Professional Documents

Culture Documents

VAT 201 Return

Uploaded by

Satyanarayana BalusaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VAT 201 Return

Uploaded by

Satyanarayana BalusaCopyright:

Available Formats

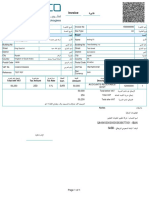

- 230005641386إﻗﺮار ﴐﻳﺒﺔ اﻟﻘﻴﻤﺔ اﳌﻀﺎﻓﺔ VAT 201 Return

Taxpayer Information

ﻣﻌﻠﻮﻣﺎت داﻓﻌﻲ اﻟﴬاﺋﺐ

VAT Return Period

TRN

ﻓﱰة اﻹﻗﺮار اﻟﴬﻳﺒﻲ ﻟﴬﻳﺒﺔ اﻟﻘﻴﻤﺔ 100596623700003 01/05/2023 - 31/07/2023

رﻗﻢ ﺗﺴﺠﻴﻞ اﻟﴬﻳﺒﺔ

اﳌﻀﺎﻓﺔ

Legal Name of

VAT Stagger Stagger 1 – Quarterly (Feb

)Entity(English MAV Brand Stories LLC

اﻟﻔﱰة اﻟﴬﻳﺒﻴﺔ ﻟﴬﻳﺒﺔ اﻟﻘﻴﻤﺔ اﳌﻀﺎﻓﺔ )to Jan

اﻻﺳﻢ اﻟﻘﺎﻧﻮﻲﻧ ﻟﻠﻜﻴﺎن ﺑﺎﻟﻠﻐﺔ اﻹﻧﺠﻠﻴﺰﻳﺔ

Legal Name of Entity VAT Return Due Date

)(Arabic ﺗﺎرﻳﺦ اﺳﺘﺤﻘﺎق إﻗﺮار ﴐﻳﺒﺔ اﻟﻘﻴﻤﺔ ام اﻳﻪ ﰲ ﺑﺮاﻧﺪ ﺳﺘﻮرﻳﺰ ذ م م 28/08/2023

اﻻﺳﻢ اﻟﻘﺎﻧﻮﻲﻧ ﻟﻠﻜﻴﺎن ﺑﺎﻟﻠﻐﺔ اﻟﻌﺮﺑﻴﺔ اﳌﻀﺎﻓﺔ

Office 10, Sharjah Media City,

Address Tax Year End

Sharjah, 515000, Sharjah, 31/01/2024

ﻋﻨﻮان ﻧﻬﺎﻳﺔ اﻟﺴﻨﺔ اﻟﴬﻳﺒﻴﺔ

+971545658267

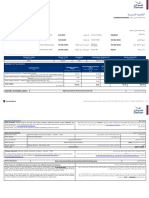

VAT on Sales and All Other outputs

ﴐﻳﺒﺔ اﻟﻘﻴﻤﺔ اﳌﻀﺎﻓﺔ ﻋﲆ اﳌﺒﻴﻌﺎت وﺟﻤﻴﻊ اﳌﺨﺮﺟﺎت اﻷﺧﺮى

VAT Amount

Amount Adjustment

Description )(AED

)(AED )(AED

وﺻﻒ ﻗﻴﻤﺔ ﴐﻳﺒﺔ اﻟﻘﻴﻤﺔ اﳌﻀﺎﻓﺔ

اﳌﺒﻠﻎ )درﻫﻢ( ﺗﺴﻮﻳﺔ )درﻫﻢ(

)درﻫﻢ(

1a Standard Rated Supplies in Abu Dhabi

0.00 0.00 0.00

أ اﻟﺘﻮرﻳﺪات اﻟﺨﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻷﺳﺎﺳﻴﺔ ﰲ أﺑﻮ ﻇﺒﻲ

1b Standard Rated Supplies in Dubai

17,200.00 860.00 0.00

ب اﻟﺘﻮرﻳﺪات اﻟﺨﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻷﺳﺎﺳﻴﺔ ﰲ دﻲﺑ

1c Standard Rated Supplies in Sharjah

0.00 0.00 0.00

ج اﻟﺘﻮرﻳﺪات اﻟﺨﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻷﺳﺎﺳﻴﺔ ﰲ اﻟﺸﺎرﻗﺔ

