Professional Documents

Culture Documents

SSRN Id3472102

Uploaded by

oratschilde.aiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SSRN Id3472102

Uploaded by

oratschilde.aiCopyright:

Available Formats

SYNDICATED LENDING IN NIGERIA: QUESTIONS AND ANSWERS

Ose Adeoluwa Binitie

Queen Mary, University of London

18th October 2019

Working Paper Series

This

is

a

question

and

answer

styled

report

with

regard

to

syndicated

lending

in

Nigeria.

1.

What

laws

govern

syndicated

loans

in

Nigeria?

There

is

no

singular

law

governing

syndicated

lending

in

Nigeria.

Also,

the

agreement

may

specify

the

preferred/applicable

law

in

the

syndicated

loan

agreement.

However,

certain

laws

in

Nigeria

may

place

requirements

on

parties

to

syndicated

lending

facilities,

especially

as

regards

taxation,

as

well

as

lending

rates.

a.

The

Companies

and

Allied

Matters

Act

2004,

where

the

loan/debenture

has

to

be

registered

under

the

Act

b

Banks

and

Other

Financial

Institutions

Act

2002

c.

Central

Bank

of

Nigeria

Act

2007

d.

CBN

Rules

and

Guidelines

e.

Stamp

duties

Act

2.

Who

are

the

parties

to

a

syndicated

loan

agreement?

a.

The

Borrower

b.

The

Arranging

Bank

c.

Participating

Banks

d.

Agent

bank

(Security

trustee)

3.

What

documents

are

required

for

a

syndicated

loan

agreement?

a.

Mandate

Letter

b.

Information

Memorandum

c.

Facility

Document

d.

Letters

of

Guarantee

and

Collateral

Agreements

4.

What

kind

of

funds

can

be

provided

to

a

borrower

in

a

syndicated

loan

facility?

1

Electronic copy available at: https://ssrn.com/abstract=3472102

It could be a credit line, a fixed amount or a combination of both.

5. What are the different types of loan syndications available?

a. Underwritten Deal-‐ This is a situation whereby the arranger guarantees the whole

loan and then proceeds to syndicate the loan. Where the arranger cannot fully subscribe

the loan, they are forced to absorb the difference and they may later try to sell to

investors.

b. Best Efforts Syndication:-‐ This is a syndication whereby the arranger commits to

underwrite less than the entire amount of the loan.

c. Club Loan:-‐ This is a smaller loan that is pre-‐marketed to a group of relationship

lenders.

6. What is the role of a mandate in syndicated lending?

A mandate is a document granted by the borrower to an arranging bank setting out the

financial terms of the proposed loan, authorizing the arranging bank to arrange the

syndication and confirming the exclusivity of the mandate.

7. On what conditions is the offer set out in the mandate?

a. The negotiation of a credit agreement and other documentation being satisfactory to

the syndicate.

b. There being no material adverse change.

c. There being no concurrent syndication by the borrower’s group.

d. Final credit approval by the bank.

e. Legal and financial diligence by the banks.

8. Are there any limits under Nigerian Law to which individual lenders may lend a

borrower?

According to the Central Bank of Nigeria Revised Guidelines for Finance Companies in

Nigeria, April 2014, the maximum loan by a finance company to any person or

corporate organization or maximum investment in any venture shall be 20% of the

finance company’s shareholders’ funds unimpaired by losses.

9. What are the standard covenants in syndicated loans?

a. Supply of information

b. Negative pledge

c. Restriction on disposals

2

Electronic copy available at: https://ssrn.com/abstract=3472102

d. Pari passu clause

10. How can it be ensured that there is an equal sharing of risk among participating

banks?

By inserting a sharing clause to ensure there is an equal sharing of default risk. It must

be couched in such a way that the Lead/Arranging Bank does not exploit its possession

of the borrower’s deposits and that there is a pro rata share of the borrower’s returns

with other banks in the syndicate.

11. What are the different forms of the pro rata sharing clause?

The different aspects include double dipping, subrogation or assignment, syndicate

equality, etc.

12. How may banks guard interest in the case of a default by the borrower?

By the use of a default interest clause, which increases the interest rate which is payable

on amounts that are not paid when they are due.

