Professional Documents

Culture Documents

Final Guidehouse 247 CFE Whitepaper 1

Uploaded by

Ananda LagoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Guidehouse 247 CFE Whitepaper 1

Uploaded by

Ananda LagoCopyright:

Available Formats

White Paper

How Trading of Granular Energy Credits Could Enable and

Accelerate the Transition to 24/7 Carbon-Free Energy

Building a Market for Granular Certificates

Published 3Q 2022

Commissioned by Powerledger

Pritil Gunjan Julia Benz

Research Director Research Associate

Scan to get in touch with Powerledger:

Confidential information for the sole benefit and use of Powerledger.

Evolution in Market-Based Instruments to Achieve 100%

Decarbonization

Recent years have seen organisations and consumers put increasing effort into the sustainability and

decarbonization of their energy consumption. Perhaps unsurprisingly, there has been a corresponding

growth in scrutiny into how this is achieved, and in particular there has been a focus on the role of

market-based instruments for promoting renewable energy. These instruments are now the primary

way that a company procures and certifies that they are consuming renewable electricity. These can

take the form of Power Purchase Agreements (PPAs), Green Energy Programs or Green Tariffs,

where the energy is sold together with its Energy Attribute Certificates (EACs) or through the

purchase of unbundled EACs.

There’s no doubt that market-based instruments, such as EACs, have generated a large growth of

renewable assets. All of them involve allowing renewable energy producers to charge a premium for

the green element of their electricity and then trade that, or rather the certificate that represents that

green element, in a market. In doing so, they receive an additional income stream that helps them

invest in the development of more renewable energy assets, such as solar panels and wind turbines,

in the future. These markets and conventions have been highly successful because they allow

industry and consumers to use a mix of renewables and fossil fuels while gradually funding a rising

quantity of renewable assets that will one day replace those fossil fuels entirely.

However, this approach has come with problems that are increasingly difficult to ignore. Although the

extra capacity of renewable energy stimulated by these markets has been welcome, it has led to

concerns around the transparency of 100% annual renewable energy claims. Put simply, the market

is focused on pairing the overall consumption of electricity with the overall generation over a period of

a year and over a large geographical area. The market isn’t focused on pairing consumption with

renewable electricity generation within an hourly or closer to real-time period. Depending on the grid

mix, this means that at times during the day, consumers claiming 100% renewable are most likely

consuming electricity being produced by fossil fuels.

The steep rise of renewables has also created significant integration issues on the grid. Whilst there is

no doubt that EACs have stimulated the adoption of renewable resources, renewables by their nature

have brought with them, a variability in supply of electricity across the day; these fluctuations arising

from this variability must be balanced, both at every particular moment in time and for every particular

place on the grid through the skilful management of fossil fuel based energy reserves. Invariably, this

leads to running conventional plants at reduced efficiency and increases wear and tear. Further, more

of the same types of renewables built in and around the same locations create bottlenecks on

transmission & distribution corridors. The current certificate system is not helpful in mitigating these

issues. What is necessary is to be able to match electricity consumption and renewable electricity

production at a granular level to identify the gaps from both a temporal and spatial perspective. This

would also give clarity on what non-fossil solutions will be required to close those gaps.

The solution is straightforward in theory but complex in practice: Make sure that the market is

incentivized to pair consumption and production in a more precise way over both time and space.

Instead of creating a renewable energy market for total energy consumption over a period of a year,

the market considers supply and demand matching at hourly (or less) intervals. This approach is

called 24/7 carbon-free energy (CFE). It brings certificate markets into line with wholesale electricity

markets and most other trading markets today.

Thus, the focus is on raising the level of granularity of information for EACs, and trading of such

granular certificates (GCs), to send the right price signals to the market and thus reduce the stress on

the grid. This would help incentivise decarbonisation across the day. This approach would also bring a

Confidential information for the sole benefit and use of Powerledger.

1

greater level of authenticity to 100% renewable electricity claims. One nuance here is that the energy

usage requirement has moved beyond renewable to carbon-free energy sources, with the ultimate

aim of decarbonising all grids, everywhere. This paper details the way this approach is progressing

and the impacts it is likely to have.

The System Today: Present State and Problems

In today’s energy system, EACs are used to track and verify the production, trade, and consumption

of renewable electricity. Each certificate represents proof that one megawatt-hour of electricity has

been produced from renewable sources. In the US, EACs were originally created to facilitate a

compliance market, where they were used by Utilities as a way to certify they were meeting

mandatory annual renewable electricity generation targets set by governments. Today EACs are now

purchased and traded voluntarily around the world by corporations, to meet their clean energy goals.

On a global scale, EACs can take the form of Renewable Energy Certificates (RECs), Guarantees of

Origin (GOs), and International RECs (I-RECs). As defined by the U.S. Environmental Protection

Agency, a REC is a tradeable, market-based instrument that represents the legal property rights to

the renewable-ness—or all non-power attributes—of renewable energy generation. 1 RECs provide

proof that the owner of an energy market instrument has procured one megawatt-hour of renewable

electricity as they account for the renewable energy that has been generated and flows through the

power grid. Whoever retires (or cancels / redeems) that REC “owns” the right to claim they are

consuming a percentage of renewable electricity. In recent years, as more individuals and

organisations have become interested in sustainability, the use of RECs to certify renewable energy

consumption has increased dramatically with thousands of terawatt-hours being tracked and traded

around the world.

EACs are usually issued on monthly timelines and are not assigned specific hours of generation, so it

is not possible to buy RECs that directly match electricity consumption. Hence, when Corporations

buy RECs to match their annual energy use, they could be buying RECs produced from generation at

an entirely different time of the day to when they consumed it. Further, while their facilities may be

located in Ohio, the RECs they procure could have come from electricity generated in California. This

mismatch in time and location has resulted in very blunt market signals. There is a demand for more

renewable electricity, but the details of where and when that electricity is needed is difficult to

determine using an annual matching mechanism that does not have timestamped energy data.

The Need for Granular Certification

In creating time-based RECs also known as Granular Certificates or GCs, RECs are essentially

fractionalized to certify electricity production using hourly data. For example, a monthly band of EACs

representing 31 days of generation would be replaced with 744 granular certificates, each

representing one hour of generation during the month. Beyond capturing time-stamped data, each of

the 744 granular certificates includes information on the amount of electricity produced, the asset type

or source, and grid on which it is produced.

