Professional Documents

Culture Documents

Chapter 1&2 Seminar QN 2023

Uploaded by

fbicia218Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1&2 Seminar QN 2023

Uploaded by

fbicia218Copyright:

Available Formats

Mzumbe University

Department of Accounting and Finance

ACC 211 Cost and Management Accounting I

Tutorial question Topics I & II

DISCUSION QUESTION

1. Should a managerial accounting system provide both financial and

nonfinancial information? Explain.

2. What are the three major elements of product costs in a manufacturing

company?

3. Define the following: (a) direct materials, (b) indirect materials, (c) direct labor,

(d) indirect labor, and (e) manufacturing overhead

4. Management accounting deals only with costs.” Do you agree? Explain.

5. With a relevant example, describe the five-step decision-making process.

6. A Resident Building company’s in Morogoro has asked your employer

(Kittau& Company) a CPA firm Located at Dar essalaam to prepare briefing

documents suitable for small and medium sized businesses. You have been

asked by the managing partner to develop the first briefing note as outlined in

the following requirement.

Requirement: Prepare a briefing note that:

i) Presents the key differences between management accounting and financial

accounting;

ii) Describes the role of the management accountant; and

iii) Outlines FOUR factors that influence a company’s demand for management

accounting information.

TUTORIAL QUESTIONS

QUESTION ONE

Kahawa Express operates a number of espresso coffee stands in busy suburban

malls. The fixed weekly expense of a coffee stand is Tzs. 1,100,000 and the

variable cost per cup of coffee served is Tzs. 260.

Required:

Fill in the following table with your estimates of total costs and average cost per

cup of coffee at the indicated levels of activity for a coffee stand and effect does

an increase in volume have on cost.

Cups served in week

1800 1900 2000

Fixed Cost ? ? ?

Variable cost ? ? ?

Total Cost ? ? ?

Average cost per cup served ? ? ?

Unit variable cost ? ? ?

Unit fixed cost ? ? ?

ACC 211 Cost and Management Accounting I 1

QUESTION TWO

Marambau Company manufactures furniture, including tables. The following are

the cost attributed to the company in December 2019,

i) The tables are made of wood that costs TZS. 100,000 per table.

ii) The tables are assembled by workers, at a wage cost of TZS. 40,000 per

table.

iii) Workers assembling the tables are supervised by a factory supervisor who is

paid TZS. 38,000,00 per year.

iv) Electrical costs are TZS. 2,000 per machine-hour. Four machine-hours are

required to produce a table.

v) The depreciation on the machines used to make the tables totals TZS.

10,000,000 per year. The machines have no resale value and do not wear

out through use.

vi) The salary of the president of the company is TZS. 100,000,000 per year.

vii) The company spends TZS. 250,000,000 per year to advertise its products.

viii) Salespersons are paid a commission of TZS. 30,000 for each table sold.

ix) Instead of producing the tables, the company could rent its factory space for

TZS. 50,000,000 per year.

Required:

Classify these costs according to the various cost terms used in Cost and

Managerial accounting as in example of (i) below

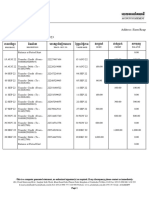

Varia Fixe Period Product Cost Su Opport

ble d (Selling Direct Dire Overh nk unity

cost cost &admn) materi ct ead cos cost

cost al Labo t

r

Wood used √ √

in table

QUESTION THREE

i) KCMC hospital has initiated a research project which is intended to develop

a new Medicine. Expenditures to date on this particular research total

TZS500,000,000 but it is now estimated that a further TZS200,000,000 will

need to be spent before the Medicine can be allowed by TFDA for Human use.

Over the estimated life of the product the profit potential has a net present

value of TZS350,000,000.

Required

ACC 211 Cost and Management Accounting I 2

Advise management whether they should continue or abandon the project.

Support your conclusion with a numerate statement and state what kind of

cost is the TZS 500,000,000.

ii) Opportunity costs is not recognized by financial accounting systems but

need to be considered in many decisions taken by management.

Required

Explain briefly the meaning of opportunity costs; give two examples of

each to illustrate the meanings you have attached to them.

