Professional Documents

Culture Documents

AA025 Chapter AT2

Uploaded by

norismah isaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AA025 Chapter AT2

Uploaded by

norismah isaCopyright:

Available Formats

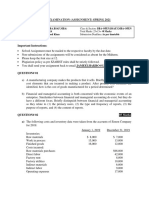

CHAPTER TWO : MANUFACTURING COST : CONCEPTS AND COMPONENTS

1. For the manufacturing company, identify the following as either a product cost or a

period cost

a) Depreciation on plant equipment

b) Depreciation on salespersons’ automobiles

c) Insurance on plant building

d) Marketing manager’s salary

e) Raw materials

f) Manufacturing overhead

g) Electricity bill for home office

h) Production employee wages

2. Jaffar , Inc., a retail distributor of futons, provided the following information for 2015.

RM

Merchandise Inventory, January 1 20,000

Merchandise Inventory, December 31 30,000

Sales Salaries Expense 50,000

Delivery Expense 18,000

Net purchase of Futons 265,000

Rent Expense 15,000

Utilities Expense 3,000

Freight In 15,000

Administrative Salaries Expense 64,000

Sales revenue 500,000

Units sold during the year 2,500 futons

Required

a) Calculate the cost of goods sold. What is the cost per futon sold?

b) Calculate the total period costs

c) Prepare Jaffar’s income statement for the year ended December 31, 2015. Do not

categorize operating expenses between selling and administrative.

Solution

(Horngren’s Accounting 10th edition)

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EFrom EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ERating: 4.5 out of 5 stars4.5/5 (6)

- Marginal & Absorption Feb 20-19 PDFDocument12 pagesMarginal & Absorption Feb 20-19 PDFhamza khanNo ratings yet

- Normal CostingDocument3 pagesNormal Costingrose llar67% (3)

- 1.1 Exercises - Cost Accounting, Cost Concepts, Understanding and Classifying CostsDocument8 pages1.1 Exercises - Cost Accounting, Cost Concepts, Understanding and Classifying CostsMeg sharkNo ratings yet

- Problem 1Document3 pagesProblem 1Cinderella Ladyong0% (2)

- FAR Practical Exercises InventoriesDocument5 pagesFAR Practical Exercises InventoriesAB Cloyd0% (1)

- Cost of Goods SoldDocument14 pagesCost of Goods Soldmuhammad irfan50% (2)

- ACT112.QS2 With AnswersDocument6 pagesACT112.QS2 With AnswersGinie Lyn Rosal89% (9)

- Group AssignmentDocument7 pagesGroup Assignmentsaidkhatib368No ratings yet

- Fma Assignment 3Document5 pagesFma Assignment 3Abdul AhmedNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingXen XeonNo ratings yet

- Managerial AccountingDocument21 pagesManagerial AccountingRam KnowlesNo ratings yet

- FABM 2 3.ACT SCIdocxDocument10 pagesFABM 2 3.ACT SCIdocxMaryPher CadioganNo ratings yet

- Module 3 - SW On MFTG Acctg & CfsDocument2 pagesModule 3 - SW On MFTG Acctg & CfsestebandgonoNo ratings yet

- Product CostDocument10 pagesProduct CostApple BaldemoroNo ratings yet

- Compute The Unit Product Cost of One Bike UnderDocument3 pagesCompute The Unit Product Cost of One Bike UndersajedulNo ratings yet

- Financial and Managerial ExercisesDocument5 pagesFinancial and Managerial ExercisesBedri M Ahmedu50% (2)

- Test Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingDocument7 pagesTest Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingMusic WorldNo ratings yet

- FYMMS Cost and MA AssignmentDocument2 pagesFYMMS Cost and MA AssignmentRahul Nishad100% (1)

- Cost Accounting 1 ACT201 InstructorsDocument4 pagesCost Accounting 1 ACT201 InstructorsAdhamNo ratings yet

- Practice Set Inventories Inventory EstimationDocument4 pagesPractice Set Inventories Inventory EstimationChristine De LeonNo ratings yet

- Unit 6Document2 pagesUnit 6Adaira HerondaleNo ratings yet

- Assignment 1Document2 pagesAssignment 1Betheemae R. MatarloNo ratings yet

- Cost Sheet HandoutDocument7 pagesCost Sheet HandoutSidhant AirenNo ratings yet

- Assignment1 CostAccountingDocument2 pagesAssignment1 CostAccountingSyed Adnan Hussain ShahNo ratings yet