On a large scale, GCs can generate insights about the availability of CFE on grids during the entire

day. This information helps energy consumers to better manage their energy usage, while promoting

more precise strategies for decarbonisation. Using this information customers can optimise their non-

carbon intensive energy usage, by delaying energy intensive activity to the hours where renewable

energy supply is high or by procuring a mix of renewables that better match their existing consumption

profile. This information also allows customers to play an informed role in advocating for energy policy

1 https://www.epa.gov/greenpower/renewable-energy-certificate-monetization/

Confidential information for the sole benefit and use of Powerledger.

2

changes in their region or new types of 24x7 products from their energy retailer. Ultimately,

consumers who struggle to source renewable energy that matches their consumption may even

consider moving their facilities to other regions where the grids are cleaner or renewable energy

sources are more readily available.

How effective are GCs and the 24/7 solution?

To explore the potential of GCs, several stakeholders across the energy industry such as large

utilities, energy consumers, grid operators, government agencies, NGOs, existing certificate schemes

and technology providing software companies have joined the non-profit organisation EnergyTag.

EnergyTag is an industry-led initiative created to define the first standard for energy certificates with a

timestamp record of an hour or less. All of its members recognise the importance of verifying the

source of energy consumption on a far more granular basis.

Adopting a 24/7 CFE solution requires consumers to identify the cumulative fuel mix of their procured

or on-site generation and match that against their consumption profile across (at least) every hour of

the day. Matching consumption spatially brings with it the requirement to connect consumption and

production geographically so that each facility’s consumption is matched against local generation.

A key benefit of granular certificates is that it will improve the authenticity around renewable energy

claims by linking renewable energy generation to a customer’s consumption in near real time and

make the certificate system much more reflective of the physics and economics of the grid.

Furthermore, this principle creates a new market signal for renewable energy developers, energy

storage and demand side management solutions. Like the energy market today, it is expected that

GCs will be priced differently throughout the day depending on the time and corresponding supply and

demand of renewables. Certificates will likely be far more affordable when there is an oversupply of

renewable electricity available, and more expensive when less renewable electricity is available. The

variation in pricing is the signal that renewable energy developers and energy storage technologies

could find invaluable. For example, in periods of high supply and low pricing, storage owners could

buy or store any renewable electricity paired with a battery (and its corresponding certificates). Then

at a later hour of the day, put the electricity back onto the market, and sell the now higher priced

certificates, when there is less renewables available.

The temporal and spatial consideration of 24/7 CFE should drive the increase in new clean energy

generation and storage technology to meet the demand of every individual grid, and in the medium

term, support the build out of the energy storage market.

The adoption of GCs will also play an important role in the development of the green fuels sector as

the time and location information contained on the certificates will provide verifiable ways to track the

production of green hydrogen, for example, using electricity generated from renewable sources.

All of this could result in significant progress towards complete decarbonisation of every grid,

everywhere. As more consumers move towards this common goal, the grid will also benefit from

increased self-sufficiency and improved infrastructure (particularly interconnectors) by avoiding the

transmission of high volumes of renewables across large, congested distances or balancing an over

or undersupply of renewables across the day.

In the near term, GCs, with their spatial and temporal information, may not replace EAC certificates,

however technical solutions for GC issuance across all markets have been defined. Existing

renewable energy producers may choose to have GCs issued for their generation and sell them on

the open market as they have higher value, and this value will ultimately help them gain acceptance.

Confidential information for the sole benefit and use of Powerledger.

3

Renewable energy Generators and MN Consumers are already considering how to work together to

begin the time-based Energy Attribute Certificate (T-EAC) market creation to ensure mutual benefit.

With granular certificates, energy consumers can build strategies that enable them to power their

systems with renewable energy around the clock. Organisations such as Peninsula Clean Energy,

Google, Microsoft, and the Sacramento Municipal Utility District have already adopted this level of

matching and announced 24/7 CFE targets. The benefits of 24/7 CFE are clear and when

demonstrated at scale can help support a global transition to a decarbonized economy.

As Doug Miller, Deputy Director, Market & Policy Innovation, Clean Energy Buyers Institute (CEBI)

said when referring to GC effectiveness, “There are emerging solutions for voluntary 24/7

procurement that will likely enable energy customers to send more targeted, powerful market signals

for carbon-free electricity (CFE) at specific times of the day. These market signals—delivered through

price premiums for time-stamped energy attribute certificates (EACs)—will help drive CFE resources

investments meeting customers’ time-sensitive procurement needs. However, to make 24/7 CFE

solutions readily available in a consistent, comparable, and scalable way for customers and enable

customers to substantiate their 24/7 claims, there is an important precondition: EAC issuing bodies

and registries globally must first adopt hourly or sub-hourly timestamped EACs (also known as

“granular certificates'') in line with the EnergyTag Scheme Standard. The Clean Energy Buyers

Institute (CEBI) is working alongside EAC registries and issuing bodies and standards bodies to

enrich EACs with timestamps—along with other sought-after attributes 2 for EACs—in order to enable

a broader menu of next generation procurement options that includes, but is not limited to, 24/7.”

24/7 Market Development Challenges

Several challenges exist for wide-scale adoption of 24/7 CFE. Early adopters have highlighted that

access to high-quality consumption, CFE, and emissions data on an hourly basis is not

straightforward. Data standards across renewable energy producers, utilities and grid operators also

vary. For multinationals (MNCs) that operate in multiple electricity markets, both access and quality

has varied widely across regions. This inevitably means more work to find and curate the granular

data that is needed for 24/7. In the US market, the Linux Foundation has established a project under

LF Energy to support industry wide collaboration to establish a data standard for both power system

and customer carbon emissions data. The establishment of data standards and how customers can

readily access their own and market data will be an important gate opener for many 24/7 activities.

But having access to standard data solves only half the challenge. In most cases, a consumer is

unlikely to have a streamlined automated process for collecting and matching metered data for their

consumption and any renewable energy generation they have procured. In fact, most corporations

and governments are unaware of the opportunities that having access to their energy data could

provide, and on how to go about accessing and analysing this information so that they can take

necessary actions.

Moving to policy, in compliance markets, GCs are not currently recognised within the existing

renewable policy frameworks. In the US for example, Federal and State-level renewable portfolio

standards (RPS) require electricity suppliers to procure a specified proportion of their annual

electricity from renewable energy sources. These annual compliance targets are verified using RECs

at a 1 MWh level rather than broken down into more granular measures. The Renewable Energy

Directive (REDII) in the EU market also contains a 1 MWh measurement of renewable energy for

GO’s.