QUESTION FOUR

Morasa travels every day to work by Mwendokasi to his 5-days a week job. Instead

of buying daily tickets she finds it cheaper to buy a quarterly season ticket which

costs TZS. 188,000 for 13 weeks.

Delphine, an acquaintance, who also makes the same journey, suggests that they

both travel in Morasa’s car and offers to give him TZS. 120,000 each quarter

towards his car expenses. Except for weekend travelling and using it for local

college attendance near his home on three evenings each week to study for her CPA

Foundation Stage, the car remains in Morasa’s garage.

Morasa estimates that using her car for work would involve him, each quarter, in

the following expenses: (TZS)

Depreciation (proportion of annual figure) 200,000

Petrol and oil 128,000

Tires and miscellaneous 52,000

Required:

State whether Morasa should accept Delphine’s offer and draft a statement to show

clearly the monetary effect of your conclusion.

QUESTION FIVE

ALEX Company which its financial Year starts from 1 December to 31November

prepared a sales budget which resulted in the following cost structure:

% of sales

Direct materials 32

Direct wages 18

Production overhead: Variable 6

Fixed 24

Administrative and selling costs: Variable 3

Fixed 7

Profit 10

After ten weeks, however, it became obvious that the sales budget was too

optimistic and it has now been estimated that because of a reduction in sales

ACC 211 Cost and Management Accounting I 3

volume, for the full year, sales will total £2,560,000,000 which is only 80% of the

previously budgeted figure.

Required

Present a statement for management showing the amended sales and cost structure

in TZS. . and percentages, in a marginal costing format.

QUESTION SIX

Output (units) Total cost (TZS )

200 7,000

300 8,000

400 9,000

Required:

(a) Calculate the variable cost per unit.

(b) Calculate the total fixed cost.

(c) Estimate the total cost if output is 350 units.

(d) Estimate the total cost if output is 600 units.

QUESTION SEVEN

Output (units) Total cost (TZS. )

200 7,000

300 8,000

400 9,000

For output volumes above 350 units the variable cost per unit falls by 10%. (Note:

this fall applies to all units – not just the excess above 350).

Required:

Estimate the cost of producing 450 units of Product LL

QUESTION EIGHT

An organisation has the following total costs at three activity levels

Activity level 4,000 6,000 7,500

(units)

Total cost TZS. 40,800 TZS. 50,000 TZS. 54,800

Variable cost per unit is constant within this activity range and there is a step up of

10% in the total fixed costs when the activity level exceeds 5,500 units.

Required:

What is the total cost at an activity level of 5,000 units?

ACC 211 Cost and Management Accounting I 4

QUESTION NINE

MLThe first unit of a new product is expected to take 100 hours. An 80% learning

curve is known to apply.

Calculate:

(a) The average time per unit for the first 16 units

(b) The average time per unit for the first 25 units

(c) The time it takes to make the 20th unit.

QUESTION TEN

The first batch of a new product took 20 hours to produce. The learning rate is

90%. (Cessation of the learning curve effect)

Required:

If the learning effect ceases after 72 batches (i.e. all subsequent batches take the

same time as the 72nd), how long will it take to make a grand total of 100 batches?

QUESTION ELEVEN

Average unit times for product X have been tabulated as follows

Unit number Cumulative average time per unit

Yx

1 20 minutes

2 17.2 minutes

4 14.792 minutes

8 12.72 minutes

Required:

What is the Learning Curve rate?

ACC 211 Cost and Management Accounting I 5

You might also like

- Question Bank For Ma 1.4Document25 pagesQuestion Bank For Ma 1.4Chitta LeeNo ratings yet

- Level 3 Costing & MA Text Update June 2021pdfDocument125 pagesLevel 3 Costing & MA Text Update June 2021pdfAmi KayNo ratings yet

- Acma Assignment MaterialDocument12 pagesAcma Assignment MaterialHay Jirenyaa100% (8)

- F2MA Test 3 From ACCA Sep 2020 QuestionDocument15 pagesF2MA Test 3 From ACCA Sep 2020 QuestionthetNo ratings yet

- Ma2 Specimen j14Document16 pagesMa2 Specimen j14talha100% (3)

- Accounting Principles Winter ExamDocument10 pagesAccounting Principles Winter ExamEkaterinaNo ratings yet

