Professional Documents

Culture Documents

A Study On Risk and Return Analysis of Selected Private Sector Banks in India

Uploaded by

Aakash DebnathOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study On Risk and Return Analysis of Selected Private Sector Banks in India

Uploaded by

Aakash DebnathCopyright:

Available Formats

International Journal for Multidisciplinary Research (IJFMR)

E-ISSN: 2582-2160 ● Website: www.ijfmr.com● Email: editor@ijfmr.com

A Study on Risk and Return Analysis of Selected

Private Sector Banks in India

Dr. A. Priya1, Nazar. M. H2

1

Assistant professor, Department of B.com (IT), Kongunadu Arts & ScienceCoimbatore – 641029

Tamilnadu, India

2

PhD Research Scholar, Kongunadu Arts & Science Coimbatore – 641029 Tamilnadu, India

ABSTRACT

The study examines determinants of risk and growth for five commercial banks in the period 2018-2022.

A bank's growth depends on its profitability and other variables of size, asset type, financial structure,

earnings dispersion and other independent variables. These variables may require finer-grained control

to maximize profits or minimize costs. Well-capitalized banks are perceived as less risky, and such

advantages lead to higher profitability. On the other hand, asset quality as measured by loan loss

reserves has a negative impact on a bank's performance. Furthermore, banks with large retail deposit-

taking networks have not achieved higher levels of profitability than banks with smaller networks. This

study examines the impact of these characteristics and financial structure variables on the importance of

the performance and profitability of the Indian banking industry. This paper presents a portion that

quantifies how internal determinants and external factors contribute to the performance of selected

private Indian banks. Finally, size and asset structure are two variables that show significant correlations

with bank profitability.

INTRODUCTION

The banking sector is responsible for providing most of the finance for trade and commerce. Banking

has always been a highly profitable and focused activity, but now banks are differentiating their products

and services for better growth and sustainability. To grow, banks must constantly innovate and update to

maintain demand and discerning customers and to provide convenient, reliable and convenient services.

Driven by the challenge of expanding the banking market and capturing a larger share, some banks have

invested in more branches and created aggressive marketing policies to expand their geographic and

market reach. Other banks are looking at more innovative approaches to offering banking services over

the Internet. After India's independence, financial reforms laid the foundation for a strong and healthy

banking system. And with great progress in the implementation of reforms, the banking system is now

entering its second phase., the Indian banking sector faces several challenges that require the

development of new standards and strategies by Indian banks. The purpose of this study is to examine

the main factors affecting the financial risk of several private sector banks in India.

IJFMR23021880 Volume 5, Issue 2, March-April 2023 1

International Journal for Multidisciplinary Research (IJFMR)

E-ISSN: 2582-2160 ● Website: www.ijfmr.com● Email: editor@ijfmr.com

REVIEW OF LITERATURE

Petria, N., Capraru, B. and Ihnatov, (2015) discusses various relationships between bank profitability.

Cost ratio, return/dividend ratio and spread ratio are three categories in which the author classifies

different ratios. These ratios can be used to understand a bank's financial position, operations and

investment attractiveness. By using such ratio analysis, he explained, comparisons can be made between

branches and the strengths and weaknesses of individual banks can be explored to make strategic

decisions and take the necessary corrective actions.

Goddard (2014) using cross-sectional, pooled cross-sectional time series and dynamic panel models.

Their model of profitability determinants incorporates size, diversification, risk, ownership type, and

dynamic effects. They found that despite increasing competition, there are significant decisions of

unusual interest each year. Evidence for a consistent or systematic relationship between size and

profitability is relatively weak. The relationship between reputation and profitability for off-balance

sheet businesses in bank portfolios is positive in the UK, but neutral or negative in other countries. The

correlation between capital adequacy and profitability is positive.

Javaid (2011) analysed the determinants of efficiency of top 10 banks in Pakistan during the period

2004-2008. They only focused on internal factors. Javaid et al. (2011) used pooled ordinary least squares

(POLS) to estimate the impact of assets, loans, stocks and deposits on return on assets (ROA), one of the

key profitability measures for banks. I investigated. Empirical results have found strong evidence that

these variables have a strong impact on profitability. However, the results show that higher returns do

not always come from higher total assets due to economies of scale. Higher borrowings also contribute

to profitability, but the effect is negligible. Shares and deposits have a significant influence on

profitability.

STATEMENT OF THE PROBLEM

The banks currently work in three formats in India viz. public sector banks, private sector banks and

foreign banks who are not aware of the growth factors which must be different in different places and

therefore the banks working in India will learn the factors. responsible for their growth.

RESEARCH METHODOLOGY

According to the RBI and CMIE (Centre for Economic Monitoring of India) business databases, there

are 22 private banks in India, all of which are listed on the Bombay Stock Exchange (BSE) and the

National Stock Exchange (NSE). The top 5 commercial banks based on total assets were selected for

study, and data for all 10 banks over the last 5 years are available. As a result, they were selected as the

sampling unit for the study. Below are the sample banks considering in this study.

