Professional Documents

Culture Documents

Marketing of Financial Services

Uploaded by

Shalu Purswani0 ratings0% found this document useful (0 votes)

4 views5 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views5 pagesMarketing of Financial Services

Uploaded by

Shalu PurswaniCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

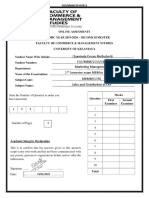

SVKM’s NMIMS ASMSOC – Course Outline

Course Code 742FI0C030

Course Title Marketing of Financial Services

Course Dr. S Palaniappan, Prof. Mangesh Jadhav, Prof. Nandip Vaidya

Instructor/s

Course Credit 4

Program and T.Y.B.Sc. Finance Semester : VI

Semester

Pre-Requisite

Learning PLO 1a To understand the distinctive characteristics of financial services;

Objectives

PLO 1b To identify the problems and issues in marketing of financial

services;

PLO 1c and 3a To apply the various marketing, services and branding

frameworks for developing a marketing strategy for financial services

PLO 5b To understand the processes and stages involved in the

development of new financial products that are more responsive to the

needs of the customers.

Learning After completion of the course, students would be able to develop:

Outcomes

A holistic understanding about the application of marketing in the context

of financial services.

Communication and critical thinking skills required to address various

marketing and selling problems in the financial services industry

Course

Description

Evaluation Specific % AOL Intended CLOs to be

Pattern Assessmen Weightage Instrumen Assessed

t Methods ts

/ Task

C C C C C

L L L L L

O O O O O

1 2 3 4 5

Google 10% Quiz

form

Survey,dat 20% Project

a analysis,

visual

analytics ,

presentatio

n and

report

MCQ + 20% Internal

subjective test

questions

Questions 50% Term End

based on Exam

application

of concepts

and

situationan

analysis

Course Session Plan

Session Topics / Module Chapters (Mention Page

Numbers) / Articles / Cases /

Material and Activities

Scope of Financial Services Instructor Notes

1

2 Distinctive Characteristics of Financial Instructor notes

Services

3 Products vs Services – 7P framework Instructor Notes

4 Getting started with the “Gap” model Zeithaml Valerie A, Mary Jo

Bitner and Dwayne D Gremier

(2010), “Services Marketing

Strategy”, Wiley International

Encyclopaedia of Marketing:

