Professional Documents

Culture Documents

Data For Development

Uploaded by

Jigar DesaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Data For Development

Uploaded by

Jigar DesaiCopyright:

Available Formats

Data for Development

Impact of Digitization on the

Private Credit Landscape in India

As India concludes its triumphant G20 presidency with the theme "One Earth,

One Family, One Future," the underlying principle of “Data for development"

showed the nation's commitment to leveraging data for quantum growth. At the

forefront of this journey is the transformative power of digitization, driven by

initiatives like Digital India. This concerted effort has catapulted the country into a

new era of growth, seen prominently in the economic, social, and health sectors.

Notably, India executed an impressive 85 billion transactions through UPI in FY

2022-23, projected to reach 1 billion daily transactions by 2026.

Data Source: NPCI Image Source: Moneycontrol

2023 © Neo Asset Management Pvt. Ltd. | 2

Along with mass economic and social benefits of digitization, niche segments

such as private credit investing are also benefiting greatly. The widespread

adoption of digitization across various economic segments, coupled with the

industry's rapid embrace of this transformation, provides investors with an

invaluable trove of data. This, in turn, enhances the efficiency and precision of

decision-making processes for private credit investors.

In our view, private debt investing is essentially a function of 5Cs -character,

capital, capacity, collateral, and conditions. Private Debt investors look at

“Character” to understand the past conduct of the borrowers, their credit history

with historic lenders and an assessment of any potential litigations, reputational

concerns, and how they navigate challenges.

CAPACITY

Assesses borrower's

debt-to-income ratio

05

CAPITAL

CONDITIONS

04 Indicates the

borrower’s level of

Factors like interest

rate & amount of 01 seriousness

principal

CHARACTER

03 COLLATERAL

02 Offers assurance that if the

Aka "credit history"

borrower defaults on the

loan, the lender can

repossess the collateral

The 5 C’s of Credit Source: Investopedia

2023 © Neo Asset Management Pvt. Ltd. | 3

Under Capital, an assessment is made of the promoter’s commitment through

equity infusion, considering the scale of the company and the difference between

book value and fair value of equity. For Capacity, the investors evaluate the

company’s earning trajectory and potential for future growth, coupled with the

successful translation of revenue into cash flows. Capital and Capacity together

reveal the leverage in the company. Collateral involves determining the security

cushion that the company can provide in case of the worst-case scenario and

Conditions is assessment of the business environment and contextual factors

such as adverse political conditions, regulatory changes, and other external

factors.

Digital sources provide

information for financial

performance, industrial

performance, market, sentiment

analysis as well as assessing

external risk factors. Information

regarding GST filings of

promoters give a sense of cash

flow of sponsors and their

entities.

To take this a step further, filings of direct taxes help investors in getting insights

into the borrower’s credit worthiness. Information from credit bureaus, filings with

insolvency and bankruptcy tribunals along with data from banks help in assessing

credit history. Banks in India now share borrower details with third parties using

Open API with the users’ permission. Additionally, records of company are

digitized and available along with history of performance. information regarding

all Directors of the company and other directorship positions held by them are all

available and analysed. This information feeds into dynamic credit assessment risk

models which help in pricing risk better.

2023 © Neo Asset Management Pvt. Ltd. | 4

In a landmark development, the Reserve Bank of India has announced the

establishment of a "Public Tech for Frictionless Credit" Platform. This platform will

create an open architecture facilitating the seamless flow of digital information

from various Central and State Government entities, credit bureaus, and digital

identity lenders. The platform, designed as a one-stop digital clearinghouse for

credit-related information, is poised to streamline the loan approval and disbursal

process, fostering a more efficient credit ecosystem.

Public Tech For Frictionless Credit

While private debt inherently involves elements of both art and science, the

digitization of data across various business segments profoundly influences the

scientific analysis of each deal. This, in turn, affords private credit investors the

space, time, and platform to focus on the nuanced art of private lending in India.

2023 © Neo Asset Management Pvt. Ltd. | 5

About Neo Wealth and

Asset Management

Neo Wealth and Asset Management is a new-age asset management

and financial advisory platform that aims to provide trustworthy,

transparent, and unbiased financial solutions to its clients. Set up by

Nitin Jain, Neo Group aims to educate, enhance, and empower

investors with optimal and value accretive financial tools for a secure

and balanced future.

