Professional Documents

Culture Documents

Amreli

Uploaded by

asad.anisons0 ratings0% found this document useful (0 votes)

4 views5 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views5 pagesAmreli

Uploaded by

asad.anisonsCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 5

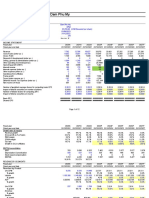

Company Fundamentals - Financial Summary

Company Name Amreli Steels Ltd (AMST.PSX)

Country of Exchange Pakistan

Country of Headquarters Pakistan

TRBC Industry Group Metals & Mining

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 21-11-2023

Statement Data 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Period End Date 30-06-2011 30-06-2012 30-06-2013 30-06-2014 30-06-2015 30-06-2016 30-06-2017 30-06-2018 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Standardized Currency PKR PKR PKR PKR PKR PKR PKR PKR PKR PKR PKR PKR PKR

Complete Statement Complete Complete Complete Complete Complete Complete Complete Complete Complete Complete Complete Complete Complete

Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross

Template Type Profit Profit Profit Profit Profit Profit Profit Profit Profit Profit Profit Profit Profit

Financial Summary - Standardized (Currency: Pakistan Rupee)

Field Name 30-06-2011 30-06-2012 30-06-2013 30-06-2014 30-06-2015 30-06-2016 30-06-2017 30-06-2018 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Selected Income Statement Items

Revenue from Business Activities - Total 5,431.7 7,208.9 10,622 11,962 14,414 12,400 13,284 15,501 28,596 26,532 39,218 58,184 45,493

Gross Profit - Industrials/Property - Total 472.6 966.2 1,161.4 1,372.5 2,514.2 2,792.0 2,468.2 2,758.4 2,423.6 1,813.2 4,542.1 6,491.5 5,962.2

Operating Profit before Non-Recurring Income/Expense 324.6 731.3 827.2 1,010.2 1,939.6 2,083.0 1,689.4 1,861.6 1,197.0 433.2 3,016.0 4,377.4 4,017.4

Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA) 399.0 960.9 1,134.4 1,305.8 2,233.1 2,435.1 2,017.3 2,295.5 1,893.6 1,316.3 3,576.5 5,116.1 4,988.7

Income before Discontinued Operations & Extraordinary Items 2.04 90.05 121.2 252.4 1,011.2 1,278.8 1,074.1 1,585.2 32.82 -1,242.0 1,368.3 1,325.5 -678.4

Selected Balance Sheet Items

Cash & Cash Equivalents 17.54 36.26 77.47 63.47 79.72 81.12 69.56 131.1 147.0 509.4 378.6 356.9 271.9

Cash & Short-Term Investments 17.54 36.26 183.2 189.3 126.3 428.9 111.7 154.6 157.4 1,142.4 387.0 367.0 275.3

Total Assets 7,242.8 10,873 11,800 11,126 12,262 16,765 18,209 26,643 29,611 35,469 36,366 43,550 40,172

Debt - Total 3,123.4 4,631.0 5,553.7 4,540.1 4,396.8 3,782.7 4,649.9 10,033 12,061 18,568 15,873 19,176 17,308

Common Equity - Total 2,265.2 2,362.8 2,543.8 2,879.0 3,952.3 8,860.6 9,390.7 10,446 12,244 11,113 13,941 15,255 14,562

Selected Cash Flow Items

Net Cash Flow from Operating Activities -186.9 -752.0 -627.8 1,102.4 406.8 -1,354.2 3,406.0 -2,613.6 -296.1 -4,016.9 2,413.6 -2,229.6 6,987.5

Depreciation, Depletion & Amortization including Impairment - Cash Flow - to Reconcile 74.38 229.6 307.2 295.6 293.5 352.2 328.0 443.4 696.6 883.1 560.5 738.8 971.3

Capital Expenditures - Net - Cash Flow 1,472.0 736.9 159.4 112.8 207.4 1,293.2 4,133.1 2,923.6 2,136.7 1,360.9 1,146.2 2,137.9 1,589.2

Net Change in Cash - Total -97.65 18.73 41.20 -14.00 16.25 301.4 -311.6 61.52 15.96 461.6 -701.5 185.3 -40.54

Free Cash Flow Net of Dividends -1,662.1 -1,522.7 -794.5 979.5 190.4 -2,654.1 -1,319.9 -6,137.1 -3,084.1 -5,391.9 1,137.2 -4,388.7 5,387.3

Selected Per Share Data

Dividend Yield - Common Stock - Gross - Issue Specific - % 0.0% 1.6% 2.8% 8.9% 0.0% 0.0% 0.0% 0.0%

Dividend Yield - Common Stock - Net - Issue Specific - % 0.0% 1.5% 2.6% 8.0% 0.0% 0.0% 0.0% 0.0%

EPS - Diluted - excluding Extraordinary Items Applicable to Common - Total 0.01 0.40 0.54 1.13 4.54 4.81 3.62 5.34 0.11 -4.18 4.61 4.46 -2.28

Shares used to calculate Diluted EPS - Total 222.8 222.8 222.8 222.8 222.8 266.1 297.0 297.0 297.0 297.0 297.0 297.0 297.0

Profitability / Return

Gross Profit Margin - % 8.7% 13.4% 10.9% 11.5% 17.4% 22.5% 18.6% 17.8% 8.5% 6.8% 11.6% 11.2% 13.1%

EBITDA Margin - % 7.4% 13.3% 10.7% 10.9% 15.5% 19.6% 15.2% 14.8% 6.6% 5.0% 9.1% 8.8% 11.0%

Operating Margin - % 6.0% 10.1% 7.8% 8.4% 13.5% 16.8% 12.7% 12.0% 4.2% 1.6% 7.7% 7.5% 8.8%

Income before Tax Margin - % 1.1% 1.8% 1.6% 3.2% 8.8% 14.1% 10.9% 9.0% 0.2% 7.3% 3.5% 3.6% 0.1%

Income Tax Rate - % 96.7% 30.9% 30.2% 33.6% 20.5% 26.9% 25.7% 13.7% 1.1% 36.2%

Net Margin - % 0.0% 1.3% 1.1% 2.1% 7.0% 10.3% 8.1% 10.2% 0.1% 4.7% 3.5% 2.3% 1.5%

Free Cash Flow -1,662.1 -1,522.7 -794.5 979.5 190.4 -2,654.1 -727.7 -5,544.4 -2,434.2 -5,391.3 1,137.5 -4,388.6 5,387.5

Return on Average Common Equity - % (Income available to Common excluding Extraordinary Items) 3.9% 4.9% 9.3% 29.6% 20.0% 11.8% 16.0% 0.3% 10.6% 10.9% 9.1% 4.6%

Return on Average Total Assets - % (Income before Discontinued Operations & Extraordinary Items) 1.0% 1.1% 2.2% 8.7% 8.8% 6.1% 7.1% 0.1% 3.8% 3.8% 3.3% 1.6%

Return on Invested Capital - % 7.2% 7.1% 8.5% 19.2% 14.4% 9.4% 12.2% 10.0% 8.7%

Growth

Revenue from Business Activities - Total 5,431.7 7,208.9 10,622 11,962 14,414 12,400 13,284 15,501 28,596 26,532 39,218 58,184 45,493

Operating Profit before Non-Recurring Income/Expense 324.6 731.3 827.2 1,010.2 1,939.6 2,083.0 1,689.4 1,861.6 1,197.0 433.2 3,016.0 4,377.4 4,017.4

Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA) 399.0 960.9 1,134.4 1,305.8 2,233.1 2,435.1 2,017.3 2,295.5 1,893.6 1,316.3 3,576.5 5,116.1 4,988.7

Income before Discontinued Operations & Extraordinary Items 2.04 90.05 121.2 252.4 1,011.2 1,278.8 1,074.1 1,585.2 32.82 -1,242.0 1,368.3 1,325.5 -678.4

EPS - Diluted - excluding Extraordinary Items Applicable to Common - Total 0.01 0.40 0.54 1.13 4.54 4.81 3.62 5.34 0.11 -4.18 4.61 4.46 -2.28

Common Shares - Outstanding - Total 222.8 222.8 222.8 222.8 222.8 297.0 297.0 297.0 297.0 297.0 297.0 297.0 297.0

Financial Strength / Leverage

Total Debt Percentage of Total Assets 43.1% 42.6% 47.1% 40.8% 35.9% 22.6% 25.5% 37.7% 40.7% 52.4% 43.7% 44.0% 43.1%

Total Debt Percentage of Total Capital 58.0% 66.2% 68.6% 61.2% 52.7% 29.9% 33.1% 49.0% 49.6% 62.6% 53.2% 55.7% 54.3%

Total Debt Percentage of Total Equity 137.9% 196.0% 218.3% 157.7% 111.3% 42.7% 49.5% 96.1% 98.5% 167.1% 113.9% 125.7% 118.9%

Debt Service 248.6 2,241.6 3,649.8 3,721.3 3,470.2 3,569.4 3,838.3 6,344.2 10,296 13,789 13,311 14,563 17,698

Debt Service Percentage of Normalized after Tax Profit 12,168.2% 2,489.3% 3,012.7% 1,474.4% 343.2% 279.1% 357.4% 400.2% 31,366.7% 973.1% 1,098.7%

Interest Coverage Ratio 1.31 1.43 1.39 1.65 3.08 6.57 7.03 4.04 0.96 0.19 1.85 1.92 1.01

Dividend Coverage - % 215.3% 180.8% 242.6%

Earnings Retention Rate 1.00 1.00 1.00 1.00 1.00 0.54 0.45 0.59 1.00 1.00 1.00

Dividend Payout Ratio - % 0.0% 0.0% 0.0% 0.0% 0.0% 46.5% 55.3% 41.2% 0.0% 0.0% 0.0%

