Professional Documents

Culture Documents

Apportionment of Input Tax

Apportionment of Input Tax

Uploaded by

tutorwarrior980 ratings0% found this document useful (0 votes)

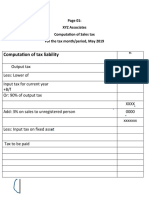

15 views1 pageInput tax must be apportioned between taxable, exempted, and zero-rated supplies. The value of taxable supplies is divided by the value of total supplies to calculate the apportionment percentage, which is then applied to the residual input tax to determine the amount claimable. Brought forward input tax and purchases of finished goods do not require apportionment. Sales and purchase return figures must be included in values.

Original Description:

Tax Practices CAF 03 Input tax

Original Title

Apportionment of Input tax

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInput tax must be apportioned between taxable, exempted, and zero-rated supplies. The value of taxable supplies is divided by the value of total supplies to calculate the apportionment percentage, which is then applied to the residual input tax to determine the amount claimable. Brought forward input tax and purchases of finished goods do not require apportionment. Sales and purchase return figures must be included in values.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views1 pageApportionment of Input Tax

Apportionment of Input Tax

Uploaded by

tutorwarrior98Input tax must be apportioned between taxable, exempted, and zero-rated supplies. The value of taxable supplies is divided by the value of total supplies to calculate the apportionment percentage, which is then applied to the residual input tax to determine the amount claimable. Brought forward input tax and purchases of finished goods do not require apportionment. Sales and purchase return figures must be included in values.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Input tax on making both Determination & Apportionment of Input Tax (Rule 25)

Residual Input Tax

Input tax on

Taxable supplies

Exempted suplies

(including zero rated)

Taxable supplies + Zero rated supplies + Exempted supplies

Shall be apportioned.

Note:- Fromula:-

Commercial Inporter: Apportionment:

* No apportionment as goods are finished. Value of taxable supplies

x Residual input tax

Value of total supplies

General:

* B/f input tax should not be apporioned. Method:-

* No apportionment in case of finished goods e.g 3rd Schedule items. Gross value of supplies Input tax

* Sales return figure should be taken.

* Purchase return figure shall be considered. Taxable supplies xxx xxx

Zero rated supplies xxx xxx

Exempted supplies xxx xxx

Total XXX XXX (Residual Input)

You might also like

- Input Taxes SummaryDocument8 pagesInput Taxes SummaryMichael AquinoNo ratings yet

- VAT Input TaxesDocument7 pagesVAT Input TaxesJocelyn Verbo-AyubanNo ratings yet

- Format Sopl and SofpDocument3 pagesFormat Sopl and SofpMuhammad Faaiz IzzeawanNo ratings yet

- 801 Value Added TaxDocument4 pages801 Value Added TaxHarold Cedric Noleal OsorioNo ratings yet

- 08 Inventories EstimationsDocument8 pages08 Inventories EstimationsKhen HannaNo ratings yet

- Consolidated Statement Formula02 PDFDocument3 pagesConsolidated Statement Formula02 PDFNiña Rica PunzalanNo ratings yet

- Valued Added TaxDocument5 pagesValued Added TaxCharles Reginald K. Hwang100% (7)

- Manufacturing Accounts Notes and QuestionsDocument31 pagesManufacturing Accounts Notes and QuestionsRoshan RamkhalawonNo ratings yet

- 03 Vat Subject TransactionsDocument5 pages03 Vat Subject TransactionsJaneLayugCabacungan100% (1)

- Cost System - Provides Updated Information About ManufacturingDocument8 pagesCost System - Provides Updated Information About ManufacturingNiccoRobDeCastroNo ratings yet

- Sales Tax Numerical FormatDocument3 pagesSales Tax Numerical Formatshefu100% (1)

- Heart Rules of Sales TaxDocument4 pagesHeart Rules of Sales Taxbroken GMDNo ratings yet

- Chapter 3 - Statement of Comprehensive IncomeDocument7 pagesChapter 3 - Statement of Comprehensive IncomeKarylle EntinoNo ratings yet

- Value-Added Tax: Pro-FormaDocument10 pagesValue-Added Tax: Pro-FormaGabrielle Joshebed AbaricoNo ratings yet

- Sale Tax Formate 2020-21Document2 pagesSale Tax Formate 2020-21Syed QasimNo ratings yet

- ACTBFAR Pro-Forma Statements - Accounting For Manufacturing-1Document5 pagesACTBFAR Pro-Forma Statements - Accounting For Manufacturing-1Gabrielle Brianna ChuaNo ratings yet

- Accounting For Manufacturing Operations: MGT 113 - Managerial Accounting Instructor: Ms. HdmirandaDocument2 pagesAccounting For Manufacturing Operations: MGT 113 - Managerial Accounting Instructor: Ms. HdmirandaKeziah Eldene VilloraNo ratings yet

- Statement of Comprehensive IncomeDocument6 pagesStatement of Comprehensive IncomeChinchin Ilagan DatayloNo ratings yet

- Ac 3103Document2 pagesAc 3103Lance UrichNo ratings yet

- CA & CMA StatementsDocument2 pagesCA & CMA StatementsArsalan KhalidNo ratings yet

