Professional Documents

Culture Documents

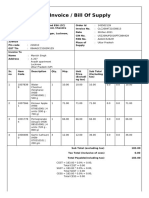

Invoice Up

Uploaded by

gulshankumar293310Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Invoice Up

Uploaded by

gulshankumar293310Copyright:

Available Formats

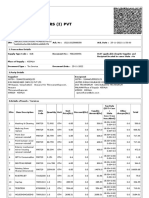

09ARWPD5494Q1ZK

DAS CONSTRUCTION

1. e-Invoice Details

IRN:

28fca6426e8a3ec24505ac8674cfaec5 Ack. No: 142313843146349 Ack. Date: 29/11/2023 07:40:00

b92ef93e0ad99ebeceaf1b5d38fa1291

2. Transaction Details

Supply Type Code: B2B Document No: DC/W/057 IGST applicable despite Supplier

and Recipient located in same State: No

Place of Supply: ORISSA

Document Type: Tax Invoice Document Date: 29/11/2023

3. Party Details

Supplier: Recipient:

GSTIN: 09ARWPD5494Q1ZK GSTIN: 21ARWPD5494Q1ZY

DAS CONSTRUCTION M/S DAS CONSTRUCTION

01 KIRSIYA DANAGADI JAJPUR ROAD

HAIDERGARH, 227301, UTTAR PRADESH Place of supply: ORISSA

DANAGADI, 755026, ORISSA

Dispatch From: Ship To:

m/s das construction GSTIN: 21ARWPD5494Q1ZY

UNNAO m/s das construction

LUCKNOW CHARMAL

UNNAO, 209801, UTTAR PRADESH SAMBALPUR

CHARMAL, 768106, ORISSA

4. Details of Goods / Services

Tax Rate(GST +

Other

Sl Unit Price Discount Taxable Cess | State Cess

Item Description HSN Code Quantity Charges Total

No (Rs) (Rs) Amount + Cess

(Rs)

Non.Advol)

1 73084000 136 500 0 68000 18 + 0 | 0 + 0 0 80240

2 73084000 16 300 0 4800 18 + 0 | 0 + 0 0 5664

3 73084000 13 1000 0 13000 18 + 0 | 0 + 0 0 15340

4 73084000 3 400 0 1200 18 + 0 | 0 + 0 0 1416

5 73084000 1 700 0 700 18 + 0 | 0 + 0 0 826

6 73084000 9 500 0 4500 18 + 0 | 0 + 0 0 5310

7 73084000 12 300 0 3600 18 + 0 | 0 + 0 0 4248

8 73084000 45 700 0 31500 18 + 0 | 0 + 0 0 37170

9 73084000 148 300 0 44400 18 + 0 | 0 + 0 0 52392

10 73084000 36 200 0 7200 18 + 0 | 0 + 0 0 8496

11 73084000 61 150 0 9150 18 + 0 | 0 + 0 0 10797

12 73084000 19 400 0 7600 18 + 0 | 0 + 0 0 8968

13 73084000 25 350 0 8750 18 + 0 | 0 + 0 0 10325

14 73084000 42 100 0 4200 18 + 0 | 0 + 0 0 4956

Tax Rate(GST +

Other

Sl Unit Price Discount Taxable Cess | State Cess

Item Description HSN Code Quantity Charges Total

No (Rs) (Rs) Amount + Cess

(Rs)

Non.Advol)

