Professional Documents

Culture Documents

Engineering Economics - PreFinal Quiz

Engineering Economics - PreFinal Quiz

Uploaded by

J BOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Engineering Economics - PreFinal Quiz

Engineering Economics - PreFinal Quiz

Uploaded by

J BCopyright:

Available Formats

ENGINEERING ECONOMICS ENGINEERING ECONOMICS ENGINEERING ECONOMICS

Prefinal Quiz 1 Prefinal Quiz 1 Prefinal Quiz 1

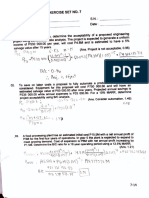

1. A telephone company purchased a microwave radio equipment for 1. A telephone company purchased a microwave radio equipment for 1. A telephone company purchased a microwave radio equipment for

P6,000,000. Freight and installation charges amounted to 3% of the P6,000,000. Freight and installation charges amounted to 3% of the P6,000,000. Freight and installation charges amounted to 3% of the

purchase price. If the equipment shall be depreciated over a period of 8 purchase price. If the equipment shall be depreciated over a period of 8 purchase price. If the equipment shall be depreciated over a period of 8

years with a salvage value of 5%, determine the following: years with a salvage value of 5%, determine the following: years with a salvage value of 5%, determine the following:

a. Annual depreciation charge using the straight-line method. a. Annual depreciation charge using the straight-line method. a. Annual depreciation charge using the straight-line method.

(10pts) (10pts) (10pts)

b. Depreciation charge during the fifth year using the b. Depreciation charge during the fifth year using the b. Depreciation charge during the fifth year using the

sum-of-the-years-digits method. (10pts) sum-of-the-years-digits method. (10pts) sum-of-the-years-digits method. (10pts)

2. A broadcasting corporation purchased an equipment that costs P7,000, 2. A broadcasting corporation purchased an equipment that costs P7,000, 2. A broadcasting corporation purchased an equipment that costs P7,000,

last 8 years and has a salvage value of P350. Determine the book value last 8 years and has a salvage value of P350. Determine the book value last 8 years and has a salvage value of P350. Determine the book value

during the 4th using the declining balance method. (10pts) during the 4th using the declining balance method. (10pts) during the 4th using the declining balance method. (10pts)

3. Power to a remote transmitting station is provided by a Diesel-electric 3. Power to a remote transmitting station is provided by a Diesel-electric 3. Power to a remote transmitting station is provided by a Diesel-electric

generator unit. The original cost of the unit is P65,000. It costs P2,000 generator unit. The original cost of the unit is P65,000. It costs P2,000 generator unit. The original cost of the unit is P65,000. It costs P2,000

to ship the unit to the job site. An additional cost of P3,000 was to ship the unit to the job site. An additional cost of P3,000 was to ship the unit to the job site. An additional cost of P3,000 was

incurred for the installation. Determine the annual depreciation cost by incurred for the installation. Determine the annual depreciation cost by incurred for the installation. Determine the annual depreciation cost by

the straight-line method, if the unit has an expected life of 10 years. The the straight-line method, if the unit has an expected life of 10 years. The the straight-line method, if the unit has an expected life of 10 years. The

salvage value of the unit at the end of its life was estimated at P5,000. salvage value of the unit at the end of its life was estimated at P5,000. salvage value of the unit at the end of its life was estimated at P5,000.

(10pts) (10pts) (10pts)

ENGINEERING ECONOMICS ENGINEERING ECONOMICS ENGINEERING ECONOMICS

Prefinal Quiz 1 Prefinal Quiz 1 Prefinal Quiz 1

1. A telephone company purchased a microwave radio equipment for 1. A telephone company purchased a microwave radio equipment for 1. A telephone company purchased a microwave radio equipment for

P6,000,000. Freight and installation charges amounted to 3% of the P6,000,000. Freight and installation charges amounted to 3% of the P6,000,000. Freight and installation charges amounted to 3% of the

purchase price. If the equipment shall be depreciated over a period of 8 purchase price. If the equipment shall be depreciated over a period of 8 purchase price. If the equipment shall be depreciated over a period of 8

years with a salvage value of 5%, determine the following: years with a salvage value of 5%, determine the following: years with a salvage value of 5%, determine the following:

a. Annual depreciation charge using the straight-line method. a. Annual depreciation charge using the straight-line method. a. Annual depreciation charge using the straight-line method.