Enterprise Value Breakdown

Market Capitalization 13,965 36,518 20,954 7,324.3 9,694.5 12,902 6,962.0 4,559.1

Debt - Total 3,123.4 4,631.0 5,553.7 4,540.1 4,396.8 3,782.7 4,649.9 10,033 12,061 18,568 15,873 19,176 17,308

Cash & Short Term Investments - Total 17.54 36.26 183.2 189.3 126.3 428.9 111.7 154.6 157.4 1,142.4 387.0 367.0 275.3

Enterprise Value 17,319 41,056 30,832 19,228 27,120 28,389 25,771 21,592

Dupont / Earning Power

Asset Turnover 0.80 0.94 1.04 1.23 0.85 0.76 0.69 1.02 0.82 1.09 1.46 1.09

Income before Tax Margin - % 1.1% 1.8% 1.6% 3.2% 8.8% 14.1% 10.9% 9.0% 0.2% 7.3% 3.5% 3.6% 0.1%

Pretax ROA - % 1.4% 1.5% 3.3% 10.9% 12.1% 8.3% 6.2% 0.2% 6.0% 3.9% 5.2% 0.1%

Total Assets to Total Shareholders Equity - including Minority Interest & Hybrid Debt 3.91 4.62 4.23 3.42 2.27 1.92 2.26 2.48 2.79 2.87 2.74 2.81

Pretax ROE - % 5.6% 7.1% 14.0% 37.2% 27.3% 15.8% 14.1% 0.6% 16.6% 11.1% 14.2% 0.2%

Tax Complement 0.03 0.69 0.70 0.66 0.80 0.73 0.74 1.14 0.99 0.64

Return on Average Common Equity - % (Income available to Common excluding Extraordinary Items) 3.9% 4.9% 9.3% 29.6% 20.0% 11.8% 16.0% 0.3% 10.6% 10.9% 9.1% 4.6%

Earnings Retention Rate 1.00 1.00 1.00 1.00 1.00 0.54 0.45 0.59 1.00 1.00 1.00

Reinvestment Rate - % 3.9% 4.9% 9.3% 29.6% 10.7% 5.3% 9.4% 0.3% 10.6% 10.9% 9.1% 4.6%

Productivity

Net Income after Tax per Employee 811,579 3,220,330 3,828,590 2,833,912 2,594,495 29,799 -891,622 1,273,391 1,760,312 -902,185

Sales per Employee 38,463,493 45,903,380 37,126,321 35,049,634 25,369,137 25,960,941 19,046,765 36,499,258 77,269,963 60,495,644

Total Assets per Employee 37,942,232 35,776,263 38,682,340 47,764,765 44,739,715 32,690,625 21,333,412 25,371,564 48,424,049 57,682,751 53,633,818

Liquidity

Current Ratio 0.93 0.85 0.83 1.03 1.08 1.88 1.13 1.05 0.86 0.98 0.97 1.00 0.89

Quick Ratio 0.35 0.23 0.30 0.42 0.43 0.72 0.34 0.25 0.31 0.44 0.51 0.36 0.40

Working Capital to Total Assets -0.02 -0.04 -0.06 0.01 0.03 0.23 0.04 0.02 -0.07 -0.01 -0.02 0 -0.06

Operating

Accounts Receivable Turnover 11.85 11.78 10.05 9.97 5.65 6.09 7.59 8.43 4.80 5.31 7.46 6.04

Average Receivables Collection Days 30.88 31.07 36.42 36.70 64.79 60.12 48.23 43.41 76.20 68.97 49.03 60.61

Payables Turnover 8.56 15.55 21.21 21.43 15.83 16.13 12.05 12.69 9.93 11.50 12.41 8.91

Average Payables Payment Days 42.74 23.54 17.25 17.08 23.12 22.68 30.36 28.83 36.85 31.82 29.49 41.10

Inventory Turnover 4.06 4.26 4.75 4.97 2.47 2.39 2.06 3.22 2.80 4.04 4.87 3.37

Average Inventory Days 90.15 85.85 77.07 73.67 148.4 152.9 177.4 113.7 130.7 90.62 75.13 108.7

Average Net Trade Cycle Days 78.29 93.38 96.23 93.29 190.1 190.3 195.3 128.2 170.0 127.8 94.67 128.2

Company Fundamentals - Income Statement

Company Name Amreli Steels Ltd (AMST.PSX)

Country of Exchange Pakistan

Country of Headquarters Pakistan

TRBC Industry Group Metals & Mining

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 21-11-2023

Statement Data 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Period End Date 30-06-2011 30-06-2012 30-06-2013 30-06-2014 30-06-2015 30-06-2016 30-06-2017 30-06-2018 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Standardized Currency PKR PKR PKR PKR PKR PKR PKR PKR PKR PKR PKR PKR PKR

Complete Statement Complete Complete Complete Complete Complete Complete Complete Complete Complete Complete Complete Complete Complete

Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross Industrial - Gross

Template Type Profit Profit Profit Profit Profit Profit Profit Profit Profit Profit Profit Profit Profit

Income Statement - Standardized (Currency: Pakistan Rupee)

Field Name 30-06-2011 30-06-2012 30-06-2013 30-06-2014 30-06-2015 30-06-2016 30-06-2017 30-06-2018 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Revenues

Revenue from Goods & Services 5,431.7 7,208.9 10,622 11,962 14,414 12,400 13,284 15,501 28,596 26,532 39,218 58,184 45,493

Sales of Goods & Services - Net - Unclassified 5,431.7 7,208.9 0 356.2 13,424 39.41 79.54 86.50 70.66 57.94 71.19

Sales Returns, Allowances & Other Revenue Adjustments 111.9 300.5 28.46 161.4 1.83 0.35 3.33 40.96 36.67 46.92 99.22

Revenue Taxes 164.9 2.22 4.43 4,507.7 6,660.1 9,906.7 7,917.6

Gross Revenue from Business Activities - Total 10,734 11,906 14,442 12,562 26.77 15,464 28,524 30,994 45,845 68,080 53,438

Revenue from Business Activities - Total 5,431.7 7,208.9 10,622 11,962 14,414 12,400 13,284 15,501 28,596 26,532 39,218 58,184 45,493

Operating Expenses

Cost of Operating Revenue 4,959.1 6,242.7 9,460.4 10,590 11,899 9,608.2 10,816 12,742 26,172 24,719 34,676 51,693 39,531

Cost of Revenues - Total 4,959.1 6,242.7 9,460.4 10,590 11,899 9,608.2 10,816 12,742 26,172 24,719 34,676 51,693 39,531

Cost of Revenues - Unclassified 7,194.5 7,804.9 8,668.2 6,562.9 7,477.7 8,280.6 18,811 19,055 28,202 42,971 33,528

Depreciation in Cost of Revenues 286.2 284.0 274.5 108.6 305.7 406.6 653.3 814.0 496.1 660.5 816.5

Labor & Related Expenses including Stock-Based Compensation in Cost of Revenues 310.2 461.8 675.8 691.2 782.1 999.0

Material Expenses 75.21 70.27 25.69 34.50 41.63 41.82 36.45 27.37 12.00 8.96 5.53

Ground leases/Rental Expenses in Cost of Revenues 75.21 70.27 25.69 34.50 41.63 41.82 36.45 27.37 12.00 8.96 5.53

Cost of Revenues - Other - Total 1,904.6 2,430.5 2,931.1 2,902.2 2,680.4 3,551.2 5,996.3 4,131.4 5,183.7 7,053.4 5,180.9

Gross Profit - Industrials/Property - Total 472.6 966.2 1,161.4 1,372.5 2,514.2 2,792.0 2,468.2 2,758.4 2,423.6 1,813.2 4,542.1 6,491.5 5,962.2

Selling, General & Administrative Expenses - Total 166.6 248.9 336.4 382.5 603.9 693.6 779.0 899.4 1,227.0 1,370.7 1,534.8 2,106.4 1,894.2

Selling, General & Administrative Expenses - Unclassified 22.53 61.84 126.7 149.9 216.9 252.3 202.0 186.9 337.4 392.3 516.1 632.1 592.5

Labor & Related Expenses including Stock-Based Compensation in Selling, General & Administrative Expenses 63.62 91.75 94.26 123.7 217.5 288.8 331.4 416.6 410.0 450.6 646.6 912.4 714.9

Depreciation in Selling, General & Administrative Expenses 20.23 20.00 20.71 11.29 18.22 14.99 15.58 19.92 31.56 56.16 55.73 70.65 125.3

Amortization of Intangibles in Selling, General & Administrative Expenses 0.25 0.33 0.33 0.33 0.74 5.34 6.53 7.27 11.70 12.90 8.68 7.64 7.62

Selling, General & Administrative Expenses - Other - Total 59.98 74.99 94.42 97.29 150.5 132.2 223.5 268.8 436.4 458.8 307.6 483.6 454.0

Advertising Expense 6.26 11.87 11.02 16.17 23.08 32.79 66.78 99.18 253.3 121.8 220.0 286.6 108.9

Rental Expense 0.26 0.53 12.16 8.85 9.81 9.15 9.56 13.04 19.79 12.52 20.13 19.04 6.90

Provision for Doubtful Accounts & Write-off 13.73 2.81 7.33 0 52.26 39.60 185.2 -69.60 5.18 119.6

Other Operating Expense/(Income) - Net -18.66 -13.96 -2.14 -20.20 -29.31 15.36 -0.25 -2.63 -0.38 9.30 -8.65 7.72 50.61