1d Standard Rated Supplies in Ajman

0.00 0.00 0.00

د اﻟﺘﻮرﻳﺪات اﻟﺨﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻷﺳﺎﺳﻴﺔ ﰲ ﻋﺠﺎﻤن

1e Standard Rated Supplies in Umm Al Quwain

0.00 0.00 0.00

ه اﻟﺘﻮرﻳﺪات اﻟﺨﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻷﺳﺎﺳﻴﺔ ﰲ أم اﻟﻘﻴﻮﻳﻦ

www.tax.gov.ae @uaetax

| Federal Authority ﻫﻴﺌﺔ اﺗﺤﺎدﻳﺔ

This is a system generated document and does not need to be signed. The Taxpayer is solely responsible for the usage of this document. FTA cannot be held liable for

any damage caused to the Taxpayer or recipient of this document.

ﻫﺬه وﺛﻴﻘﺔ ﺗﻢ إﻧﺸﺎؤﻫﺎ ﺑﻮاﺳﻄﺔ اﻟﻨﻈﺎم وﻻ ﺗﺤﺘﺎج إﱃ اﻟﺘﻮﻗﻴﻊ .داﻓﻊ اﻟﴬاﺋﺐ ﻫﻮ اﳌﺴﺆول اﻟﻮﺣﻴﺪ ﻋﻦ اﺳﺘﺨﺪام ﻫﺬه اﻟﻮﺛﻴﻘﺔ .ﻻ ﻤﻳﻜﻦ أن ﺗﻜﻮن اﻟﻬﻴﺌﺔ اﻻﺗﺤﺎدﻳﺔ ﻟﻠﴬاﺋﺐ ﻣﺴﺆوﻟﺔ ﻋﻦ أي ﴐر ﻳﻠﺤﻖ ﺑﺪاﻓﻌﻲ اﻟﴬاﺋﺐ أو ﻣﺘﻠﻘﻲ ﻫﺬه اﻟﻮﺛﻴﻘﺔ.

1f Standard Rated Supplies in Ras Al Khaimah

0.00 0.00 0.00

و اﻟﺘﻮرﻳﺪات اﻟﺨﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻷﺳﺎﺳﻴﺔ ﰲ رأس اﻟﺨﻴﻤﺔ

1g Standard Rated Supplies in Fujairah

0.00 0.00 0.00

ز اﻟﺘﻮرﻳﺪات اﻟﺨﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻷﺳﺎﺳﻴﺔ ﰲ اﻟﻔﺠﺮﻴة

2 Tax Refunds provided to Tourists under the Tax

Refunds for Tourists Scheme 0.00 0.00

اﳌﺒﺎﻟﻎ اﻟﺘﻲ ﺗﻢ ردﻫﺎ ﻟﻠﺴﻴﺎح ﺑﻨﺎء ﻋﲆ ﻧﻈﺎم رد اﻟﴬﻳﺒﺔ ﻟﻠﺴﻴﺎح

3 Supplies subject to the reverse charge provisions

0.00 0.00

ﺗﺨﻀﻊ اﻟﺘﻮرﻳﺪات ﻷﺣﻜﺎم اﻻﺣﺘﺴﺎب اﻟﻌﻜﴘ

4 Zero Rated Supplies

0.00

ﺗﻮرﻳﺪات ﺧﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻟﺼﻔﺮﻳﺔ

5 Exempt Supplies

0.00

اﻟﺘﻮرﻳﺪات اﳌﻌﻔﺎة

6 Goods imported into the UAE

0.00 0.00

اﻟﺒﻀﺎﺋﻊ اﻟﻮاردة إﱃ اﻟﺪوﻟﺔ

7 Adjustments to goods imported into the UAE

0.00 0.00

ﺗﺴﻮﻳﺔ ﻋﲆ اﻟﺒﻀﺎﺋﻊ اﳌﺴﺘﻮردة إﱃ دوﻟﺔ اﻹﻣﺎرات اﻟﻌﺮﺑﻴﺔ اﳌﺘﺤﺪة

8 Totals

17,200.00 860.00 0.00

اﳌﺠﻤﻮع

VAT on Expenses and All Other Inputs

ﴐﻳﺒﺔ اﻟﻘﻴﻤﺔ اﳌﻀﺎﻓﺔ ﻋﲆ اﳌﺒﻴﻌﺎت وﺟﻤﻴﻊ اﳌﺨﺮﺟﺎت اﻷﺧﺮى

VAT Amount

Amount Adjustment

Description (AED)

