Professional Documents

Culture Documents

04 Salaries

Uploaded by

KN KolkataOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

04 Salaries

Uploaded by

KN KolkataCopyright:

Available Formats

4. Salary 4.

Chapter 4 – Salaries

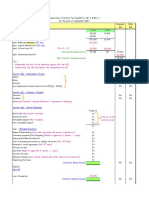

Proforma for computation of income under the head “Salaries”

Particulars Amt

(i) Basic Salary XXX

(ii) Fees/Commission XXX

(iii) Bonus XXX

(iv) Allowances:

(a) Dearness Allowance XXX

(b) House Rent Allowance (HRA) (115BAC – Not Allowed) xx

Less: Least of the following is exempt [Section 10(13A)] xx XXX

HRA actually received xxx

Rent paid (-)10% of salary for the relevant period xxx

50% of salary, if accommodation is located in

Mumbai, Kolkata, Delhi or Chennai or 40% of xxx

salary in any other city for the relevant period

(c) Children Education Allowance (115BAC – Not Allowed) xx

Less: Rs. 100 per month per child upto maximum of two xx XXX

children

(d) Children Hostel Allowance (115BAC – Not Allowed) xx

Less: Rs. 300 per month per child upto maximum of two xx XXX

children

(e) Transport allowance (115BAC – Allowed) xx

Less: Rs.3,200 per month in case of blind/ deaf and XXX

dumb/ orthopedically handicapped employeeonly xx

(f) Entertainment Allowance (115BAC – Not Allowed) XXX

(g) Other Allowances including overtime allowance, city compensatory XXX

allowance etc. (115BAC –Not Allowed except Travel, Conveyance, Daily)

(v) Taxable Even after 115BAC the calculation of perquisites remains the same except the exemption

Perquisit of food beverages of Rs. 50 per meal per day is not allowed)

es

(a) Valuation of rent free accommodation* XXX

I) Where the accommodation is provided by the Govt. to its

employees

License fee determined by the Govt. xx

Less: Rent actually paid by the employer xx

II) Where the accommodation is provided by any other employer

If accommodation is owned by the employer

(i) Cities having population > 25 lakh as per

2001census

15% of salary in respect of the period of occupation

(–) rent recovered from employee xx

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.2

(ii) Cities having population >10 lakh < 25 lakh as

per 2001census

10% of salary in respect of the period of occupation

(–) rent recovered from employee xx

(iii) In other cities

7.5% of salary in respect of the period of occupation

(–) rent recovered from employee xx

If accommodation is taken on lease by the employer

Lower of lease rental paid or payable by the employer xx

(or) 15% of salary

Less: Rent actually paid by the employee xx

(b) Obligation of employee discharged by employer. For XXX

e.g. Professional tax paid by the employer

(c) Any sum payable by the employer to effect an assurance on the life XXX

of the employee or to effect a contract for annuity: Actual

expenditure incurred by the employer

(d) Value of use of motor car XXX

(e) Any other perquisite: For example, XXX

(1) Provision of services of a sweeper, gardener, watchman or

personal attendant : Actual cost to employer by way of salary paid or

payable for such services (-) amount paid by the employee

(2) Gas, electricity, or water supplied by employer for household

consumption of the employee : Amount paid on that account by the

Specified employer to the agency supplying gas etc. (-) amount paid by the

employees – employee

a. Director (3) Provision of free or concessional education facilities for any

b. Employee member of employee’s household : Sum equal to the expenditure

having incurred by the employer (-) amount paid or recovered from the

substantial employee

interest (i.e. Where educational institution is maintained and owned by employer:

minimum 20% Cost of such education in similar institution in or near the locality (-)

share holding amount paid or recovered from employee [However, there would be

no perquisite if the value of benefit per child does not exceed Rs.

c. Income

1,000 p.m.]

under the head

Salaries > Rs. Note: Above perquisites including Motor car are taxable only in case

50,000 of specified employees.

excluding (4) Interest-free or concessional loan exceeding

perquisites Rs. 20,000 : Interest computed at the rate charged by SBI as on 1st

day of relevant PY in respect of loans for similar purposes on the

maximum outstanding monthly balance (-) interest actually paid by

employee

(5) Value of gift, voucher: Sum equal to the amount of such gift

[If value of gift, voucher is upto Rs. 5,000, there would be

no perquisite]

(6) Use of moveable assets

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.3

Asset given Value of benefit

a) Use of laptops and computers Nil

b) Movable assets, other than - 10% p.a. of the actual cost of

(i) laptops and computers; and such assets, or the amount of

(ii) assets already specified rent or charge paid or payable

by the employer, as the case

may be

(-)

amount paid by/recovered from

an employee

(7) Transfer of movable assets: Actual cost of asset to employer – cost of

normal wear and tear – Amount paid or recovered from employee.

Assets transferred Computation of cost of normal wear and

tear

Computers and electronic items @ 50% on WDV for each completed year of

usage

Motor cars @ 20% on WDV for each completed year of

usage

Any other asset @ 10% of actual cost of such asset to

employer for each completed year of usage [on

SLM basis]

(vi) Leave travel concession (115BAC – Not Allowed) xxx

Less: Exempt u/s 10(5) xxx XXX

(vii) Gratuity

(a) Received during the tenure of employment (fully taxable) xxx

(b) Received at the time of retirement or otherwise xxx

Less: Exempt u/s 10(10) xxx XXX

(viii) Uncommuted pension (fully taxable) Commuted pension xxx

(ix) Less: Exempt u/s 10(10A) xxx

XXX

(x) Leave encashment

(a) Received during the employment (fully taxable) xxx

(b) Received at the time of retirement or otherwise xxx

Less: Exempt u/s 10(10AA) xxx XXX

(xi) Voluntary retirement compensation xxx

Less: Exempt u/s 10(10C) - Least of the following: xxx XXX

(a) Compensation received/ receivable on voluntary xxx

retirement

(b) Rs. 5,00,000 xxx

(c) 3 months’ salary x completed years of service xxx

(d) Last drawn salary x remaining months of service left xxx

(xi) Retrenchment compensation etc. xxx

Less: Exempt u/s 10(10B)] – Least of the following: xxx XXX

(a) Compensation actually received xxx

(b) Rs. 5,00,000 xxx

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.4

(c) 15 days average pay x completed years of service and

part thereof in excess of 6months xxx

Gross Salary XXX

Less: Deduction under section16 (115BAC – All 3 Not Allowed)

Standard deduction u/s 16(ia) upto Rs. 50,000 XXX

Entertainment allowance u/s 16(ii) (only for Govt. employees) xxx

Least of the following is allowable as deduction: xxx XXX

(a) Rs. 5,000 xxx

(b) 1/5th of basic salary xxx

(c) Actual entertainment allowance received xxx

Professional Tax (paid by employer/ employee) under section 16(iii) XXX

Income under the head salary XXX

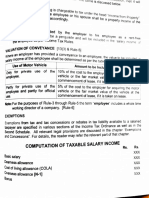

1. Basics

Basis of Charge [Section 15]

(i) Salary is chargeable to tax either on ‘due’ basis or on ‘receipt’ basis, whichever is earlier.