Other Operating Income - Total 34.79 15.40 5.74 20.73 6.19 7.17 28.27 22.31 8.31

Other Operating Expense 5.48 30.76 5.48 18.10 5.81 16.47 19.62 30.03 58.92

Operating Expenses - Total 5,107.1 6,477.6 9,794.7 10,952 12,474 10,317 11,594 13,639 27,399 26,099 36,202 53,807 41,475

Operating Profit

Operating Profit before Non-Recurring Income/Expense 324.6 731.3 827.2 1,010.2 1,939.6 2,083.0 1,689.4 1,861.6 1,197.0 433.2 3,016.0 4,377.4 4,017.4

Non-Operating Expenses

Financing Income/(Expense) - Net - Total -254.8 -588.0 -651.0 -628.2 -667.7 -332.5 -245.8 -469.0 -1,265.1 -2,377.2 -1,649.5 -2,301.5 -4,042.2

Interest Expense - Net of (Interest Income) 248.6 510.0 595.0 611.1 630.3 317.0 240.3 461.1 1,244.2 2,285.6 1,630.9 2,279.1 3,986.1

Interest Expense - Net of Capitalized Interest 248.6 510.0 595.0 611.1 630.3 317.0 240.3 461.1 1,244.2 2,285.6 1,630.9 2,279.1 3,986.1

Non-Interest Financial Income/(Expense) - Total -6.12 -78.04 -55.95 -17.14 -37.40 -15.54 -5.45 -7.96 -20.84 -91.64 -18.57 -22.39 -56.11

Foreign Exchange Gain/(Loss) - Non-Business -3.62 -70.57 -45.13 -6.25 -18.03 -5.41 0 -11.90 -77.92 0 -24.10

Sale of Investments Held for Sale, Maturity & Trading - Gain/(Loss) 1.69 1.03 1.30 3.16

Non-Interest Financial Income/(Expense) - Other - Net -4.20 -8.50 -12.12 -14.05 -19.37 -10.13 -5.45 -7.96 -8.94 -13.72 -18.57 -22.39 -32.01

Sale of Tangible & Intangible Fixed Assets - Gain/(Loss) -1.26 1.62 1.82 0.91 1.00 17.04 2.20 -1.08

Other Non-Operating Income/(Expense) - Total -8.13 -12.90 -2.66 -1.97

Normalized Pre-tax Profit 61.76 130.3 173.6 379.9 1,271.9 1,749.2 1,445.3 1,394.4 -67.16 -1,943.0 1,383.5 2,078.1 -25.88

Non-Recurring Income/Expense

Non-Recurring Income/(Expense) - Total -0.08 0 0.42 0

Impairment - Tangible & Intangible Fixed Assets 0.08 0

Impairment - Intangibles excluding Goodwill 0.08 0

Early Extinguishment of Lease Related Debts - Gain/(Loss) 0.42 0

Pre-Tax Income

Income before Taxes 61.76 130.3 173.6 379.9 1,271.8 1,749.2 1,445.3 1,394.4 -67.16 -1,943.0 1,384.0 2,078.1 -25.88

Taxes

Income Taxes 59.72 40.27 52.42 127.5 260.7 470.5 371.3 -190.8 -99.98 -701.0 15.69 752.6 652.6

Income Taxes for the Year - Current 58.70 42.13 51.44 121.4 165.3 262.7 395.3 -48.18 0 397.6 587.9 853.1 256.6

Income Taxes - Domestic - Current 53.30 120.2 188.2 262.4 395.3 -48.18 0

Income Taxes - Other (KFAS/NLST) - Current -1.86 1.19 -22.93 0.29 0 0 0

Income Taxes - Deferred 1.02 -1.86 0.98 6.18 95.39 207.8 -24.03 -142.6 -99.98 -1,098.6 -572.2 -100.6 396.0

Net Income After Tax

Net Income after Tax 2.04 90.05 121.2 252.4 1,011.2 1,278.8 1,074.1 1,585.2 32.82 -1,242.0 1,368.3 1,325.5 -678.4

After Tax Income/Expense

Income before Discontinued Operations & Extraordinary Items 2.04 90.05 121.2 252.4 1,011.2 1,278.8 1,074.1 1,585.2 32.82 -1,242.0 1,368.3 1,325.5 -678.4

Net Income before Minority Interest 2.04 90.05 121.2 252.4 1,011.2 1,278.8 1,074.1 1,585.2 32.82 -1,242.0 1,368.3 1,325.5 -678.4

Net Income after Minority Interest 2.04 90.05 121.2 252.4 1,011.2 1,278.8 1,074.1 1,585.2 32.82 -1,242.0 1,368.3 1,325.5 -678.4

Net Income

Income Available to Common Shares 2.04 90.05 121.2 252.4 1,011.2 1,278.8 1,074.1 1,585.2 32.82 -1,242.0 1,368.3 1,325.5 -678.4

Other Comprehensive Income

Other Comprehensive Income - Starting Line 32.82 -1,242.0 1,368.3 1,325.5 -678.4

Other Comprehensive Income - Other 0 0 1,625.8 0 0

Other Comprehensive Income - Pension Related -15.97 -3.78 -3.98 -11.44 -14.02

Other Comprehensive Income - Net of Tax - Total -15.97 -3.78 1,621.9 -11.44 -14.02

Comprehensive Income before Minority Interest - Total 16.86 -1,245.8 2,990.1 1,314.1 -692.5

Comprehensive Income - Attributable to Parent Company Equity Holders - Total 16.86 -1,245.8 2,990.1 1,314.1 -692.5

Share/Per Share - Basic

Net Income - Basic - including Extraordinary Items Applicable to Common - Total 2.04 90.05 121.2 252.4 1,011.2 1,278.8 1,074.1 1,585.2 32.82 -1,242.0 1,368.3 1,325.5 -678.4

Income available to Common excluding Extraordinary Items 2.04 90.05 121.2 252.4 1,011.2 1,278.8 1,074.1 1,585.2 32.82 -1,242.0 1,368.3 1,325.5 -678.4

Shares used to calculate Basic EPS - Total 222.8 222.8 222.8 222.8 222.8 266.1 297.0 297.0 297.0 297.0 297.0 297.0 297.0

EPS - Basic - including Extraordinary Items Applicable to Common - Total 0.01 0.40 0.54 1.13 4.54 4.81 3.62 5.34 0.11 -4.18 4.61 4.46 -2.28

EPS - Basic - excluding Extraordinary Items Applicable to Common - Total 0.01 0.40 0.54 1.13 4.54 4.81 3.62 5.34 0.11 -4.18 4.61 4.46 -2.28

EPS - Basic - excluding Extraordinary Items - Normalized - Total 0.01 0.40 0.54 1.13 4.54 4.81 3.62 5.34 0.11 -4.18 4.61 4.46 -2.28

Allocated Net Income including Extraordinary Items Applicable to Common - Issue Specific 2.04 90.05 121.2 252.4 1,011.2 1,278.8 1,074.1 1,585.2 32.82 -1,242.0 1,368.3 1,325.5 -678.4

Earnings Allocation Factor - Basic - Issue Specific 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

Shares used to calculate Basic EPS - Issue Specific 222.8 222.8 222.8 222.8 222.8 266.1 297.0 297.0 297.0 297.0 297.0 297.0 297.0

EPS - Basic - including Extraordinary Items Applicable to Common - Issue Specific 0.01 0.40 0.54 1.13 4.54 4.81 3.62 5.34 0.11 -4.18 4.61 4.46 -2.28

EPS - Basic - excluding Extraordinary Items Applicable to Common - Issue Specific 0.01 0.40 0.54 1.13 4.54 4.81 3.62 5.34 0.11 -4.18 4.61 4.46 -2.28

EPS - Basic - excluding Extraordinary Items - Normalized - Issue Specific 0.01 0.40 0.54 1.13 4.54 4.81 3.62 5.34 0.11 -4.18 4.61 4.46 -2.28

EPS - Basic from Discontinued Operations & Extraordinary Items 0 0 0 0 0 0 0 0 0 0 0 0 0

Comprehensive Earnings Per Share - Basic - Issue Specific 0.06 -4.19 10.07 4.42 -2.33

Share/Per Share - Diluted

Net Income - Diluted - including Extraordinary Items Applicable to Common - Total 2.04 90.05 121.2 252.4 1,011.2 1,278.8 1,074.1 1,585.2 32.82 -1,242.0 1,368.3 1,325.5 -678.4

Diluted Income available to Common excluding Extraordinary Items 2.04 90.05 121.2 252.4 1,011.2 1,278.8 1,074.1 1,585.2 32.82 -1,242.0 1,368.3 1,325.5 -678.4

Shares used to calculate Diluted EPS - Total 222.8 222.8 222.8 222.8 222.8 266.1 297.0 297.0 297.0 297.0 297.0 297.0 297.0

EPS - Diluted - including Extraordinary Items Applicable to Common - Total 0.01 0.40 0.54 1.13 4.54 4.81 3.62 5.34 0.11 -4.18 4.61 4.46 -2.28

EPS - Diluted - excluding Extraordinary Items Applicable to Common - Total 0.01 0.40 0.54 1.13 4.54 4.81 3.62 5.34 0.11 -4.18 4.61 4.46 -2.28

EPS - Diluted - excluding Extraordinary Items - Normalized - Total 0.01 0.40 0.54 1.13 4.54 4.81 3.62 5.34 0.11 -4.18 4.61 4.46 -2.28

Allocated Diluted Net Income including Extraordinary Items Applicable to Common - Issue Specific 2.04 90.05 121.2 252.4 1,011.2 1,278.8 1,074.1 1,585.2 32.82 -1,242.0 1,368.3 1,325.5 -678.4

Earnings Allocation Factor - Diluted - Issue Specific 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

