Professional Documents

Culture Documents

CF Export 27 11 2023

Uploaded by

juan.farrel0 ratings0% found this document useful (0 votes)

4 views10 pagesOriginal Title

CF-Export-27-11-2023

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views10 pagesCF Export 27 11 2023

Uploaded by

juan.farrelCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 10

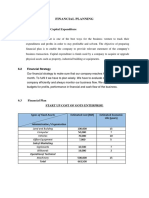

Company Fundamentals - Financial Summary

Company Name Telkom Indonesia (Persero) Tbk PT (TLKM.JK)

Country of Exchange Indonesia

Country of Headquarters Indonesia

TRBC Industry Group Telecommunications Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 27-11-2023

Statement Data 2022 2021 2020 2019 2018

Period End Date 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Statement Date 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Standardized Currency IDR IDR IDR IDR IDR

Template Type Industrial - Industrial - Industrial - Industrial - Industrial -

Operating Operating Operating Operating Operating

Financial Summary - Standardized (Currency: Indonesia Rupiah)

Field Name 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Selected Income Statement Items

Revenue from Business Activities - Total 147,306,000 143,210,000 136,462,000 135,567,000 130,784,000

Gross Profit - Industrials/Property - Total 65,810,000 68,080,000 67,571,000 65,086,000 61,304,000

Operating Profit before Non-Recurring Income/Expense 45,763,000 44,081,000 43,591,000 42,480,000 38,777,000

Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA) 83,635,000 75,529,000 72,317,000 65,658,000 60,183,000

Income before Discontinued Operations & Extraordinary Items 27,680,000 33,948,000 29,563,000 27,592,000 26,979,000

Selected Balance Sheet Items

Cash & Cash Equivalents 21,185,000 24,321,000 6,488,000 4,498,000 4,326,000

Cash & Short-Term Investments 33,296,000 38,804,000 21,892,000 18,796,000 18,743,000

Total Assets 275,192,000 277,184,000 246,943,000 221,208,000 206,196,000

Debt - Total 63,041,000 69,078,000 65,462,000 52,084,000 44,087,000

Common Equity - Total 129,258,000 121,646,000 102,527,000 99,561,000 98,910,000

Selected Cash Flow Items

Net Cash Flow from Operating Activities 73,371,000 68,353,000 65,322,000 54,960,000 45,680,000

Capital Expenditures - Net - Cash Flow 37,871,000 31,801,000 31,862,000 35,730,000 34,205,000

Net Change in Cash - Total -6,364,000 17,722,000 2,347,000 803,000 -7,706,000

Free Cash Flow Net of Dividends 20,118,000 19,153,000 17,962,000 1,505,000 -5,763,000

Selected Per Share Data

Dividend Yield - Common Stock - Gross - Issue Specific - % 4.0% 3.0% 3.4% 2.8% 3.8%

Dividend Yield - Common Stock - Gross - Issue Specific - % 4.0% 4.2% 4.7% 4.1% 4.5%

Dividend Yield - Common Stock - Net - Issue Specific - % 3.0% 2.4% 2.7% 2.3% 3.1%

Dividend Yield - Common Stock - Net - Issue Specific - % 3.4% 3.5% 4.0% 3.5% 3.8%

EPS - Diluted - excluding Extraordinary Items Applicable to Common - Total 209.5 249.9 210.0 188.4 182.0

Shares used to calculate Diluted EPS - Total 99,062 99,062 99,062 99,062 99,062

Profitability / Return

Gross Profit Margin - % 44.7% 47.5% 49.5% 48.0% 46.9%

EBITDA Margin - % 56.8% 52.7% 53.0% 48.4% 46.0%

Operating Margin - % 31.1% 30.8% 31.9% 31.3% 29.7%

Income before Tax Margin - % 24.7% 30.6% 28.6% 28.1% 27.8%

Income Tax Rate - % 23.8% 22.2% 23.6% 27.1% 25.9%

Net Margin - % 18.8% 23.7% 21.7% 20.4% 20.6%

Free Cash Flow 34,974,000 35,796,000 33,224,000 17,734,000 10,846,000

Return on Average Common Equity - % (Income available to Common excluding Extraordinary Items) 16.5% 22.1% 20.6% 18.8% 18.8%

Return on Average Total Assets - % (Income before Discontinued Operations & Extraordinary Items) 10.0% 13.0% 12.6% 12.9% 13.3%

Return on Invested Capital - % 11.2% 14.1% 13.6% 13.2% 13.4%

Growth

Revenue from Business Activities - Total 147,306,000 143,210,000 136,462,000 135,567,000 130,784,000

Operating Profit before Non-Recurring Income/Expense 45,763,000 44,081,000 43,591,000 42,480,000 38,777,000

Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA) 83,635,000 75,529,000 72,317,000 65,658,000 60,183,000

Income before Discontinued Operations & Extraordinary Items 27,680,000 33,948,000 29,563,000 27,592,000 26,979,000

EPS - Diluted - excluding Extraordinary Items Applicable to Common - Total 209.5 249.9 210.0 188.4 182.0

Common Shares - Outstanding - Total 99,062 99,062 99,062 99,062 99,062

Financial Strength / Leverage

Total Debt Percentage of Total Assets 22.9% 24.9% 26.5% 23.6% 21.4%

Total Debt Percentage of Total Capital 29.7% 32.2% 35.1% 30.8% 27.3%

Total Debt Percentage of Total Equity 42.2% 47.5% 54.2% 44.4% 37.6%

Debt Service 25,308,500 27,313,500 25,168,500 17,425,000 11,411,500

Debt Service Percentage of Normalized after Tax Profit 74.0% 89.3% 82.3% 60.2% 42.4%