15 73084000 16 400 0 6400 18 + 0 | 0 + 0 0 7552

16 73084000 11 300 0 3300 18 + 0 | 0 + 0 0 3894

17 73084000 58 100 0 5800 18 + 0 | 0 + 0 0 6844

18 73084000 321 50 0 16050 18 + 0 | 0 + 0 0 18939

19 73084000 634 50 0 31700 18 + 0 | 0 + 0 0 37406

20 73084000 69 500 0 34500 18 + 0 | 0 + 0 0 40710

21 73084000 110 500 0 55000 18 + 0 | 0 + 0 0 64900

22 73084000 1 500 0 500 18 + 0 | 0 + 0 0 590

23 73084000 159 500 0 79500 18 + 0 | 0 + 0 0 93810

24 73084000 55 600 0 33000 18 + 0 | 0 + 0 0 38940

25 73084000 1393 100 0 139300 18 + 0 | 0 + 0 0 164374

26 73084000 68 250 0 17000 18 + 0 | 0 + 0 0 20060

27 73084000 36 200 0 7200 18 + 0 | 0 + 0 0 8496

28 73084000 19 150 0 2850 18 + 0 | 0 + 0 0 3363

29 73084000 8 100 0 800 18 + 0 | 0 + 0 0 944

30 73084000 362 150 0 54300 18 + 0 | 0 + 0 0 64074

31 73084000 1047 30 0 31410 18 + 0 | 0 + 0 0 37063.8

32 73084000 247 30 0 7410 18 + 0 | 0 + 0 0 8743.8

33 73084000 30 200 0 6000 18 + 0 | 0 + 0 0 7080

34 73084000 7 200 0 1400 18 + 0 | 0 + 0 0 1652

35 73084000 18 100 0 1800 18 + 0 | 0 + 0 0 2124

Taxable State Other

CGST Amt SGST Amt IGST Amt CESS Amt Discount Round Off Amt Total Inv. Amt

Amt CESS Amt Charges

743820 0 0 133887.6 0 0 0 0 0 877707.6

5. Eway Bill Details

EWB No.: 421391069195 EWB. Date: 29/11/2023 Valid Till Date: 05/12/2023

Generated By: 09ARWPD5494Q1ZK

Print date: 29/11/2023 07:40:15

142313843146349 Digitally signed by NIC-IRP

On: 29/11/2023 07:40:00

You might also like

- Revised E InvoiceDocument2 pagesRevised E InvoiceVaibhav ShahNo ratings yet

- G.K Galaxy World 01.01.2023Document1 pageG.K Galaxy World 01.01.2023ashok515No ratings yet

- Credit Note InvoiceDocument2 pagesCredit Note InvoiceVaibhav ShahNo ratings yet

- Rain NDocument1 pageRain NBANWARI JOSHINo ratings yet

- Invoice - 2023-09-25T134116.243Document17 pagesInvoice - 2023-09-25T134116.243Surendra PanwarNo ratings yet

- QutotionDocument1 pageQutotionmanishsngh24No ratings yet

- Einv 1Document1 pageEinv 1Chandrasekar KrishnamurthyNo ratings yet

- Einv2 - GS FlatsDocument1 pageEinv2 - GS FlatsVaibhav ShahNo ratings yet

- Sale Sep. 22Document3 pagesSale Sep. 22birpal singhNo ratings yet

- Irn 29004Document1 pageIrn 29004lukuplokeshNo ratings yet

- Crystal Autocars Private Limited: Accessory - Tax InvoiceDocument2 pagesCrystal Autocars Private Limited: Accessory - Tax InvoiceDeepak BrohmaNo ratings yet

- Debit Note-9 VitalDocument1 pageDebit Note-9 VitalsrilakshminarasimhabbNo ratings yet

- Artha PoDocument3 pagesArtha Poankush7779No ratings yet

- RF Zigzag 801Document1 pageRF Zigzag 801siddharthtexsuratNo ratings yet

- Tax Invoice / Bill of SupplyDocument1 pageTax Invoice / Bill of SupplyUrvashi NemeiaNo ratings yet

- 29AMBPG7773M000 The Odisha State Co-Operative Marketing Federation LimitedDocument1 page29AMBPG7773M000 The Odisha State Co-Operative Marketing Federation LimitedPRASHANT KUMAR SAHOONo ratings yet

- LeverEDGE billPrint31Oct20231856450223Document1 pageLeverEDGE billPrint31Oct20231856450223pratibharajiv81No ratings yet

- Spine AMCDocument1 pageSpine AMCIT HelpdeskNo ratings yet

- ExportDocument1 pageExportAnkit DalsaniyaNo ratings yet

- Parts Invoice - 2022-12-01T114656.716Document1 pageParts Invoice - 2022-12-01T114656.716C RamakrishnaNo ratings yet

- Sale Sep. 22Document4 pagesSale Sep. 22birpal singhNo ratings yet

- Tax Invoice / Bill of SupplyDocument2 pagesTax Invoice / Bill of SupplyManish Kumar SinghNo ratings yet

- Tax Invoice: Vehicle Details Invoice Details BilledtoDocument4 pagesTax Invoice: Vehicle Details Invoice Details BilledtoRama Mohan Reddy PeddakotlaNo ratings yet

- Oner New DN After 20% CDDocument2 pagesOner New DN After 20% CDUjjwal GuptaNo ratings yet

- Return To VendorDocument1 pageReturn To VendorPavan Kumar PNo ratings yet

- E-Way Bill System 08.09Document2 pagesE-Way Bill System 08.09sitapodilaNo ratings yet