2https://cebuyers.org/blog/with-enhanced-energy-attribute-certificates-energy-customers-can-use-their-voluntary-

procurement-to-send-more-powerful-and-targeted-market-signals-for-systemic-grid-decarbonization/

Confidential information for the sole benefit and use of Powerledger.

4

There are, however, proposed policy changes happening across global markets to match a

percentage of electricity producer portfolios as 24/7 CFE. President Biden signed an executive order

in December 2021 that specifically addressed 24/7 CFE, proposing a goal of 100% carbon pollution-

free electricity on a net annual basis by 2030, including 50% 24/7 carbon pollution-free electricity.3

Sub-national RPSs are moving to include targets for new clean energy sources as well. In the EU,

REDIII proposes to update the measurement metric, building on the 2018/2001 EU Directive (RED II)

biofuels requirements that stated in order to be eligible for the renewable transport fuel target, there is

a requirement for both temporal and geographical correlation. This is to ensure that the production of

biofuels, such as green hydrogen can be certified and tracked in a reliable, transparent manner.

However, these policy changes are still in a nascent phase or yet to be endorsed, and will need to be

tested out over time. While voluntary reporting groups, such as the RE100 initiative, acknowledge that

some of their members are looking to match at a more granular level, there is limited guidance on how

to report 24/7 CFE. Beyond these challenges, there is simply a need for more regulation or policy

consideration to assist the development and scaling of CFE markets.

Ultimately, the barriers are indicative of a young marketplace and can be addressed with greater

collaboration, data uniformity, policy, and the right level of investment.

Market Growth and Assessment - Three Types of Profiles

When assessing MNCs, Commercial and Industrial (C&I) customer requirements and their likely

uptake of 24/7 CFE, the market can be grouped into three broad segments.

The first segment consists of 24/7 CFE innovators and contains less than 1% of all consumers, sitting

predominantly in the Technology sector. This segment has both the resources and data capabilities to

support the workload and complexity of measuring the carbon intensity of energy procured in every

hour of the day. They have already met, or are well progressed towards their 100% annual renewable

energy target and have dedicated energy teams, a budget and the technology required to move

towards a more precise measurement. After all, measuring progress towards 24/7 CFE requires

identifying usage of electricity down to (at least) hourly intervals across all facilities on each grid and

then considering the strategies required to improve upon the %CFE Score. It is not a trivial task.

What has been particularly interesting in recent months is the way top tier companies are recognising

and adapting to the challenge. Comparable organisations have been building alliances and sharing

their insights of early problems to be solved, along with their successes. So, unlike many other

commercial arenas where secrecy and patenting methods and techniques has been the approach,

24/7 has resulted in a much more collaborative ethos. Effectively, the top tier of 24/7 consumers, grid

operators and service providers are helping to educate the market and each other via informal

channels and industry working groups, as they progress towards the build out of early solutions that

will support the market as it grows.

The second market segment might aspire to go carbon free 24/7 but may not have the necessary

resources or budget. These organisations typically manage their sustainability activities with

spreadsheets and a low level of automation. For this group, moving to a 24/7 CFE measurement and

defining a roadmap to get there would be a huge commitment of resources and time, with no clear

business case. Anecdotally, while C&I customers in this tier understand the benefits this transition

could bring, they have been hesitant about changing their current targets or over-committing and not

having the expertise or internal buy-in to meet more granular targets. Unsure on how they will

3https://www.whitehouse.gov/briefing-room/statements-releases/2021/12/08/fact-sheet-president-biden-signs-

executive-order-catalyzing-americas-clean-energy-economy-through-federal-sustainability/

Confidential information for the sole benefit and use of Powerledger.

5

evidence and accurately measure themselves against more granular targets has also been an

emerging theme. Scrutiny on greenwashing has only amplified those concerns.

The third and likely largest segment of MNC and C&I customers may or may not be clear about what

24/7 CFE is and its distinction from 100% annual matching claims. They will probably also be waiting

for a clear pathway, policy changes and the right tools to implement any 24/7 CFE policy. There are

some misconceptions around the 24/7 solution in this segment that it only addresses the last 10-20%

of decarbonisation. But that is not the case. It will do much more than that. Industry groups such as

the Eurelectric 24/7 Taskforce4 have been working hard to help grow the understanding for all

electricity users. As Bruce Douglas, Business and Communications Director at Eurelectric said “There

is increasing interest in 24/7 Carbon Free Energy (CFE) matching from a range of stakeholders—

buyers, suppliers, third party solution providers and policy makers. However, there is still a lack of

knowledge and understanding of what it is, why to do it (the benefits) and how to implement it.

Eurelectric are coordinating a European 24/7 hub to raise awareness, deliver thought leadership and

policy recommendations, and train market players in order to increase demand for granular energy

matching”. Without the continued focus and advocacy of groups such as Eurelectric and CEBI in the

US, potentially getting to 100% annual matching is as far as this segment’s ESG commitment will take

them. Particularly where shareholders or market regulations aren’t requiring them to do so,

Governments and their 24/7 policy changes will be needed to drive real uptake and growth in this

segment.

Given that the move towards 24x7 CFE matching is still relatively young, the growth of the market in

the near term depends on how each customer segment responds to the regulatory and the general

zeitgeist of the ESG environment. Adoption of 24/7 goals requires corporate vision, regulatory

commitment and buy-in; however, its adoption is making good headway.

As Savannah Goodman, Tech Lead of Data and Software Climate Solutions at Google, said recently,

“In the past 2 years, T-EACs have been transformed from a concept into development and now early

deployment. Advancing granular certificates can enable 24/7 CFE as an hourly tracking solution that

brings emphasis to the co-location of consumption on the same grid as production for the T-EAC.

Until there is a collective awareness at a local grid level, it won’t be apparent what tools will be

needed to bring scale to decarbonisation. We are seeing progress, but this can be further accelerated

by growing demand signals from large buyers (e.g., companies, utilities, and governments) and by

supporting registries in transitioning to hourly or sub-hourly tracking and issuance.”