IJFMR23021880 Volume 5, Issue 2, March-April 2023 2

International Journal for Multidisciplinary Research (IJFMR)

E-ISSN: 2582-2160 ● Website: www.ijfmr.com● Email: editor@ijfmr.com

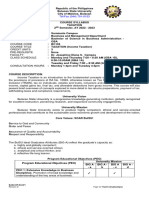

LIST OF SELECTED PRIVATE SECTOR BANKS FOR THE STUDY.

SL. No BANK NAME Total Assets in crores

1 ICICI Bank Ltd 1,411,297.74

2 HDFC Bank Ltd 2,068,535.05

3 Axis Bank Ltd 1,175,178.11

4 Yes bank 318,220.23

5 IDBI bank 301,419.36

OBJECTIVES OF THE STUDY:

The purpose of conducting this research paper is to examine the determinants of profitability

(growth) of banks operating in the Indian private sector.

To evaluate the risk and returns factors for the selected private banks in India

RESEARCH HYPOTHESIS:

H1: The characteristics that make up a bank's profitability in the key figures you choose have great

significance for the bank's earnings.

RESEARCH METHODOLOGY

Sample Size

For data analysis purposes, data from 5 banks, are the private sector banks (HDFC, ICICI, Federal, Yes

Bank, Axis Bank) were taken into profitability terms. selected based on.

Data Source and Data Analysis

Data source:

Data for the purpose of this study was obtained from secondary sources. This includes bank annual

reports and other data published by RBI and other reliable sources.

Data analysis tools:

Bank data was used to analyse the dependence of bank profitability therefore ratio analysis was used to

analyse the data using profitability as the dependent variable and the other independent variable.

DATA ANALYSIS AND INTERPRETATION:

For data analysis purposes of the data from five private sectors from 2018 to 2022 were selected from

annual reports. Data were analysed using ratio analysis of risk and returns factors and profitability ratios

as the dependent variable and other ratios as the independent variable. The collected data is shown

below.

Factors

Bank size: Uses the bank's total assets (log). In general, the effect of increased scale on profitability

has been found to be positive to some extent. However, for banks that grow very large, size may be

negative for bureaucratic and other reasons. The effect is not clear. On the one hand, large banks can

IJFMR23021880 Volume 5, Issue 2, March-April 2023 3

International Journal for Multidisciplinary Research (IJFMR)

E-ISSN: 2582-2160 ● Website: www.ijfmr.com● Email: editor@ijfmr.com

reduce costs through economies of scale and economies of scale. On the other hand, some argue that

smaller banks can achieve economies of scale by scaling up to a certain point where further

expansion leads to economies of scale. Therefore, there is no a priori forecast of the impact of this

variable on banks' profitability.

Bank Ownership: There is no clear empirical evidence to support a positive relationship between

ownership and profitability, which is peculiar to the Indian banking sector. To capture this

relationship, we use dummy variable 1 for public banks and dummy variable 0 for private and

foreign banks, according to the literature.

Equity capital to Total Assets (EC TA): Use the ratio of Equity to Total Assets as a proxy.

Operating Efficiency (OE): We are use the bank's operating expenses to total assets as a proxy for

operating efficiency. This measurement is widely used in the literature.

Credit risk (CR): Uses the ratio of a bank's total loss reserve to total loans (TL). It indicates the

probability of a loss due to the debtor's failure to fulfil its obligations to the bank.

NPA Ratio: Uses the ratio of non-performing assets to total assets as a proxy. This ratio directly

affects the bank's profitability.

PSL Ratio: Uses the ratio of preferred branch advances to total bank branch advances. In India,

banks are required to earmark a percentage of loans in priority sectors such as agriculture, housing,

education, SMEs and export-oriented units. Therefore, there is no a priori expected value for this

variable in terms of profitability

Interest Income Ratio (RII): This variable is measured using the ratio of interest income to total

income. In addition, banks with more diversified activities have the opportunity to reduce costs

based on economies of scale. But before banks become less profitable, competition in the fee-

generating business is heating up. Therefore, there are no prior expectations for this variable.

Labour Productivity (LP): Uses the ratio of total sales to total number of employees. This variable is

widely used to examine the impact on bank profitability. Improving labour productivity not only

reflects effective bank management, but also increases bank efficiency and further increases bank

profitability. To investigate whether the observed productivity gains contributed to the bank's profits,

we include the rate of change in labour productivity (measured by total real sales to number of

employees) in the model.

Cost of Funds (KF): This ratio is calculated as the total cost of funds. That is, interest paid on bank

deposits and other borrowed money. Use this ratio as a proxy for the cost of funds. Higher cost of

funds and lower bank profitability.

Banking Sector Development to GDP (DPGDP): Uses the ratio of total banking sector deposits to a

country's GDP. It reflects the overall level of development in the banking sector and measures the

importance of bank mobilization of savings in the economy.

