Professional Documents

Culture Documents

Financial-Planning-and-Budgeting Paper

Uploaded by

rjyasir1985Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial-Planning-and-Budgeting Paper

Uploaded by

rjyasir1985Copyright:

Available Formats

IBP Superior Qualification

Winter 2022

The Institute of

Bankers Pakistan

Time Allowed: 3 Hours Maximum Marks: 100

Financial Planning and Budgeting

Date: March 15, 2022 AIBP (Core Subject) Roll No:

Instructions:

i. Attempt ALL questions;

ii. Answers must be neat, relevant and brief;

iii. In marking the answers, the examiner takes into account clarity of exposition, logic of arguments,

presentation and language;

iv. Read the instructions printed inside the top cover of answer script CAREFULLY before attempting the

paper;

v. DO NOT write your Name, Access No. or Roll No. etc. anywhere inside the answer script(s);

vi. Candidates are advised not to mark any of the objective answer on the Question Paper, otherwise their

paper will be cancelled;

vii. Question Paper must be returned to invigilator before leaving the examination hall;

SECTION B: SUBJECTIVE

Attempt ALL Questions. (40 Marks)

Q1. Blue Limited has annual credit sales of Rs. 1,000,000. Credit customers take 45 days to pay. Bad debts are

2% of sales. The company finances its trade receivables with a bank overdraft, on which interest is payable

at an annual rate of 15%.

A factor has offered to take over administration of the receivables ledger and collections for a fee of 2.5%

of the credit sales. This will be a non-recourse factoring service. It has also guaranteed to reduce the

payment period to 30 days. It will provide finance for 80% of the trade receivables, at an interest cost of

8% per year.

Blue Limited estimates that by using the factor, it will save administration costs of Rs. 8,000 per year.

Required:

A. What would be the effect on annual profits if Blue Limited decides to use the factor’s services?

(Assume a 365-day year). (06 marks)

B. State any three advantages and disadvantages of using a factor. (06 marks)

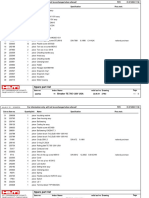

Q2. Ochre is a company that is managed by the two individuals who set it up 12 years ago. In the current year

the company was launched on the stock market. Previously, all of the shares had been owned by its two

founders and certain employees. Now, 40% of the shares are in the hands of the investing public. The

company's profit growth and dividend policy are set out below:

Year

Profit Dividend Share Capital

Rs. in ‘000’ Rs. in ‘000’ Rs.

4 years ago 176 88 800,000

3 years ago 200 104 800,000

2 years ago 240 120 1,000,000

Winter 2022 Page 1 of 2

IBP Superior Qualification

Winter 2022

The Institute of

Bankers Pakistan

1 year ago 290 150 1,000,000

Current year 444 222 (proposed) 1,500,000

Will the continuation of the same dividend policy as in the past be suitable as now that the company is

quoted on the stock market? (06 marks)

Q3. What are the main responsibilities of an Asset-Liability Committee (ALCO)? (06 marks)

Q4. In the light of the Guidelines on Interest Rate Risk Management by SBP, answer the following:

A. What are the quantitative factors and qualitative factors which an independent reviewer should

consider in making interest rate risk assessment? THREE each. (06 Marks)

B. What are the functions of interest rate risk measurement system in relation to both earnings and

economic values that are consistent with the scope of bank's activities? Any FOUR. (04 Marks)

Q5. Royal Toys is a manufacturer of toys and children’s products. The following are selected items appearing

in the recent balance sheet. (06 Marks)

Rs. in Million

Cash and short-term investments 94.6

Receivables 319.4

Inventories 144.6

Prepaid expenses 64

Total current liabilities 260.2

Total liabilities 558.8

Total shareholders’ equity 688

Required:

Compute the following:

A. Quick Ratio

B. Current Ratio

C. Working Capital

D. Debt Ratio

X ───── END OF PAPER ───── X

Winter 2022 Page 2 of 2

You might also like

- Financial-Planning-and-Budgeting-S-22 PaperDocument3 pagesFinancial-Planning-and-Budgeting-S-22 Paperrjyasir1985No ratings yet

- Case StudyDocument5 pagesCase StudySashin NaidooNo ratings yet

- Q.P. Code: 62202: Managerial AccountingDocument6 pagesQ.P. Code: 62202: Managerial Accountinganshul bhutangeNo ratings yet