Shares used to calculate Diluted EPS - Issue Specific 222.8 222.8 222.8 222.8 222.8 266.1 297.0 297.0 297.0 297.0 297.0 297.0 297.0

EPS - Diluted - including Extraordinary Items Applicable to Common - Issue Specific 0.01 0.40 0.54 1.13 4.54 4.81 3.62 5.34 0.11 -4.18 4.61 4.46 -2.28

EPS - Diluted - excluding Extraordinary Items Applicable to Common - Issue Specific 0.01 0.40 0.54 1.13 4.54 4.81 3.62 5.34 0.11 -4.18 4.61 4.46 -2.28

EPS - Diluted - excluding Extraordinary Items - Normalized - Issue Specific 0.01 0.40 0.54 1.13 4.54 4.81 3.62 5.34 0.11 -4.18 4.61 4.46 -2.28

EPS - Diluted from Discontinued Operations & Extraordinary Items 0 0 0 0 0 0 0 0 0 0 0 0 0

Comprehensive Earnings Per Share - Diluted - Issue Specific 0.06 -4.19 10.07 4.42 -2.33

Share/Per Share - Dividends

DPS - Common - Gross - Issue - By Announcement Date 0 0 0 0 0 0 2.00 2.00 2.20 0 0 0 0

DPS - Common - Net - Issue - By Announcement Date 0 0 0 0 0 0 1.80 1.80 1.98 0 0 0 0

EBIT/EBITDA & related

Earnings before Interest & Taxes (EBIT) 324.6 731.3 827.2 1,010.2 1,939.6 2,083.0 1,689.4 1,861.6 1,197.0 433.2 3,016.0 4,377.4 4,017.4

Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA) 399.0 960.9 1,134.4 1,305.8 2,233.1 2,435.1 2,017.3 2,295.5 1,893.6 1,316.3 3,576.5 5,116.1 4,988.7

Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA) and Operating Lease Payments 399.3 961.4 1,221.8 1,384.9 2,268.6 2,478.8 2,068.5 2,350.3 1,949.8 1,356.1 3,608.6 5,144.1 5,001.1

Depreciation/Amortization - Income Statement

Depreciation & Amortization - Supplemental 20.47 20.32 307.2 295.6 293.4 129.0 327.8 433.8 696.6 883.1 560.5 738.8 971.3

Depreciation Expense - Total - Supplemental 20.23 20.00 306.9 295.3 292.7 123.6 321.3 426.6 684.9 870.2 551.8 731.1 963.7

Depreciation - Fin Lease Right-of-Use Assets - Total - Suppl 10.82 23.01 23.88 42.96

Amortization - Total - Supplemental 0.25 0.33 0.33 0.33 0.74 5.34 6.53 7.27 11.70 12.90 8.68 7.64 7.62

Intangible Amortization - Other - Supplemental 0.25 0.33 0.33 0.33 0.74 5.34 6.53 7.27 11.70 12.90 8.68 7.64 7.62

Amortization of Computer Software - Supplemental 0.25 0.33 0.33 0.33 0.74 5.34 6.53 7.27 11.70 12.90 8.68 7.64 7.62

Depreciation/Amortization - Total

Depreciation, Depletion & Amortization - Total 74.38 229.6 307.2 295.6 293.4 352.2 327.8 433.8 696.6 883.1 560.5 738.8 971.3

Depreciation - Total 74.13 229.3 306.9 295.3 292.7 346.8 321.3 426.6 684.9 870.2 551.8 731.1 963.7

Amortization of Intangible Assets excluding Goodwill - Total 0.25 0.33 0.33 0.33 0.74 5.34 6.53 7.27 11.70 12.90 8.68 7.64 7.62

Labor & Related Expenses

Labor & Related Expenses - Total 63.62 91.75 94.26 123.7 217.5 288.8 641.5 878.4 1,085.8 1,141.7 1,428.8 1,911.5 714.9

Labor & Related Expenses - Supplemental 63.62 91.75 94.26 123.7 217.5 288.8 641.5 878.4 1,085.8 1,141.7 1,428.8 1,911.5 714.9

Auditor Fees

Auditor Fees 0.83 0.96 1.02 1.10 2.50 2.07 2.17 2.31 2.51 2.72 2.96 3.90 4.16

Audit-Related Fees 0.83 0.96 1.02 1.10 2.50 1.83 1.98 2.07 2.07 2.28 2.48 3.40 3.57

Fees - Other 0.24 0.20 0.24 0.44 0.45 0.48 0.50 0.59

Normalized

Normalized after Tax Profit 2.04 90.05 121.2 252.4 1,011.3 1,278.8 1,074.1 1,585.2 32.82 -1,242.0 1,367.8 1,325.5 -678.4

Normalized Net Income from Continuing Operations 2.04 90.05 121.2 252.4 1,011.3 1,278.8 1,074.1 1,585.2 32.82 -1,242.0 1,367.8 1,325.5 -678.4

Normalized Net Income - Bottom Line 2.04 90.05 121.2 252.4 1,011.3 1,278.8 1,074.1 1,585.2 32.82 -1,242.0 1,367.8 1,325.5 -678.4

Earnings before Interest & Taxes (EBIT) - Normalized 310.4 640.3 768.6 991.0 1,902.3 2,066.2 1,685.6 1,855.5 1,177.1 342.5 3,014.5 4,357.2 3,960.2

Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA) - Normalized 384.8 870.0 1,075.8 1,286.7 2,195.7 2,418.3 2,013.5 2,289.3 1,873.7 1,225.6 3,575.0 5,095.9 4,931.5

Lease Expenses

Lease Expense -Total - Supplemental

Depreciation of Financial Lease ROU Assets - Supplemental 10.82 23.01 23.88 42.96

Interest Expense on Financial Lease Liabilities - Supple 20.01

Other

Rental/Operating Lease Expense 0.26 0.53 87.37 79.12 35.50 43.65 51.19 54.85 56.24 39.89 32.14 28.01 12.43

Advertising Expenses - Supplemental 6.26 11.87 11.02 16.17 23.08 32.79 66.78 99.18 253.3 121.8 220.0 286.6 108.9

Cost of Revenue including Operation & Maintenance (Utility) - Total 4,959.1 6,242.7 9,460.4 10,590 11,899 9,608.2 10,816 12,742 26,172 24,719 34,676 51,693 39,531

Cost of Revenues excluding Depreciation 4,959.1 6,242.7 9,174.3 10,306 11,625 9,499.6 10,510 12,336 25,519 23,905 34,180 51,032 38,714

Interest Expense 248.6 510.0 595.0 611.1 630.3 317.0 240.3 461.1 1,244.2 2,285.6 1,630.9 2,279.1 3,986.1

Operating Expenses 5,107.1 6,477.6 9,794.7 10,952 12,474 10,317 11,594 13,639 27,399 26,099 36,202 53,807 41,475

Selling, General & Administrative Expenses excluding Research & Development Expenses 166.6 248.9 336.4 382.5 603.9 693.6 779.0 899.4 1,227.0 1,370.7 1,534.8 2,106.4 1,894.2

Employees

Employees - Average 300.0 300.0 308.0 347.0 398.0 813.0 1,345.0 1,393.0 737.0 744.0 757.0

Company Fundamentals - Balance Sheet

Company Name Amreli Steels Ltd (AMST.PSX)

Country of Exchange Pakistan

Country of Headquarters Pakistan

TRBC Industry Group Metals & Mining

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 21-11-2023

Statement Data 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Period End Date 30-06-2011 30-06-2012 30-06-2013 30-06-2014 30-06-2015 30-06-2016 30-06-2017 30-06-2018 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Standardized Currency PKR PKR PKR PKR PKR PKR PKR PKR PKR PKR PKR PKR PKR

Complete Statement Complete Complete Complete Complete Complete Complete Complete Complete Complete Complete Complete Complete Complete

Industrial - Industrial - Industrial - Industrial - Industrial - Industrial - Industrial - Industrial - Industrial - Industrial - Industrial - Industrial - Industrial -

Template Type Differentiated Differentiated Differentiated Differentiated Differentiated Differentiated Differentiated Differentiated Differentiated Differentiated Differentiated Differentiated Differentiated

Balance Sheet - Standardized (Currency: Pakistan Rupee)

Field Name 30-06-2011 30-06-2012 30-06-2013 30-06-2014 30-06-2015 30-06-2016 30-06-2017 30-06-2018 30-06-2019 30-06-2020 30-06-2021 30-06-2022 30-06-2023

Current Assets

Cash & Short-Term Investments 17.54 36.26 183.2 189.3 126.3 428.9 111.7 154.6 157.4 1,142.4 387.0 367.0 275.3

Cash & Cash Equivalents 17.54 36.26 77.47 63.47 79.72 81.12 69.56 131.1 147.0 509.4 378.6 356.9 271.9

Short-Term Investments - Total 105.8 125.8 46.62 347.7 42.09 23.56 10.40 633.0 8.47 10.16 3.40

Loans & Receivables - Net - Short-Term 583.1 633.2 1,169.9 1,210.5 1,680.1 2,710.4 1,654.0 2,431.3 4,352.7 6,695.4 8,086.0 7,503.3 7,563.9

Trade Accounts & Trade Notes Receivable - Net 358.8 379.2 571.6 929.9 1,158.0 2,070.5 1,455.2 1,787.7 3,402.7 4,900.3 6,320.4 5,680.4 4,973.4

Trade Accounts & Trade Notes Receivable - Gross 399.0 422.0 621.7 976.1 1,188.2 2,108.5 1,530.5 1,914.9 3,569.5 5,252.3 6,602.7 5,867.4 5,271.1

Provision - Trade Accounts & Trade Notes Receivable 40.21 42.76 50.09 46.14 30.12 38.04 75.28 127.2 166.8 352.0 282.4 187.0 297.7

