Professional Documents

Culture Documents

Kamageri

Uploaded by

ashutoshbbk7860 ratings0% found this document useful (0 votes)

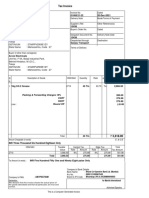

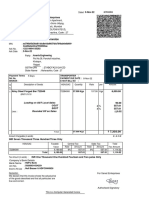

17 views1 page1. This GST invoice from Shiva Enterprises is for the sale of 150 gold bags to State Bank of India - Simrol branch.

2. The total amount due is Rs. 3,750 which includes Rs. 3,348.21 for the goods and Rs. 401.79 in integrated GST.

3. The goods will be delivered through an unspecified dispatch method to the destination of Simrol Branch in Indore, Madhya Pradesh.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. This GST invoice from Shiva Enterprises is for the sale of 150 gold bags to State Bank of India - Simrol branch.

2. The total amount due is Rs. 3,750 which includes Rs. 3,348.21 for the goods and Rs. 401.79 in integrated GST.

3. The goods will be delivered through an unspecified dispatch method to the destination of Simrol Branch in Indore, Madhya Pradesh.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views1 pageKamageri

Uploaded by

ashutoshbbk7861. This GST invoice from Shiva Enterprises is for the sale of 150 gold bags to State Bank of India - Simrol branch.

2. The total amount due is Rs. 3,750 which includes Rs. 3,348.21 for the goods and Rs. 401.79 in integrated GST.

3. The goods will be delivered through an unspecified dispatch method to the destination of Simrol Branch in Indore, Madhya Pradesh.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

GST Invoice

Shiva Enterprises Invoice No. Dated

3/33, Patrakarpuram (Vinay Khand), SE/265/2023-24 27-Apr-23

Gomti Nagar, Lucknow- 226010 Delivery Note Mode/Terms of Payment

GSTIN/UIN: 09ACUPY0267D1Z2

State Name : Uttar Pradesh, Code : 09

Reference No. & Date. Other References

Contact : +91-9076500731, +91-9076500748,+91-8127558888, +918400002449

E-Mail : shivaenterprises.head@gmail.com GB/APR/42 dt. 27-Apr-23

Buyer’s Order No. Dated

Consignee (Ship to)

State Bank of India - Simrol

B. M. Mr. Vikas Saini Dispatch Doc No. Delivery Note Date

, Simrol Branch, Tehsil Mhow, Dist. - Indore,

Madhya Pradesh - 452020, Ph. No. :

07027412244 Dispatched through Destination

GSTIN/UIN : 23AAACS8577K1ZX

State Name : Madhya Pradesh, Code : 23 Terms of Delivery

Buyer (Bill to)

State Bank of India - Simrol

B. M. Mr. Vikas Saini

, Simrol Branch, Tehsil Mhow, Dist. - Indore,

Madhya Pradesh - 452020, Ph. No. :

07027412244

GSTIN/UIN : 23AAACS8577K1ZX

State Name : Madhya Pradesh, Code : 23

Sl Description of Goods HSN/SAC GST Quantity Rate per Amount

No. Rate

1 Gold Bag 4802 12 % 150 Pcs 22.32 Pcs 3,348.21

3,348.21

Output IGST 12% 401.79

Total 150 Pcs 3,750.00

Amount Chargeable (in words) E. & O.E

Three Thousand Seven Hundred Fifty Indian Rupees Only

HSN/SAC Taxable Integrated Tax Total

Value Rate Amount Tax Amount

4802 3,348.21 12% 401.79 401.79

Total 3,348.21 401.79 401.79

Tax Amount (in words) : Four Hundred One Indian Rupees and Seventy Nine Only

Company’s PAN : ACUPY0267D

Declaration for Shiva Enterprises

We declare that this invoice shows the actual price of

the goods described and that all particulars are true

and correct. Authorised Signatory

This is a Computer Generated Invoice

You might also like

- Accounting VoucherDocument1 pageAccounting VoucherUttam PurohitNo ratings yet

- Tax Invoice: Chennai-600059 Gstin/Uin: 33BMOPM1236R1ZJ State Name: Tamil Nadu, Code: 33Document1 pageTax Invoice: Chennai-600059 Gstin/Uin: 33BMOPM1236R1ZJ State Name: Tamil Nadu, Code: 33Abhinaya JoNo ratings yet