- Practice QuestionsDocument10 pagesPractice QuestionsDana El SakkaNo ratings yet

- Management Accounting For Financial ServicesDocument2 pagesManagement Accounting For Financial ServicesJAVEDNo ratings yet

- Strategic Finance Mid-Term Examination 1Document6 pagesStrategic Finance Mid-Term Examination 1سردار عطا محمدNo ratings yet

- Financial Management End Term Paper - Batch 2020-22Document4 pagesFinancial Management End Term Paper - Batch 2020-22Swastik NayakNo ratings yet

- Midterm Test April2021Document5 pagesMidterm Test April2021NURUL FATIN NABILA BINTI MOHD FADZIL (BG)No ratings yet

- CBCS 3.3.3 Corporate Valuation and Restructuring 2020Document4 pagesCBCS 3.3.3 Corporate Valuation and Restructuring 2020Bharath MNo ratings yet

- FINANCIAL MANAGEMENT EXAMDocument6 pagesFINANCIAL MANAGEMENT EXAMsubhasis mahapatraNo ratings yet

- J8. CAPII - RTP - June - 2023 - Group-IIDocument162 pagesJ8. CAPII - RTP - June - 2023 - Group-IIBharat KhanalNo ratings yet

- Stove Kraft Limited-3Document5 pagesStove Kraft Limited-3venkyniyerNo ratings yet

- PST AAA 2015 2022Document45 pagesPST AAA 2015 2022mulika99No ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall 2012 ExamsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall 2012 Examsmagnetbox8No ratings yet

- 78735bos63031 p6Document44 pages78735bos63031 p6dileepkarumuri93No ratings yet

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- 1 2 3 4 5 6 7 8 MergedDocument78 pages1 2 3 4 5 6 7 8 MergedKartik GuptaNo ratings yet

- PAC All CAF Subjects Mock QP With Solutions Compiled by Saboor AhmadDocument132 pagesPAC All CAF Subjects Mock QP With Solutions Compiled by Saboor AhmadHadeed HafeezNo ratings yet

- Modern Construction Company R 18062020Document7 pagesModern Construction Company R 18062020Ali KayaNo ratings yet

- CPA 10 - Financial ManagementDocument10 pagesCPA 10 - Financial ManagementAbby KiweewaNo ratings yet

- Dialog Finance Annual Report 2022Document180 pagesDialog Finance Annual Report 2022Batticaloa BuildingsNo ratings yet

- Prime Urban ICRA April 17Document7 pagesPrime Urban ICRA April 17BALMERNo ratings yet

- Advanced Financial ManagementDocument12 pagesAdvanced Financial Managementnitin bajajNo ratings yet

- Assign QP 2024 May - DP11.2 Intro Fin MgtDocument5 pagesAssign QP 2024 May - DP11.2 Intro Fin MgtshalomechinodyaNo ratings yet

- Universiti Teknologi Mara Final Assessment: Confidential 1 AC/JUL 2022/MAF503Document10 pagesUniversiti Teknologi Mara Final Assessment: Confidential 1 AC/JUL 2022/MAF503Alyn AdnanNo ratings yet

- FM IiDocument5 pagesFM IiDarshan GandhiNo ratings yet

- FAR160 PYQ JULY2023Document8 pagesFAR160 PYQ JULY2023nazzyusoffNo ratings yet

- CA-Inter-FM-SM-Q-MTP-2-May-2024-castudynotes-comDocument12 pagesCA-Inter-FM-SM-Q-MTP-2-May-2024-castudynotes-comsaurabhNo ratings yet

- FM Eco 100 Marks Test 1Document6 pagesFM Eco 100 Marks Test 1AnuragNo ratings yet

- Management Accounting For Financial ServicesDocument2 pagesManagement Accounting For Financial ServicesJAVEDNo ratings yet

- GTU MBA Semester 2 Financial Management Exam QuestionsDocument3 pagesGTU MBA Semester 2 Financial Management Exam QuestionsAmul PatelNo ratings yet

- Wipro Limited - Update On Material Event: Summary of Rating(s) OutstandingDocument7 pagesWipro Limited - Update On Material Event: Summary of Rating(s) OutstandingMegha PrakashNo ratings yet