Energy Portfolio Management

The first step a consumer will need to take towards 24/7 CFE is understanding their current renewable

to non-renewable electricity consumption on an (at least) hourly interval. This effort should not be

underestimated, as the energy sources need to consist of all renewable (i.e., wind, solar, hydro,

biomass) and non-renewable fuel types being consumed. The contracts for those sources could be

with renewable energy producers via PPAs, energy retailers, community choice aggregators or

utilities. Sustainability Energy Management platforms that automate data collection for energy

provenance and traceability of each energy source are essential to establishing a consumer’s energy

portfolio. Additionally, a means to accurately track granular emissions at individual sites and enable

users to track the percentage of carbon free energy by site and time is also essential. In recent years,

blockchain technology has been an efficient way to enable the tracking of energy and all its attributes

by creating a time and location stamped digital record using granular meter data. Blockchains such as

Solana, are faster and far more energy efficient than others, which is essential as smart meters can

4 https://247.eurelectric.org/

Confidential information for the sole benefit and use of Powerledger.

6

post data in near-real-time, requiring the consolidation of millions of small energy transactions in

seconds.

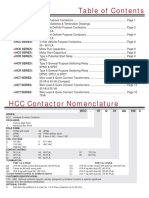

Figure 1 shows a sample visualisation of hourly consumption mapped to various types of generation

matched off against a customer’s consumption across the same period.

Figure 1 An 24/7 Example Energy Portfolio -- Management View

(Source: Powerledger)

A core feature to increase transparency is customisable reporting based on locations and time frames

selected. Such reports contain descriptive analytics on total consumption and its breakdown, and CFE

metrics based on the renewable vs non-renewable consumption, carbon emissions avoided, and

finally, a way to verify that renewable sources have allocated certificates to the corresponding

consumption at a granular level.

Enhancing a 24/7 System by Enabling Trading

There are several ways that a corporation can go about purchasing EACs today. “Bundled” EACs are

sold together with the generated renewable electricity. They can be bought through multiple channels

such as PPAs, green energy tariffs, or green programs. When the EACs are unbundled or sold as a

separate transaction from renewable energy generation, customers buy the certificates separate to

the electricity they consume. Regardless of the procurement method adopted, EACs are the common

thread required to substantiate any CFE procurement claims.

For corporations beginning their decarbonization journey, unbundled EACs are the most common

procurement method adopted to achieve their sustainability targets, because the purchase contracts

are relatively simple, provide flexibility and low risk. Unbundled EACs have also been a way for other

customers to address gaps in their existing onsite renewables production or PPA contracts to achieve

Confidential information for the sole benefit and use of Powerledger.

7

a 100% annual renewable claim. In the US in 20205, unbundled RECs represented the largest

renewable energy market instrument used by voluntary buyers to meet their sustainability targets.

Enabling Trading

Evolving traditional unbundled EAC marketplaces to a digital and accessible GC marketplace comes

with low participation barriers for 24/7 aspirants. One of the most important roles a digital marketplace

will play is being able to efficiently aggregate and match off participants' needs against the available

supply of granular certificates within a region. This aggregation at a regional level will send clear price

signals in the short term that will drive both renewable energy generation and consumption decisions.

In the longer term, price signals created by an undersupply of clean energy at specific times (or

locations) will direct the development of new clean technology, storage solutions or a combination of

both that can cover the most carbon intensive hours of a grid’s generation mix with clean power. For

instance, storage operators will be able to leverage market price signals to benefit from price arbitrage

across the hours of high demand by discharging clean energy stored during periods of low demand

and selling the associated GCs of that clean energy.

Enabling a marketplace for granular certificates also guarantees the lowest price for consumers as the

clean generation with the lowest cost will be the first to clear in the market. The market price will be

set where demand matches supply within a given hour. This is the highest price corporations will be

willing to pay and the lowest price that energy developers will be willing to receive for clean energy.

The marketplace will provide valuable signals to all participants of oversupply, excessive demand and

to an extent, where policy is not working. Meaningful progress on grid decarbonisation will not be

delivered by individuals, but rather a market driven response.

To be able to optimise their individual orders in a GC market, consumers would benefit from the

support of visualisation tools that identify their non-renewable consumption gaps, and efficiently match

those hours across a given period with CFE purchase opportunities. Additional portfolio optimisation

tools such as being able to set %CFE targets or pricing thresholds will also help ensure that granular

trades can clear and settle with efficiency, but also to suit a consumer's own portfolio preferences.

Ideally, customers will have the autonomy to customise their GC buying criteria beyond matching

granular certificates to their location or local grid bidding zone, such as choosing to procure GCs from

projects that provide the greatest level of emissions reductions. However, in nascent GC markets

customised matching of consumption and the GC, will require careful consideration. Energy market

participants will need to work together to develop a shared understanding of this and more importantly

how the transfers of GCs across bidding zones will be coordinated. The most important step initially

will be to grow the volume of GCs so that initial liquidity pools aren’t limited.

Ultimately, a digital and transparent marketplace can provide strong market signals for developers

and individual grids to make informed investment decisions regarding siting and technology for new

projects. Moreover, the availability of pricing information for GCs can assist regulators monitoring the

markets as well as informing policy.

Smart Energy Trading and De-Risking PPAs

Digital energy trading platforms can also help facilitate the transition towards 24/7 CFE by enabling

large C&I consumers to collaborate through their renewable energy providers by forming local energy

trading groups. Trading rules can be established by the Renewable energy supplier to allow

customers to balance their excess of contracted renewable generation on an hourly interval with other

contracted customers in the market who may be in deficit for that hour. Such trading practices can

5 https://www.nrel.gov/docs/fy22osti/81141.pdf

Confidential information for the sole benefit and use of Powerledger.

8

help both off-takers as well as renewable energy producers to de-risk commitment to contracted

volumes in long-term conventional PPAs.

Case Study: Midwest Renewable Energy Tracking System

Powerledger has partnered with the Midwest Renewable Energy Tracking System (M-RETS) to

launch TraceX, a blockchain-enabled certificate trading platform with bespoke features that

provides for a seamless trading experience. This platform is essential as M-RETS issues more

than 145 million EACs annually and is the largest EAC registry in North America. Currently

offering standard EACs, TraceX’s architecture is already evolving to support the issuance,

trading, and retirement of granular certificates. The TraceX marketplace allows participants to

customise their EAC purchases with several attributes to align with their business sustainability

goals, such as buying EACs from a specific project, location, renewable technology, or one that

is eligible for a compliance or voluntary program. Signals are already being sent by customers

wanting to procure EACs from locations based in the same state as their facilities. Being able to

refine those signals to their local balancing authority will provide even sharper signals for the

siting of future renewable projects.