(AED) (AED)

وﺻﻒ ﻗﻴﻤﺔ ﴐﻳﺒﺔ اﻟﻘﻴﻤﺔ اﳌﻀﺎﻓﺔ

(اﳌﺒﻠﻎ )درﻫﻢ (ﺗﺴﻮﻳﺔ )درﻫﻢ

()درﻫﻢ

9 Standard Rated Expenses

0.00 0.00 0.00

اﻟﻨﻔﻘﺎت اﻟﺨﺎﺿﻌﺔ ﻟﻠﻨﺴﺒﺔ اﻷﺳﺎﺳﻴﺔ

10 Supplies subject to the reverse charge provisions

0.00 0.00

ﺗﺨﻀﻊ اﻟﺘﻮرﻳﺪات ﻷﺣﻜﺎم اﻻﺣﺘﺴﺎب اﻟﻌﻜﴘ

11 Totals

0.00 0.00 0.00

اﳌﺠﻤﻮع

www.tax.gov.ae @uaetax

Federal Authority | ﻫﻴﺌﺔ اﺗﺤﺎدﻳﺔ

This is a system generated document and does not need to be signed. The Taxpayer is solely responsible for the usage of this document. FTA cannot be held liable for

any damage caused to the Taxpayer or recipient of this document.

. ﻻ ﻤﻳﻜﻦ أن ﺗﻜﻮن اﻟﻬﻴﺌﺔ اﻻﺗﺤﺎدﻳﺔ ﻟﻠﴬاﺋﺐ ﻣﺴﺆوﻟﺔ ﻋﻦ أي ﴐر ﻳﻠﺤﻖ ﺑﺪاﻓﻌﻲ اﻟﴬاﺋﺐ أو ﻣﺘﻠﻘﻲ ﻫﺬه اﻟﻮﺛﻴﻘﺔ. داﻓﻊ اﻟﴬاﺋﺐ ﻫﻮ اﳌﺴﺆول اﻟﻮﺣﻴﺪ ﻋﻦ اﺳﺘﺨﺪام ﻫﺬه اﻟﻮﺛﻴﻘﺔ.ﻫﺬه وﺛﻴﻘﺔ ﺗﻢ إﻧﺸﺎؤﻫﺎ ﺑﻮاﺳﻄﺔ اﻟﻨﻈﺎم وﻻ ﺗﺤﺘﺎج إﱃ اﻟﺘﻮﻗﻴﻊ

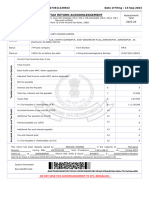

Amount

Net VAT Due

(AED)

ﺻﺎﰲ ﴐﻳﺒﺔ اﻟﻘﻴﻤﺔ اﳌﻀﺎﻓﺔ اﳌﺴﺘﺤﻘﺔ

(اﳌﺒﻠﻎ )درﻫﻢ

12 Total Value of due tax for the period

860.00

(إﺟﺎﻤﱄ ﻗﻴﻤﺔ اﻟﴬﻳﺒﺔ اﳌﺴﺘﺤﻘﺔ ﻋﻦ اﻟﻔﱰة )درﻫﻢ

13 Total Value of recoverable tax for the period

0.00

(إﺟﺎﻤﱄ ﻗﻴﻤﺔ اﻟﴬﻳﺒﺔ اﻟﻘﺎﺑﻠﺔ ﻟﻼﺳﱰداد ﻟﻠﻔﱰة )درﻫﻢ

14 Payable tax for the period

860.00

(اﻟﴬﻳﺒﺔ اﳌﺴﺘﺤﻘﺔ اﻟﺪﻓﻊ ﻋﻦ اﻟﻔﱰة )درﻫﻢ

Profit Margin Scheme

ﻫﺎﻣﺶ اﻟﺮﺑﺢ

Did you apply the profit margin scheme in respect of any supplies made during the tax period?