- 3344INVDocument2 pages3344INVgeorgy wilsonNo ratings yet

- Inter Tech 3Document3 pagesInter Tech 3Harsh DiwakerNo ratings yet

- Invoice - 2023-09-25T133901.713Document5 pagesInvoice - 2023-09-25T133901.713Surendra PanwarNo ratings yet

- 29AMBPG7773M000 The Odisha State Co-Operative Marketing Federation LimitedDocument1 page29AMBPG7773M000 The Odisha State Co-Operative Marketing Federation LimitedPRASHANT KUMAR SAHOONo ratings yet

- E Invoice Oct, 21Document9 pagesE Invoice Oct, 21Anuj SharmaNo ratings yet

- Invoice - GST 614 2023 24Document1 pageInvoice - GST 614 2023 24pdprasanta48No ratings yet

- Marwar Sale 23 24 MS1 10325 180808Document1 pageMarwar Sale 23 24 MS1 10325 180808woodlab4uNo ratings yet

- TAX0179 SalesInvoiceDocument1 pageTAX0179 SalesInvoiceJassi SinghNo ratings yet

- Screenshot 2023-10-30 at 8.32.39 PMDocument1 pageScreenshot 2023-10-30 at 8.32.39 PMkakarlasrinu1No ratings yet

- RoughDocument3 pagesRoughbalvant.darshnaNo ratings yet

- InvoiceDocument1 pageInvoicesce mduNo ratings yet

- 29AMBPG7773M000 The Odisha State Co-Operative Marketing Federation LimitedDocument1 page29AMBPG7773M000 The Odisha State Co-Operative Marketing Federation LimitedPRASHANT KUMAR SAHOONo ratings yet

- Credit Note 10Document1 pageCredit Note 10srilakshminarasimhabbNo ratings yet

- 9c RequirementsDocument10 pages9c RequirementsKomet Study AbroadNo ratings yet

- 2nd Floor, NIRMAL-PAMAN Kamal Phool Chowk, Jaripatka, NAGPURDocument1 page2nd Floor, NIRMAL-PAMAN Kamal Phool Chowk, Jaripatka, NAGPURprimeexotica1No ratings yet

- Lease Rent Satguru 01.01.23-31.12.23Document1 pageLease Rent Satguru 01.01.23-31.12.23sourabh nawaniNo ratings yet

- CableDocument1 pageCableJetha JethaaNo ratings yet

- Air Force SirsaDocument1 pageAir Force Sirsapiechuckers.shaanNo ratings yet

- Khandelwal Agencies PVT - LTD.: Sari Ganeshay Namah GST - Invoice Original For BuyerDocument1 pageKhandelwal Agencies PVT - LTD.: Sari Ganeshay Namah GST - Invoice Original For BuyerSabuj SarkarNo ratings yet

- 1 Khandelwal Agencies PVTDocument1 page1 Khandelwal Agencies PVTSabuj SarkarNo ratings yet

- Tax Invoice / Bill of SupplyDocument1 pageTax Invoice / Bill of SupplyabhimanyuNo ratings yet

- 09AAECC7577P1ZR Countrywide Logistics India Private Limited: Supplier: RecipientDocument3 pages09AAECC7577P1ZR Countrywide Logistics India Private Limited: Supplier: Recipientjatin doshiNo ratings yet

- ST SupO 2944 2022 23 183233 PDFDocument1 pageST SupO 2944 2022 23 183233 PDFRajat SharmaNo ratings yet

- Profor 1Document1 pageProfor 1John FernendiceNo ratings yet

- PDF 7000002152Document1 pagePDF 7000002152PRASHANT KUMAR SAHOONo ratings yet

- 73 Dahej-1Document1 page73 Dahej-1nishthaequipments2004No ratings yet

- Einv 1Document2 pagesEinv 1Tarun DiwakarNo ratings yet

- Fin Tab 70231206 105997027Document5 pagesFin Tab 70231206 105997027advance electricalNo ratings yet

- Khandelwal Agencies Pvt. LTD.: GST - InvoiceDocument6 pagesKhandelwal Agencies Pvt. LTD.: GST - InvoiceSabuj SarkarNo ratings yet

- Util GetXPSDocument3 pagesUtil GetXPSJassi SinghNo ratings yet

- F HarleyDocument4 pagesF HarleyShaon majiNo ratings yet

- Rajasthan Rajya Vidyut Uthpadan Nigam LTD 07.12.2023 PDF-2Document1 pageRajasthan Rajya Vidyut Uthpadan Nigam LTD 07.12.2023 PDF-2primeengineers444No ratings yet