(ii) However, where any salary, paid in advance, is assessed in the year of payment, it cannot

be subsequently brought to tax in the year in which it becomes due.

(iii) If the salary paid in arrears has already been assessed on due basis, the same cannot be

taxed again when it is paid.

2. Few examples given in module -

Professor → Examinership fees →from the same IOS

university in which he is employed

Director → Dual capacity Remuneration received – Salary

Attending the meetings - IOS

Official Liquidator Salary

Partner of a firm PGBP

Member of Parliament IOS

Income from tips IOS

Reason - not from the employer

ITC Ltd. gurgaon Vs Commissioner of Income-tax

(TDS) (SC).

Salaries received by Judges Salary

Justice Deoki Nandan Agarwala Vs Union of India (SC)

3. Computation of Salary in Grade system – varying Pay Scale

In this concept the person gets an increment in Salary after every completion of

duration of 12 months in employment.

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.5

Example – A person joined ABC ltd. On 1stJuly 2016 on a pay scale of monthly salary of Rs

30,000 – 3000 – 39000 – 5000 – 49000. The salary gets due on last day of every month. Find the

taxable salary of this person for P.Y 17 – 18 and PY 20 – 21.

Solution

Working Note

Cycle of 12 months Per month Salary (INR)

July 16 to June 17 30,000.00

July 17 to June 18 33,000.00

July 18 to June 19 36,000.00

July 19 to June 20 39,000.00

July 20 to June 21 44,000.00

July 21 to June 22 49,000.00

Therefore, for PY 17 -18 i.e. April 17 to March 18 = Rs 30,000 * 3 months and 33,000* 9 months =

Rs. 3,87,000

And for PY 20-21 i.e. April 20 to March 21 = Rs. 39,000 * 3 months and 44,000* 9 months = Rs.

5,13,000

Immediately Refer Past Exam Questions now. Baad me nahi hota hai. Sath sath me karo.

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.6

Retirement Benefits

4. Leave Encashment[Section 10(10AA)

Leave Encashment

Received during Received on

the period of retirement whether

Service on Superannuation

or otherwise

Full Taxable

By a Government By any other

employee employee

Full Exempt Least of the

following

is exempt

Rs. 3,00,000 Leave salary 10 months’ salary (Total leaves allowed/ 10 months

actually received (on the basis of average

average salary of

Earned – Total leaves

last 10 months) Availed) monthly

salary

30

Earned leave entitlement cannot

exceed 30 days for every year of

actual service

Points to note - Mnemonics

➢ पिछले 10 महीनेमें average 4- 4 पिनकीछु ट्टी ली है (Means 4 amounts to compare)

➢ हरपिन important है (for calculating preceding 10 months, start counting from immediately

preceding day)

➢ तोसाल ignore (Means Total leaves allowed = Completed number of years of service *

max. 30 days per year)

Salary

Basic Conditional D.A Commission fixed

% of T.O

V. Imp- “Salary” is defined as above at total 4 calculations in this Chapter

a. Leave Encashment c. Not Covered by POGA – Gratuity payment

b. H.R.A d. Provident Fund

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.7

5. Gratuity 10(10)

Gratuity

Received during Received at the time of

service retirement/Death

Fully Taxable

Government Non-Government

Employees Employees

Fully Exempt

Covered under Not covered

Payment of underpayment of

Gratuity Act, 1972 Gratuity Act, 1972

Least of the following Least of the following

would be exempt: would be exempt:

- Rs 20 lakh - Rs. 20 lakhs

- Gratuity received - Gratuity received

- 15/26 * Last drawn

- ½ * Salary *

Salary * Number of

years of service completed number

(where > 6 moths = 1 years of service (ignore

year. fraction of years

Covered by POGA – Points to Note

➢ Last Drawer(means Drawn)मेंSalary रखीहै

➢ Covered है तोचीज़ेंज़रा specific (i.e. 15/26 and > 6 month = 1 year)

➢ Full Drawer खोलोतोिोचीज़ेंपमली ( FULL DA and Basic Salary)

Not covered by POGA–

Salary

Basic Conditional D.A Commission fixed

% of T.O

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.8

6. Pension 10 (10A)

Pension

Commuted Uncommuted

Lumpsum)d (Monthly)

Employees of the Non-Government Fully taxable

Central Employees

Government/local

authorities/Statutory

Corporation/Members

of the Defence Services If the If the employee

employee is does not

in receipt of receive any

gratuity gratuity

1/3 (commuted ½ (commuted

pension received pension received

commutation commutation

%) 100, would %) 100, would

be exempt be exempt

Points to Note

• If nothing is given in question – assume that the person is not in receipt of Gratuity

• Family Pension received – Head IOS – 1/3rd of amount received or Rs. 15,000 per year

(Lower one) is the deduction allowed.

• Don’t forget to reduce monthly pension amount if the assessee is getting the amount

commuted during the year.

For example – The assessee was receiving Rs 10,000 p.m. as monthly pension for PY 22-

23.

Now on 31st Jan 23 the assessee got 60% of pension commuted, so now for Feb and

March monthly pension will be Rs. 4.000 for each month.

7. Compensation on voluntary Retirement

Refers to compensation received on voluntarily retirement or termination of service before the date of

actual retirement. Voluntary retirement compensation to be included under the head Salary = Voluntary

Retirement Compensation Less Exemption u/s10(10C)

Exemption u/s 10(10C)

Types of Employee • Employees of Central or State government or Local Authority or

Statutory Corporation

• Company or Co-operative Society

• Declared University, IIT, Notified IIM or Notified institutions

Conditions to be satisfied • Compensation received on Voluntary Retirement and

• The scheme of Voluntary Retirement should be as per rule 2BA

Amount of • Actual Compensation received/receivable

Exemption Least of • Rs. 5,00,000

• 3 months Total Salary * Completed years of service (Part of the service

following

to be ignored

• Current Salary per month * Balance months of service left

Salary = Basic + DA (retirement Benefits) + Commission % of turnover

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.9

Special Points:

1. [Rule 2BA]: The scheme of Voluntary Retirement should be framed in accordance with below guidelines.

i. Employee should have completed 10 years of service or 40 years of age. [This condition is not

applicable in the case of an employee of a public sector company].

ii. Scheme should be applicable to all employee (except Directors).

iii. Scheme should be drawn to result in overall reduction in existing strength of employees.

i. Vacancy caused by voluntary retirement should not be filled up.

ii. Retiring employee shall not be employed in other concern of same management.

If the guidelines are not followed, exemption shall not be available

2. Exemption under 10(10C) can be claimed only once by the Assessee.

Example

Mr. X received voluntary retirement compensation of Rs. 7,00,000 after 30 years 4 months of service. He still

has 6 years of service left. At the time of voluntary retirement, he was drawing basic salary Rs. 20,000 p.m.;

Dearness allowance (which forms part of pay) Rs. 5,000 p.m. Compute his taxable voluntary retirement

compensation.