Neo Asset Management, Multifamily Office, and Retail businesses

seek to serve both institutional and retail customers, through global

best-in-class governance standards, innovative technology-driven

services, and a highly accomplished team with deep domain

expertise in all its operations.

For more Information, please visit www.neo-group.in

2023 © Neo Asset Management Pvt. Ltd. | 6

You might also like

- Unlocking Capital: The Power of Bonds in Project FinanceFrom EverandUnlocking Capital: The Power of Bonds in Project FinanceNo ratings yet

- Credit Risk and Underwriting ProdegreeDocument6 pagesCredit Risk and Underwriting ProdegreeDEBABRATA BHUNIANo ratings yet

- Moodys Prodegree EbrochureDocument6 pagesMoodys Prodegree EbrochureJayakumarNo ratings yet

- RISK Management CASE STUDY - 2022Document4 pagesRISK Management CASE STUDY - 2022BobbyNo ratings yet

- Rating Methodology For Infrastructure Investment Trusts (Invits)Document9 pagesRating Methodology For Infrastructure Investment Trusts (Invits)arpanarajbhattNo ratings yet

- Credit Rating ArticleDocument2 pagesCredit Rating ArticleLaweesh KumarNo ratings yet

- Credit RiskDocument5 pagesCredit RiskANNA BIEN DELA CRUZNo ratings yet

- Credit AwarenessDocument62 pagesCredit AwarenessHimanshu Mishra100% (1)

- Cibil Link - Volume I, Issue X, Oct - Dec 06Document4 pagesCibil Link - Volume I, Issue X, Oct - Dec 06Rajeev RathNo ratings yet

- Cac Prelim ReviewerDocument3 pagesCac Prelim ReviewerAnna Lyssa BatasNo ratings yet

- Webinar ReportDocument10 pagesWebinar Reportmohd ChanNo ratings yet

- SLR-Big Data For Credit Risk EvaluationDocument28 pagesSLR-Big Data For Credit Risk Evaluationbisrat.redaNo ratings yet

- Credit RatingDocument8 pagesCredit RatingchandanchiksNo ratings yet

- Credit Analysis and Distress PredictionDocument57 pagesCredit Analysis and Distress Predictionrizki nurNo ratings yet

- Credit Rating PDFDocument74 pagesCredit Rating PDFsnehachandan91No ratings yet

- Debt Securitization in IndiaDocument16 pagesDebt Securitization in Indiasaurabhm590No ratings yet

- Chapter 4 Loans and AdvancesDocument36 pagesChapter 4 Loans and AdvancesHeena DhingraNo ratings yet

- Peer 2 Peer Lending (India) Report: Compiled byDocument24 pagesPeer 2 Peer Lending (India) Report: Compiled byPulkit SharmaNo ratings yet

- Project Report On Credit Rating: Submitted By: - Pulkit Garg Regn. No. 220610440/07/2008Document39 pagesProject Report On Credit Rating: Submitted By: - Pulkit Garg Regn. No. 220610440/07/2008Mayank GoyalNo ratings yet

- Unit 1Document28 pagesUnit 1saurabh thakurNo ratings yet

- Blackbook Project On Credit RatingDocument74 pagesBlackbook Project On Credit RatingRagini Sundarraman62% (13)

- Credit Derivatives: Techniques to Manage Credit Risk for Financial ProfessionalsFrom EverandCredit Derivatives: Techniques to Manage Credit Risk for Financial ProfessionalsNo ratings yet

- Chapter 2Document8 pagesChapter 2Pradeep RajNo ratings yet

- Ratio AnalysisDocument8 pagesRatio AnalysisAbdul RehmanNo ratings yet

- Credit Appraisal System of Commercial Vehicle Loans.Document43 pagesCredit Appraisal System of Commercial Vehicle Loans.Pravin Kolpe92% (12)

- Credit Rating GROUP 11Document11 pagesCredit Rating GROUP 11Siddharth Shah0% (1)

- Research Paper On Credit Appraisal ProcessDocument6 pagesResearch Paper On Credit Appraisal Processgatewivojez3100% (1)

- Certified Credit Counsellors For Msmes: A HandbookDocument43 pagesCertified Credit Counsellors For Msmes: A HandbookSekar ThangavelNo ratings yet

- Are You Creditworthy?: What Are Special Accessing Entities?Document2 pagesAre You Creditworthy?: What Are Special Accessing Entities?Allyzza MarieNo ratings yet

- Unlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditFrom EverandUnlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditNo ratings yet