- Accounting Voucher 289Document1 pageAccounting Voucher 289rajesh puhanNo ratings yet

- Solution Manual For Oracle 12c SQL 3rd Edition CasteelDocument6 pagesSolution Manual For Oracle 12c SQL 3rd Edition CasteelHeatherRobertstwopa100% (35)

- Cii Seniorcareindustryreportindia2018 180524043125Document36 pagesCii Seniorcareindustryreportindia2018 180524043125N InbasagaranNo ratings yet

- Perfect Rigor - A Genius and The Mathematical Breakthrough of The CenturyDocument217 pagesPerfect Rigor - A Genius and The Mathematical Breakthrough of The CenturyChin Mun LoyNo ratings yet

- CubicDocument1 pageCubicSurajmal TansukhraiNo ratings yet

- Digital Systems Design and PrototypingDocument633 pagesDigital Systems Design and PrototypingAshish Shrivastava50% (2)

- Nandy Sewing Solutions Private Limited 1668 28-Apr-23: Tax InvoiceDocument1 pageNandy Sewing Solutions Private Limited 1668 28-Apr-23: Tax InvoiceManish ShawNo ratings yet

- PM TB Solutions C07Document6 pagesPM TB Solutions C07Vishwajeet Ujhoodha100% (6)

- GoodDocument1 pageGoodEntertain with musicNo ratings yet

- Probability Distributions Summary - Exam PDocument1 pageProbability Distributions Summary - Exam Proy_gettyNo ratings yet

- Accounting Voucher PDFDocument1 pageAccounting Voucher PDFAnonymous ROMGYBGyqnNo ratings yet

- Estimation of Measurement Uncertainty Printout 2016-2Document94 pagesEstimation of Measurement Uncertainty Printout 2016-2GustavoCaicutoNo ratings yet

- SFC FranchiseDocument10 pagesSFC FranchisecorinacretuNo ratings yet

- Process Pump ControlDocument4 pagesProcess Pump ControlBramJanssen76No ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnjani KumariNo ratings yet

- Eamcet 2013-2014 Opening and Closing RanksDocument201 pagesEamcet 2013-2014 Opening and Closing RanksCarolyn C. EyreNo ratings yet

- State Bank of India - UttaraDocument1 pageState Bank of India - Uttaraashutoshbbk786No ratings yet

- Sudev Podder 084Document1 pageSudev Podder 084ssd dNo ratings yet

- Rtgs FormDocument1 pageRtgs Formshree.sairamthangamaligaiNo ratings yet

- Gobindgarh Gstin/Uin: 23AAFCA3608N1ZQ State Name: Madhya Pradesh, Code: 23 Place of Supply: Madhya PradeshDocument2 pagesGobindgarh Gstin/Uin: 23AAFCA3608N1ZQ State Name: Madhya Pradesh, Code: 23 Place of Supply: Madhya PradeshasasasassNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherVinay VenugopalNo ratings yet

- 552 Prathmesh EnterprisesDocument1 page552 Prathmesh EnterprisesPrathmesh EntNo ratings yet

- Sobraj SinghDocument2 pagesSobraj SinghSHEKHARNo ratings yet

- Shubham PIDocument1 pageShubham PIVarsha JiNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceᴘᴇᴀᴄᴏᴄᴋNo ratings yet

- Tax Invoice Shree Durga Traders: E-Way Bill NoDocument1 pageTax Invoice Shree Durga Traders: E-Way Bill NoRisi Spice industriesNo ratings yet

- Pi MaldaDocument1 pagePi Maldaraja734No ratings yet

- 8863 PDFDocument1 page8863 PDFmalar studioNo ratings yet

- Output CGST 14% Output SGST 14% Round Off Fright Charge: 1 Kit Front SuspensionDocument1 pageOutput CGST 14% Output SGST 14% Round Off Fright Charge: 1 Kit Front SuspensionmadhurNo ratings yet

- BISPL PI 87-22-23 Savitri DeviDocument1 pageBISPL PI 87-22-23 Savitri DeviBHEEMAA INFRANo ratings yet

