econometrics

3. Specification of the Econometric Model of Consumption

I The relationships between economic variables are generally inexact. In

addition to income, other variables affect consumption expenditure.

For example, size of family, ages of the members in the family, family

religion, etc., are likely to exert some influence on consumption.

I To allow for the inexact relationships between economic variables, the

mathematical equation is modified as follows:

Y = β1 + β2 X + u 0 < β2 < 1

where u is disturbance term or error term. It is a random or stochastic

variable.

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 11 / 30

Methodology of Econometrics

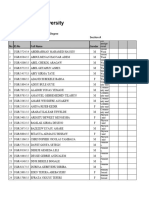

4. Obtaining Data

I An econometric model requires data on all the variables in the model.

Figure: Data on Y (Personal Consumption Expenditure) and X (Gross

Domestic Product), both in Billions of Dollars

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 12 / 30

Methodology of Econometrics

Methodology of Econometrics

5. Estimation of the Econometric Model

I The actual mechanics of estimating the parameters will be discussed in

Chapter 2. For now, note that the statistical technique of regression

analysis is the main tool used to obtain the estimates.

I Using this technique and the data given in Table 1, we obtain the

following estimates of β1 and β2 , namely, 299.5913 and 0.7218. Thus,

the estimated consumption function is:

Ŷt = −299.5913 + 0.7218Xt

I The hat on the Y indicates that it is an estimate.

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 13 / 30

Methodology of Econometrics

Methodology of Econometrics

6. Hypothesis Testing

Are the estimates in accord with the expectations of the theory that is

being tested? Is M P C < 1 statistically?

7. Forecasting or Prediction

I With given future value(s) of X, what is the future value(s) of Y ?

I Example: if GDP=$6000Bill in 1994, what is the forecast consumption

expenditure?

Ŷ = −299.5913 + 0.7218(6000) ≈ 4031.21

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 14 / 30

Methodology of Econometrics

Methodology of Econometrics

8. Use of the Model for Control or Policy Purposes

I Suppose that the government believes that consumer expenditure of

about 8750 (billions of 2000 dollars) will keep the unemployment rate

at its current level of about 4.2 percent (early 2006). What level of

income will guarantee the target amount of consumption expenditure?

I If the regression results seem reasonable, simple arithmetic will show

that

8750 = −299.5913 + 0.7218(GDP2006 )

which gives X = 12537, approximately.

I That is, an income level of about 12537 (billion) dollars, given an

M P C of about 0.72, will produce an expenditure of about 8750 billion

dollars.

I By appropriate fiscal and monetary policy mix, the government can

manipulate the control variable X to produce the desired level of the

target variable Y .

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 15 / 30

Types of Data for Econometric Analysis

Types of Data for Econometric Analysis

Data based on sources is classified in to primary and secondary.

Data types can also be classified as:

Non-experimental vs. experimental data

I Non-experimental data are obtained from observations of a system that

is not subject to experimental control, while experimental data are

obtained from controlled experiments in laboratory.

Qualitative versus quantitative data

I Data, as a matter of definition, is quantitative. Thus facts, which are

already expressed as numbers.

I There are also variables, which are qualitative by nature and variables

which show qualitative shifts over time or space.

I Such qualitative information is usually quantified by what are known as

dummy variables .

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 16 / 30

Types of Data for Econometric Analysis

The Structure of Economic Data

Economic data sets come in a variety of types.

Whereas some econometric methods can be applied with little or no

modification to many different kinds of data sets, the special features

of some data sets must be accounted for or should be exploited.

The most important data structures encountered in applied work

include the following:

1 Cross-Sectional Data

2 Time Series Data

3 Pooled Cross Sections

4 Panel or Longitudinal Data

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 17 / 30

Types of Data for Econometric Analysis

Cross-Sectional Data

1. Cross-Sectional Data

Sample of individuals, households, firms, cities, states, countries, or

other units of interest at a given point of time/in a given period.

Cross-sectional observations are more or less independent.

For example, pure random sampling from a population.

Sometimes pure random sampling is violated, e.g. units refuse to

respond in surveys, or if sampling is characterized by clustering

Cross-sectional data typically encountered in applied microeconomics

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 18 / 30

Types of Data for Econometric Analysis

Cross-Sectional Data (Continued)

Example

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 19 / 30

Types of Data for Econometric Analysis

Time Series Data

Observations of a variable or several variables over time.