Figure 4 The TraceX Platform

(Source: Powerledger)

Customers also benefit from the platform’s real-time price discovery when they enter the market,

providing a high level of trust and transparency for buyers and sellers. Upon sign up, customers

link their existing EAC registry account, allowing them to import EACs into the marketplace, list

for sale, and have ownership in the registry updated seamlessly when an EAC sale or purchase

is successfully completed. All EACs listed for sale are secured in the registry so that they cannot

be double-sold at the same time to another customer.

The permissions-based blockchain tracks each successful transfer of ownership, providing an

immutable audit trail for each transaction. With built-in transaction reporting, customers gain

greater insight and traceability of their EACs. TraceX is built to scale and can support up to

Confidential information for the sole benefit and use of Powerledger.

9

50,000 transactions per second, which will become very important as the EAC market evolves to

a more granular time-based EAC procurement model.

In the move toward 24/7 CFE, the TraceX marketplace works cohesively with VISION, an energy

portfolio management tool that allows users to overlay the time and location stamped renewable

energy generation profile against their energy consumption from non-renewable resources. For

periods where the energy consumed exceeds contracted renewable energy, customers can

procure granular certificates to increase their % CFE. In cases where renewable energy

generation exceeds energy consumed, customers can sell off those granular certificates in the

market to optimise their energy costs. Marketplace participants can use these findings on

TraceX and make data-driven decisions to fill their deficits or trim their excess of clean energy

on an hourly or sub-hourly basis (depending on the availability of data).

Liquid, transparent markets with a robust price signal are a key prerequisite for 24/7 CFE

adoption and growth. The development of these markets is an important foundation for the

energy transition.

Confidential information for the sole benefit and use of Powerledger.

10

Conclusion

There is no doubt that the ambitious net zero targets of nations require the scaling of carbon free

energy well beyond current capacity. The challenges posed by arbitrary and uncontrolled renewable

deployment, that ignore time and space considerations of the grid will only serve to destabilise the

network, add cost, and possibly result in carbon consumption too.

The 24/7 Carbon Free energy concept emerges as a credible route to solving this problem but

requires adoption by a broad range of energy users. In this paper we have segmented the energy

users in terms of appetite to push change through, with the top tier doing much of the work in helping

define the tools needed and a successful approach. The second and third tiers have given indications

of following suit, and this is a welcome sign. It is also something the tier one group are actively

encouraging by making many of their field studies public.

To support time and space energy considerations, Industry groups, such as Energy Tag, have

developed a granular energy certificate standard so that market instruments can evolve; However,

barriers still exist. Policy changes will be required to ensure targets move beyond the low-resolution

format of annual measurement to something far more granular and authentic.

What is also very clear is that the essential first steps for any organisation embarking on a 24/7 CFE

program is to establish the complete credentials of the energy they are consuming. A sentiment often

expressed by committed 24/7 companies is that moving from 100% annual renewable energy matching

to 24/7 CFE first requires getting really clear about what energy you are using and when you are using it.

What that demands then are tools that can trace, track and trade that energy. It is a prerequisite for

everything else that follows.

While some of those enterprises are developing their own solutions to benchmark and deliver

compelling 24/7 targets, a robust tool kit of 24/7 solutions covering granular CFE measurement and

24/7 trading will be required for broad market adoption. The tipping point for 24/7 adoption is

dependent on tools that automate and streamline all the activities that every large energy consumer

will need to undertake. Tools to verify electricity source and emissions consumption already exist and

are in early stages of scaling. Digital EAC platforms and marketplaces that can provide 24/7

procurement solutions will go a long way towards addressing a core market need for the largest EAC

procurement channel in both the US and EU markets.

Ultimately as large companies pioneer this effort and pave the way with technology providers and

regulatory support, smaller companies will be able to follow suit. Many companies define themselves

as being on some kind of journey and for the very top tier that journey also includes bringing others

along with them for the ride.

As Savannah Goodman, Tech Lead of Data and Software Climate Solutions at Google, says, “Our

goal as a company is to support the rapid decarbonization of global electricity systems. Naturally we

are keen to encourage other companies to join us as we feel individual commitments will spur the

collective outcome we are all trying to achieve.”

24/7 CFE has made promising inroads into the problem of full decarbonisation. If the current

momentum from the Innovation leaders can continue to trickle down, the targets for 2050 may well yet

be reached.

Confidential information for the sole benefit and use of Powerledger.

11

Acronym and Abbreviation List

CFE Carbon-Free Energy

C&I Commercial and Industrial

EAC Energy Attribute Certificate

EU Europe

GO Guarantee of Origin

I-REC International Renewable Energy

Credit

MNC Multinational Corporation

MW Megawatt

MWh Megawatt Hour

MNC Multinational Corporation

PPA Power Purchase Agreement

REC Renewable Energy Credit

RPS Renewable Portfolio Standard

T-EAC Time-Based Energy Attribute

Certificate

US United States

Confidential information for the sole benefit and use of Powerledger.

12

Table of Contents

How Trading of Granular Energy Credits Could Enable and Accelerate the Transition to 24/7

Carbon-Free Energy 0

Evolution in Market-Based Instruments to Achieve 100% Decarbonization 1

The System Today: Present State and Problems 2

The Need for Granular Certification 2

How effective are GCs and the 24/7 solution? 3

24/7 Market Development Challenges 4

Market Growth and Assessment - Three Types of Profile 5

Energy Portfolio Management 7

Enhancing a 24/7 System by Enabling Trading 8

Enabling Trading 8

Smart Energy Trading and De-Risking PPAs 9

Conclusion 11

Acronym and Abbreviation List 12

Table of Contents 13

Scope of Study 14

Sources and Methodology 14

Confidential information for the sole benefit and use of Powerledger.

13

Scope of Study

Guidehouse Insights has prepared this white paper, commissioned by Powerledger, to provide an

overview of 24/7 carbon free energy (CFE). It provides an overview of the key elements of CFE and its

value in supporting a truly 100% decarbonized grid; a case study that uses 24/7 CFE technologies and

strategies to create granular energy attribute certificates (EACs) and fill in consumption gaps with

renewable energy; and recommendations for regulators and corporates getting started with CFE.