Interest Coverage Ratio 11.35 10.10 9.64 10.02 11.06

Dividend Coverage - % 135.3% 166.7% 125.0% 166.7% 53.6%

Earnings Retention Rate 0.26 0.40 0.20 0.40 -0.86

Dividend Payout Ratio - % 73.9% 60.0% 80.0% 60.0% 186.4%

Enterprise Value Breakdown

Market Capitalization 371,483,312 400,211,355 327,895,937 393,277,000 371,483,312

Debt - Total 63,041,000 69,078,000 65,462,000 52,084,000 44,087,000

Minority Interest - Total 20,004,000 23,753,000 18,362,000 17,689,000 18,393,000

Cash & Short Term Investments - Total 33,296,000 38,804,000 21,892,000 18,796,000 18,743,000

Enterprise Value 421,232,312 454,238,355 389,827,937 444,254,000 415,220,312

Dupont / Earning Power

Asset Turnover 0.53 0.55 0.58 0.63 0.65

Income before Tax Margin - % 24.7% 30.6% 28.6% 28.1% 27.8%

Pretax ROA - % 13.2% 16.7% 16.7% 17.8% 18.0%

Total Assets to Total Shareholders Equity - including Minority Interest & Hybrid Debt 1.87 1.97 1.97 1.82 1.76

Pretax ROE - % 24.7% 32.9% 32.8% 32.5% 31.7%

Tax Complement 0.76 0.78 0.76 0.73 0.74

Return on Average Common Equity - % (Income available to Common excluding Extraordinary Items) 16.5% 22.1% 20.6% 18.8% 18.8%

Earnings Retention Rate 0.26 0.40 0.20 0.40 -0.86

Reinvestment Rate - % 4.3% 8.8% 4.1% 7.5% 16.3%

Productivity

Net Income after Tax per Employee 1,327,453,090 1,471,967,468 1,201,491,334 1,148,377,221 1,118,746,884

Sales per Employee 7,042,237,361 6,195,275,999 5,500,282,144 5,608,547,256 5,433,937,178

Total Assets per Employee 13,135,029,354 13,272,553,151 9,742,109,831 9,113,711,272 8,566,158,448

Liquidity

Current Ratio 0.78 0.89 0.67 0.71 0.94

Quick Ratio 0.77 0.88 0.66 0.70 0.92

Working Capital to Total Assets -0.06 -0.03 -0.09 -0.08 -0.01

Operating

Accounts Receivable Turnover 12.57 11.38 10.29 10.50 11.27

Average Receivables Collection Days 29.12 32.16 35.57 34.85 32.48

Payables Turnover 4.57 4.40 4.46 4.92 4.58

Average Payables Payment Days 80.00 83.23 82.07 74.42 79.91

Inventory Turnover 84.76 85.28 87.87 108.3 103.1

Average Inventory Days 4.32 4.29 4.17 3.38 3.55

Average Net Trade Cycle Days -46.56 -46.78 -42.34 -36.19 -43.89

Company Fundamentals - Segments

Company Name Telkom Indonesia (Persero) Tbk PT (TLKM.JK)

Country of Exchange Indonesia

Country of Headquarters Indonesia

TRBC Industry Group Telecommunications Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 27-11-2023

Statement Data 2022 2021 2020 2019 2018

Period End Date 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Statement Date 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Standardized Currency IDR IDR IDR IDR IDR

Template Type Industrial Industrial Industrial Industrial Industrial

Segments - Geographic Line By Statement Item (Currency: Indonesia Rupiah)

Field Name 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

External Revenue 147,306,000 143,210,000 136,462,000 135,567,000 130,784,000

Foreign 7,323,000 6,728,000 6,365,000 4,578,000 3,346,000

Indonesia 139,983,000 136,482,000 130,097,000 130,989,000 127,438,000

Total Non-Current Assets 181,631,000 172,532,000 167,769,000 163,419,000 148,280,000

Foreign 3,207,000 2,709,000 3,581,000 3,608,000 3,649,000

Indonesia 178,424,000 169,823,000 164,188,000 159,811,000 144,631,000

International Assets 3,207,000 0 0 0 0

International Sales 7,323,000 0 0 0 0

Company Fundamentals - Segments

Company Name Telkom Indonesia (Persero) Tbk PT (TLKM.JK)

Country of Exchange Indonesia

Country of Headquarters Indonesia

TRBC Industry Group Telecommunications Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 27-11-2023

Statement Data 2022 2021 2020 2019 2018

Period End Date 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Statement Date 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Standardized Currency IDR IDR IDR IDR IDR

Template Type Industrial Industrial Industrial Industrial Industrial

Segments - Business Line By Segment (Currency: Indonesia Rupiah)

Field Name TRBC 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Mobile 517112

Depreciation & Amortization 21,028,000 20,333,000 16,945,000 13,829,000 13,095,000

External Revenue 85,493,000 84,267,000 83,720,000 87,897,000 85,338,000

Fixed Assets - Purchased - Cash Flow 12,343,000 10,548,000 9,520,000 11,963,000 14,373,000