ﻫﻞ ﻗﻤﺖ ﺑﺘﻄﺒﻴﻖ ﻧﻈﺎم ﻫﺎﻣﺶ اﻟﺮﺑﺢ ﻓﻴﺎﻤ ﻳﺘﻌﻠﻖ ﺑﺄي ﺗﻮرﻳﺪات ﺗﻢ إﺟﺮاؤﻫﺎ ﺧﻼل اﻟﻔﱰة اﻟﴬﻳﺒﻴﺔ؟

No

Authorised Signatory

اﳌﻔﻮﺿﻦﻴ ﺑﺎﻟﺘﻮﻗﻴﻊ

Name in English Name in Arabic

Amita Vikram Pratap اﻣﻴﺘﺎ ﻓﻴﻜﺮام ﺑﺮاﺗﺎب

اﻻﺳﻢ ﺑﺎﻻﻧﺠﻠﻴﺰﻳﺔ اﻻﺳﻢ ﺑﺎﻟﻌﺮﻲﺑ

Mobile Country Code Mobile Number

رﻣﺰ اﻟﺪوﻟﺔ رﻗﻢ اﻟﻬﺎﺗﻒ

Date of Submission Email Address

24/08/2023

ﺗﺎرﻳﺦ اﻟﺘﻘﺪﻳﻢ اﻟﱪﻳﺪ اﻹﻟﻜﱰوﻲﻧ

Date and time when this document was generated

28/11/2023 16:55:33

اﻟﺘﺎرﻳﺦ واﻟﻮﻗﺖ اﻟﺬي ﺗﻢ ﻓﻴﻪ إﻧﺸﺎء ﻫﺬا اﳌﺴﺘﻨﺪ

www.tax.gov.ae @uaetax

Federal Authority | ﻫﻴﺌﺔ اﺗﺤﺎدﻳﺔ

This is a system generated document and does not need to be signed. The Taxpayer is solely responsible for the usage of this document. FTA cannot be held liable for

any damage caused to the Taxpayer or recipient of this document.

. ﻻ ﻤﻳﻜﻦ أن ﺗﻜﻮن اﻟﻬﻴﺌﺔ اﻻﺗﺤﺎدﻳﺔ ﻟﻠﴬاﺋﺐ ﻣﺴﺆوﻟﺔ ﻋﻦ أي ﴐر ﻳﻠﺤﻖ ﺑﺪاﻓﻌﻲ اﻟﴬاﺋﺐ أو ﻣﺘﻠﻘﻲ ﻫﺬه اﻟﻮﺛﻴﻘﺔ. داﻓﻊ اﻟﴬاﺋﺐ ﻫﻮ اﳌﺴﺆول اﻟﻮﺣﻴﺪ ﻋﻦ اﺳﺘﺨﺪام ﻫﺬه اﻟﻮﺛﻴﻘﺔ.ﻫﺬه وﺛﻴﻘﺔ ﺗﻢ إﻧﺸﺎؤﻫﺎ ﺑﻮاﺳﻄﺔ اﻟﻨﻈﺎم وﻻ ﺗﺤﺘﺎج إﱃ اﻟﺘﻮﻗﻴﻊ

You might also like

- Infor - ERP - VISUAL - Detailed Functionality - Version9Document78 pagesInfor - ERP - VISUAL - Detailed Functionality - Version9CAT MINING SHOVELNo ratings yet

- VAT 201 ReturnDocument3 pagesVAT 201 ReturnRonses ChannelNo ratings yet

- Brandix Sustainability Report 2019 - 2020Document80 pagesBrandix Sustainability Report 2019 - 2020Ishu GunasekaraNo ratings yet

- Vendor Cliam PDFDocument1 pageVendor Cliam PDFManoj KumarNo ratings yet

- Get Free Google AdsDocument18 pagesGet Free Google AdsFrance JosephNo ratings yet

- Siggel TejariDocument2 pagesSiggel Tejarijobaid islamNo ratings yet

- Citibank Case Study Group1Document11 pagesCitibank Case Study Group1Deepaksayu100% (1)

- Invoice INV318Document2 pagesInvoice INV318shecamazicaNo ratings yet

- Online Payment Acknowledgement Receipt CDocument1 pageOnline Payment Acknowledgement Receipt CSatyanarayana BalusaNo ratings yet