Solution

Voluntary retirement compensation received Rs. 7,00,000

Less: Exemption under section 10(10C) [Note 1] Rs. (5,00,000)

Taxable voluntary retirement compensation Rs. 2,00,000

Note 1: Exemption is to the extent of least of the following:

(i) Compensation actually received = Rs. 7,00,000

(ii) Statutory limit = Rs. 5,00,000

(iii) Last drawn salary × 3 × completed years of service

= (20,000 + 5,000) × 3 × 30 years = Rs. 22,50,000

(iv) Last drawn salary × remaining months of service

= (20,000 + 5,000) × 6 × 12 months = Rs. 18,00,000

Immediately Refer Past Exam Questions now. Baad me nahi hota hai. Sath sath me karo.

Allowances 8.

7A. Allowance partially taxable (115BAC – Not Allowed)

House Rent Allowance 10(13A)

Section Allowance Exemption

10(13A) House Rent Least of the following is exempt:

Allowance (a) HRA actually received

(b) Rent paid less10% of salary

(c) 50% of salary, if accommodation is

located in Mumbai, Kolkata, Delhi or

Chennai

40% of salary, if the accommodation is

located in any other city.

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.10

Points

➢ Salary means -> Basic + Conditional D.A + Commission fixed % of Turnover

➢ Exemption is given only for that period during which the house is occupied by the

assessee.

➢ If any of the given elements change, the calculation also needs to be done accordingly –

Actual HRA received, rent paid, Salary, Location of the house taken on rent.

7B.Allowance exemption depends upon the actual expenditure (115BAC –

Colouring)

Mnemonics - (Daily Uniform िहन के Helper साथ Research करने पनकलता है और C.T.T बजाता है )

1. Daily allowance–to meet the ordinary daily charges incurred by an employee on account

of absence from his normal place of duty

2. Uniform allowance.

3. Helper allowance –Helper for official duties(But Servant allowance fully taxable)

4. Research allowance - encouraging the academic research and training pursuits in

research institutions

5. Conveyance allowance - performance of duties of an office

6. Travelling Allowance - cost of travel on tour one city to another – Official tour

7. Transfer allowance–Shifting city - transfer, packing and shifting of personal effects on

such transfer

7C.Allowance exemption does not depend upon the actual expenditure

(115BAC – Not allowed except Transport)

S. Name of Allowance Extent to which

No. allowance is exempt

1 Special Compensatory(Tribal Areas/Schedule Areas / Agency Rs. 200 per month.

Areas)Allowance

2 Any allowance granted to an employee working in any 70% of such allowance

transport system to meet his personal expenditure during his upto a maximum of

duty performed in the course of running such transport from one Rs. 10,000 per month.

place to another, provided that such employee is not in receipt

of daily allowance

3 Children Education Allowance Rs. 100 per month per

child upto a maximum of

two children.

4 Any allowance granted to an employee to meet the hostel Rs. 300 per month per

expenditure on his child child upto a maximum of

two children.

5 Any transport allowance granted to an employee to meet his Rs. 1,600 per month

expenditure for the purpose of commuting between the place of Withdrawn

his residence and the place of his duty from AY 19-20

6 Any transport allowance granted to an employee who is blind or Rs. 3,200 per month.

deaf and dumb or orthopedically handicapped with disability of

the lower extremities of the body, to meet his expenditure for

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.11

commuting between his residence and place of duty

7 Underground Allowance would be granted to an employee who Rs. 800 per month

is working in uncongenial, unnatural climate in underground

mines. This is applicable to whole of India.

7D. Allowances Fully Exempt (115BAC – Not Allowed)

a. Allowance to High Court Judges and Supreme court Judges

b. Allowance received from United Nations Organisation (UNO): Allowance

paid by the UNO to its employees is not taxable

c. Allowances payable outside India [Section10(7)] – By the Government to a citizen of

India for services rendered outside India.

7E. Allowances Fully Taxable

Dearness Allowance Non-Practicing allowance

City compensatory allowance Family allowance

Medical allowance (From AY 19-20, specified Special allowance

medical perquisite is also fully taxable)

Tiffin/ Lunch/Dinner allowance Secret allowance

(But if perquisite – Exempt upto Rs. 50 per

meal)

Overtime allowance Deputation allowance

Servant allowance Interim allowance

Warden/ Proctor allowance Any other cash allowance

Reminding again

Note: If the assessee opted concessional tax slab U/S 115BAC of the income tax act, 1961, then

assessee is not eligible to claim exemption from any allowances

except:

1. Travelling allowances

2. Daily allowances

3. Conveyance allowance

4. Transport allowance(For blind, handicapped, deaf or dumb employee)

Immediately Refer Past Exam Questions now. Baad me nahi hota hai. Sath sath me karo.

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.12

8. Perquisites

8A. Rent free accommodation (Reduce recovery from employer wherever done)

8A.1. Valuation of accommodation only (Excluding furniture)

Rent Free Accommodation

Govt. Employee (Central/State) Non-Govt. Employee

License fee determined by

Govt. would be the value of Accommodation Accommodation not

perquisite Owned by employer Owned by employer

Population# of Population# of City Population# of 15% of Salary*

City upto 10 Lac > 10 lac to 25 lacs City > 25 Lac or

Rent paid

Whichever

7.5% of Salary* 10% of Salary* 15% of Salary* is lower

Note – Calculate for only that number of months for which the house is occupied by the

employee.

*Salary means

Basic Salary

⬧ DA (forming part of the retirement benefits)

⬧ Bonus

⬧ Fee

⬧ Commission (also includes fixed commission)

⬧ Taxable allowances i.e. only taxable portion of allowances

Monetary payment

# ⬧Population notas

of the city being

peerperquisites

2011 census(e.g. Leave encashment) i.e. “Ignore ALL

types of perquisites inmay

Accommodation this be

calculation”)

provided:

(1) Rent free; or

(2) At concessional rate.

Note: In case the house is provided at concessional rate, the value determined above

shall be reduced by the rent, if any, actually paid by the employee.

8A.2.Value of Furniture provided (To Govt. + Non - Govt. Employees)

1. Owned by employer –10% p.aof actual cost.

2. Rented by employer – Actual rent paid

8A.3. Accommodation in a hotel

➢ Lower of 24% of Salary or actual hotel charges

8A.4. Where RFA is not taxable– Exceptions

a. Hotel accommodation provided for a period of maximum15 days on his transfer from one

place to another.

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.13

b. Any accommodation provided to an employee working at a mining site or an on-shore

oil exploration site or a project execution site, or a dam site or a power generation site or

an off-shore site

c. Accommodation provided at new place of posting (New City) while retaining the

accommodation at the other place (Old city). Only 1 accommodation will be taxable upto a

period of 90 days at the option of the Assessee, thereafter both the accommodations will

be taxable.

Immediately Refer Past Exam Questions now. Baad me nahi hota hai. Sath sath me karo.

8B. Leave Travel Concession 10(15) (Section 115BAC Not Allowed)

• This clause exempts leave travel concession (LTC)received by employees from their

employers for proceeding to any place in India,

• The benefit is available for assessee, spouse, children and (dependent) parents/

brother/sister

• Exemption will be available in respect of 2 journeys performed in a block of 4 calendar

years. Current block 2018 to 2021 calendar years)

• Where such travel concession or assistance is not availed by the individual during any

block of 4 calendar years, one such unavailed LTC will be carried forward to the

immediately succeeding block of 4 calendar years and will be eligible for exemption if

used in the first year of the block.

