Professional Documents

Culture Documents

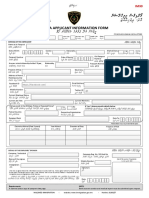

Page Loan Form

Uploaded by

Chukwuemeka Great NwankwoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Page Loan Form

Uploaded by

Chukwuemeka Great NwankwoCopyright:

Available Formats

T 01 631 PAGE (7243) E customer@pagefinancials.

com

23 Norman Williams Street, Ikoyi, Lagos, Nigeria Affix recent

www.pagefinancials.com passport

photograph

here

PERSONAL ACCOUNT OPENING FORM

Account type (tick as appropriate) Loan Account Borrowings Target Plan Account Credit Card Account

The items should be completed in CAPITAL LETTERS.

Branch Account No. (for official use only)

Account Name

Personal Details

Title Mr Mrs Miss Other

First Name Middle Name

Surname Mother’s Maiden Name

Gender F M Date of Birth D D / M M / Y Y Y Y Place of Birth

Marital Status Single Married Others (specify) Bank Verification No. (BVN)

Employment Status Employed Self-employed Job Description

Official Email Address

Current Employer

Current Employer’s Address

Employer’s LGA State

Popular landmark closest to this address

Net Monthly Income (N) Number of Dependants NIN

Highest level of Education SSCE B.Sc/HND M.Sc/M.Ed Others (specify)

Contact Details

Mobile No. 1 - - Mobile No. 2 - -

Residential Address

State of Origin LGA

Personal Email Address

Nationality (for non Nigerian) Resident Permit No.

Permit Issue Date D D / M M / Y Y Y Y Permit Expiry Date D D / M M / Y Y Y Y

Valid means of identification

National ID Card National Drivers Licence International Passport *Others (please specify)

ID No. ID Issue Date D D / M M / Y Y Y Y ID Expiry Date D D / M M / Y Y Y Y

ID No. ID Issue Date D D / M M / Y Y Y Y ID Expiry Date D D / M M / Y Y Y Y

Next of kin information

First Name Middle Name

Surname

Gender F M Date of Birth D D / M M / Y Y Y Y Place at Birth

Relationship Sibling Parent Spouse Others (specify)

Mobile No. 1 - - Mobile No. 2 - -

Personal Email Address

Official Email Address

House Number Street name

City/Town NIN

How did you hear about us? Walk in Website Fliers/Banners Online Advertising

Telesales Word of mouth Radio/TV Others, specify

Salesperson Social Media Outdoor Advertising

FOR BANK USE ONLY

Address Verification carried out by

Name

Signature Date D D / M M / Y Y Y Y

Comment(s) (Address description and result finding):

Account Officer’s Signature Supervisor’s Signature

Loan Applicants Only Borrowings Applicants only

Personal Loan Mandate

Official pay day D D Amount of initial Borrowings (N)

Loan Amount Value of Borrowings (in words)

Tenor Agreed

Number of Cheques submitted:

Reason for Loan

Disbursement Details Source of Funding: Cheque Fund Transfer Card

If approved, what account would you like to receive the money in ?

Others (specify)

Account Name

Duration

30 Days 60 Days 90 Days

NUBAN Account Number

180 Days 270 Days 360 Days

Bank Name

Preferred Options to Credit Interest Payments

Acknowledgement

I hereby confirm my application for the above facility and certify that all information provided by me Interval Upfront Quarterly End of Term

Monthly

above and attached thereto is correct and complete. I authorize you to make any enquiry you consider

necessary and appropriate for the purpose of evaluating this application.

NUBAN Account Number

I/We

Bank Name

hereby apply for the opening of account(s) with Page IFSL. I/We understand that the information given

herein and the documents supplied are the basis for opening such account(s) and I/We therefore

warrant such information is correct. I/We further undertake to indemnify Page IFSL for any loss suffered as

a result of any false information or error in the information provided to page IFSL.

