Professional Documents

Culture Documents

Cost Accounting 1

Uploaded by

Rohan RalliOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Accounting 1

Uploaded by

Rohan RalliCopyright:

Available Formats

Q1.

(A) Prime cost- It refers to the total of direct costs and further includes cost of material which is

consumed for a product in a particular time frame.

(B) Factory overhead- It refers to the total cost incurred in operating a production facility of a

manufacturing business which can’t be traced directly to a product.

(C) Factory cost- In the prime cost if we add factory overheads we get the Total factory cost.

(D) Overhead- It refers to the business expenses not directly related to creating a product or service.

(E) Cost of sale- The selling and distribution cost required to be incurred in selling the available

units for sale.

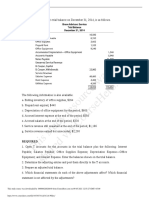

COST SHEET Rs.

Opening stock 2,82,000

ADD: Purchases 12,48,000

ADD: Freight inward 48,000

LESS: Closing stock 3,00,000

Raw material consumed 12,78,000

Direct wages 3,57,000

(A) Prime cost 16,35,000

(B) ADD: Factory overheads

Indirect wages 24000

Repairs to plan and machinery 63600

Rent, rates and taxes of factory 18000

Depreciation - plant and machinery 42600

Electricity charges 72000

Fuel 96000

Managers salary 20% 14400 330600

(C) Factory cost 19,65,600

(D) ADD: Overheads

Salary for admin sta 60000

Freight outward 30000

Rent, rates and taxes of o ce 9600

Travelling expenses 18,600

ff

ffi

COST SHEET Rs.

Salesman salaries 50,400

Depreciation furniture 3600

Directors fees 36000

General charges 37200

Managers salary 80% 57600 303000

(E) Cost of sale 22,68,600

Q2.

There are various methods of labour turnover ratio which are as follows :-

1. ADDITION RATE- According to this method the number of employees added during a

particular time frame are used to measure the labour turnover ratio. The formula for calculating

addition rate is -

LABOUR TURNOVER = (NUMBER OF ADDITIONS DURING THE PERIOD/ AVERAGE

NUMBER OF WORKERS DURING THE PERIOD) * 100

LABOUR TURNOVER = (560/4000) * 100 = 14%

2. SEPARATION RATE- According to this method the number of employees who quit during a

particular time frame are used to measure the labour turnover ratio. The formula for calculating

separation rate is -

LABOUR TURNOVER = (NUMBER OF SEPARATIONS DURING THE PERIOD/ AVERAGE

NUMBER OF WORKERS DURING THE PERIOD) * 100

LABOUR TURNOVER = (130/4000) * 100 = 3.25%

3. REPLACEMENT RATE- According to this method the number of workers replaced in a

particular time frame is taken into consideration for calculating labour turnover. The formula for

calculating replacement rate is -

LABOUR TURNOVER ON ACCOUNT OF REPLACEMENT = (NUMBER OF

REPLACEMENTS DURING THE PERIOD/AVERAGE NUMBER OF WORKERS DURING

THE PERIOD) * 100

LABOUR TURNOVER = (60/4000) * 100 = 1.5%

4. FLUX RATE- This method is slightly different from the other ones where the labour turnover is

calculated by considering the additions of workers during the period and also the separations during

the period. It is calculated through the following method -

FLUX RATE = {[(NUMBER OF NEW JOINING + NUMBER OF SEPARATIONS DURING THE

PERIOD)/2] / AVERAGE NUMBER OF WORKERS DURING THE PERIOD} * 100

Remember, the average number is taken as the simple average.

FLUX RATE = {[(560 + 130)/2] / 4000} * 100 = 8.625%

Q3.

(a) Absorption costing- It refers to an approach which considers the fixed and variable costs while

considering production cost.