• Monetary limits – For comparison Amount not exceeding the shortest route by first class

rail fare or amount not exceeding the air economy fare of the National Carrier (Generally

Air India).

• The exemption referred to shall not be available to more than two surviving children of

an individual on or after 1.10.1998. This restrictive sub-rule shall not apply in respect

of children born before 1.10.1998 and also in case of multiple births after one child.

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.14

Calculation

Case Amount Amount Compariso Amount Amount Taxable

actually actually n amount - exempt

received spent Rail/ Flight

I 40,000.00 35,000.00 50,000.00 35,000.00 5000 (40,000 - 35,000)

(As amount sent is less than the amount

received from employer)

II 40,000.00 42,000.00 50,000.00 40,000.00 Nil

(As whole amount received is spent)

III 40,000.00 45,000.00 38,000.00 38,000.00 2000 (40,000 - 38000)

(As the amount given to employee is more

than the maximum limit regarding Rail/

Flight)

IV 50,000.00 43,000.00 42,000.00 42,000.00 8000 (50,000 - 42000)

(As amount given to employee is more than

the maximum limit regarding Rail/ Flight)

V 50,000.00 30,000.00 43,000.00 30,000.00 20,000

LTC cash voucher scheme - (ICSI Supplementary June 21)

To compensate and incentivize consumption by employees thereby giving a boost to consumption

expenditure, it has been decided that cash equivalent of LTC, comprising Leave Encashment and LTC

fare of the entitled LTC may be paid by way of reimbursement.

Condition

The employee spends

(i) an amount equal to the value of leave encashment (100% Payment) and;

(ii) an amount 3 times of the cash equivalent of deemed fare, as given above on purchase of such

items / availing of such services

(iii)which carry a GST rate of not less than 12%

Limit for CG employees –

Deemed LTC fare per person (Round Trip)

Employees who are entitled to business class of Rs. 36,000

airfare

Employees who are entitled to economy class of Rs. 20,000

airfare

Employees who are entitled to Rail fare of any class Rs. 6,000

Limit for other than CG employees (state governments, public sector enterprises, banks and

private sector)

Payment of cash allowance, subject to maximum of Rs 36,000 per person as Deemed LTC fare per

person (Round Trip) to non-Central Government employees.

New Rules added

Under Rule 2B of Income Tax Rules as follows:

Sub-Rule 1A

Maximum amount exempt shall be lower of –

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.15

Rs. 36,000 per person

Or

1/3rd of the specified expenditure

Specified expenditure – Buying goods/Services having minimum 12% GST Rate.

Sub-Rule 1B

Where an exemption is claimed and allowed, shall have effect as if for the words “two journeys”, the

words “one journey” has been substituted.”

8C. Motor Car

Immediately Refer Past Exam Questions now. Baad me nahi hota hai. Sath sath me karo.

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.16

8D. Medical Facilities

Medical

Facilities

Outside

India

In India

Travel Stay Treatment Maintained Princi. CC/ Other

Expenditure Maintained clinics/

Expenditure (For 1 by Comm.

by Govt./ LA hospitals

(For 2 (For 2 person) employer approved +

persons) persons) Specified

diseases

Exempt if GTI Exempt Exempt

before subject to Exempt

incuding subject Fully

RBI limits

travel exp. to RBI Taxable

upto Rs 2 lacs limits

Points

1. Family means – Spouse, Children, Dependent Parents, Brothers & Sisters

2. Health/ Medical insurance policy premium paid by the employer for employee/

employee’s family members is exempt

3. Payment of premium on personal accident insurance policies of employees is exempt.

4. Reimbursement - in respect of any illness relating to COVID-19 subject to conditions notified by the

Central Government.

AY 23-24

Immediately Refer Past Exam Questions now. Baad me nahi hota hai. Sath sath me karo.

Interest Free Loan

Interest free or Concessional outstanding Balance for Note taxable if -

Loan each loan on last day of 1. Loan < 20,000

Provided to Employee or each month Rate of 2. Loan for diseases specified in

household members Interest charged by SBI on the rule 3A (Cancer, TB, AIDS,

1st day of the relevant Disease requiring surgical

PY. operation, mental disorder,

Less: Interest charged caesarean operation).

However, not applicable to so

much of the loan as has been

reimbursed to the employee

under medical insurance

scheme.

Immediately Refer Past Exam Questions now. Baad me nahi hota hai. Sath sath me karo.

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.17

8E. Other Perquisites

Nature of Perquisite Taxable Value of Note

Perquisite

Free Domestic Servant Actual cost of the

Service of sweeper, employer Less: Amount

gardener or watchman or paid by employee

personal attendant

Supply of gas, electricity The amount determined shall be

or water for household reduced by the amount, if any

consumption recovered from the employee for

a) Procured from outside Amount paid to outside such benefit.

agency agency

b) Resources owned by Manufacturing cost per

employer himself unit

Education Facilities for 1. Amount paid for free training of

Children the employee is not taxable

a) Free education to Cost to the Employer 2. Payment or reimbursement of

employee's own children school fee is taxable in all cases

Less: Rs. 1,000 per

in the school 3. No restriction on number of

month

owned/maintained by children

Less: Amount recovered

the employer or the

from employee

school sponsored by the

employer

b) Other Schools Cost to the Employer

Less: Amount

recovered from

employee

c) For others (other than Cost of education to

assessees children i.e., Employer

grandchildren and other Less: Amount

household members) recovered from

employee

Educatoin Perq - Immediately Refer Past Exam Questions now. Baad me nahi hota hai. Sath

sath me karo.

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.18

Nature of Perquisite Taxable Value of Note

Perquisite

Travelling, Touring, The amount determined shall be

Accommodation reduced by the amount, if any

a) Where such facility is It will be the value at recovered from the employee

maintained by the which such facilities are for such benefit

employer, and is not offered by other

available uniformly to all agencies to the public.

employees.

b) Where the employee is The amount of

on official tour and the expenditure so incurred.

expenses are incurred in

respect of any member

of his household

accompanying him.

c) Where any official tour is The value will be limited

extended as a vacation. to the expenses incurred

in relation to such

extended period of stay

or vacation

d) In any other case, where A sum equal to the

such facility is given to amount of expenditure

the employee or any incurred by the

member of his employer.

household. (Facility

available uniformly to all

employee)

Free food and Non-Alcoholic Working hours include extended

Beverages office hours (like working on

holidays, over time)

a) Tea or snacks provided Nil

during working hours

b) Free food and non- Nil

alcoholic beverages

during working hours

provided in a:

(i) Remote area; or

(ii) An offshore

installation.

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.19

Nature of Perquisite Taxable Value of Note

Perquisite

c) Free food and non- Cost to the employer in excess Not allowed u/s 115BAC

alcoholic beverages of Rs. 50 per meal

provided by the Less: Recovery from the

employer during working employee

hours:

(i) at office or business

premises; or

(ii) Through paid

vouchers which are

not transferable and

usable only at eating

joints.

d) In any other case Actual amount of expenditure

incurred by the employer

Less: Recovery from the

employee

Value of any Gift, Voucher or Gifts made in cash or

Token convertible into money

The value of any gift, or Amountover and above of Rs. (like gift cheques) are not

voucher, or token received by 5,000 onlyshall be taxable exempt.

the employee or by member [CircularNo.15/2001 dated

of his household on 12.12.2001]

ceremonial occasions or Alternative view → proviso to

otherwise from the employers Rule 3(7)(iv)

If amount > Rs. 5,000, full

amount taxable.