Marketing Strategy Vol 1, Robert

A Peterson and Roger A Kerin,

eds: Chichester, UK: John Wiley

& Sons, 208-218

5 “Gap” model: more examples Instructor Notes

6 Concepts in Consumer Behaviour applied Chapter 3, Kotler Keller 16th

to Financial Services_Overview edition

7 Cultural factors_examples Fin Services Chapter 3, Kotler Keller 16th

edition

8 Social factors_examples_Fin Services Chapter 3, Kotler Keller 16th

edition

9 Personal factors_examples_Fin Services Chapter 3, Kotler Keller 16th

edition

10 Psychological factors_examples_Fin Chapter 3, Kotler Keller 16th

Services edition

11 Behaviour Finance Concepts applied to Instructor Notes

Fin Services consumer behaviour

12 EKB model, short frameworks using Chapter 3, Kotler Keller 16th

indicator variables edition

13 Situation Analyses practice session for Instructor Notes

consumer behaviour in various categories

of financial services

14 B2B factors influencing buyer behaviour Chapter 4, Kotler Keller 16th

edition

15 Segmentation_ geographic and Chapter 6, Kotler Keller 16th

Demographic segmentation in Fin. edition

Services

16 VALS framework for psychographic Chapter 6, Kotler Keller 16th

segmentation in Fin Services edition

17 B2B segmentation framework in Fin Chapter 6, Kotler Keller 16th

Services edition

18 Segmentation Viability evaluation Chapter 6, Kotler Keller 16th

edition

19 Hedge Fund situation analysis in Instructor Notes

segmentation

20 Selecting and targeting segments and Chapter 7, Kotler Keller 16th

product/service positioning: Hedge fund edition

situation analysis continued

21 Five levels of Products with reference to Chapter 8, Kotler Keller 16th

Fin Services edition

22 Product Mix vs Product Family vs Chapter 8, Kotler Keller 16th

Product line edition

23 Types of price differentiation in Financial Instructor Notes

Services

24 First 5 Ps (Product, Price, Process, People Instructor Notes

and Physical evidence) by category _

consumer credit

25 First 5 Ps by category _ corporate credit Instructor Notes

26 First 5 Ps by category _ liability products Instructor Notes

27 First 5 Ps by category _ transaction Instructor Notes

banking

28 First 5 Ps by category _ investment Instructor Notes

banking and advisory services

29 First 5 Ps by category _ distribution of Instructor Notes

third party investment products

30 First 5 Ps by category _ broking Instructor Notes

31 First 5 Ps by category _ asset management Instructor Notes

32 First 5 Ps by category _ insurance and Instructor Notes

pension

33 Branding and Positioning in Fin Instructor Notes

Services_Overview

34 BAV model to evaluate Brand Equity Chapter 10, Kotler Keller 16th

edition

35 Brandz, Brand Resonance and Aaker Chapter 10, Kotler Keller 16th

models edition

36 Colombo Morrison approach to measure Chapter 10, Kotler Keller 16th

Brand Loyalty edition

37 Brand Building in Financial Services: Instructor Notes

Situation analyses

38 Brand valuation approaches Chapter 10, Kotler Keller 16th

edition

39 Branding strategies and brand Chapter 10, Kotler Keller 16th

architecture edition

40 Various examples of positioning in Fin Chapter 10, Kotler Keller 16th

Services edition

41 Objectives and types of Communication Chapter 12, Kotler Keller 16th

with examples edition

42 Communication message format types Chapter 12, Kotler Keller 16th

edition

43 Communication media alternatives Chapter 12, Kotler Keller 16th

edition

44 Communication summary: 5Ms of Chapter 12, Kotler Keller 16th

communication edition

45 Situation analyses: Advertising in Fin Instructor Notes, WARC

Services (using WARC database) database

46 Types of promotion strategies for B2C Chapter 11, Kotler Keller 16th

and B2B businesses in Fin Services edition

47 Evaluating owned vs outsourced Chapters 14,15 and 16, Kotler

distribution across various categories of Keller 16th edition

Fin services

48 Building distribution strategy: Situation Chapters 14,15 and 16, Kotler

analyses Keller 16th edition

49 Using SPIN framework in consultative Chapters 14,15 and 16, Kotler

selling Keller 16th edition

50 Fintech 1: Digital platforms for 1. Instructor Notes

Communication and brand building 2.

Chatbots for customer servicing, lead

generation platforms, transaction services

(payment gateways, neo banking), digital

currency

51 Fintech 2: For Credit businesses-credit Instructor Notes

scoring, peer-to-peer lending, crowd

funding

52 Fintech 3: For insurance services- Instructor Notes

Underwriting, improving persistency

53 Fintech for Broking: building algorithms Instructor Notes

for trading, Simulation and back-testing

platforms, Risk “control”, Netting off

margins across related entity transactions

54 Fintech4: For asset management: Instructor Notes

Quantitative techniques in investing

using factor and smart beta models,

sentiment analysis using text analytics

55 Fintech 5: Robo advisory Instructor Notes

56 Fintech 6: Global remittances using block Instructor Notes

chain technology

57 Fintech 7: Business Process Improvement: Instructor Notes

Robotic Process Automation, Cloud

based data storage and retrieval,

Encryption and data security, Enterprise-

wide Risk Management, CRM – session 1

58 Fintech 7: Business Process Improvement: Instructor Notes

Robotic Process Automation, Cloud

based data storage and retrieval,

Encryption and data security, Enterprise-

wide Risk Management, CRM – session 2

59 Integrated situation analyses_ GAP,STP, Services Marketing, 7th edition,

Marketing mix example 1 2018, McGraw Hill

by Valerie Zeithaml, Mary Bitner,

Dwayne Gremler and Ajay

Pandit

60 Integrated situation analyses_ GAP,STP, Services Marketing, 7th edition,

Marketing mix example 2 and summing 2018, McGraw Hill

up by Valerie Zeithaml, Mary Bitner,

Dwayne Gremler and Ajay

Pandit

Prescribed Text Books:

1. Marketing Management, 16th edition, 2021, Pearson

Reading

by Philip Kotler, Kevin Keller, Alexander Chernev,Jagdish N Sheth

List and

2. Services Marketing, 7th edition, 2018, McGraw Hill

References

by Valerie Zeithaml, Mary Bitner, Dwayne Gremler and Ajay Pandit

References:

Fintech Founders: Inspiring Tales from the Entrepreneurs that are Changing

Finance, 2019, De Gruyter

by Augustin Rubini

Prepared by Faculty Approved by Program Approved by Associate Deans

Members Chairperson

Mr. Nandip Vaidya

Approved by I/C Dean –

ASM SOC

You might also like

- Course Outline POMDocument7 pagesCourse Outline POMSufyan KhanNo ratings yet

- Course Outline 8.9.2021Document12 pagesCourse Outline 8.9.2021Ennovate 16No ratings yet

- Course Outline Principle of Accounting BESE10 2K21 Final VersionDocument14 pagesCourse Outline Principle of Accounting BESE10 2K21 Final VersionHasan AhmedNo ratings yet

- Coursle Outline-Fundamentals of Marketing - 2023Document10 pagesCoursle Outline-Fundamentals of Marketing - 2023Ayesha RehmanNo ratings yet

- Unit GuideDocument7 pagesUnit GuideHải Anh ĐặngNo ratings yet

- Vedica 2019 - 20 - Marketing - Course OutlineDocument5 pagesVedica 2019 - 20 - Marketing - Course OutlinemNo ratings yet

- BRMT Course Outline - 2018-Final PDFDocument7 pagesBRMT Course Outline - 2018-Final PDFsumanaNo ratings yet

- Accounting For Managerial Decisions (B205201) Total Credits-5 L T P Semester 2 4 1 0 Course OutcomesDocument9 pagesAccounting For Managerial Decisions (B205201) Total Credits-5 L T P Semester 2 4 1 0 Course Outcomesmani singhNo ratings yet

- ME - Marketing Essentials Scheme of Work 2021Document6 pagesME - Marketing Essentials Scheme of Work 2021KLinh NguyenNo ratings yet

- Course Book BBA 2022-25 RevisedDocument139 pagesCourse Book BBA 2022-25 RevisedAshish SinghNo ratings yet

- Entrepreneurial Marketing: Beyond Professionalism to Creativity, Leadership, and SustainabilityFrom EverandEntrepreneurial Marketing: Beyond Professionalism to Creativity, Leadership, and SustainabilityNo ratings yet

- Syllabus 2 2023Document4 pagesSyllabus 2 2023Dinesh KumarNo ratings yet

- Global Investment Performance Standards and Financial ReportingDocument3 pagesGlobal Investment Performance Standards and Financial ReportingShalu PurswaniNo ratings yet

- Course Outline Marketing of BFSDocument7 pagesCourse Outline Marketing of BFSKaranNo ratings yet

- Marketing Fundamentals: Instructor: Dr. Ali Rehman Level: Undergraduate Credit Hours: 3 Lecture Hours: 51 EmailDocument5 pagesMarketing Fundamentals: Instructor: Dr. Ali Rehman Level: Undergraduate Credit Hours: 3 Lecture Hours: 51 EmailKuri AnmolNo ratings yet