Loans - Short-Term 102.9 37.67 59.44 27.03 87.46 125.6 22.22 23.38 18.80 28.92 34.04 53.45 45.49

Income Tax - Receivables - Short-Term 99.73 71.55 140.4 137.4 101.2 86.25 0 393.0 930.9 1,765.3 1,647.3 1,769.1 2,333.7

Receivables - Other - Total 21.64 144.8 398.5 116.2 333.5 428.0 176.5 227.2 0.35 0.85 84.24 0.27 211.2

Inventories - Total 1,086.5 1,989.0 2,449.2 2,010.3 2,780.1 5,010.0 4,023.4 8,328.8 7,924.5 9,723.8 7,448.0 13,774 9,701.4

Inventories - Raw Materials 1,018.2 436.2 1,232.4 1,382.6 2,244.3 5,315.0 3,463.3 4,725.2 3,415.9 5,853.5 3,397.0

Inventories - Work in Progress 468.3 180.7 231.8 1,128.7 793.8 1,000.1 746.6 1,023.9 791.0 1,245.7 967.7

Inventories - Finished Goods 567.1 948.6 810.7 1,898.8 366.2 1,144.1 2,376.7 2,291.2 1,785.3 3,918.4 2,732.5

Inventories - Other - Total 1,086.5 1,989.0 395.7 444.9 505.2 599.9 619.2 869.8 1,337.9 1,683.5 1,455.8 2,756.6 2,604.1

Prepaid Expenses - Short-Term 40.55 76.04 0.80 1.35 2.07 1.15 1.86 20.68 25.54 9.86 12.60 21.10 17.37

Total Current Assets 1,727.6 2,734.5 3,803.1 3,411.5 4,588.6 8,150.4 5,790.9 10,935 12,460 17,572 15,934 21,666 17,558

Non-Current Assets

Investments - Long-Term 1.00 1.00 0 15.29 15.29 15.29 15.29 15.29 15.29 15.29 15.29 14.29 14.29

Investments - Available for Sale/Held to Maturity - Long-Term 1.00 1.00 0 15.29 15.29 15.29 15.29 15.29 15.29 15.29 15.29 14.29 14.29

Receivables & Loans - Long-Term 0.96 74.96 74.96

Finance Lease Receivables - Long-Term 0.96 74.96 74.96

Property, Plant & Equipment - Net - Total 5,402.9 7,926.2 7,778.7 7,566.3 7,504.2 8,441.6 12,253 15,529 16,966 17,723 20,247 21,655 22,399

Property, Plant & Equipment - excluding Assets Leased Out - Net - Total 7,778.7 7,566.3 7,504.2 8,441.6 12,253 15,529 16,966 17,723 20,247 21,655 22,399

Land & Buildings - Net 1,971.9 1,895.3 1,815.2 1,718.7 1,631.8 1,192.6 2,655.4 3,063.9 4,431.5 4,476.1 5,399.7

Leasehold Improvements - Net 1,971.9 1,895.3 1,815.2 1,718.7 1,631.8 1,192.6 2,655.4 3,063.9 4,431.5 4,476.1 5,399.7

Plant, Machinery & Equipment - Net 5,224.5 5,439.7 5,626.9 5,586.7 5,488.6 10,612 11,990 11,777 14,161 15,204 15,072

Transportation Equipment - Net 6.06 7.42 7.57 21.70 16.98 22.30 35.00 24.06 32.16 151.5 184.9

Computer Software & Equipment - Net 6.49 6.88 15.42 15.44 13.67 18.62 23.89 25.35 21.47 62.79 67.64

Construction in Progress - Net 114.5 5.67 6.48 1,107.0 5,098.4 2,285.0 2,235.9 2,720.4 1,467.2 1,787.1 1,631.3

Property, Plant & Equipment - Under Capital Lease - Net 389.8 164.1 0

Right of Use Tangible Assets - Total - Net 72.46 100.3 76.41 135.7

Right of Use Tangible Assets - Capital/Finance Lease - Net 72.46 100.3 76.41 135.7

Property, Plant & Equipment - Other - Net 77.96 61.51 55.61 29.22 34.34 1,438.6 84.63 90.16 87.07 110.8 160.1

Property, Plant & Equipment - Gross - Total 8,127.2 8,209.5 8,428.5 9,711.1 13,839 17,532 19,649 21,265 24,328 26,368 28,044

Property, Plant & Equipment - excluding Assets Leased Out - Gross 8,127.2 8,209.5 8,428.5 9,711.1 13,839 17,532 19,649 21,265 24,328 26,368 28,044

Land & Buildings - Gross 2,107.5 2,153.7 2,192.3 2,200.6 2,212.2 1,875.5 3,460.1 3,989.7 5,386.0 5,469.4 6,435.6

Leasehold Improvements - Gross 2,107.5 2,153.7 2,192.3 2,200.6 2,212.2 1,875.5 3,460.1 3,989.7 5,386.0 5,469.4 6,435.6

Plant, Machinery & Equipment - Gross 5,395.9 5,792.4 6,158.7 6,354.3 6,470.6 11,905 13,832 14,336 17,200 18,804 19,506

Transportation Equipment - Gross 13.19 15.51 12.58 29.55 27.85 38.26 59.74 49.62 61.25 198.5 264.6

Computer Software & Equipment - Gross 17.79 20.46 27.69 33.11 36.50 47.55 63.09 74.47 82.36 135.1 152.5

Construction in Progress - Gross 114.5 5.67 6.48 1,107.0 5,098.4 2,285.0 2,235.9 2,720.4 1,467.2 1,787.1 1,631.3

Property, Plant & Equipment - Under Capital Lease - Gross 417.4 180.0 0

Right of Use Tangible Assets - Total - Gross 83.27 133.2 133.1 235.4

Right of Use Tangible Assets - Capital/Finance Lease - Gross 83.27 133.2 133.1 235.4

Property, Plant & Equipment - Other - Gross 91.94 77.74 71.00 49.29 57.82 1,466.7 121.4 135.2 141.3 174.6 235.0

Property, Plant & Equipment - Accumulated Depreciation & Impairment - Total 348.5 643.2 924.3 1,269.5 1,585.9 2,003.3 2,683.9 3,541.4 4,080.9 4,713.1 5,644.4

Property, Plant & Equipment - excluding Assets Leased Out - Accumulated Depreciation & Impairment - Total 348.5 643.2 924.3 1,269.5 1,585.9 2,003.3 2,683.9 3,541.4 4,080.9 4,713.1 5,644.4

Land & Buildings - Accumulated Depreciation & Impairment 135.6 258.4 377.1 481.9 580.4 682.9 804.8 925.8 954.5 993.3 1,035.9

Leasehold Improvements - Accumulated Depreciation & Impairment 135.6 258.4 377.1 481.9 580.4 682.9 804.8 925.8 954.5 993.3 1,035.9

Plant, Machinery & Equipment - Accumulated Depreciation & Impairment 171.3 352.7 531.8 767.6 982.0 1,292.3 1,842.4 2,559.8 3,039.4 3,599.3 4,433.9

Transportation Equipment - Accumulated Depreciation & Impairment 7.13 8.09 5.01 7.86 10.87 15.96 24.74 25.57 29.09 47.02 79.73

Computer Software & Equipment - Accumulated Depreciation & Impairment 11.29 13.58 12.28 17.67 22.83 28.93 39.20 49.12 60.89 72.26 84.88

Property, Plant & Equipment - Under Capital Lease - Accumulated Depreciation & Impairment 27.60 15.86 0

Right of Use Tangible Assets - Total/Unspecified - Accumulated Depreciation 10.82 32.82 56.69 99.66

Right of Use Tangible Assets - Capital/Finance Lease - Accumulated Depreciation 10.82 32.82 56.69 99.66

Property, Plant & Equipment - Other - Accumulated Depreciation & Impairment 13.98 16.23 15.39 20.07 23.48 28.12 36.73 44.99 54.20 63.74 74.95

Other Non-Current Assets - Total 109.3 135.1 142.6 133.0 129.8 131.4 129.4 135.6 137.8 135.0 152.4 204.0 193.7

Other Non-Current Assets 109.3 135.1 142.6 133.0 129.8 131.4 129.4 135.6 137.8 135.0 152.4 204.0 193.7

Intangible Assets - Total - Net 0.99 1.05 0.73 0.40 24.35 26.74 20.40 27.89 31.93 24.27 18.62 11.87 6.60

Intangible Assets - excluding Goodwill - Net - Total 0.99 1.05 0.73 0.40 24.35 26.74 20.40 27.89 31.93 24.27 18.62 11.87 6.60

Computer Software - Intangible Assets - Net 0.99 1.05 0.73 0.40 24.35 26.74 20.40 27.89 31.93 24.27 18.62 11.87 6.60

Intangible Assets - Gross - Total 1.24 1.63 1.05 0.73 25.49 32.49 32.69 47.44 63.18 68.43 71.47 72.36 74.70

Intangible Assets - excluding Goodwill - Gross 1.24 1.63 1.05 0.73 25.49 32.49 32.69 47.44 63.18 68.43 71.47 72.36 74.70

Computer Software - Intangible Assets - Gross 1.24 1.63 1.05 0.73 25.49 32.49 32.69 47.44 63.18 68.43 71.47 72.36 74.70

Intangible Assets - Accumulated Amortization & Impairment - Total 0.25 0.57 0.33 0.33 1.14 5.75 12.29 19.55 31.26 44.16 52.84 60.48 68.10

Intangible Assets - excluding Goodwill - Accumulated Amortization & Impairment - Total 0.25 0.57 0.33 0.33 1.14 5.75 12.29 19.55 31.26 44.16 52.84 60.48 68.10