Stock Market Movement to GDP (MCAPGDP): Uses the ratio of stock market value to GDP. This

variable serves as a proxy for the relationship between financial developments and bank and capital

market funding and developments. As the stock market develops, more companies will raise funds

from the stock market rather than from banks. This not only reduces the volume of lending by banks,

but also reduces the risk of loan default.

GDP Growth Rate: Economic growth, expressed as GDP growth rate, has several effects, such as

increased banking activity. Researchers argue that an upturn in the economy will have a positive

impact on banks' profitability as demand for loans increases. Increases in bank deposits and lending

IJFMR23021880 Volume 5, Issue 2, March-April 2023 4

International Journal for Multidisciplinary Research (IJFMR)

E-ISSN: 2582-2160 ● Website: www.ijfmr.com● Email: editor@ijfmr.com

have a positive impact on bank profitability. When economic activity slows down, demand for loans

and deposits declines, adversely affecting profit margins.

STATEMENT OF RETURNS OF SELECTED PRIVATE BANKS

In this table shows about the statistical details of assets, the period of capital gain, revenue and

efficiency of 2018 to2022

STATEMENT OF RETURN OF ICICI BANK

Year 2018 2019 2020 2021 2022

ASSET 879189.16 964459.15 1098365.15 1,230,432.68 1,411,297.74

REVENUE 72,385.52 77,913.36 91,246.94 98,086.80 104,892.08

ASSET 0.77 0.34 0.72 1.31 1.65

STRUCTURE

CAPITAL 6.63 3.19 6.99 11.21 13.94

STRUCTURE

REVENUE -1.21 -1.15 -0.77 -0.22 0.34

STRUCTURE

EFFICIENCY 0.04 0.04 0.04 0.04 0.05

STRUCTURE

INTERPRETATIONS

The above table shows the clear view of the asset, revenue and other ratios of the ICICI Bank. The value

of asset of the ICICI Bank goes on increasing from the period of 2018 to2022. From 879189.16 to

1,411,297.74. the revenue of the ICICI Bank also same for the increasing value at the five years. The

capital and asset structure of the bank was increased for the last five years (2018 to 2022). Even though

the value of returns increases, due to covid the earnings of the bank was in stagnant level.

STATEMENT OF RETURN OF HDFC BANK

Year 2018 2019 2020 2021 2022

ASSET 1,063,934.32 1,244,540.69 1,530,511.26 1,746,870.52 2,068,535.05

REVENUE 95,461.66 116,597.94 138,073.47 146,063.12 157,263.02

ASSET 1.64 1.69 1.71 1.78 1.78

STRUCTURE

CAPITAL 16.45 14.12 15.35 15.27 15.39

STRUCTURE

REVENUE 0.21 0.27 0.19 0.33 0.36

IJFMR23021880 Volume 5, Issue 2, March-April 2023 5

International Journal for Multidisciplinary Research (IJFMR)

E-ISSN: 2582-2160 ● Website: www.ijfmr.com● Email: editor@ijfmr.com

STRUCTURE

EFFICIENCY 0.04 0.03 0.06 0.04 0.05

STRUCTURE

INTERPRETATIONS

The above table shows the descriptive view of the asset and revenue and other ratios of the HDFC Bank.

The asset values of the HDFC Bank goes on inflection from the period of 2018 to2022. From

1,063,934.32 to 2,068,535.05. The revenue of HDFC bank also goes for the increasing value at the five

years. The asset structure and revenue structure of the bank was increased for the last five years (2018 to

2022) from 1.64 to 1.78 and 0.21 to 0.36. Even though the value of returns increases, due to covid, the

earningscapacity of the bank was in increasing level.

STATEMENT OF RETURN OF AXIS BANK

Year 2018 2019 2020 2021 2022

ASSET 691,329.58 800,996.53 915,164.82 996,118.42 1,175,178.11

REVENUE 56,747.40 68,116.11 78,171.72 78,483.49 82,597.37

ASSET 0.03 0.58 0.17 0.66 1.10

STRUCTURE

CAPITAL 0.43 7.01 1.91 6.48 11.30

STRUCTURE

REVENUE -1.54 -1.05 -1.51 -0.82 -0.18

STRUCTURE

EFFICIENCY 0.00 0.02 0.02 0.03 0.06

STRUCTURE

INTERPRETATIONS

The above table shows the clear view of the asset and revenue and ratios of the AXIS Bank. The asset

values and revenue values of the AXIS Bank goes on increasing trend from the period of 2018 to2022.

From 691,329.58to 1,175,178.11 and 56,747.40 to 82,597.37. The asset structure and capital structure of

the bank was volatility for the last five years and 2020 was lowest ratio compare to the other years. Even

though the value of returns for fluctuating due to covid, the earnings capacity of the bank was in

improving trend.