- Functions of A Credit Rating AgencyDocument22 pagesFunctions of A Credit Rating Agencyharshubhoskar3500No ratings yet

- E-Handbook For CCCsDocument42 pagesE-Handbook For CCCsRahul KumarNo ratings yet

- Nkama Project Proofread PDFDocument117 pagesNkama Project Proofread PDFibrahimNo ratings yet

- A Navigator Study On Responsible Lending For India'Document6 pagesA Navigator Study On Responsible Lending For India'Ni007ckNo ratings yet

- Ê They Are Simply Opinions, Based On Analysis of The RiskDocument13 pagesÊ They Are Simply Opinions, Based On Analysis of The RiskMegha ChhabraNo ratings yet

- A Study On Credit Appraisal For Working Capital Finance To Smes at Ing Vysya BankDocument22 pagesA Study On Credit Appraisal For Working Capital Finance To Smes at Ing Vysya Bankprincejac4u2478894No ratings yet

- ArtikelDocument12 pagesArtikelShintiya Permata PuteriNo ratings yet

- Project 3Document11 pagesProject 3Goku NarutoNo ratings yet

- SritexDocument5 pagesSritexuzzyNo ratings yet

- FM Mod 5Document9 pagesFM Mod 5Gauri SinghNo ratings yet

- Real Estate FinancingDocument29 pagesReal Estate FinancingRaymon Prakash100% (1)

- Introduction To Bank Credit ManagementDocument26 pagesIntroduction To Bank Credit ManagementNeeRaz KunwarNo ratings yet

- Credit, Collection and Compliance Application 1 - Introduction To CreditDocument5 pagesCredit, Collection and Compliance Application 1 - Introduction To CreditGabriel Matthew Lanzarfel GabudNo ratings yet

- Credit Rating AND Term Loans: Presented By: Hemant Kumar Upadahyay Pawan Kumar Ravi Kumar Sonika SharmaDocument28 pagesCredit Rating AND Term Loans: Presented By: Hemant Kumar Upadahyay Pawan Kumar Ravi Kumar Sonika SharmaSush KaushikNo ratings yet

- Basic Enlish GrammerDocument30 pagesBasic Enlish Grammerdaniel rajkumarNo ratings yet

- Growth and Prospects of Leasing Industry in Bangladesh: A Study Based On Performance Evaluation of Selected Leasing FirmsDocument14 pagesGrowth and Prospects of Leasing Industry in Bangladesh: A Study Based On Performance Evaluation of Selected Leasing FirmsShafkatNo ratings yet

- How To Prevent Fraud in MSMEDocument16 pagesHow To Prevent Fraud in MSMEsidh0987No ratings yet

- Npa 119610079679343 5Document46 pagesNpa 119610079679343 5Teju AshuNo ratings yet

- Financing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksFrom EverandFinancing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksRating: 5 out of 5 stars5/5 (1)

- Credit Analysis, Working Capital Credit, and Investment CreditDocument17 pagesCredit Analysis, Working Capital Credit, and Investment CreditFidyNo ratings yet

- Manual SmeDocument636 pagesManual SmeSiddhesh SatputeNo ratings yet

- SCFS Cooperative Bank LTDDocument64 pagesSCFS Cooperative Bank LTDLïkïth RäjNo ratings yet

- Budgetary Control Katherine Jackson - FeedbackDocument20 pagesBudgetary Control Katherine Jackson - FeedbackkatieNo ratings yet

- Lecture 3aDocument35 pagesLecture 3aJason TeohNo ratings yet

- Credit Analysis Purpose and Factors To Be Considered An OverviewDocument69 pagesCredit Analysis Purpose and Factors To Be Considered An OverviewLily SequeiraNo ratings yet

- FFM1-Ch 3. Receivables ManagementDocument49 pagesFFM1-Ch 3. Receivables ManagementQuỳnhNo ratings yet

- Credit AnalysisDocument90 pagesCredit AnalysisShashi Kant Shrivastava100% (1)

- Credit Management Overview and Principles of LendingDocument44 pagesCredit Management Overview and Principles of LendingTavneet Singh100% (2)

- Research Paper On Credit Rating in IndiaDocument7 pagesResearch Paper On Credit Rating in Indiatgkeqsbnd100% (1)

- AN44061A Panasonic Electronic Components Product DetailsDocument3 pagesAN44061A Panasonic Electronic Components Product DetailsAdam StariusNo ratings yet