For example, stock prices, money supply, consumer price index, gross

domestic product, annual homicide rates, automobile sales, etc.

Time series observations are typically serially correlated.

Ordering of observations conveys important information.

Data frequency: daily, weekly, monthly, quarterly, annually, etc.

Typical features of time series: trends and seasonality.

Typical applications: applied macroeconomics and finance.

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 20 / 30

Types of Data for Econometric Analysis

Time Series Data (Continued)

Example

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 21 / 30

Types of Data for Econometric Analysis

Pooled Cross Sections

Two or more cross sections are combined in one data set

Cross sections are drawn independently of each other

Pooled cross sections often used to evaluate policy changes

Example:

I Evaluate effect of change in property taxes on house prices.

I Random sample of house prices for the year 1993

I A new random sample of house prices for the year 1995.

I Compare before/after (1993: before reform, 1995: after reform).

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 22 / 30

Types of Data for Econometric Analysis

Pooled Cross Sections (Continued)

Example

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 23 / 30

Types of Data for Econometric Analysis

Panel or Longitudinal Data

The same cross-sectional units are followed over time.

Panel data have a cross-sectional and a time series dimension.

Panel data can be used to account for time-invariant unobservables.

Panel data can be used to model lagged responses.

Example:

I City crime statistics; each city is observed in two years.

I Time-invariant unobserved city characteristics may be modeled.

I Effect of police on crime rates may exhibit time lag.

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 24 / 30

Types of Data for Econometric Analysis

Panel or Longitudinal Data (Continued)

Example

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 25 / 30

Types of Data for Econometric Analysis

Causality and the Notion of Ceteris Paribus

Definition of causal effect of x on y:

How does variable y change if variable x is changed but all other relevant

factors are held constant?

Most economic questions are ceteris paribus questions.

It is important to define which causal effect one is interested in

It is useful to describe how an experiment would have to be designed

to infer the causal effect in question

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 26 / 30

Types of Data for Econometric Analysis

Causality and the Notion of Ceteris Paribus

Example (Effects of Fertilizer on Crop Yield)

Q: "By how much will the production of soybeans increase if one

increases the amount of fertilizer applied to the ground?"

Implicit assumption: all other factors that influence crop yield such as

quality of land, rainfall, presence of parasites etc. are held fixed

Experiment:

Choose several one-acre plots of land; randomly assign different

amounts of fertilizer to the different plots; compare yields

Experiment works because amount of fertilizer applied is unrelated to

other factors influencing crop yields

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 27 / 30

Types of Data for Econometric Analysis

Causality and the Notion of Ceteris Paribus

Example (Effect of Education on Earnings)

Q: "If a person is chosen from the population and given another year

of education, by how much will his or her wage increase?"

Implicit assumption: all other factors that influence wages such as

experience, family background, intelligence etc. are held fixed

Experiment:

Choose a group of people; randomly assign different amounts of

eduction to them (infeasable!); compare wage outcomes

Problem without random assignment: amount of education is related

to other factors that influence wages (e.g. intelligence)

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 28 / 30

Types of Data for Econometric Analysis

Causality and the Notion of Ceteris Paribus

Reading Assignment:

I Wooldridge (2019). Introductory Econometrics: A Modern Approach.

Ch. 1

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 29 / 30

Types of Data for Econometric Analysis

************* End of Chapter One *************

Lemi Taye (AAUSC) Ch 1: Introduction March 25, 2021 30 / 30

You might also like

- Stochastic Economics: Stochastic Processes, Control, and ProgrammingFrom EverandStochastic Economics: Stochastic Processes, Control, and ProgrammingNo ratings yet

- Econ 3044: Introduction To Econometrics Chapter-1: IntroductionDocument37 pagesEcon 3044: Introduction To Econometrics Chapter-1: IntroductionBizu AtnafuNo ratings yet

- CH 1Document28 pagesCH 1Desala HabteNo ratings yet

- Econometrics ModuleDocument185 pagesEconometrics ModuleTsinatNo ratings yet

- Econometrics Module 2Document185 pagesEconometrics Module 2Neway Alem100% (1)

