Professional Documents

Culture Documents

LAIP_Original_

Uploaded by

Mcnet WideCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LAIP_Original_

Uploaded by

Mcnet WideCopyright:

Available Formats

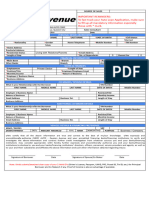

Application Form number

LOAN AGAINST INSURANCE POLICY

(Please complete all sections of this application form in CAPITAL LETTERS) *Mandatory Fields

PERSONAL DETAILS

Name (same as OVD)*

Prefix First Name Middle Name Last Name

Father/Spouse/

Mother name*

Prefix First Name Middle Name Last Name

Gender* Male Female Transgender

Marital Status* Single Married Others

Date of Birth* D D M M Y Y Y Y

Qualification Graduate Post Graduate Professional

Others (please specify)

PAN*

CKYC No. (KYC Identifier/ Self-attested

KYC no.- KIN) Recent photograph

*Officially Valid Valid Passport Expiry Date (Signature)

Documents (OVD’s) Voter ID card

Any one Valid Driving Licence Expiry Date NREGA

Job Card National Population Register Letter

Proof of possession of Aadhaar Number (i.e. Aadhaar letter/Aadhaar Card)

(Mention only last 4 digits of Aadhaar Number, Redact first 8 digits on copy of

Aadhaar obtained)

Document Number X X X X X X X X X X X X

*I hereby confirm that I am an Indian resident.

In case OVD does not have Current Address of the client, obtain below listed documents which are treated as Deemed to be Officially

Valid Documents (DOVD) for the limited purpose of Proof of Address

*Deemed Officially Valid Documents (DOVD)

Utility Bill, in the name of the client which is not more than two months old of any service provider (Electricity

bill, telephone bill, post-paid mobile phone bill, piped gas bill, water bill)

Pension or family pension payment orders (PPOs) issued to retired employees by Government Departments or

Public Sector Undertakings, if they contain the address

Property or Municipal tax receipt

Letter of allotment of accommodation from employer issued by the State Government or Central Government

Departments Statutory or Regulatory Bodies, Public Sector Undertakings Scheduled Commercial Banks,

Financial Institutions and Listed Companies and Leave and License agreements with such employers allotting

official accommodation.

*In case a client submits Deemed to be OVD (DOVD) towards Current Address, client must submit an OVD mentioned

above with updated Current Address, within three months of submission of the DOVD.

CONTACTDETAILS

Current Residential Address*

City/Town*

Village, District*

Landmark

Pin Code*

BFL/Loan Cum Security Cum Guarantee Agreement

1 (Loan Against Life Insurance Policy)/May 2022/Ver. 2

Std Code - Tel. No.

CommunicationAddress Same as Current address or Other Address

Other Address

City/Town*

Village, District*

Landmark

Pin Code*

Mobile*

Email ID*

EMPLOYMENTDETAILS

Occupation Salaried Self-employed Retired Housewife

Student Others

Employment Sector Public Sector Private Sector Government Sector

Name of the Employer/

Company

Address of the company

Gross Salary per annum/

Annual Income

Designation

No. of years in current job

NetIncome/Profit

Official email id

Department

Constitution of the Business

LLP Public Ltd. Co. Private Ltd. Co. Sole Proprietorship

Partnership Trust Others (please specify)

Nature of Business/ Agriculture

Employer Manufacturing Medical

Construction/Real Estate Government Banking/Finance

Information Technology Others (pleasespecify)

SOURCING DETAILS

Case Type* Direct Indirect

Sourcing Channel Name*

Sourcing Channel Code*

Sourcing Channel Branch*

RM Name*

RM Employee Code*

MA D H U R I KUMAR

1 0 0 3 0 2 2 Branch Name

DETAILS OF LOAN REQUIRED

Loan amount*

Tenor in months* 96 Month Securityoffered

Purpose of loan* Long term Investment Purchase of Vehicle

Purchase/Renovation of House Working Capital Requirement

Wedding/Education Travel Others (Please specify)

BFL/Loan Cum Security Cum Guarantee Agreement

2 (Loan Against Life Insurance Policy)/May 2022/Ver. 2

BANK DETAILS

Account Holder’s Name

Bank Name

Branch Name City

Account Type

Savings Current OD/CC

MICR Code

IFSC Code

DETAILS OF EXISTING RELATIONSHIP WITH BAJAJ FINANCE LTD.* NO IFYES, FILL THE BELOWDETAILS

Loans Consumer Durable Personal LAS Mortgage

Others (Please specify)

Customer ID No. Type of Loan

Loan Account Number (LAN) Tenor (Years)

Loan Amount

Interest Rate Methodology

Interest rate applicable for Loan against securities variesfrom 6%p.a. to 20%p.a. basis BFL’sinternal credit and risk policy and as per an algorithmic

multivariate score card which includes following variables (the variable list mentioned below is not exhaustive):

- Interest rate risk (fixed vs floating loan) - Secured Vs unsecured loan

- Credit and default risk in the related business segment - Subvention available

- Historical performance of similar homogeneous clients - Ticket size of loan

- Profile of the borrower - Bureau Score

- Industry segment - Tenure of Loan

- Repayment track record of the borrower - Location delinquency and collection performance

- Nature and Value of collateral security - Customer Indebtedness (other existing loans)

The aforesaid variables may be revised from time to time as per the Lender’s past performance in a given loan portfolio.

Fees & Charges

Interest Rate Between 6% p.a. to 20% p.a.

Processing Fee As per Schedule

Bounce Charges Rs. 1,200 per bounce (inclusive of applicable taxes)

Penal Interest 2% per month

Annual Maintenance Charges Rs.1179 (Inclusive of applicable taxes) to be collected on annually on

renewal

Declaration

I/We am/are hereby applying for Loan Against Securities facility (‘Loan’) from Bajaj Finance Limited (‘BFL’), as specified in this Application Form.

I/We confirm that no insolvency proceedings or suits for recovery of outstanding dues or monies whatsoever or properties and/or any criminal

proceedings have been initiated and/or are impending against me/us and that I/we have never been adjudicated insolvent by any court or other

authority. I/We have not taken any action and no other steps have been taken or legal proceedings started by or against me/us in any court of law/

other authorities for the appointment of a receiver, administrator, administrative receiver, trustee or similar officer or for my/our assets.

I/We declare that I/We have not received any request for or made any payment in cash, bearer cheque or kind along with or in connection with this

Application Form to the person collecting my/our Application Form. I/We shall not hold BFL liable in case any such payment is made by us to the

person collecting this Application Form.

I/We declare that all the particulars, KYC details, any other information and details given/filled in this Application Form are true, correct, complete

and up-to- date in all respects and that I/we have not withheld any information whatsoever. I/We authorize BFL to verify the said information directly

or through any third party agent, as deemed fit. In case any of the information is found to be false or untrue or misleading or misrepresenting, I/we

am/are aware that I/we may be held liable for it.

I/we hereby confirm that the details furnished me/us are true and correct to the best of my/our knowledge and belief and undertake to inform

Bajaj Finance Ltd. (“BFL”) of any changes therein, immediately. In case any of the above information is found to be false or untrue or misleading or

misrepresenting, I am aware that I may be held liable for it.

CKYC Consent-I/we hereby authorize BFL to verify/check/obtain/download//upload/update/retrieve/receive my/ our KYC details from the CKYC

Registry by (i) verifying such details through the CKYC number (i.e. KYC Identifier Number- KIN) provided by me/us or (ii) by obtaining such CKYC

number/KYC Number-KIN, through details shared by me/us for this Application Form. I/We further consent to receiving information from Central

BFL/Loan Cum Security Cum Guarantee Agreement

3 (Loan Against Life Insurance Policy)/May 2022/Ver. 2

KYC Registry (CERSAI) and BFL through SMS/Email on the number/email address provided by me/us to BFL.