- 1 PDFDocument1 page1 PDFAkshay Kumar swamiNo ratings yet

- Accounting VoucherDocument1 pageAccounting Vouchershailesh patilNo ratings yet

- Tax Invoice: IS9537 25MMDocument1 pageTax Invoice: IS9537 25MMPunit SinghNo ratings yet

- Proforma Invoice: State Name: Telangana, Code: 36Document1 pageProforma Invoice: State Name: Telangana, Code: 36DrKiran Kumar ReddyNo ratings yet

- Ba 2795Document1 pageBa 2795omkar sawantNo ratings yet

- Invoice 012 SK InfrastructureDocument2 pagesInvoice 012 SK InfrastructurePoonam RaiNo ratings yet

- 11PKBDocument1 page11PKBBIKRAM KUMAR BEHERANo ratings yet

- Pankaj SalesDocument1 pagePankaj SalesvineetNo ratings yet

- 031 - StelloidDocument1 page031 - Stelloidsumit chaudharyNo ratings yet

- Asc 5033Document1 pageAsc 5033omkar sawantNo ratings yet

- MST 1295Document1 pageMST 1295digital lifeNo ratings yet

- Jodhpur Gstin/Uin: 08ABGPL3664C1ZS State Name: Rajasthan, Code: 08Document2 pagesJodhpur Gstin/Uin: 08ABGPL3664C1ZS State Name: Rajasthan, Code: 08Hemlata LodhaNo ratings yet

- Tax Invoice: Bombay Chowk, Jharsuguda GSTIN/UIN: 21AGHPS3530J1ZI State Name: Odisha, Code: 21Document1 pageTax Invoice: Bombay Chowk, Jharsuguda GSTIN/UIN: 21AGHPS3530J1ZI State Name: Odisha, Code: 21talabirachp siteNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- 107-Falguni Gruh UdhyogDocument1 page107-Falguni Gruh UdhyogdeepNo ratings yet

- Yeamin Pi 73Document1 pageYeamin Pi 73Tofail IslamNo ratings yet

- Perfoma InvoiceDocument1 pagePerfoma InvoiceashishNo ratings yet

- Shiv 1Document1 pageShiv 1viren.khatri94288No ratings yet

- Amba TownshipDocument1 pageAmba TownshipshiviNo ratings yet

- Shope No. Sarve No. 20/3, Gatha Mandir Road Dehu Road, Pune GSTIN/UIN: 27AACFY4277H1ZT State Name: Maharashtra, Code: 27 Contact: +91 9518338851Document1 pageShope No. Sarve No. 20/3, Gatha Mandir Road Dehu Road, Pune GSTIN/UIN: 27AACFY4277H1ZT State Name: Maharashtra, Code: 27 Contact: +91 9518338851cnanda89No ratings yet

- Ae 4197Document1 pageAe 4197omkar sawantNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- Rajender ShopDocument1 pageRajender ShopKunj KariaNo ratings yet

- Hindustan HardwareDocument1 pageHindustan HardwareKunj KariaNo ratings yet

- Tax Invoice: State Name: Maharashtra, Code: 27Document1 pageTax Invoice: State Name: Maharashtra, Code: 27Kunj KariaNo ratings yet

- Tax Invoice: State Name: Maharashtra, Code: 27Document1 pageTax Invoice: State Name: Maharashtra, Code: 27Kunj KariaNo ratings yet

- Tax Invoice: State Name: Maharashtra, Code: 27Document1 pageTax Invoice: State Name: Maharashtra, Code: 27Kunj KariaNo ratings yet

- Accounting Voucher 9Document1 pageAccounting Voucher 9Gaurav BiswasNo ratings yet

- Tax Invoice: Radha Rani & CompanyDocument1 pageTax Invoice: Radha Rani & CompanyCA Shrikant VaranasiNo ratings yet

- Juliet Apparels Pvt. LTDDocument1 pageJuliet Apparels Pvt. LTDraj sahil100% (1)

- Bill Format Gypusm BoardDocument8 pagesBill Format Gypusm BoardRamachandra SahuNo ratings yet

- 2 - P. S. Sikarwar EnterprisesDocument1 page2 - P. S. Sikarwar Enterprisespriyanka singhNo ratings yet