- EconometricsDocument8 pagesEconometricssamidan tubeNo ratings yet

- Chapter 1Document5 pagesChapter 1Minaw BelayNo ratings yet

- Basics of EconometricsDocument10 pagesBasics of Econometricsstutis006No ratings yet

- Econometrics: Introduction To The Econometrics DisciplineDocument10 pagesEconometrics: Introduction To The Econometrics DisciplinesajidalirafiqueNo ratings yet

- Chapter One: Introduction: 1.1 Definition and Scope of EconometricsDocument8 pagesChapter One: Introduction: 1.1 Definition and Scope of EconometricsGetachew HussenNo ratings yet

- Eco CH1Document33 pagesEco CH1mesfinabera180No ratings yet

- AIS Lecture 1Document27 pagesAIS Lecture 1Crazy SoulNo ratings yet

- CH 1 EconometricsDocument49 pagesCH 1 EconometricsGenemo FitalaNo ratings yet

- Chapter 01 - EMDocument44 pagesChapter 01 - EMRashmi RathnayakaNo ratings yet

- Topic 1 Introduction To EconometricsDocument34 pagesTopic 1 Introduction To EconometricsEileen WongNo ratings yet

- Applied Econometrics CHAPTER 1 (Autosaved)Document19 pagesApplied Econometrics CHAPTER 1 (Autosaved)Mintayto TebekaNo ratings yet

- By: Domodar N. Gujarati: Prof. M. El-SakkaDocument19 pagesBy: Domodar N. Gujarati: Prof. M. El-SakkarohanpjadhavNo ratings yet

- Econometric SDocument26 pagesEconometric SMunnah BhaiNo ratings yet

- Chapter One (Econ-3061)Document11 pagesChapter One (Econ-3061)abebealemu292112No ratings yet

- Introduction EconometricsDocument27 pagesIntroduction EconometricsRamjan Ali100% (1)

- SRSTRT ModDocument184 pagesSRSTRT ModTsinat100% (1)

- Econometrics 1 Topic 1Document38 pagesEconometrics 1 Topic 1Iskandar ZulkarnaenNo ratings yet

- Ntroduction and Overview of The and Overview of The Course Course Course CourseDocument34 pagesNtroduction and Overview of The and Overview of The Course Course Course CourseArbi ChaimaNo ratings yet

- Unit 1 PDFDocument10 pagesUnit 1 PDFSabaa ifNo ratings yet

- Introduction First Lecture in ClassDocument27 pagesIntroduction First Lecture in ClassbaltimorluNo ratings yet

- 1 EconometricsDocument63 pages1 Econometricsanesahmedtofik932No ratings yet

- ECN 5121 Econometric Methods IDocument19 pagesECN 5121 Econometric Methods IjingNo ratings yet

- Topic 2 - Stages of Econometric ResearchDocument16 pagesTopic 2 - Stages of Econometric Researchshaibu amanaNo ratings yet

- Chapter 1Document61 pagesChapter 1Legese TusseNo ratings yet

- Econometrics Chapter 1& 2Document35 pagesEconometrics Chapter 1& 2Dagi AdanewNo ratings yet

- chp1 EconometricDocument52 pageschp1 EconometricCabdilaahi CabdiNo ratings yet

- Problem Formulation &ECONOMETRICSDocument16 pagesProblem Formulation &ECONOMETRICSAbhimanyu VermaNo ratings yet

- شابتر 1Document18 pagesشابتر 1Omar SalehNo ratings yet

- Presentation On EconometricsDocument12 pagesPresentation On EconometricsMajestic QueenNo ratings yet

- Econometrics For MGT Chapter1Document24 pagesEconometrics For MGT Chapter1yodahekahsay19No ratings yet

- ETW2410 Introductory Econometrics: Lecture Slides Week 1Document21 pagesETW2410 Introductory Econometrics: Lecture Slides Week 1Mohammad RashmanNo ratings yet

- Chapter 1Document26 pagesChapter 1Hamid UllahNo ratings yet

- Day 2 Introduction To EconometricsDocument11 pagesDay 2 Introduction To EconometricsSegoata EvandaNo ratings yet

- The Nature and Scope of Econometrics: Confirming PagesDocument18 pagesThe Nature and Scope of Econometrics: Confirming PagesHasnain GhaniNo ratings yet