- File 1647930802 0007971 CorporateFinance-SyllabusDocument3 pagesFile 1647930802 0007971 CorporateFinance-SyllabusTanya gargNo ratings yet

- WMP Mmii - Co - 2022-23Document5 pagesWMP Mmii - Co - 2022-23amit.rana21No ratings yet

- MADM Course Outline 2020 - 21 - v2Document6 pagesMADM Course Outline 2020 - 21 - v2KaranNo ratings yet

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- Leveraging Constraints for Innovation: New Product Development Essentials from the PDMAFrom EverandLeveraging Constraints for Innovation: New Product Development Essentials from the PDMANo ratings yet

- Marketing Metrics (2019-2021)Document11 pagesMarketing Metrics (2019-2021)Varun NandaNo ratings yet

- Marketing Management SyllabusDocument5 pagesMarketing Management SyllabusHannah jean EnabeNo ratings yet

- FM Pgpwe 2024Document4 pagesFM Pgpwe 2024ANKIT SHARMANo ratings yet

- Sbm-Nmims: Course Teaching Plan Assurance of Learning AOL Specific Course Code Course TitleDocument10 pagesSbm-Nmims: Course Teaching Plan Assurance of Learning AOL Specific Course Code Course Titlerishabh4mishra-6No ratings yet

- Post Graduate Programme in Management: 2021-23 - Term 01Document3 pagesPost Graduate Programme in Management: 2021-23 - Term 01Dhruv GandhiNo ratings yet

- Businesss Analysis StudentDocument24 pagesBusinesss Analysis StudentThịnh Đỗ QuốcNo ratings yet

- Course Handout MM 2022Document3 pagesCourse Handout MM 2022Seeboli GhoshNo ratings yet

- Course Outline MicroeconomicsDocument3 pagesCourse Outline Microeconomicsmfarazkhan650No ratings yet

- Course Outline - EM 505Document2 pagesCourse Outline - EM 505Mahmud AhmedNo ratings yet

- BUS 230 Intro To Finance Begrakyan Fall 2022 BDocument11 pagesBUS 230 Intro To Finance Begrakyan Fall 2022 BOvsanna HovhannisyanNo ratings yet

- Final Course Outline Retail Man 2021Document5 pagesFinal Course Outline Retail Man 2021Aman SaxenaNo ratings yet

- Finance Module OutlineDocument5 pagesFinance Module OutlinemihsovyaNo ratings yet

- Course Outline - Marketing ManagementDocument4 pagesCourse Outline - Marketing ManagementBhavesh KaushikNo ratings yet

- Marketing PrinciplesDocument2 pagesMarketing Principles225952233No ratings yet

- Final Course Outline-MSO-DCP 2017Document7 pagesFinal Course Outline-MSO-DCP 2017Intekhab AslamNo ratings yet

- Department of Business Administration: Course Outline & Class Calendar Semester: Spring 2019 Program: BBADocument3 pagesDepartment of Business Administration: Course Outline & Class Calendar Semester: Spring 2019 Program: BBAAKM AMINUL ISLAMNo ratings yet

- T1 - CO - MM-I - Batch 2022-24Document14 pagesT1 - CO - MM-I - Batch 2022-24Mr. Shahil Kumar Student, Jaipuria LucknowNo ratings yet

- Mu Mba Teaching Plan 2017Document42 pagesMu Mba Teaching Plan 2017ssg290394No ratings yet

- Consumer BehaviourDocument12 pagesConsumer BehaviourSurbhi SabharwalNo ratings yet

- CF - SyllabusDocument5 pagesCF - SyllabusRishabhNo ratings yet

- Syllabus Aug 2022 NHTM 2Document10 pagesSyllabus Aug 2022 NHTM 2Dương Thuỳ TrangNo ratings yet

- Marketing Management-I Term-I Section-B C Prof. Ritu Mehta Course Outline FinalDocument4 pagesMarketing Management-I Term-I Section-B C Prof. Ritu Mehta Course Outline FinalKumar AnandNo ratings yet

