Professional Documents

Culture Documents

PS Jul-23 MP

Uploaded by

myphotosfetOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PS Jul-23 MP

Uploaded by

myphotosfetCopyright:

Available Formats

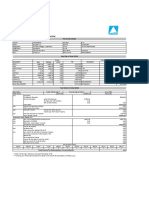

BIC CELLO INDIA PVT LTD

Regd. Off. : Plot No.711/1,2,3,4, Somnath Road, Dabhel, Daman -396210 (U.T.)

Corp. Off. : C-1/702, G-1/701, G-2/702, 7Th Floor, Lotus Corporate Park, Western Express Highway, Goregaon (East),

Mumbai 400 063

Payslip for the Month of : JULY 2023

Employee Code 891132 Bank Name STATE BANK OF INDIA Paid Days 4.00

Name MIHIR NILESHBHAI PANCHAL Bank Account No. 37268914245 LOP Days 0.00

Date of Joining 01-Jul-2022 PF No. Arrear Days 0.00

Location UAN 101849168426 Days in Month 31.00

Department MANUFACTURING PAN CELPN8586B

Designation Senior Executive - Manufacturing Excellence ESI No.

Gender Male Level Non Level (1.2)

Earning Entitled Paid Arrear YTD Deduction Deduction Arrear YTD

(Excl. Arrear) Amount

Basic 14000.00 1806.00 0.00 43806.00 PF 578.00 0.00 5978.00

House Rent Allowance 5600.00 723.00 0.00 17523.00 Other Deductions 60.00 0.00 1400.00

Leave Travel Allowance 1400.00 181.00 0.00 4381.00

Education Allowance 200.00 26.00 0.00 626.00

Supplementary Allowance 21743.25 2806.00 0.00 68035.00

Total Earnings 42,943.25 5,542.00 0.00 134,371.00 Total Deductions 638.00 0.00 7,378.00

Net Pay : 4,904.00

Indian rupee Four Thousand(s) Nine Hundred Four Only

YTD figures are from April

Details of Leave

Leave Type Opening Balance Credit Availed Closing Balance

CL 1.51 1.17 0.00 2.68

FH 2.00 0.00 1.00 1.00

LOP -1.98 0.00 0.00 -1.98

PL 3.72 1.34 1.00 4.06

Income Tax Calculation HRA Exemption

Particulars Till date Projected Taxable Amount Note: HRA exemption = Least of Columns 1,2,3

Basic 43806.00 43806.00 Months Basic Rent Metro HRA Rent Less 40/50% of HRA

Paid Paid (Y/N) 10% Basic Basic Exemp.

House Rent Allowance 17523.00 17523.00

(1) (2) (3)

Leave Travel Allowance 4381.00 4381.00

Apr 23 14000 N 5600 0 0

Education Allowance 626.00 626.00

May 23 14000 N 5600 0 0

Supplementary Allowance 68035.00 68035.00

Jun 23 14000 N 5600 0 0

Gross Salary 134371.00

Jul 23 1806 N 723 0 0

Less: EXEMPTION U/S 10 Total 0

Standard deduction u/s 50000.00 Tax Deducted Breakup

Sec 16(i)

Particulars Amount

Salary income after 84371.00

deduction u/s 16 Apr ,2023

May ,2023

DEDUCTIONS U/S 80C

Jun ,2023

DEDUCTIONS U/S CHAPTER VI A Jul ,2023

Total Income 84370.00

Tax Deducted - Current

Month

Balance - Tax payable /

refundable

* Computer generated salary slip. Signature not required

You might also like

- EmployeeData Oct (2)Document2 pagesEmployeeData Oct (2)Ankit SinghNo ratings yet

- Salary & Reliving LetterDocument6 pagesSalary & Reliving LetterYash ShettyNo ratings yet

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPNo ratings yet

- FNF 02 I33514 Ankit ShuklaDocument3 pagesFNF 02 I33514 Ankit ShuklaAnkit ShuklaNo ratings yet

- Naresh PayslipDocument1 pageNaresh PayslipBADI APPALARAJUNo ratings yet

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- Jan18 PDFDocument1 pageJan18 PDFomkassNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- Salary SlipDocument2 pagesSalary Slipchethankapoor9999No ratings yet

- Salary SlipDocument2 pagesSalary Slipchethankapoor9999No ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- Salary SlipDocument2 pagesSalary Slipchethankapoor9999No ratings yet

- Ravi MukharjeeDocument2 pagesRavi MukharjeeDivesh RaiNo ratings yet

- Tata Business Support Services LTD: 00110283 KhushbuDocument1 pageTata Business Support Services LTD: 00110283 KhushbuKhushbu SinghNo ratings yet

- 100000000494378Document1 page100000000494378Dalbir SinghNo ratings yet

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- Payslip March 2023Document1 pagePayslip March 2023kaushalNo ratings yet

