Professional Documents

Culture Documents

Ikhtisar Pertanggungan Asuransi Kendaraan Bermotor Motor Vehichle Insurance Schedule

Uploaded by

teamwidhi0 ratings0% found this document useful (0 votes)

5 views2 pagesThis document provides an insurance schedule for a motor vehicle insurance policy. It summarizes the key details of the policy, including:

- The policy number, insured name and address, and period of coverage from December 7, 2021 to December 7, 2022.

- Details of the insured vehicle - a 2017 Suzuki Ignis.

- The sum insured of IDR 104,500,000 and additional insured amounts for drivers and passengers personal accidents and third party liability.

- The types of coverage, premium calculations, and total premium of IDR 3,155,225 to be paid by February 5, 2022.

- The deductibles that apply to different types of losses.

Original Description:

Original Title

b0dbf3b2-a669-4c33-b066-f1ff16e72f38-97cac443-ae61-4cf8-b6c3-571c724e8e49-PS

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an insurance schedule for a motor vehicle insurance policy. It summarizes the key details of the policy, including:

- The policy number, insured name and address, and period of coverage from December 7, 2021 to December 7, 2022.

- Details of the insured vehicle - a 2017 Suzuki Ignis.

- The sum insured of IDR 104,500,000 and additional insured amounts for drivers and passengers personal accidents and third party liability.

- The types of coverage, premium calculations, and total premium of IDR 3,155,225 to be paid by February 5, 2022.

- The deductibles that apply to different types of losses.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesIkhtisar Pertanggungan Asuransi Kendaraan Bermotor Motor Vehichle Insurance Schedule

Uploaded by

teamwidhiThis document provides an insurance schedule for a motor vehicle insurance policy. It summarizes the key details of the policy, including:

- The policy number, insured name and address, and period of coverage from December 7, 2021 to December 7, 2022.

- Details of the insured vehicle - a 2017 Suzuki Ignis.

- The sum insured of IDR 104,500,000 and additional insured amounts for drivers and passengers personal accidents and third party liability.

- The types of coverage, premium calculations, and total premium of IDR 3,155,225 to be paid by February 5, 2022.

- The deductibles that apply to different types of losses.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

ORIGINAL

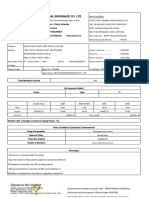

IKHTISAR PERTANGGUNGAN ASURANSI KENDARAAN BERMOTOR

MOTOR VEHICHLE INSURANCE SCHEDULE

No. Polis/Policy No. : 030221001888 (BARU/NEW)

- Nama Tertanggung : SUPARMAN

Insured Name

- Alamat Tertanggung : KENJERAN 4/4, RT. 005 RW. 002, KEL SIMOKERTO, KEC. SIMOKERTO, SURABAYA

Address Kota Surabaya

- Jangka Waktu Pertanggungan : From 7 December 2021 to 7 December 2022

Period of Insurance Pertanggungan dimulai dan berakhir pukul 12.00 siang waktu setempat dimana objek pertanggungan berada

Both days inclusive at 12.00 PM o'clock at local time at the location of insured object

- Objek Pertanggungan :

Detail of Insured

VEHICLE CODE : SUZUKI IGNIS GLX M/T

VEHICLE LICENSE : L 1954 TY

NUMBER

VEHICLE CHASIS NUMBER : MA3NFG81SH0144553

VEHICLE MACHINE : K12MN4304044

NUMBER

VEHICLE YEAR OF : 2017

MANUFACTURING

VEHICLE FUNCTION : PRIBADI / PRIVATE

- Harga Pertanggungan : Kendaraan / Motor Vehicle 7/12/2021 - 7/12/2022 IDR 104,500,000.00

Total Sum Insured

- Pertanggungan Tambahan : Kecelakaan Diri Pengemudi (Perluasan) / 7/12/2021 - 7/12/2022 IDR 10,000,000.00

Additional Insured Drivers Personal Accident (Additional)

Kecelakaan Diri Penumpang (Perluasan) / 7/12/2021 - 7/12/2022 IDR 20,000,000.00

Passengers Personal Accident (Additional)

Tanggung Jawab Hukum Pihak Ketiga 7/12/2021 - 7/12/2022 IDR 10,000,000.00

(Perluasan) / Third Party Liability (Additional)

- Jenis Pertanggungan &

:

Perhitungan Premi

Type of Coverage &

Premium Calculation

Periode / Jenis Pertanggungan / Perhitungan premi / Premi /

Period Type of Coverage Premium Calculation Premium

07/12/21 - 07/12/22 Angin Topan, Badai, Banjir, Hujan Es, 100% x 0.075% x 104,500,000.00 IDR 78,375.00

Tanah Longsor / Typhoon, Storm,

Flood, Hail, Landslide

Bengkel Resmi / Authorized Workshop 100% x 0.150% x 104,500,000.00 IDR 156,750.00

Comprehensive / Comprehensive 100% x 2.530% x 104,500,000.00 IDR 2,643,850.00

Kecelakaan Diri Penumpang / 100% x 0.100% x 20,000,000.00 IDR 20,000.00

Passengers Personal Accident

Kecelakaan Diri Pengemudi / Drivers 100% x 0.500% x 10,000,000.00 IDR 50,000.00

Personal Accident

Pemogokan, Kerusuhan, dan Huru-Hara 100% x 0.050% x 104,500,000.00 IDR 52,250.00

/ Strike, Riot, and Civil Commotion

Tanggung Jawab Hukum Pihak Ketiga / 100% x 1.000% x 10,000,000.00 IDR 100,000.00

Third Party Liability

WebPS00000000 v5.0.2 - PSC0200001 v5.0.2 - 030221001888 Page 1 of 2

ORIGINAL

Biaya Polis/Policy Cost IDR 44,000.00

Biaya Materai/Stamp Duty IDR 10,000.00

IDR 3,155,225.00

* Premium Calculation = Loading x Rate x Total Sum Insured

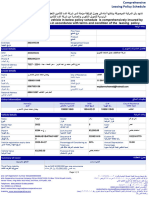

- Pembayaran Premi : Premi asuransi sudah harus dibayarkan dan diterima oleh PT Asuransi Adira Dinamika Tbk

Premium Payment paling lambat tanggal 5 Februari 2022. Tidak dibayarkan premi asuransi dalam jangka waktu

tersebut menyebabkan batalnya polis secara otomatis dan pembayaran premi asuransi untuk

masa yang sudah berjalan sesuai dengan ketentuan-ketentuan dalam Polis Standar Asuransi

Kendaraan Bermotor Indonesia.

Insurance premium must be paid to and received by PT Asuransi Adira Dinamika Tbk no

later than 5 February 2022. In any case whereby the insurance premium is not paid and

received within this period, this Policy shall be automatically terminated and the Insured

shall remain obliged to pay the insurance premium for the lapsed period as stipulated in

Indonesia Motor Vehicle Insurance Standard Policy.

- Risiko Sendiri : - Kerugian Sebagian - Autocillin Garage & Non ATPM : IDR 300,000.00 untuk setiap kejadian (Pribadi/Dinas)

Deductible Partial Loss - Autocillin Garage & Non ATPM : IDR 300,000.00 for any one accident (Private/Operational)

- Kerugian Sebagian - Autocillin Garage & Non ATPM : IDR 400,000.00 untuk setiap kejadian (Komersial)

Partial Loss - Autocillin Garage & Non ATPM : IDR 400,000.00 for any one accident (Commercial)

- Kerugian Sebagian - Bengkel Rekanan ATPM (tanpa perluasan jaminan ATPM) : IDR 500,000.00 untuk setiap kejadian

(Pribadi/Dinas)

Partial Loss - ATPM Partner Workshop (without additional ATM warranty) : IDR 500,000.00 for any one accident

(Private/Operational)

- Kerugian Total : 5% dari nilai klaim, minimum : IDR 1,000,000.00

Total Loss : 5% of claim, minimum : IDR 1,000,000.00

- Angin Topan, Badai, Hujan Es, Banjir, Tanah Longsor : 10% dari nilai klaim, minimum : IDR 500,000.00 untuk setiap

kejadian / Typhoon, Storm, Hail, Flood, Landslide : 10% of claim, minimum : IDR 500,000.00 for any one accident

- Kerugian Sebagian - Autocillin Garage & Non ATPM : IDR 300,000.00 untuk setiap kejadian (Pribadi/Dinas) / Partial

Loss - Autocillin Garage & Non ATPM : IDR 300,000.00 for any one accident (Private/Operational)

- Huru-Hara & Kerusuhan : 10% dari nilai klaim, minimum : IDR 500,000.00 untuk setiap kejadian / Civil Commotion &