Computer Software - Intangible Assets - Accumulated Amortization & Impairment 0.25 0.57 0.33 0.33 1.14 5.75 12.29 19.55 31.26 44.16 52.84 60.48 68.10

Total Non-Current Assets 5,515.2 8,138.4 7,996.9 7,715.0 7,673.7 8,615.0 12,418 15,707 17,151 17,898 20,433 21,885 22,614

Total Assets

Total Assets 7,242.8 10,873 11,800 11,126 12,262 16,765 18,209 26,643 29,611 35,469 36,366 43,550 40,172

Current Liabilities

Trade Accounts Payable & Accruals - Short-Term 650.5 807.4 603.1 820.5 728.9 1,068.6 959.9 2,188.4 3,552.7 3,720.9 5,077.1 6,238.3 4,979.4

Trade Accounts & Trade Notes Payable - Short-Term 650.5 807.4 409.4 589.1 521.6 692.2 648.5 1,465.6 2,658.3 2,319.4 3,710.4 4,621.1 4,256.2

Accrued Expenses - Short-Term 193.7 231.4 207.3 376.4 311.4 722.8 894.4 1,401.6 1,366.7 1,617.2 723.2

Short-Term Debt & Current Portion of Long-Term Debt

Short-Term Debt & Notes Payable 982.1 1,894.3 3,157.1 1,805.2 2,268.8 2,761.6 3,627.6 7,053.1 9,087.9 11,913 9,474.1 12,573 11,331

Current Portion of Long-Term Debt including Capitalized Leases 159.1 427.9 630.3 628.0 977.8 496.6 310.2 775.3 1,186.6 820.3 1,152.1 1,368.0 2,150.5

Current Portion of Long-Term Debt excluding Capitalized Leases 147.1 333.9 523.3 577.2 977.8 496.6 310.2 775.3 1,186.6 811.5 1,129.3 1,353.6 2,116.0

Capitalized Leases - Current Portion 11.99 93.97 106.9 50.77 0 8.75 22.85 14.35 34.53

Income Taxes - Payable - Short-Term 16.65 0 7.34 10.39

Dividends/Distributions Payable 3.11 6.58 5.99 5.72 5.61 5.46

Other Current Liabilities - Total 59.74 85.69 166.2 54.00 260.5 12.31 215.0 376.1 633.6 1,544.7 779.5 1,539.8 1,306.7

Deferred Income - Short-Term 280.8 962.8 499.7 976.0 479.2

Customer Advances - Short-Term 166.2 54.00 260.5 12.31 158.7 240.4

Other Current Liabilities 59.74 85.69 56.37 135.7 352.8 581.9 279.8 563.8 827.5

Total Current Liabilities 1,851.4 3,215.2 4,556.6 3,307.6 4,236.0 4,339.1 5,129.4 10,396 14,475 18,015 16,489 21,725 19,773

Non-Current Liabilities

Debt - Long-Term - Total 1,982.3 2,308.9 1,766.4 2,107.0 1,150.2 524.5 712.1 2,204.4 1,786.9 5,834.9 5,247.2 5,234.7 3,826.7

Long-Term Debt excluding Capitalized Leases 1,941.9 2,020.0 1,584.1 2,048.6 1,150.2 524.5 712.1 2,204.4 1,786.9 5,771.3 5,162.2 5,162.3 3,704.9

Debt - Non-Convertible - Long-Term 1,941.9 2,020.0 1,584.1 2,048.6 1,150.2 524.5 712.1 2,204.4 1,786.9 5,771.3 5,162.2 5,162.3 3,704.9

Capitalized Lease Obligations - Long-Term 40.38 288.8 182.3 58.41 0 63.60 84.96 72.42 121.8

Deferred Tax & Investment Tax Credits - Long-Term 151.1 819.8 812.2 824.0 929.9 1,139.4 1,104.9 1,006.7 900.1 243.9 213.0 641.1 1,028.2

Deferred Tax - Liability - Long-Term 151.1 819.8 812.2 824.0 929.9 1,139.4 1,104.9 1,006.7 900.1 243.9 213.0 641.1 1,028.2

Other Non-Current Liabilities - Total 992.9 2,166.2 2,121.1 2,008.8 1,993.9 1,901.8 1,872.0 2,590.1 205.4 262.4 477.1 695.0 981.4

Provisions - Long-Term 17.79 25.24 40.63 46.42 67.16 72.18 116.9 155.7 205.4 254.8 476.2 524.4 599.9

Post Employment Benefits - Pension & Other - Long-Term 17.79 25.24 40.63 46.42 67.16 72.18 116.9 155.7 205.4 254.8 309.2 369.9 453.0

Provisions - Other - Long-Term 167.0 154.5 146.9

Other Non-Current Liabilities 975.1 2,140.9 2,080.5 1,962.4 1,926.8 1,829.6 1,755.0 2,434.4 7.63 0.93 170.6 381.6

Total Non-Current Liabilities 3,126.2 5,294.8 4,699.6 4,939.8 4,074.0 3,565.7 3,688.9 5,801.2 2,892.5 6,341.2 5,937.3 6,570.8 5,836.3

Total Liabilities

Total Liabilities 4,977.6 8,510.0 9,256.3 8,247.4 8,310.0 7,904.8 8,818.3 16,197 17,367 24,356 22,426 28,296 25,609

Shareholders' Equity

Shareholders' Equity - Attributable to Parent Shareholders - Total 2,265.2 2,362.8 2,543.8 2,879.0 3,952.3 8,860.6 9,390.7 10,446 12,244 11,113 13,941 15,255 14,562

Common Equity Attributable to Parent Shareholders 2,265.2 2,362.8 2,543.8 2,879.0 3,952.3 8,860.6 9,390.7 10,446 12,244 11,113 13,941 15,255 14,562

Common Equity - Contributed 2,227.6 2,227.6 2,227.6 2,227.6 2,227.6 2,970.1 2,970.1 2,970.1 2,970.1 2,970.1 2,970.1 2,970.1 2,970.1

Common Stock - Issued & Paid 2,227.6 2,227.6 2,227.6 2,227.6 2,227.6 2,970.1 2,970.1 2,970.1 2,970.1 2,970.1 2,970.1 2,970.1 2,970.1

Equity - Non-Contributed - Reserves & Retained Earnings 37.59 135.2 316.2 651.4 1,724.7 5,890.5 6,420.6 7,475.6 9,273.5 8,143.1 10,971 12,285 11,592

Retained Earnings - Total 37.59 135.2 316.2 651.4 1,724.7 5,890.5 6,451.4 7,516.0 6,968.7 5,914.7 7,260.1 8,654.5 8,039.0

Comprehensive Income - Accumulated - Total -30.82 -40.44 2,304.8 2,228.4 3,710.4 3,630.1 3,553.2

Hedging Reserves 0

Comprehensive Income - Pension Liabilities -30.82 -40.44 -56.41 -60.19 -64.17 -75.61 -89.63

Revaluation Reserves 2,361.2 2,288.6 3,774.6 3,705.7 3,642.8

Common Equity - Total 2,265.2 2,362.8 2,543.8 2,879.0 3,952.3 8,860.6 9,390.7 10,446 12,244 11,113 13,941 15,255 14,562

Total Shareholders' Equity

Total Shareholders' Equity - including Minority Interest & Hybrid Debt 2,265.2 2,362.8 2,543.8 2,879.0 3,952.3 8,860.6 9,390.7 10,446 12,244 11,113 13,941 15,255 14,562

Total Liabilities & Shareholders' Equity

Total Liabilities & Equity 7,242.8 10,873 11,800 11,126 12,262 16,765 18,209 26,643 29,611 35,469 36,366 43,550 40,172

Share/Per Share - Common

Common Shares - Issued - Total 222.8 222.8 222.8 222.8 222.8 297.0 297.0 297.0 297.0 297.0 297.0 297.0 297.0

Common Shares - Outstanding - Total 222.8 222.8 222.8 222.8 222.8 297.0 297.0 297.0 297.0 297.0 297.0 297.0 297.0

Common Shares - Treasury - Total 0 0 0 0 0 0 0 0 0 0 0 0 0

Common Shares - Authorized - Issue Specific 350.0 350.0 350.0 350.0 500.0 500.0 500.0 500.0 500.0 500.0 500.0 500.0 500.0

Common Shares - Issued - Issue Specific 222.8 222.8 222.8 222.8 222.8 297.0 297.0 297.0 297.0 297.0 297.0 297.0 297.0

Common Shares - Outstanding - Issue Specific 222.8 222.8 222.8 222.8 222.8 297.0 297.0 297.0 297.0 297.0 297.0 297.0 297.0

Common Shares - Treasury - Issue Specific 0 0 0 0 0 0 0 0 0 0 0 0 0

Share/Per Share - Other

Asset Allocation Factor - Issue Specific 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

Right of Use Tangible Assets

Right of Use Tangible Assets - Total - Net - Supplemental 72.46 100.3 76.41 135.7

Right of Use Tangible Assets - Capital/Finance Lease - Net - Supplemental 72.46 100.3 76.41 135.7

Right of Use Tangible Assets - Total - Gross - Supplemental 83.27 133.2 133.1 235.4

Right of Use Tangible Assets - Capital/Finance Lease - Gross - Supplemental 83.27 133.2 133.1 235.4

Right of Use Tangible Assets - Total - Accumulated Depreciation - Supplemental 10.82 32.82 56.69 99.66

Right of Use Tangible Assets - Capital/Finance Lease - Accumulated Depreciation - Supplemental 10.82 32.82 56.69 99.66