STATEMENT OF RETURN OF YES BANK

Year 2018 2019 2020 2021 2022

ASSET 312,445.60 380,826.17 257,826.92 273,542.77 318,220.23

REVENUE 25,491.26 34,214.90 37,923.10 23,382.56 22,285.98

IJFMR23021880 Volume 5, Issue 2, March-April 2023 6

International Journal for Multidisciplinary Research (IJFMR)

E-ISSN: 2582-2160 ● Website: www.ijfmr.com● Email: editor@ijfmr.com

ASSET 1.35 0.45 -6.36 -1.26 0.33

STRUCTURE

CAPITAL 16.40 6.39 -75.56 -10.42 3.15

STRUCTURE

REVENUE -0.31 -0.75 -10.96 -2.48 -0.69

STRUCTURE

EFFICIENCY 0.06 0.03 -0.58 -0.09 0.03

STRUCTURE

INTERPRETATIONS

The above table shows the clear view of the asset and revenue and ratios of the YES Bank. The asset

values and of the YES Bank goes on fluctuating trend from the period of 2018 to2022. The revenue of

the YES bank also negative. The asset structure and capital structure of the bank was volatility for the

last five years and 2020 was lowest ratio compare to the other years. Even though the value of returns

for fluctuating due to covid, the earnings capacity of the bank was in improving trend.

STATEMENT OF RETURN OF IDBI BANK

Year 2018 2019 2020 2021 2022

ASSET 350,313.64 320,284.49 299,942.37 297,764.08 301,419.36

REVENUE 30,035.41 25,371.53 25,295.48 24,556.93 22,985.19

ASSET -2.35 -4.71 -4.29 0.45 0.80

STRUCTURE

CAPITAL -50.99 -48.94 -46.82 4.45 7.34

STRUCTURE

REVENUE -4.35 -5.75 -5.78 -1.09 -0.74

STRUCTURE

EFFICIENCY -0.37 -0.42 -0.64 0.03 0.05

STRUCTURE

INTERPRETATIONS

The above table shows the clear view of the asset and revenue and ratios of the IDBI Bank. The asset

values and of the IDBI Bank goes on fluctuating trend from the period of 2018 to2022 and 2018 highest

asset value and the lowest value is in the year of 2020. The revenue of the IDBI bank also decreasing

trend. The asset structure and capital structure of the bank was volatility for the last five years and the

efficiency ratio was improving in each year from -.37 to .05. Even though the value of returns for

fluctuating due to covid, the earnings capacity of the bank was in increasing level.

BANK CORRELATION AND DESCRIPTIVE STATISTICS

A. ASSET AND REVENUE (CORRELATION AND STD. ERRORA)

IJFMR23021880 Volume 5, Issue 2, March-April 2023 7

International Journal for Multidisciplinary Research (IJFMR)

E-ISSN: 2582-2160 ● Website: www.ijfmr.com● Email: editor@ijfmr.com

Asset correlation Revenue correlation Std. Errora

.491 .319 .200

.096 .033 .303

.030 .016 .355

.029 -029 .386

.292 .294 .409

.357 .287 .430

.180 .145 .437

.016 .044 .439

.068 .073 .439

-079 -.061 .442

.103 .100 .448

.125 .125 .457

-.110 -.068 .467

.134 .107 .478

.188 .147 .490

.245 -.201 .503

B. DESCRIPTIVE STATISTICS

Items Mean Std. Deviation N

Asset 1249404.7740 2251736.41345 25

revenue 69345.7336 42056.05650 25

asset ratio .0256 2.17658 25

revenue ratio 1.5620 2.50950 25

efficiency ratio .0540 .20682 25

INTERPRETATION

The size of the correlation which has relationship between (perfect negative correlation) and (perfect

positive correlation). If the correlation is "statistically significant". It is also flags this number samples

[significant at least at the .05 level] or [significant at least at the .01 level]. If the correlation statistic

doesn't have a minus in front of it, that means that the correlation is positive, which means that high

scores for both variables go together, and low scores for both variables go together. If the correlation

statistic had a minus in front of it, that would mean that as the values of one variable goes up, the values

of the other variable go down (i.e., a negative or inverse correlation).

The study revealed power of to predict the future profitability of the banks. The correlation analysis

which is the statistical test for overall model fit in terms of further revealed that the ratio of Size and

Assets Structure explained the profitability. The total sum of squares (122.549) is the standard error that

would accrue if the mean of Size and Assets have been used to predict the dependent variable

(Profitability). Using the values of Size (five year) and Assets Structure these errors can be reduced by

28.14% (.200/.503). This reduction is deemed statistically significant with the average of .014% and

significance at level of 0.05%. With the above analysis, finally, it can be concluded that two variables

i.e., asset and revenue Structure explains the profitability in Indian private banks.

IJFMR23021880 Volume 5, Issue 2, March-April 2023 8

International Journal for Multidisciplinary Research (IJFMR)

E-ISSN: 2582-2160 ● Website: www.ijfmr.com● Email: editor@ijfmr.com

CONCLUSION

The current study was conducted to identify the determinants of profitability of Indian private banks five

selected banks) for the period of 2018-2022. The ratios wasused to relationships of two variable like,

banking performance and the profitability of Indian banks. This study identified that the differences

between private banks in terms of size structure were statistically significant. Therefore, the study found

that taking higher risks yields to make a high returns.

