Professional Documents

Culture Documents

Bonds Assignment 1

Uploaded by

thinkestan0 ratings0% found this document useful (0 votes)

6 views3 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesBonds Assignment 1

Uploaded by

thinkestanCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

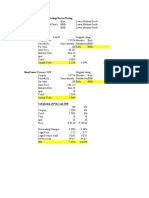

Type of

Company Years to Final Maturity Security Coupon S&P Rating

360 Communications 7 Senior Notes 6.55%

Ameritech Corp. 30 Debentures 6.55% AA+

ATT Corp. 3 Notes 5.13% AA

Century Telephone

Enterp. 5 Senior Notes 6.55% BBB+

GTE Corp. 3 Notes 6.39% AA

GTE Corp. 5 Debentures 9.10% AA

GTE Corp. 7 Debentures 6.36% A

GTE Corp. 30 Debentures 6.94% A

MCI Corp. 6 Senior Notes 7.50% BBB+

New England Telephone 3 Notes 8.63% AA

News America Holdings 2 Notes 7.45% BBB-

News America Holdings 5 Notes 8.63% BBB-

News America Holdings 7 Notes 8.50% BBB-

News America Holdings 30 Notes 7.75% BBB-

WorldCom 6 Senior Notes 7.55% BBB+

WorldCom 8 Senior Notes 7.75% BBB+

Moody Rating Face Value Price per $100 of FV Interest YTM

Baa1 100 103.7 6.55 5.89%

Aa3 100 99.25 6.55 6.61%

Aa3 100 98.5 5.125 5.68%

Baa1 100 101.74 6.55 6.14%

Baa1 100 100.68 6.39 6.13%

Baa1 100 111.85 9.1 6.27%

Baa1 100 99.75 6.36 6.41%

Baa1 100 100.56 6.94 6.90%

Baa2 100 105.88 7.5 6.29%

Aa2 100 107.25 8.63 5.92%

Baa3 100 102.45 7.45 6.11%

Baa3- 100 109.12 8.625 6.43%

Baa3 100 110.5 8.5 6.58%

Baa3 100 106.63 7.75 7.20%

Baa2 100 105.75 7.55 6.37%

Baa2 100 107.7 7.75 6.49%

Maturity NCP WCOM GTE

3 years

5 years

7 years

30 years

Maturity NCP WCOM GTE Treasury Yield

3 years 6.13% 5.52%

5 years 6.27% 5.56%

7 years 6.41% 5.56%

30 years 6.90% 5.70%

You might also like

- AssignmentsDocument11 pagesAssignmentsthinkestanNo ratings yet

- Group 6 - CalculationDocument5 pagesGroup 6 - CalculationDINKAR JAISWALNo ratings yet

- Worldcom AnalyisDocument16 pagesWorldcom Analyislouiegoods24No ratings yet

- XXX Case DataDocument4 pagesXXX Case DataVivek SinghNo ratings yet

- Astungkara CBR Selese KlengDocument43 pagesAstungkara CBR Selese Klengrefaalana4No ratings yet

- Bloomberg BondsDocument2 pagesBloomberg BondsVicky RajoraNo ratings yet

- Price R 1 6 1 100 2 8 2 100 3 9.5 3 100 4 10.5 4 100 5 11 5 100 Coupon (Annual, %) Maturity (Years) B (Discount Factor)Document11 pagesPrice R 1 6 1 100 2 8 2 100 3 9.5 3 100 4 10.5 4 100 5 11 5 100 Coupon (Annual, %) Maturity (Years) B (Discount Factor)Archit PateriaNo ratings yet

- Answers To Textbook Problems - Chapter 6Document1 pageAnswers To Textbook Problems - Chapter 6Ashutosh KumarNo ratings yet

- Capital Markets - 6/30/2008Document1 pageCapital Markets - 6/30/2008Russell KlusasNo ratings yet

- CapAlertPDF 072508Document1 pageCapAlertPDF 072508Russell KlusasNo ratings yet

- Capital Alert - 5/30/2008Document1 pageCapital Alert - 5/30/2008Russell KlusasNo ratings yet

- Capital Alert - 8/29/2008Document1 pageCapital Alert - 8/29/2008Russell KlusasNo ratings yet

- Capital Markets - 8/15/2008Document2 pagesCapital Markets - 8/15/2008Russell KlusasNo ratings yet