13. Is it possible for the borrower to make an early payment on the loan? How?

Yes, with the use of a prepayment clause.

14. Are there any guarantees that need to be obtained with regard to syndicated

lending?

Optionally, the underwriting bank could guarantee that the entire loan amount would

be made available to the borrower.

There is usually a guarantee agent, in charge of the implementation of guarantees for

the syndicated loan.

15. Are there any tax exemptions in syndicated lending in Nigeria?

There are withholding tax exemptions for companies that are incorporated in Nigeria, as

well as where the lender is a company incorporated in one of the 14 countries that have

double taxation treaties (DTTs) with Nigeria. There are also no provisions under Nigerian

laws for anti treaty shopping rules.

16. What transactions are syndicated loans used in?

For the construction of major infrastructure projects by government, projects by public

and private companies, and so forth.

3

Electronic copy available at: https://ssrn.com/abstract=3472102

17. When is underwriting to be advised on a syndicated loan facility?

It all depends. An underwritten loan incurs a higher premium to be paid to the arranging

bank, and it is also beneficial to the profile of the arranging bank. However, it would

increase borrowing costs for the lender. But the underwriting may ensure greater

efficiency in the administrative duties of the arranging bank.

18. What role does foreign exchange play in syndicated loan transactions?

It functions to preserve the value of the lenders’ currency. In addition, it is easier to

raise loans in foreign currency especially because the London Interbank Rate (LIBOR),

which has become the benchmark rate for about $350 trillion in financial transactions

globally is relatively low.

19. What are the advantages of syndicated lending?

Borrowers get access to large financing amounts, long financing terms, a large number

of participating banks and low financing thresholds.

20. What clauses are peculiar to syndicated lending agreements?

Pro rata sharing clauses

This clause specifies how lenders share or allocate payments from the borrower under

the facility agreement.

21. What is the legal effect of pro rata sharing clauses used in syndicated loan

agreements?

It is to ensure equality in the repayment of loans by the borrower. It provides that all

payments must be distributed pro rata to each lender according to their participation

percentages.

22. What does a pro rata sharing clause provide for?

It provides that if any bank receives a greater proportion of its share, it must

immediately pay the excess to the agent, who redistributes to the banks pro rata and

the paying bank is subrogated to the claims of the banks that are paid.

23. What are the advantages of the pro rata sharing clause in a syndicated loan

agreement?

4

Electronic copy available at: https://ssrn.com/abstract=3472102

a. It is a clause to uphold equality among the lenders. It is also an indirect protection for

the borrower.

b. It functions to discourage a syndicate member from unilaterally enforcing its rights

under the loan syndication since it will be liable to share the proceeds of the litigation.

24. Is it possible to extend the sharing clause to give a contractual right to a syndicate

member, that has shared funds with the other syndicate members to be subrogated to

the rights of the other syndicate members?

Yes, in a situation where a third party satisfies a debtor's debt owed to a creditor, the

third party is entitled to be subrogated to the rights of that creditor.

25. Should the syndicate lenders' rights under the sharing clause be subject to prior

equities or affected by bankruptcy and insolvency laws?

This should not be an issue if the conditions precedent to the facility agreement are

properly complied with and no asset of the borrower is secured by other loans. Also, if

there is a fixed charge in place, the lenders rank high on the insolvency ladder should

the occasion arise.

26. Is it advisable to allow double dipping from the deposit agreement to offset the

unpaid proportions of the other syndicate members?

We may find the borrower resisting the inclusion of a provision that allows for double-‐

dipping, but it is to the advantage of the lenders that any excess deposit funds held by a

recovering member with regard to the borrower be discharged to offset the unpaid

proportions of the other syndicate members.

27. What does a mandate letter contain?

Term sheet containing the financial terms of the proposed loan and the offer, which

would be subject to conditions. It contains things like amount, term, repayment

schedule, interest margin, fees, special terms, and a general statement that the loan will

contain representations and warranties, covenants and events of default, etc.

28. Is it possible for the arranging bank to unilaterally revise the pricing terms and

structure of the syndication facility?