REFERENCES

1. Reserve Bank of India (2022) Report on Trend and Progress of Banking in India 2021-2022.

2. Reserve Bank of India (2022) Basic Statistical Returns of Scheduled Commercial Banks in India.

Vol. 51.

3. Javaid (2011) Risk, Capital and Efficiency in Chinese Banking. Journal of International Financial

Markets, Institutions and Money, 26, 378-393. https://doi.org/10.1016/j.intfin.2013.07.009

4. Goddard (2014) The Dynamics of US Bank Profitability. The European Journal of Finance, 21, 426-

443.

5. Petria, N., Capraru, B. and Ihnatov, I. (2015) Determinants of Banks’ Profitability: Evidence from

EU 27 Banking Systems. Procedia Economics and Finance, 20, 518-524.

https://doi.org/10.1016/S2212-5671(15)00104-5

IJFMR23021880 Volume 5, Issue 2, March-April 2023 9

You might also like

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- The Bank-Specific Factors Affecting The Profitability of Commercial Banks in Bangladesh: A Panel Data AnalysisDocument8 pagesThe Bank-Specific Factors Affecting The Profitability of Commercial Banks in Bangladesh: A Panel Data AnalysisAbdu MohammedNo ratings yet

- Analyzing the Financial Performance of Andhra Bank from 2006-2010Document21 pagesAnalyzing the Financial Performance of Andhra Bank from 2006-2010Mane DaralNo ratings yet

- IJMSS2273Jan31 PDFDocument12 pagesIJMSS2273Jan31 PDFdsfgNo ratings yet

- India Bank 2018.Document12 pagesIndia Bank 2018.Mihaela TanasievNo ratings yet

- SBI and Associate Bank Performance StudyDocument11 pagesSBI and Associate Bank Performance StudyAnjum Ansh KhanNo ratings yet

- Determinants Bank Profitability Empirical EvidenceDocument8 pagesDeterminants Bank Profitability Empirical EvidenceEi MinNo ratings yet

- Harsh & Apurv & AdityaDocument14 pagesHarsh & Apurv & AdityaApurv AswaleNo ratings yet

- Impact of Credit-Deposit Ratio on Indian Public Sector Banks' PerformanceDocument5 pagesImpact of Credit-Deposit Ratio on Indian Public Sector Banks' Performanceaaditya01No ratings yet

- 07 Evaluating The Financial Soundness of Indian - Anita Makkar - FINC025Document15 pages07 Evaluating The Financial Soundness of Indian - Anita Makkar - FINC025shresth_801464No ratings yet

- gjfmv12n1 01Document18 pagesgjfmv12n1 01Deepika ENo ratings yet

- International Journal of Engineering and Management Sciences (IJEMS) Vol. 3. (2018). No. 5Document7 pagesInternational Journal of Engineering and Management Sciences (IJEMS) Vol. 3. (2018). No. 5RabinNo ratings yet

- An Analysis of The Performance of Select Public Sector Banks Using Camel ApproachDocument17 pagesAn Analysis of The Performance of Select Public Sector Banks Using Camel Approachmithunraj packiyanathanNo ratings yet

- AComparativeStudyOfEfficientLendingByIndianCommercialBanks (54 58) PDFDocument5 pagesAComparativeStudyOfEfficientLendingByIndianCommercialBanks (54 58) PDFDristiNo ratings yet

- Proposal On SOCBsDocument15 pagesProposal On SOCBsRipa AkterNo ratings yet

- Harish eDocument9 pagesHarish eTamil SelvamNo ratings yet

- "Will Asset Quality Issues Continue To Affect Indian Public Sector BanksDocument14 pages"Will Asset Quality Issues Continue To Affect Indian Public Sector BanksShrutiNo ratings yet

- Measuring Efficiency in Indian Commercial Banks With DEA and Tobit RegressionDocument6 pagesMeasuring Efficiency in Indian Commercial Banks With DEA and Tobit RegressioncharanNo ratings yet

- A Comparative Study of Book Value Insolvency of Indian Commercial Banks: An Application of Z-Score ModelDocument12 pagesA Comparative Study of Book Value Insolvency of Indian Commercial Banks: An Application of Z-Score ModelthakkermayuriNo ratings yet

- FINANCIAL PERFORMANCE ANALYSIS - A COMPARATIVE STUDY OF SELECTED PUBLIC SECTOR AND PRIVATE SECTOR BANKS Ijariie12652Document15 pagesFINANCIAL PERFORMANCE ANALYSIS - A COMPARATIVE STUDY OF SELECTED PUBLIC SECTOR AND PRIVATE SECTOR BANKS Ijariie12652Rehana AnsariNo ratings yet

- Performance Analysis Using Camel Model-A Study of Select Private BanksDocument10 pagesPerformance Analysis Using Camel Model-A Study of Select Private BanksLIKHITHA RNo ratings yet

- Performance of Public Sector Banks in IndiaDocument17 pagesPerformance of Public Sector Banks in IndiaSabana AsmiNo ratings yet

- 11FMMarch 4709 1 PDFDocument20 pages11FMMarch 4709 1 PDFpratz1996No ratings yet