- Salary September2023Document2 pagesSalary September2023depiha5135No ratings yet

- Final Payslip of Circle For 7-17Document11 pagesFinal Payslip of Circle For 7-17Manas Kumar SahooNo ratings yet

- Salary Slip EDIT-AUGDocument4 pagesSalary Slip EDIT-AUGpathyashisNo ratings yet

- Jul 192017Document1 pageJul 192017Anonymous qqE8o5QNo ratings yet

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDocument2 pagesDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairNo ratings yet

- CRM Services Payslip for September 2021Document1 pageCRM Services Payslip for September 2021Phagun BehlNo ratings yet

- Micro Payslip - May, 2022 (Emp Code00111500)Document1 pageMicro Payslip - May, 2022 (Emp Code00111500)chagusahoo170No ratings yet

- Oct 23Document2 pagesOct 23VIKAS TIWARINo ratings yet

- Chola Business Services Pay SlipDocument3 pagesChola Business Services Pay SlipsathyaNo ratings yet

- Employee DataDocument2 pagesEmployee DataJitender singhNo ratings yet

- May Salary PDFDocument1 pageMay Salary PDFomkassNo ratings yet

- Essilor India Payslip TitleDocument1 pageEssilor India Payslip TitlekrishnaNo ratings yet

- Payslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)praveen kumarNo ratings yet

- 9107 Payslip Jul2023Document1 page9107 Payslip Jul2023ArunanandNo ratings yet

- Bharti AXA Life Insurance Employee PayslipDocument1 pageBharti AXA Life Insurance Employee PayslipJoginderNo ratings yet

- Aether Industries payroll reportDocument1 pageAether Industries payroll reportBharat DevareNo ratings yet

- Info Sys Salary SlipDocument2 pagesInfo Sys Salary SlipGurpreetS Myvisa100% (1)

- Intelenet payslip titleDocument1 pageIntelenet payslip titleSandeep SranNo ratings yet

- Manpreet Kaur: EligibilityDocument1 pageManpreet Kaur: EligibilityRajesh KumarNo ratings yet

- A-28, Lawrence Road,, New Delhi - 110035 Delhi Pay Slip For The Month of January-2018Document2 pagesA-28, Lawrence Road,, New Delhi - 110035 Delhi Pay Slip For The Month of January-2018Reiki Channel Anuj BhargavaNo ratings yet

- Corona Remedies PVT LTD: Pay Slip For The Month of Apr - 2019Document1 pageCorona Remedies PVT LTD: Pay Slip For The Month of Apr - 2019Emmanuel melvinNo ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- RPT Pay Slip NIIT1Document1 pageRPT Pay Slip NIIT1kingnilay9831No ratings yet

- Associate Payment Slip - HarmonyDocument1 pageAssociate Payment Slip - Harmonythebhavesh93No ratings yet

- PDF Rendition 1 1Document2 pagesPDF Rendition 1 1chethankapoor9999No ratings yet

- Payslip Jul2023 EDU - 01098Document1 pagePayslip Jul2023 EDU - 01098PrabhuNo ratings yet

- CRM Services India Private Limited: Earnings DeductionsDocument1 pageCRM Services India Private Limited: Earnings DeductionsInnama SayedNo ratings yet

- Payslip For The Month of Oct 2021: Rivigo Services PVT LTDDocument1 pagePayslip For The Month of Oct 2021: Rivigo Services PVT LTDDeeptimayee SahooNo ratings yet

- 100000000494378Document1 page100000000494378Dalbir SinghNo ratings yet

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipRahimaNo ratings yet

- Payslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, GurugramDocument1 pagePayslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, Gurugramps384077No ratings yet

- EMP1314Document1 pageEMP1314Laxmi JaiswalNo ratings yet

- Ub23m03 561476Document1 pageUb23m03 561476Ratul KochNo ratings yet

- DDICGDIAP72DINOV22Document1 pageDDICGDIAP72DINOV22raghav bharadwajNo ratings yet

- Mar18 PDFDocument1 pageMar18 PDFomkassNo ratings yet

- SettlementReportDocument1 pageSettlementReportSarath KumarNo ratings yet

- A Unit of Haryana Power Generation Corporation LTD.: Panipat Thermal Power Station Urja Bhawan, C-7, Sector - 6 PanchkulaDocument2 pagesA Unit of Haryana Power Generation Corporation LTD.: Panipat Thermal Power Station Urja Bhawan, C-7, Sector - 6 PanchkulaRamchanderNo ratings yet

- RPT Pay Slip NIIT1Document1 pageRPT Pay Slip NIIT1kingnilay9831No ratings yet

- Teleperformance Payslip for February 2021Document1 pageTeleperformance Payslip for February 2021x foxNo ratings yet