Yes, it can, to ensure the overall success of the facility, using the market flex clause.

29. When should the market flex clause be used?

It should be used when the arrangers are assuming a massive underwriting risk.

5

Electronic copy available at: https://ssrn.com/abstract=3472102

30. Are there any circumstances in which a mandate can be legally binding?

Yes, as long as the legal terms are clearly delineated, and if it is not expressed to be

subject to contract.

31. Are there any circumstances in which an arranging bank’s underwriting

commitment legally binding?

No, it is not usually legally binding.

Yes, as long as the legal terms are clearly delineated, even if it is not expressed to be

subject to contract.

32. What are the functions of the arranging bank? What must the arranging banks be

seen to do?

i. Assist the borrower in preparing information memorandum

ii. Solicit expressions of interest from other banks

iii. Negotiate loan documentation

33. How can individual lending banks protect themselves with regard to the principle

of syndicate democracy?

Ensuring the borrower has an account in the individual bank.

34. What legal defects may arise to make the participating banks not liable to lend?

a. Introduction of exchange control prohibiting the borrower from making payments to

foreign creditors, if it is a matter of time before the default occurs

b. If an event of default occurs

c. If there is a material adverse change

d. Where the borrower’s certificates are found to be defective

35. What charges created would require registration at the Corporate Affairs

Commission?

A floating charge over the assets of the borrower, book debts etc. The floating charge

must also be registered with FIRS.

36. How can a borrower deal with high interest rates in Nigeria?

6

Electronic copy available at: https://ssrn.com/abstract=3472102

He can do several draw downs or ask for floating rate, instead of fixed, bearing in mind

the present economic conditions and also take into account the currency to be used for

the loan.

39. Will the borrower be discharged if it pays the agent but the agent fails to pay the

banks?

Yes.

40. What happens if the borrower does not apply the proceeds of the loan toward the

stated purpose?

It could trigger an event of default if that is stated in the facility. It could be made a

warranty, which may suspend certain rights of the borrower, as provided in the

agreement

41. Do investment grade borrowers have an advantage over individual borrowers?

Yes, they can usually obtain better documentary terms than borrowers rated

speculative

42. How can individual borrowers make up the shortfall?

By registering as a company or by borrowing through a company.

43. What must be done for banks to be obliged to make a loan to a borrower?

a. The representations and warranties must be true and up to date.

b. No event of default or which with giving of notice, lapse of time or other conditions

that would constitute an event of default has occurred.

c. No material adverse change with the borrowers financial condition.

d. The borrowers’ certificates are made available.

44. What condition precedents should be included in syndicated lending agreements?

a. Evidence of corporate authorisations and copies of the borrower’s documents.

b. Borrower’s most recent financial information.

c. Copies of relevant insurance policies.

e. Copies of any reports presented by any third parties.

f. Copies of executed transaction documents, including security and inter-‐creditor

agreements.

7

Electronic copy available at: https://ssrn.com/abstract=3472102

45. What could prevent participating banks from lending?

a. If an event of default occurs, like representations and warranties are not true/kept or

breach of other material terms.

b. If there is a material adverse change.

c. Breach of conditions precedent-‐Where the borrower’s certificates are found to be

defective, If the borrower has breached a financial ratio or granted security in breach of

a negative pledge.

d. Where there is an illegality.

e. If a subsequent defect has arisen

f. If it is only a matter of time before a default occurs

46. What remedies are open to the borrower where the banks refuse to lend?

Suing the banks based on promissory estoppel

Also where loss suffered by failure of banks to lend arises in the ordinary course of

things, they are recoverable

47. How can a borrower deal with high interest rates in Nigeria?

He can do several draw downs or ask for floating rate instead of fixed, bearing in mind

the present economic conditions and also take into action the currency to be used for

the loan.

48. What are the usual warranties in a syndicated loan agreement?

They are usually standardized representations and warranties by the borrower.

Warranties are in 2 divisions-‐legal and commercial

a. Legal warranties

The borrower will make warranties as to his legal status, his powers and authorisations,

the enforceability of his obligations, that his company is duly incorporated.

b. Commercial warranties

Warranties as to no litigation, whether actual or threatened, borrower’s last group

accounts are materially correct, the information memorandum is correct and not

misleading, projections are reasonably based, no material omissions, no material

adverse change, the financial conditions since the date of last accounts, no material

defaults on contracts or other debt.