Further, I hereby confirm, certify and declare that my current address is same as the address on the Aadhaar/KYC documents retrieved/downloaded

from offline KYC/CKYCR and the same is correct and updated. In case of any change in address or any other details, I agree and undertake to notify

Bajaj Finance Limited (BFL) and will submit the latest self-attested KYC documents through acceptable mode of communication”

I/We hereby expressly authorize BFL and its group companies/business partners/affiliate/subsidiaries/agents/ representatives/

empanelled merchants, service provider/permitted assigns and any such third party to send me communications, including but not limited

to promotional communications, regarding loans, insurance and their respective products and/or services through telephone calls/SMSs/

emails/post/bots/bitly etc. I/We agree and understand that products/services belonging to afore-mentioned entities, are governed by

their own set of terms and conditions, which shall be in addition to and not in derogation to the terms and conditions prescribed by BFL

herein. I/We understand that I/we can at any time opt not to receive any telecommunication.

I/We understand and acknowledge that BFL shall have the absolute discretion, without assigning any reasons (unless required by applicable

law), to reject my/our application and that BFL shall not be responsible/liable in any manner whatsoever to me/us for such rejection or any

delay in notifying me of such rejection and any cost, losses, damages or expenses, or other consequences, caused by reason of such

rejection, or any delay in notifying me of such rejection, of my/our application.

I/We have carefully read and understood or I/we have been explained in English or the vernacular language understood by me/us, the terms

and conditions of this Application Form as well as the terms and conditions of the Loan Documents which shall be executed by me/us to

avail the Loan subject to acceptance of this Application Form by BFL.

I/We have read and understood the “BFL WhatsApp Terms and Conditions” available at http://bit.ly/bfl-wtsp-tnc and I/We hereby expressly

consent to receive important updates on WhatsApp pertaining to my/our relationship with Bajaj Finance Ltd/its Assigns. I agree and

understand that products/services belonging to BFL’s Assigns, are governed by their own set of terms and conditions, which shall be in

addition to and not in derogation to the terms and conditions prescribed by BFL herein. I understand that I can at any time opt not to receive

any telecommunication.

Signature of Applicant

Date of Application Place

BFL/Loan Cum Security Cum Guarantee Agreement

4 (Loan Against Life Insurance Policy)/May 2022/Ver. 2

LOAN CUM SECURITY AGREEMENT

(LOAN AGAINST LIFE INSURANCE POLICY)

This loan cum security agreement is made on the day and place as set out in the Schedule hereto by and amongst:

BAJAJ FINANCE LIMITED, a company incorporated under the Companies Act, 1956 and a company within the meaning of Section 2(20) of the

Companies Act, 2013 and a non-banking finance company, having its registered office at Mumbai–Pune Road, Akurdi, Pune–411035,

Maharashtra, India, and acting through its branch offices at Delhi (hereinafter called “Lender” or “BFL”, which expression shall, unless repugnant

to the context or meaning thereof, be deemed to include its successors, administrators and assigns), of the FIRST PART;

AND

The Borrower as described in the Schedule (hereinafter referred to as “Borrower”, which expression shall, unless repugnant to the context or

meaning thereof, be deemed to include its heirs, successors, administrators and legal representatives), of the SECOND PART.

The term “Parties” shall mean and include all the parties to this Agreement and the term “Party” shall mean any one of them.

WHEREAS:

1. The Lender is, inter alia, engaged in the business of providing various types of loans, both secured and unsecured, to its borrowers.

2. The Borrower has requested the Lender to sanction a Loan (as defined below) and the Lender has agreed to grant the said Loan subject

to the terms and conditions set out herein.

THIS AGREEMENT WITNESSETH AND THE PARTIES HERETO AGREE AS UNDER:

1. DEFINITIONS

For the purposes of this Agreement, words and expressions used herein but not defined shall have the same meaning as assigned to them

in General Clauses Act, 1897; or unless there is anything repugnant to the subject or context thereof in any other statutory mandate, the

following words and expressions shall have the meanings as set-out herein below:

“Acceptable Means of Communication” with reference to:

Borrower, shall mean:

(i) a telephonic call on the registered mobile number/landline number of the Borrower as provided in the Schedule hereto; or

(ii) photo/video; or

(iii) an email on the registered email address of the Borrower as provided in the Schedule hereto; or

(iv) a text message on the registered mobile number of the Borrower; or

(v) a written notice sent by courier/post on the registered postal address of the Borrower as provided in the Schedule hereto; or

(vi) text message through chatbot, bitly, social media, such as WhatsApp communication and/or any other electronic mode; or

(vii) notification by BFL on its Website;

(A) BFL, shall mean:

(i) a telephonic call on the designated mobile/landline number of BFL as provided on the Website; or

(ii) an email on the designated email address of BFL as provided on the Website; or

(iii) a text message on the BFL chatbot; or

(iv) a written notice sent by courier on the designated postal address of BFL, as provided on the Website.

“Affiliate” means, subsidiary company, holding company and/or associate company of BFL where the terms ‘subsidiary company’, ‘holding

company’ and ‘associate company’ shall have the meaning ascribed to such terms in the Companies Act, 2013, as amended from time to

time.

“Agreement” means this agreement including the Schedule, and all the documents/annexure/schedules executed pursuant hereto as

may be amended and/or modified by BFL from time to time.

“Applicable Laws” means the ‘Indian law’, regulation, ordinance, judgement, order, decree, and/or any published directive, guideline,

requirement or regulatory/governmental restriction having the force of law applicable at the relevant point of time.

“Application Form” means, the loan application(s) which is/are submitted to BFL through any of the Mode(s) of Application permitted

together with all other information as may be required by BFL in relation to the Borrower.

“Assignment of Insurance Policy” shall mean and include assignment as per Section 38 of the Insurance Act, 1938 as amended, modified

or supplemented from time to time in reference to the Insurance Policy issued by the Insurance Company.

“BFL Representatives” mean employees and/or personnel directly or indirectly engaged by BFL from time to time.

“Bounce Charges” means an amount payable by the Borrower to BFL as a penalty where the cheque(s), National Automated Clearing

House (NACH) mandate, or any other Repayment Mode(s) provided by the Borrower, is/are returned unpaid and/or not honoured by the

bank.

“Broken Period Interest” is the interest charged from the date of debit of the loan amount from BFL’s bank account to the first date of

EMI commencement and depending on the type of loan (product variant) availed, it will either get deducted from the Loan amount or shall

be included in the first EMI.

“Business Day” means a day on which BFL and banks are open for business in the concerned state/union territory of India where the office

of BFL, as stated herein, is located.

“Due Date” means, in respect of: (i) the Monthly Installments, the respective date on or before which each Monthly Installment is to be

repaid by the Borrower, as more specifically mentioned in the Schedule hereto; (ii) if costs, charges and/or expenses are incurred or paid

by BFL under the Loan Documents, within seven 7 (seven) Business Days from the date on which BFL notifies the same to the Borrower

providing details of such costs, charges and/or expenses through any Acceptable Means of Communication; and (iii) any other amount

payable under the Loan Documents, the date on which such amount falls due in terms of the Loan Documents, or on demand if the due date

is not specified in such Loan Document.