Applicant’s Signature

Applicant’s Signature D D / M M / Y Y Y Y

Date

Date D D / M M / Y Y Y Y

Applicant’s Signature

Date D D / M M / Y Y Y Y

TERMS AND CONDITIONS - LOANS TERMS AND CONDITIONS - BORROWINGS 15. The amount of the prepayment adjustment is calculated by

These terms and conditions apply to and regulate the provision of credit facilities advanced by Page International Financial Services I confirm and agree that my Borrowings and Page taking into account the amount withdrawn, the length

Limited(”Page”).These Standard Terms and Conditions, together with our offer letter set out the terms governing this Loan Agreement. It all banking transactions between me (”the customer”) of time since the borrowing was lodged as a percentage of the

is important that you read the offer letter and these terms and conditions carefully and keep them for future reference. and Page International Financial Services Limited (”Page)

original term, and the application of an adjusted rate of interest.

shall be governed by the conditions contained herein.

A. INTEREST General Terms Breach of Prevailing Laws

.

i. The Annualized Percentage Rate of Interest (”APR”) for the direct Loan Account are (- %) or at such higher rate which Page may 1. Definitions: Page means Page International Financial

Services Limited’ . Business day means a day on which

16. If it appears to Page that the Customer may:

a. be in breach of the laws of Nigeria and of any other jurisdiction

in its sole discretion (subject to applicable laws and regulations) determine from time to time and also varied by Page under Nigeria Bannks are open for business; . Borrowings means

subclauses a(ii) and/or a(iii) below. relating to money laundering or counter-terrorism: or

funds from customers‘You’;‘your’ means the customer

ii. Page may in its sole discretion increase or decrease the prevailing interest rate for any reasons and who is the person or persons in whose n a m e t h e f i x e d b. appear in a list of persons with whom dealings are proscribed by

iii. Any change in interest rate will take effect on the borrower’s account following a minimum of 7 days written notice. deposit is held. the government or a regulatory authority of any jurisdiction:

iv. All charges will be capitalized into the interest calculation. 2. Page will not open or operate the requested account Page may immediately do one or more of the following:

unless and until it has received the required supporting c. Refuse to process any transaction of the Customer’s;

documentation for the account. d. Suspend the provision of a product or service to the Customer

B. PAYMENTS 3. Page is hereby authorized to undertake all “Know Your

Customer” (KYC) procedures specified by applicable laws e. Freeze the Customer’s account; or

All payments by the Borrower will be made by one of the following methods: Direct Deposit at Page, Personal Cheque, Standing f. Close the Customer’s account. The Customer accepts that

Order or through an acceptable electronic channel. All other methods will be accepted with Page’s consent only. in particular: and/or regulations and/or Bank policies.

i. The borrower will be given a dedicated and customized repayment plan upon approval of the loan application; 4. Page may without prior notice impose or change the Page will be under no liability to them if they do any or all of the

ii. The Borrower will be expected to make monthly repayments in accordance with the repayment plan minimum balance requirements for the borrowings or above t h i n g s . B a n k ’ s L i m i t a t i o n o f l i a b i l i t i e s

iii. The Borrower will be sent an electronic message or SMS alert two (2) working days -before each monthly repayment date and alter the applicable interest rate(s) or the charges relating 17. The Customer agrees to hold Page free of any responsibility for

the Borrower hereby agrees that such notice shall be conclusively deemed received by the Borrower without need of any further to such account.

5. Page is authorized where the balance standing to the any loss or damage of borrowings with Page due to any

notice.

iv. The Borrower hereby agrees that non-payment of the amount owed by the Payment Due Date shall render the Borrower in borrowing is below the required minimum balance. future Government order, law, tax, embargo, moratorium,

default and entitles Page to take steps to recover the outstanding loan amount in accordance with clause E below. to either amend the rate(s) of interest payable or close the exchange restriction and/or all other causes beyond Page’s

account. control.