Intersegment Revenue 3,344,000 3,097,000 3,297,000 3,163,000 3,880,000

Operating Expenses - Total 54,051,000 56,864,000 55,449,000

Operating Income/Loss 26,122,000 34,435,000 32,966,000 34,196,000 33,769,000

Consumer 517112, 517111

Depreciation & Amortization 6,738,000 6,566,000 3,925,000 3,438,000 3,060,000

External Revenue 26,354,000 24,930,000 20,957,000 17,706,000 13,891,000

Fixed Assets - Purchased - Cash Flow 9,038,000 10,444,000 9,770,000 10,581,000 6,958,000

Intersegment Revenue 195,000 187,000 1,148,000 786,000 2,290,000

Operating Expenses - Total 17,544,000 15,904,000 15,531,000

Operating Income/Loss 7,579,000 5,894,000 4,561,000 2,588,000 650,000

Enterprise 517121, 541511

Depreciation & Amortization 3,999,000 3,909,000 3,208,000 2,737,000 2,128,000

External Revenue 19,161,000 19,141,000 17,729,000 18,701,000 21,054,000

Fixed Assets - Purchased - Cash Flow 5,983,000 4,514,000 5,178,000 5,614,000 5,325,000

Intersegment Revenue 24,646,000 22,395,000 18,591,000 16,834,000 17,995,000

Operating Expenses - Total 36,864,000 36,768,000 37,833,000

Operating Income/Loss 831,000 -307,000 -544,000 -1,233,000 1,216,000

Wholesale & International Business (WIB) 519290, 517810,

541511

Depreciation & Amortization 5,805,000 4,702,000 4,750,000 3,262,000 3,146,000

External Revenue 15,442,000 14,255,000 13,501,000 10,609,000 10,084,000

Fixed Assets - Purchased - Cash Flow 6,612,000 4,756,000 4,587,000 7,907,000 6,321,000

Intersegment Revenue 19,658,000 18,072,000 16,139,000 16,265,000 16,678,000

Operating Expenses - Total 23,143,000 21,111,000 20,634,000

Operating Income/Loss 8,925,000 9,192,000 6,497,000 5,763,000 6,128,000

Other 519290, 517112

Depreciation & Amortization 19,000 20,000 21,000 21,000 21,000

External Revenue 239,000 205,000 219,000 197,000 130,000

Fixed Assets - Purchased - Cash Flow 5,000.0 13,000 12,000 21,000 18,000

Intersegment Revenue 2,486,000 2,395,000 1,550,000 1,289,000 886,000

Operating Expenses - Total 1,662,000 1,546,000 1,073,000

Operating Income/Loss -1,063,000 199,000 107,000 -60,000 -57,000

Eliminations

Depreciation & Amortization -4,334,000 -3,714,000 43,000 -109,000 -44,000

External Revenue 617,000 412,000 336,000 457,000 287,000

Fixed Assets - Purchased - Cash Flow 175,000 66,000 369,000 499,000 625,000

Intersegment Revenue -50,329,000 -46,146,000 -40,725,000 -38,337,000 -41,729,000

Operating Expenses - Total -40,307,000 -39,020,000 -38,581,000

Operating Income/Loss -6,055,000 -5,735,000 -82,000 1,140,000 -2,861,000

Total

Depreciation & Amortization 33,255,000 31,816,000 28,892,000 23,178,000 21,406,000

External Revenue 147,306,000 143,210,000 136,462,000 135,567,000 130,784,000

Fixed Assets - Purchased - Cash Flow 34,156,000 30,341,000 29,436,000 36,585,000 33,620,000

Intersegment Revenue 0 0 0 0 0

Operating Expenses - Total 92,957,000 93,173,000 91,939,000

Operating Income/Loss 36,339,000 43,678,000 43,505,000 42,394,000 38,845,000

Company Fundamentals - Segments

Company Name Telkom Indonesia (Persero) Tbk PT (TLKM.JK)

Country of Exchange Indonesia

Country of Headquarters Indonesia

TRBC Industry Group Telecommunications Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 27-11-2023

Statement Data 2022 2021 2020 2019 2018

Period End Date 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Statement Date 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Standardized Currency IDR IDR IDR IDR IDR

Template Type Industrial Industrial Industrial Industrial Industrial

Segments - Business Line By Statement Item (Currency: Indonesia Rupiah)

Field Name TRBC 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Operating Expenses - Total 92,957,000 93,173,000 91,939,000

Consumer 517112, 517111 17,544,000 15,904,000 15,531,000

Eliminations -40,307,000 -39,020,000 -38,581,000

Enterprise 517121, 541511 36,864,000 36,768,000 37,833,000

Mobile 517112 54,051,000 56,864,000 55,449,000

Other 519290, 517112 1,662,000 1,546,000 1,073,000

Wholesale & International Business (WIB) 519290, 517810, 23,143,000 21,111,000 20,634,000

541511

Fixed Assets - Purchased - Cash Flow 34,156,000 30,341,000 29,436,000 36,585,000 33,620,000

Consumer 517112, 517111 9,038,000 10,444,000 9,770,000 10,581,000 6,958,000

Eliminations 175,000 66,000 369,000 499,000 625,000

Enterprise 517121, 541511 5,983,000 4,514,000 5,178,000 5,614,000 5,325,000

Mobile 517112 12,343,000 10,548,000 9,520,000 11,963,000 14,373,000

Other 519290, 517112 5,000.0 13,000 12,000 21,000 18,000

Wholesale & International Business (WIB) 519290, 517810, 6,612,000 4,756,000 4,587,000 7,907,000 6,321,000