(10pts) (10pts) (10pts)

b. Depreciation charge during the fifth year using the b. Depreciation charge during the fifth year using the b. Depreciation charge during the fifth year using the

sum-of-the-years-digits method. (10pts) sum-of-the-years-digits method. (10pts) sum-of-the-years-digits method. (10pts)

2. A broadcasting corporation purchased an equipment that costs P7,000, 2. A broadcasting corporation purchased an equipment that costs P7,000, 2. A broadcasting corporation purchased an equipment that costs P7,000,

last 8 years and has a salvage value of P350. Determine the book value last 8 years and has a salvage value of P350. Determine the book value last 8 years and has a salvage value of P350. Determine the book value

during the 4th using the declining balance method. (10pts) during the 4th using the declining balance method. (10pts) during the 4th using the declining balance method. (10pts)

3. Power to a remote transmitting station is provided by a Diesel-electric 3. Power to a remote transmitting station is provided by a Diesel-electric 3. Power to a remote transmitting station is provided by a Diesel-electric

generator unit. The original cost of the unit is P65,000. It costs P2,000 generator unit. The original cost of the unit is P65,000. It costs P2,000 generator unit. The original cost of the unit is P65,000. It costs P2,000

to ship the unit to the job site. An additional cost of P3,000 was to ship the unit to the job site. An additional cost of P3,000 was to ship the unit to the job site. An additional cost of P3,000 was

incurred for the installation. Determine the annual depreciation cost by incurred for the installation. Determine the annual depreciation cost by incurred for the installation. Determine the annual depreciation cost by

the straight-line method, if the unit has an expected life of 10 years. The the straight-line method, if the unit has an expected life of 10 years. The the straight-line method, if the unit has an expected life of 10 years. The

salvage value of the unit at the end of its life was estimated at P5,000. salvage value of the unit at the end of its life was estimated at P5,000. salvage value of the unit at the end of its life was estimated at P5,000.

(10pts) (10pts) (10pts)

You might also like

- Quiz No. 2 - Eecon 1 - Set ADocument1 pageQuiz No. 2 - Eecon 1 - Set AKen Archer SeleraNo ratings yet

- Lecture 9 - Problem Solving For Engineering Economy (Depreciation)Document3 pagesLecture 9 - Problem Solving For Engineering Economy (Depreciation)angelo diaz100% (1)

- Engineering Economics (18HS1T02) - End-Term Exam - 2019-2020Document3 pagesEngineering Economics (18HS1T02) - End-Term Exam - 2019-2020sahu.tukun003No ratings yet

- FT Problem Set 01 DepreciationDocument2 pagesFT Problem Set 01 DepreciationshaneNo ratings yet

- Lesson 5 Depreciation ConceptsDocument35 pagesLesson 5 Depreciation ConceptsVjion BeloNo ratings yet

- Chapter 3 Economic Study MethodsDocument62 pagesChapter 3 Economic Study MethodsJohn Fretz AbelardeNo ratings yet

- Chapter 3 DEPRECIATION SEMIDocument16 pagesChapter 3 DEPRECIATION SEMIJames EscribaNo ratings yet

- Depreciation Problems With AnswersDocument1 pageDepreciation Problems With AnswersJHEZERIE NEPOMUCENONo ratings yet

- ME005 Engineering Economics (7 April 2022) Part 1Document37 pagesME005 Engineering Economics (7 April 2022) Part 1JORENCE PHILIPP ENCARNACIONNo ratings yet

- Module 4 Depreciation NEWDocument34 pagesModule 4 Depreciation NEWMarielle CochicoNo ratings yet

- DepreciationDocument4 pagesDepreciationDrakath0rk100% (2)

- Review in Depreciation Part 1Document3 pagesReview in Depreciation Part 1Justin GrantosNo ratings yet

- Depreciation Problem Set B QADocument2 pagesDepreciation Problem Set B QAJason Carl BorresNo ratings yet

- Activity I. Straight Line MethodDocument2 pagesActivity I. Straight Line MethodJhune UrabaNo ratings yet

- Engineering EconomicsDocument17 pagesEngineering EconomicsIan BondocNo ratings yet

- Engg Eco Problem SetsDocument2 pagesEngg Eco Problem SetsTango FoxtrotNo ratings yet

- SOYDDocument3 pagesSOYDNathan Dungog100% (2)

- Value Risk and Capital MarketsDocument3 pagesValue Risk and Capital MarketspranavNo ratings yet

- Em 5 Final Term Take Home Quiz Bsee2 1Document3 pagesEm 5 Final Term Take Home Quiz Bsee2 1ParisDelaCruzNo ratings yet

- Q6 Eco 017Document3 pagesQ6 Eco 017RazexaLNo ratings yet

- Sample Problems On DepreciationDocument1 pageSample Problems On DepreciationrobNo ratings yet