PARTICULARS YEAR 1 YEAR 2

(A) SALES @ 3 PER UNIT 4500 5400

(B) COST OF GOODS SOLD

COST OF PRODUCTION:

VARIABLE MANUFACTURING COST 1050 750

FIXED MANUFACTURING COST 1050 1050

COST OF PRODUCTION 2100 1800

ADD: OPENING STOCK - 600

LESS: CLOSING STOCK 600 360

COST OF GOODS SOLD 1500 2040

(C) GROSS PROFIT (A) - (B) 3000 3360

(D) MARKETING AND ADMINISTRATIVE COST:

VARIABLE 1500 1800

FIXED 600 600

TOTAL 2100 2400

(E) PROFIT (C) - (D) 900 960

*Working notes:

Cost of manufacturing per unit = Total manufacturing cost / Total production

Year 1: Rs. 2100/ 2100 = Re. 1

Year 2: Rs. 1800/ 1500 = Rs. 1.2

Valuation of closing stock:

Year 1: 600 @ Re. 1 = 600

Year 2: 300 @ Rs. 1.2 = 360

[Closing stock of Year 1 becomes the opening stock of Year 2]

Fixed manufacturing overhead allocation rate:

Year 1: Rs. 1050 / 2100 = Rs. 0.50 per unit

Year 2: Rs. 1050 / 1800 = Rs. 0.58 per unit

(b)

Income statement (variable costing):

PARTICULARS YEAR 1 YEAR 2

SALES (A) 4500 5400

COST OF GOODS SOLD

COST OF PRODUCTION:

VARIABLE MANUFACTURING COST 1050 750

ADD: OPENING STOCK - 300

1050 1050

LESS: CLOSING STOCK 300 150

COST OF GOODS SOLD (B) 750 900

GROSS MARGINAL CONTRIBUTION (A) - (B) = (C) 3750 4500

LESS: FIXED MANUFACTURING COST 1050 1050

VARIABLE MARKETING AND ADMINISTRATION 1500 1800

FIXED MARKETING AND ADMINISTRATIVE COST 600 600

TOTAL (D) 3150 3450

PROFIT (C) - (D) 600 1050

Variable costing- It refers to the concept of recognising income based on variable production cost.

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Cost N Management AccountingDocument4 pagesCost N Management AccountingChoudharyPremNo ratings yet

- Mystic SportsDocument34 pagesMystic SportshelloNo ratings yet

- CA Work Sheet Unit 2Document23 pagesCA Work Sheet Unit 2Shalini SavioNo ratings yet

- Solution Cost and Management AccountingDocument7 pagesSolution Cost and Management AccountingbillNo ratings yet

- (Chap 26) MaDocument16 pages(Chap 26) MaDuong TrinhNo ratings yet

- Chapter 7, 8, 9: Answers Cost Accounting ACCT3395Document11 pagesChapter 7, 8, 9: Answers Cost Accounting ACCT3395Quynhu Smiley Nguyen50% (10)

- Soalan2 Quiz Chapter 3Document8 pagesSoalan2 Quiz Chapter 3biarrahsiaNo ratings yet

- MAC2601-SuggestedsolutionOct November2013Document12 pagesMAC2601-SuggestedsolutionOct November2013DINEO PRUDENCE NONGNo ratings yet

- Fima Week 2 ActivitiesDocument9 pagesFima Week 2 ActivitiesKatrina PaquizNo ratings yet

- Cost & Management AccountingDocument3 pagesCost & Management AccountingAnurag AwasthiNo ratings yet

- 5 Job CostingDocument22 pages5 Job CostingAbimanyu Shenil0% (1)

- Cma ProblemsDocument25 pagesCma ProblemsPridhvi Raj ReddyNo ratings yet

- 4variable vs. Absorption ExerciseDocument2 pages4variable vs. Absorption ExerciseBlesa May SaliliNo ratings yet

- WK 4 Solutions To Thread Practice ProblemsDocument3 pagesWK 4 Solutions To Thread Practice Problemsmasta4ulskilzNo ratings yet

- Unit-1 Cost Accounting and Cost Sheet Choose The Best AnswerDocument14 pagesUnit-1 Cost Accounting and Cost Sheet Choose The Best AnswerDhanu ShriNo ratings yet