541511

Operating Income/Loss 36,339,000 43,678,000 43,505,000 42,394,000 38,845,000

Consumer 517112, 517111 7,579,000 5,894,000 4,561,000 2,588,000 650,000

Eliminations -6,055,000 -5,735,000 -82,000 1,140,000 -2,861,000

Enterprise 517121, 541511 831,000 -307,000 -544,000 -1,233,000 1,216,000

Mobile 517112 26,122,000 34,435,000 32,966,000 34,196,000 33,769,000

Other 519290, 517112 -1,063,000 199,000 107,000 -60,000 -57,000

Wholesale & International Business (WIB) 519290, 517810, 8,925,000 9,192,000 6,497,000 5,763,000 6,128,000

541511

External Revenue 147,306,000 143,210,000 136,462,000 135,567,000 130,784,000

Consumer 517112, 517111 26,354,000 24,930,000 20,957,000 17,706,000 13,891,000

Eliminations 617,000 412,000 336,000 457,000 287,000

Enterprise 517121, 541511 19,161,000 19,141,000 17,729,000 18,701,000 21,054,000

Mobile 517112 85,493,000 84,267,000 83,720,000 87,897,000 85,338,000

Other 519290, 517112 239,000 205,000 219,000 197,000 130,000

Wholesale & International Business (WIB) 519290, 517810, 15,442,000 14,255,000 13,501,000 10,609,000 10,084,000

541511

Intersegment Revenue 0 0 0 0 0

Consumer 517112, 517111 195,000 187,000 1,148,000 786,000 2,290,000

Eliminations -50,329,000 -46,146,000 -40,725,000 -38,337,000 -41,729,000

Enterprise 517121, 541511 24,646,000 22,395,000 18,591,000 16,834,000 17,995,000

Mobile 517112 3,344,000 3,097,000 3,297,000 3,163,000 3,880,000

Other 519290, 517112 2,486,000 2,395,000 1,550,000 1,289,000 886,000

Wholesale & International Business (WIB) 519290, 517810, 19,658,000 18,072,000 16,139,000 16,265,000 16,678,000

541511

Depreciation & Amortization 33,255,000 31,816,000 28,892,000 23,178,000 21,406,000

Consumer 517112, 517111 6,738,000 6,566,000 3,925,000 3,438,000 3,060,000

Eliminations -4,334,000 -3,714,000 43,000 -109,000 -44,000

Enterprise 517121, 541511 3,999,000 3,909,000 3,208,000 2,737,000 2,128,000

Mobile 517112 21,028,000 20,333,000 16,945,000 13,829,000 13,095,000

Other 519290, 517112 19,000 20,000 21,000 21,000 21,000

Wholesale & International Business (WIB) 519290, 517810, 5,805,000 4,702,000 4,750,000 3,262,000 3,146,000

541511

Company Fundamentals - Operating Metrics

Company Name Telkom Indonesia (Persero) Tbk PT (TLKM.JK)

Country of Exchange Indonesia

Country of Headquarters Indonesia

TRBC Industry Group Telecommunications Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Measure system Metric

Statement Data 2018

Period End Date 31-12-2018

Statement Date 31-12-2018

Standardized Currency IDR

Template Type Industrial

Operating Metrics - Standardized (Currency: Indonesia Rupiah)

Field Name 31-12-2018

Subscribers and Other Numbers

Subscribers - Connections - Number - Total 287,911,000

Revenues & Expenses

Sales - Value - Total ###

Company Fundamentals - Valuation

Company Name Telkom Indonesia (Persero) Tbk PT (TLKM.JK)

Country of Exchange Indonesia

Country of Headquarters Indonesia

TRBC Industry Group Telecommunications Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 27-11-2023

Statement Data 2022 2021 2020 2019 2018

Period End Date 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Statement Date 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Standardized Currency IDR IDR IDR IDR IDR

Template Type Industrial - Industrial - Industrial - Industrial - Industrial -

Operating Operating Operating Operating Operating

Valuation - Standardized (Currency: Indonesia Rupiah)

Field Name 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Enterprise Value

Enterprise Value 421,232,312 454,238,355 389,827,937 444,254,000 415,220,312

Enterprise Value, 5 Year Average 424,954,583 435,732,718 429,466,044 418,491,054 391,659,852

Market Capitalization

Market Capitalization 371,483,312 400,211,355 327,895,937 393,277,000 371,483,312

Market Capitalization, 5 Year Average 372,870,183 388,083,918 388,278,444 385,296,054 364,399,052

Price Close

Price Close (End of Period) 3,750.0 4,040.0 3,310.0 3,970.0 3,750.0

Price Close (End of Period), 5 Year Average 3,764.0 3,902.0 3,890.0 3,849.0 3,628.0

FOCF Yield

Free Cash Flow Yield - % 9.4% 8.9% 10.1% 4.5% 2.9%

Free Cash Flow Yield - %, 5 Year Average 7.1% 5.9% 5.0% 4.1% 3.9%

Dividend Yield

Dividend Yield - Common Stock - Net - Issue Specific - % 3.0% 2.4% 2.7% 2.3% 3.1%

Dividend Yield - Common Stock - Net - Issue Specific - % 3.4% 3.5% 4.0% 3.5% 3.8%