Where the value of such gift, The value of perquisite shall

voucher or token, as the case be nil. As per proviso to Rule

may be, is upto Rs. 5,000 in 3(7)(iv)

the aggregate during the

previous year.

Expenses on Credit Cards

Expenses including The amount paid for or

membership fees and annual reimbursed by the employer.

fees are incurred by the Less: Expenditure on use for

employee or any member of official purpose

his household, which is Less: Amount recovered from

charged to a credit card, employee

provided by the employer or

otherwise are paid for or

reimbursed by the employer

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.20

Nature of Perquisite Taxable Value of Note

Perquisite

Club Membership

The payment or The actual amount of

reimbursement by the expenditure incurred or

employer of any reimbursed by the employer.

expenditure incurred Less: Expenditure on use for

(including the amount of official purpose

annual or periodical fee) Less: Amount recovered from

in a club by the employee employee

or by any member of his

household

Use of Moveable Assets

a) Use of laptops and Nil The amount determined shall

computers be reduced by the reduced by

the amount, if any paid or

b) Moveable assets other i) If owned by employer than

recovered from the employee

than Laptops and 10% per annum of the actual

for such benefit.

computers cost of such asset, or

ii) If taken on hire by employer

the amount of rent or charge

paid, or payable by the

employer as the case may

be.

Transfer of any Moveable

Assets

a) Computers and Actual cost of such asset to the The amount determined shall

Electronic Items employer as reduced by 50% for be reduced by the amount, if

each completed year during any paid or recovered from the

which such asset was put to use employee for such benefit.

by the employer, on the basis of (Note – Completed year means

reducing balance method. ignore fraction of the year)

b) Motor Cars Actual cost of such asset to the

employer as reduced by 20% for

each completed year during

which such asset was put to use

by the employer, on the basis of

reducing balance method.

c) Any other Assets Actual cost of such asset to the

employer as reduced by

10%SLM of the actual cost to

the employer for each

completed year during which

such asset was put to use by the

employer.

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.21

Other Points –

1. Perquisites exempt in all cases

a. Telephone d. Transport Facility by employer engaged on

transportation of goods/ passengers

b. Employer’s contribution to e. Refreshment during working

staff group insurance hours in office premises

scheme

c. Recreational facilities if f. Rent-free official Residence to a Judge of a High

provided to all employees Court, the Supreme Court, Officer of Parliament,

Union Minister and aLeader of Opposition in

Parliament.

2. ESOP

Vesting Period ExercisePeriod

1st year 2nd year 3rd year 4th year 5th year

Date of

Date of Date of

Option Acquired Exercise

Allotment

MP = Rs. 175 MP = Rs.

100 shares @ 20 200

MP = Rs. 100

Vesting

DateMP = Rs.

150

Solution :

Perquisite = MV on the date of Exercise - Amount recovered from employee

= 100 Shares X Rs. 175 - 100 Shares X Rs. 20

= Rs. 17,500 - Rs. 2,000

But taxable in the year of allotment (i.e. 5 year).

Immediately Refer Past Exam Questions now. Baad me nahi hota hai. Sath sath me karo.

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.22

9. Provident Fund

Particulars Statutory Recognized PF Unrecognized Public PF

PF PF

Employer’s Fully Amount in excess Not taxable N.A.

Contribution exempt of 12% of salary is yearly

taxable

Employee’s Eligible for Eligible for Not eligible for Eligible

Contribution deduction deduction u/s 80C deduction for

u/s 80C deduction

u/s 80C

Interest Fully Amount in excess of Not taxable yearly Fully exempt

Credited exempt 9.5%

p.a. is taxable

On Employer’s

Contribution

Interest Exempt upto Amount in excess of Not taxable yearly Fully exempt

Credited certainlimit of 9.5%

On Employee’s contribution p.a. is

Contribution [See Note 2 taxable“salary” u/s

below] 17(1) [See

Note 2 below]

Amount Fully Exempt from tax Employer’s Fully

received on exempt u/s if employee contribution and exempt u/s

retirement, 10(11) served a interest thereon 10(11)

etc. continuous is

period of 5 years taxable as salary.

or more or Employee’s

retires before contribution

rendering 5 is not taxable.

years of service Interest on

because of employee’s

reason contribution is

beyondthe taxable under

control of the income from

employee. In other source.

other case, it will

be taxable.

Note 1 - For PF, Salary means – Basic + Conditional DA + Fixed % commission on Turnover

Note 2 - Interest credited on contribution by such person/employee

✓ Clause became applicable from 1.4.2021

✓ Interest o over and above contribution taxable - Interest accrued on the

principal contribution made b y that person/employee during the previous

year to the extent it relates to the amount or the aggregate of amounts of

contribution made > exceeding Rs. 2,50,000

✓ In case there is no employer’s contribution, then, a higher limit of `

5,00,000 would be applicable

✓ It may be noted that interest accrued on contribution to such funds upto 31st

March, 2021 would be exempt without any limit, even if the accrual of income is

after that date.

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.23

RPF, Superannuation & NPS - New Upper cap of 7.5 Lacs

1. The amount or the aggregate of amounts of any contribution made to the account of the

assessee by the employer—

(a) in a recognized provident fund;

(b) in the scheme of National Pension Scheme (NPS) ; and

(c) in an approved superannuation fund,

to the extent it exceeds 7.5 Lacs rs. in a previous year shall be taxable

2. The annual accretion by way of interest, dividend on the above amounts is also to be

included in value of 7.5 Lacs rupees.

Note – Previously, contribution of employer to Superannuation fund was exempt to

employee upto Rs. 1.5 lacs. Now this clause has been removed and an overall limit

of 7.5 lacs is given.

Illustration: Mr. X, working in MNO ltd., draws the following amount of emoluments from the

company:

Particulars Amount (in lakhs)

Basic Pay 50

Commission 15

Employer's contribution to recognized provident fund 10

Employer's contribution to NPS 7

Employer's contribution to the superannuation fund 5

Total 87

Solutions:

Amount (in lakhs)

Particulars After

Amendment

Basic Pay 50

Commission 15

Employer's contribution to recognized provident fund (in 4

excess of 12% of basic pay) [Rs. 10 lakh (less) Rs.6 lakh (Rs. 50

lakh * 12%] [Section 17(1)]

Employer's contribution to NPS 7

Employer's contribution to the superannuation fund in excess -

of rs. 1.5 lakhs [Old Section 17(2)(vii)]

Perquisite arising from Employer's contribution to the 14.50

superannuation fund, RPF and NPS in excess of rs. 7.5 lakhs

[New Section 17(2)(vii)]

Income chargeable to tax under the head "Salary" 90.50

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.24

AS Per CBDT Notification No. 11 Dated March 5, 2021

Finance Act, 2020 inserted a new sub-clause (viia) in section 17(2) so as to provide that annual accretion

by way of interest, dividend or any other amount of similar nature during the previous year to the

balance at the credit of the fund or scheme referred to in sub-clause (vii) may also be treated as

perquisite.