- Jan SlipDocument1 pageJan Slipherlyn8762No ratings yet

- Associate Payment Slip - HarmonyDocument1 pageAssociate Payment Slip - Harmonythebhavesh93No ratings yet

- India Local Monthly130122210312905Document1 pageIndia Local Monthly130122210312905NAGARJUNANo ratings yet

- Service Condit On 01.08.2016Document57 pagesService Condit On 01.08.2016Venkat SubbuNo ratings yet

- 2018 Xiaohe Huang Tax ReturnDocument48 pages2018 Xiaohe Huang Tax ReturnKaren Xie100% (2)

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldSafferon SaffronNo ratings yet

- Pa 312 Midterm - 1Document10 pagesPa 312 Midterm - 1Khyla AmorNo ratings yet

- Types of Employee BenefitsDocument11 pagesTypes of Employee BenefitsSandy Marie DavidNo ratings yet

- Legal Practitioners GuideDocument44 pagesLegal Practitioners GuideALNo ratings yet

- Introduction to Taxation and Income Tax PrinciplesDocument11 pagesIntroduction to Taxation and Income Tax Principlesjulius art maputiNo ratings yet

- SOA TemplateDocument28 pagesSOA Templatepatrick wafulaNo ratings yet

- Retire With A Smile Retire With A Smile: Investment Solutions Investment SolutionsDocument16 pagesRetire With A Smile Retire With A Smile: Investment Solutions Investment SolutionsParam SaxenaNo ratings yet

- W-2 Form Details Employee PayDocument4 pagesW-2 Form Details Employee PayMark OasayNo ratings yet

- GROSS INCOME and DEDUCTIONSDocument10 pagesGROSS INCOME and DEDUCTIONSMHERITZ LYN LIM MAYOLANo ratings yet

- What Is Double Taxation PDFDocument3 pagesWhat Is Double Taxation PDFxyzNo ratings yet

- Final Taxation ModuleDocument18 pagesFinal Taxation ModuleKia Mae PALOMARNo ratings yet

- Presentation - DSP BlackRock CoRe FundDocument36 pagesPresentation - DSP BlackRock CoRe FundJonNo ratings yet

- Understanding Tax ExemptionDocument1 pageUnderstanding Tax Exemptionirene ibonNo ratings yet

- Pre-Screening: Tenant ApplicationDocument10 pagesPre-Screening: Tenant ApplicationAlex ErschenNo ratings yet

- Get Ready For Ifrs 17 ADocument70 pagesGet Ready For Ifrs 17 Aالخليفة دجوNo ratings yet

- 2017 BCSC 1226 (CanLII) - H.C.F. V D.T.F. - CanLIIDocument3 pages2017 BCSC 1226 (CanLII) - H.C.F. V D.T.F. - CanLIICharles BinghamNo ratings yet

- Smart Choice Super Employer AigDocument85 pagesSmart Choice Super Employer AigrkNo ratings yet

- An Overview of The Nigerian Pension Scheme From 1951-2004: Global Journal of Humanities Vol 7, No. 1&2, 2008: 61-70Document10 pagesAn Overview of The Nigerian Pension Scheme From 1951-2004: Global Journal of Humanities Vol 7, No. 1&2, 2008: 61-70OtuagaNo ratings yet

- TAX4862 TL107 - 2019 Slides 1 Per PGDocument139 pagesTAX4862 TL107 - 2019 Slides 1 Per PGMagda100% (1)

- Canada Pension Plan Contributions and Overpayment: T1-2021 Schedule 8Document6 pagesCanada Pension Plan Contributions and Overpayment: T1-2021 Schedule 8Greg KnightNo ratings yet

- BSP V COADocument12 pagesBSP V COAJuan AlatticaNo ratings yet

- Chapter - 1: 1.1 Definition of Personal Financial PlanningDocument32 pagesChapter - 1: 1.1 Definition of Personal Financial PlanningkomalNo ratings yet

- Prorata Pension DetailsDocument6 pagesProrata Pension Detailsshaunak_srNo ratings yet

- Module 9 - Government Accounting ProcessDocument10 pagesModule 9 - Government Accounting ProcessJeeramel TorresNo ratings yet

- Lecture Notes On Payroll Accounting Payroll AccountingDocument4 pagesLecture Notes On Payroll Accounting Payroll AccountingOdult Chan100% (2)

- Corporate Income Tax: Section A - Multiple Choice QuestionsDocument24 pagesCorporate Income Tax: Section A - Multiple Choice QuestionsWanda NguyenNo ratings yet

- Factoring Sap PayrollDocument10 pagesFactoring Sap Payrollvickywesucceed67% (3)

- WBHS Related G.O.s. For PensionersDocument13 pagesWBHS Related G.O.s. For PensionerssudipNo ratings yet