- Course Syllabus: ECO 600 Advanced Managerial Economics Header (Course Information)Document5 pagesCourse Syllabus: ECO 600 Advanced Managerial Economics Header (Course Information)Chadi AboukrrroumNo ratings yet

- Consumer BehaviourDocument12 pagesConsumer Behaviourritesh singhNo ratings yet

- COS 102 - Marketing Management-IDocument6 pagesCOS 102 - Marketing Management-Iyupp3279No ratings yet

- Busi-296 3Document3 pagesBusi-296 3bhavik patelNo ratings yet

- Principles of Macroeconomics: Course DescriptorDocument5 pagesPrinciples of Macroeconomics: Course Descriptormahnoor javaidNo ratings yet

- Course Outline For ItB (BUS 1102) (Section - T) - Fall 2022 - JKNDocument4 pagesCourse Outline For ItB (BUS 1102) (Section - T) - Fall 2022 - JKNArafat SifatNo ratings yet

- Marketing Analytics Course Handout-1Document6 pagesMarketing Analytics Course Handout-1Arpit JainNo ratings yet

- Course Outline MKT6002 T5 B20-22Document6 pagesCourse Outline MKT6002 T5 B20-22Abhijith VargheseNo ratings yet

- Course Guide: RICS School of Built EnvironmentDocument14 pagesCourse Guide: RICS School of Built EnvironmentManglam AgarwalNo ratings yet

- Financial Analysis - Lecture - Final - ST - K20 2023Document120 pagesFinancial Analysis - Lecture - Final - ST - K20 2023Trân Tạ Đặng BảoNo ratings yet

- Marketing 401 Marketing Management: Creating Value For Customers Temple UniversityDocument4 pagesMarketing 401 Marketing Management: Creating Value For Customers Temple UniversityLee JNo ratings yet

- Mirajul Islam - Internship ReportDocument41 pagesMirajul Islam - Internship ReportThomas HarveyNo ratings yet

- Eco101 Iso (L)Document31 pagesEco101 Iso (L)jingen0203No ratings yet

- BUS 510 Course OutlineDocument2 pagesBUS 510 Course OutlineNoor NabiNo ratings yet

- FIN331 Commercial Bank Management: Course Guide 2014Document9 pagesFIN331 Commercial Bank Management: Course Guide 2014Thuỳ LinhNo ratings yet

- Applied EconometricsDocument5 pagesApplied EconometricsShalu PurswaniNo ratings yet

- Mah Mba Cet Question Paper 2018 64Document134 pagesMah Mba Cet Question Paper 2018 64Shalu PurswaniNo ratings yet

- A Study of Impact of Information Technology On Accounting SystemsDocument78 pagesA Study of Impact of Information Technology On Accounting SystemsShalu PurswaniNo ratings yet

- Study On E-Banking System in India NewDocument65 pagesStudy On E-Banking System in India NewShalu PurswaniNo ratings yet

- Mah Mba Cet Question Paper 2018 64Document134 pagesMah Mba Cet Question Paper 2018 64Shalu PurswaniNo ratings yet

- A Study of Impact of Information Technology On Accounting SystemsDocument78 pagesA Study of Impact of Information Technology On Accounting SystemsShalu PurswaniNo ratings yet

- Study On E-Banking System in India NewDocument65 pagesStudy On E-Banking System in India NewShalu PurswaniNo ratings yet

- Finstreet - Finance Committee, Kjsimsr: Where Knowledge & Learning Are Key To SuccessDocument7 pagesFinstreet - Finance Committee, Kjsimsr: Where Knowledge & Learning Are Key To SuccessShalu PurswaniNo ratings yet

- BMPS AssignmentDocument8 pagesBMPS AssignmentamirfajisNo ratings yet

- Sponsorship Proposal (General) v1-1Document14 pagesSponsorship Proposal (General) v1-1Andrew Tay100% (1)