49. What is the function of the evergreen clause?

It renders the representations and warranties as promises for the future.

8

Electronic copy available at: https://ssrn.com/abstract=3472102

50. Is a security document relevant to a syndicated facility?

Yes, it is advised in order to secure the assets of the borrower in the interest of the

lenders.

51. What security is advisable to take in a syndicated lending?

a. A full debenture containing fixed and floating charges over all the assets of the

borrowing company

52. What is the function of negative pledge?

This clause provides that that the borrower is prohibited from creating subsequent

charges or security interests over the property it wishes to use as security in the

syndicated facility agreement.

53. What market practice clauses are found in LMA agreements?

a. Market Disruption Clause

This clause requires the borrower to compensate the lenders for actual costs of funds in

the event of a market disruption. It could be that LIBOR cannot be determined (because

no screen rate is available) or where one of the lenders (30-‐50% participation) informs

the facility agent that the cost of funding at LIBOR exceeds the LIBOR rate that applies to

that loan, according to the terms of the agreement. To cover the cost of the lenders’

funds, a substitute rate that is binding on all lenders will apply or the rate could be

calculated on a lender-‐by-‐lender basis.

However, the borrower could insert a clause in the agreement to ensure that the

market disruption clause is only triggered or invoked where the bank is unable to fund

the loan as a result of circumstances affecting relevant interbank market generally.

54. What legal defects may arise to make the participating banks not liable to lend?

Introduction of an exchange control prohibiting the borrower from making payments to

foreign creditors, if it is a matter of time before the default occurs.

55. What determines the scope of financial covenants in syndicated loans?

a. The nature of the borrower determines the scope – loan to a corporate versus

government borrower.

b. It covers/determines the kind of risk that can be undertaken by the lenders.

c. It determines whether the loan is secured or unsecured.

9

Electronic copy available at: https://ssrn.com/abstract=3472102

56. What clauses should borrowers look for in their other syndicated loan

agreements?

Loans that put a restraint on prejudicial management of the borrower’s business.

57. What clauses are designed to protect the margin or the banks gross profit or the

whole of the loan?

a. Tax grossing up clause

Grossing up protects the bank against withholding taxes on interests and ensures that

the bank receives 100% of its funds. Under this clause, if the borrower must deduct

taxes or if tax is withheld at source, the borrower will pay extra so that the bank

receives the full loan amount. It could be provided that the borrower may prepay that

bank.

b. Increased risks

If any law or official directive increases the bank’s underlying costs, the borrower must

compensate as certified by the bank and may prepay that bank.

c. VAT Clause

Here, payments chargeable as regards VAT shall be paid by the borrower to the bank.

58. What quasi security clauses may be added to the syndicated facility agreement in

addition to securing some parts of the loan with the borrower’s assets?

Sale and leaseback, set off, financial leasing, recourse factoring, retention of title

clauses, sale and purchase (repos), stock borrowings, etc.

59. What powers do majorities of banks have in a syndicated loan agreement and how

can the syndicate democracy principle protect it?

Majority members have the following powers:

a. Waivers of breaches of covenants or consents to the relaxation of covenants such as

negative pledge.

b. Determining whether an incorrect representation or an adverse change in financial

condition is material enough for the purposes of events of default.

c. Directing the agent bank to accelerate the loans, following an event of default.

d. Clauses can be amended once consent is obtained by majority of lenders.

Basically, the majority of the banks will decide whether to forgive a slow borrower or a

borrower inefficient in repaying his loans.

10

Electronic copy available at: https://ssrn.com/abstract=3472102

60. Are there amendments by the majority that are not permitted?

Yes.

a. Waiver of conditions precedent to the advance of loans.

b. Power to extend maturities or reduce the amounts of payments or the interest rates,

or to change the currency, extend commitment, change obligors, certain matters.

61. Do banks have other options when an event of default occurs other than making

the whole loan immediately payable?