- IRMA Financial Accounting Exam Cash Flow AnalysisDocument5 pagesIRMA Financial Accounting Exam Cash Flow AnalysisDharampreet SinghNo ratings yet

- CRD Foods 8apr2020Document6 pagesCRD Foods 8apr2020samudragupta05No ratings yet

- PST FM 2015 2023Document92 pagesPST FM 2015 2023PhilipNo ratings yet

- The Question Paper Comprises Five Case Study Questions. The Candidates Are Required To Answer Any Four Case Study Questions Out of FiveDocument15 pagesThe Question Paper Comprises Five Case Study Questions. The Candidates Are Required To Answer Any Four Case Study Questions Out of FiveGokul dnNo ratings yet

- SFM Q 2Document5 pagesSFM Q 2riyaNo ratings yet

- MSc Project Management Exam QuestionsDocument5 pagesMSc Project Management Exam Questionsmy pcNo ratings yet

- Caf-01 Far-01 Skans Mock QPDocument8 pagesCaf-01 Far-01 Skans Mock QPTaha MalikNo ratings yet

- Nov 2021 Path ProfessionalDocument181 pagesNov 2021 Path ProfessionalMd. Ramim RanaNo ratings yet

- BBF201/03 Assignment 1 Financial Ratios AnalysisDocument6 pagesBBF201/03 Assignment 1 Financial Ratios AnalysisJane HoNo ratings yet

- Al MT 202101 BBCF2013Document4 pagesAl MT 202101 BBCF2013Nabila Abu BakarNo ratings yet

- COM 96th AIBB Solved-FBDocument29 pagesCOM 96th AIBB Solved-FBShamima AkterNo ratings yet

- FABVDocument10 pagesFABVdivyayella024No ratings yet

- Updated FileDocument16 pagesUpdated Fileshubham agarwalNo ratings yet

- Capital Budgeting Techniques-For StudentsDocument4 pagesCapital Budgeting Techniques-For StudentsIshika HimatsinghkaNo ratings yet

- Final Exam FM Summer 2021Document2 pagesFinal Exam FM Summer 2021AAYAN FARAZNo ratings yet

- AS Business AnalysisDocument4 pagesAS Business AnalysisLaskar REAZNo ratings yet

- Maf605 - Final Exam 24.09.2022Document6 pagesMaf605 - Final Exam 24.09.2022sanjuladasanNo ratings yet

- Audit of Liabilities QuizDocument13 pagesAudit of Liabilities QuizAldrin DagamiNo ratings yet

- IIM Rohtak ePGPx01 Term III Financial Management End Term ExamDocument3 pagesIIM Rohtak ePGPx01 Term III Financial Management End Term Examkaushal dhapareNo ratings yet

- Last Time Tips by CA Ankit PatwariDocument41 pagesLast Time Tips by CA Ankit PatwariSundarNo ratings yet

- AFAR1 Main Exam Q (Feb 2022)Document5 pagesAFAR1 Main Exam Q (Feb 2022)Alice LowNo ratings yet

- Alkali Metals Limited - R - 26112020Document7 pagesAlkali Metals Limited - R - 26112020Yogi173No ratings yet

- Karvy Stock Broking - R-08032019 PDFDocument7 pagesKarvy Stock Broking - R-08032019 PDFManohar nayakNo ratings yet

- IJNRD2207081Document11 pagesIJNRD2207081RIZWAN SHAIKNo ratings yet

- Vivriti Capital Private Limited PDFDocument9 pagesVivriti Capital Private Limited PDFIb SulochanaNo ratings yet

- Assignment/ Tugasan - Financial Accounting and Reporting IDocument14 pagesAssignment/ Tugasan - Financial Accounting and Reporting IdalilaNo ratings yet

- Mba Summer 2019Document4 pagesMba Summer 2019Dhruvi PatelNo ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- CF-Chap 02-Analysis of Financial StatementDocument58 pagesCF-Chap 02-Analysis of Financial StatementM7No ratings yet

- Down These Mean StreetsDocument4 pagesDown These Mean StreetsAndra Elena AgafiteiNo ratings yet

- Spare Part List: Breaker TE 705 120V USADocument7 pagesSpare Part List: Breaker TE 705 120V USAJoseLuisCarrilloMenaNo ratings yet