- Cost Classification: Total Product/ ServiceDocument21 pagesCost Classification: Total Product/ ServiceThureinNo ratings yet

- Acctg201 Assignment 1Document7 pagesAcctg201 Assignment 1sarahbeeNo ratings yet

- Act 6010 C Fall 2022 Final Sem ExaminationsDocument5 pagesAct 6010 C Fall 2022 Final Sem ExaminationsSimon JosiahNo ratings yet

- Cost 2021-MayDocument8 pagesCost 2021-MayDAVID I MUSHINo ratings yet

- Cost Classification-PQDocument7 pagesCost Classification-PQRomail QaziNo ratings yet

- F2 Past Paper - Question12-2005Document13 pagesF2 Past Paper - Question12-2005ArsalanACCA100% (1)

- RVU CMA Work Sheet March 2019Document12 pagesRVU CMA Work Sheet March 2019Henok FikaduNo ratings yet

- Cost 2022-MayDocument7 pagesCost 2022-MayDAVID I MUSHINo ratings yet

- F 5 Progressssjune 2016 SOLNDocument12 pagesF 5 Progressssjune 2016 SOLNAnisahMahmoodNo ratings yet

- Working Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadDocument26 pagesWorking Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadsajedulNo ratings yet

- Ch5 LimitingFactorsDocument19 pagesCh5 LimitingFactorsali202101No ratings yet

- ACCA Level 2&3 Foundation Course (Text II)Document8 pagesACCA Level 2&3 Foundation Course (Text II)CarnegieNo ratings yet

- SLC ACCT5 2019S3 101 Assignment04Document8 pagesSLC ACCT5 2019S3 101 Assignment04kasad jdnfrnasNo ratings yet

- 2014 December Management Accounting L2Document17 pages2014 December Management Accounting L2Dixie CheeloNo ratings yet

- Management Information May-Jun 2016Document2 pagesManagement Information May-Jun 2016SomeoneNo ratings yet

- C01 Exam Practice KitDocument240 pagesC01 Exam Practice Kitlesego100% (2)

- CVP CLASS ILLUSTRATIONS.Document4 pagesCVP CLASS ILLUSTRATIONS.Sam DizongaNo ratings yet

- Tutorial 5 - CHAPTER 9 - QDocument13 pagesTutorial 5 - CHAPTER 9 - QThuỳ PhạmNo ratings yet

- PMBA Cost Accounting Assignment AnalysisDocument8 pagesPMBA Cost Accounting Assignment AnalysisLabib SafeenNo ratings yet

- F2 MockDocument23 pagesF2 MockH Hafiz Muhammad AbdullahNo ratings yet

- Full Book Test 5Document12 pagesFull Book Test 5alihanaveed9No ratings yet

- QS07 - Class Exercises SolutionDocument8 pagesQS07 - Class Exercises Solutionlyk0texNo ratings yet

- HW Assignment #2 F22Document16 pagesHW Assignment #2 F22Jesse DanielsNo ratings yet

- MA 13.2 (No Solutions)Document2 pagesMA 13.2 (No Solutions)Michael ComunelloNo ratings yet

- 4.2 Costs, Scale of Production and Break-Even AnalysisDocument10 pages4.2 Costs, Scale of Production and Break-Even Analysisgeneva conventionsNo ratings yet

- CSU-Andrews Cost Management Quiz 1Document4 pagesCSU-Andrews Cost Management Quiz 1Wynie AreolaNo ratings yet

- Lecture 5-6 Unit Cost CalculationDocument32 pagesLecture 5-6 Unit Cost CalculationAfzal AhmedNo ratings yet

- Marginal and Absorption Costing TechniqueDocument4 pagesMarginal and Absorption Costing TechniqueADEYANJU AKEEMNo ratings yet

- Exam 21082011Document8 pagesExam 21082011Rabah ElmasriNo ratings yet

- Mock Test 2021 PMDocument5 pagesMock Test 2021 PMBao Thy PhoNo ratings yet

- Tutorial Questions CVPDocument6 pagesTutorial Questions CVPChristopher LoisulieNo ratings yet

- KABARAK UNIVERSITY ACCT 520 EXAMDocument5 pagesKABARAK UNIVERSITY ACCT 520 EXAMMutai JoseahNo ratings yet

