Professional Documents

Culture Documents

Capital Markets - 4/18/2008

Uploaded by

Russell KlusasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Markets - 4/18/2008

Uploaded by

Russell KlusasCopyright:

Available Formats

04/18/2008

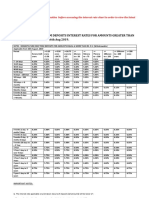

Multi-Family Loan Programs > $3 Million

Agency Lenders Portfolio Lenders*

Term Leverage Max. Interest Rates Leverage Max. Interest Rates

5 Yr. 80% 5.83% to 5.98% 75% 5.65% to 6.15%

7 Yr. 80% 5.90% to 6.05% 75% 6.25% to 6.75%

10 Yr. 80% 6.09% to 6.33% 75% 6.25% to 6.75%

15 Yr. 80% 6.54% to 6.74% 75% 6.50% to 7.00%

*Rates based on Act/360

Multi-Family Loan Programs < $3 Million

Fixed Rate Agency Lenders Portfolio Lenders*

Term Leverage Max. Interest Rates Leverage Max. Interest Rates

3 Yr. 80% 5.25% to 5.68% 75% 5.50% to 6.00%

5 Yr. 80% 5.60% to 5.98% 75% 5.65% to 6.15%

7 Yr. 80% 5.72% to 6.02% 75% 6.25% to 6.75%

10 Yr. 80% 5.96% to 6.26% 75% 6.25% to 6.75%

15 Yr. 80% 6.53 to 7.42% 75% 6.50% to 7.00%

*Rates based on Act/360

Commercial Loan Programs

Fixed Rate Portfolio Lenders* Index Rate as of 4/18/2008

Variable Rates Fixed Rates

Term Leverage Max. Interest Rates

11th District Cofi: 5.87% 1 Year Treasury (TCM) 2.31%

5 Yr. 75% 5.65% to 6.15%

12 MAT: 3.794% 3 Year Treasury: 2.90%

7 Yr. 75% 6.25% to 6.75%

1 Month LIBOR: 2.87% 5 Year Treasury: 3.75%

10 Yr. 75% 6.25% to 6.75%

3 Month LIBOR: 2.91% 10 Year Treasury: 3.82%

15 Yr. 75% 6.50% to 7.00%

6 Month LIBOR: 3.02% Bank of America Prime: 5.25%

Bridge Floating Leverage Max. Spread Over Libor

Stabilized 75% 225 to 300

Re-Position 90% 275 to 350

(*Proprietary Lenders include Banks, Life Insurance Companies and Credit Unions)

Economic Commentary

4-18-08 Interest rates increased across the board 30 – 50 basis

points this week as investors moved away from government debt in

response to positive news in the capital markets sector as Citigroup

beat its revenue forecast. Swaps declined slightly though not enough

to counter the rise in Treasury yields. Speculation increased that the

Fed will cut its benchmark rate at its next session on April 30.

However, the emergence of long-term inflationary concerns will likely

push interest rates up further. Commercial banks continue to tighten

their underwriting standards with limited availability of non-recourse

debt and leverage of 65 – 70 percent typical.

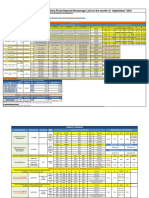

Recent Transactions

Branford Industrial Broadway Plaza 83 Melrose Avenue Checker Auto

Industrial Retail 11-Unit Apartment Single Tenant

Los Angeles, CA Tempe, AZ Pasadena, CA Aurora, CO

$15,600,000 $3,000,000 $2,000,000 $1,890,000

5.56% Interest Rate 5.83% Interest Rate 5.54% Interest Rate 5.25% Interest Rate

Fixed 10-yr Term/30-yr Amortization 15-yr Term/30-yr Amortization 10-yr Term/30-yr Amortization

For more information, contact:

William E. Hughes

Senior Vice President/Managing Director

Newport Beach, CA

Office: (949) 851-3030

whughes@marcusmillichap.com

You might also like

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- Capital Markets - 4/25/2008Document1 pageCapital Markets - 4/25/2008Russell KlusasNo ratings yet

- Multi-Family Loan Programs $3 MillionDocument1 pageMulti-Family Loan Programs $3 MillionRussell KlusasNo ratings yet

- Capital Alert - 5/30/2008Document1 pageCapital Alert - 5/30/2008Russell KlusasNo ratings yet

- Capital Alert - 8/29/2008Document1 pageCapital Alert - 8/29/2008Russell KlusasNo ratings yet

- Capital Markets - 6/30/2008Document1 pageCapital Markets - 6/30/2008Russell KlusasNo ratings yet

- CapAlertPDF 072508Document1 pageCapAlertPDF 072508Russell KlusasNo ratings yet

- Capital Markets - 8/15/2008Document2 pagesCapital Markets - 8/15/2008Russell KlusasNo ratings yet