- T B L J: HE Anking AW OurnalDocument9 pagesT B L J: HE Anking AW OurnalsamrajcseNo ratings yet

- G.pushkala - SC - Sexual HarassmentDocument11 pagesG.pushkala - SC - Sexual HarassmentSCOIBlogNo ratings yet

- Davao Del Sur - MunDocument41 pagesDavao Del Sur - MunireneNo ratings yet

- Feinberg Freedom and Fulfillment PDFDocument2 pagesFeinberg Freedom and Fulfillment PDFBobNo ratings yet

- Introduction To Criminology and Psychology of CrimeDocument10 pagesIntroduction To Criminology and Psychology of CrimeDarwynn Bondoc Estillore100% (3)

- Pro-choice or pro-life? The case for women's rights and rape victimsDocument2 pagesPro-choice or pro-life? The case for women's rights and rape victimsTreseaNo ratings yet

- Transfer of JudgesDocument5 pagesTransfer of JudgesRAJANo ratings yet

- Latin Words N MaximsDocument38 pagesLatin Words N MaximsJoly_M_Hubilla_2759No ratings yet

- Aadvik Ipr Psda 8 SemDocument12 pagesAadvik Ipr Psda 8 SemZubu KhshNo ratings yet

- Department of Education Republic of The PhilippinesDocument17 pagesDepartment of Education Republic of The PhilippinesGlychalyn Abecia 23No ratings yet

- Mission 2 Contact List Telephone Numbers 20200331Document42 pagesMission 2 Contact List Telephone Numbers 20200331Dawood KhanNo ratings yet

- Ala in Finacct 3Document4 pagesAla in Finacct 3VIRGIL KIT AUGUSTIN ABANILLANo ratings yet

- Application For Volunteer Services: Personal InformationDocument2 pagesApplication For Volunteer Services: Personal InformationSara SpringleNo ratings yet

- Urdaneta City University College of Criminal Justice Education Outcomes-Based Teaching Learning PlanDocument9 pagesUrdaneta City University College of Criminal Justice Education Outcomes-Based Teaching Learning PlanSheane Mincy M. SiyangbigayNo ratings yet

- Barangay Samara: Office of The Sangguniang Barangay Series of 2018Document1 pageBarangay Samara: Office of The Sangguniang Barangay Series of 2018Maria RinaNo ratings yet

- Overview of New Security Controls in ISO 27002 ENDocument15 pagesOverview of New Security Controls in ISO 27002 ENsotomiguelNo ratings yet

- Complaint - Fairbanks v. Roller (1 June 2017) - RedactedDocument13 pagesComplaint - Fairbanks v. Roller (1 June 2017) - RedactedLaw&CrimeNo ratings yet

- Citigroup, Inc., v. Citistate Savings Bank, Inc.Document1 pageCitigroup, Inc., v. Citistate Savings Bank, Inc.Samantha MakayanNo ratings yet

- From Steven & From Makers: OfficialDocument68 pagesFrom Steven & From Makers: Officialcomicbookman100% (3)

- Derrida Kafka EssayDocument18 pagesDerrida Kafka EssayKushal HaranNo ratings yet

- SKF FYJ 509 SpecificationDocument4 pagesSKF FYJ 509 SpecificationgulieionutNo ratings yet

- SCO - GOLDBULLION - CIF HI Switz Thai 12% 9 3Document4 pagesSCO - GOLDBULLION - CIF HI Switz Thai 12% 9 3Luis Fernando Parra Zapata Medellín Líderes INo ratings yet

- Principles of Risk Management and Insurance Class Notes Chapter 3 Introduction To Risk Management TopicsDocument7 pagesPrinciples of Risk Management and Insurance Class Notes Chapter 3 Introduction To Risk Management Topicsshrishti sharmaNo ratings yet

- Boston Bank V Manalo - : Gr. No. 158149Document2 pagesBoston Bank V Manalo - : Gr. No. 158149Anonymous C5NWrY62No ratings yet

- Registration Form CRO0601096-IPCDocument2 pagesRegistration Form CRO0601096-IPCHimanshi VohraNo ratings yet

- A guide to Malaysian payroll basicsDocument43 pagesA guide to Malaysian payroll basicsmelanieNo ratings yet

- Netec Video Player Quick Start Guide 5.5Document10 pagesNetec Video Player Quick Start Guide 5.5Abelito FloresNo ratings yet