Riot : 10% of claim, minimum : IDR 500,000.00 for any one accident

*a.o.a = anyone accident

- Klausul : 1. FITUR TOWING CAR POLIS TLO

Clauses 2. KLAUSUL ANGIN TOPAN, BADAI, HUJAN, ES, BANJIR DAN ATAU TANAH LONGSOR

3. KLAUSUL CACAT SEMULA

4. KLAUSUL HURU-HARA

5. KLAUSUL KENDARAAN BERMOTOR COMPLETELY BUILT-UP (CBU)

6. KLAUSUL MODIFIKASI DAN BAGIAN BERPASANGAN / SET

7. KLAUSUL PEMBERITAHUAN PENTING

8. KLAUSUL PENGESAMPINGAN

9. KLAUSUL PENGGANTIAN SUKU CADANG

10. KLAUSUL PERSELISIHAN

Surabaya, 2 November 2021

PT Asuransi Adira Dinamika Tbk

WebPS00000000 v5.0.2 - PSC0200001 v5.0.2 - 030221001888 Page 2 of 2

You might also like

- Property, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!From EverandProperty, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!Rating: 5 out of 5 stars5/5 (1)

- Dec PageDocument2 pagesDec PageKerry Henry100% (1)

- JP Morgan CDO HandbookDocument60 pagesJP Morgan CDO HandbookForeclosure Fraud100% (2)

- MENA Family Businesses Report 17-Apr-11Document30 pagesMENA Family Businesses Report 17-Apr-11ramdams100% (1)

- IFRS9 FinancialInstruments ScreenDocument118 pagesIFRS9 FinancialInstruments ScreenmerryNo ratings yet

- MNN3701 Mo001 70463654Document160 pagesMNN3701 Mo001 70463654brain moyo0% (1)

- Car InsuranceDocument5 pagesCar InsuranceAditya kumarNo ratings yet

- Cima E1 Notes Organisational ManagementDocument120 pagesCima E1 Notes Organisational ManagementLamar BrownNo ratings yet

- AIG Malaysia CovernoteDocument2 pagesAIG Malaysia CovernoteKelly ObrienNo ratings yet

- Polis + Wording PL Bandara KertajatiDocument22 pagesPolis + Wording PL Bandara KertajatiM Khaerul Umam100% (1)

- Polis + Wording Cecr Bandara KertajatiDocument19 pagesPolis + Wording Cecr Bandara KertajatiM Khaerul UmamNo ratings yet

- Selamat Di Zurich Syariah: BergabungDocument3 pagesSelamat Di Zurich Syariah: BergabungdarningbaturajaNo ratings yet

- Polis Bach QQ Tou Rano 3Document9 pagesPolis Bach QQ Tou Rano 3Fitria AndayaniNo ratings yet

- Yohan DirgantaraDocument7 pagesYohan DirgantaraSteffi SantosoNo ratings yet

- Polis Suzuki Carry Pick UpDocument21 pagesPolis Suzuki Carry Pick Upfirdaus2002kuNo ratings yet

- Polis Bach QQ Tou Rano 2Document9 pagesPolis Bach QQ Tou Rano 2Fitria AndayaniNo ratings yet

- C89HPuR9tezSwW2ZTxZ-XbH3 qCRIKFu6MprtUdN9iI 180341 20240210063429 29Document2 pagesC89HPuR9tezSwW2ZTxZ-XbH3 qCRIKFu6MprtUdN9iI 180341 20240210063429 29joegesang07No ratings yet

- D Assuretech Ecrm Live ECRM NIC DocumentPrint DocumentPrint Temp Quotation - PDF - 2023-01-31T172658.866Document2 pagesD Assuretech Ecrm Live ECRM NIC DocumentPrint DocumentPrint Temp Quotation - PDF - 2023-01-31T172658.866Raja ShahmirNo ratings yet

- QS MV Wuling 2018Document1 pageQS MV Wuling 2018Elang Timor Putera BumiNo ratings yet

- 2016 Ford Everest - Christopher N. AriasDocument4 pages2016 Ford Everest - Christopher N. Ariasalmagpelino1322No ratings yet

- Intra Asia 20240129 083100041155315Document19 pagesIntra Asia 20240129 083100041155315joegesang07No ratings yet

- Quotation - Slip - All Risk Central MedicareDocument4 pagesQuotation - Slip - All Risk Central MedicareDtj246810No ratings yet

- Motor Scheme - 2023 (NEW) Insurance Quotatio: Vehicle Owner Quotation No Quotation ValidityDocument2 pagesMotor Scheme - 2023 (NEW) Insurance Quotatio: Vehicle Owner Quotation No Quotation ValidityPrashant SoniNo ratings yet

- Vehicle Insurance Policy FormatDocument6 pagesVehicle Insurance Policy Formatshrey kukadeNo ratings yet