- Capital Alert - 7/3/2008Document1 pageCapital Alert - 7/3/2008Russell KlusasNo ratings yet

- Capital Alert 6/13/2008Document1 pageCapital Alert 6/13/2008Russell KlusasNo ratings yet

- Capital Markets - 5/16/2008Document1 pageCapital Markets - 5/16/2008Russell KlusasNo ratings yet

- Capital Alert - 7/12/2008Document1 pageCapital Alert - 7/12/2008Russell KlusasNo ratings yet

- Capital Alert - 6/20/2008Document1 pageCapital Alert - 6/20/2008Russell KlusasNo ratings yet

- Capital Alert - 8/22/2008Document1 pageCapital Alert - 8/22/2008Russell KlusasNo ratings yet

- Capital Alert - 2/1/2008Document1 pageCapital Alert - 2/1/2008Russell KlusasNo ratings yet

- Capital Markets - 3/07/2008Document1 pageCapital Markets - 3/07/2008Russell KlusasNo ratings yet

- Website Disclosure Effective 05 Apr 2024Document4 pagesWebsite Disclosure Effective 05 Apr 2024Ab CdNo ratings yet

- Capital Markets - 2/29/2008Document1 pageCapital Markets - 2/29/2008Russell KlusasNo ratings yet

- Capital Markets - 3/14/2008Document2 pagesCapital Markets - 3/14/2008Russell KlusasNo ratings yet

- Bank A: Housing Loan Property Equity LoanDocument6 pagesBank A: Housing Loan Property Equity LoanRaesa BadelNo ratings yet

- Capital Markets - 4/11/2008Document1 pageCapital Markets - 4/11/2008Russell KlusasNo ratings yet

- Cho RM 73 2020-21Document1 pageCho RM 73 2020-21Steve WozniakNo ratings yet

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Document3 pagesAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakNo ratings yet

- Bank A: Housing Loan Property Equity LoanDocument5 pagesBank A: Housing Loan Property Equity LoanRaesa BadelNo ratings yet

- Website Disclosure Effective 02nd May 2023Document3 pagesWebsite Disclosure Effective 02nd May 2023Prathamesh PatikNo ratings yet

- Interest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankDocument1 pageInterest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankSusovan DasNo ratings yet

- Tel No: 022-4215 9068Document3 pagesTel No: 022-4215 9068mamatha niranjanNo ratings yet

- Website Disclosure Effective 03 Feb 2024Document3 pagesWebsite Disclosure Effective 03 Feb 2024abhishek sharmaNo ratings yet

- Website Disclosure EffectiveDocument3 pagesWebsite Disclosure EffectiveHimanshu MilanNo ratings yet

- Interest Rates On FDR: Monthly Benefit PlanDocument2 pagesInterest Rates On FDR: Monthly Benefit Planmushfik arafatNo ratings yet

- HDFC RatesDocument4 pagesHDFC RatesdesikanttNo ratings yet

- IIFL Associate FD List September'2021Document4 pagesIIFL Associate FD List September'2021BHARAT SNo ratings yet

- HDFC Deposit FormDocument4 pagesHDFC Deposit FormnaguficoNo ratings yet

- Website Disclosure Effective 30 Nov 2023Document3 pagesWebsite Disclosure Effective 30 Nov 2023bggbggNo ratings yet

- BankingDocument4 pagesBankingBhavin GhoniyaNo ratings yet

- Rates of Return On PLSDeposits OtherDepositsDocument2 pagesRates of Return On PLSDeposits OtherDepositsranamkhan553No ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssaurav katarukaNo ratings yet

- Term Deposit Rate Sheet: ShajarDocument1 pageTerm Deposit Rate Sheet: ShajarchqaiserNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssasi 'sNo ratings yet

- Yes Bank Interest ChargesDocument3 pagesYes Bank Interest ChargessaiaviNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsD SunilNo ratings yet

- Interest Rate RetailDocument6 pagesInterest Rate RetailRavie S DhamaNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsV NaveenNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsY_AZNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsspshekarNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsIndranil Roy ChoudhuriNo ratings yet

- Interest Rates On Domestic Fixed Deposit and Recurring DepositDocument1 pageInterest Rates On Domestic Fixed Deposit and Recurring DepositMuditNo ratings yet

- Week 2 Practice Questions SolutionDocument8 pagesWeek 2 Practice Questions SolutionCaroline FrisciliaNo ratings yet

- Yes Bank FD Rates - 5.6.21Document1 pageYes Bank FD Rates - 5.6.21Chandan SahaNo ratings yet

- Project FşnanceDocument2 pagesProject FşnanceAhmet ErNo ratings yet

- FD Leaflet - A5 - 13 Dec 23Document2 pagesFD Leaflet - A5 - 13 Dec 23Shaily SinhaNo ratings yet