- Global Div Inv Grade Income Trust II-IndyMac 2005-AR14!3!31-10Document17 pagesGlobal Div Inv Grade Income Trust II-IndyMac 2005-AR14!3!31-10Barbara J. FordeNo ratings yet

- Estructura de Tasas - Renta FijaDocument13 pagesEstructura de Tasas - Renta FijaJulian Brescia2No ratings yet

- Capital Markets - 4/25/2008Document1 pageCapital Markets - 4/25/2008Russell KlusasNo ratings yet

- Progress Monitoring (Design, Supply & Execution) As at 30 - 04 - 2022Document45 pagesProgress Monitoring (Design, Supply & Execution) As at 30 - 04 - 2022Shaarim AJSNo ratings yet

- Phân Lo I ABC Theo Tiêu Chí Doanh Thu - Docx 2Document2 pagesPhân Lo I ABC Theo Tiêu Chí Doanh Thu - Docx 2Nguyen Thi Bich PhuongNo ratings yet

- Deposit RatesDocument3 pagesDeposit RatesAb CdNo ratings yet

- Capital Alert - 6/20/2008Document1 pageCapital Alert - 6/20/2008Russell KlusasNo ratings yet

- Capital Markets - 4/18/2008Document1 pageCapital Markets - 4/18/2008Russell KlusasNo ratings yet

- Capital Alert - 7/3/2008Document1 pageCapital Alert - 7/3/2008Russell KlusasNo ratings yet

- Pre Post Salam: StatisticsDocument4 pagesPre Post Salam: StatisticsdewiNo ratings yet

- Yield CurveDocument3 pagesYield CurveRochelle Anne OpinaldoNo ratings yet

- Month Average Market Month: BOG TBC BOGDocument4 pagesMonth Average Market Month: BOG TBC BOGNino NatradzeNo ratings yet

- Example Loan PricingDocument4 pagesExample Loan PricingNino NatradzeNo ratings yet

- Effective Annualized Rate of Return - Resident-NRO TD 1-09-2023Document1 pageEffective Annualized Rate of Return - Resident-NRO TD 1-09-2023Arun sharmaNo ratings yet

- Multi-Family Loan Programs $3 MillionDocument1 pageMulti-Family Loan Programs $3 MillionRussell KlusasNo ratings yet

- SexDocument6 pagesSexpiawsibolanjiaoNo ratings yet

- Tarifarios Mes de Enero 2021: Nominal Interest Rates DPF-ProposedDocument4 pagesTarifarios Mes de Enero 2021: Nominal Interest Rates DPF-ProposedGenesis CoronelNo ratings yet

- Capital Alert - 8/22/2008Document1 pageCapital Alert - 8/22/2008Russell KlusasNo ratings yet

- Calculating All-In Cost Over 5 Years: Principal Coupon Yrs 1-2 Coupon Yrs 3-5Document38 pagesCalculating All-In Cost Over 5 Years: Principal Coupon Yrs 1-2 Coupon Yrs 3-5OUSSAMA NASRNo ratings yet

- Profit Rates November 2021Document4 pagesProfit Rates November 2021Abubakar112No ratings yet

- Product Dashboard-21Document21 pagesProduct Dashboard-21Abhishek DubeyNo ratings yet

- Capital Alert 6/13/2008Document1 pageCapital Alert 6/13/2008Russell KlusasNo ratings yet

- Progress Monitoring (DesignSupply Execution) As at 31 - 05 - 2022Document27 pagesProgress Monitoring (DesignSupply Execution) As at 31 - 05 - 2022Shaarim AJSNo ratings yet

- Dividend Yield Stocks - HDFC Sec - 26 09 09Document1 pageDividend Yield Stocks - HDFC Sec - 26 09 09vishalknoxNo ratings yet

- Financial Modeling Mid-Term ExamDocument17 pagesFinancial Modeling Mid-Term ExamКамиль БайбуринNo ratings yet

- NNFE EconomyDocument5 pagesNNFE EconomyMatt HunterNo ratings yet

- NBP PLS Plus Term Deposit Certificates PDFDocument1 pageNBP PLS Plus Term Deposit Certificates PDFdoctorirfanNo ratings yet

- County MA RateDocument2 pagesCounty MA RateTheCullmanTribuneNo ratings yet

- How To Pricing LoansDocument2 pagesHow To Pricing LoansMatNo ratings yet

- Soil and Rock InvestigationDocument8 pagesSoil and Rock Investigationadama lasanaNo ratings yet