Some of the banks can sell their participating interests to hedge funds or other

specialized recovery firms, like AMCON.

62. Can implementation of changes in the loan agreement cause any kind of

problems?

Yes, it can impede private restructuring and cause problems in the case of insolvency.

63. Should there be a clause to ensure a restraint on prejudicial management of the

borrower’s business?

Yes, if the borrower’s business will contribute to funding the repayment of the loan. For

example, a sale by the borrower of all its assets, provisions for early termination if the

borrower does not comply with the terms of the agreement or events happen which

make it likely that the borrower will not be able to perform.

64. Can banks individually sue for unpaid amounts?

Yes, but they may have to share under the pro rata sharing clause.

In cases of project finance, with a no action clause, the trustee may have the sole right

to take out proceedings on behalf of the lenders.

65. What are the methods of enforcement in the case of an event of default?

a. Taking possession of the borrower’s security.

b. Winding up of the borrower’s company.

c. Appointment of a receiver/manager for the security.

d. Bringing an action for foreclosure.

e. An action for debt recovery.

f. Exercising a power of sale of the secured asset.

g. Taking possession of the security.

66. What are the various remedies for the breach of conditions or warranties in a

syndicated loan facility?

Trigger of an event of default, Suspension, cancellation, acceleration, rescission, and

11

Electronic copy available at: https://ssrn.com/abstract=3472102

suing for damages.

REFERENCES:

1. Legal Vision, 8 Key Terms to Consider When Reviewing a Loan

Agreement,https://legalvision.com.au/8-‐key-‐terms-‐to-‐consider-‐when-‐reviewing-‐a-‐loan-‐

agreement/

2. Lexology, https://www.lexology.com/library/detail.aspx?g=d3cfd2c1-‐7887-‐4184-‐

9945-‐b1e50966407d

3. Sharing Clauses in Syndicated Loan Agreements, http://v1.lawgazette.com.sg/2002-‐

2/Feb02-‐focus3.htm

4. Pinsent Masons, Preconditions to Lending, https://www.pinsentmasons.com/out-‐

law/guides/pre-‐conditions-‐to-‐lending

5. Lexology, Structuring a Lending Transaction in Nigeria

www.lexology.com/library/detail.aspx?g=f817a82f-‐67ce-‐4871-‐b506-‐956d658acad8

6. Central Bank of Nigeria Revised Guidelines for Finance Companies in Nigeria, April

2014

7. Finweb, The 3 Types of Syndicated Loans https://finweb.com/loans/the-‐3-‐types-‐of-‐

syndicated-‐loans.html

8.Investopedia, Upstream Guarantee www.investopedia.com/terms/u/upstream-‐

guarantee.asp

9. https://ukpracticallaw.thomsonreuters.com

10. Gluchowski J, Tax Clauses in Syndicated Loan Agreements

www3.mruni.eu/ojs/intellectual-‐economics/article/view/view/4/998/4537

11. Mondaq, What to Expect When You’re Expecting the End of Libor

www.mondaq.com/unitedstates/x/817716/Commodities+Stock+Exchanges/What+to+E

xpect+When+Youre+Expecting+the+end+of+Libor

12.https://www.lexisnexis.com/uk.lexispsl/bankingandfinance/document/391290/55KX

-‐XBB1-‐F185-‐SOMM-‐00000-‐00/Market_disruption_clauses_in_facility_agreements

13.https://heinonline.org/HOL/LandingPage?handle=hein.journals/lawfinancemr3&div=

12

Electronic copy available at: https://ssrn.com/abstract=3472102

8&id=&page=

14. Investopedia, Libor, https://www.investopedia.com/terms/l/libor.asp

13

Electronic copy available at: https://ssrn.com/abstract=3472102

You might also like

- Loan SyndicationDocument12 pagesLoan SyndicationArpit Jain100% (1)

- Real Estate Principles A Value Approach 5Th Edition Ling Solutions Manual Full Chapter PDFDocument19 pagesReal Estate Principles A Value Approach 5Th Edition Ling Solutions Manual Full Chapter PDFoctogamyveerbxtl100% (8)