- Management Accounting Level 3/series 3 2008 (Code 3024)Document12 pagesManagement Accounting Level 3/series 3 2008 (Code 3024)Hein Linn Kyaw100% (1)

- Marketing Bachelor of Business (Hons) ACC103 Management Accounting 1 AssignmentDocument8 pagesMarketing Bachelor of Business (Hons) ACC103 Management Accounting 1 AssignmentReina TrầnNo ratings yet

- MANAGEMENT INFORMATION REPORTDocument2 pagesMANAGEMENT INFORMATION REPORTLaskar REAZNo ratings yet

- Bcom 5 Sem Cost Accounting 1 22100106 Jan 2022Document4 pagesBcom 5 Sem Cost Accounting 1 22100106 Jan 2022Internet 223No ratings yet

- FinanceDocument14 pagesFinanceJarvis Gych'No ratings yet

- Midterm Question Strategic Management Accounting (11th Batch)Document5 pagesMidterm Question Strategic Management Accounting (11th Batch)Samir Raihan ChowdhuryNo ratings yet

- IUB Mid Autumn 2021Document2 pagesIUB Mid Autumn 2021Navid Al Faiyaz ProviNo ratings yet

- t4 2008 Dec QDocument8 pagest4 2008 Dec QShimera RamoutarNo ratings yet

- Icaew Cfab Mi 2018 Sample Exam 1Document29 pagesIcaew Cfab Mi 2018 Sample Exam 1Anonymous ulFku1v100% (1)

- CA Course Work Take HomeDocument4 pagesCA Course Work Take HomeOgwang JoshuaNo ratings yet

- Cost Management Problems CA FinalDocument266 pagesCost Management Problems CA Finalksaqib89100% (1)

- Paper - 4: Cost Accounting and Financial ManagementDocument20 pagesPaper - 4: Cost Accounting and Financial ManagementdhilonjimyNo ratings yet

- Cost ClassificationDocument91 pagesCost ClassificationJack PayneNo ratings yet

- Which Type of Benchmarking Is The Company Using?Document20 pagesWhich Type of Benchmarking Is The Company Using?Aslam SiddiqNo ratings yet

- SA Syl12 Jun2014 P10 PDFDocument21 pagesSA Syl12 Jun2014 P10 PDFpatil_viny1760No ratings yet

- Acca F2 Revision QuestionDocument16 pagesAcca F2 Revision QuestionZe Ling TanNo ratings yet

- Cost allocation methods and break-even analysis questionsDocument11 pagesCost allocation methods and break-even analysis questionssarahbeeNo ratings yet

- Ma 2 AccaDocument18 pagesMa 2 AccaRielleo Leo67% (3)

- 4 2007 Jun QDocument9 pages4 2007 Jun Qapi-19836745No ratings yet

- Cost Accounting Exam Good For 2 Hours OnlyDocument6 pagesCost Accounting Exam Good For 2 Hours OnlyCaptain Jellyfish MasterNo ratings yet

- Management InformationDocument10 pagesManagement InformationTanjil AhmedNo ratings yet

- CVP TTQDocument4 pagesCVP TTQChristopher LoisulieNo ratings yet

- Topic 2Document51 pagesTopic 2fbicia218No ratings yet

- Topic 3Document29 pagesTopic 3fbicia218No ratings yet

- Topic 2Document58 pagesTopic 2fbicia218No ratings yet

- Topic 2-1Document35 pagesTopic 2-1fbicia218No ratings yet

- Topic 1Document35 pagesTopic 1fbicia218No ratings yet

- Topic 1 BDocument30 pagesTopic 1 Bfbicia218No ratings yet

- Seminar QNS Topic 1Document24 pagesSeminar QNS Topic 1fbicia218No ratings yet

- Baf PS 2BDocument5 pagesBaf PS 2Bfbicia218No ratings yet

- Acc 212 - Course OutlineDocument3 pagesAcc 212 - Course Outlinefbicia218No ratings yet

- Baf PS 2BDocument5 pagesBaf PS 2Bfbicia218No ratings yet

- A REVIEW OF CAPITAL STRUCTURE THEORIES EditeDocument8 pagesA REVIEW OF CAPITAL STRUCTURE THEORIES EditeMega capitalmarketNo ratings yet