Sources and Methodology

Guidehouse Insights’ industry analysts use a variety of research sources in preparing research reports

and white papers. The key component of Guidehouse Insights’ analysis is primary research gained from

phone and in-person interviews with industry leaders including executives, engineers, and marketing

professionals. Analysts are diligent in ensuring that they speak with representatives from every part of

the value chain, including but not limited to technology companies, utilities and other service providers,

industry associations, government agencies, and the investment community.

Additional analysis includes secondary research conducted by Guidehouse Insights’ analysts and its

staff of research assistants. Where applicable, all secondary research sources are appropriately cited

within this report.

These primary and secondary research sources, combined with the analyst’s industry expertise, are

synthesized into the qualitative and quantitative analysis presented in Guidehouse Insights’ reports.

Great care is taken in making sure that all analysis is well-supported by facts, but where the facts are

unknown and assumptions must be made, analysts document their assumptions and are prepared to

explain their methodology, both within the body of a report and in direct conversations with clients.

Guidehouse Insights is a market research group whose goal is to present an objective, unbiased view

of market opportunities within its coverage areas. Guidehouse Insights is not beholden to any special

interests and is thus able to offer clear, actionable advice to help clients succeed in the industry,

unfettered by technology hype, political agendas, or emotional factors that are inherent in cleantech

markets.

Confidential information for the sole benefit and use of Powerledger.

14

Published 3Q 2022

This deliverable was prepared by Guidehouse Inc. for the sole use and benefit of, and pursuant to a

client relationship exclusively with Powerledger ("Client"). The work presented in this deliverable

represents Guidehouse’s professional judgement based on the information available at the time this

report was prepared. Guidehouse is not responsible for a third party’s use of, or reliance upon, the

deliverable, nor any decisions based on the report. Readers of the report are advised that they assume

all liabilities incurred by them, or third parties, as a result of their reliance on the report, or the data,

information, findings, and opinions contained in the report.

© 2022 Guidehouse Inc. All rights reserved.

15

You might also like

- The Smart Grid - Enabling Energy Efficiency and Demand Response - C3Document24 pagesThe Smart Grid - Enabling Energy Efficiency and Demand Response - C3Kiên PhạmNo ratings yet

- Disruption Innovation in ElectricityDocument6 pagesDisruption Innovation in ElectricityPrateekGuptaNo ratings yet

- Electric Power Grid ModernizationDocument17 pagesElectric Power Grid ModernizationLeroy Lionel Sonfack100% (1)

- February Final Perspectives Decentralisation - 2020Document2 pagesFebruary Final Perspectives Decentralisation - 2020dedypunyaNo ratings yet

- Diversifying Into Renewable Energy: Challenges and OpportunitiesDocument9 pagesDiversifying Into Renewable Energy: Challenges and OpportunitiesCTRM CenterNo ratings yet

- Challenges in Renewable Energy Integration: Saddikuti Manasa 2247470Document7 pagesChallenges in Renewable Energy Integration: Saddikuti Manasa 2247470Throw AwayNo ratings yet

- Exergy BIZWhitepaper v10Document30 pagesExergy BIZWhitepaper v10Vinod JeyapalanNo ratings yet

- Cap The GridDocument8 pagesCap The GridPost Carbon InstituteNo ratings yet

- STRIVE by STX - Renewable Energy Procurement For CorporatesDocument14 pagesSTRIVE by STX - Renewable Energy Procurement For CorporatesAdi BrotonimpunoNo ratings yet

- Recurve - Preprint - Decarbonization of Electricity Requires Procurable Market-Based Demand Flexibility - Electricity Journal Sept 2019Document20 pagesRecurve - Preprint - Decarbonization of Electricity Requires Procurable Market-Based Demand Flexibility - Electricity Journal Sept 2019Lakis PolycarpouNo ratings yet

- Renewable Energy Certificates: Understanding RECsDocument4 pagesRenewable Energy Certificates: Understanding RECsIndumathi SekarNo ratings yet

- CREW: Council On Environmental Quality: Global Warming Documents: CEQ 007650 - CEQ 007654 Climate Change PolicyDocument5 pagesCREW: Council On Environmental Quality: Global Warming Documents: CEQ 007650 - CEQ 007654 Climate Change PolicyCREWNo ratings yet

- Prosumer Integration Indemand Repsonce-2023-ImpDocument11 pagesProsumer Integration Indemand Repsonce-2023-ImpAntoiitbNo ratings yet

- ESN Elec Storage in The National Interest Report Final Web PDFDocument8 pagesESN Elec Storage in The National Interest Report Final Web PDFroyclhorNo ratings yet

- Conventional Power Plants in Liberalized Electricity Markets With Renewable EntryDocument35 pagesConventional Power Plants in Liberalized Electricity Markets With Renewable EntryPeter VallejoNo ratings yet

- Zigbee: The Choice For Energy Management and Efficiency: June 2007Document7 pagesZigbee: The Choice For Energy Management and Efficiency: June 2007bnh_faelNo ratings yet

- Achieving Carbon Goals with Renewable Energy PurchasesDocument44 pagesAchieving Carbon Goals with Renewable Energy Purchasespushpendra21No ratings yet

- Leveraging Micro GridsDocument3 pagesLeveraging Micro GridsjohnribarNo ratings yet

- Grid of The Future: Are We Ready To Transition To A Smart Grid?Document11 pagesGrid of The Future: Are We Ready To Transition To A Smart Grid?XavimVXSNo ratings yet

- Karaduman JMP 2019Document53 pagesKaraduman JMP 2019रवि धाकड़No ratings yet

- Decarbonising End-use Sectors: Green Hydrogen CertificationFrom EverandDecarbonising End-use Sectors: Green Hydrogen CertificationNo ratings yet

- Dynamic Energy Response WPDocument12 pagesDynamic Energy Response WPwidayat81No ratings yet

- Peer To Peer Business Model Approach For Renewable Energy CooperativesDocument4 pagesPeer To Peer Business Model Approach For Renewable Energy CooperativesFauzan Azhiman Irham100% (1)

- Demand Response and Advanced Metering: Modernizing The Electric GridDocument29 pagesDemand Response and Advanced Metering: Modernizing The Electric GridFaaez Ul HaqNo ratings yet

- Energy Demand Management, Also Known As Demand Side Management (DSM), Is TheDocument4 pagesEnergy Demand Management, Also Known As Demand Side Management (DSM), Is TheRamuPenchalNo ratings yet