- FSs For CompaniesDocument9 pagesFSs For CompaniesFarid UddinNo ratings yet

- Taxable IncomeDocument18 pagesTaxable Incomerav danoNo ratings yet

- Vat - Ransfer & Business Taxation Enrico D. TabagDocument30 pagesVat - Ransfer & Business Taxation Enrico D. TabagJhon baal S. SetNo ratings yet

- Macro Group 2 SummaryDocument3 pagesMacro Group 2 SummaryReggieNo ratings yet

- Chap-7, 8 & 9 (Income Statemnet & Statement of Financial Position)Document18 pagesChap-7, 8 & 9 (Income Statemnet & Statement of Financial Position)7a4374 hisNo ratings yet

- Transfer and Business Taxation Accounting Methods and PeriodsDocument5 pagesTransfer and Business Taxation Accounting Methods and PeriodsApril Joy Padua SimonNo ratings yet

- Is SofpDocument2 pagesIs SofpHilwa FarhanNo ratings yet

- CPTR 5 Optional Corporate Tax On Branch Profit Remittance 1Document5 pagesCPTR 5 Optional Corporate Tax On Branch Profit Remittance 1NaikNo ratings yet

- Lesson 3d Preparation of Statement of Comprehensive Income - Manufacturing BusinessDocument8 pagesLesson 3d Preparation of Statement of Comprehensive Income - Manufacturing BusinessBenedict CladoNo ratings yet

- Chap-7, 8 & 9 (Income Statemnet & Statement of Financial Position)Document17 pagesChap-7, 8 & 9 (Income Statemnet & Statement of Financial Position)7a4374 hisNo ratings yet

- Chargeable ExpensesDocument33 pagesChargeable ExpensesMahmud MugdhoNo ratings yet

- Cost SheetDocument6 pagesCost SheetabhineshNo ratings yet

- CGT Notes - AnnotatedDocument54 pagesCGT Notes - AnnotatedDr SafaNo ratings yet

- Income Statement and Balance SheetDocument20 pagesIncome Statement and Balance Sheetpankaj tiwariNo ratings yet

- Revised Unit 1 - Ch. - Methods of Costing - 25!07!2021Document9 pagesRevised Unit 1 - Ch. - Methods of Costing - 25!07!2021aayushgiri21No ratings yet

- 1 (D) National Income (Measurement of National Income)Document6 pages1 (D) National Income (Measurement of National Income)bhadanashivam696No ratings yet

- Notes On Value Added TaxDocument7 pagesNotes On Value Added TaxPines MacapagalNo ratings yet

- CF StatementDocument3 pagesCF StatementSukumarVenkataNo ratings yet

- CGS ScheduleDocument6 pagesCGS ScheduleMariaCarlaMañagoNo ratings yet

- 07 Business Tax and VATDocument5 pages07 Business Tax and VATlemvin121003No ratings yet

- Week 10 CorporationssDocument9 pagesWeek 10 CorporationssAdrian MontemayorNo ratings yet

- FAR 215 Inventory EstimationDocument8 pagesFAR 215 Inventory EstimationJai BacalsoNo ratings yet

- Final Account of Sole TradersDocument16 pagesFinal Account of Sole Tradersheena mohnaniNo ratings yet

- Manufacturing Accounts NotesDocument5 pagesManufacturing Accounts Notestelemaque ewin123No ratings yet

- Cost Accounting NotesDocument97 pagesCost Accounting NotesSumiya AkterNo ratings yet

- A Cost Sheet Depicts The Following FactsDocument18 pagesA Cost Sheet Depicts The Following Factsharsh singhNo ratings yet

- Mutiara Enterprise Statement of Profit or Loss For The Year Ended 31 December 2019Document3 pagesMutiara Enterprise Statement of Profit or Loss For The Year Ended 31 December 2019Zafran100% (1)

- Cost Accounting PDFDocument22 pagesCost Accounting PDFLaiba Javed Javed IqbalNo ratings yet

- VAT Powerpoint PDFDocument202 pagesVAT Powerpoint PDFRuchie EtolleNo ratings yet

- .Manufacturing Accounts 1707462151000Document5 pages.Manufacturing Accounts 1707462151000noahtarus21No ratings yet

- Part Ii - Statement of Profit and LossDocument3 pagesPart Ii - Statement of Profit and LossSaumyajit DeyNo ratings yet

- Chapter 5: Job Order Costing System: Characteristics of Production ProcessDocument3 pagesChapter 5: Job Order Costing System: Characteristics of Production ProcessANo ratings yet

- Customs & FTP: Indirect TaxesDocument9 pagesCustoms & FTP: Indirect TaxesRudraNo ratings yet

- Sample Problems - CT & CBDocument6 pagesSample Problems - CT & CBGwyn GwynethNo ratings yet

- Computation of Tax LiabilityDocument7 pagesComputation of Tax LiabilityHasnainNo ratings yet

- CFR ProblemsDocument28 pagesCFR ProblemsMadhu kumarNo ratings yet

- Cash Flow Statement - FormatDocument2 pagesCash Flow Statement - FormatHassan AsgharNo ratings yet

- CSEC National Income Accounting NotesDocument11 pagesCSEC National Income Accounting Notesainnoxid123No ratings yet