Professional Documents

Culture Documents

Tax Engagement Letter

Uploaded by

inemjosh210 ratings0% found this document useful (0 votes)

13 views2 pagesThis letter confirms Viclakes Consulting Services' acceptance of an offer to provide annual tax retainership services to CW Builders Limited. The services include computing taxes payable, filing tax returns, obtaining tax receipts and credits, raising objections if needed, and liaising with tax authorities. The annual fee is 1.2 million Naira, payable in three installments, and expenses will also be billed. Viclakes thanks CW Builders for its patronage and promises to fulfill its duties as tax consultants.

Original Description:

Original Title

TAX ENGAGEMENT LETTER

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis letter confirms Viclakes Consulting Services' acceptance of an offer to provide annual tax retainership services to CW Builders Limited. The services include computing taxes payable, filing tax returns, obtaining tax receipts and credits, raising objections if needed, and liaising with tax authorities. The annual fee is 1.2 million Naira, payable in three installments, and expenses will also be billed. Viclakes thanks CW Builders for its patronage and promises to fulfill its duties as tax consultants.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views2 pagesTax Engagement Letter

Uploaded by

inemjosh21This letter confirms Viclakes Consulting Services' acceptance of an offer to provide annual tax retainership services to CW Builders Limited. The services include computing taxes payable, filing tax returns, obtaining tax receipts and credits, raising objections if needed, and liaising with tax authorities. The annual fee is 1.2 million Naira, payable in three installments, and expenses will also be billed. Viclakes thanks CW Builders for its patronage and promises to fulfill its duties as tax consultants.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

June 24th, 2022

The Managing Director/Chief Executive Officer,

CW Builders Limited,

Suite 43, Phase 3, LSDPC Complex,

Oba Ogunji Road, Ogba,

Lagos.

Dear Sir,

LETTER OF ENGAGEMENT RE: APPOINTMENT AS EXTERNAL

AUDITOR AND TAX CONSULTANTS TO CW BUILDERS LIMITED

Above subject matter refers,

We thank you for your letter dated 24 th June 2022 appointing us as tax

consultants to CW Builders Limited and hereby confirm our acceptance of

the offer.

Our understanding of the terms of our engagement are as follows:

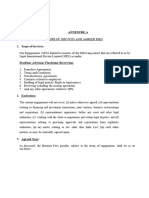

1. SCOPE

Our firm is to provide annual tax retainership services to the company

The annual retainership services referred to above covers the following:

Computation of income tax, Capital allowances and Education Tax

payable,

Computation of Capital Gains Tax (CGT) payable on chargeable

assets and Deferred Tax provision for inclusion in the annual financial

statements;

Filling with the Federal Inland Revenue Service of the Annual Tax

returns together with duly completed Self – Assessment Form

IR3C4COY

Obtaining approval to pay tax liabilities on instalmental basis;

Applying for and obtaining withholding tax receipts in respect of

deduction of tax at source from the company’s income. Also applying

for and obtaining withholding tax credit Notes for set-off against income

tax payable.

Raising objection to “Best of Judgment Assessment” (if any) within

statutorily allowed.

Dealing with tax queries that may be raised by the Federal Inland

Revenue Service on tax returns submitted by us;

Liason with Federal Inland Revenue Service for the purpose of

following up on outstanding tax matters.

2. PROFESSIONAL FEES

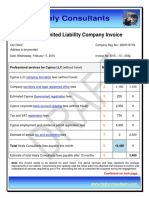

Our annual professional fee of one million two hundred thousand

(#1,200,000.00) exclusive of disbursements for carrying out the annual

tax compliance services listed above is normally based on time and

skills of the various professional staff engaged on the assignment.

However, the fee is negotiable and subject to periodic review.

At the appropriate time, the fee payable for our retainership services to

your company will be negotiated along with fees payable for similar

services being rendered to other companies in the Wealth Group.

In other words, group fee is agreed and shared out between

companies within the group.

3. TERM OF PAYMENT

Agreed professional fees is payable as follows: -

(a) 60% on commencement of assignment

(b) 30% on submission of draft tax computation to the company

(c) 10% on submission of tax return to the tax authority

100%

4. RECOVERABLE EXPENSES.

Recoverable expenses for transport, stationeries, photocopies etc will

be billed and paid along with our final bill.