C. PROVISION OF FINANCIAL INFORMATION Term of Deposit 18. The Customer agrees to be bound by any notification of

At our request, you will be required to provide us with your last financial statements, contingent liability details and any other 6. The Minimum term for which the customer’s borrowing can change in the conditions governing the account directed to

reasonable information relating to you and/or your financial affairs. be held is sixty (60) days. the customer’s last known address and any notice or l e t t e r

7. The Maximum term for which the Customer’s borrowing (electronic o r p h y s i c a l ) s e n t t o P a g e t h e

D. USE OF CREDIT BUREAU can be held is three hundred and sixty (360) days. Customer’s last know physical or electronic address shall be

Page will approach a dedicated Credit Reference Agency for a credit report on the Applicant in considering any application for considered as duly delivered and received by the Customer at

credit Payment of Interest the time it would be delivered in the ordinary course of post or

The Borrower authorizes Page to access any information available to it as provided by the Credit Agency. The Borrower also 8. The interest rate applicable to the Customer’s borrowing is electronically.

agrees that his/her details and the loan application decision will be registered with the Credit Agency. fixed at the time of lodgment for the whole of

19. The Customer agrees that Page will accept no liability

In the event the Borrower wishes to access the credit report, Page will advise the Borrower of the contact details of the relevant the nominated term. Page may vary the interest rates on

whatsoever for funds handed to members of staff at any point in

credit agency and the Borrower waives any claims he/she may have against Page in respect of such disclosure. offer for new borrowings at any time without notice.

time outside banking hours or outside Page’s premises.

9. Interest is calculated daily on the balance of the

E. DEFAULT borrowing, commencing on the first day of the lodgment 20. The customer accepts that their attention has been drawn to the

Default in terms of this Agreement will occur if: term and excluding the date of maturity. Unless otherwise necessity of safeguarding their password and access codes to

v. The Borrower fails to make repayment in full, on or before the payment date in accordance with the monthly repayment plan given to stated, the Customer may choose one of the following Page’s non- branch channels including but not limited to internet

the Borrower interest payment options: banking telephone banking, mobile banking and sms

vi. Any representation, warranty or assurance made or given by the Borrower in connection with the application for this loan or any a. Interest credited to a nominated bank account every end banking, so that unauthorized persons are unable to gain access

information or document supplied by the Borrower, is later discovered to be materially incorrect; or of month. to it and to the fact that neglect of this precaution may be a

vii. The Borrower does or omits to do anything which may prejudice Page’s rights in terms of this Agreement or course Page to suffer any loss b. interest credited to a nominated bank account upon ground for any consequential loss being charged to the

or damage. maturity Customer’s account.

If the Borrower defaults in their obligation under this Agency, Page will be entitled to do the following: 21. The Customer accepts that any disagreements with entries on

Maturiry

Page will on each Repayment Date collect the total amount payable by that date in accordance with the repayment plan schedule 10. Page will issue a renewal notice approximately three days their bank statement will be made by them within fifteen (15)

given to the Borrower. where the Borrower fails to honor their obligation to repay their total monthly repayment amount by the due date. prior to the borrowings maturing, unless the tenor was for working days of the dispatch of the bank statement. failure to

Page will attempt to collect the outstanding amount within the next twenty-four(24) hours. less than 60 days. this notice will seek instructions for receive any such notice of disagreement with the entries

Where more than forty-eight (48) hours have elapsed since the repayment date and the repayment amount (total or partial) still remains renewal or redemption of the tenured deposits. inputted therein within the stipulated time frame shall amount to

outstanding . Page will start calculating accelerated interest at the rate 30% plus the applicable borrowing interest rate. Following the 11. Where instructions are not received prior to the date of acquiescence that all entries in the statements have been

borrower’s default, page reserves the right to assign its right, title and, interest under the Agreement an external Collections Agency maturity. Page will renew the borrowing for the same rendered correctly.

investment term as before at the interest rate currently

who will take all steps to collect the outstanding loan amount.

applicable and on the terms and conditions then applying Communications

Page also reserves the right to start legal proceedings against the defaulting Borrower and is under no obligation to inform the Borrower to new standard borrowings. The interest rate 22. Any communication by Page shall be deemed to have been

before such proceedings commence. applicable to the new tenor Deposit may be significantly made as soon as it is sent to the most recent address provided