- Chapter 1. IntroductionDocument28 pagesChapter 1. IntroductionShalom FikerNo ratings yet

- Econometrics Material For Exit ExamDocument81 pagesEconometrics Material For Exit Examlemma4aNo ratings yet

- CH - 1 - Econometrics UGDocument8 pagesCH - 1 - Econometrics UGMewded DelelegnNo ratings yet

- CH 1. IntroductionDocument18 pagesCH 1. Introductiontemesgen yohannesNo ratings yet

- Econometrics For ManagementDocument53 pagesEconometrics For Managementetebark h/michaleNo ratings yet

- Chapter OneDocument5 pagesChapter OneHabtamu BoreNo ratings yet

- Econometrics Chapter # 0: IntroductionDocument19 pagesEconometrics Chapter # 0: IntroductioncoliNo ratings yet

- EconometricsDocument115 pagesEconometricstilahun menamoNo ratings yet

- EcotrixDocument23 pagesEcotrixDanish ShaikhNo ratings yet

- IntroduEconometrics - MBA 525 - FEB2024Document266 pagesIntroduEconometrics - MBA 525 - FEB2024Aklilu GirmaNo ratings yet

- Econometrics Notes PDFDocument8 pagesEconometrics Notes PDFumamaheswariNo ratings yet

- Econometrics Notes of BookDocument161 pagesEconometrics Notes of Booksarahjamal9084908No ratings yet

- Econometrics MethodologiesDocument4 pagesEconometrics MethodologiesKamran AliNo ratings yet

- Chapter 2 in Managerial EconomicDocument54 pagesChapter 2 in Managerial EconomicmyraNo ratings yet

- Chapter 1Document11 pagesChapter 1sintayehugonfa988No ratings yet

- Basic EconometricsDocument18 pagesBasic EconometricsGetachew HussenNo ratings yet

- Basic Econometrics Lectues 1Document18 pagesBasic Econometrics Lectues 1Sadhu PramuditaNo ratings yet

- Econometrics Lecture Notes BookletDocument81 pagesEconometrics Lecture Notes BookletilmaNo ratings yet

- Nature and Scope of EconometricsDocument2 pagesNature and Scope of EconometricsDebojyoti Ghosh86% (7)

- Econometrics Till MidsemDocument236 pagesEconometrics Till MidsemApurv PatelNo ratings yet

- Econometrics Lecture Houndout FinalDocument115 pagesEconometrics Lecture Houndout FinalKelem DessalegnNo ratings yet

- Human and Women S RightDocument10 pagesHuman and Women S RightFasiko AsmaroNo ratings yet

- QUALITATIVEDocument163 pagesQUALITATIVEFasiko AsmaroNo ratings yet

- Ethiopia - Health Accounts 2019-20 (SHA 2011)Document44 pagesEthiopia - Health Accounts 2019-20 (SHA 2011)Wondimu TegegneNo ratings yet

- Chapter FourDocument29 pagesChapter FourFasiko AsmaroNo ratings yet

- Social Work Year 2A ListDocument4 pagesSocial Work Year 2A ListFasiko AsmaroNo ratings yet

- Chapter 1 and 2Document111 pagesChapter 1 and 2Fasiko AsmaroNo ratings yet

- Session 5 - Assessment and Planning With IndividualsDocument30 pagesSession 5 - Assessment and Planning With IndividualsFasiko AsmaroNo ratings yet

- Aregay Editd ProposalDocument25 pagesAregay Editd ProposalFasiko AsmaroNo ratings yet

- 4 5868236919153887449-1Document49 pages4 5868236919153887449-1Fasiko Asmaro100% (1)

- Abenezer Worku (2121) - 1Document38 pagesAbenezer Worku (2121) - 1Fasiko AsmaroNo ratings yet

- Ifrs 17 Project SummaryDocument16 pagesIfrs 17 Project Summarymarhadi100% (1)

- ECO - Chapter 2 SLRMDocument40 pagesECO - Chapter 2 SLRMErmias GuragawNo ratings yet

- 03 Multiple RegressionDocument50 pages03 Multiple RegressionLidiya wodajenehNo ratings yet

- 04 Violation of Assumptions AllDocument24 pages04 Violation of Assumptions AllFasiko AsmaroNo ratings yet