We thank you for your patronage and promise not to betray the

confidence reposed in us by appointing our firm as your tax

consultants.

Yours faithfully,

For: Viclakes Consulting Services

Victor Falade

Managing Partner

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesFrom EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNo ratings yet

- Hopewell EngagementDocument4 pagesHopewell EngagementSamson OlubodeNo ratings yet

- Kokamavic EngagementDocument4 pagesKokamavic EngagementSamson OlubodeNo ratings yet

- Service Proposal - RUDKY TemplateDocument2 pagesService Proposal - RUDKY TemplateYuvraj Sharma PersandNo ratings yet

- Engagement LetterDocument13 pagesEngagement LetterAtiaTahiraNo ratings yet

- Engagement LetterDocument8 pagesEngagement LetterErnest O'BrienNo ratings yet

- Income Tax ComplianceDocument4 pagesIncome Tax ComplianceJusefNo ratings yet

- TTP Auditing Company LimitedDocument6 pagesTTP Auditing Company LimitedNguyễn Quang SángNo ratings yet

- Payroll Engagement Proposal (PPC Asia Corporation)Document4 pagesPayroll Engagement Proposal (PPC Asia Corporation)Marvin Celedio100% (2)

- Accounting Fees 2023Document12 pagesAccounting Fees 2023processingNo ratings yet

- Engagement Letter Business Clients NEW PDFDocument9 pagesEngagement Letter Business Clients NEW PDFMark TorresNo ratings yet

- Engagement Proposal - MegawideDocument3 pagesEngagement Proposal - Megawideianlayno71No ratings yet

- Pa Bica J Importance of Engagement Letters Appendix IDocument14 pagesPa Bica J Importance of Engagement Letters Appendix IFelix GabrielNo ratings yet

- PWC - Tax Compliance & Vat RefundsDocument22 pagesPWC - Tax Compliance & Vat RefundsNESTOR LUIS DE ARCO MARTINEZNo ratings yet

- ICAB Knowledge Level Taxation-I Suggested Answer May June 2010 - Nov Dec 2017Document150 pagesICAB Knowledge Level Taxation-I Suggested Answer May June 2010 - Nov Dec 2017Optimal Management Solution91% (11)

- Accounting Principles and StandardsDocument6 pagesAccounting Principles and StandardswondmagegnNo ratings yet

- Draft Invoice Cyprus LLC MigrationDocument7 pagesDraft Invoice Cyprus LLC MigrationShehryar KhanNo ratings yet

- FAR05 - Accounting For Income and Deferred TaxesDocument4 pagesFAR05 - Accounting For Income and Deferred TaxesDisguised owlNo ratings yet

- Comprehensive Exam EDocument10 pagesComprehensive Exam Ejdiaz_646247100% (1)

- Deductions and Exemptions: Tel. Nos. (043) 980-6659Document22 pagesDeductions and Exemptions: Tel. Nos. (043) 980-6659MaeNo ratings yet

- Shuttlers Metropolitan ReportDocument7 pagesShuttlers Metropolitan ReportAkinyemi SilasNo ratings yet

- Rafael Tepeneu CIS AgreementDocument19 pagesRafael Tepeneu CIS Agreementy9jkdgvvdkNo ratings yet

- Principles of Taxation ND2020Document2 pagesPrinciples of Taxation ND2020Sharif MahmudNo ratings yet

- Notes StmtofcondDocument5 pagesNotes StmtofcondAira Mae Quinones OrendainNo ratings yet

- Ey Ireland Early Payment of 2020 Excess Randd Tax CreditsDocument5 pagesEy Ireland Early Payment of 2020 Excess Randd Tax CreditsharryNo ratings yet

- Principles of Taxation For Business and Investment Planning 2016 19Th Edition Jones Solutions Manual Full Chapter PDFDocument21 pagesPrinciples of Taxation For Business and Investment Planning 2016 19Th Edition Jones Solutions Manual Full Chapter PDFrosyseedorff100% (8)

- Stonebridge CIS FAQ v2-1Document1 pageStonebridge CIS FAQ v2-1lucianadrian79No ratings yet