- Banking Unit 4Document12 pagesBanking Unit 4PaatrickNo ratings yet

- Real Estate Principles A Value Approach 5th Edition Ling Solutions ManualDocument23 pagesReal Estate Principles A Value Approach 5th Edition Ling Solutions Manualleightonayarza100% (18)

- Lu 6Document40 pagesLu 6Phetho MachiliNo ratings yet

- Loan Syndication: 1. Pre-Signing StageDocument5 pagesLoan Syndication: 1. Pre-Signing StageFarhan Ashraf SaadNo ratings yet

- Assignment IIDocument47 pagesAssignment IIapi-19984025No ratings yet

- Group 3Document9 pagesGroup 3eranyigiNo ratings yet

- Loan SyndicationDocument2 pagesLoan SyndicationChandan Kumar ShawNo ratings yet

- Corporate BankingDocument6 pagesCorporate BankingDeven RanaNo ratings yet

- TB Bank loans-đã chuyển sang wordDocument8 pagesTB Bank loans-đã chuyển sang wordVi TrươngNo ratings yet

- Law and Practice of International FinanceDocument9 pagesLaw and Practice of International FinanceCarlos Belando PastorNo ratings yet

- This Study Resource Was: Page - 1Document9 pagesThis Study Resource Was: Page - 1NishiNo ratings yet

- Understanding MortgagorsDocument2 pagesUnderstanding MortgagorsDiane ヂエンNo ratings yet

- This Study Resource Was: Page - 1Document9 pagesThis Study Resource Was: Page - 1NishiNo ratings yet

- Indonesia Loans & Secured Financing - Getting The Deal Through - GTDTDocument12 pagesIndonesia Loans & Secured Financing - Getting The Deal Through - GTDTDewa Gede Praharyan JayadiputraNo ratings yet

- This Study Resource Was: Page - 1Document9 pagesThis Study Resource Was: Page - 1NishiNo ratings yet

- BNKINGDocument6 pagesBNKINGjyotiprashad041No ratings yet

- The Risks and Rewards of Multiple Lender FinancingsDocument5 pagesThe Risks and Rewards of Multiple Lender Financingsjude loh wai sengNo ratings yet

- CH 8 Sources of Business Finance Class 11 BSTDocument19 pagesCH 8 Sources of Business Finance Class 11 BSTRaman SachdevaNo ratings yet

- 3.2. Law Relating To Commercial Banks-2Document51 pages3.2. Law Relating To Commercial Banks-2Madan ShresthaNo ratings yet

- Edurev - In-Social Studies SST Class 10Document9 pagesEdurev - In-Social Studies SST Class 10asfiyarahmath2008No ratings yet

- Lecture 4 - Syndicated - LoansDocument12 pagesLecture 4 - Syndicated - LoansYvonneNo ratings yet

- Important Quess) Tions ch-3Document9 pagesImportant Quess) Tions ch-3AnnaNo ratings yet

- Tutorial For Financial Markets & Institutions An Economic Analysis of Financial StructureDocument3 pagesTutorial For Financial Markets & Institutions An Economic Analysis of Financial StructureHi I'm ConyNo ratings yet

- A Domestic Framework For Group InsolvencyDocument23 pagesA Domestic Framework For Group InsolvencyPradhuymn MishraNo ratings yet

- Company LawDocument6 pagesCompany LawshreyanshiNo ratings yet

- Loan SyndicationDocument57 pagesLoan SyndicationSandya Gundeti100% (1)

- Introduction of Credit Default Swaps For Corporate Bonds in IndiaDocument11 pagesIntroduction of Credit Default Swaps For Corporate Bonds in Indiagagan3211No ratings yet

- Loan SyndicationDocument4 pagesLoan Syndicationsantu15038847420No ratings yet

- Lecture 4 - Syndicated LoansDocument13 pagesLecture 4 - Syndicated LoansEmmanuel MwapeNo ratings yet

- Chapter 7. Sources of FinanceDocument20 pagesChapter 7. Sources of FinanceHastings KapalaNo ratings yet

- Corporate Finance Foundations Global Edition 15th Edition Block Solutions ManualDocument9 pagesCorporate Finance Foundations Global Edition 15th Edition Block Solutions Manualderrickjacksondimowfpcjz100% (27)