- Ok Lifecare Private Limited (H03) : Tax Collection SummaryDocument3 pagesOk Lifecare Private Limited (H03) : Tax Collection Summaryparveen122133No ratings yet

- Return TicketsDocument2 pagesReturn Ticketsmallesh mNo ratings yet

- 2020-04-23 0012724719 590.00 PDFDocument1 page2020-04-23 0012724719 590.00 PDFAnjan MondalNo ratings yet

- FlatskimDocument3 pagesFlatskimAbhijit C. BireNo ratings yet

- Form GST REG-06: (Amended)Document3 pagesForm GST REG-06: (Amended)ParasNo ratings yet

- GST Interest Liability U/Sec - 50 of CGST Act 2017Document6 pagesGST Interest Liability U/Sec - 50 of CGST Act 2017Saurabh JunejaNo ratings yet

- Consultancy For Small and Medium Enterprises BusinessDocument2 pagesConsultancy For Small and Medium Enterprises BusinessUmesh MangroliyaNo ratings yet

- Ibps Application Form PDFDocument4 pagesIbps Application Form PDFvikramNo ratings yet

- GPA PolicyDocument11 pagesGPA PolicysravsofficalNo ratings yet

- 0068 NehaDocument1 page0068 Nehang.neha8990No ratings yet

- Adobe Scan 23-Jan-2024Document1 pageAdobe Scan 23-Jan-2024Sahana ShreeNo ratings yet

- GAIL Gas Limited: Tender Document For Procurement of Pe Pipes (1 Year Arc)Document219 pagesGAIL Gas Limited: Tender Document For Procurement of Pe Pipes (1 Year Arc)BGL NAGARNo ratings yet

- Teesta Torsha Sleeper Class (SL)Document2 pagesTeesta Torsha Sleeper Class (SL)hriday store cyber cafeNo ratings yet

- DsdsDocument1 pageDsdsGulfnde IndiaNo ratings yet

- Invoice DocumentDocument1 pageInvoice DocumentAman SharmaNo ratings yet

- Wa0029.Document6 pagesWa0029.anusha.veldandiNo ratings yet

- LLB GST Notes-Unit-3-Part-2 - Final PDFDocument2 pagesLLB GST Notes-Unit-3-Part-2 - Final PDFravi kumarNo ratings yet

- Bill - 001 For Cool Fashion Co. (2019-2020) 25.03.2019Document4 pagesBill - 001 For Cool Fashion Co. (2019-2020) 25.03.2019Future InnovationsNo ratings yet

- Invoice AKE - 29 11 23Document1 pageInvoice AKE - 29 11 23jaikant.hccNo ratings yet

- DhauliDocument2 pagesDhauliratiranjan mohapatraNo ratings yet

- Ajio 1706695254075Document1 pageAjio 1706695254075shaelkmr550No ratings yet

- NXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceDocument2 pagesNXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceInclusive Education BranchNo ratings yet

- InvoiceDocument1 pageInvoiceAryan KumarNo ratings yet

- Electronic Reservation Slip (ERS) : 2163738365 12279/TAJ EXPRESS Second Sitting (Reserved) (2S)Document2 pagesElectronic Reservation Slip (ERS) : 2163738365 12279/TAJ EXPRESS Second Sitting (Reserved) (2S)Vikram RoyNo ratings yet

- Petrol Prices in IndiaDocument24 pagesPetrol Prices in IndiaRakhi KumariNo ratings yet

- Basic Concepts and Features of Goods and Service Tax in IndiaDocument3 pagesBasic Concepts and Features of Goods and Service Tax in Indiamansi nandeNo ratings yet

- Ticket 4Document3 pagesTicket 4kanikak97No ratings yet

- Current Booking Current Booking: Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageCurrent Booking Current Booking: Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Puneeth N RanapurNo ratings yet

- Tender No.: PRMM184055: FRP Tanks For Ro Plant TTPDocument23 pagesTender No.: PRMM184055: FRP Tanks For Ro Plant TTPANIMESH JAINNo ratings yet

- Sales - UDP-100-22-23 RachTR Chemicals PVT LTDDocument2 pagesSales - UDP-100-22-23 RachTR Chemicals PVT LTDRachTRNo ratings yet

- CRB25021903199Document2 pagesCRB25021903199amresh gokulNo ratings yet