Page will be entitled to terminate this agreement (after service of any notice required there under) if the Borrower in any way different, higher or lower, to the interest rate applied in the by the Customer and the date indicated on the duplicate

perpetrates or attempts to or is involved in any act of fraud or other criminal activity in respect of Page International Financial Services previous terms as a consequence of market rate copy of such letter or on the Bank’s mailing list will constitute the

Limited or the Loan, or if any in formation provided by the Borrower as part of the application is incorrect or misleading in any material movements. Also, the borrowings terms giving the best date on which the communication was sent.

nanner. On such termination, Page reserves the right to demand repayment of full loan amount with interest calculated in the same interest rates may change from time to time. it is 23. Page is hereby authorized to honor or debit the Customer’s

manner as in sub-clause (2) above. Hold the Borrower responsible for legal costs and expenses incurred by Page attempting to obtain recommended that the Customer contact Page on or account(s) with any and all payment instruction issued in

before the maturity date to determine if the rate that accordance with the mandate for the Customer’s account(s)

repayment any outstanding loan balance owed by the Borrower. interest on any amount which becomes due and payable shall be

applies to the renewed borrowings meets their needs. which bear or purports to bear the facsimile or electronic mail

charged in accordance with sub clause 2 above. 12. Were the Customer has previously giving the Bank signature of the person(s) whose specimen signatures have

instructions that all or part of their borrowings should be been provided to the bank by the Customer.

F. COMMUNICATION paid to a nominated account monthly or at the Bank on

The Borrower agrees that Page may communicate with them by sending notices, messages, alerts and statements in relation to this maturity. the Customer is not able to change or cancel Severance

Agreement in the following manner: those instructions on or after the maturity date.

24. If any of these Terms and Conditions is found to be void or

I. To the most recent address Page holds for the Borrower on file. unenforceable for unfairness or any other reason. the

ii. By delivery to any email address provided during the application process. Withdrawal in Advance of Maturity remaining parts of these Terms and Conditions will continue to

iii. By delivery of an SMS to any mobile telephone number the Borrower has provided to Page. 13. Where the Customer requests to withdraw their funds prior apply to the extent possible as if the void or unenforceable

to the maturity date, Page may, in its absolute discretion part had never existed.

G. MISCELLANEOUS approve a request for early withdrawal in which case a Miscellaneous

i. This Agreement shall be governed by the laws of the Federal Republic of Nigeria and shall be subject to the jurisdiction of the courts of prepayment adjustment will be effected and an early 25. The Terms and Conditions stated herein shall be governed and

the Federal Republic of Nigeria. withdrawal fee levied.

ii. If Page does not strictly enforce its right under this Agreement (including its right to insist on the repayment of all sums due on the construed in accordance with the laws of the Federal Republic

14. where on early withdrawal fee is deemed applicable due of Nigeria. The Customer agrees that any disputes arising out of

Repayment Due Date) or grant the Borrower an indulgence, Page will not be deemed to have lost those rights and will not be prevented

to withdrawal in advance of maturity, such fee shall be or in connection therewith may be brought in the courts of the

from insisting upon its strict rights at a later date.

iii. Page reserves the right to transfer or assign its right and obligations under this Agreement (including its obligation to lend money to the calculated at the rate of twenty per cent (20%) of the Federal republic of Nigeria.

Borrower or the amount owed under owed under this Agreement) to another person. Page will only tell the Borrower it such a transfer accrued interest that would have been payable on the 26. When disbursing interest accrued, such funds will be credited into

causes the arrangements for the administration of this Agreement to change. tenured deposit as of the date the early withdrawal the same accounts as nominated by the customer.

All the terms and conditions in this Page International Financial Services Limited Loan Application Package have been read understood request is processed by the Bank. 27. This form also serve as an account opening form.

by me. I hereby accept the tern and conditions as evidenced by my signature below.