- Smart Gris SystemDocument16 pagesSmart Gris SystemSri KrishnaNo ratings yet

- Microgrid Policy Review of Selected Major Countries, Regions, and OrganizationsDocument34 pagesMicrogrid Policy Review of Selected Major Countries, Regions, and OrganizationsAlessandro Harry LaterzaNo ratings yet

- Report on the Brazilian Power System: An OverviewDocument68 pagesReport on the Brazilian Power System: An OverviewAbhi JindalNo ratings yet

- Charting A Path For Utility Digital Transformation Salesforce EbookDocument15 pagesCharting A Path For Utility Digital Transformation Salesforce EbookAnil KNo ratings yet

- Europe: Impact of Dispersed and Renewable Generation On Power System StructureDocument38 pagesEurope: Impact of Dispersed and Renewable Generation On Power System StructuredanielraqueNo ratings yet

- Sensors 21 04533 With CoverDocument27 pagesSensors 21 04533 With CoverBrou Cédrick ATSENo ratings yet

- Energia Renovable 1Document11 pagesEnergia Renovable 1Ivanna De Jesus Peña CorenaNo ratings yet

- Overcome Barriers To Renewable Energy Procurement: WBCSD Leadership Program 2015Document24 pagesOvercome Barriers To Renewable Energy Procurement: WBCSD Leadership Program 2015M Murshed Haider, FCMINo ratings yet

- Net Metering - Wikipedia, The Free EncyclopediaDocument13 pagesNet Metering - Wikipedia, The Free Encyclopediablue_sea_00No ratings yet

- Rate Issues and Benefits of Distributed GenerationDocument6 pagesRate Issues and Benefits of Distributed GenerationDanny AlamNo ratings yet

- The Future Electricity Grid: Key Questions and Considerations For Developing CountriesDocument72 pagesThe Future Electricity Grid: Key Questions and Considerations For Developing CountriesNemezis1987No ratings yet

- 1 s2.0 S2666955223000254 MainDocument11 pages1 s2.0 S2666955223000254 MainMann StrongNo ratings yet

- Power Plan: Rethinking Policy To Deliver ADocument32 pagesPower Plan: Rethinking Policy To Deliver Ashadydogv5No ratings yet

- Energy Efficiency As A Resource: The Power of Getting More From LessDocument12 pagesEnergy Efficiency As A Resource: The Power of Getting More From LessArianna IsabelleNo ratings yet

- Photovoltaic System ManagementDocument72 pagesPhotovoltaic System Managementanandpandiyan39No ratings yet

- Catalogo Caccia Nr.14 2019Document10 pagesCatalogo Caccia Nr.14 2019Nuno MonteiroNo ratings yet

- The Future of Electricity Rate Design - McKinseyDocument10 pagesThe Future of Electricity Rate Design - McKinseyNuno MonteiroNo ratings yet

- Or Researchpaper - Admin11Document17 pagesOr Researchpaper - Admin11Yashika ANo ratings yet

- Challenges For Wholesale Electricity Markets With Intermittent Renewable Generation at Scale: The US ExperienceDocument41 pagesChallenges For Wholesale Electricity Markets With Intermittent Renewable Generation at Scale: The US ExperiencePaulo OyanedelNo ratings yet

- Smart Grid: Integrating Renewable, Distributed and Efficient EnergyFrom EverandSmart Grid: Integrating Renewable, Distributed and Efficient EnergyNo ratings yet

- Liquidising Energy in a Peer-to-Peer NetworkDocument8 pagesLiquidising Energy in a Peer-to-Peer NetworkAnshul BawriNo ratings yet

- Electricity Marginal Cost Pricing: Applications in Eliciting Demand ResponsesFrom EverandElectricity Marginal Cost Pricing: Applications in Eliciting Demand ResponsesNo ratings yet

- Microgrid Transactive Energy Systems Reviewed With Distributed Ledger and Market AnalysesDocument23 pagesMicrogrid Transactive Energy Systems Reviewed With Distributed Ledger and Market AnalysesMiguel JuarezNo ratings yet

- Designing A National Renewable Electricity StandardDocument16 pagesDesigning A National Renewable Electricity StandardCarnegie Endowment for International PeaceNo ratings yet

- Literature Review Renewable EnergyDocument5 pagesLiterature Review Renewable Energydowxgtbnd100% (1)

- Fueling Healthy Communities V1 Energy Storage Secure Supplies Whitepaper: POWER TO GAS ENERGY STORAGEFrom EverandFueling Healthy Communities V1 Energy Storage Secure Supplies Whitepaper: POWER TO GAS ENERGY STORAGENo ratings yet

- How Decoupling Creates Win-Win For Power Companies and CustomersDocument11 pagesHow Decoupling Creates Win-Win For Power Companies and CustomersClutha Mata-Au River Parkway GroupNo ratings yet

- Photovoltaics (PV) and Electric Vehicle-To-grid (V2G) Strategies For Peak Demand Reduction in Urban Regions in Brazil in A Smart Grid EnvironmentDocument9 pagesPhotovoltaics (PV) and Electric Vehicle-To-grid (V2G) Strategies For Peak Demand Reduction in Urban Regions in Brazil in A Smart Grid EnvironmentEngEzequielNo ratings yet

- A Framework For Designing and Evaluating Realistic Blockchain-Based Local Energy MarketsDocument17 pagesA Framework For Designing and Evaluating Realistic Blockchain-Based Local Energy Marketsamira dhorbaniNo ratings yet

- Energia 6Document6 pagesEnergia 6pleonNo ratings yet

- Grid Applications For Energy StorageDocument1 pageGrid Applications For Energy StorageBharat PrabhakarNo ratings yet

- Why Are Power Purchase Agreements Essential For Renewable AdoptionDocument11 pagesWhy Are Power Purchase Agreements Essential For Renewable Adoptionpremnath16No ratings yet

- The Key To Cost-Effective and Sustainable Buildings: Intelligent EnergyDocument14 pagesThe Key To Cost-Effective and Sustainable Buildings: Intelligent EnergyManasvi MehtaNo ratings yet

- UK Carbon Content Energy Products CfeDocument42 pagesUK Carbon Content Energy Products CfeAnnisa FillaeliNo ratings yet

- Designandsimulationofstandalonesolar PVsystemusing PVsystDocument8 pagesDesignandsimulationofstandalonesolar PVsystemusing PVsystAnanda LagoNo ratings yet