- How Bankruptcy Laws Affect Loan Supply and Recovery: Lecturer, School of Business and Economics North South UniversityDocument14 pagesHow Bankruptcy Laws Affect Loan Supply and Recovery: Lecturer, School of Business and Economics North South UniversitySalauddin Imran MumitNo ratings yet

- This Study Resource Was: Page - 1Document9 pagesThis Study Resource Was: Page - 1NishiNo ratings yet

- Loans and AdvanceDocument8 pagesLoans and AdvanceDjay SlyNo ratings yet

- Bankers Lien 3Document9 pagesBankers Lien 3NishiNo ratings yet

- 3.foreign Loan SyndicationDocument19 pages3.foreign Loan SyndicationAPOLLO BISWASNo ratings yet

- Financial Markets (Chapter 10)Document3 pagesFinancial Markets (Chapter 10)Kyla Dayawon100% (1)

- Banking Law FinalDocument20 pagesBanking Law FinalRoy Vincent ManiteNo ratings yet

- The Nigeria Deposit Insurance Corporation: The Journey So Far BYDocument26 pagesThe Nigeria Deposit Insurance Corporation: The Journey So Far BYrapidshonuffNo ratings yet

- Types of Lending and Facilities PDFDocument18 pagesTypes of Lending and Facilities PDFKnowledge GuruNo ratings yet

- Mortgage Markets and Derivatives 2Document35 pagesMortgage Markets and Derivatives 2caballerod0343No ratings yet

- This Study Resource Was: Page - 1Document9 pagesThis Study Resource Was: Page - 1NishiNo ratings yet

- Loan SyndicationDocument35 pagesLoan Syndicationdivyapillai0201_No ratings yet

- Loan Agreement As A Valid Form of Agreement in India.: Name: Trishit Kumar SatpatiDocument16 pagesLoan Agreement As A Valid Form of Agreement in India.: Name: Trishit Kumar SatpatiSAURABH SINGHNo ratings yet

- Class 5 Notes 27062022Document3 pagesClass 5 Notes 27062022Munyangoga BonaventureNo ratings yet

- Bank Management FIN 303: Overview of Loan SyndicationDocument4 pagesBank Management FIN 303: Overview of Loan SyndicationTashahudul IslamNo ratings yet

- FM302: Tutorial Questions Topic: Secured Transactions in The Pacic Region (Week 11)Document5 pagesFM302: Tutorial Questions Topic: Secured Transactions in The Pacic Region (Week 11)Hitesh MaharajNo ratings yet

- Syndicate LaonDocument6 pagesSyndicate Laonarpitm61No ratings yet

- Week 12: Chapter 17-Banking and Management of Financial InstitutionsDocument4 pagesWeek 12: Chapter 17-Banking and Management of Financial InstitutionsJay Ann DomeNo ratings yet

- Chapter01 TestbankDocument40 pagesChapter01 TestbankDuy ThứcNo ratings yet

- 14 Financing Foreign Investment: Chapter ObjectivesDocument18 pages14 Financing Foreign Investment: Chapter ObjectivesJayant312002 ChhabraNo ratings yet

- Trufis: Saujanya P. (Director)Document4 pagesTrufis: Saujanya P. (Director)Sudhanshu N RanjanNo ratings yet

- Research 3Document32 pagesResearch 3Andile MlotsaNo ratings yet

- Some SPECCOM BAR QUESTIONS AND ANSWERSDocument29 pagesSome SPECCOM BAR QUESTIONS AND ANSWERSMark TeaNo ratings yet

- Hard Money LendingDocument16 pagesHard Money Lendingnikhilraheja100% (1)

- Approval LetterDocument2 pagesApproval Lettersonebhadrahyundai salesNo ratings yet

- Data Envelopment Analysis: Joe Zhu EditorDocument594 pagesData Envelopment Analysis: Joe Zhu EditorBrahyam Emmanuel Cruz RinconNo ratings yet

- Dealing Room StrategyDocument13 pagesDealing Room StrategyFatima MacNo ratings yet