Name Name

Applicant’s Signature Applicant’s Signature

Date D D / M M / Y Y Y Y Date D D / M M / Y Y Y Y

You might also like

- Payment Systems Part 1Document282 pagesPayment Systems Part 1ashimadania100% (2)

- Home Loan Application FormDocument9 pagesHome Loan Application FormSachin KmNo ratings yet

- Account Opening FormDocument11 pagesAccount Opening FormTotimeh WisdomNo ratings yet

- Individual Account Opening Form PARALLEX BANKDocument7 pagesIndividual Account Opening Form PARALLEX BANKNifesi BalogunNo ratings yet

- PNB Customer Information Form IndividualDocument1 pagePNB Customer Information Form IndividualBrittaney BatoNo ratings yet

- Bank Confirmation FormatDocument4 pagesBank Confirmation FormatTasdik MahmudNo ratings yet

- QPSTECC Operational Policy Manual SummaryDocument90 pagesQPSTECC Operational Policy Manual SummaryEmanuel Laceda100% (3)

- Business Finance PrelimDocument2 pagesBusiness Finance PrelimYna PangilinanNo ratings yet

- Account Opening Form-Entities: COMPANY DETAILS (Please Complete in BLOCK LETTERS and Tick Where Necessary)Document12 pagesAccount Opening Form-Entities: COMPANY DETAILS (Please Complete in BLOCK LETTERS and Tick Where Necessary)Elie MeouchiNo ratings yet

- Salary Loan/Advance - Application Form: Personal InformationDocument2 pagesSalary Loan/Advance - Application Form: Personal InformationJohn Ray Velasco100% (1)

- Zitra Personal Account FormDocument2 pagesZitra Personal Account FormUgo BenNo ratings yet

- Information Form: Maldives Islamic BankDocument5 pagesInformation Form: Maldives Islamic BankyrafeeuNo ratings yet

- AccntopeningDocument5 pagesAccntopeningEzekiel F Sirleaf jrNo ratings yet

- Individual Account Opening FormDocument4 pagesIndividual Account Opening FormTinz JoeyNo ratings yet

- Additional Applicant Form: Personal DetailsDocument2 pagesAdditional Applicant Form: Personal DetailsAlhassan EmmanuelNo ratings yet

- Persoanl Account Opening Form English A1edbfb2bdDocument8 pagesPersoanl Account Opening Form English A1edbfb2bdsubhsarki4No ratings yet

- Individual Information FormDocument2 pagesIndividual Information FormTanzir HasanNo ratings yet

- ALAT Account Customer Update FormDocument1 pageALAT Account Customer Update FormJamiu JabaruNo ratings yet

- Zenith FormDocument2 pagesZenith Formadewumiaboderin13No ratings yet

- 18 Account Opening FormDocument11 pages18 Account Opening Formhl2225742No ratings yet

- D D M M Y Y Y Y D D M M Y Y Y Y D D M M Y Y Y Y: IFD Code: Independent Financial Distributor (Ifd) Registration FormDocument7 pagesD D M M Y Y Y Y D D M M Y Y Y Y D D M M Y Y Y Y: IFD Code: Independent Financial Distributor (Ifd) Registration Formdharam singhNo ratings yet

- Account Opening Form - IndividualDocument5 pagesAccount Opening Form - IndividualoyindaNo ratings yet

- Update Info FormDocument1 pageUpdate Info FormEsan BiolaNo ratings yet

- Home Loans ApplicationDocument12 pagesHome Loans Applicationzirri23No ratings yet

- Loan Application FormDocument2 pagesLoan Application FormSarah Jane VallarNo ratings yet

- Account Opening FormDocument13 pagesAccount Opening FormAbdulJaseemNo ratings yet

- Retail Asset Bundle Form 10-07-2023Document2 pagesRetail Asset Bundle Form 10-07-2023mk2475576No ratings yet

- APPLICANT - RBL - Retail Loan AF (LAP-Home Loan) Jan22Document4 pagesAPPLICANT - RBL - Retail Loan AF (LAP-Home Loan) Jan22AFFII MARKETINGNo ratings yet

- Emp Bus SPC AirportsDocument1 pageEmp Bus SPC AirportsShami MudunkotuwaNo ratings yet