- Managing The Finance FunctionDocument12 pagesManaging The Finance FunctionDumplings DumborNo ratings yet

- FIN622 Online Quiz - PdfaDocument531 pagesFIN622 Online Quiz - Pdfazahidwahla1100% (3)

- Accounting Fundamentals: Dr. Reena Agrawal Assistant Professor-Accounting, Finance, Entrepreneurship, Design ThinkingDocument14 pagesAccounting Fundamentals: Dr. Reena Agrawal Assistant Professor-Accounting, Finance, Entrepreneurship, Design Thinkingharsh mauruaNo ratings yet

- Caso Star Appliance CompanyDocument10 pagesCaso Star Appliance CompanyJuan0% (1)

- MCQ Finance Exam Advanced Financial ManagementDocument3 pagesMCQ Finance Exam Advanced Financial ManagementBasappaSarkar78% (36)

- Intelligent Advisory Portfolios PDFDocument9 pagesIntelligent Advisory Portfolios PDFCASrinivasaRaoGuduruNo ratings yet

- GS - Quantamentals - The Quality FactorDocument10 pagesGS - Quantamentals - The Quality Factormac roNo ratings yet

- Clingly Company (Eric Madia)Document4 pagesClingly Company (Eric Madia)Eric MadiaNo ratings yet

- Financial Accounting: Volume 3 Summary ValixDocument10 pagesFinancial Accounting: Volume 3 Summary ValixPrincess KayNo ratings yet

- Activity 1 UTSDocument14 pagesActivity 1 UTSdoieNo ratings yet

- UnderwritingDocument16 pagesUnderwritingChienny HocosolNo ratings yet

- Format of Bottlers NepalDocument12 pagesFormat of Bottlers NepalReya TaujaleNo ratings yet

- TCS 2010 AnalysisDocument22 pagesTCS 2010 AnalysisDilip KumarNo ratings yet

- PRTC 1stPB - 05.22 Sol AFARDocument4 pagesPRTC 1stPB - 05.22 Sol AFARCiatto SpotifyNo ratings yet

- Indirect and Mutual HoldingsDocument36 pagesIndirect and Mutual HoldingssiwiNo ratings yet

- Working Capital Management Analysis of ACCDocument77 pagesWorking Capital Management Analysis of ACCVijay ReddyNo ratings yet

- Circualr No.217Document17 pagesCircualr No.217Raghavendra M RNo ratings yet

- Cash FlowDocument12 pagesCash FlowalguienNo ratings yet

- Liquidation of Companies: After Studying This Chapter, You Will Be Able ToDocument47 pagesLiquidation of Companies: After Studying This Chapter, You Will Be Able ToRishi LodhNo ratings yet

- ស៊ីម ខេមរា20230212 073338 PDFDocument1 pageស៊ីម ខេមរា20230212 073338 PDFsim khemraNo ratings yet

- Fundamentals of Advanced Accounting Hoyle Doupnik 4th Edition Solutions ManualDocument44 pagesFundamentals of Advanced Accounting Hoyle Doupnik 4th Edition Solutions ManualCarolineAndersoneacmg100% (34)

- 1 - Introduction To The CourseDocument17 pages1 - Introduction To The CourseGioacchinoNo ratings yet

- A3 Assignment Equity and Debt SecuritiesDocument5 pagesA3 Assignment Equity and Debt SecuritiesEmmanuel MamarilNo ratings yet

- Draft Solutions Diploma in IFRS For SMEs Final Exam JD21Document84 pagesDraft Solutions Diploma in IFRS For SMEs Final Exam JD21Vuthy DaraNo ratings yet

- Hfa Unit 2Document14 pagesHfa Unit 2Darshan PanchalNo ratings yet

- Voluntary Petition For Non-Individuals Filing For BankruptcyDocument13 pagesVoluntary Petition For Non-Individuals Filing For BankruptcyJimmy ElliottNo ratings yet

- PT Pma Guidance and RegulationDocument3 pagesPT Pma Guidance and RegulationRajifakbrNo ratings yet

- CFA Level II Mock Exam 5 - Questions (AM)Document41 pagesCFA Level II Mock Exam 5 - Questions (AM)Sardonna FongNo ratings yet