- 10 Chapter 2Document8 pages10 Chapter 2Y.durgadeviNo ratings yet

- Determinants of Profitability in Indian BanksDocument7 pagesDeterminants of Profitability in Indian BanksmajorraveeshNo ratings yet

- Non-Performing Assets: A Study of State Bank of India: Dr.D.Ganesan R.SanthanakrishnanDocument8 pagesNon-Performing Assets: A Study of State Bank of India: Dr.D.Ganesan R.SanthanakrishnansusheelNo ratings yet

- Rashmi Kumari, Prabhat Kumar Singh, V.C. SharmaDocument12 pagesRashmi Kumari, Prabhat Kumar Singh, V.C. SharmaPalak WaswaniNo ratings yet

- A Comparative Study of Financial Permormance of State Bank of India and ICICI BankDocument10 pagesA Comparative Study of Financial Permormance of State Bank of India and ICICI Bankprteek kumarNo ratings yet

- IRJHIS2105021Document9 pagesIRJHIS2105021Vinayak PadaveNo ratings yet

- A Comparative Study of Non Performing Assets in Indian Banking IndustryDocument11 pagesA Comparative Study of Non Performing Assets in Indian Banking IndustryIJEPT Journal67% (6)

- Corrections of research report data analysisDocument5 pagesCorrections of research report data analysisDaman Deep Singh ArnejaNo ratings yet

- JETIR2302448Document7 pagesJETIR2302448Rupak RoyNo ratings yet

- k1 PDFDocument7 pagesk1 PDFMegan WillisNo ratings yet

- Ijms202211 (3) 103 114Document12 pagesIjms202211 (3) 103 114wnamanpc2No ratings yet

- Literature Review For Profitability Analysis of Public Sector BanksDocument2 pagesLiterature Review For Profitability Analysis of Public Sector Bankskarthut100% (4)

- DuPont AnalysisDocument11 pagesDuPont AnalysisShashidhar dNo ratings yet

- AFBRupd PDFDocument9 pagesAFBRupd PDFhasan mdNo ratings yet

- Bank NiftyDocument14 pagesBank NiftySwarupKumarNo ratings yet

- An Empirical Study On The Performance Evaluation of Public Sector Banks in IndiaDocument16 pagesAn Empirical Study On The Performance Evaluation of Public Sector Banks in Indiapratik053No ratings yet

- Non Performing Assets and Profitability of Indian Banks: A ReviewDocument6 pagesNon Performing Assets and Profitability of Indian Banks: A Reviewshubham kumarNo ratings yet

- December 2013 5Document13 pagesDecember 2013 5bedilu77No ratings yet

- Gwilr Paper Performance Affecting Factors of Indian Banking Sector An Empirical AnalysisDocument15 pagesGwilr Paper Performance Affecting Factors of Indian Banking Sector An Empirical AnalysisDr Bhadrappa HaralayyaNo ratings yet

- A Study On The Financial Performance of Scheduled Commercial BanksDocument15 pagesA Study On The Financial Performance of Scheduled Commercial BanksSadaf SayedqejklpNo ratings yet

- Credit Risk, Liquidity Risk and Profitability in Nepalese Commercial BanksDocument9 pagesCredit Risk, Liquidity Risk and Profitability in Nepalese Commercial BanksKarim FarjallahNo ratings yet

- November 2016 1478613409 68 PDFDocument4 pagesNovember 2016 1478613409 68 PDFBajrangNo ratings yet

- Asset Liability Management Practices in HDFC Bank: KEYWORDS: Liquidity Risk, Interest Rate Risk, NIIDocument7 pagesAsset Liability Management Practices in HDFC Bank: KEYWORDS: Liquidity Risk, Interest Rate Risk, NIINIMMANAGANTI RAMAKRISHNANo ratings yet

- Bank Specific, Industry Specific and Macroeconomic Determinants of Bank Profitability in EthiopiaDocument23 pagesBank Specific, Industry Specific and Macroeconomic Determinants of Bank Profitability in EthiopiaBikashRanaNo ratings yet

- DOC-20240407-WA0004.Document50 pagesDOC-20240407-WA0004.pradhanraja05679No ratings yet

- 166093-407590-1-PB (6)Document14 pages166093-407590-1-PB (6)fosixir474No ratings yet

- HdfcuploadDocument5 pagesHdfcuploadjimbru ttanNo ratings yet

- Financial Performance of Indian Banks During CovidDocument8 pagesFinancial Performance of Indian Banks During CovidshanmithaNo ratings yet

- INSPIRA JOURNAL OF COMMERCEECONOMICS COMPUTER SCIENCEJCECS Vol 05 No 01 January March 2019 Pages 133 To 137Document5 pagesINSPIRA JOURNAL OF COMMERCEECONOMICS COMPUTER SCIENCEJCECS Vol 05 No 01 January March 2019 Pages 133 To 137sharonNo ratings yet

- Camel Analysis India RankingDocument15 pagesCamel Analysis India RankingManita KunwarNo ratings yet

