Professional Documents

Culture Documents

Ordinance Amending Section 37 (D), Article Ii, Chapter Ii of Ordinance No. 241, S. 1994, Otherwise Known As The Pasay City Revenue Code.

Ordinance Amending Section 37 (D), Article Ii, Chapter Ii of Ordinance No. 241, S. 1994, Otherwise Known As The Pasay City Revenue Code.

Uploaded by

Anaiah HoneyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ordinance Amending Section 37 (D), Article Ii, Chapter Ii of Ordinance No. 241, S. 1994, Otherwise Known As The Pasay City Revenue Code.

Ordinance Amending Section 37 (D), Article Ii, Chapter Ii of Ordinance No. 241, S. 1994, Otherwise Known As The Pasay City Revenue Code.

Uploaded by

Anaiah HoneyCopyright:

Available Formats

REPUBLIC OF THE PHILIPPINES

SANGGUNIANG PANLUNGSOD

PASAYCITY

��

! ;��-

\ � ORDINANCE NO. sso S, 19996

, \�RDINANCE AMENDING SECTION 37 (d), ARTICLE II, CHAPTER

"- II OF ORDINANCE NO. 241, S. 1994, OTHERWISE KNOWN AS THE

PASAY CITY REVENUE CODE

Sponsored by: Councilors TEODUW R. WRCA, JR

and ROMUW M. CABRERA

----------------------------------

WHEREAS Section 37 (d), Artticlle Il, Chapter Il of Ordinance No. 241, S.

1994, reads as follows:

�

"Gross sales c ,or Receipt for the preceding calendar year of:

P400,000.00 or less ............ 3%

400,000.00 or more ............. 2%"

WHEREAS, the percentages for FOUR HUNDRED 'fl/OUSAND(P400, 000. 00)

PESOS in said ordinance overlap with one another resulting to confusion on the amount

to be charge for gross sales or receipts for said amount;

WHEREAS, Section 151, Article ill of Republic Act 7160 provides:''that the

rates of taxes that the City levy may exceed the maximum rates allowed for the province

or municipality by not more than fifty percent ( 50%) except the rates of professional and

amusement taxes";

WB�S, Section 37 (d), Article II, Chapter Il of the Pasay City Revenue

Code, particularly with respect to "P400,000.00 or more" exceeded the increase allowed

by Section 151, Article II of Republic Act 7160;

WHEREAS, there is a need to amend the said ordinance in order to conform

·th RA 7160 and to remove the confusion on the overlapping amount ofP400,000.00;

NOW THEREFORE, be it ORDAINED as it is hereby ORDAINED, in session

duly assembled, that:

SECTION 1. Section 37 (d), Article II, Chapter II of Ordinance No. 241, S.-

1994, otherwise known as the Pasay City Revenue Code is hereby amended to read as

follows:

FOR THE PRECEDING YEAR OF:

0,000.00 or less ................ 3%

More than P400,000.00........... l 1/2%"

.

h,-..(

You might also like

- NCWS Core Manual PDFDocument146 pagesNCWS Core Manual PDFnolan50% (2)

- Islamic-Finance-Book Volume 4 Web PDFDocument166 pagesIslamic-Finance-Book Volume 4 Web PDFlarbiNo ratings yet

- Role of Sebi in Corporate GoveranceDocument13 pagesRole of Sebi in Corporate GoveranceTanima RoyNo ratings yet

- Le Road Traffic (Amendment) Act 2018Document43 pagesLe Road Traffic (Amendment) Act 2018L'express Maurice100% (2)

- Ordinance 750, S-2019 - 0001 PDFDocument26 pagesOrdinance 750, S-2019 - 0001 PDFalayka anuddinNo ratings yet

- An Ordinance Amending Section 37 (G) Article Ii of Pasay City Ordinance No. 241 - Series of 1993, Otherwise Known As The Ordinance Adopting The Pasay City Revenue Code.Document2 pagesAn Ordinance Amending Section 37 (G) Article Ii of Pasay City Ordinance No. 241 - Series of 1993, Otherwise Known As The Ordinance Adopting The Pasay City Revenue Code.Anaiah HoneyNo ratings yet

- Piltdtml: @0egu, TdeDocument4 pagesPiltdtml: @0egu, TdeNawabNo ratings yet

- KP Finance Act 2021Document19 pagesKP Finance Act 2021Arshad MahmoodNo ratings yet

- Finance (Supplementary) Act, 2023Document9 pagesFinance (Supplementary) Act, 2023Umair NeoronNo ratings yet

- Finance Bill 2014Document75 pagesFinance Bill 2014Irfan KhanNo ratings yet

- Stat ConDocument103 pagesStat Confusker123No ratings yet

- TheFinanace (Supplementary) Act2022Document24 pagesTheFinanace (Supplementary) Act2022Syed Adnan raza ShahNo ratings yet