- CE Interim ReportingDocument2 pagesCE Interim ReportingalyssaNo ratings yet

- Department AccountingDocument12 pagesDepartment AccountingRajesh NangaliaNo ratings yet

- BMAC5203 AssignmentDocument10 pagesBMAC5203 Assignmentsheyen choongNo ratings yet

- 6-Cost Sheet (Unsolved) (25-02-2024)Document17 pages6-Cost Sheet (Unsolved) (25-02-2024)Kajal BindalNo ratings yet

- Financial Statements ER Problem 2 SolutionDocument11 pagesFinancial Statements ER Problem 2 SolutionSYED ALI SHAH SYED MUKHTIYAR ALINo ratings yet

- 1 Cost Sheet TexbookDocument6 pages1 Cost Sheet TexbookVishal Kumar 5504No ratings yet

- Review of Cost Acctg 1 PDF FreeDocument5 pagesReview of Cost Acctg 1 PDF FreeEu NiceNo ratings yet

- 11-11-21... 4060 GR I... Ni-3124... Costing... QueDocument4 pages11-11-21... 4060 GR I... Ni-3124... Costing... QueVimal Shroff55No ratings yet

- Mentoring AB UTS 2015 GasalDocument10 pagesMentoring AB UTS 2015 GasalGilang Aji PradanaNo ratings yet

- Manufacturing Accounts 2020-2 PDFDocument15 pagesManufacturing Accounts 2020-2 PDFAlvin K. JohnsonNo ratings yet

- Cost & Management - X Is The Manufacture of MumbaiDocument6 pagesCost & Management - X Is The Manufacture of MumbaiSailpoint CourseNo ratings yet

- Cost Sheet Questions FastrackDocument8 pagesCost Sheet Questions Fastrackdegikoh540No ratings yet

- Company: ManufacturingDocument8 pagesCompany: Manufacturingzain khalidNo ratings yet

- CGS ScheduleDocument6 pagesCGS ScheduleMariaCarlaMañagoNo ratings yet

- Accounting - X Is The Manufacture of MumbaiDocument4 pagesAccounting - X Is The Manufacture of MumbaiSailpoint CourseNo ratings yet

- Assignment ProblemDocument7 pagesAssignment ProblemAnantha KrishnaNo ratings yet

- Management Information June-2012Document2 pagesManagement Information June-2012Laskar REAZNo ratings yet

- Marginal CostingDocument4 pagesMarginal CostingFareha Riaz100% (3)

- Worksheet1-Basics & COGSDocument5 pagesWorksheet1-Basics & COGSmohsinmustafa.2001No ratings yet

- Cost of Goods Sold Statement - Practice QuestionDocument3 pagesCost of Goods Sold Statement - Practice QuestionMuhammad MansoorNo ratings yet

- Mcom Sem 4 PricingDocument2 pagesMcom Sem 4 PricingVishal VasaNo ratings yet

- Cost Accounting Scanner - 240218 - 174108Document15 pagesCost Accounting Scanner - 240218 - 174108ViratNo ratings yet

- Activity in Inventory Estimation, Retail InventoryDocument2 pagesActivity in Inventory Estimation, Retail InventoryTrisha VillegasNo ratings yet

- Applied Cost AccountingDocument2 pagesApplied Cost AccountingamaljacobjogilinkedinNo ratings yet

- 04 Inventory EstimationDocument5 pages04 Inventory EstimationWinnie ToribioNo ratings yet

- Cost Sheet: RequiredDocument1 pageCost Sheet: RequiredmuhsinNo ratings yet

- Problem Lecture - MANUFACTURING 2 With ANSWERSDocument4 pagesProblem Lecture - MANUFACTURING 2 With ANSWERSNia BranzuelaNo ratings yet

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoNo ratings yet

- Finals Unit 4 Exercise - Variable and Absorption CostingDocument2 pagesFinals Unit 4 Exercise - Variable and Absorption CostingMelo RiegoNo ratings yet

- Banitog, Brigitte C. BSA 211Document8 pagesBanitog, Brigitte C. BSA 211MyunimintNo ratings yet

- Ca (Bsaf - Bba.mba)Document5 pagesCa (Bsaf - Bba.mba)kashif aliNo ratings yet

- ManAc Quiz 1Document12 pagesManAc Quiz 1random122No ratings yet

- TUTORIAL Manufacturing With SolutionDocument10 pagesTUTORIAL Manufacturing With SolutionmaiNo ratings yet

- Forest Products: Advanced Technologies and Economic AnalysesFrom EverandForest Products: Advanced Technologies and Economic AnalysesNo ratings yet