- Ch03 II Revenue RecognitionDocument138 pagesCh03 II Revenue RecognitionFasiko AsmaroNo ratings yet

- ADVANCED FA Chap IIIDocument7 pagesADVANCED FA Chap IIIFasiko Asmaro100% (1)

- Midwifery Program CatalogueDocument20 pagesMidwifery Program CatalogueMhelshy Villanueva100% (1)

- ExpertSystems RSCH PaperDocument7 pagesExpertSystems RSCH PaperYash BalharaNo ratings yet

- Industrial TrainingDocument1 pageIndustrial TrainingRohit GuptaNo ratings yet

- "Event Management": Bharati Vidyapeeth University School of Distance EducationDocument19 pages"Event Management": Bharati Vidyapeeth University School of Distance EducationkammyNo ratings yet

- Field Work No.1. (Pacing)Document3 pagesField Work No.1. (Pacing)JAY-AR DISOMIMBANo ratings yet

- Half Yearly Exam 2022Document2 pagesHalf Yearly Exam 2022Ilay RajaNo ratings yet

- The Standard of Civilisation' in World Politics - LinklaterDocument17 pagesThe Standard of Civilisation' in World Politics - LinklaterDanielNo ratings yet

- Kitab Al-AsarDocument327 pagesKitab Al-AsarAnon_Prophet100% (5)

- Black Holes, Wormholes and The Secrets of Quantum SpacetimeDocument7 pagesBlack Holes, Wormholes and The Secrets of Quantum SpacetimeFr Joby PulickakunnelNo ratings yet

- Ethical Issues in PsychologyDocument16 pagesEthical Issues in PsychologyQasim Ali ShahNo ratings yet

- Time Travel Formula PowerDocument1 pageTime Travel Formula PowerJoey Warne100% (1)

- Lydia Halls TheoryDocument15 pagesLydia Halls TheoryLyka PacsoderonNo ratings yet

- PR 1 DLPDocument3 pagesPR 1 DLPRubenNo ratings yet

- Astrigue 2014 BookletDocument110 pagesAstrigue 2014 BookletgayNo ratings yet

- Sophia Roosth: Crafting Life: A Sensory Ethnography of Fabricated Biologies (2010)Document326 pagesSophia Roosth: Crafting Life: A Sensory Ethnography of Fabricated Biologies (2010)Hodie CsillaNo ratings yet

- VOL. 28 (S1) 2020: A Special Issue Devoted ToDocument399 pagesVOL. 28 (S1) 2020: A Special Issue Devoted ToSuviana SudartoNo ratings yet

- Scientific American MagazineDocument92 pagesScientific American MagazineCarolina Chakur100% (1)

- 2018 ECE Annex II - Sample ECE Curriculum Map 2018Document3 pages2018 ECE Annex II - Sample ECE Curriculum Map 2018Janice PusposNo ratings yet

- 4.determines The Objectives and Structures of ReportsDocument23 pages4.determines The Objectives and Structures of ReportsJustineNo ratings yet

- Eckman PDFDocument6 pagesEckman PDFLFNo ratings yet

- Grade Five Capstone ProjectDocument5 pagesGrade Five Capstone Projectapi-79455357No ratings yet

- Fairhurst e Putnam Organization As Discursive ConstructionsDocument22 pagesFairhurst e Putnam Organization As Discursive ConstructionsFábio MelgesNo ratings yet

- Writing A Publishable Paper 2Document29 pagesWriting A Publishable Paper 2Hanelen DadaNo ratings yet

- Task - Case Study - DLMDSME01Document7 pagesTask - Case Study - DLMDSME01Brayan NRLNo ratings yet

- UntitledDocument100 pagesUntitledwilliamp997No ratings yet

- Chapter 7Document5 pagesChapter 7Sami Ullah Khan NiaziNo ratings yet

- Aristotle On Induction and First PrinciplesDocument20 pagesAristotle On Induction and First PrinciplesAsfaw MisikerNo ratings yet

- Photoelectric EffectDocument15 pagesPhotoelectric EffectAjlaNo ratings yet

- Environ Mental Awaren ESS: College of Teacher EducationDocument8 pagesEnviron Mental Awaren ESS: College of Teacher EducationJacob AgboNo ratings yet

- Bitadton National High SchoolDocument3 pagesBitadton National High SchoolMailene Magsico100% (1)