In Simple words the accretion amount will be calculated as –

Employer's Current year's

contribution > 7.5 lacs / 2 x Rate

Plus

Past Contribution >7.5 lacs +

Past Taxable amount x Rate

Simplified form of formula given

TP= (PC/2)*R + (PC1+ TP1)*R

Terms Meaning

TP Final answer which will be calculated

PC Employers' Contribution > 7.5 lacs during the current year

Employers' Contribution > 7.5 lacs during the current year other than of current

PC1 year

R I/ Favg

I Income accrued during the current previous

Funds Average

Favg (opening + Closing Balance )/2

TP1 Aggregate of taxable perquisite other than the current previous year

Example

Opening balance of NPS/RPF etc. 20,00,000

During the year contribution of

Employer 10,00,000

Employee 10,00,000

Interest earned during the year 8,00,000

Immediately Refer Past Exam Questions now. Baad me nahi hota hai. Sath sath me karo.

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.25

10.Deductions under the Head Salary (115BAC – All 3 Not Allowed)

Deductions from gross salary [Section 16]

a. Standard Deduction - Section 16(ia) -

A standard deduction of 50,000 or the amount of salary, whichever is lower, is

to be provided to “ALL” employees (Govt. Non Govt., Handicapped etc.)

b. Entertainment allowance (allowable only in the case of government

employees) [Section 16(ii)]

Least of the following is allowed as deduction:

(1) Rs. 5,000

(2) 1/5th of basic salary

(3) Actual entertainment allowance received

c. Profession tax [Section 16(iii)]

Any sum paid by the Assessee on account of tax on employment is allowable

as deduction.

In case profession tax is paid by employer on behalf of employee, the amount

paid shall be included in gross salary as a perquisite and then deduction can

be claimed.

Following table illustrates the impact of 115BAC under the head salaries (only the impacted

portion)

Sr. Nature of Exemption/Deduction Relating to Head Salaries New System Existing

No. of Tax u/s system of

115BAC Tax

A RETIREMENT BENEFITS EXEMPTIONS

leave travel Concession u/s 10(5) Not allowed allowed

B Allowances

Sr. Nature of Exemption/Deduction Relating to Head Salaries New System Existing

No. of Tax u/s system of

115BAC Tax

exemption u/s 10(13A) and rule 2Afrom House rent allowance Not allowed allowed

1. Exemption u/s 10(14)(i) and Rule 2BB

Travelling allowance allowed allowed

Conveyance allowance allowed allowed

daily allowance allowed allowed

Helper allowance Not allowed allowed

any allowance granted for encouraging the academic, research and Not allowed allowed

training pursuits in educational and research institutions

uniform allowance Not allowed allowed

2. Exemption u/s 10(14)(ii) and Rule 2BB

Children education allowance Not allowed allowed

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.26

Hostel expenditure allowance Not allowed allowed

tribal area allowance Not allowed allowed

transport allowance to Handicapped/deaf/dumb/Blind employee allowed allowed

transport allowance to other than above employees Not allowed Not allowed

C Perquisites

Free food and beverage through vouchers provided to the employee Not allowed allowed

upto 50/meal/tea & snacks

Other exemptions from perquisites e.g. use of Computers, laptops allowed allowed

etc

D Deductions u/s 16

Standard deduction u/s 16(ia) Not allowed allowed

entertainment allowance u/s 16(ii) Not allowed allowed

Professional tax u/s 16(iii) Not allowed allowed

Module - Case Laws

1. Can notional interest on security deposit given to the landlord in respect of residential premises taken on rent by

the employer and provided to the employee, be included in the perquisite value of rent-free accommodation given

to the employee ? CIT v. Shankar Krishnan (2012)(Bom.)

Decision - No

1. CanthelimitofINR1,000 per month per child be allowed as standard deduction, while computing the perquisite value

of free or concessional education facility provided to the employee by the employer?

CIT (TDS) v. Director, Delhi Public School (2011) (Punj. & Har.)

Decision – More than 1,000 – Fully taxable

Immediately Refer Past Exam Questions now. Baad me nahi hota hai. Sath sath me karo.

Accidental Points

1. While computation of Salary in Grade system – Change the salary after the completion of 12

months period and not from the beginning of the new Financial Year.

2. Remember “Salary” is differently defined in different calculations –

a.

Salary

Basic Conditional D.A Commission fixed

% of T.O

“Salary” is defined as above at total 4 calculations in this Chapter

c. Leave Encashment c. Not Covered by POGA – Gratuity

payment

d. H.R.A d. Provident Fund

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.27

b. Covered under POGA – Salary means → Basic + Full DA

c. Entertainment allowance - Salary means → Only Basic Salary

d. Rent Free Accomodation → Salary means

⬧ Basic Salary

⬧ DA (forming part of the retirement benefits)

⬧ Bonus

⬧ Fee

⬧ Commission (also includes fixed commission)

⬧ Taxable allowances i.e. only taxable portion of allowances

⬧ Monetary payment not being perquisites (e.g. Leave encashment) i.e. “Ignore ALL types of

perquisites in this calculation”)

3. Remember the mnemonics given in the chapter for different provisions like retirement benefits

calculations, allowances etc. This will make the retention of minute points very easy.

4. Read the beginning of any question very carefully. It may give you the hints regarding –

a. Who is the Person – Individual, Company, Firm etc.

b. Age of the person

c. City of stay of the person

d. Type of employee – Government/ Non Govt. Employee

e. Indian Citizen/ Person of Indian Origin etc.

5. In Pension calculate 1/2 or 1/3 of the (amount received/ commutation %). Generally, students

multiply 1/2 or 1/3 with the amount received and the whole calculation goes wrong.

6. Don’t forget to reduce monthly pension amount if the assessee is getting the amount

commuted during the year.

7. Need to mandatory remember the names and categories of the allowances.

8. Check carefully whether the House/ Furniture/ Car/ movable asset given to the employee for use

is “Owned” or “Rented” by the employer?

9. For Medical reimbursements and LTC, spouse, children can be dependent/ Independent but

parents/ brother/sister needs to be dependent to claim the benefit.

10. LTC restriction on Number of children (i.e. Maximum 2 ) is applicable only for those children who

are born 1.10.1998 onwards.

11. In Motor Car, Recovery from the employee is deducted from the value of the perquisite only and

only in the Second Category i.e. car/ expenses provided for “Fully Personal Use”.

The recovery is not to be deducted from Third Category i.e. Car provided for “Partly Official +

Partly Personal Use”

12. Calculation is different for below mentioned category of Motor Car –

Particulars Office + Personal purpose

3. Only Expenditure provided Total Expenditure

(-) 1800/2400 p.m

(-) 900 p.m for Driver (If any)

--------------------------------------

x x x → Taxable perquisite

(If higher amount to claim as expense, then

maintain documents)

13. Regarding reimbursement of Medical Expenses (Perquisite) now is taxable.

14. In Children’s Education allowance, there is a limit on the Number of Children (Max. 2) but for

Perquisite of education there is no limit on the number of Children.