- Accounting Voucher 1Document1 pageAccounting Voucher 1Daksh BavawalaNo ratings yet

- MP 1805 23 24Document1 pageMP 1805 23 24minarplastic200No ratings yet

- Accounting Voucher Aluminium GlassDocument1 pageAccounting Voucher Aluminium GlassPRIYA KUMARINo ratings yet

- Trainer Recognition InvoiceDocument1 pageTrainer Recognition InvoiceKiruba JacobNo ratings yet

- Arihant VastralayDocument1 pageArihant VastralaypcprakashchopraNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument78 pagesMobile Services: Your Account Summary This Month'S Chargesashutoshbbk786No ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument14 pagesMobile Services: Your Account Summary This Month'S Chargesashutoshbbk786No ratings yet

- WWGa 7 YANIoejf 6 CHDocument5 pagesWWGa 7 YANIoejf 6 CHashutoshbbk786No ratings yet

- Product ListDocument6 pagesProduct Listashutoshbbk786No ratings yet

- Indian Post Cod FormatDocument1 pageIndian Post Cod Formatashutoshbbk786No ratings yet

- Principles of Health EducationDocument3 pagesPrinciples of Health EducationJunah DayaganonNo ratings yet

- Giignl Reload Guidelines 2019 FinalDocument15 pagesGiignl Reload Guidelines 2019 FinalFernando Igor AlvarezNo ratings yet

- 01-PPS SMOI User Manual BodyDocument93 pages01-PPS SMOI User Manual BodyGuelahourou Joel SossieNo ratings yet

- SCIENCE 6 Q4 WK2 TMDocument20 pagesSCIENCE 6 Q4 WK2 TMHershey Celine LaguaNo ratings yet

- Money and BankingDocument20 pagesMoney and BankingFAH EEMNo ratings yet

- FS2122-INCOMETAX-01A: BSA 1202 Atty. F. R. SorianoDocument7 pagesFS2122-INCOMETAX-01A: BSA 1202 Atty. F. R. SorianoKatring O.No ratings yet

- 2021 Holiday Consumer Protection GuideDocument61 pages2021 Holiday Consumer Protection GuidePeterBurkeNo ratings yet

- GIS and Regional Economic Development Planning: Chen Fei Du Daosheng Jiang JingtongDocument8 pagesGIS and Regional Economic Development Planning: Chen Fei Du Daosheng Jiang JingtongJuragan MudaNo ratings yet

- Gene KnockDocument5 pagesGene KnockAnne Marian JosephNo ratings yet

- Gaap QuizDocument3 pagesGaap QuizShadab KhanNo ratings yet

- TVL IACSS9 12ICCS Ia E28 MNHS SHS CAMALIGDocument4 pagesTVL IACSS9 12ICCS Ia E28 MNHS SHS CAMALIGKattie Alison Lumio MacatuggalNo ratings yet

- PI and PID Controller Tuning Rules - An OverviewDocument7 pagesPI and PID Controller Tuning Rules - An OverviewRobert VillavicencioNo ratings yet

- Independent Contractor Agreement For Accountant & BookkeeperDocument7 pagesIndependent Contractor Agreement For Accountant & BookkeeperWen' George BeyNo ratings yet

- Ellena's Book of Birds in SingaporeDocument38 pagesEllena's Book of Birds in SingaporeEllena GabrielleNo ratings yet

- UMTS Material (LT)Document215 pagesUMTS Material (LT)Matthew JejeloyeNo ratings yet

- AEB Mortgage Services - Capacity Planning and ControlDocument2 pagesAEB Mortgage Services - Capacity Planning and ControlDua LeoNo ratings yet

- Cantor Set FunctionDocument15 pagesCantor Set FunctionRenato GaloisNo ratings yet

- Small Business Management Entrepreneurship and Beyond 6th Edition Hatten Solutions ManualDocument36 pagesSmall Business Management Entrepreneurship and Beyond 6th Edition Hatten Solutions ManualketmieoilstoneqjdnwqNo ratings yet

- CGC TemplateDocument19 pagesCGC TemplateVictoria Stephanie AshleyNo ratings yet

- IT1251 Information Coding TechniquesDocument23 pagesIT1251 Information Coding TechniquesstudentscornersNo ratings yet