- Comisiones Multiproductos.Document3 pagesComisiones Multiproductos.larry.01.laysNo ratings yet

- GB3 SheetDocument3 pagesGB3 SheetjarodsoonNo ratings yet

- Sigma Tabla Menos 100 DPMODocument5 pagesSigma Tabla Menos 100 DPMOgheoda8926No ratings yet

- Nps Scheme - G (Tier-I) : 7.22% NA NA NADocument1 pageNps Scheme - G (Tier-I) : 7.22% NA NA NAKolluri VenkataraoNo ratings yet

- Capital Alert - 7/12/2008Document1 pageCapital Alert - 7/12/2008Russell KlusasNo ratings yet

- Manila, Kervin E. 4 Ce - C Borja, Christopher Class Interval CB CM F CF %RF F (X - Class IntervalDocument2 pagesManila, Kervin E. 4 Ce - C Borja, Christopher Class Interval CB CM F CF %RF F (X - Class Intervalkervin manilaNo ratings yet

- 1°A 1°B 2°A 2°B 3°A 3°B: Grupos 1 Bim 2 Bim 3 BimDocument3 pages1°A 1°B 2°A 2°B 3°A 3°B: Grupos 1 Bim 2 Bim 3 BimDennis PerezNo ratings yet

- Appendix 1. Statistical ResultsDocument17 pagesAppendix 1. Statistical ResultsMark Nel VenusNo ratings yet

- Interest Rates On FDR: Monthly Benefit PlanDocument2 pagesInterest Rates On FDR: Monthly Benefit Planmushfik arafatNo ratings yet

- Equit Alpha Bofa 1julDocument12 pagesEquit Alpha Bofa 1julgerrich rusNo ratings yet

- Exercises w4Document4 pagesExercises w4hqfNo ratings yet

- Hand Rankings List: AA KK QQ JJ Q A5 A K J8Document8 pagesHand Rankings List: AA KK QQ JJ Q A5 A K J8jedaias91No ratings yet

- Hand Rankings List: AA KK QQ JJ Q A5 A K J8Document8 pagesHand Rankings List: AA KK QQ JJ Q A5 A K J8JuanNo ratings yet

- Penilaian KPI Mantri Kurasi - Juni 2022..Document196 pagesPenilaian KPI Mantri Kurasi - Juni 2022..Dwi JayantiNo ratings yet

- Historical Profit Rates 2020Document5 pagesHistorical Profit Rates 2020Hassan RaXaNo ratings yet

- Amulya Dairy MCC Sikar Rate Chart W.E.F 21.08.2022Document1 pageAmulya Dairy MCC Sikar Rate Chart W.E.F 21.08.2022Dinesh BagariaNo ratings yet

- P23180 - Bariya Piyush RohitbhaiDocument3 pagesP23180 - Bariya Piyush RohitbhaithinkestanNo ratings yet

- FormDocument2 pagesFormthinkestanNo ratings yet

- MergedDocument229 pagesMergedthinkestanNo ratings yet

- P23253 - Sapna Shivdas Case Study 4Document6 pagesP23253 - Sapna Shivdas Case Study 4thinkestanNo ratings yet

- Dream 11Document7 pagesDream 11thinkestanNo ratings yet

- Amazon India Sales DataDocument76 pagesAmazon India Sales DatathinkestanNo ratings yet

- Chapter 13Document2 pagesChapter 13thinkestanNo ratings yet

- Ba - Lec 10 - SolverDocument11 pagesBa - Lec 10 - SolverthinkestanNo ratings yet

- 2043 Manish Jain Manish Jain P23105 25033 838424877Document3 pages2043 Manish Jain Manish Jain P23105 25033 838424877thinkestanNo ratings yet

- P23244 OAD Jaipur Rugs Pritam Ghosh AdhikariDocument3 pagesP23244 OAD Jaipur Rugs Pritam Ghosh AdhikarithinkestanNo ratings yet

- Capital Budgeting at Agrico IncDocument1 pageCapital Budgeting at Agrico IncthinkestanNo ratings yet

- Group 4 OAD Interim ReportDocument7 pagesGroup 4 OAD Interim ReportthinkestanNo ratings yet

- Student Performance RegressionDocument4 pagesStudent Performance RegressionthinkestanNo ratings yet

- Dream 11Document7 pagesDream 11thinkestanNo ratings yet

- Call Centre SchedulingDocument1 pageCall Centre SchedulingthinkestanNo ratings yet