- Mo Ghara GuidelinesDocument28 pagesMo Ghara GuidelinesRajnikant BilungNo ratings yet

- Internal Control Guide: The AES CorporationDocument70 pagesInternal Control Guide: The AES CorporationSaleem RahmanNo ratings yet

- Screenshot 2024-03-12 at 5.28.33 PMDocument8 pagesScreenshot 2024-03-12 at 5.28.33 PMchiraggajjar242No ratings yet

- TCH302-Topic 3&4-Time Value of Money & Applications PDFDocument38 pagesTCH302-Topic 3&4-Time Value of Money & Applications PDFHà ThưNo ratings yet

- CH 06Document62 pagesCH 06nguyenbuithao22No ratings yet

- FINAL REPORT WV Albania Buiding Futures PotentialDocument30 pagesFINAL REPORT WV Albania Buiding Futures PotentialVasilijeNo ratings yet

- Balance Sheet of Tata Power Company: - in Rs. Cr.Document3 pagesBalance Sheet of Tata Power Company: - in Rs. Cr.ashishrajmakkarNo ratings yet

- Chithra Baskar: Account StatementDocument5 pagesChithra Baskar: Account StatementSarath KumarNo ratings yet

- Newsletter 7Document2 pagesNewsletter 7Gustavo BenaderetNo ratings yet

- Assignment AnswerDocument2 pagesAssignment AnswerMims ChiiiNo ratings yet

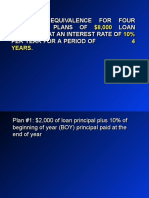

- Economic Equivalence For Four Repayment Plans of $8,000 Loan Borrowed at An Interest Rate of 10% Per Year For A Period of 4 YearsDocument21 pagesEconomic Equivalence For Four Repayment Plans of $8,000 Loan Borrowed at An Interest Rate of 10% Per Year For A Period of 4 YearsMuhammad atif latifNo ratings yet

- COOPDocument8 pagesCOOPJohn Kenneth BoholNo ratings yet

- General Mathematics: Simple InterestsDocument7 pagesGeneral Mathematics: Simple InterestsClaire BalatucanNo ratings yet

- DBA-724-Enterprise-Analysis-Final PaperDocument20 pagesDBA-724-Enterprise-Analysis-Final PaperEarl Louie MasacayanNo ratings yet

- Module 2 AnnuityDocument38 pagesModule 2 AnnuityOwel CabugawanNo ratings yet

- 11 ACC Journal'Document3 pages11 ACC Journal'Naman TiwariNo ratings yet

- Avon Stampings Private Limited: Plot No-18/21/2, Revenue Estate, Village Nathupur, Tehsil Rai, Sonipat, Haryana, 131029Document1 pageAvon Stampings Private Limited: Plot No-18/21/2, Revenue Estate, Village Nathupur, Tehsil Rai, Sonipat, Haryana, 131029vishal_srivastava_48No ratings yet

- Palma, Ian Jeric MagtalasDocument2 pagesPalma, Ian Jeric MagtalasIan PalmaNo ratings yet

- MCQ On MortgagesDocument3 pagesMCQ On MortgagesShyamNo ratings yet

- CALAMBA NegoSale Batch 47105 111422Document16 pagesCALAMBA NegoSale Batch 47105 111422Michael Chavez AlvarezNo ratings yet

- Max Loans Form 1Document2 pagesMax Loans Form 1cre8tiv1No ratings yet

- Mount Moreland Hospital: Perform Financial CalculationsDocument9 pagesMount Moreland Hospital: Perform Financial CalculationsJacob Sheridan0% (1)

- VIDA Living - HandbookDocument12 pagesVIDA Living - HandbookImranNo ratings yet

- 1 1backgroundDocument51 pages1 1backgroundAlpha BetaNo ratings yet

- 4th AssignmentDocument18 pages4th AssignmentLow El LaNo ratings yet

- Money and Credit: Economics Class-10Document7 pagesMoney and Credit: Economics Class-10Ankita MondalNo ratings yet

- Perpetual Bank: ReceivablesDocument13 pagesPerpetual Bank: ReceivablesYes ChannelNo ratings yet