- Revised Re-KYC Form For NRIDocument2 pagesRevised Re-KYC Form For NRIjhahpNo ratings yet

- Account Opening Form: Bank AL Habib LimitedDocument4 pagesAccount Opening Form: Bank AL Habib LimitedaqsaNo ratings yet

- OPEN BANK ACCOUNT FORMDocument5 pagesOPEN BANK ACCOUNT FORMaribandikNo ratings yet

- Individual Account Opening Form: DdmmyyyyDocument2 pagesIndividual Account Opening Form: DdmmyyyyRamzi ChattiNo ratings yet

- Account Opening Tier 3Document4 pagesAccount Opening Tier 3Benedict WannyamNo ratings yet

- Open Your AccountDocument4 pagesOpen Your AccountGabriel JosephNo ratings yet

- Information Form - FillableDocument5 pagesInformation Form - FillableAbdul Majeed MohamedNo ratings yet

- ACCOUNT OPENINGDocument2 pagesACCOUNT OPENINGkenaiaNo ratings yet

- Aof Account Fatca Final 15-9-17Document13 pagesAof Account Fatca Final 15-9-17Zainah HussainNo ratings yet

- Common Retail Loan Application Form For GuarantorDocument2 pagesCommon Retail Loan Application Form For GuarantorNukamreddy Venkateswara ReddyNo ratings yet

- Home Loan Application FormDocument5 pagesHome Loan Application FormHimanshu AshwiniNo ratings yet

- DOCUMENTDocument2 pagesDOCUMENTHussainNo ratings yet

- Im23 Permit Extension FormDocument2 pagesIm23 Permit Extension FormHussainNo ratings yet

- Auto Loan Application FormDocument10 pagesAuto Loan Application FormVijayNo ratings yet

- AL Form Document MITCDocument9 pagesAL Form Document MITCRamyaSathyanathanNo ratings yet

- Individual Account Opening Form: For Official Use OnlyDocument4 pagesIndividual Account Opening Form: For Official Use OnlyDaniel RitaNo ratings yet

- Application FormDocument13 pagesApplication Formmadhukar sahayNo ratings yet

- Personal Loan Application Form 2019Document5 pagesPersonal Loan Application Form 2019bamarteNo ratings yet

- Boresha Maisha Umbrella Retirement ApplicationDocument3 pagesBoresha Maisha Umbrella Retirement ApplicationxeniaNo ratings yet

- Loan Application Form Please Complete in BLOCK LETTERS.: Office UseDocument4 pagesLoan Application Form Please Complete in BLOCK LETTERS.: Office UseKennedy SimumbaNo ratings yet

- EHFL App Form Morgage 15.7.21Document13 pagesEHFL App Form Morgage 15.7.21prashantrp78No ratings yet

- Application FormDocument2 pagesApplication FormKamlesh SamaliyaNo ratings yet

- Savings Account Opening Application Form: MUFG Bank, LTDDocument24 pagesSavings Account Opening Application Form: MUFG Bank, LTDayuNo ratings yet

- Loan Application Form: Applicant Co-ApplicantDocument4 pagesLoan Application Form: Applicant Co-ApplicantStatus SambavanghalNo ratings yet

- Customer Information Update Form: Account DetailsDocument1 pageCustomer Information Update Form: Account DetailsDolapo OlukotunNo ratings yet

- Confidential Diaspora FormDocument1 pageConfidential Diaspora FormBrian ChukwuNo ratings yet

- Reactivation Application Form 2Document4 pagesReactivation Application Form 2alina aguirre de la cruzNo ratings yet

- Migration Individual Customer InformationDocument1 pageMigration Individual Customer InformationSime OnnyNo ratings yet

- Vehicle Loan ApplicationDocument6 pagesVehicle Loan ApplicationЛена КиселеваNo ratings yet

- KYC DormantDocument1 pageKYC DormantslohariNo ratings yet

- LAIP_Original_Document11 pagesLAIP_Original_Mcnet WideNo ratings yet

- Kina AccountDocument6 pagesKina AccountNathan LakaNo ratings yet

- New Format Application Form CLRDocument8 pagesNew Format Application Form CLRtheonelNo ratings yet