- GPA PolicyDocument10 pagesGPA Policyparas INSURANCENo ratings yet

- DL7CK7894 - Acko Insurance PolicyDocument1 pageDL7CK7894 - Acko Insurance PolicyTAUSEEF HASSANNo ratings yet

- Acko Bike Policy - DBCR00596028002 - 00Document2 pagesAcko Bike Policy - DBCR00596028002 - 00abhishek borateNo ratings yet

- AckoPolicy-DBTR00369008489 00Document1 pageAckoPolicy-DBTR00369008489 00vishalirkalNo ratings yet

- Pulido ApparelDocument2 pagesPulido ApparelAggy ReynadoNo ratings yet

- Vehicle Insurance Policy FormatDocument7 pagesVehicle Insurance Policy FormatKesavanNo ratings yet

- Example:: 1 Pmg/Egtb/Motor/Pds/Eng/Echannel/Direct/2105V2.5Document3 pagesExample:: 1 Pmg/Egtb/Motor/Pds/Eng/Echannel/Direct/2105V2.5aniesNo ratings yet

- Motor Quotation Slip14Document2 pagesMotor Quotation Slip14Iman AsrafNo ratings yet

- Comprehensive Bike Insurance PolicyDocument2 pagesComprehensive Bike Insurance PolicyRaki GowdaNo ratings yet

- Direct / Direct: Reliance Private Car Vehicle Certificate Cum Policy ScheduleDocument4 pagesDirect / Direct: Reliance Private Car Vehicle Certificate Cum Policy ScheduleZeeshan KhanNo ratings yet

- Schedule - 2020-10-13T172846.298Document5 pagesSchedule - 2020-10-13T172846.298psakeer770No ratings yet

- AckoPolicy-DCTR00377466426 00Document1 pageAckoPolicy-DCTR00377466426 00Souvik BanerjeeNo ratings yet

- Bosch LTDDocument50 pagesBosch LTDmanishsngh24No ratings yet

- InsuranceDocument2 pagesInsuranceTiong Ing HoungNo ratings yet

- KCN 206T SCHDocument2 pagesKCN 206T SCHjudithmaurice76No ratings yet

- Policy Schedule Compulsory Personal Accident (Owner-Driver) Under Motor Insurance PoliciesDocument2 pagesPolicy Schedule Compulsory Personal Accident (Owner-Driver) Under Motor Insurance PoliciesRupesh PawarNo ratings yet

- Polis Liability VUDS 2023Document127 pagesPolis Liability VUDS 2023Mashita SuryaniNo ratings yet

- Qic SCH 050Document3 pagesQic SCH 050nuwan dananjayaNo ratings yet

- AckoPolicy-DBCR00632113302 00Document2 pagesAckoPolicy-DBCR00632113302 00Sharthak PrasharNo ratings yet

- 4.1 LevoID & LittleEatRestaurantDocument1 page4.1 LevoID & LittleEatRestaurantEHS OnlineNo ratings yet

- Abdul Raheem 205001Document1 pageAbdul Raheem 205001AlizaShaikhNo ratings yet

- Liability Only Policy - Private Bike: Policy Details Vehicle DetailsDocument1 pageLiability Only Policy - Private Bike: Policy Details Vehicle DetailsMOHAN SANGANINo ratings yet

- Sbi InsDocument7 pagesSbi Insrajbrar98No ratings yet

- Reliance Private Car Policy-Stand-alone Own DamageDocument11 pagesReliance Private Car Policy-Stand-alone Own DamageSomveer SheoranNo ratings yet

- Download2022-11-13 193904Document5 pagesDownload2022-11-13 193904WejdanNo ratings yet

- WC Policy SingrauliDocument3 pagesWC Policy Singrauliskaurravneet1No ratings yet

- AckoPolicy DBDocument2 pagesAckoPolicy DBGaurav SinghNo ratings yet

- Reliance Two Wheeler Package Policy - Schedule: SK01J3081 APR-2015 100 2 1274.00 SIKKIM - Gangtok 14511.00 NADocument7 pagesReliance Two Wheeler Package Policy - Schedule: SK01J3081 APR-2015 100 2 1274.00 SIKKIM - Gangtok 14511.00 NAManojNo ratings yet

- Scooty InsuranceDocument5 pagesScooty InsuranceZa HidNo ratings yet

- sameerPVT RNDocument2 pagessameerPVT RNRakesh VermaNo ratings yet

- MTR13041 - Natoya Robinson - PolicyDocument3 pagesMTR13041 - Natoya Robinson - PolicybabytoyaNo ratings yet