- List of Top UAE CompaniesDocument8 pagesList of Top UAE CompaniesTauheedalHasan58% (19)

- Inv 2023 0267Document1 pageInv 2023 0267infoNo ratings yet

- Chapter 17 Limits To The Use of DebtDocument25 pagesChapter 17 Limits To The Use of DebtFahmi Ahmad FarizanNo ratings yet

- Invoice - 2021-06-08T003040.941Document1 pageInvoice - 2021-06-08T003040.941Quality DepartmentNo ratings yet

- Einvoice 1694619077137Document1 pageEinvoice 1694619077137irfanali19815No ratings yet

- 150 Massar Al-Ingaz 3M Cat6 CablesDocument1 page150 Massar Al-Ingaz 3M Cat6 CablesIbrahim AljunaidiNo ratings yet

- Invoice -شركة سلام البناء للمقاولاتDocument2 pagesInvoice -شركة سلام البناء للمقاولاتMuhammad Daniyal100% (1)

- Invoice -مكتب الخليج للاستشارات الهندسيةDocument2 pagesInvoice -مكتب الخليج للاستشارات الهندسيةMuhammad DaniyalNo ratings yet

- Receipt - ASC Apt 52 - Mr. Abdulllah Al TuwairijiDocument1 pageReceipt - ASC Apt 52 - Mr. Abdulllah Al TuwairijiNasser AltuwaijriNo ratings yet

- 1ed82dd0 56051Document1 page1ed82dd0 56051Ahmed ElhawaryNo ratings yet

- Invoice Form 9606099Document4 pagesInvoice Form 9606099Xx-DΞΛDSH0T-xXNo ratings yet

- BillForAccount AspxDocument1 pageBillForAccount AspxImran Muhammed SahirNo ratings yet

- 6e9db38 48211Document1 page6e9db38 48211howef96789No ratings yet

- Mahran Arabian Company For Industry Saudi Arabia Jiddah, Saudi Arabia, Second Industrial City - Street 46 - Plot No 3752, 22244 0536677050Document1 pageMahran Arabian Company For Industry Saudi Arabia Jiddah, Saudi Arabia, Second Industrial City - Street 46 - Plot No 3752, 22244 0536677050Quality DepartmentNo ratings yet

- Draft: ﺔﻴﺒﻳﺮﺿ ةرﻮﺗﺎﻓ Tax InvoiceDocument1 pageDraft: ﺔﻴﺒﻳﺮﺿ ةرﻮﺗﺎﻓ Tax InvoiceTilalNo ratings yet

- 1226262836Document1 page1226262836Asamir AlHaidar0% (3)

- 120241898Document1 page120241898غاده الحارثيNo ratings yet

- Lulua InvoiceDocument1 pageLulua InvoiceUmair SarwarNo ratings yet

- Lulua InvoiceDocument1 pageLulua InvoiceUmair SarwarNo ratings yet

- Vu - 01663671385683Document1 pageVu - 01663671385683salman AlbulukNo ratings yet

- Invoice - 2021-06-08T002801.878Document1 pageInvoice - 2021-06-08T002801.878Quality DepartmentNo ratings yet

- Flight Invoice A9120303364Document2 pagesFlight Invoice A9120303364Jatinder Singh GillNo ratings yet

- Check - INVOICE 12600000799Document2 pagesCheck - INVOICE 12600000799Ronei DelinaNo ratings yet

- VAT Invoice - 2024-01-31 - 00000007031318-2401-18359960Document2 pagesVAT Invoice - 2024-01-31 - 00000007031318-2401-18359960mhzp4ckj47No ratings yet

- Lulua InvoiceDocument1 pageLulua InvoiceUmair SarwarNo ratings yet

- Noon Doc 80038888Document2 pagesNoon Doc 80038888Hisham HussainNo ratings yet

- Exceptional Broadband Bill - April2022Document1 pageExceptional Broadband Bill - April2022Raju JhaNo ratings yet

- Simple GST Invoice For Single Rate of Goods and ServicesDocument8 pagesSimple GST Invoice For Single Rate of Goods and ServicesKM computer & online workNo ratings yet

- Feature of Simple GST Invoice Template 1.0 in Microsoft ExcelDocument8 pagesFeature of Simple GST Invoice Template 1.0 in Microsoft ExcelShivam SrivastavaNo ratings yet