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

4. Salary 4.28

15. For interest free or Concessional Loan – Consider the interest Rate of SBI only & that too of 1 st

Day of the relevant Year. Don’t get confused with the rates given of RBI, CG etc. and rate of

interest of different dates of the year.

16. Lunch/ Dinner perquisite provided at normal place of duty or paid vouchers provided – Taxable

but with the exemption limit of Rs. 50 per meal.

17. Lunch/ Dinner perquisite provided at offshore sites etc. – Fully exempt i.e. Taxable Value of

Perquisite is Nil

18. Lunch Dinner/ Meal allowance – Fully Taxable

19. Gift from Employer gets taxable under the head Salary (Exemption limit can be taken as Rs.

5000) and from other than employer gets taxable under the head “I.O.S” (Exemption limit can be

taken as Rs. 50,000)

20. If movable assets are transferred to the employee (i.e. sold 2nd Hand) follow the rates of

depreciation given as per valuation rules only –

a. Computers and Electronic Items - 50% w.d.v method

b. Motor Cars – 20% w.d.v method

c. Any other Assets – 10% SLM method.

Never get confused if the question specifies any other depreciation rate. Other rates if given,

have to be ignored.

21. Telephone perquisite – Not Taxable

Telephone allowance – Fully taxable

22. Specifically remember the category of the allowances where actual expenditure is relevant for

calculation and in which category it is irrelevant.

23. RPF category is most important for exams as this is the only category which contains limits if

12% of Salary and 9.5% of interest.

24. Entertainment allowance is “FULLY TAXABLE” for Non Govt. employee. Deduction is provided

only to the Govt employee.

Unique Academy - 8007916622 CA Saumil Manglani - Contact 9921051593

You might also like

- Role of Personal Finance Towards Managing of Money - DraftaDocument35 pagesRole of Personal Finance Towards Managing of Money - DraftaAndrea Denise Lion100% (1)

- Modulo EminicDocument13 pagesModulo EminicAndreaNo ratings yet

- TCL LD24D50 - Chassis MS09A-LA - (TKLE2413D) - Manual de Servicio PDFDocument41 pagesTCL LD24D50 - Chassis MS09A-LA - (TKLE2413D) - Manual de Servicio PDFFabian OrtuzarNo ratings yet

- Kahneman & Tversky Origin of Behavioural EconomicsDocument25 pagesKahneman & Tversky Origin of Behavioural EconomicsIan Hughes100% (1)

- Grade 7 ExamDocument3 pagesGrade 7 ExamMikko GomezNo ratings yet

- Service Manual: SV01-NHX40AX03-01E NHX4000 MSX-853 Axis Adjustment Procedure of Z-Axis Zero Return PositionDocument5 pagesService Manual: SV01-NHX40AX03-01E NHX4000 MSX-853 Axis Adjustment Procedure of Z-Axis Zero Return Positionmahdi elmay100% (3)

- Hey Friends B TBDocument152 pagesHey Friends B TBTizianoCiro CarrizoNo ratings yet

- Checklist & Guideline ISO 22000Document14 pagesChecklist & Guideline ISO 22000Documentos Tecnicos75% (4)

- Richardson Heidegger PDFDocument18 pagesRichardson Heidegger PDFweltfremdheitNo ratings yet

- Bos 50392 CP 4 U 1Document116 pagesBos 50392 CP 4 U 1Gokul AkrishnanNo ratings yet

- 56464bos45796cp4u1 PDFDocument119 pages56464bos45796cp4u1 PDFVinay kumarNo ratings yet

- Bos 53217 CP 4 U 1Document122 pagesBos 53217 CP 4 U 1Yash SharmaNo ratings yet

- Wa0001.Document134 pagesWa0001.Mehul ChoudharyNo ratings yet

- A Study On Income From SalaryDocument65 pagesA Study On Income From SalaryShannon GonsalvesNo ratings yet

- 02 - Taxation - Chapter-2 - Salary Part-1Document27 pages02 - Taxation - Chapter-2 - Salary Part-1apandeyproNo ratings yet

- On Income From Salary - 20210202100403Document14 pagesOn Income From Salary - 20210202100403AJ WalkerNo ratings yet

- Salaries NotesDocument48 pagesSalaries Notesbhatiasanjay89No ratings yet

- Salary Material Py 2017-18Document16 pagesSalary Material Py 2017-18MS editzzNo ratings yet

- Prepared By: (Zeeshan Amjad Baig)Document20 pagesPrepared By: (Zeeshan Amjad Baig)zeeshan655No ratings yet

- CHAP - 5 SalaryDocument44 pagesCHAP - 5 Salarypriya chauhanNo ratings yet

- Direct Taxes Module 2 Class NotesDocument13 pagesDirect Taxes Module 2 Class NotesSwetha AshokNo ratings yet

- Meaning of Salary: Section 17Document12 pagesMeaning of Salary: Section 17Xenqiyj XyenttukNo ratings yet

- Chapter 4 Ptx1033/Statutory Income From EmploymentDocument14 pagesChapter 4 Ptx1033/Statutory Income From EmploymentNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Income From SalaryDocument35 pagesIncome From SalaryNistha RayNo ratings yet

- Income From Salary Computation of Gross Salary of Mr. - For The Assessment Year 2020-21Document21 pagesIncome From Salary Computation of Gross Salary of Mr. - For The Assessment Year 2020-21sini rayNo ratings yet

- InTax Formate 2021-22 Nuaman Khalid 03446046421 PDFDocument8 pagesInTax Formate 2021-22 Nuaman Khalid 03446046421 PDFMuhammad sheran sattiNo ratings yet

- Taxation SalaryDocument13 pagesTaxation SalarySumant ParakhNo ratings yet

- International Institute of Professional Studies, DAVVDocument5 pagesInternational Institute of Professional Studies, DAVVGulshan GurnaniNo ratings yet

- Income Tax (B.com Ii)Document9 pagesIncome Tax (B.com Ii)iramanwarNo ratings yet

- Income Under The Head SalaryDocument14 pagesIncome Under The Head SalaryTarun SinghalNo ratings yet

- Income Tax RevisionDocument249 pagesIncome Tax Revisionsharmayashi1111No ratings yet

- Income Tax Department - Salary BenefitsDocument19 pagesIncome Tax Department - Salary BenefitsHarty RobertNo ratings yet

- Summary of SalaryDocument6 pagesSummary of SalaryRahul GhosaleNo ratings yet

- Employees - Benefits AllowableDocument15 pagesEmployees - Benefits Allowablesubashjayaraj25No ratings yet

- Revised Valuation Rules For PerquisitesDocument6 pagesRevised Valuation Rules For PerquisitesShashi Bala ChaudharyNo ratings yet

- 30 SalaryDocument13 pages30 SalaryBahi Rathan RNo ratings yet

- Taxation of Individuals: Step 1 Step 2: Step 3Document39 pagesTaxation of Individuals: Step 1 Step 2: Step 3Pratyanshi MehtaNo ratings yet