- rymw1: Ea AzaDocument5 pagesrymw1: Ea AzajosephineNo ratings yet

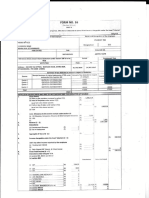

- Form 16 2017 of Prabhat RajDocument2 pagesForm 16 2017 of Prabhat RajDevendra singhNo ratings yet

- "Section 450. Requisites For Creation.Document2 pages"Section 450. Requisites For Creation.Lynlyn JaranillaNo ratings yet

- Tamil Nadu Government Gazette: ExtraordinaryDocument2 pagesTamil Nadu Government Gazette: ExtraordinaryNavya S RadhakrishnanNo ratings yet

- RR No. 23-2018Document2 pagesRR No. 23-2018nathalie velasquezNo ratings yet

- Tax Codal NewDocument11 pagesTax Codal NewPrincess Hazel GriñoNo ratings yet

- Title I: ERN17490 S.L.CDocument172 pagesTitle I: ERN17490 S.L.CCBS News PoliticsNo ratings yet

- BetterCareJuly13 2017Document172 pagesBetterCareJuly13 2017kballuck10% (2)

- Codified Ammendatory OrdinancesDocument39 pagesCodified Ammendatory OrdinancesbassarrabsNo ratings yet

- Sps. Sinamban v. China Banking Corporation, G.R. 193890, March 11, 2015Document10 pagesSps. Sinamban v. China Banking Corporation, G.R. 193890, March 11, 2015Albertjohn ZamarNo ratings yet

- Cuomo Vetoes 2020Document7 pagesCuomo Vetoes 2020Amanda Fries50% (2)

- RR No. 8-2022Document4 pagesRR No. 8-2022rodrigoNo ratings yet

- 61cdbb8ff11ef 645Document33 pages61cdbb8ff11ef 645Junaid iqbalNo ratings yet

- 2019rev MS417Document3 pages2019rev MS417Mallikarjun KanumaNo ratings yet

- Amplified Noise Emergency Amendment ActDocument3 pagesAmplified Noise Emergency Amendment ActRachel KurziusNo ratings yet

- !:ourt: L/epublic of TbeDocument21 pages!:ourt: L/epublic of TbeHannah Keziah Dela CernaNo ratings yet

- Amendments To CREATE IRRDocument3 pagesAmendments To CREATE IRRJeffrey JosolNo ratings yet

- Ransl (Il: XX/J XalDocument1 pageRansl (Il: XX/J XalnetortizNo ratings yet

- BSP MTPP (Circular Letter 2019-012) ReferenceDocument1 pageBSP MTPP (Circular Letter 2019-012) ReferenceKristine ArangNo ratings yet

- Department Order No. 23 PDFDocument4 pagesDepartment Order No. 23 PDFLGCDD region 10No ratings yet

- Excise: 1 of 1944. Amendment of Section 9Document2 pagesExcise: 1 of 1944. Amendment of Section 9vickytatkareNo ratings yet

- 62nd Regular Session November 13, 2020Document3 pages62nd Regular Session November 13, 2020finance2018 approNo ratings yet

- Cost-of-Living Increases FreezeDocument2 pagesCost-of-Living Increases FreezeThe Jersey City IndependentNo ratings yet

- In The House of Representatives, U. S.,: House Amendment To Senate AmendmentDocument18 pagesIn The House of Representatives, U. S.,: House Amendment To Senate Amendmentapi-45584616No ratings yet

- Approved: February 24, 2001Document1 pageApproved: February 24, 2001Allen OlayvarNo ratings yet

- Sindh Act No - XXV of 2018Document3 pagesSindh Act No - XXV of 2018Mohammad SiddiquiNo ratings yet

- SENATEHEALTHCAREDocument142 pagesSENATEHEALTHCARECBS News Politics100% (4)

- Senate Healthcare BillDocument142 pagesSenate Healthcare BillBreitbart NewsNo ratings yet

- Senate Health Care Bill - Discussion DraftDocument142 pagesSenate Health Care Bill - Discussion DraftAnonymous 2lblWUW6rS85% (13)

- I I I I I: Lungsod NG Pasay, Kalakhang MaynilaDocument2 pagesI I I I I: Lungsod NG Pasay, Kalakhang MaynilaAnaiah HoneyNo ratings yet

- An Ordinance Amending Section 37 (1) Business Tax On Lessors or Sub Lessors of Ordinance No. 1614 Series of 1999, Otherwise Known As The Pasay City Revenue CodeDocument3 pagesAn Ordinance Amending Section 37 (1) Business Tax On Lessors or Sub Lessors of Ordinance No. 1614 Series of 1999, Otherwise Known As The Pasay City Revenue CodeAnaiah HoneyNo ratings yet