- Engineering Economy - Set 2 Review InnovationsDocument2 pagesEngineering Economy - Set 2 Review InnovationsAnjo VasquezNo ratings yet

- ENGG ECON Part2Document11 pagesENGG ECON Part2shinamaevNo ratings yet

- Engineering EcoDocument26 pagesEngineering EcoEric John Enriquez100% (2)

- Day 3 - Module 3 ExamDocument5 pagesDay 3 - Module 3 ExamBenedick Jayson MartiNo ratings yet

- Individual Activity No. 1 Straight Line MethodDocument2 pagesIndividual Activity No. 1 Straight Line MethodIroha IsshikiNo ratings yet

- DEPRECIATION Practice Problems QDocument3 pagesDEPRECIATION Practice Problems QThalia RodriguezNo ratings yet

- Eng Econ 2 May 2021Document3 pagesEng Econ 2 May 2021Jillian PamaylaonNo ratings yet

- Econ Ex 7Document12 pagesEcon Ex 7manalastas.maridellevictoriaNo ratings yet

- En Econ - Replacement and Retention DecisionDocument11 pagesEn Econ - Replacement and Retention DecisionMoshi JungkasemsukNo ratings yet

- Depreciation Try ThisDocument1 pageDepreciation Try ThisJAN YDNAR GALLARDONo ratings yet

- PDF Tugas 2 Kimia Dasar - CompressDocument9 pagesPDF Tugas 2 Kimia Dasar - CompressRisman FirmansyahNo ratings yet

- Depreciation Concepts 1Document5 pagesDepreciation Concepts 1fathima camangianNo ratings yet

- Learning Activity 4Document1 pageLearning Activity 4zyx xyzNo ratings yet

- Exercise 01 Solution - CE18Document3 pagesExercise 01 Solution - CE18Harris Dominic De ChavezNo ratings yet

- Depreciation and DepletionDocument8 pagesDepreciation and DepletionheythereitsclaireNo ratings yet

- PT 8Document6 pagesPT 8KidlatNo ratings yet

- PROFITABILITY ANALYSIS Problems QDocument2 pagesPROFITABILITY ANALYSIS Problems QThalia RodriguezNo ratings yet

- Straight Line & Sinking Fund MethodDocument2 pagesStraight Line & Sinking Fund MethodNathan Dungog100% (1)

- 4 - ES Econ 1Document29 pages4 - ES Econ 1jorgenovachrolloNo ratings yet

- Evaluating Single Project: PROBLEM SET: Money-Time RelationshipsDocument4 pagesEvaluating Single Project: PROBLEM SET: Money-Time RelationshipsAnjo Vasquez100% (1)

- 2383dac Tinh Ky Thuat May Cat 500kVDocument13 pages2383dac Tinh Ky Thuat May Cat 500kVTuân PVNo ratings yet

- BES 221 (PART I - Prefinal Module)Document9 pagesBES 221 (PART I - Prefinal Module)Kristy SalmingoNo ratings yet

- Engineering Eco PDF FreeDocument26 pagesEngineering Eco PDF FreeMJ ArboledaNo ratings yet

- Engineering Economy Lecture 7 Replacement StudyDocument1 pageEngineering Economy Lecture 7 Replacement StudyGrotesques WhixxersNo ratings yet

- Engineering EconomyDocument35 pagesEngineering EconomyGodofredo Luayon Jipus Jr.No ratings yet

- Republic of The Philippines: Battery - 1Document5 pagesRepublic of The Philippines: Battery - 1Ariel LunaNo ratings yet

- ESENECO 4 Depreciation 1Document35 pagesESENECO 4 Depreciation 1Joshua SkribikinNo ratings yet

- PDF Kelompok 7 Modul 7 Tik KB 1 2 DLDocument15 pagesPDF Kelompok 7 Modul 7 Tik KB 1 2 DLenjel printingNo ratings yet

- Revised Accounting 15Document26 pagesRevised Accounting 15Jennifer Garnette50% (2)

- Year Book Value at The Beginning of The Year (P) Depreciation (P) Book Value at The End of The Year (P) 1 2 3 4 5Document9 pagesYear Book Value at The Beginning of The Year (P) Depreciation (P) Book Value at The End of The Year (P) 1 2 3 4 5Kevin SimonsNo ratings yet

- TCVN-7898-2018-Binh Dun Nuoc Nong Du TruDocument7 pagesTCVN-7898-2018-Binh Dun Nuoc Nong Du Truecolux.vietnamNo ratings yet

- Benefit Cost2Document2 pagesBenefit Cost2Jsbebe jskdbsjNo ratings yet

- Engineering Economy - Part 2Document1 pageEngineering Economy - Part 2Ervin AboboNo ratings yet