- Impact of Mergers & Acquisitions on the Financial Performance of Indian BanksDocument6 pagesImpact of Mergers & Acquisitions on the Financial Performance of Indian BanksTamil TrendingNo ratings yet

- Ijrbm - Effect of Macro-Economic and Banks Specific Determinants of Credit Risk of Select Public Sector Banks in The Post Financial Crisis Period Evidence From IndiaDocument11 pagesIjrbm - Effect of Macro-Economic and Banks Specific Determinants of Credit Risk of Select Public Sector Banks in The Post Financial Crisis Period Evidence From IndiaImpact JournalsNo ratings yet

- Ajrbf:: Performance Evaluation of Scheduled Commercial Banks in India-A Comparative StudyDocument21 pagesAjrbf:: Performance Evaluation of Scheduled Commercial Banks in India-A Comparative StudyManvi JainNo ratings yet

- Thesis On Non Performing LoansDocument7 pagesThesis On Non Performing LoansWriteMyPaperJackson100% (2)

- Financial Efficiency of Commercial Banks: A Comparative Study of Public and Private Banks in India in The Post-Global Recession EraDocument14 pagesFinancial Efficiency of Commercial Banks: A Comparative Study of Public and Private Banks in India in The Post-Global Recession Eraಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- Ijm 11 10 081-2Document14 pagesIjm 11 10 081-2MINESHNo ratings yet

- Ijrar - Issue - 1075 ManagementDocument8 pagesIjrar - Issue - 1075 ManagementdharminderNo ratings yet

- 02 PIEB Vol10 Issue1 2012 Geetha and Ramesh Demographic Factors Investment Decisions pp.14-27Document15 pages02 PIEB Vol10 Issue1 2012 Geetha and Ramesh Demographic Factors Investment Decisions pp.14-27ADINo ratings yet

- 8317 PramodBSDocument7 pages8317 PramodBSAakash DebnathNo ratings yet

- Jalaj SirDocument1 pageJalaj SirAakash DebnathNo ratings yet

- Risk Management of Investment Projects Based On Artificial Neural NetworkDocument13 pagesRisk Management of Investment Projects Based On Artificial Neural NetworkAakash DebnathNo ratings yet

- Improving Returns On Stock Investment Through Neural Network SelectionDocument7 pagesImproving Returns On Stock Investment Through Neural Network SelectionAakash DebnathNo ratings yet

- SIRC Teachers' Conference For Colleges On Empowering Educators' On Friday, 23rd September, 2022Document1 pageSIRC Teachers' Conference For Colleges On Empowering Educators' On Friday, 23rd September, 2022Aakash DebnathNo ratings yet

- ProposalDocument4 pagesProposalAakash DebnathNo ratings yet

- Students Study Circle Programme On Thursday, 15th September, 2022 at ICSI-SIRC House, No.9, Wheat Crofts Road, Nungambakkam, Chennai - 600034Document1 pageStudents Study Circle Programme On Thursday, 15th September, 2022 at ICSI-SIRC House, No.9, Wheat Crofts Road, Nungambakkam, Chennai - 600034Aakash DebnathNo ratings yet

- District INDORE Proposal for Awas Sahayata SchemeDocument2 pagesDistrict INDORE Proposal for Awas Sahayata SchemeAakash DebnathNo ratings yet

- Tripura University: Date: 24/02/2021Document6 pagesTripura University: Date: 24/02/2021Aakash DebnathNo ratings yet

- The Harm of Symbolic Actions and Green-Washing - Corporate ActionsDocument50 pagesThe Harm of Symbolic Actions and Green-Washing - Corporate ActionsAakash DebnathNo ratings yet

- ProposalDocument4 pagesProposalAakash DebnathNo ratings yet

- Measure of Central TendencyDocument60 pagesMeasure of Central TendencyAakash DebnathNo ratings yet

- Green Washing: An Alarming IssueDocument6 pagesGreen Washing: An Alarming IssueAakash DebnathNo ratings yet

- Corrigendum Commerce Mphil List 28-1-20Document1 pageCorrigendum Commerce Mphil List 28-1-20Aakash DebnathNo ratings yet

- I J M E R: Greenwashing and Its Impact On Consumers and Environment Poorvi RaiDocument3 pagesI J M E R: Greenwashing and Its Impact On Consumers and Environment Poorvi RaiAakash DebnathNo ratings yet

- Canada India Paper No-8Document25 pagesCanada India Paper No-8Aakash DebnathNo ratings yet

- Banking and Financial Institutions NET-JRFDocument65 pagesBanking and Financial Institutions NET-JRFAakash DebnathNo ratings yet

- CorrelationDocument29 pagesCorrelationAakash DebnathNo ratings yet

- CamScanner Document Scan PagesDocument46 pagesCamScanner Document Scan PagesAakash DebnathNo ratings yet

- Project Work On Spending and Saving Habits of College Students.Document42 pagesProject Work On Spending and Saving Habits of College Students.Aakash Debnath50% (4)