- Healy Consultants Healy Consultants: Botswana Public Limited Company InvoiceDocument8 pagesHealy Consultants Healy Consultants: Botswana Public Limited Company InvoiceVenkatramaniNo ratings yet

- ADV2Document3 pagesADV2Rommel RoyceNo ratings yet

- DanOwa VAT & ERP Services Proposal 2019 KeepersDocument9 pagesDanOwa VAT & ERP Services Proposal 2019 KeepersMohamed EzzatNo ratings yet

- Chapter 6Document13 pagesChapter 6vitbau98100% (1)

- 19668ipcc Acc Vol1 Chapter-3Document20 pages19668ipcc Acc Vol1 Chapter-3Vignesh SrinivasanNo ratings yet

- TAX PLANNING & COMPLIANCE - MA-2024 - QuestionDocument6 pagesTAX PLANNING & COMPLIANCE - MA-2024 - QuestionmizanacmaNo ratings yet

- Chapter 05 DDocument74 pagesChapter 05 DnewonemadeNo ratings yet

- Jasa Perpajakan Dan Pembukuan 3Document4 pagesJasa Perpajakan Dan Pembukuan 3Revli Meyhendra HarbangkaraNo ratings yet

- Part - 1 - Dashboard - Accounting For Income TaxesDocument4 pagesPart - 1 - Dashboard - Accounting For Income TaxesbagayaobNo ratings yet

- Withholding Taxes in ZimbabweDocument61 pagesWithholding Taxes in ZimbabweJeremiah NcubeNo ratings yet

- Business Federal Tax UpdateDocument9 pagesBusiness Federal Tax Updatesean dale porlaresNo ratings yet

- Costs Disclosure and Costs Agreement Legal Set OutDocument6 pagesCosts Disclosure and Costs Agreement Legal Set OutHeba SarhanNo ratings yet

- Forex Gains and Losses Notes 2020Document46 pagesForex Gains and Losses Notes 2020chelasimunyolaNo ratings yet

- Compliance SDocument2 pagesCompliance SJaya JamdhadeNo ratings yet

- Corporate Tax Instructions - FinalDocument15 pagesCorporate Tax Instructions - Finalapi-306226330No ratings yet

- CK Foods Significant Accounting PoliciesDocument9 pagesCK Foods Significant Accounting PoliciesA YoungNo ratings yet

- P6MYS AnsDocument12 pagesP6MYS AnsLi HYu ClfEiNo ratings yet

- TaxationDocument38 pagesTaxationEphraim LopezNo ratings yet

- Saudi Jan2010Document8 pagesSaudi Jan2010Shawkat AbbasNo ratings yet

- Amicus TestDocument5 pagesAmicus TestMiguel MorenoNo ratings yet

- Tax Syllabus 2023Document10 pagesTax Syllabus 2023Md HasanNo ratings yet

- Taxation of PartnershipDocument8 pagesTaxation of PartnershipInnocent escoNo ratings yet

- M.Akbar Wianda - Resume SalinanDocument3 pagesM.Akbar Wianda - Resume SalinanDaff PanelNo ratings yet

- Engagement and Consultant Nda With SSBDocument6 pagesEngagement and Consultant Nda With SSBlexsolutionshub2020No ratings yet

- Japonica Payroll PresentationDocument19 pagesJaponica Payroll Presentationoxeeco100% (1)

- Income Tax at A Glance: Domestic Taxes DepartmentDocument16 pagesIncome Tax at A Glance: Domestic Taxes DepartmentClifton SangNo ratings yet

- TAX PLANNING & COMPLIANCE - MA-2022 - QuestionDocument6 pagesTAX PLANNING & COMPLIANCE - MA-2022 - QuestionsajedulNo ratings yet

- GEC Nov 13Document7 pagesGEC Nov 13koreanissueNo ratings yet

- TAX Budget2012 Annexa4Document40 pagesTAX Budget2012 Annexa4Fiona Jinn NNo ratings yet

- Due Diligence-Tax Due Dil - FinalDocument6 pagesDue Diligence-Tax Due Dil - FinalEljoe VinluanNo ratings yet