- Bill No 23Document1 pageBill No 23panwarjagdishlodhaNo ratings yet

- Jarir ReceiptDocument1 pageJarir ReceiptInes Laura AgiuNo ratings yet

- Archirodon Inv January 2024 (RTTS)Document11 pagesArchirodon Inv January 2024 (RTTS)SyedAsrarNo ratings yet

- Tanish Travels InvoiceDocument1 pageTanish Travels Invoicerahnumaansari1982No ratings yet

- Draf T: Form Gstr-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesDocument4 pagesDraf T: Form Gstr-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesSinghal 220000No ratings yet

- Iff 03bdapk0147g4z5 022024Document4 pagesIff 03bdapk0147g4z5 022024SANJEEV KUMARNo ratings yet

- Lulua Credit NoteDocument1 pageLulua Credit NoteUmair SarwarNo ratings yet

- Draf T: Form Gstr-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesDocument4 pagesDraf T: Form Gstr-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or Servicesrohan keshriNo ratings yet

- Tax Invoice: Name of Customer (Bill To) : Tanu JainDocument1 pageTax Invoice: Name of Customer (Bill To) : Tanu JainTanu JainNo ratings yet

- Easy GSTDocument1 pageEasy GSTAshish PathakNo ratings yet

- Invoice: 315 Marvella Corridor Vip Road Vesu Surat GSTIN NO-24BYXPK0658L1ZR 8866783067Document1 pageInvoice: 315 Marvella Corridor Vip Road Vesu Surat GSTIN NO-24BYXPK0658L1ZR 8866783067KaranNo ratings yet

- Simplified Tax Invoice - DiomDocument1 pageSimplified Tax Invoice - DiomMostafa MousaNo ratings yet

- 1801/ 1, 3rd Phase, Plot No-1909 3rd Phase, Gidc Umbergaon Dist-Valsad 9978327400/9725504111 Gstin/Uin: 24AAJPU9609A1ZN State Name: Gujarat, Code: 24Document1 page1801/ 1, 3rd Phase, Plot No-1909 3rd Phase, Gidc Umbergaon Dist-Valsad 9978327400/9725504111 Gstin/Uin: 24AAJPU9609A1ZN State Name: Gujarat, Code: 24Jignesh UpadhyayNo ratings yet

- شركة جوتن السعودية المحدودة CD5024003037Document2 pagesشركة جوتن السعودية المحدودة CD5024003037alrashdydecorationNo ratings yet

- Tax Invoice: VAT Reg. NumberDocument1 pageTax Invoice: VAT Reg. NumberAhmed MousaNo ratings yet

- E InvoicDocument1 pageE Invoicabdul raheemNo ratings yet

- GST Sample VoucherDocument1 pageGST Sample VoucherVenu GopalNo ratings yet

- SpymDocument1 pageSpymVishal KumarNo ratings yet

- GST SALES A - 9259-A - 23-Nov-23Document1 pageGST SALES A - 9259-A - 23-Nov-23prabhat088No ratings yet

- Habeeb Water BillDocument1 pageHabeeb Water Billpraveen kumarNo ratings yet

- Payment Voucher: هيبيرض ةروتاف TAX InvoiceDocument2 pagesPayment Voucher: هيبيرض ةروتاف TAX InvoiceM ANo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceMohammedShahrukhNo ratings yet

- إيصال العملية (PDF) Document1 pageإيصال العملية (PDF) meshalml7m2008No ratings yet

- Kiosk NTDocument1 pageKiosk NTfahadalisaas234No ratings yet

- Invoice Data Invoice Data اﻟ ﻔ ﺎﺗ ﻮ رة اﻟ ﻔ ﺎﺗ ﻮ رة ﺑﻴ ﺎﻧ ﺎ ت ﺑﻴ ﺎﻧ ﺎ تDocument1 pageInvoice Data Invoice Data اﻟ ﻔ ﺎﺗ ﻮ رة اﻟ ﻔ ﺎﺗ ﻮ رة ﺑﻴ ﺎﻧ ﺎ ت ﺑﻴ ﺎﻧ ﺎ تctnz94bbdsNo ratings yet

- Gurugram Delhi Ajmersharif GurugramDocument2 pagesGurugram Delhi Ajmersharif Gurugramrahnumaansari1982No ratings yet