Dividend Yield - Common Stock - Net - Issue Specific - %, 5 Year Average 2.7% 2.5% 2.5% 2.4% 2.5%

Dividend Yield - Common Stock - Net - Issue Specific - %, 5 Year Average 3.6% 3.4% 3.1% 2.8% 2.6%

Dividend Yield - Common Stock - Gross - Issue Specific - % 4.0% 3.0% 3.4% 2.8% 3.8%

Dividend Yield - Common Stock - Gross - Issue Specific - % 4.0% 4.2% 4.7% 4.1% 4.5%

Dividend Yield - Common Stock - Gross - Issue Specific - %, 5 Year Average 3.4% 3.0% 3.0% 2.8% 2.9%

Dividend Yield - Common Stock - Gross - Issue Specific - %, 5 Year Average 4.3% 4.0% 3.7% 3.3% 3.1%

Price to Book

Price to Book Value per Share - Issue Specific 2.85 3.36 3.15 3.84 3.63

Price to Book Value per Share - Issue Specific 2.87 3.29 3.20 3.95 3.76

Price to Book Value per Share - Issue Specific, 5 Year Average 3.34 3.67 3.88 4.03 4.05

Price to Book Value per Share - Issue Specific, 5 Year Average 3.38 3.75 4.03 4.22 4.28

Price to Tangible Book

Price to Tangible Book Value per Share 3.07 3.51 3.43 4.22 3.96

Price to Tangible Book Value per Share, 5 Year Average 3.60 3.98 4.25 4.43 4.46

Price to Sales

Price to Revenue from Business Activities - Total per Share 2.52 2.79 2.40 2.90 2.84

Price to Revenue from Business Activities - Total per Share, 5 Year Average 2.69 2.87 2.97 3.10 3.15

Price to FOCF

Price to Free Cash Flow per Share 10.62 11.18 9.87 22.18 34.25

Price to Free Cash Flow per Share, 5 Year Average 14.06 16.99 20.06 24.24 25.36

Price to CF Per Share

Price to Cash Flow per Share 5.67 6.12 5.63 7.75 7.68

Price to Cash Flow per Share, 5 Year Average 6.46 7.00 7.45 7.86 7.82

Price to Diluted EPS

Price to EPS - Diluted - excluding Extraordinary Items Applicable to Common - Total 17.90 16.16 15.76 21.07 20.60

Price to EPS - Diluted - excluding Extraordinary Items Applicable to Common - Total, 5 Year Average 18.10 18.51 19.45 20.30 19.99

Price to Normalized Diluted EPS

Price to EPS - Diluted - excluding Extraordinary Items - Normalized - Total 13.66 18.76 15.20 19.83 20.60

Price to EPS - Diluted - excluding Extraordinary Items - Normalized - Total, 5 Year Average 3.38 3.75 4.03 4.22 4.28

PEG Ratio

PE Growth Ratio -1.11 0.85 1.37 6.02 -1.11

PE Growth Ratio, 5 Year Average -14.03 3.73 3.30 4.12 4.64

EV to Sales

Enterprise Value to Revenue from Business Activities - Total 2.86 3.17 2.86 3.28 3.17

Enterprise Value to Revenue from Business Activities - Total, 5 Year Average 3.06 3.23 3.32 3.41 3.45

EV to EBITDA

Enterprise Value to Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA) 5.04 6.01 5.39 6.77 6.90

Enterprise Value to Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA), 5 Year Average 5.95 6.45 6.70 7.00 7.03

EV to CFO

Enterprise Value to Net Cash Flow from Operating Activities 5.74 6.65 5.97 8.08 9.09

Enterprise Value to Net Cash Flow from Operating Activities, 5 Year Average 6.91 7.68 8.18 8.68 8.75

EV to FOCF

Enterprise Value to Free Cash Flow 12.04 12.69 11.73 25.05 38.28

Enterprise Value to Free Cash Flow, 5 Year Average 16.03 19.15 22.37 26.68 27.78

Company Fundamentals - Pension

Company Name Telkom Indonesia (Persero) Tbk PT (TLKM.JK)

Country of Exchange Indonesia

Country of Headquarters Indonesia

TRBC Industry Group Telecommunications Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 27-11-2023

Statement Data 2022 2021 2020 2019 2018

Period End Date 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Statement Date 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Standardized Currency IDR IDR IDR IDR IDR

Template Type Industrial Industrial Industrial Industrial Industrial

Pension - Standardized (Currency: Indonesia Rupiah)

Field Name 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Funded Status

Funded Status - including Unfunded Plan Obligations -9,031,000 -10,330,000 -11,778,000 -7,022,000 -4,623,000

Funded Status -9,031,000 -10,330,000 -11,778,000 -7,022,000 -4,623,000

Funded Status - Total Pension -9,031,000 -9,692,000 -10,371,000 -6,026,000 -4,428,000

Funded Status - Post-Retirement 0 -638,000 -1,407,000 -996,000 -195,000

Fair Value of Plan Assets 32,633,000 32,557,000 33,381,000 34,079,000 32,485,000

Fair Value of Plan Assets - Total Pension 19,755,000 19,779,000 20,345,000 21,252,000 20,257,000

Fair Value of Plan Assets - Post-Retirement 12,878,000 12,778,000 13,036,000 12,827,000 12,228,000

Projected Benefit Obligation - Total 41,664,000 42,887,000 45,159,000 41,101,000 37,108,000