- Marwa Year 1 Using Marginal Costing ApproachDocument6 pagesMarwa Year 1 Using Marginal Costing ApproachMak PussNo ratings yet

- Cost Accounting Assignment 2Document4 pagesCost Accounting Assignment 2leeroy mekiNo ratings yet

- COSMAN2 Final ExamDocument18 pagesCOSMAN2 Final ExamRIZLE SOGRADIELNo ratings yet

- UntitledDocument3 pagesUntitledVatsal ChangoiwalaNo ratings yet

- CostingDocument4 pagesCostingPaulNo ratings yet

- Chapter 4 Overhead ProblemsDocument5 pagesChapter 4 Overhead Problemsthiluvnddi100% (1)

- Cost Sheet AnswersDocument11 pagesCost Sheet AnswersDiptee ShettyNo ratings yet

- PROBLEM 2-45:: Particulars Case A Case B Case CDocument6 pagesPROBLEM 2-45:: Particulars Case A Case B Case CSrihari KumarNo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeHaidee Flavier SabidoNo ratings yet

- MTP 12 16 Answers 1696782053Document14 pagesMTP 12 16 Answers 1696782053harshallahotNo ratings yet

- Tutorial OverheadDocument6 pagesTutorial OverheadImran FarhanNo ratings yet

- A - Mock PSPM Set 1Document5 pagesA - Mock PSPM Set 1IZZAH NUR ATHIRAH BINTI AZLI MoeNo ratings yet

- Using The Equation Method:: Distribution Summary Particulars Ratios Production Dept. Service DeptDocument3 pagesUsing The Equation Method:: Distribution Summary Particulars Ratios Production Dept. Service DeptRomjan HusainNo ratings yet

- Manufacturing A LevelDocument21 pagesManufacturing A LevelSheraz AhmadNo ratings yet

- Unit 3 Part 1 - CostingDocument17 pagesUnit 3 Part 1 - CostingPrarthana R Industrial EngineeringNo ratings yet

- Fixed Overhead Incurred (REAL)Document5 pagesFixed Overhead Incurred (REAL)Anny ChainNo ratings yet

- MASDocument5 pagesMASMusic LastNo ratings yet

- These Overhead Are To Be Allocated and Apportioned To The Four Departements Using The Information BelowDocument13 pagesThese Overhead Are To Be Allocated and Apportioned To The Four Departements Using The Information BelowKos PaviliunNo ratings yet

- Manac3 Main Exam Memo June 2023Document9 pagesManac3 Main Exam Memo June 2023LuciaNo ratings yet

- 106 - Prajwal Khandare - ABM Case 2 (Pepe Denim)Document6 pages106 - Prajwal Khandare - ABM Case 2 (Pepe Denim)Prajwal KhandareNo ratings yet

- Quiz Absorption and Variable CostingDocument2 pagesQuiz Absorption and Variable CostingPISONANTA KRISETIANo ratings yet

- Chapter 5 MASDocument3 pagesChapter 5 MASDemie demsNo ratings yet

- 3 RTP Nov 21Document34 pages3 RTP Nov 21Bharath Krishna MVNo ratings yet

- Overheads PracticalDocument37 pagesOverheads PracticalSushant Maskey100% (1)

- 66088bos53351inter p3Document34 pages66088bos53351inter p3Asfarin ShaikhNo ratings yet

- Cost Accounting: 1/4/2010 10:55:09 AM Page 1 of 7Document7 pagesCost Accounting: 1/4/2010 10:55:09 AM Page 1 of 7meelas123No ratings yet

- MAS-03 WorksheetDocument32 pagesMAS-03 WorksheetPaupauNo ratings yet

- SS Process Ac Jun19 Dec16jun16Document8 pagesSS Process Ac Jun19 Dec16jun16anis izzatiNo ratings yet

- TYBCOM - Cost - OverheadsDocument8 pagesTYBCOM - Cost - Overheadsmkbooks4uNo ratings yet

- WorkDocument4 pagesWorkhassan KyendoNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- Cost and Management Accounting CIA 1.1Document5 pagesCost and Management Accounting CIA 1.1Kanika BothraNo ratings yet