- Turnover of Files and Google Drive Format InstructionDocument1 pageTurnover of Files and Google Drive Format InstructionAnaiah HoneyNo ratings yet

- Linkedin Notification FormatDocument2 pagesLinkedin Notification FormatAnaiah HoneyNo ratings yet

- (Compliance Function and Role of Chief Compliance Officer (CCO) - NBFCs - NT9ADocument8 pages(Compliance Function and Role of Chief Compliance Officer (CCO) - NBFCs - NT9ATUSHAR KRISHNANo ratings yet

- Full Download Business Ethics Now 5th Edition Ghillyer Test BankDocument35 pagesFull Download Business Ethics Now 5th Edition Ghillyer Test Bankadugbatacainb100% (31)

- LARARDocument12 pagesLARARRajwinder SInghNo ratings yet

- CRIS - Assessing Communication Rights: A HandbookDocument88 pagesCRIS - Assessing Communication Rights: A Handbook_sdpNo ratings yet

- Network Outsourcing July 2011Document18 pagesNetwork Outsourcing July 2011Shankar VenugopalNo ratings yet

- Primer Resource 8Document6 pagesPrimer Resource 8Sebastian ZhangNo ratings yet

- Budget TheoryDocument8 pagesBudget TheoryShubhendu VermaNo ratings yet

- (Remuneration) : Overview of Corporate Governance Corporate Governance - Various PerspectivesDocument22 pages(Remuneration) : Overview of Corporate Governance Corporate Governance - Various PerspectivesValentina Tan DuNo ratings yet

- A Governance Framework National Cybersecurity StrategiesDocument13 pagesA Governance Framework National Cybersecurity StrategiesDidane13No ratings yet

- 2020 - 11 - 14 Prof Eko Ganis Webinar FEB UNEJ Akuntansi KeberlanjutanDocument35 pages2020 - 11 - 14 Prof Eko Ganis Webinar FEB UNEJ Akuntansi KeberlanjutanUbayNo ratings yet

- Pe MCQSDocument53 pagesPe MCQSS DeekshithaNo ratings yet

- Reading Assignment 8 (Royal Bank of Scotland)Document14 pagesReading Assignment 8 (Royal Bank of Scotland)Valentine AyiviNo ratings yet

- Abusive Constitutional Borrowing Legal Globalization and The Subversion of Liberal Democracy 1St Edition Rosalind Dixon Full ChapterDocument68 pagesAbusive Constitutional Borrowing Legal Globalization and The Subversion of Liberal Democracy 1St Edition Rosalind Dixon Full Chaptercatherine.morris903100% (5)

- test bank đạo đức nghềDocument55 pagestest bank đạo đức nghềThịnh Nguyễn Long100% (1)

- Civic Education Grade 10 ... 1 PDFDocument41 pagesCivic Education Grade 10 ... 1 PDFKathryn Chongwe100% (1)

- The Case For Stakeholder CapitalismDocument8 pagesThe Case For Stakeholder CapitalismPatricia GarciaNo ratings yet

- Bantay GuidelinesDocument2 pagesBantay GuidelinesRyan JD LimNo ratings yet

- Camilon Concept PaperDocument2 pagesCamilon Concept PaperJamespatrick CamilonNo ratings yet

- (Tue & Thu) Midterm Revision - TA Dr. HuanDocument49 pages(Tue & Thu) Midterm Revision - TA Dr. HuanLinh HồNo ratings yet

- Corporate Governance and Cost of Capital in Oecd Countries: Aws AlharesDocument21 pagesCorporate Governance and Cost of Capital in Oecd Countries: Aws AlharesOZZYMANNo ratings yet

- Missing Causality and Absent Institutionalization. A Case of Poland and Methodological Challenges For Future Studies of Interlocking DirectoratesDocument16 pagesMissing Causality and Absent Institutionalization. A Case of Poland and Methodological Challenges For Future Studies of Interlocking Directoratesneca pecaNo ratings yet

- John Keells Holdings PLC AR 2021 22 CSEDocument332 pagesJohn Keells Holdings PLC AR 2021 22 CSEDINESH INDURUWAGENo ratings yet

- Jelena StaburovaDocument48 pagesJelena StaburovaArzu ZeynalovNo ratings yet

- Cricket Match Fixing Draft 1Document6 pagesCricket Match Fixing Draft 1Ashutosh SamantNo ratings yet

- Ecos3003 Final ReviewDocument30 pagesEcos3003 Final Reviewapi-255740189100% (2)

- Politics and Government With Philippine Constitution - Midyear 2020Document48 pagesPolitics and Government With Philippine Constitution - Midyear 2020YZRAJAEL CELZONo ratings yet

- The Role of NGOs, SHGs - Development ProcessDocument14 pagesThe Role of NGOs, SHGs - Development ProcessCecil ThompsonNo ratings yet