- Online Mock ExamDocument4 pagesOnline Mock ExamChaminda Devan MuthuhettiNo ratings yet

- Cost Accounting 2010 Updatex2Document87 pagesCost Accounting 2010 Updatex2Anipa Hubert50% (2)

- GrowthDocument161 pagesGrowthSyed FahadNo ratings yet

- (WWW - Entrance-Exam - Net) - ICFAI University, MBA, International Management II Sample Paper 2Document21 pages(WWW - Entrance-Exam - Net) - ICFAI University, MBA, International Management II Sample Paper 2Vaishnavi SubramanianNo ratings yet

- Individual Assignment 4: Competitive AnalysisDocument5 pagesIndividual Assignment 4: Competitive AnalysisStephanie SargentoNo ratings yet

- Brand Equity Models and Measurement - Insights AssociationDocument8 pagesBrand Equity Models and Measurement - Insights Associationshashikant prasadNo ratings yet

- Transport Development Areas RICSDocument4 pagesTransport Development Areas RICSFrank van der Hoeven50% (2)

- John Lewis Christmas AdvertDocument6 pagesJohn Lewis Christmas AdvertAngelika HajdulNo ratings yet

- Marketing Seminar ReportDocument12 pagesMarketing Seminar Reportmasabumair6No ratings yet

- Columbus Brewing Company Marketing Proposal: CM SquaredDocument11 pagesColumbus Brewing Company Marketing Proposal: CM SquaredMikayla McCormicNo ratings yet

- 1 - CV - Arti Panchal Updated Resume-1-1Document1 page1 - CV - Arti Panchal Updated Resume-1-1Bharat RathoreNo ratings yet

- Starbucks Delivering Customer ServiceDocument5 pagesStarbucks Delivering Customer ServiceAnkit Kumar0% (1)

- Liquid Hand Wash Rs. 5.06 Million Mar-2020 SMEDADocument19 pagesLiquid Hand Wash Rs. 5.06 Million Mar-2020 SMEDAgladiator_usNo ratings yet

- Kelloggs PromotionDocument4 pagesKelloggs PromotionWint Wah HlaingNo ratings yet

- No Frills Plaza DecisionDocument24 pagesNo Frills Plaza DecisionBrad PritchardNo ratings yet

- TrappedTraders v1-0 PDFDocument36 pagesTrappedTraders v1-0 PDFwanqi08No ratings yet

- How To Double Your Business in Six Months PDFDocument43 pagesHow To Double Your Business in Six Months PDFChester Dalitso MwanzaNo ratings yet

- Four Pillars To Business SuccessDocument20 pagesFour Pillars To Business SuccessDonna PriceNo ratings yet

- Tools For Identifying Investment Opportunities: Porter Model Life Cycle Approach Experience ApproachDocument17 pagesTools For Identifying Investment Opportunities: Porter Model Life Cycle Approach Experience ApproachUdit PareekNo ratings yet

- Lacoste BrandDocument11 pagesLacoste BrandAndreas MobergNo ratings yet

- Inquiry LetterDocument13 pagesInquiry LetterElvin FadillaNo ratings yet

- Architectural Lighting - September October 2016Document68 pagesArchitectural Lighting - September October 2016Nadeem HassoonNo ratings yet

- Supply-Chain-Control Tower PDFDocument11 pagesSupply-Chain-Control Tower PDFRADHA1200% (1)

- WanjikuDocument41 pagesWanjikujohn mwangi100% (1)

- Site Logistics PlanDocument2 pagesSite Logistics Plansampath_priyashantha75% (4)

- Unit 2 Marketing EssentialsDocument10 pagesUnit 2 Marketing EssentialsUsamaNo ratings yet

- Assignment 12 Case Study-Home Style CookiesDocument3 pagesAssignment 12 Case Study-Home Style CookiesFish de Paie100% (2)

- Strama PresentationDocument26 pagesStrama PresentationRONALYN DELFINNo ratings yet