- Inome Tax April 15Document2 pagesInome Tax April 15brainNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- FAR 1st PreboardDocument10 pagesFAR 1st PreboardLui100% (2)

- Odisha PWD Code Vol 1Document139 pagesOdisha PWD Code Vol 1lrajat1991No ratings yet

- Welding Machine Production PlantDocument26 pagesWelding Machine Production PlantJohn100% (1)

- Social Security Numbers For Noncitizens: Does A Noncitizen Need A Social Security Number?Document2 pagesSocial Security Numbers For Noncitizens: Does A Noncitizen Need A Social Security Number?antonioNo ratings yet

- Ontario Production Services TAX Credit (Opstc) : Ontario Media Development Corporation (OMDC)Document46 pagesOntario Production Services TAX Credit (Opstc) : Ontario Media Development Corporation (OMDC)efex66No ratings yet

- Prepared By: Jessy ChongDocument7 pagesPrepared By: Jessy ChongDaleNo ratings yet

- A Project Report On FlexDocument8 pagesA Project Report On FlexZaren Murry0% (3)

- Interest and DepreciationDocument34 pagesInterest and DepreciationBismuthNo ratings yet

- Mental Bank Ledger Workbook PDFDocument4 pagesMental Bank Ledger Workbook PDFVikas Agarwal100% (3)

- Cost Sheet ProblemsDocument11 pagesCost Sheet ProblemsPrem RajNo ratings yet

- Orion PharmaDocument20 pagesOrion PharmaShamsun NaharNo ratings yet

- Income Taxation ActivityDocument10 pagesIncome Taxation ActivityRodolfo CorpuzNo ratings yet

- Fundamentals of Credit AnalysisDocument5 pagesFundamentals of Credit AnalysisKatherine David de Ramos0% (1)

- Ifrs 5 Non Current Assets Held For Sales and Discontinued Operations SummaryDocument5 pagesIfrs 5 Non Current Assets Held For Sales and Discontinued Operations Summaryart galleryNo ratings yet

- Flash Reports DefinitionDocument8 pagesFlash Reports Definitionca_rudraNo ratings yet

- (2013 Pattern) PDFDocument230 pages(2013 Pattern) PDFSanket SonawaneNo ratings yet

- Gnotes Skinny (Full)Document22 pagesGnotes Skinny (Full)Vada De Villa RodriguezNo ratings yet

- Sanlam Alternative Income FundDocument2 pagesSanlam Alternative Income FundJohnNo ratings yet

- Case 6-1 Transfer Pricing ProblemDocument4 pagesCase 6-1 Transfer Pricing ProblemNur Kumala Dewi67% (3)

- Plant Assets and Intangible AssetsDocument14 pagesPlant Assets and Intangible AssetsSamuel DebebeNo ratings yet

- Hamdard Case StudyDocument11 pagesHamdard Case StudyPooja SinghNo ratings yet

- Partnership AccountingDocument55 pagesPartnership AccountingMarilou Garcia100% (1)

- Departmental Interpretation and Practice Notes No. 24 (Revised)Document17 pagesDepartmental Interpretation and Practice Notes No. 24 (Revised)Difanny KooNo ratings yet

- (Trading Ebook) Thomas Stridsman - Trading Systems That WorkDocument366 pages(Trading Ebook) Thomas Stridsman - Trading Systems That WorkAnurag Saini85% (20)

- Exercise 1 Investment in AssociatesDocument7 pagesExercise 1 Investment in AssociatesJoefrey Pujadas BalumaNo ratings yet

- Fs (Water Refilling) Jun 2Document17 pagesFs (Water Refilling) Jun 2Jun Ortizo81% (37)

- Atlantic Computer CaseDocument8 pagesAtlantic Computer CaseKarthick Nathan ShanmuganathanNo ratings yet

- Spiceland SM ch11 PDFDocument79 pagesSpiceland SM ch11 PDFmas aziz100% (3)

- Gulfstream Mid Size Cabin 4Q 2016Document4 pagesGulfstream Mid Size Cabin 4Q 2016David MicklewhyteNo ratings yet

- FA Analysis - HUL RatiosDocument29 pagesFA Analysis - HUL RatiosharjinderNo ratings yet