Property, Plant & Equipment - excluding Right of Use Tangible Assets & Capital Leases - Net 7,388.9 7,402.2 7,504.2 17,651 20,146 21,578 22,264

Property, Plant & Equipment - excluding Right of Use Tangible Assets & Capital Leases - Gross 7,709.8 8,029.5 8,428.5 21,181 24,194 26,235 27,808

Property, Plant & Equipment - excluding Right of Use Tangible Assets & Capital Leases - Accumulated

Depreciation 320.9 627.4 924.3 3,530.5 4,048.1 4,656.4 5,544.7

Right of Use Liabilities

Finance and Operating Lease Liabilities - Total 52.37 382.8 289.2 109.2 0 72.35 107.8 86.77 156.3

Long-Term & Short-Term

Investments - Total 1.00 1.00 105.8 141.1 61.91 363.0 57.38 38.84 25.69 648.3 23.76 24.45 17.69

Loans & Receivables - Total 584.0 708.2 1,244.9 1,210.5 1,680.1 2,710.4 1,654.0 2,431.3 4,352.7 6,695.4 8,086.0 7,503.3 7,563.9

Accounts & Notes Receivable - Trade - Gross - Total 399.0 422.0 621.7 976.1 1,188.2 2,108.5 1,530.5 1,914.9 3,569.5 5,252.3 6,602.7 5,867.4 5,271.1

Other Assets - Total 109.3 135.1 142.6 133.0 129.8 131.4 129.4 135.6 137.8 135.0 152.4 204.0 193.7

Income Taxes - Payable - Long-Term & Short-Term 16.65 0 7.34 10.39

Dividends Payable 3.11 6.58 5.99 5.72 5.61 5.46

Payables & Accrued Expenses 650.5 807.4 603.1 820.5 728.9 1,068.6 959.9 2,188.4 3,552.7 3,720.9 5,077.1 6,238.3 4,979.4

Trade Account Payables - Total 650.5 807.4 409.4 589.1 521.6 692.2 648.5 1,465.6 2,658.3 2,319.4 3,710.4 4,621.1 4,256.2

Accrued Expenses 193.7 231.4 207.3 376.4 311.4 722.8 894.4 1,401.6 1,366.7 1,617.2 723.2

Debt Related

Net Debt 3,105.9 4,594.8 5,370.5 4,350.9 4,270.5 3,353.8 4,538.3 9,878.1 11,904 17,426 15,486 18,809 17,033

Debt - Total 3,123.4 4,631.0 5,553.7 4,540.1 4,396.8 3,782.7 4,649.9 10,033 12,061 18,568 15,873 19,176 17,308

Revolving Line of Credit - Outstanding - Supplemental 6,043.4 5,921.4

Other

Contract Liabilities - Short-Term - Advance Consideration & Progress Billings in Excess of Unbilled Revenue 280.8 962.8 499.7 976.0 479.2

Accruals - Short-Term -141.3 -517.0 -831.0 40.38 272.9 3,730.2 591.9 408.4 -2,161.5 -952.9 -933.5 -416.2 -2,487.2

Asset Accruals 7,224.3 10,762 11,648 11,063 12,183 16,684 18,140 26,512 29,464 34,960 35,988 43,194 39,900

Cash & Cash Equivalents - Total 17.54 36.26 77.47 63.47 79.72 81.12 69.56 131.1 147.0 509.4 378.6 356.9 271.9

Cash & Short Term Investments - Total 17.54 36.26 183.2 189.3 126.3 428.9 111.7 154.6 157.4 1,142.4 387.0 367.0 275.3

Investments - Permanent 1.00 1.00 0 15.29 15.29 15.29 15.29 15.29 15.29 15.29 15.29 14.29 14.29

Net Book Capital 5,371.0 6,957.6 7,914.3 7,229.9 8,222.7 12,214 13,929 20,324 24,148 28,539 29,427 34,064 31,595

Net Operating Assets 5,371.0 6,957.6 7,914.3 7,229.9 8,222.7 12,214 13,929 20,324 24,148 28,539 29,427 34,064 31,595

Provisions - Total 168.9 845.0 852.8 870.4 997.1 1,211.6 1,221.8 1,162.3 1,105.6 498.6 689.2 1,165.5 1,628.0

Shareholders Equity - Common 2,265.2 2,362.8 2,543.8 2,879.0 3,952.3 8,860.6 9,390.7 10,446 12,244 11,113 13,941 15,255 14,562

Tangible Total Equity 2,264.2 2,361.8 2,543.0 2,878.6 3,927.9 8,833.9 9,370.3 10,418 12,212 11,089 13,922 15,243 14,556

Tangible Book Value 2,264.2 2,361.8 2,543.0 2,878.6 3,927.9 8,833.9 9,370.3 10,418 12,212 11,089 13,922 15,243 14,556

Total Book Capital 5,388.6 6,993.8 8,097.5 7,419.2 8,349.1 12,643 14,041 20,478 24,305 29,681 29,814 34,431 31,871

Total Capital 5,388.6 6,993.8 8,097.5 7,419.2 8,349.1 12,643 14,041 20,478 24,305 29,681 29,814 34,431 31,871

Total Long Term Capital 5,391.4 7,657.6 7,243.4 7,818.8 8,026.3 12,426 13,080 16,247 15,136 17,454 19,878 21,826 20,399

Total Fixed Assets - Net 5,514.2 8,063.4 7,921.9 7,715.0 7,673.7 8,615.0 12,418 15,707 17,151 17,898 20,433 21,885 22,614

Unearned Revenue - Total 166.2 54.00 260.5 12.31 158.7 240.4 280.8 962.8 499.7 976.0 479.2

Working Capital -123.8 -480.7 -753.5 103.9 352.6 3,811.3 661.5 539.4 -2,014.5 -443.6 -554.9 -59.30 -2,215.3

Working Capital - Non-Cash -141.3 -517.0 -936.7 -85.42 226.3 3,382.4 549.9 384.8 -2,171.9 -1,586.0 -942.0 -426.3 -2,490.6

Working Capital excluding Other Current Assets & Liabilities -64.02 -395.0 -587.3 157.9 613.1 3,823.6 876.5 915.5 -1,380.9 1,101.2 224.5 1,480.5 -908.6

Book Value excluding Other Equity 2,265.2 2,362.8 2,543.8 2,879.0 3,952.3 8,860.6 9,390.7 10,446 12,244 11,113 13,941 15,255 14,562

Shareholders

Common Shareholders - Number 17,858 9,613.0 9,749.0 10,905 11,110 11,712 10,464 10,306

Operating Lease Maturity

Operating Lease Payments - Total 142.0

Operating Lease Payments - Due in Year 1 56.83

Operating Lease Payments - Due in Year 5 85.18

Employees

Employees - Full-Time/Full-Time Equivalents - Period End 311.0 311.0 317.0 351.0 407.0 815.0 1,388.0 1,398.0 751.0 755.0 749.0

Employees - Full-Time/Full-Time Equivalents - Current Date 311.0 311.0 317.0 351.0 407.0 815.0 1,388.0 1,398.0 751.0 755.0 749.0

You might also like

- CF Export 03 05 2023Document1 pageCF Export 03 05 2023Dhena DarmawanNo ratings yet

- CF-Export-05-03-2024 10Document11 pagesCF-Export-05-03-2024 10v4d4f8hkc2No ratings yet

- CF Export 27 11 2023Document10 pagesCF Export 27 11 2023juan.farrelNo ratings yet

- AMAR CFmaruhDocument6 pagesAMAR CFmaruhratuhsNo ratings yet

- BCIC CF-Export-19-12-2023Document7 pagesBCIC CF-Export-19-12-2023ratuhsNo ratings yet

- CF-Export-05-03-2024 12Document12 pagesCF-Export-05-03-2024 12v4d4f8hkc2No ratings yet

- CF-Export-05-03-2024 18Document11 pagesCF-Export-05-03-2024 18v4d4f8hkc2No ratings yet

- CF-Export-05-03-2024 20Document11 pagesCF-Export-05-03-2024 20v4d4f8hkc2No ratings yet

- CF-Export-26-02-2024 43Document12 pagesCF-Export-26-02-2024 43v4d4f8hkc2No ratings yet

- Kalbe Farma Annualy (2017-2021)Document16 pagesKalbe Farma Annualy (2017-2021)Anana PlminanNo ratings yet

- CF-Export-05-03-2024 7Document11 pagesCF-Export-05-03-2024 7v4d4f8hkc2No ratings yet

- CF Export 30 11 2023Document8 pagesCF Export 30 11 2023Sayantika MondalNo ratings yet

- FM ProjectDocument22 pagesFM ProjectJunaid MalikNo ratings yet

- CF-Export-05-03-2024 21Document13 pagesCF-Export-05-03-2024 21v4d4f8hkc2No ratings yet

- BINA CF-Export-19-12-2023Document7 pagesBINA CF-Export-19-12-2023ratuhsNo ratings yet

- CF Export 28 11 2023Document17 pagesCF Export 28 11 2023juan.farrelNo ratings yet

- Aisha Final Enterpreneurship ReportDocument6 pagesAisha Final Enterpreneurship Reportaisha malikNo ratings yet

- AMTEXDocument87 pagesAMTEXBilal Ahmed KhanNo ratings yet

- Calculations of OGDCL by Safdar, Safi Ullah, Muhamad AminDocument39 pagesCalculations of OGDCL by Safdar, Safi Ullah, Muhamad AminSaeed Ahmed (Father Name:Jamal Ud Din)No ratings yet

- DiviđenDocument12 pagesDiviđenPhan GiápNo ratings yet

- M.I. Cement Factory Limited (MICEMENT) : Income StatementDocument15 pagesM.I. Cement Factory Limited (MICEMENT) : Income StatementWasif KhanNo ratings yet