- Management Accounting: Suggested Answers Final Examination (Transitional Scheme) - Summer 2017Document6 pagesManagement Accounting: Suggested Answers Final Examination (Transitional Scheme) - Summer 2017AbdulAzeemNo ratings yet

- ACMA Unit 6 Problems - Overheads PDFDocument4 pagesACMA Unit 6 Problems - Overheads PDFPrabhat SinghNo ratings yet

- Empire Enterprise Statament of Account For Profit and Loss As at 31 December 2015 RM RM RMDocument3 pagesEmpire Enterprise Statament of Account For Profit and Loss As at 31 December 2015 RM RM RMJasmin JimmyNo ratings yet

- Final AccountsDocument19 pagesFinal AccountsHammadNo ratings yet

- August Q1Document3 pagesAugust Q1tengku rilNo ratings yet

- Cost Accounting Group Assignment: BY Madhu Varshini Maheswari Mithun Monika Navin NeelaveniDocument15 pagesCost Accounting Group Assignment: BY Madhu Varshini Maheswari Mithun Monika Navin NeelaveniNaveen RecizNo ratings yet

- Key To Correction - Intermediate Accounting - Midterm - 2019-2020Document10 pagesKey To Correction - Intermediate Accounting - Midterm - 2019-2020Renalyn ParasNo ratings yet

- Accounts Case LetDocument7 pagesAccounts Case Letriya lakhotiaNo ratings yet

- Activity Based CostingDocument7 pagesActivity Based CostingCzar Ysmael RabayaNo ratings yet

- Suggested Answer - Syl12 - Dec2014 - Paper - 19 Final Examination: Suggested Answers To QuestionsDocument16 pagesSuggested Answer - Syl12 - Dec2014 - Paper - 19 Final Examination: Suggested Answers To QuestionsRanadeep ReddyNo ratings yet

- Costing Systems - Lessons ExamplesDocument15 pagesCosting Systems - Lessons ExamplesNicolasNo ratings yet

- Cost Sheet (M-I)Document17 pagesCost Sheet (M-I)Yolo GuyNo ratings yet

- Management Concepts Notes by - DR - Neha Mathur Ma AmDocument6 pagesManagement Concepts Notes by - DR - Neha Mathur Ma AmRohan RalliNo ratings yet

- Module 1Document40 pagesModule 1Rohan RalliNo ratings yet

- Organisational Theory 1Document7 pagesOrganisational Theory 1Rohan RalliNo ratings yet

- Project Management 1Document6 pagesProject Management 1Rohan RalliNo ratings yet

- Class 10 Science Notes Chapter 3 Studyguide360Document14 pagesClass 10 Science Notes Chapter 3 Studyguide360Rohan RalliNo ratings yet

- Class 10 Science Notes Chapter 4 Studyguide360Document17 pagesClass 10 Science Notes Chapter 4 Studyguide360Rohan RalliNo ratings yet

- Class 10 Science Notes Chapter 5 Studyguide360Document16 pagesClass 10 Science Notes Chapter 5 Studyguide360Rohan RalliNo ratings yet

- Paper 3Document2 pagesPaper 3Rohan RalliNo ratings yet

- Hunt Maloney 2022Document13 pagesHunt Maloney 2022Rohan RalliNo ratings yet

- Class 10 Science Notes Chapter 2 Studyguide360Document18 pagesClass 10 Science Notes Chapter 2 Studyguide360Rohan RalliNo ratings yet

- Class 10 Science Notes Chapter 1 Studyguide360Document13 pagesClass 10 Science Notes Chapter 1 Studyguide360Rohan RalliNo ratings yet

- Leaving The Academy A Participatory Open ResearchDocument4 pagesLeaving The Academy A Participatory Open ResearchRohan RalliNo ratings yet

- This Study Resource Was: RequiredDocument4 pagesThis Study Resource Was: RequiredRuelliyas xxNo ratings yet

- CS - GMN - 22 - Collateral Supply and Overnight RatesDocument49 pagesCS - GMN - 22 - Collateral Supply and Overnight Rateswmthomson50% (2)