- Finvasia Client Guidance NSE BSE 2016Document18 pagesFinvasia Client Guidance NSE BSE 2016tommyNo ratings yet

- VB94 ScaledDocument69 pagesVB94 Scaledsvetlana_sdNo ratings yet

- Financial Statement Analysis FWBLDocument21 pagesFinancial Statement Analysis FWBLAamir Raza100% (2)

- MScFE 560 FM - Notes1 - M1 - U1Document7 pagesMScFE 560 FM - Notes1 - M1 - U1chiranshNo ratings yet

- Form 16 ADocument23 pagesForm 16 Amlkhantwal8404No ratings yet

- Module 3-Merchant Banking: Financial Services MBA III Semester Finance Elective Ranjani. JDocument17 pagesModule 3-Merchant Banking: Financial Services MBA III Semester Finance Elective Ranjani. Jwelcome2jungleNo ratings yet

- Icpu Registration FormDocument1 pageIcpu Registration FormGhulam AbbasNo ratings yet

- HRM Strategies of SCBDocument52 pagesHRM Strategies of SCBajish808No ratings yet

- Adan Salah Abdi - SP and P - Case - National Bank of Kenya - Kenya - Thesis - 2014Document62 pagesAdan Salah Abdi - SP and P - Case - National Bank of Kenya - Kenya - Thesis - 2014Ahmedin AbdurahmanNo ratings yet

- Seashell Logistics PVT LTD Vendor Registration FormDocument2 pagesSeashell Logistics PVT LTD Vendor Registration Formjubin4snapNo ratings yet

- S - Y - B - Com Sem-4 All Subject Syllabus 2019-20 10-12-2019Document13 pagesS - Y - B - Com Sem-4 All Subject Syllabus 2019-20 10-12-2019nandanibhurakhayaNo ratings yet

- SBI Sanction Letter 2019-20-1Document14 pagesSBI Sanction Letter 2019-20-1s2amirthaNo ratings yet

- Commerce Specimen PaperDocument4 pagesCommerce Specimen PaperNeha MehtaNo ratings yet

- Capital MarketsDocument40 pagesCapital MarketsItronix MohaliNo ratings yet

- 12-Page Rbs 6 Nations Championship Guide: Bumper Rugby SpecialDocument40 pages12-Page Rbs 6 Nations Championship Guide: Bumper Rugby SpecialCity A.M.No ratings yet

- Chairman & MD Brief Bio Data PDFDocument2 pagesChairman & MD Brief Bio Data PDFVivek PandeyNo ratings yet

- All Fees and Charges are Tax Inclusive for NMB Bank AccountsDocument2 pagesAll Fees and Charges are Tax Inclusive for NMB Bank Accountsdoplapesa dpNo ratings yet

- ILPDocument4 pagesILPSajal JainNo ratings yet

- Case Study and Practical Problem Combo Part 1Document17 pagesCase Study and Practical Problem Combo Part 1SOUMYA MUKHERJEE-DM 20DM215No ratings yet

- Important Sections of Companies Act-1994:, Schedule-IDocument12 pagesImportant Sections of Companies Act-1994:, Schedule-IBabu babuNo ratings yet

- Internship ReportDocument33 pagesInternship ReportBoricha AjayNo ratings yet

- A Project Report: ON Customer Perception Towards Plastic MoneyDocument47 pagesA Project Report: ON Customer Perception Towards Plastic Moneyfrnds4everzNo ratings yet

- City Limits Magazine, November 1999 IssueDocument40 pagesCity Limits Magazine, November 1999 IssueCity Limits (New York)No ratings yet

- Accounting Chapter 8 Warren AnswerDocument16 pagesAccounting Chapter 8 Warren AnswerFadhly Azzuhry0% (1)

- BankingDocument141 pagesBankingc4chita9700No ratings yet

- VIVA Presentation on FinTech Adoption in Islamic BanksDocument21 pagesVIVA Presentation on FinTech Adoption in Islamic BanksnatasyaNo ratings yet