BFL/Loan Cum Security Cum Guarantee Agreement

5 (Loan Against Life Insurance Policy)/May 2022/Ver. 2

“Disbursement” or “Disbursal” of Loan amount are the terms which are synonymously referred in this Agreement in order to explicitly

refer to the earlier occurrence of either of the following event(s):

(i) Date of debit of Loan amount from BFL’s account for (a) issuance of account payee cheque/pay order/demand draft in favour of

Borrower; or (b) effecting online transfer of Loan amount to the bank account of Borrower; or

(ii) Date of issuance of account payee cheque/pay order/demand draft towards the disbursal of Loan amount, whether or not

received/encashed/acknowledged by the Borrower; or

(iii) Date of effecting online transfer of Loan amount to the bank account of Borrower by Electronic Payment Instruction, whether or

not withdrawn/utilized by Borrower.

“Electronic Payment Instruction” means NACH or any other electronic payment instructions routed through the electronic clearing

services and electronic payment services, notified by the Reserve Bank of India (“RBI”) from time to time.

“Insurance Company” means a company carrying on the business of an insurer in terms of the Insurance Act, 1938.

“Insurance Policy” means such individual unit linked insurance policy issued by the Insurance Company in the name of any of the Borrower

which is valid and in force and acceptable to the Lender which shall include (wherever the context of this Agreement so requires), such

other insurance policies of a nature and description acceptable to the Lender, which are assigned by the relevant Borrower in favour of the

Lender as security for the due repayment of the Loan.

“Letter of Assignment of Insurance Policy” means the letter, agreement or any other writing as may be required by the Insurance

Company to be executed by the relevant Borrower for assignment of the Insurance Policy in favour of BFL.

“Loan” means the amount of loan/credit facility sanctioned by BFL to the Borrower for an amount as mentioned in the Schedule hereto,

against the assignment of the Insurance Policy in favour of BFL, as mentioned in the Schedule hereto.

“Loan Documents” means collectively, the Application Form, Sanction Letter, this Agreement, Letter of Assignment of Insurance Policy

and such other documents/terms executed by the Borrower in relation to the Loan.

“Mode of Application” shall mean submission of Application Form for availing of Loan by a Borrower by either of the following modes or

such other modes as may be as permitted by BFL, from time to time:

(i) submitting a physical Application Form to an authorized BFL Representative; or

(ii) submitting an online/digital Application Form by submitting one-time password (“OTP”) to BFL, in such form and manner as

acceptable to BFL; or

(iii) by such other mode as prescribed and acceptable to BFL, from time to time.

“Monthly Installments” or “EMIs”, means the amount repaid every month by the Borrower to BFL comprising of interest, or as the case

may be, principal amount of the Loan and/or interest.

“Outstanding Dues” “Loan Dues” means, at any time, all the amounts outstanding and payable by the Borrower to BFL, pursuant to

the terms of the Loan Documents and as stipulated herein and/or any other documents related with the Loan including but not limited

to the following: (i) the principal amount, the interest on the Loan and the Penal Interest; (ii) all other obligations and liabilities of the

Borrower such as indemnities, liquidated damages, costs, charges, expenses and other fees and interest incurred under, arising out of or

in connection with Loan (either severally or jointly) or incurred by BFL for the enforcement of and collection of any amounts due under this

Loan or otherwise.

“Penal Interest” means an additional interest/amount payable by the Borrower to BFL as a penalty in case of delay in payment of Monthly

Installments, at the rate/amount as mentioned in the Schedule hereto.

“Pre-payment Charges” means an amount payable by the Borrower to BFL for repayment of the Loan amount, either in part or whole,

before its scheduled Due Date as detailed in the Schedule hereto or as communicated through email/SMS under reference of Loan availed

from BFL.

“Repayment Modes” means the payment of the Monthly Installments and the Outstanding Dues, as the case may be, by any of the

physical or electronic modes, such as: (i) NACH; (ii) National Electronic Fund Transfer in terms of the regulations (“NEFT”); (iii) real time

gross settlement (“RTGS”); (iv) instant real time inter-bank electronic fund transfer system (“IMPS”), in terms of the regulations and

directions issued by RBI or any regulatory or statutory body; (v) Standing instructions at the bank; (vi) Cheque(s); and/or (vii) Any other

instrument/any other mode of payment that is suitable and acceptable to BFL from time to time.

“Sanction Letter” shall mean the letter dated , bearing reference no. containing the broad terms of

the Loan, as may be amended, varied, supplemented or renewed including, any subsequent sanction letter(s) issued by the Lender from

time to time.

“SMS” or “Short Message Service” means the instant text messaging services provided by telecom operators in India for sending/

receiving text messages between mobile and other electronic communication devices.

“Website” means the website of BFL presently being www.bajajfinserv.in/finance including the microsite if any or such other website of

BFL published and marketed from time to time.

2. SCOPE

This Agreement shall be in addition and not in derogation to the terms set out in the Application Form, and such other terms and conditions

as may be agreed between BFL and the Borrower and/or communicated to the Borrower by BFL from time to time, through any Acceptable

Means of Communication. The Loan may be granted to the Borrower as per the terms of Loan Documents and the internal policies of BFL.

2.1 The Borrower agrees that any communication may be provided by BFL through any Acceptable Means of Communication and BFL

shall not be responsible or liable for any error in the content or delay in receipt of such communication due to any reason.

2.2 The Borrower shall execute such documents as may be required by BFL/Insurance Company, including but not limited to effecting

Assignment of Insurance Policy in favour of BFL. The letter issued by the Insurance Company shall be conclusive evidence as to the

assignment of such Insurance Policy.

3. LOAN

3.1 The Loan may be granted to the Borrower as per the terms of the Loan Documents and upon execution of such other documents

as may be deemed necessary by BFL in its absolute discretion. BFL may at its absolute discretion reduce and/or cancel the Loan

limit completely or cancel the undisbursed limit or disallow further drawdowns or revise repayment schedule at any time, with or

BFL/Loan Cum Security Cum Guarantee Agreement

6 (Loan Against Life Insurance Policy)/May 2022/Ver. 2

without prior notice and without assigning any reason to the Borrower and the Borrower shall be liable to repay the entire amounts

outstanding under the Loan as per the terms of the demand notice and be bound by such reduction or cancellation including recall

and hereby confirms that BFL shall not be liable to any person whatsoever for recalling or reducing or cancelling the Loan limit. The

Loan amount shall be utilized for the purpose as mentioned in the Schedule only.

4. DISBURSEMENT

4.1 The disbursement of the Loan shall be, in one lump sum or in such tranches as per the details in the Schedule, subject to the terms

and conditions in this Agreement and deduction of the amounts payable for the cross-sell products & applicable fees/charges. The

Borrower shall not cancel the Loan or refuse to accept disbursement of the Loan or any part of the Loan, except with prior written

approval of BFL and payment of such cancellation or foreclosure charges as may be stipulated by BFL.

The disbursement of the Loan amount shall be made in accordance with RTGS/NEFT/IMPS business hours as notified by the RBI. BFL

shall not be liable for any delay(s) in disbursement of the Loan due to technical errors or delays including acts of God. .

5. INTEREST

5.1 The Borrower shall pay interest on the Loan on or before the Due Date at the applicable rate of interest as mentioned in the Schedule

from the date of Disbursal (“Interest Rate”). The Interest Rate shall be subject to changes based on: (i) guidelines/directives issued

by RBI from time to time; (ii) the internal policies of BFL; (iii) market conditions; (iv) absolute discretion of BFL and/or applicable laws,

rules and regulations. All interest on Outstanding Dues under the Loan shall accrue from day to day and shall be calculated on the

reducing balance.

5.2 Interest Rate Methodology

Interest rate applicable for Loan in Bajaj Finance Limited may vary basis our BFL’s internal credit and risk policy and as per an

algorithmic multivariate score card which includes following variables which may be revised from time to time (the variable list

mentioned below is not exhaustive):

Interest rate risk (fixed vs floating loan), Credit and default risk in the related business segment, Historical performance of similar

homogeneous clients, Profile of the borrower, Industry segment, Repayment track record of the borrower, Nature and Value of

collateral security, Secured Vs unsecured loan, Subvention available, Ticket size of loan, Bureau Score, Tenure of Loan, Location

delinquency and collection performance, Customer Indebtedness (other existing loans).