- 09 Ratio AnalysisDocument16 pages09 Ratio AnalysisHimanshu VermaNo ratings yet

- Alembic Angel 020810Document12 pagesAlembic Angel 020810giridesh3No ratings yet

- 10 Years Treasury NoteDocument2 pages10 Years Treasury NoteGna OngNo ratings yet

- 1q 2022 Fish Fks+Multi+Agro+TbkDocument123 pages1q 2022 Fish Fks+Multi+Agro+TbkCaster XampakhNo ratings yet

- Pinegar: What Managers Think of Capital Structure PinegarDocument11 pagesPinegar: What Managers Think of Capital Structure PinegarMarilyn Woo100% (1)

- Trading For Everyone: Simple Skills For An Easy StartDocument51 pagesTrading For Everyone: Simple Skills For An Easy StartShelby Antonio50% (2)

- Finals With AnswersDocument6 pagesFinals With AnswersWilfred Diaz BumanlagNo ratings yet

- TECHNOR CaseDocument4 pagesTECHNOR CaseДенис ЗаславскийNo ratings yet

- 2020 Bandhan-Bank - Shareholding-Pattern PDFDocument7 pages2020 Bandhan-Bank - Shareholding-Pattern PDFVAIBHAV WADHWANo ratings yet

- Alpah-Moghuls The-Weekend-MBA-in-InvestingDocument12 pagesAlpah-Moghuls The-Weekend-MBA-in-InvestingShivaprasad PatilNo ratings yet

- CFRA S&P Morning Briefing 4.23.19Document8 pagesCFRA S&P Morning Briefing 4.23.19Abdullah18No ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- Proof of CashDocument27 pagesProof of CashSophia Ysabel DagohoyNo ratings yet

- Example: Newco Investment Recommendations by Ryland HamletDocument4 pagesExample: Newco Investment Recommendations by Ryland HamletRyland Hamlet100% (8)

- Quantifying The Private Company Discount: Multiples Approach and Acquisition ApproachDocument7 pagesQuantifying The Private Company Discount: Multiples Approach and Acquisition ApproachAlexVNo ratings yet

- IFRS 9 SummaryDocument13 pagesIFRS 9 SummaryCharles BarcelaNo ratings yet

- CONSIGNMENT ACCOUNT - Docx2Document8 pagesCONSIGNMENT ACCOUNT - Docx2Gamer nestNo ratings yet

- CFA 2 - Equity - Multiplo Valuation (2022)Document7 pagesCFA 2 - Equity - Multiplo Valuation (2022)RuthNo ratings yet

- Lecture 8 - Problem Solving For Engineering EconomyDocument2 pagesLecture 8 - Problem Solving For Engineering Economyangelo diazNo ratings yet

- ORI (Old Republic International Corporation) Statement of Changes in Beneficial Ownership of Securities (4) 2022-05-31Document2 pagesORI (Old Republic International Corporation) Statement of Changes in Beneficial Ownership of Securities (4) 2022-05-31Ki IphoneNo ratings yet

- Advanced Accounting ProblemsDocument4 pagesAdvanced Accounting ProblemsAjay Sharma0% (1)

- Bhavesh Work Sheet 01 - FDDocument8 pagesBhavesh Work Sheet 01 - FDBhavesh RathiNo ratings yet

- Complete Trading Journal For ShareDocument3 pagesComplete Trading Journal For ShareHaslina Mohd SallehNo ratings yet

- Depository SystemDocument4 pagesDepository SystemShubhanjaliNo ratings yet

- Lecture NotesDocument32 pagesLecture NotesRavinesh PrasadNo ratings yet

- Kotak International REIT FOF: India's First Global REIT Fund of FundDocument27 pagesKotak International REIT FOF: India's First Global REIT Fund of FundVinit ShahNo ratings yet

- Trading Manual PDFDocument24 pagesTrading Manual PDFmr12323No ratings yet

- Tilaknagar DRHP PDFDocument221 pagesTilaknagar DRHP PDFsusegaadNo ratings yet