- Estimation of Population Mean SeatworkDocument1 pageEstimation of Population Mean SeatworkLeigh YahNo ratings yet

- Classical Approach to Constrained and Unconstrained Molecular DynamicsFrom EverandClassical Approach to Constrained and Unconstrained Molecular DynamicsNo ratings yet

- Pagsasalin NG IdyomaDocument17 pagesPagsasalin NG IdyomaSheila Beth Galduen0% (1)

- 2014 Fr. Zaven BOOK 2014 Final VersionDocument243 pages2014 Fr. Zaven BOOK 2014 Final VersionpalitosanjuanNo ratings yet

- Kids College Periodic 1 Examination (2019-20) Class: 9: Subject: English Date: Max. Marks: 50 TimeDocument4 pagesKids College Periodic 1 Examination (2019-20) Class: 9: Subject: English Date: Max. Marks: 50 TimeAbhishekNo ratings yet

- (David M. Guss) The Festive State Race, EthnicityDocument254 pages(David M. Guss) The Festive State Race, EthnicityJoana Melo ResendeNo ratings yet

- Frauds in Plastic MoneyDocument60 pagesFrauds in Plastic MoneyChitra Salian0% (1)

- A Nation For Our ChildrenDocument6 pagesA Nation For Our Childrenstrength, courage, and wisdomNo ratings yet

- Judicial Control Administrative LawDocument12 pagesJudicial Control Administrative LawShailvi RajNo ratings yet

- The Ephesia Grammata - Logos Orphaikos or Apolline Alexima Pharmak PDFDocument8 pagesThe Ephesia Grammata - Logos Orphaikos or Apolline Alexima Pharmak PDFMario Richard Sandler100% (1)

- WS-011 Windows Server 2019/2022 AdministrationDocument44 pagesWS-011 Windows Server 2019/2022 AdministrationSyed Amir IqbalNo ratings yet

- Ficha de LECTURA INGLES PDFDocument9 pagesFicha de LECTURA INGLES PDFJhosmel Baru Butrón MontoyaNo ratings yet

- Laboratorio 3 - Setting Up The Lab EnvironmentDocument6 pagesLaboratorio 3 - Setting Up The Lab Environmentjuan peresNo ratings yet

- COPC Brochure Quality ManagementDocument2 pagesCOPC Brochure Quality Managementlibra.tigress01No ratings yet

- H.3. GAMBOA V TEVESDocument1 pageH.3. GAMBOA V TEVESJuris Doctor 2BNo ratings yet

- Letter of IntentDocument3 pagesLetter of IntentLee100% (1)

- Narrative TextDocument5 pagesNarrative TextRizka SukmasariNo ratings yet

- English ReportDocument5 pagesEnglish ReportEleina Bea BernardoNo ratings yet

- I Thank God CDocument1 pageI Thank God Cjeremisam09No ratings yet

- 6468Document266 pages6468Faheem67% (3)

- CISM 1a Information Security Governance PDFDocument4 pagesCISM 1a Information Security Governance PDFBrkNo ratings yet

- Technical Assistance 2020Document1 pageTechnical Assistance 2020Ricardo S.Blanco80% (5)

- Tapjeet Final ProjectDocument33 pagesTapjeet Final Projectggi2022.1928No ratings yet

- Dissertation PDFDocument226 pagesDissertation PDFmurugan_muruNo ratings yet

- Presbyterian Review - January - March, 2012Document35 pagesPresbyterian Review - January - March, 2012Mizoram Presbyterian Church Synod100% (1)

- Homeroom Guidance: Me, Myself, and My CareerDocument13 pagesHomeroom Guidance: Me, Myself, and My CareerBernadeth Irma Sawal Caballa75% (4)

- IUMI EyeDocument22 pagesIUMI EyeJackNo ratings yet

- Robbins mgmt14 PPT 18bDocument19 pagesRobbins mgmt14 PPT 18bAmjad J AliNo ratings yet

- CISO Roles ResponsibilitiesDocument6 pagesCISO Roles ResponsibilitiesVignesh KumarNo ratings yet

- Wellington Tamil Christian Fellowship News Letter May 2012Document8 pagesWellington Tamil Christian Fellowship News Letter May 2012clem2kNo ratings yet

- Environmental Free Online CoursesDocument7 pagesEnvironmental Free Online CoursesFormationgratuite.netNo ratings yet

- The Ultimate Mega-Training in Real World Results Magick - Jason Louv - Magick - MeDocument11 pagesThe Ultimate Mega-Training in Real World Results Magick - Jason Louv - Magick - Mej mooreNo ratings yet