- CF-Export-26-02-2024 11Document11 pagesCF-Export-26-02-2024 11v4d4f8hkc2No ratings yet

- Financial Statements enDocument30 pagesFinancial Statements enNHÃ THY TRẦN PHƯƠNGNo ratings yet

- Company Fundamentals - Income StatementDocument28 pagesCompany Fundamentals - Income StatementThắm TrầnNo ratings yet

- (FM) AssignmentDocument7 pages(FM) Assignmentnuraini putriNo ratings yet

- KRONOLOGI ASIA BERHAD (Company No. 1067697-K)Document7 pagesKRONOLOGI ASIA BERHAD (Company No. 1067697-K)TestNo ratings yet

- CF-Export-26-02-2024 41Document11 pagesCF-Export-26-02-2024 41v4d4f8hkc2No ratings yet

- Financial Statement UltimateDocument52 pagesFinancial Statement UltimateTEDY TEDYNo ratings yet

- Majeed Traders Projections 2024 To 2025Document12 pagesMajeed Traders Projections 2024 To 2025vayave5454No ratings yet

- Interim Financial Statements For Quarter Ended 30th Chaitra 2079Document20 pagesInterim Financial Statements For Quarter Ended 30th Chaitra 2079AaluNo ratings yet

- Tgs Ar2020 Final WebDocument157 pagesTgs Ar2020 Final Webyasamin shajiratiNo ratings yet

- Harish Anchan: Re:-Annual Report For The Financial Year Ended 31 March 2023Document209 pagesHarish Anchan: Re:-Annual Report For The Financial Year Ended 31 March 2023abhi1234kumar402389No ratings yet

- Project Far Group C (g2)Document3 pagesProject Far Group C (g2)jalilah jamaludinNo ratings yet

- Zara: IT For Fast FashionDocument12 pagesZara: IT For Fast FashionRajalakshmi MuthukrishnanNo ratings yet

- Iain 26 SeptDocument27 pagesIain 26 SeptHarisNo ratings yet

- 2014Document791 pages2014Ichal ReaperNo ratings yet

- Consolidated Financial Statements - FY23Document59 pagesConsolidated Financial Statements - FY23Bhuvaneshwari .ANo ratings yet

- Presented by Haily Shah (SYBFM A044)Document19 pagesPresented by Haily Shah (SYBFM A044)HailyNo ratings yet

- CHB Sep19 PDFDocument14 pagesCHB Sep19 PDFSajeetha MadhavanNo ratings yet

- CP ALL Public Company Limited CP ALL Public Company Limited: FY19 Performance HighlightsDocument27 pagesCP ALL Public Company Limited CP ALL Public Company Limited: FY19 Performance HighlightsNattanonSirirungruangNo ratings yet

- 2018 Annual Report enDocument276 pages2018 Annual Report enbaranitharanNo ratings yet

- A01252381 - Examen - Edos Fin OXY SimplificadosDocument20 pagesA01252381 - Examen - Edos Fin OXY SimplificadosAnhia ChavezNo ratings yet

- Building: Annual 2 0 2 1 / 2 2Document128 pagesBuilding: Annual 2 0 2 1 / 2 2TharushikaNo ratings yet

- IBF Term ReportDocument12 pagesIBF Term ReportSaad A MirzaNo ratings yet

- Q4FY22 Presentation - EIH LTDDocument31 pagesQ4FY22 Presentation - EIH LTDRajiv BharatiNo ratings yet

- 7B20N001Document21 pages7B20N001pbNo ratings yet

- BPPL Holdings PLCDocument15 pagesBPPL Holdings PLCkasun witharanaNo ratings yet

- ad792e0f-bd98-4e82-ad2d-738edd542bb3Document17 pagesad792e0f-bd98-4e82-ad2d-738edd542bb3Raj EevNo ratings yet

- Wipro Annual Report PDFDocument212 pagesWipro Annual Report PDFRadhika RuhyNo ratings yet

- Tiong Nam 2016 Annual ReportDocument156 pagesTiong Nam 2016 Annual Reportnajihah radziNo ratings yet

- Agri Auto IndustriesDocument14 pagesAgri Auto IndustriesHamza TahirNo ratings yet

- SIRA1H11Document8 pagesSIRA1H11Inde Pendent LkNo ratings yet

- "Turning Glove From GOLD To DIAMOND": Supermax Corporation Berhad Analyst Briefing Slides 4Q'2020 RESULTSDocument35 pages"Turning Glove From GOLD To DIAMOND": Supermax Corporation Berhad Analyst Briefing Slides 4Q'2020 RESULTSmroys mroysNo ratings yet

- Electrotherm (India) : Profit & Loss Consolidated in Rs. CroresDocument4 pagesElectrotherm (India) : Profit & Loss Consolidated in Rs. CroresTanmay AgnaniNo ratings yet

- Strong Today For A: Brighter TomorrowDocument6 pagesStrong Today For A: Brighter TomorrowVysh PujaraNo ratings yet

- Business Strategy For The Petrochemicals & Plastics Sector: October 8, 2015Document36 pagesBusiness Strategy For The Petrochemicals & Plastics Sector: October 8, 2015afs araeNo ratings yet

- Annual Report - 2020 - Linde Bangladesh BOCDocument90 pagesAnnual Report - 2020 - Linde Bangladesh BOCAtiqul islamNo ratings yet

- Letchoose Farm Corporation Financial Highlights (Insert FS)Document31 pagesLetchoose Farm Corporation Financial Highlights (Insert FS)Cking CunananNo ratings yet

- Sales Report 2020 Vs 2021Document114 pagesSales Report 2020 Vs 2021Hongyi KaltimNo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- 3 6int 2006 Dec QDocument9 pages3 6int 2006 Dec QHannan SalimNo ratings yet

- Gina Balance SheetDocument4 pagesGina Balance SheetNawshin DastagirNo ratings yet

- Ifrs Viewpoint 3 Inventory Discounts and RebatesDocument8 pagesIfrs Viewpoint 3 Inventory Discounts and RebatesCollenNo ratings yet

- Guide To Cashflow 101 TrainingDocument5 pagesGuide To Cashflow 101 TrainingTong Kah Haw100% (2)

- Accounting Cycle 101Document16 pagesAccounting Cycle 101Jane VillanuevaNo ratings yet

- Inventory CostiDocument8 pagesInventory CostiChowsky123No ratings yet

- Ia2 16 Accounting For Income TaxDocument55 pagesIa2 16 Accounting For Income TaxJoyce Anne Garduque100% (1)

- Filinvest Credit Corporation v. Court of AppealsDocument15 pagesFilinvest Credit Corporation v. Court of AppealsKR ReborosoNo ratings yet

- SAP Reports Record Third Quarter 2011 Software RevenueDocument18 pagesSAP Reports Record Third Quarter 2011 Software RevenueVersion2dkNo ratings yet

- 1205 Sfa 08WDocument8 pages1205 Sfa 08WomareiNo ratings yet

- Fundamentals of Petroleum EconomicsDocument38 pagesFundamentals of Petroleum Economicsfavou5100% (2)

- LIMRAagentrecruitmentDocument30 pagesLIMRAagentrecruitmentshay68No ratings yet

- Damo CH 12Document65 pagesDamo CH 12HP KawaleNo ratings yet

- Group 'C'Document11 pagesGroup 'C'Gyalmu LamaNo ratings yet

- Financial Analysis of Fauji Cement LTDDocument27 pagesFinancial Analysis of Fauji Cement LTDMBA...KIDNo ratings yet

- Fin Man - Module 3Document38 pagesFin Man - Module 3Francine PrietoNo ratings yet

- Chapter-1: Introduction About InternshipDocument57 pagesChapter-1: Introduction About InternshipSalman gsNo ratings yet

- House Leader Welcomes Court Ruling Rejecting Petition Against New Sin Tax LawDocument1 pageHouse Leader Welcomes Court Ruling Rejecting Petition Against New Sin Tax Lawpribhor2No ratings yet

- Building Strategy and Performance Through Time: The Critical PathDocument19 pagesBuilding Strategy and Performance Through Time: The Critical PathBusiness Expert PressNo ratings yet

- List of Important Committees in India and Their AreaDocument3 pagesList of Important Committees in India and Their AreaabhiNo ratings yet

- Furry Tales FinalDocument46 pagesFurry Tales FinalRitu Makkar100% (1)

- Practice Test 6.7 Revaluation and Impairment 945am Attempt ReviewDocument8 pagesPractice Test 6.7 Revaluation and Impairment 945am Attempt ReviewKRISTINA DENISSE SAN JOSENo ratings yet

- Income From Bussiness and ProfessionDocument2 pagesIncome From Bussiness and ProfessionKr KvNo ratings yet

- Manufacturing in AfricaDocument6 pagesManufacturing in AfricaMohiuddin MuhammadNo ratings yet

- AuditingDocument4 pagesAuditingMaria Carmela MoraudaNo ratings yet

- Maskeliya Plantations PLC: ANNUAL REPORT 2016/ 2017Document130 pagesMaskeliya Plantations PLC: ANNUAL REPORT 2016/ 2017Anjalika PemarathnaNo ratings yet

- Steve Ballmer Email To Microsoft EmployeesDocument2 pagesSteve Ballmer Email To Microsoft EmployeesFOXBusiness.comNo ratings yet

- CORPORATE TAX PLANNING AND MANAGEMENT CiaDocument4 pagesCORPORATE TAX PLANNING AND MANAGEMENT CiaAaronNo ratings yet

- Natural IndigoDocument17 pagesNatural IndigoNur AishaNo ratings yet

- Case Study GlobeDocument13 pagesCase Study GlobeAnn Camaya100% (1)