Projected Benefit Obligation 41,664,000 42,887,000 45,159,000 41,101,000 37,108,000

Projected Benefit Obligation - Total Pension 28,786,000 29,471,000 30,716,000 27,278,000 24,685,000

Projected Benefit Obligation - Post-Retirement 12,878,000 13,416,000 14,443,000 13,823,000 12,423,000

Assumptions - Period-End

Discount Rate - Period End 7.3% 7.0% 6.5% 7.3% 8.3%

Discount Rate - Period End - Total Pension 7.3% 7.0% 6.5% 7.3% 8.3%

Compensation Rate - Period End 8.0% 8.0% 8.0% 8.0% 8.0%

Compensation Rate - Period End - Total Pension 8.0% 8.0% 8.0% 8.0% 8.0%

Income/Expense

Total Pension Plans - Total Pension & Post-Retirement 1,431,000 1,074,000 1,042,000 1,423,000

Post-Retirement Plan Expense 263,000 253,000 167,000 335,000

Total Pension Plan Expense - Total 1,168,000 821,000 875,000 1,088,000

Defined Benefit Income/Expense - Pension & Post-Retirement 1,431,000 1,074,000 1,042,000 1,423,000

Defined Benefit Income/Expense - Total Pension 1,168,000 821,000 875,000 1,088,000

Defined Benefit Post-Retirement Income/Expense 263,000 253,000 167,000 335,000

Interest Cost 391,000 343,000 278,000 448,000

Interest Cost - Total Pension 296,000 264,000 261,000 273,000

Interest Cost - Post-Retirement 95,000 79,000 17,000 175,000

Net Interest Cost 354,000 161,000 76,000 102,000

Net Interest Cost - Total Pension 354,000 161,000 76,000 102,000

Service Cost 378,000 255,000 475,000 651,000

Service Cost - Total Pension 378,000 255,000 475,000 651,000

Actual Return on Assets 984,000 822,000 1,121,000 158,000 315,000

Actual Return on Assets - Total Pension 984,000 822,000 1,121,000 158,000 315,000

Other Pension - Net 308,000 315,000 213,000 222,000

Other Pension - Net - Total Pension 140,000 141,000 63,000 62,000

Other Post-Retirement - Net 168,000 174,000 150,000 160,000

Company Fundamentals - Segments

Company Name Telkom Indonesia (Persero) Tbk PT (TLKM.JK)

Country of Exchange Indonesia

Country of Headquarters Indonesia

TRBC Industry Group Telecommunications Services

CF Template IND

Consolidation Basis Consolidated

Scaling Millions

Period Annual

Export Date 27-11-2023

Statement Data 2022 2021 2020 2019 2018

Period End Date 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Statement Date 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Standardized Currency IDR IDR IDR IDR IDR

Template Type Industrial Industrial Industrial Industrial Industrial

Segments - Geographic Line By Segment (Currency: Indonesia Rupiah)

Field Name 31-12-2022 31-12-2021 31-12-2020 31-12-2019 31-12-2018

Indonesia

External Revenue 139,983,000 136,482,000 130,097,000 130,989,000 127,438,000

Total Non-Current Assets 178,424,000 169,823,000 164,188,000 159,811,000 144,631,000

Foreign

External Revenue 7,323,000 6,728,000 6,365,000 4,578,000 3,346,000

Total Non-Current Assets 3,207,000 2,709,000 3,581,000 3,608,000 3,649,000

Total

External Revenue 147,306,000 143,210,000 136,462,000 135,567,000 130,784,000

International Assets 3,207,000 0 0 0 0

International Sales 7,323,000 0 0 0 0

Total Non-Current Assets 181,631,000 172,532,000 167,769,000 163,419,000 148,280,000

You might also like

- CF-Export-30-11-2023Document8 pagesCF-Export-30-11-2023Sayantika MondalNo ratings yet

- A01252381 - Examen - Edos Fin OXY SimplificadosDocument20 pagesA01252381 - Examen - Edos Fin OXY SimplificadosAnhia ChavezNo ratings yet

- AMAR CFmaruhDocument6 pagesAMAR CFmaruhratuhsNo ratings yet

- CF Export 28 11 2023Document17 pagesCF Export 28 11 2023juan.farrelNo ratings yet

- Company Fundamentals - Income StatementDocument28 pagesCompany Fundamentals - Income StatementThắm TrầnNo ratings yet

- CF-Export-26-02-2024 40Document12 pagesCF-Export-26-02-2024 40v4d4f8hkc2No ratings yet

- CAL BankDocument2 pagesCAL BankFuaad DodooNo ratings yet

- FS Analysis Horizontal Vertical ExerciseDocument5 pagesFS Analysis Horizontal Vertical ExerciseCarla Noreen CasianoNo ratings yet

- CF Export 03 05 2023Document1 pageCF Export 03 05 2023Dhena DarmawanNo ratings yet

- CHB Sep19 PDFDocument14 pagesCHB Sep19 PDFSajeetha MadhavanNo ratings yet

- Discounted Cash FlowDocument9 pagesDiscounted Cash FlowAditya JandialNo ratings yet

- CAG Financials 2020Document4 pagesCAG Financials 2020AzliGhaniNo ratings yet

- Uba Annual Report Accounts 2022Document286 pagesUba Annual Report Accounts 2022G mbawalaNo ratings yet

- Cash Flow From Assets - Solution PDFDocument3 pagesCash Flow From Assets - Solution PDFSeptian Sugestyo PutroNo ratings yet