5.3 The Borrower shall be liable to pay Broken Period Interest on the Loan. In the event the first Due Date for payment of EMI is after

30 (thirty) days from the date of Disbursement, BFL may deduct upfront interest from Loan amount or add such amount in Monthly

Instalment payable for such days beyond the aforementioned period. In the event of Borrower defaulting in payment of any sum

payable hereunder/in relation to Loan on the due date/s, the Borrower shall be liable to pay Penal Interest as detailed in the Schedule

on such overdue amounts, from the date of default till the date of realization of such amounts. If Borrower breaches or defaults any

other condition of this Agreement/Loan Documents or under other document in relation to the Loan, the Borrower shall be liable

to pay Penal Interest as detailed in the Schedule on Outstanding Dues from the date of default till the cure of such breach by the

Borrower. The Penal Interest payable in terms of this clause shall be in addition to interest payable under sub-clause 5.1 herein. The

payment of Penal Interest shall not absolve the Borrower of obligations in respect of such breach/default or affect the rights of BFL

in respect of breach/default. The Penal Interest is subject to change from time to time & shall be updated on website of BFL https://

www.bajajfinserv.in.

6. FEES & CHARGES

6.1 BFL reserves the right to levy fees and/or charges such as Penal Interest, processing fees/convenience fee, maintenance charges,

Bounce Charges, Prepayment Charges, service charges, statement of account charges, foreclosure letter charge and other charges

as specified in the Loan Documents or as may be specified by BFL, from time to time (“Fees and Charges”). The Fees and Charges

levied shall be non-refundable and non-transferable.

6.2 The Borrower shall be liable to pay the fees and charges, as detailed in the Schedule and on BFL Website (https://www.bajajfinserv.in/

all-fees-and-charges). BFL may during the Loan tenure and at its absolute discretion, with prior intimation to the Borrower, amend/

revise any of the terms and conditions including the repayment schedule, Interest Rate and/or any Fees and Charges and the

Borrower shall be bound by such revised terms. BFL shall give a 30 (thirty) days’ notice through Acceptable Means of Communication

to the Borrower of any such amendment/addition which shall be affected prospectively. Any amount/charge as specified in the

Schedule may be adjusted against amounts to be disbursed under the Loan.

7. REPAYMENT

7.1 The Borrower shall be liable to repay the Instalments and the Outstanding Dues as set out in the Schedule or as may be agreed

between the Borrower and BFL. The Monthly Instalments may automatically change by reason of change in rates, taxes, charges,

levies whatsoever & shall be effected prospectively with intimation to Borrower.

All sums payable by the Borrower to BFL shall be paid without deductions whatsoever & to enable BFL to realize the sum on or before

the Due Date. .

7.2 BFL shall present such NACH and/or Electronic Payment Instruction from time to time towards payment of the Outstanding Dues,

with or without advance intimation to the Borrower and the Borrower shall not claim that the NACH and/or Electronic Payment

Instruction given by the Borrower is invalid due to any reason whatsoever.

7.3 The Borrower shall ensure availability of sufficient funds in the bank account on which NACH mandate/Electronic Payment Instruction

has been given & shall not close such bank account and/or issue any notice instructing BFL to suspend the NACH mandate or instruct

the relevant bank to terminate or revoke the NACH mandate until the outstanding dues are repaid. Borrower shall forthwith issue

Security Cheques/NACH/any other Electronic Payment Instructions to BFL in the event of any revision in the repayment schedule.

Any dispute or difference of any nature whatsoever shall not entitle the Borrower to withhold or delay payment of any Monthly

Instalments or Outstanding Dues. BFL shall, at its absolute discretion present the NACH mandate or any other electronic or other

clearing mandate or cheques for recovering the Outstanding Dues without prior intimation to Borrower.

7.4 Asset classification: In case of non-receipt of Loan Dues on the due date/loan repayment, the Loan account shall be flagged as

overdue in compliance with the RBI Circular RBI/2021-2022/125 DOR.STR.REC.68/21.04.048/2021-22 dated November 12, 2021. For

ease of your understanding, following is an illustration:

BFL/Loan Cum Security Cum Guarantee Agreement

7 (Loan Against Life Insurance Policy)/May 2022/Ver. 2

REGULATORY REQUIREMENTS ILLUSTRATION

Classification as Special Mention Account Criteria for classification of Loan account, Date of paym ent of Loan Dues (January

(SMA) / Non-Performing Asset (NPA) is based on Non-receipt of Principal or interest 07, 2022) & i ts classification upon non-

payment or any other amount wholly or partly payment.

overdue (shortly referred below as “Loan

Dues”)

SMA-0 Non-receipt of Loan Dues till 30 days from the SMA-0: Upto F ebruary 05, 2022

Due Date.

SMA-1 Non-receipt of Loan Dues for more than 30 SMA-1: On February 06, 2022, it shall be

days and upto 60 days from the Due Date. classified as SMA-1 if complete loan dues are

not paid to BFL.

SMA-2 Non-receipt of Loan Dues for more than 60 SMA-2: On March 08. 2022, it shall be

days and upto 90 days from the Due Date. classified as SMA-2 if complete loan dues are

not paid to BFL.

NPA Non-receipt of Loan Dues as of 91st day from NPA: On April 0 7, 2022, it shall be classified as

the Due Date. NPA if complete loan dues are not paid to BFL.

8. PRE-PAYMENT

On written request of Borrower & payment of Prepayment Charges as per Schedule, BFL may permit prepayment of the Loan by accepting

pre-payment of Outstanding Dues (“Foreclosure”/“Pre-Payment”) as below: -

(a) Full Pre-Payment/Foreclosure: BFL may permit full Pre-Payment subject to payment of minimum one Monthly Installment & on

payment of Prepayment Charges.

(b) Part Pre-Payment: BFL may accept part Pre-Payment provided the amount of part Pre-Payment shall be equal to a minimum of one

Monthly Instalment and subject to payment of Prepayment Charges. Based on the part Pre-Payment made by the Borrower, either

the tenure of the Loan shall be reduced to the extent of the part Pre-Payment or the Monthly Installment amount shall be reduced

with mutual written consent.

9. SECURITY

9.1 In order to secure due repayment of the Outstanding Dues and performance by the Borrower of its obligations under the Agreement,

the Borrower hereby assigns the Insurance Policy in favour of the Lender by way of absolute assignment, by having delivered and/

or hereafter delivering to the Lender, proof of absolute Assignment of Insurance Policy in terms of the Insurance Act, 1938 and

requirements of the Insurance Company. The Borrower agrees to execute such further documents as may be stipulated by BFL. BFL

shall be entitled to all benefits of Insurance Policy and entitled to exercise its rights over the Insurance Policy as an assignee in terms

of the provisions of the Insurance Act, 1938 including receiving such sums on account of death paid under the Insurance Policy.

9.2 The Lender may require the Borrower to maintain with the Lender at all times, a margin of such percentage of Loan amount as

stipulated by the Lender from time to time (“Margin”), consisting of security acceptable to the Lender.

9.3 The Borrower agrees that if the Lender deems appropriate for any reason whatsoever, the Lender may serve upon the Borrower, a

written notice demanding additional security by way of cash payment, surrender of the Insurance Policy, and/or pledge of further

security in the form of equity, mutual funds, bonds etc., acceptable to BFL or other security as approved by the Lender and the

Borrower undertakes to provide the additional security within 1 (one) Business Day of the receipt of the notice. Notwithstanding that

no Event of Default has occurred, the Lender shall be absolutely entitled at its sole discretion, to surrender the Insurance Policy and

apply the insurance settlement amounts received towards the Outstanding Dues, in order to maintain the Margin.