- Acko Car PolicyDocument1 pageAcko Car Policyksonukumar6213No ratings yet

- AckoPolicy-DBCR00638521340 00Document2 pagesAckoPolicy-DBCR00638521340 00Tarun GeorgeNo ratings yet

- TL202002765996 AnnualStatement 2022Document5 pagesTL202002765996 AnnualStatement 2022Atie ZakariaNo ratings yet

- File 20221219155150Document24 pagesFile 20221219155150mohd iqbalNo ratings yet

- Policy 468140003 1899483072595Document1 pagePolicy 468140003 1899483072595Ishan AnandNo ratings yet

- PMTB102316149941 HTMLDocument2 pagesPMTB102316149941 HTMLvishalsablok2017No ratings yet

- AckoPolicy-DBTR00645728216 00Document1 pageAckoPolicy-DBTR00645728216 00Tamil ArasuNo ratings yet

- Scorpio PDF 1Document4 pagesScorpio PDF 1ED STORYNo ratings yet

- AckoPolicy-DBTR00186090748 00 PDFDocument1 pageAckoPolicy-DBTR00186090748 00 PDFnirajNo ratings yet

- Suzuki Access InsuranceDocument2 pagesSuzuki Access InsuranceRaki GowdaNo ratings yet

- CH 06Document20 pagesCH 06Seth HolifieldNo ratings yet

- Fraud Diamond 1Document25 pagesFraud Diamond 1Yulia Deby PratiwiNo ratings yet

- Fasb 133 PDFDocument2 pagesFasb 133 PDFHannahNo ratings yet

- Corporate Governance Mallin Chapter 1: Prof. Dr. Laxmi RemerDocument13 pagesCorporate Governance Mallin Chapter 1: Prof. Dr. Laxmi RemeransarNo ratings yet

- PrintDocument59 pagesPrintmeryll daphneNo ratings yet

- Case Study Enron (CG)Document25 pagesCase Study Enron (CG)Hashma KhalidNo ratings yet

- Accounting ScandalsDocument4 pagesAccounting Scandalsyatz24No ratings yet

- Boh4m Chapter 1 NotesDocument5 pagesBoh4m Chapter 1 Noteshurricain42100% (1)

- Management Control Systems - InfosysDocument11 pagesManagement Control Systems - InfosysSanam Lakhani0% (1)

- Guidance Note On Derivative AccountingDocument9 pagesGuidance Note On Derivative AccountingHimanshu AggarwalNo ratings yet

- MbaDocument54 pagesMbasadathnooriNo ratings yet

- Guficbio Ar 2009-2010Document44 pagesGuficbio Ar 2009-2010hitehsmutha662No ratings yet

- Airtel N ZainDocument31 pagesAirtel N ZainPooja LilaniNo ratings yet

- Preparation of Company Accounts: Chapter-01Document18 pagesPreparation of Company Accounts: Chapter-01My ComputerNo ratings yet

- Strategic Management Journal10Document28 pagesStrategic Management Journal10sekar_smrNo ratings yet

- Irma Kasri Dan N. LukviarmanDocument29 pagesIrma Kasri Dan N. Lukviarmanjaharuddin.hannoverNo ratings yet

- Jurnal Al AjmiDocument16 pagesJurnal Al AjmiamandaNo ratings yet

- ATKearney Green Winners Feb2009Document4 pagesATKearney Green Winners Feb2009marybeth8103No ratings yet

- Corporate: GovernanceDocument5 pagesCorporate: GovernanceMostafizur Rahman TareqNo ratings yet

- Ajinomoto Annual Report 2018Document119 pagesAjinomoto Annual Report 2018Amirul Amin0% (1)

- 1-3 Business Combination 1-3 Business Combination: Summary of IFRS 3 BackgroundDocument11 pages1-3 Business Combination 1-3 Business Combination: Summary of IFRS 3 BackgroundNiceth JanNo ratings yet

- Objective of PAS 1Document7 pagesObjective of PAS 1kristelle0marisseNo ratings yet

- Forwards Futures and OptionsDocument11 pagesForwards Futures and OptionsSHELIN SHAJI 1621038No ratings yet

- 812318722Document9 pages812318722Duy PhamNo ratings yet

- Adoc - Pub - 1 Daftar Ifrs Dan Sak Berbasis IfrsDocument17 pagesAdoc - Pub - 1 Daftar Ifrs Dan Sak Berbasis IfrsFarhan SyadidannNo ratings yet