- Cocoaland Holdings 2Q19 resultsDocument14 pagesCocoaland Holdings 2Q19 resultsSajeetha MadhavanNo ratings yet

- National College of Business Administration & Economics Front Lane Campus (FLC)Document7 pagesNational College of Business Administration & Economics Front Lane Campus (FLC)Abdul RehmanNo ratings yet

- H and V Anal ExerciseDocument3 pagesH and V Anal ExerciseSummer ClaronNo ratings yet

- Q4 2022 Bursa Announcement - 2Document13 pagesQ4 2022 Bursa Announcement - 2Quint WongNo ratings yet

- Restaurant Business Financial ModelDocument16 pagesRestaurant Business Financial ModelRaghava JinkaNo ratings yet

- Aisha Steel Mills LTDDocument19 pagesAisha Steel Mills LTDEdnan HanNo ratings yet

- Cocoland Holdings 4Q 2018 Results SummaryDocument15 pagesCocoland Holdings 4Q 2018 Results SummarySajeetha MadhavanNo ratings yet

- FSA Tutorial 1Document2 pagesFSA Tutorial 1KHOO TAT SHERN DEXTONNo ratings yet

- Cocoaland Holdings Berhad: (Incorporated in Malaysia)Document15 pagesCocoaland Holdings Berhad: (Incorporated in Malaysia)Sajeetha MadhavanNo ratings yet

- Vitrox q22020Document16 pagesVitrox q22020Dennis AngNo ratings yet

- CHB Mar19 PDFDocument14 pagesCHB Mar19 PDFSajeetha MadhavanNo ratings yet

- SomewhatDocument6 pagesSomewhatPauline VejanoNo ratings yet

- Mayes 8e CH05 SolutionsDocument36 pagesMayes 8e CH05 SolutionsRamez AhmedNo ratings yet

- Annual Report of Fy 2021 22Document156 pagesAnnual Report of Fy 2021 22DUBEY ADARSHNo ratings yet

- Forecasting ProblemsDocument7 pagesForecasting ProblemsJoel Pangisban0% (3)

- FM ProjectDocument22 pagesFM ProjectJunaid MalikNo ratings yet

- Jamna Auto 2017-18Document184 pagesJamna Auto 2017-18Karun DevNo ratings yet

- AmreliDocument5 pagesAmreliasad.anisonsNo ratings yet

- Session 5 Financial Statement Analysis Part 1-2Document17 pagesSession 5 Financial Statement Analysis Part 1-2Prakriti ChaturvediNo ratings yet

- Safaricom PLC Earnings Report H1 2023 Report v1Document13 pagesSafaricom PLC Earnings Report H1 2023 Report v1Solomon MainaNo ratings yet

- Comparative Financial StatementsDocument2 pagesComparative Financial StatementsomairNo ratings yet

- LWL Dec2021Document7 pagesLWL Dec2021Shabry SamoonNo ratings yet

- Introduction To Business Finance Feasibility Plan of Skydiving in KarachiDocument18 pagesIntroduction To Business Finance Feasibility Plan of Skydiving in KarachiAsad HaiderNo ratings yet

- Activision Blizzard IncDocument10 pagesActivision Blizzard IncTay Yu JieNo ratings yet

- Competitor 1 Sanofi Aventis Pakistan Limited Balance Sheets and Income Statements 2016-2020Document6 pagesCompetitor 1 Sanofi Aventis Pakistan Limited Balance Sheets and Income Statements 2016-2020Ahsan KamranNo ratings yet

- CF-Export-05-03-2024 7Document11 pagesCF-Export-05-03-2024 7v4d4f8hkc2No ratings yet

- 2018 ResultsDocument36 pages2018 ResultstheredcornerNo ratings yet

- Vitrox q42019Document17 pagesVitrox q42019Dennis AngNo ratings yet

- Enterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Document8 pagesEnterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Fuaad DodooNo ratings yet

- GCB-Q3 2023 - Interim - ReportDocument16 pagesGCB-Q3 2023 - Interim - ReportGan ZhiHanNo ratings yet

- BCIC CF-Export-19-12-2023Document7 pagesBCIC CF-Export-19-12-2023ratuhsNo ratings yet

- Vitrox q42021Document17 pagesVitrox q42021Dennis AngNo ratings yet

- Good Hope PLC: Annual ReportDocument11 pagesGood Hope PLC: Annual ReporthvalolaNo ratings yet

- 6.1 Financial Model Working - Lecture 30Document63 pages6.1 Financial Model Working - Lecture 30Alfred DurontNo ratings yet

- 2.1 Financial Model Working - Lecture 26Document51 pages2.1 Financial Model Working - Lecture 26Alfred DurontNo ratings yet

- BOC Kenya H1 2020 Group ResultsDocument2 pagesBOC Kenya H1 2020 Group ResultsValamunis DomingoNo ratings yet

- Financial Planning: 6.1 Start-Up Cost and Capital ExpenditureDocument4 pagesFinancial Planning: 6.1 Start-Up Cost and Capital ExpenditurearefeenaNo ratings yet

- Bangladesh q3 Report 2020 Tcm244 556009 enDocument8 pagesBangladesh q3 Report 2020 Tcm244 556009 entdebnath_3No ratings yet