9.4 The Borrower agrees that all accretions to the said Insurance Policy by way of any benefits from time to time accruing in respect of

the said Insurance Policy or any part thereof shall be deemed to be assigned and charged in favour of the Lender and the Borrower

agrees that in the event of any such requirements, it shall ensure execution of such additional supplementary document in this

respect to effectively assign the same in favour of BFL.

9.5 The Borrower acknowledges that the fund value of Insurance Policy is highly volatile basis its underlying investments, and prone

to daily movements of its net asset value based on the stock market movements. In order to ensure that there is no shortfall in the

Margin under the Loan due to an erosion in the fund value of the Insurance Policy, BFL shall at its sole discretion, as the assignee

of the Insurance Policy, be entitled to request the relevant Insurance Company to re-allocate/switch the investment portfolio from

equity funds to liquid funds or vice versa and/or such other asset allocation and permutation and combinations and as may be

deemed appropriate. Ssuch requests be absolutely binding upon the Borrower.

9.6 The Borrower shall ensure that the shall not be subjected to encumbrance, any adverse action or risk (including litigation risk) which

may impact interests of Lender.

10. OTHER COVENANTS

The Borrower declares and confirms the following:

10.1 The Borrower shall pay the premium and charges of the assigned Insurance Policy when due and ensure that the interest in Insurance

Policy remains live and valid.

10.2 The Borrower shall not surrender/attempt to surrender Insurance Policy until discharge of Outstanding Dues to the satisfaction of

BFL & without the prior written consent of BFL.

10.3 The Borrower is ‘person resident in India’ as defined under the Foreign Exchange Management Act, 1999 as may be amended from

time to time, and the circulars/directions/notifications thereunder and is/are the lawful beneficial owner of the Insurance Policy.

10.4 The Borrower agrees that, the Assignment of Insurance Policy made in favour of the Lender in accordance with Section 38 of the

Insurance Act, 1938 shall result in the rights/interests of any registered nominee reduced to the extent of the Outstanding Dues to

the Lender in the event of surrender.

BFL/Loan Cum Security Cum Guarantee Agreement

8 (Loan Against Life Insurance Policy)/May 2022/Ver. 2

11. DEFAULT

11.1 The Borrower shall be deemed to have committed an act of default, if the Borrower does not comply with its obligations under this

Agreement as well as Application Form and also on the happening of any one or more of the following events, (each an “Event of

Default” and collectively “Events of Default”):

(i) The Borrower fails to pay Monthly Installments/Outstanding Dues/other amounts for any reason on or before the Due Date or

breaches any terms, covenants/conditions in this Agreement or other loan facility provided by BFL/any Affiliates of BFL;

(ii) if the Borrower is called upon to make good the Margin & fails to do so within the period specified.

(iii) the Borrower fails to pay premium/charges in respect of the Insurance Policy when due/surrenders or attempts to surrender

Insurance Policy without prior written consent of BFL;

(iv) there exists any circumstances which in the opinion of BFL prejudicially affects or may affect the Borrower’s ability to repay the

Loan, and/or the security created;

(v) Death, lunacy or disability of Borrower;

(vi) Borrower commits an act of insolvency or is declared insolvent or bankrupt or receiver or official assignee is appointed in respect

of any property of the Borrower or an application for declaring the Borrower as insolvent is made or any order is passed by any

competent authority for declaring the Borrower as insolvent;

(vii) proceedings are pending/threatened against the Borrower by government authority for any reason;

(viii) Change of residential status of the Borrower

11.2 Upon the occurrence of Event of Default, BFL may:

(i) Accelerate repayment of Loan/Outstanding Dues;

(ii) place the Loan on demand or declare Outstanding Dues to be due and payable immediately;

(iii) surrender the Insurance Policy (either before or after maturity) & appropriate the insurance proceeds towards the Outstanding

Dues;

(iv) recover the Outstanding Dues and any other amounts as may be due from the Borrower;

(v) exercise such other rights and remedies as may be available to BFL under law; and/or

(vi) stipulate such other condition(s) or take such other action(s) as BFL deems fit.

11.3 The Borrower expressly recognizes and accepts that BFL shall, without prejudice to its rights to perform such activities itself or

through its officers/employees, be entitled to appoint/delegate to any third party/agent all or any of its functions rights and powers

under this Agreement.

12. LIEN/SET-OFF

BFL may at its sole discretion, though not obliged to, exercise its right of lien with respect to any accounts of the Borrower held with BFL

and/or adjust and set off the Outstanding Dues or any part thereof from the Borrower’s accounts if any with BFL. Further, BFL reserves the

right to retain the title deeds or other security documents, till such time all the Outstanding Dues are paid by the Borrower. BFL may as soon

as reasonably practicable after exercise of such right, notify the Borrower.

13. OTHER TERMS

13.1 BFL may at any time in its absolute discretion, without giving any prior notice and without assigning any reason, either cancel the

disbursement or withdraw the undisbursed sum, if any or call to pay the Outstanding Dues and thereupon the Borrower shall within

7 (seven) days of being so called upon pay the whole of the Outstanding Dues without any delay or demur.

13.2 Any statement of account furnished by BFL regarding the Outstanding Dues shall be binding on the Borrower and be conclusive

proof of the correctness of the amounts.

13.3 Any provision of this Agreement which is unenforceable due to any notification, guidelines, circular issued government/regulatory

authority from time to time, in any jurisdiction shall, as to such jurisdiction, be ineffective only to the extent of such prohibition or

un-enforceability and shall not affect the remaining provisions of this Agreement/provision in any other jurisdiction.

13.4 Any delay in exercising or omission to exercise any right, power or remedy accruing to BFL shall not impair any such right, power or

remedy and shall not be construed to be waiver thereof.

13.5 Any notice to be given to the Borrower in respect of this Agreement/Loan Documents shall be deemed to have been validly received

by the Borrower if served through any Acceptable Means of Communication. .

13.6 Notwithstanding any of the provisions of the Indian Contract Act, 1872/Applicable Law, or any terms and conditions contained in this

Agreement, BFL may, at its absolute discretion, appropriate any payments made by the Borrower under this Agreement or amounts

realised by BFL by enforcement of security or otherwise, towards the dues payable under this Agreement and/or other agreements

entered between the Borrower and BFL and in any manner whatsoever.

13.7 BFL may during the Loan tenure, at its absolute discretion, amend/revise any of the terms and conditions contained in this Agreement

and the Borrower shall be bound by such revised terms and conditions.

14. ASSIGNMENT OF RIGHTS

BFL shall at any time, be entitled to securitise, sell, assign, discount or transfer all or any part of BFL’s right and obligations under this

Agreement or other Loan Documents, to any person(s) and in such manner and on such terms as BFL may decide, without any prior written

notice/consent of the Borrower and such transfer, assignment etc. shall be binding on the Borrower. The Borrower shall not be entitled

to directly or indirectly assign or in any manner transfer, whether in whole or part, any rights, benefits or obligations under the Loan

Documents to any person whatsoever.