- Group 4 OAD Interim ReportDocument7 pagesGroup 4 OAD Interim ReportthinkestanNo ratings yet

- Cash Flow Estimation Class ExcerciseDocument5 pagesCash Flow Estimation Class ExcercisethinkestanNo ratings yet

- 1.reasons For VariationsDocument2 pages1.reasons For Variationsscribd99190No ratings yet

- Prestressed ConcreteDocument9 pagesPrestressed ConcreteDiploma - CE Dept.No ratings yet

- ASTM A586-04aDocument6 pagesASTM A586-04aNadhiraNo ratings yet

- NGOs in Satkhira PresentationDocument17 pagesNGOs in Satkhira PresentationRubayet KhundokerNo ratings yet

- About UPSC Civil Service Examination Schedule and Subject ListDocument4 pagesAbout UPSC Civil Service Examination Schedule and Subject Listjaythakar8887No ratings yet

- Document 20Document3 pagesDocument 20api-586815209No ratings yet

- BBI2002 SCL 7 WEEK 8 AdamDocument3 pagesBBI2002 SCL 7 WEEK 8 AdamAMIRUL RIDZLAN BIN RUSIHAN / UPMNo ratings yet

- ShinojDocument4 pagesShinojArish BallanaNo ratings yet

- Chinaware - Zen PDFDocument111 pagesChinaware - Zen PDFMixo LogiNo ratings yet

- One Way Slab DesignDocument10 pagesOne Way Slab DesignBijendra PradhanNo ratings yet

- 3.2.3 Practice - Taking The PSAT (Practice)Document5 pages3.2.3 Practice - Taking The PSAT (Practice)wrighemm200No ratings yet

- AFAR Problems PrelimDocument11 pagesAFAR Problems PrelimLian Garl100% (8)

- Risk in Poject FinanceDocument20 pagesRisk in Poject FinanceShahid KhanNo ratings yet

- TIP - IPBT M - E For MentorsDocument3 pagesTIP - IPBT M - E For Mentorsallan galdianoNo ratings yet

- South West Mining LTD - Combined CFO & HWA - VerDocument8 pagesSouth West Mining LTD - Combined CFO & HWA - Verapi-3809359No ratings yet

- 3UF70121AU000 Datasheet enDocument7 pages3UF70121AU000 Datasheet enJuan Perez PerezNo ratings yet

- Engineering Materials-Istanbul .Technical UniversityDocument40 pagesEngineering Materials-Istanbul .Technical UniversitybuggrraaNo ratings yet

- Cap. 1Document34 pagesCap. 1Paola Medina GarnicaNo ratings yet

- Ibt - Module 2 International Trade - Theories Are: Classical and Are From The PerspectiveDocument9 pagesIbt - Module 2 International Trade - Theories Are: Classical and Are From The PerspectiveLyca NegrosNo ratings yet

- Telstra InterviewsDocument3 pagesTelstra InterviewsDaxShenNo ratings yet

- Reterta V MoresDocument13 pagesReterta V MoresRam Migue SaintNo ratings yet

- Galanz - Galaxy 7-9-12K - SPLIT PDFDocument42 pagesGalanz - Galaxy 7-9-12K - SPLIT PDFUbaldo BritoNo ratings yet

- Enabling Trade Report 2013, World Trade ForumDocument52 pagesEnabling Trade Report 2013, World Trade ForumNancy Islam100% (1)

- Template For Homework6Document2 pagesTemplate For Homework6Никола СтефановићNo ratings yet

- Pavement Design - (Rigid Flexible) DPWHDocument25 pagesPavement Design - (Rigid Flexible) DPWHrekcah ehtNo ratings yet

- 25 - Marketing Channels - Value Networks.Document2 pages25 - Marketing Channels - Value Networks.zakavision100% (1)

- History of Phosphoric Acid Technology (Evolution and Future Perspectives)Document7 pagesHistory of Phosphoric Acid Technology (Evolution and Future Perspectives)Fajar Zona67% (3)

- CDCS Self-Study Guide 2011Document21 pagesCDCS Self-Study Guide 2011armamut100% (2)

- Saarthi Education Jija Mata Colony, Near Paithan Gate A Bad. Cont: 8694947070 / 5050Document8 pagesSaarthi Education Jija Mata Colony, Near Paithan Gate A Bad. Cont: 8694947070 / 5050Roshan KumarNo ratings yet

- God Save The Queen Score PDFDocument3 pagesGod Save The Queen Score PDFDarion0% (2)