- 10rajendra JiDocument1 page10rajendra JiBs RaoNo ratings yet

- ACK253273911130923Document1 pageACK253273911130923Satyanarayana BalusaNo ratings yet

- Indian Income Tax Return Acknowledgement: Assessment YearDocument2 pagesIndian Income Tax Return Acknowledgement: Assessment YearSatyanarayana BalusaNo ratings yet

- Project Report.01-ACQA FEEDSDocument27 pagesProject Report.01-ACQA FEEDSSatyanarayana BalusaNo ratings yet

- Key Objective: Team Members (Div/Dept.)Document3 pagesKey Objective: Team Members (Div/Dept.)Shariful IslamNo ratings yet

- Entrepreneurship and Business PlanningDocument6 pagesEntrepreneurship and Business PlanningLala AlalNo ratings yet

- Auditing Concepts and Applications - Reviewer 4 (Materiality and Audit Risk)Document32 pagesAuditing Concepts and Applications - Reviewer 4 (Materiality and Audit Risk)ben yiNo ratings yet

- Bingcang & Tamon (CVP, Module 5)Document67 pagesBingcang & Tamon (CVP, Module 5)FayehAmantilloBingcangNo ratings yet

- Cross-Functional CompetenciesDocument2 pagesCross-Functional Competenciesasdkhn khnNo ratings yet

- Managers - We Are Katti With You - DarpanDocument2 pagesManagers - We Are Katti With You - DarpanDarpan ChoudharyNo ratings yet

- Weekly Test Schedule 2nd SemDocument1 pageWeekly Test Schedule 2nd Semhsudehue3No ratings yet

- Boeing 777 - A Financial Analysis of New Product LaunchDocument26 pagesBoeing 777 - A Financial Analysis of New Product LaunchChristian CabariqueNo ratings yet

- Curriculum - Vitae - Format Juliette PDFDocument3 pagesCurriculum - Vitae - Format Juliette PDFJuli JulioNo ratings yet

- HFZA EEHS Investors Information KitDocument36 pagesHFZA EEHS Investors Information KitHelp Tubestar CrewNo ratings yet

- Competitive Intelligence and Marketing Effectiveness in Corporate Organizations in NigeriaDocument13 pagesCompetitive Intelligence and Marketing Effectiveness in Corporate Organizations in Nigeriazemen tadesseNo ratings yet

- NTCC On Interior DesigningDocument20 pagesNTCC On Interior DesigningMohitAgarwalNo ratings yet

- Top 10 FMCG Companies in The WorldDocument8 pagesTop 10 FMCG Companies in The WorldSparsh AgarwalNo ratings yet

- XXX eWOM Via The TikTok ApplicationDocument11 pagesXXX eWOM Via The TikTok ApplicationDuy KhánhNo ratings yet

- List of Cases From Articles 1156 To 1178Document7 pagesList of Cases From Articles 1156 To 1178barbashera10No ratings yet

- Bengkalis MuriaDocument10 pagesBengkalis Muriareza hariansyahNo ratings yet

- SFPP 3 Fold BrochureDocument2 pagesSFPP 3 Fold BrochureAmii AmoreNo ratings yet

- Ch. 1 Ch. 2 Aswath DamodaranDocument15 pagesCh. 1 Ch. 2 Aswath Damodarandeeps0705No ratings yet

- Kickstarter - Launchboom Guide: Pre CampaignDocument2 pagesKickstarter - Launchboom Guide: Pre CampaignStella NguyenNo ratings yet

- Separate and Consolidated Dayag Part 3Document4 pagesSeparate and Consolidated Dayag Part 3Edi wow WowNo ratings yet

- Netflix: Everything You Need To Know!Document6 pagesNetflix: Everything You Need To Know!Nastya GoyNo ratings yet

- Assignment No 2Document6 pagesAssignment No 2Amazing worldNo ratings yet

- INDUSTRIAL ENGINEERING Assignment 1Document21 pagesINDUSTRIAL ENGINEERING Assignment 1AmanNo ratings yet

- BCI - Certificate of Foreign Inward RemittanceDocument2 pagesBCI - Certificate of Foreign Inward RemittanceCacptCoachingNo ratings yet