15. DISCLOSURE

15.1 The Borrower hereby understands and agrees that BFL shall be entitled to obtain and disclose under the Applicable Law: (a)

information, documents and data relating to the Borrower or the Loan; and (b) default if any, committed by the Borrower in payment

of Outstanding Dues as BFL may deem appropriate and necessary to disclose and furnish to credit information companies (“CICs”),

RBI, Central Registry of Securitisation Asset Reconstruction and Security Interest of India (“CERSAI”), TransUnion CIBIL Limited, any

BFL/Loan Cum Security Cum Guarantee Agreement

9 (Loan Against Life Insurance Policy)/May 2022/Ver. 2

other agency authorized in this behalf by RBI and/or under Applicable Law, to Information Utilities (“IU”) or other person pursuant

to the Insolvency and Bankruptcy Code 2016; to any other statutory or regulatory or law enforcement authority. BFL, RBI, CICs, IU

and/or any other agency authorised under the Applicable Law, shall be entitled to publish the Borrower’s name as defaulters in such

manner and through such medium as BFL, RBI, CICs and/or IU in their absolute discretion may think fit.

15.2 The Borrower further agrees that BFL shall have the right to use/share information and details as provided by the Borrower with any

third party including its group companies, banks, financial institutions, credit bureaus, etc. for the purpose of any potential assignment

of the Loan, Borrower’s due diligence, credit rating, marketing or promotion of BFL products and services or related products or that

of its associates, third party, Central KYC Registry and affiliates or for enforcement of any obligations. The information and data

furnished by the Borrower to BFL shall be deemed to be true and correct. The Borrower represents that he/she has not withheld any

material information that may be required by BFL.

16. INDEMNITY

16.1 The Borrower shall indemnify BFL (and its Affiliates) at all times hereafter from and against any and all claims, damages, costs,

losses, expenses, suits, proceedings, actions, liabilities, etc. that may have been suffered by BFL and/or its Affiliates by reason of

any act/omission by the Borrower or default on the part of the Borrower under this Agreement or in respect of the Loan and/or for

the recovery of the Outstanding Dues (including legal/attorney fee). The Borrower shall indemnify and keep indemnified, BFL and/

or its Affiliates from time to time and at all times hereafter, against any and all claims, duties, damages, costs, losses expenses,

suits, proceedings, actions, liabilities etc. whatsoever: (a) for or under which BFL and/or its Affiliates may be liable on account of

destruction of the Cheques of the Borrower at any point of time, whether at the time of availment of Loan or any time thereafter; and

(b) arising in connection with or relating to any Communications (as defined below) provided or received by BFL and/or its Affiliates

by Electronic Media or disclosure made by BFL under the reference of this Agreement and Application Form.

17. ELECTRONIC MEDIA

17.1 The transmission of this Agreement, any addendums, instructions and communications (“Communications”) through electronic

means such as e-mail, SMS text messaging, websites, etc. (“Electronic Media”) involves a number of risks including fraudulent

alterations and incorrect transmissions and absence of confidentiality. The Borrower acknowledges that there are inherent risks

involved in such Communications and agree that all risks arising therefrom shall be fully borne by the Borrower, whether or not it has

resulted due to any non-communication, miscommunication, or technological error beyond the control of BFL. Further, the Borrower

shall duly inform BFL about any change in the email ID/address and indemnify BFL against non-communication, miscommunication,

error, loss and damage and otherwise caused to BFL. The Borrower shall be solely liable for disclosure of any personal/sensitive

personal information without exercising proper due diligence at the Borrower’s end.

17.2 The Borrower undertakes that he/she shall be solely liable for any unauthorized disclosure/breach of data, etc. and any direct/

indirect losses suffered. The Borrower shall exercise utmost caution to ensure that their personal data/sensitive personal data are

NOT shared/stored/made accessible through any physical means with or without the Borrower’s knowledge or disclosed to any

person/third party, etc. .

17.3 The Borrower understands and agrees as under: (a) BFL shall be entitled to rely upon the Communications provided through Electronic

Media and the records of the Electronic Media received by BFL shall be treated as final & binding; (b) BFL shall not be responsible

for conducting any verification whatsoever; (c) BFL shall not be bound to act in accordance with whole/part of the Communications

received from the Borrower (d) BFL shall not be liable for the consequences of any act or any refusal or omission to act or deferment

of action by BFL on the basis of the Communications through the Electronic Media; (e) BFL shall not be required to await receipt of

any further confirmation before taking any action in connection with the Communications provided through any Electronic Media

and the non-delivery and non-conformity of the same shall not prejudice BFL’s rights;

18. DISPUTE RESOLUTION

18.1 Any claims and disputes arising out of or in connection to the Loan, including this Agreement and/or Loan Documents shall be

referred to a sole arbitrator for adjudication, who shall be appointed in the following manner:

(i) BFL shall address a notice to the Borrower suggesting the names of three arbitrators, from whom, the relevant Borrower

shall, either:

a. confirm acceptance of one among the proposed names as the sole arbitrator in writing to BFL within a period of ten

(10) days from the date of notice (“Notice Period”); or

b. convey objection if any in writing to BFL, against the proposed names of the sole arbitrator within the said Notice Peri-

od.

(ii) However, if BFL does not receive any response from the Borrower within the said Notice Period, BFL shall construe the same

to be deemed consent/acceptance by the Borrower for the appointment of the sole arbitrator as may be decided by BFL.

18.2 The venue & Seat of arbitration shall be at Delhi & shall be conducted in English & under the provisions of the Arbitration

and Conciliation Act, 1996 together with its amendments, any statutory modification or re-enactment thereof. Pending the passing

of final award, the Borrower shall continue to be liable to perform all their obligations under this Agreement.

19. GOVERNING LAW AND JURISDICTION

The validity, interpretation and resolution of disputes arising out of or in connection with this Agreement shall be governed by Applicable

law. All matters arising out of/in relation to this Agreement shall be subject to the exclusive jurisdiction of the courts or tribunals at New

Delhi, India.

IN WITNESS WHEREOF the Parties hereto sign this Agreement in acceptance of all terms and conditions stated herein on the day, month and year

stated herein below

SIGNED and DELIVERED by the within-named Borrower SIGNED and DELIVERED by BAJAJ FINANCE LIMITED

Borrower Signature Authorised Signatory

BFL/Loan Cum Security Cum Guarantee Agreement

10 (Loan Against Life Insurance Policy)/May 2022/Ver. 2

SCHEDULE

DATE OF EXECUTION OF AGREEMENT

PLACE OF EXECUTION OF AGREEMENT Delhi

NAME, ADDRESS, MOBILE NUMBER/LANDLINE NUMBER AND EMAIL ID

OF THE BORROWER

LOAN AMOUNT (IN RUPEES)

PURPOSE OF LOAN/End Use

MECHANISM OF DISBURSEMENT RTGS/NEFT

TENURE (IN MONTHS) Up to 96 Months (for lock in policies - renewable on lock in completion and for lock

in free policies - renewable after every 12 months

ANNUALIZED RATE OF INTEREST (%P.A.) 10.65% per annum to be paid on completion of lock in policy if the Insurance Policy

is within the Lock-in period.

9.9% per annum to be paid Monthly on 7th of every month if Insurance Policy is

Lock-in-Free.

METHOD OF INTEREST Written Down Value Method in case of Lock in Free Policy.

Compounding Interest Rate in case of Lock in Policy.

PROCESSING FEE (Inclusive of Applicable taxes)

BOUNCE CHARGES Rs.1200/- for every bounce (Inclusive of applicable taxes)

COMMITMENT CHARGES NA

PENAL INTEREST RATE 2%Per month (plus applicable taxes) in case of default for interest

DESCRIPTION OF INSURANCE POLICY (Name of Insured, Policy

Number, Term, Premium amounts, dates etc.)

SURRENDER/REDEMPTION VALUE OF THE INSURANCE POLICY

AMC (Annual Maintenance Charges) Rs.1179 (Inclusive of applicable taxes) to be collected on renewal.