- Report Title: Date Course Title Student'S Name Teacher'S NameDocument4 pagesReport Title: Date Course Title Student'S Name Teacher'S NameJoemadz Dela CruzNo ratings yet

- Itrpv 2023Document83 pagesItrpv 2023Ananda LagoNo ratings yet

- Fala - Apresentação Energy InnovationDocument1 pageFala - Apresentação Energy InnovationAnanda LagoNo ratings yet

- Untitled DocumentDocument1 pageUntitled DocumentAnanda LagoNo ratings yet

- Itrpv 2023Document83 pagesItrpv 2023Ananda LagoNo ratings yet

- Peerj 8113Document19 pagesPeerj 8113Ananda LagoNo ratings yet

- Apostila CiclonesDocument6 pagesApostila CiclonesAnanda LagoNo ratings yet

- Opu 1 Resumo U3-20180428190745Document31 pagesOpu 1 Resumo U3-20180428190745Ananda LagoNo ratings yet

- Conservation of Energy and Economic AnalysisDocument24 pagesConservation of Energy and Economic AnalysisAnanda LagoNo ratings yet

- Engineering Center of Competences for Green HydrogenDocument34 pagesEngineering Center of Competences for Green HydrogenAnanda LagoNo ratings yet

- Thyssenkrupp gH2 - 202104Document26 pagesThyssenkrupp gH2 - 202104Ananda LagoNo ratings yet

- Aspen Plus Model of An Alkaline Electrolysis System For Hydrogen ProductionDocument14 pagesAspen Plus Model of An Alkaline Electrolysis System For Hydrogen ProductionAnanda Lago100% (1)

- Ecommerce-Act 040924Document5 pagesEcommerce-Act 040924Michael BongalontaNo ratings yet

- Power Team PA6 Pumps - CatalogDocument2 pagesPower Team PA6 Pumps - CatalogTitanplyNo ratings yet

- Graph motion along straight lineDocument2 pagesGraph motion along straight lineFranchesca Mari YuzonNo ratings yet

- Expl or Upl Oa Lo Gi Sig Nu: e e D N PDocument9 pagesExpl or Upl Oa Lo Gi Sig Nu: e e D N PYohannes BushoNo ratings yet

- Jorge Menacho Perú 2015 Presentación J.menachoDocument42 pagesJorge Menacho Perú 2015 Presentación J.menachoCorazon ValienteNo ratings yet

- Standard Operating Procedure Operation of Power Plant: Punyam Manufacturing INCDocument2 pagesStandard Operating Procedure Operation of Power Plant: Punyam Manufacturing INCMAYMODERN STEEL0% (1)

- Dos Windows 95 Fat Fat12 Fat16 Windows 98 Windows Me Fat32 Windows 2000 Logical Disk Manager DiskpartDocument1 pageDos Windows 95 Fat Fat12 Fat16 Windows 98 Windows Me Fat32 Windows 2000 Logical Disk Manager Diskpartgagandhawan31No ratings yet

- UAE CAR 147 - Oct 17Document26 pagesUAE CAR 147 - Oct 17Vikramjeet BanerjeeNo ratings yet

- Introduction to StatisticsDocument9 pagesIntroduction to StatisticsJudith CuevaNo ratings yet

- Braking Resistor SAFUR180F460 Braking Resistor 460V 180kW 2.4 OhmDocument2 pagesBraking Resistor SAFUR180F460 Braking Resistor 460V 180kW 2.4 OhmmanthuNo ratings yet

- ISL95829CHRTZDocument74 pagesISL95829CHRTZJavier Marcelo BastetNo ratings yet

- TE-6300 Series Temperature Sensors: DescriptionDocument4 pagesTE-6300 Series Temperature Sensors: DescriptionÖzgürNo ratings yet

- SERIES2016 Post PrintversionDocument21 pagesSERIES2016 Post PrintversionSara ZeynalzadeNo ratings yet

- Noob HackersDocument7 pagesNoob HackersKavin MartinNo ratings yet

- Technical Brochure Gruntec BlocksDocument5 pagesTechnical Brochure Gruntec BlockspatnipranayNo ratings yet

- Deep Learning: A New Paradigm for Rapid Orebody ModellingDocument11 pagesDeep Learning: A New Paradigm for Rapid Orebody ModellingCristhian Ł. Barrientos100% (1)

- 103-2024 BlackScreen SDocument2 pages103-2024 BlackScreen Sİbrahim KocakNo ratings yet

- Catalog Hartland RelayDocument16 pagesCatalog Hartland RelayEslam SalamonyNo ratings yet

- Lift General CatalogueDocument160 pagesLift General Cataloguejavivi_75No ratings yet

- Introduction To Algorithms: Chapter 3: Growth of FunctionsDocument29 pagesIntroduction To Algorithms: Chapter 3: Growth of FunctionsAyoade Akintayo MichaelNo ratings yet

- Manual Honda Jazz Idsi PDF DownloadDocument6 pagesManual Honda Jazz Idsi PDF DownloadPuthra BungsuNo ratings yet

- Help Guide: Xperia 1 II XQ-AT51/XQ-AT52Document134 pagesHelp Guide: Xperia 1 II XQ-AT51/XQ-AT52Jarbas ViníciusNo ratings yet

- UTD-SOP-Workshop GuideDocument57 pagesUTD-SOP-Workshop GuideAvez AhmedNo ratings yet

- Promoting Digital InclusivityDocument12 pagesPromoting Digital InclusivityFrench Mariee P. EdangNo ratings yet

- Wireless remote controller guide for round flow cassette air conditionerDocument23 pagesWireless remote controller guide for round flow cassette air conditionerSicologo CimeNo ratings yet

- Chapter 8 SummaryDocument3 pagesChapter 8 SummaryNagiib Haibe Ibrahim Awale 6107No ratings yet

- Calendar Script PDFDocument2 pagesCalendar Script PDFKyawt htet htet SoeNo ratings yet

- 3 LTE eRAN6.0 Power Control Feature ISSUE1.00Document53 pages3 LTE eRAN6.0 Power Control Feature ISSUE1.00diporufaiNo ratings yet

- Transformer Oil Purification Procedure StepsDocument9 pagesTransformer Oil Purification Procedure StepsDilipNo ratings yet

- Math108x Doc CHECKPOINTpredictionsDocument2 pagesMath108x Doc CHECKPOINTpredictionsJackson LumbasioNo ratings yet