- Statement of Financial Position: Fundamentals of Accountancy, Business and Management 2Document55 pagesStatement of Financial Position: Fundamentals of Accountancy, Business and Management 2Arminda Villamin75% (4)

- Chap 007 Business PlanDocument31 pagesChap 007 Business PlanAliAdnan AliAdnanNo ratings yet

- Sidra Zia's ResumeDocument3 pagesSidra Zia's Resumesadeed2121No ratings yet

- Saic P 3002Document1 pageSaic P 3002aneeshjokay0% (1)

- Best Call Tracking System, in India To Track Sales Calls - CallyzerDocument5 pagesBest Call Tracking System, in India To Track Sales Calls - CallyzerWebs Optimization Software SolutionNo ratings yet

- ACOUSTICRYL™ AV-1331 Copolymer Emulsion: Regional Product Availability DescriptionDocument3 pagesACOUSTICRYL™ AV-1331 Copolymer Emulsion: Regional Product Availability DescriptionJaved ShaikhNo ratings yet

- Fifo, Lifo, Simple and Weighted AverageDocument12 pagesFifo, Lifo, Simple and Weighted AverageSanjay SolankiNo ratings yet

- FAR 1 - Journal EntriesDocument3 pagesFAR 1 - Journal EntriesAnime LoverNo ratings yet

- The End of Bureaucracy: How Haier is Building a New Management ModelDocument11 pagesThe End of Bureaucracy: How Haier is Building a New Management ModelWendel RharaelNo ratings yet

- True/False Questions: labor-intensive (cần nhiều nhân công)Document31 pagesTrue/False Questions: labor-intensive (cần nhiều nhân công)Ngọc MinhNo ratings yet

- REAL ESTATE and COVIDDocument6 pagesREAL ESTATE and COVIDAcademic WarriorNo ratings yet

- Adobe Scan May 04, 2021Document12 pagesAdobe Scan May 04, 2021Anil ShuklaNo ratings yet

- Iso-Dis-10009-2023 enDocument15 pagesIso-Dis-10009-2023 enSandro GarcíaNo ratings yet

- A Study The Compatative of Income Tax For Partnership Firm With Reference To KDMC AreaDocument49 pagesA Study The Compatative of Income Tax For Partnership Firm With Reference To KDMC AreaTasmay EnterprisesNo ratings yet

- A2 8.4.19Document15 pagesA2 8.4.19ikhwan azmanNo ratings yet

- Consumer Perception About Retail Medicine Provided by Apollo PharmacyDocument56 pagesConsumer Perception About Retail Medicine Provided by Apollo PharmacySantu Dey100% (1)

- Week 5 - Production SmoothingDocument34 pagesWeek 5 - Production SmoothingQuynh Chau Tran100% (1)

- Fortinet Specialized Partner NFR KitDocument8 pagesFortinet Specialized Partner NFR KitQualit ConsultingNo ratings yet

- MPR Project Report Sample FormatDocument24 pagesMPR Project Report Sample FormatArya khattarNo ratings yet

- Startup Evolution Curve Excerpt 2017-05-31Document193 pagesStartup Evolution Curve Excerpt 2017-05-31LEWOYE BANTIENo ratings yet

- Test Bank For Macroeconomics 7th Edition AbelDocument24 pagesTest Bank For Macroeconomics 7th Edition AbelDeborahMartingabed100% (29)

- Cost Accounting Part 1 (University of Cebu) Cost Accounting Part 1 (University of Cebu)Document6 pagesCost Accounting Part 1 (University of Cebu) Cost Accounting Part 1 (University of Cebu)Shane TorrieNo ratings yet

- BC 103. Taxation IncomeDocument8 pagesBC 103. Taxation Incomezekekomatsu0No ratings yet

- 149 Newbury Boulevard Craigieburn 3064 CONTRACT of SALEDocument198 pages149 Newbury Boulevard Craigieburn 3064 CONTRACT of SALERAINBOW FUN FACTORNo ratings yet

- Angel One LTD.: Applica On Number: Applica On Type : o New KYC o Modifica On KYCDocument30 pagesAngel One LTD.: Applica On Number: Applica On Type : o New KYC o Modifica On KYCAk AkNo ratings yet

- FundOfIS Midterm Quiz 2 ReviewerDocument2 pagesFundOfIS Midterm Quiz 2 ReviewerBsis.Ardave Nickie MacunanNo ratings yet

- Credit Card Application Form: Personal InformationDocument5 pagesCredit Card Application Form: Personal InformationHansi PereraNo ratings yet

- Negotiable Instruments Law ReviewerDocument8 pagesNegotiable Instruments Law ReviewerKath100% (1)

- Easy Lunchboxes Social Media Marketing PlanDocument6 pagesEasy Lunchboxes Social Media Marketing PlanKareem NabilNo ratings yet

- Plaint in The Court of Civil Judge Senior Division Nasik Summary Suit No. 1987Document3 pagesPlaint in The Court of Civil Judge Senior Division Nasik Summary Suit No. 1987AaradhyNo ratings yet