- Valuation of PerquisitesDocument11 pagesValuation of PerquisitesGopinathan Ae100% (1)

- Calculation of Salary IncomeDocument3 pagesCalculation of Salary IncomeIqra HayatNo ratings yet

- Chapter 6. Income From Property v2Document6 pagesChapter 6. Income From Property v2LEARN FROM MENo ratings yet

- Direct Tax Summary Notes For IPCC JKQK1AK0Document24 pagesDirect Tax Summary Notes For IPCC JKQK1AK0Vivek ShimogaNo ratings yet

- 2 Income From SalaryDocument3 pages2 Income From Salaryatharvaanila5587No ratings yet

- Afsal TaxDocument2 pagesAfsal Taxplacementcell Govt ITI AttingalNo ratings yet

- Income From Houseproperty A.Y. 2022-23Document4 pagesIncome From Houseproperty A.Y. 2022-23Vivek LedwaniNo ratings yet

- BCom Income Tax Procedure and PracticeDocument61 pagesBCom Income Tax Procedure and PracticeUjjwal KandhaweNo ratings yet

- Imp Points of IncomeTaxDocument4 pagesImp Points of IncomeTaxKushal D KaleNo ratings yet

- PerquisitiesDocument13 pagesPerquisitiesDeeksha KapoorNo ratings yet

- Allowances Allowable To Tax PayerDocument13 pagesAllowances Allowable To Tax PayerbabakababaNo ratings yet

- Income Tax Department - BENEFITS AND SECDocument18 pagesIncome Tax Department - BENEFITS AND SECpratyush1200No ratings yet

- Allowances Allowable To Tax PayerDocument15 pagesAllowances Allowable To Tax PayerAkhikNo ratings yet

- Unit 4 FPTMDocument38 pagesUnit 4 FPTMAmit GuptaNo ratings yet

- Sunil BDocument2 pagesSunil Bplacementcell Govt ITI AttingalNo ratings yet

- PerquisitesDocument6 pagesPerquisitesArgha DeySarkarNo ratings yet

- Suggested Solution I.P.C.C Nov. 2017 EXAM Taxation Test Code - INJ4007Document9 pagesSuggested Solution I.P.C.C Nov. 2017 EXAM Taxation Test Code - INJ4007Ravi SinghNo ratings yet

- A1846812814 24953 21 2019 Rent Free Accommodation Computation & Taxability-StudyDocument3 pagesA1846812814 24953 21 2019 Rent Free Accommodation Computation & Taxability-StudyAvi MaheshwariNo ratings yet

- Income From House Property SEM IVDocument8 pagesIncome From House Property SEM IVThenmozhi RameshNo ratings yet

- SalaryDocument29 pagesSalarySarvar PathanNo ratings yet

- IntroductionDocument16 pagesIntroductionseshu187No ratings yet

- Salary: After Studying This Chapter, You Would Be Able ToDocument67 pagesSalary: After Studying This Chapter, You Would Be Able Torishikesh kumarNo ratings yet

- Income Tax Procedure and Practice II Year Tax Specilization 20 FinalDocument37 pagesIncome Tax Procedure and Practice II Year Tax Specilization 20 FinalDivya DubeyNo ratings yet

- Format Relief Rebate Ya 2021 - LatestDocument4 pagesFormat Relief Rebate Ya 2021 - LatestJasne OczyNo ratings yet

- List of Beneftis For Salaries Income Tax AY 2023 24Document20 pagesList of Beneftis For Salaries Income Tax AY 2023 24Shaik ChandNo ratings yet

- About The Charts: CA Pooja Kamdar DateDocument8 pagesAbout The Charts: CA Pooja Kamdar DatekbalakarthikaNo ratings yet

- Retirement BenifitDocument10 pagesRetirement BenifitAyush SarawagiNo ratings yet

- List of Benefits Available To Salaried Persons (AY 2021-22) S. N. Sec Tio N Particulars BenefitsDocument17 pagesList of Benefits Available To Salaried Persons (AY 2021-22) S. N. Sec Tio N Particulars BenefitsAnkit SinghalNo ratings yet

- Print This PageDocument1 pagePrint This PageTenali ChandanaNo ratings yet

- Chapter 2.2 TaxDocument13 pagesChapter 2.2 TaxSiddharth VaswaniNo ratings yet

- Unit 1: Income From Salaries: Key PointsDocument220 pagesUnit 1: Income From Salaries: Key PointsAnkIt KRNo ratings yet

- Technology Management 1Document38 pagesTechnology Management 1Anu NileshNo ratings yet

- 7400 IC SeriesDocument16 pages7400 IC SeriesRaj ZalariaNo ratings yet

- Making Effective Powerpoint Presentations: October 2014Document18 pagesMaking Effective Powerpoint Presentations: October 2014Mariam TchkoidzeNo ratings yet

- Working Capital in YamahaDocument64 pagesWorking Capital in YamahaRenu Jindal50% (2)

- Business Plan 3.3Document2 pagesBusiness Plan 3.3Rojin TingabngabNo ratings yet

- Chapter 13 Exercises With AnswerDocument5 pagesChapter 13 Exercises With AnswerTabitha HowardNo ratings yet

- Huawei R4815N1 DatasheetDocument2 pagesHuawei R4815N1 DatasheetBysNo ratings yet

- Week 7Document24 pagesWeek 7Priyank PatelNo ratings yet

- Deal Report Feb 14 - Apr 14Document26 pagesDeal Report Feb 14 - Apr 14BonviNo ratings yet

- Soft Ground Improvement Using Electro-Osmosis.Document6 pagesSoft Ground Improvement Using Electro-Osmosis.Vincent Ling M SNo ratings yet

- Obesity - The Health Time Bomb: ©LTPHN 2008Document36 pagesObesity - The Health Time Bomb: ©LTPHN 2008EVA PUTRANTO100% (2)

- AIA1800 Operator ManualDocument184 pagesAIA1800 Operator ManualZain Sa'adehNo ratings yet

- How Drugs Work - Basic Pharmacology For Healthcare ProfessionalsDocument19 pagesHow Drugs Work - Basic Pharmacology For Healthcare ProfessionalsSebastián Pérez GuerraNo ratings yet

- User S Manual AURORA 1.2K - 2.2KDocument288 pagesUser S Manual AURORA 1.2K - 2.2KEprom ServisNo ratings yet

- PM CH 14Document24 pagesPM CH 14phani chowdaryNo ratings yet

- Hamstring - WikipediaDocument21 pagesHamstring - WikipediaOmar MarwanNo ratings yet

- Working With Difficult People Online WorksheetDocument4 pagesWorking With Difficult People Online WorksheetHugh Fox IIINo ratings yet

- History of The Sikhs by Major Henry Cour PDFDocument338 pagesHistory of The Sikhs by Major Henry Cour PDFDr. Kamalroop SinghNo ratings yet

- SHCDocument81 pagesSHCEng Mostafa ElsayedNo ratings yet

- QP December 2006Document10 pagesQP December 2006Simon ChawingaNo ratings yet

- Carob-Tree As CO2 Sink in The Carbon MarketDocument5 pagesCarob-Tree As CO2 Sink in The Carbon MarketFayssal KartobiNo ratings yet