- The WWF Indonesia Foundation and Subsidiaries Consolidated Statement of Financial Position 30 June 2020Document4 pagesThe WWF Indonesia Foundation and Subsidiaries Consolidated Statement of Financial Position 30 June 2020Mohammad Abram MaulanaNo ratings yet

- Habib Motors 2022Document6 pagesHabib Motors 2022usmansss_606776863No ratings yet

- AYER HOLDINGS BERHAD - Financial Report 2021-16-17Document2 pagesAYER HOLDINGS BERHAD - Financial Report 2021-16-172023149467No ratings yet

- 2018 q2 Servus Financial StatementsDocument13 pages2018 q2 Servus Financial Statements1flailstarNo ratings yet

- Nabil Bank Q1 FY 2021Document28 pagesNabil Bank Q1 FY 2021Raj KarkiNo ratings yet

- DATEDocument10 pagesDATEbiancaftw90No ratings yet

- PSO StatementDocument1 pagePSO StatementNaseeb Ullah TareenNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Quiz ConsolidatedDocument131 pagesQuiz ConsolidatedSudhanshu GuptaNo ratings yet

- Citroen C4 Picasso/Grand Picasso BilmetropolenDocument5 pagesCitroen C4 Picasso/Grand Picasso BilmetropolenAlberto Miglino100% (1)

- 1 s2.0 S0304885323009770 MainDocument8 pages1 s2.0 S0304885323009770 Mainzmaxprom5No ratings yet

- Digital Transducers: Group 3Document76 pagesDigital Transducers: Group 3Jasmine RaiNo ratings yet

- IELTS PART 1 (Autoguardado)Document8 pagesIELTS PART 1 (Autoguardado)CARLOS CAICEDONo ratings yet

- 2023 Gaming Report PDFDocument57 pages2023 Gaming Report PDFCésar HéctorNo ratings yet

- Cloze Test For The Upcoming SSC ExamsDocument9 pagesCloze Test For The Upcoming SSC ExamsAbhisek MishraNo ratings yet

- Sub Engineer Test Model PaperDocument8 pagesSub Engineer Test Model PaperZeeshan AhmadNo ratings yet

- Presentation On AIR POWERED VEHICLEDocument26 pagesPresentation On AIR POWERED VEHICLEVishal SrivastavaNo ratings yet

- Channel CapDocument9 pagesChannel CapDeepika RastogiNo ratings yet

- Radiant Heating and Cooling SystemDocument8 pagesRadiant Heating and Cooling SystemLaurentiuNo ratings yet

- Optical Burst Switching (OBS)Document27 pagesOptical Burst Switching (OBS)adityaNo ratings yet

- 524 799 Coach - K - Coach - Knight - CaseDocument15 pages524 799 Coach - K - Coach - Knight - Casekaushalmighty100% (1)

- Revised Circular On Secretariat Meeting Held On 9th July, 2023Document4 pagesRevised Circular On Secretariat Meeting Held On 9th July, 2023Mohit SoniNo ratings yet

- Prismatic Oil Level GaugeDocument2 pagesPrismatic Oil Level GaugevipulpanchotiyaNo ratings yet

- Craftsman: TractorDocument64 pagesCraftsman: TractorsNo ratings yet

- Chapter 4 Duality and Post Optimal AnalysisDocument37 pagesChapter 4 Duality and Post Optimal AnalysisMir Md Mofachel HossainNo ratings yet

- Beam Loader Tributary ExcelDocument2 pagesBeam Loader Tributary ExcelHari Amudhan IlanchezhianNo ratings yet

- Dual Rectifier Solo HeadDocument11 pagesDual Rectifier Solo HeadВиктор АлимовNo ratings yet

- 8959C4F253F33BB139F788350D0E6D0035455AB9A56BFAC9F3070E66F25AC10EDocument20 pages8959C4F253F33BB139F788350D0E6D0035455AB9A56BFAC9F3070E66F25AC10Edroping cowsNo ratings yet

- Entrepreneurship & New Venture Management 6e - Chapter 1Document19 pagesEntrepreneurship & New Venture Management 6e - Chapter 1Hlulani Decision50% (2)

- FoCal Multi-class Toolkit GuideDocument32 pagesFoCal Multi-class Toolkit Guidethyagosmesme100% (1)

- Gmail - DFA Passport Appointment System - Confirmation Notification PDFDocument2 pagesGmail - DFA Passport Appointment System - Confirmation Notification PDFGarcia efrilNo ratings yet

- Guide Spec DX Air Outdoor Condensing Unit 2 2017Document5 pagesGuide Spec DX Air Outdoor Condensing Unit 2 2017JamesNo ratings yet

- Walmart Drug ListDocument6 pagesWalmart Drug ListShirley Pigott MDNo ratings yet

- Q Asgt - Biz Law - A192Document10 pagesQ Asgt - Biz Law - A192otaku himeNo ratings yet

- RFPDocument88 pagesRFPJayaram Peggem P0% (1)

- Benguet Management v. Keppel BankDocument3 pagesBenguet Management v. Keppel BankChester BryanNo ratings yet

- pc102 - Final ProjectW13 - Ramon GutierrezDocument10 pagespc102 - Final ProjectW13 - Ramon GutierrezEJ LacdaoNo ratings yet

- Kick Control: BY: Naga Ramesh D. Assistant Professor Petroleum Engineering Dept. KlefDocument13 pagesKick Control: BY: Naga Ramesh D. Assistant Professor Petroleum Engineering Dept. Klefavula43No ratings yet