SIGNED and DELIVERED by the within-named Borrower

Borrower Signature

BFL/Loan Cum Security Cum Guarantee Agreement

11 (Loan Against Life Insurance Policy)/May 2022/Ver. 2

You might also like

- Credit Card Application Form: Personal InformationDocument5 pagesCredit Card Application Form: Personal InformationHansi PereraNo ratings yet

- Mortgage Loan Application FormDocument8 pagesMortgage Loan Application Formmadhukar sahayNo ratings yet

- Retail Asset Bundle Form 10-07-2023Document2 pagesRetail Asset Bundle Form 10-07-2023mk2475576No ratings yet

- Axis Bank FormDocument14 pagesAxis Bank FormTokuto Vitoi ZhimomiNo ratings yet

- HDFC Ergo: General Insurance Company LimitedDocument2 pagesHDFC Ergo: General Insurance Company Limitedईश्वर हैNo ratings yet

- Vehicle Insurance Certificate in IndiaDocument2 pagesVehicle Insurance Certificate in IndiaED STORYNo ratings yet

- SodapdfDocument5 pagesSodapdflucky senNo ratings yet

- Two Wheeler Comprehensive Policy New PDFDocument2 pagesTwo Wheeler Comprehensive Policy New PDFhappy maheruNo ratings yet

- Consumer Application SampleDocument1 pageConsumer Application Sampleahmed02_99No ratings yet

- Account Opening FormDocument14 pagesAccount Opening FormAbdirahman mohamed100% (1)

- Prepaid Card KYC FormDocument1 pagePrepaid Card KYC FormAnmolNo ratings yet

- RBL App Form 18 01 2019Document1 pageRBL App Form 18 01 2019Yasar AliNo ratings yet

- Assignment Form: InstructionsDocument2 pagesAssignment Form: InstructionsjahgfNo ratings yet

- Retail Credit Card ApplicationDocument2 pagesRetail Credit Card ApplicationNiyomahoro Jean HusNo ratings yet

- Application:: CkycrDocument7 pagesApplication:: CkycrManna BhardwajNo ratings yet

- SME Finance (CMG) - Loan Application FormDocument6 pagesSME Finance (CMG) - Loan Application FormqkfvzqutqcuuiivzslNo ratings yet

- ApplDocument4 pagesApplkartikvij351No ratings yet

- Bank of Bhutan Limited Visa Credit Card Application FormDocument10 pagesBank of Bhutan Limited Visa Credit Card Application FormTempa Jikme0% (1)

- NPS Application FormDocument5 pagesNPS Application Formcgaru073No ratings yet

- Retail Asset Bundle Form - 16.09.2021Document2 pagesRetail Asset Bundle Form - 16.09.2021mk2475576No ratings yet

- Re Kyc Form For Nri Amp Pio CustomersDocument3 pagesRe Kyc Form For Nri Amp Pio CustomerskishoreperlaNo ratings yet

- Account Opening Form SummaryDocument14 pagesAccount Opening Form SummarySan ThiyaNo ratings yet

- Common Application Form: For Holding Units in Demat ModeDocument6 pagesCommon Application Form: For Holding Units in Demat ModevasucristalNo ratings yet

- BDO Auto LoanDocument2 pagesBDO Auto LoanRalph Christian Lusanta FuentesNo ratings yet

- KHP - Total - GO GREEN - Proposal Form - v1 (22-23) - 17032022Document6 pagesKHP - Total - GO GREEN - Proposal Form - v1 (22-23) - 17032022zaidkhanNo ratings yet

- cherry application formDocument1 pagecherry application formklynnesstaycationNo ratings yet

- KYC Form - Non Individual - Jan22Document7 pagesKYC Form - Non Individual - Jan22emelia mirandaNo ratings yet

- REKYC Form Individual BOBDocument1 pageREKYC Form Individual BOBbhavin.hawkeyeNo ratings yet

- Solar Application FormDocument8 pagesSolar Application FormsohaibchNo ratings yet

- congi_application_formDocument6 pagescongi_application_formsharathkumarreddy2021No ratings yet

- CC_Application_PDF_231028083450Document8 pagesCC_Application_PDF_231028083450husainsk615No ratings yet

- SafariDocument10 pagesSafarishakthi54321No ratings yet

- Revised Re-KYC Form For NRIDocument2 pagesRevised Re-KYC Form For NRIjhahpNo ratings yet

- Individual Information FormDocument2 pagesIndividual Information FormTanzir HasanNo ratings yet

- Account Opening FormDocument10 pagesAccount Opening Formsujit kcNo ratings yet

- Select: Account Opening/Registration FormDocument14 pagesSelect: Account Opening/Registration FormAdityaGelaniNo ratings yet

- Please Fill The Form in English and in BLOCK Letters)Document4 pagesPlease Fill The Form in English and in BLOCK Letters)Shree Prakash PandeyNo ratings yet

- Modified KRA SBIsmartDocument1 pageModified KRA SBIsmartShiftinchargeengineer dadri coal0% (1)

- Health Insurance Plan DetailsDocument4 pagesHealth Insurance Plan DetailsHarish HuddarNo ratings yet

- Re-KYC Form for IndividualsDocument6 pagesRe-KYC Form for IndividualsNL. LTDNo ratings yet

- Camskra Kyc Application Form-IndividualDocument2 pagesCamskra Kyc Application Form-IndividualN V Sumanth VallabhaneniNo ratings yet

- CarProposal QVPN107614961Document6 pagesCarProposal QVPN107614961sajithmon785No ratings yet

- Savings Account Opening Application Form: MUFG Bank, LTDDocument24 pagesSavings Account Opening Application Form: MUFG Bank, LTDayuNo ratings yet

- Metrobank Car Loan Application Form Individual Oct 2022Document2 pagesMetrobank Car Loan Application Form Individual Oct 2022rhu penarandaNo ratings yet

- Information Form - FillableDocument5 pagesInformation Form - FillableAbdul Majeed MohamedNo ratings yet

- E-Insurance Account (eIA) Opening Form For IndividualsDocument3 pagesE-Insurance Account (eIA) Opening Form For IndividualsKiran KumarNo ratings yet

- CC Application PDF 221210050852Document7 pagesCC Application PDF 221210050852Vishwas SalveNo ratings yet

- Bdo Application FormDocument2 pagesBdo Application FormAnonymous pnCfNWeCUZ100% (1)

- TW ApplicationFormDocument4 pagesTW ApplicationFormmohammed rafiNo ratings yet

- Fixed Deposit Account Opening FormDocument8 pagesFixed Deposit Account Opening FormAbhishek giriNo ratings yet

- CC Application PDF 230308083626Document7 pagesCC Application PDF 230308083626JD GamingNo ratings yet

- New CVL-KRA-Individual-FormDocument2 pagesNew CVL-KRA-Individual-FormTrilokynathNo ratings yet

- From ID 15 v8Document6 pagesFrom ID 15 v8sandysanjay2220No ratings yet

- All Fields Are Mandatory: The Branch Head Axis Bank LTDDocument3 pagesAll Fields Are Mandatory: The Branch Head Axis Bank LTDHarpreet0gjgkbkv KaurNo ratings yet

- On Behalf of Minor: Guardian Named Is: Father Mother Court Appointed Proof Attached Date of BirthDocument2 pagesOn Behalf of Minor: Guardian Named Is: Father Mother Court Appointed Proof Attached Date of Birthpriya selvarajNo ratings yet

- CKYC Registration Form for Financial InstitutionsDocument5 pagesCKYC Registration Form for Financial Institutionsmsn_testNo ratings yet

- Form For Nomination / Appointee Addition: General InformationDocument2 pagesForm For Nomination / Appointee Addition: General InformationSonu SinghNo ratings yet