- 3DS 2017 GEO GEMS Brochure A4 WEBDocument4 pages3DS 2017 GEO GEMS Brochure A4 WEBlazarpaladinNo ratings yet

- Bhavesh ProjectDocument14 pagesBhavesh ProjectRahul LimbaniNo ratings yet

- Storage-Tanks Titik Berat PDFDocument72 pagesStorage-Tanks Titik Berat PDF'viki Art100% (1)

- Nursing Assessment in Family Nursing PracticeDocument22 pagesNursing Assessment in Family Nursing PracticeHydra Olivar - PantilganNo ratings yet

- S3 U4 MiniTestDocument3 pagesS3 U4 MiniTestĐinh Thị Thu HàNo ratings yet

- Design of Purlins: Try 75mm X 100mm: Case 1Document12 pagesDesign of Purlins: Try 75mm X 100mm: Case 1Pamela Joanne Falo AndradeNo ratings yet

- PretestDocument8 pagesPretestAlmonte Aira LynNo ratings yet

- Case Study McsDocument4 pagesCase Study McsManjushree PatilNo ratings yet

- Cummins: ISX15 CM2250Document17 pagesCummins: ISX15 CM2250haroun100% (4)

- LT3845ADocument26 pagesLT3845Asoft4gsmNo ratings yet

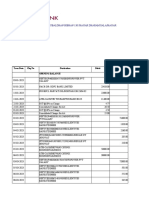

- XXXX96 01 01 2023to28 08 2023Document18 pagesXXXX96 01 01 2023to28 08 2023dabu choudharyNo ratings yet

- The Handmaid's TaleDocument40 pagesThe Handmaid's Taleleher shahNo ratings yet

- NA ReadingStrategies U5M11L03Document1 pageNA ReadingStrategies U5M11L03Lila AlwaerNo ratings yet

- Hand Winches 122 Load Sheaves 126 Gear-And Worm Gear Winches 127 Electric Worm Gear Winches 131 Snatch Blocks 133Document14 pagesHand Winches 122 Load Sheaves 126 Gear-And Worm Gear Winches 127 Electric Worm Gear Winches 131 Snatch Blocks 133Rajaram JayaramanNo ratings yet

- Teamcenter 10.1: Publication Number PLM00015 JDocument122 pagesTeamcenter 10.1: Publication Number PLM00015 JmohanNo ratings yet

- DIY Toolkit Arabic Web VersionDocument168 pagesDIY Toolkit Arabic Web VersionAyda AlshamsiNo ratings yet

- Debate Brochure PDFDocument2 pagesDebate Brochure PDFShehzada FarhaanNo ratings yet

- Mossbauer SpectrosDocument7 pagesMossbauer SpectroscyrimathewNo ratings yet

- MC4 CoCU 6 - Welding Records and Report DocumentationDocument8 pagesMC4 CoCU 6 - Welding Records and Report Documentationnizam1372100% (1)

- AIP 2020 FINAL JuneDocument5 pagesAIP 2020 FINAL JuneVINA ARIETANo ratings yet

- KM170, KM171, KM172, F3A21, F3A22: 3 SPEED FWD (Lock Up & Non Lock Up)Document4 pagesKM170, KM171, KM172, F3A21, F3A22: 3 SPEED FWD (Lock Up & Non Lock Up)krzysiek1975No ratings yet

- Pipe Freezing StudyDocument8 pagesPipe Freezing StudymirekwaznyNo ratings yet

- 1id Abstracts Season 2 Episode 6Document406 pages1id Abstracts Season 2 Episode 6Jennifer BrownNo ratings yet

- CH 1 Viscous Fluid Flow Part 1Document29 pagesCH 1 Viscous Fluid Flow Part 1Ammar WahabNo ratings yet

- Ferroelectric RamDocument20 pagesFerroelectric RamRijy LoranceNo ratings yet

- Charter of The New UrbanismDocument4 pagesCharter of The New UrbanismBarabas SandraNo ratings yet

- 00022443the Application of A Continuous Leak Detection System To Pipelines and Associated EquipmentDocument4 pages00022443the Application of A Continuous Leak Detection System To Pipelines and Associated EquipmentFaizal AbdullahNo ratings yet

- Matutum View Academy: (The School of Faith)Document14 pagesMatutum View Academy: (The School of Faith)Neil Trezley Sunico BalajadiaNo ratings yet

- Book Chapter 11 SubmissionDocument18 pagesBook Chapter 11 Submissioncristine_2006_g5590No ratings yet