- Personal Loan Application Form (Addendum) April 2020Document4 pagesPersonal Loan Application Form (Addendum) April 2020modjo072No ratings yet

- Wa0011.Document20 pagesWa0011.somdebdawnNo ratings yet

- B Code MIS Tied Agency 02-02-24Document1,072 pagesB Code MIS Tied Agency 02-02-24Mcnet WideNo ratings yet

- B Code MIS Tied Agency 02-02-24Document1,072 pagesB Code MIS Tied Agency 02-02-24Mcnet WideNo ratings yet

- ANNEXURE+-5+LIST+OF+RWA’s+&+MTAsDocument11 pagesANNEXURE+-5+LIST+OF+RWA’s+&+MTAsMcnet WideNo ratings yet

- 60031048240Document9 pages60031048240Mcnet WideNo ratings yet

- 27_173828648Document2 pages27_173828648Mcnet WideNo ratings yet

- Health Ensure-BrochureDocument18 pagesHealth Ensure-BrochureUday SuryanarayanarajuNo ratings yet

- Report1710572511683_Document2 pagesReport1710572511683_Mcnet WideNo ratings yet

- PreDocument2 pagesPreMcnet WideNo ratings yet

- IB_DSR_SDocument22 pagesIB_DSR_SMcnet WideNo ratings yet

- Ac Database of RC Jaipur - 28!02!2023Document175 pagesAc Database of RC Jaipur - 28!02!2023Skillytek ServiceNo ratings yet

- fDocument3 pagesfMcnet WideNo ratings yet

- IC_CoDocument34 pagesIC_CoMcnet WideNo ratings yet

- Key Feature DocumentDocument8 pagesKey Feature DocumentPiyush VisputeNo ratings yet

- MaiDocument85 pagesMaiMcnet WideNo ratings yet

- IC_ContDocument40 pagesIC_ContMcnet WideNo ratings yet

- Report1710572511683_Document2 pagesReport1710572511683_Mcnet WideNo ratings yet

- ADAClaimFormDocument2 pagesADAClaimFormMcnet WideNo ratings yet

- Product Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsDocument6 pagesProduct Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life Goalsshikha742642No ratings yet

- 60042548944Document5 pages60042548944Mcnet WideNo ratings yet

- Product Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsDocument6 pagesProduct Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life Goalsshikha742642No ratings yet

- Key Feature DocumentDocument8 pagesKey Feature DocumentPiyush VisputeNo ratings yet

- Key Feature DocumentDocument8 pagesKey Feature DocumentPiyush VisputeNo ratings yet

- Key Feature DocumentDocument8 pagesKey Feature DocumentPiyush VisputeNo ratings yet

- Key Feature DocumentDocument8 pagesKey Feature DocumentPiyush VisputeNo ratings yet

- Product Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsDocument6 pagesProduct Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life Goalsshikha742642No ratings yet

- Product Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsDocument6 pagesProduct Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life Goalsshikha742642No ratings yet

- Wa0023.Document6 pagesWa0023.pandu93goudNo ratings yet

- Key Feature DocumentDocument8 pagesKey Feature DocumentPiyush VisputeNo ratings yet

- Sample Policy - Obvi Elite Warranty (MBI)Document11 pagesSample Policy - Obvi Elite Warranty (MBI)jaykumar patelNo ratings yet

- file học vấn đápDocument34 pagesfile học vấn đápHoang NguyenNo ratings yet

- Loblaw Annual InformationDocument39 pagesLoblaw Annual InformationOwen PlatzerNo ratings yet

- Parts and Garage Cover Policy CurrentDocument24 pagesParts and Garage Cover Policy CurrentJoe GaffneyNo ratings yet

- U.S. Bancorp Investments Client Relationship Summary: What Investment Services and Advice Can You Provide Me?Document23 pagesU.S. Bancorp Investments Client Relationship Summary: What Investment Services and Advice Can You Provide Me?Rodrigo SantosNo ratings yet

- Exide Life Insurance Cover Note: Summary of Proposed PolicyDocument2 pagesExide Life Insurance Cover Note: Summary of Proposed PolicyFiroj ShaikhNo ratings yet

- Root Policy 20210205Document47 pagesRoot Policy 20210205Nelson HilarioNo ratings yet

- Birla Sun Life Vision PlanDocument3 pagesBirla Sun Life Vision Planshahtejas12No ratings yet

- IT II AnswerDocument4 pagesIT II AnswerChandhini RNo ratings yet

- IG 1 Element 1Document38 pagesIG 1 Element 1Abdo Al-farsi100% (1)

- Insurance Industry and Bharti AXA Life ReportDocument4 pagesInsurance Industry and Bharti AXA Life ReportdeepankrknNo ratings yet

- Uberrima Fides in Marine Insurance Contract Fairness Commercial Suitability and Possible ReformsDocument27 pagesUberrima Fides in Marine Insurance Contract Fairness Commercial Suitability and Possible ReformsDileep ChowdaryNo ratings yet

- Homework - Sectioin 3&4 - SolutionDocument25 pagesHomework - Sectioin 3&4 - Solutioncherri blos59No ratings yet

- Nontraditional Banking Activities Impact on Bank Failures During Financial CrisisDocument25 pagesNontraditional Banking Activities Impact on Bank Failures During Financial CrisisIbrahim KhatatbehNo ratings yet

- Year-End/New Year Checklist: Item Action To Be Taken DoneDocument2 pagesYear-End/New Year Checklist: Item Action To Be Taken Donelarryching_884369919No ratings yet

- Vul Answer KeyDocument2 pagesVul Answer KeyNato50% (2)

- Property & Casualty ConceptsDocument93 pagesProperty & Casualty ConceptsEuphoria33100% (1)

- Publove Terms Conditions - Individual Bookings 618baef3d487eDocument4 pagesPublove Terms Conditions - Individual Bookings 618baef3d487eNnaemeka NwobodoNo ratings yet

- 5.5 Manufacturing AccountsDocument6 pages5.5 Manufacturing AccountsZaynab ChowdhuryNo ratings yet

- PHIL - GUARANTY V CIR Case DigestDocument1 pagePHIL - GUARANTY V CIR Case DigestZirk TanNo ratings yet

- Ch-3 (Public, Private & Global Entreprises) Multiple Choice Questions (MCQ Based On Hots and Applications)Document6 pagesCh-3 (Public, Private & Global Entreprises) Multiple Choice Questions (MCQ Based On Hots and Applications)JasleenNo ratings yet

- Current Affairs Q&A PDF February 4-5-2024 by Affairscloud 1Document19 pagesCurrent Affairs Q&A PDF February 4-5-2024 by Affairscloud 1keerthirajNo ratings yet

- Offshore Construction Law and Practice Second Edition Stuart BeadnallDocument483 pagesOffshore Construction Law and Practice Second Edition Stuart BeadnallЕвгений ВолодинNo ratings yet

- Online Banking Customer SatisfactionDocument24 pagesOnline Banking Customer SatisfactionUrvi RanaNo ratings yet

- Ass. 1 Insurance LawDocument5 pagesAss. 1 Insurance LawRossette Anasario100% (1)

- Affidavit of lost ID cards and documentsDocument2 pagesAffidavit of lost ID cards and documentsVoltaire Delos ReyesNo ratings yet

- Reshaping The IT Governance inDocument9 pagesReshaping The IT Governance inFacicNo ratings yet

- B&i C.P.Document3 pagesB&i C.P.Aditya D TanwarNo ratings yet

- Contractors All Risk vs Professional Indemnity Insurance: Key DifferencesDocument11 pagesContractors All Risk vs Professional Indemnity Insurance: Key DifferenceshieutlbkreportNo ratings yet

- Ilovepdf Merged 4Document223 pagesIlovepdf Merged 4Dani ShaNo ratings yet