- Slabs Profit Rate: Deposit and Prematurity RatesDocument1 pageSlabs Profit Rate: Deposit and Prematurity RatesJay KhanNo ratings yet

- Loan RatesDocument1 pageLoan RatesAndrew ChambersNo ratings yet

- Group Members:: Comparison Between Bank AL Habib & Habib Metro BankDocument13 pagesGroup Members:: Comparison Between Bank AL Habib & Habib Metro BankAbbas AliNo ratings yet

- Revision of Interest Rate On Fixed Deposit Wef February 28 2019Document1 pageRevision of Interest Rate On Fixed Deposit Wef February 28 2019sg06No ratings yet

- Interest Rate RetailDocument6 pagesInterest Rate RetailYashaswi SharmaNo ratings yet

- Yield CurveDocument3 pagesYield CurveRochelle Anne OpinaldoNo ratings yet

- Rates Declaration LCY FCY From Jul Dec16 6Document1 pageRates Declaration LCY FCY From Jul Dec16 6M Abbas JadoonNo ratings yet

- Excel FormatDocument38 pagesExcel FormatSaad QureshiNo ratings yet

- Interest Rates On Domestic Fixed Deposits and Recurring DepositsDocument1 pageInterest Rates On Domestic Fixed Deposits and Recurring Depositsavnish singhNo ratings yet

- Capital Markets - 8/15/2008Document2 pagesCapital Markets - 8/15/2008Russell KlusasNo ratings yet

- Milwaukee - Office - 8/7/08Document4 pagesMilwaukee - Office - 8/7/08Russell KlusasNo ratings yet

- Capital Alert - 8/22/2008Document1 pageCapital Alert - 8/22/2008Russell KlusasNo ratings yet

- CapAlertPDF 072508Document1 pageCapAlertPDF 072508Russell KlusasNo ratings yet

- Chicago - Industrial - 1/1/2008Document1 pageChicago - Industrial - 1/1/2008Russell KlusasNo ratings yet

- Capital Alert - 7/12/2008Document1 pageCapital Alert - 7/12/2008Russell KlusasNo ratings yet

- Milwaukee - South Milwaukee County Submarket - Retail - 10/1/2007Document2 pagesMilwaukee - South Milwaukee County Submarket - Retail - 10/1/2007Russell KlusasNo ratings yet

- Chicago - Southwest Submarket - Retail - 1/1/2008Document2 pagesChicago - Southwest Submarket - Retail - 1/1/2008Russell KlusasNo ratings yet

- DesMoines Submarket - Retail - 10/1/2007Document2 pagesDesMoines Submarket - Retail - 10/1/2007Russell KlusasNo ratings yet

- Milwaukee - Retail Construction - 4/1/2008Document3 pagesMilwaukee - Retail Construction - 4/1/2008Russell Klusas100% (1)

- Milwaukee - Retail - 4/1/2008Document4 pagesMilwaukee - Retail - 4/1/2008Russell KlusasNo ratings yet

- Chicago - South Submarket - Retail - 7/1/2007Document2 pagesChicago - South Submarket - Retail - 7/1/2007Russell KlusasNo ratings yet

- Indianapolis - Retail - 4/1/2008Document4 pagesIndianapolis - Retail - 4/1/2008Russell Klusas100% (1)

- Chicago - Retail - 4/1/2008Document4 pagesChicago - Retail - 4/1/2008Russell KlusasNo ratings yet

- Chicago - Near West Submarket - Retail - 7/1/2007Document2 pagesChicago - Near West Submarket - Retail - 7/1/2007Russell KlusasNo ratings yet

- Indianapolis - Apartment - Construction - 4/1/2008Document3 pagesIndianapolis - Apartment - Construction - 4/1/2008Russell Klusas100% (1)

- Evansville - Apartment - 1/1/2008Document2 pagesEvansville - Apartment - 1/1/2008Russell KlusasNo ratings yet

- Debt Consolidation TipsDocument6 pagesDebt Consolidation TipsKrittiNo ratings yet

- Full and Final Settlement Letter TemplateDocument1 pageFull and Final Settlement Letter TemplateSD100% (1)

- Art 2058Document3 pagesArt 2058Ellaine Pearl AlmillaNo ratings yet

- Insolvency & Bankruptcy Code, 2016Document23 pagesInsolvency & Bankruptcy Code, 2016Jeswin JohnNo ratings yet

- PDF DocumentDocument9 pagesPDF DocumentnahidahcomNo ratings yet

- Quantum REDocument32 pagesQuantum REBenjaminRavaruNo ratings yet

- Great Article About TILA and RescissionDocument63 pagesGreat Article About TILA and Rescissionllynn517100% (1)

- Financial Distress Process Federal Bankruptcy Law Reorganization LiquidationDocument31 pagesFinancial Distress Process Federal Bankruptcy Law Reorganization LiquidationsidhanthaNo ratings yet

- Contract For Credit Restoration ServDocument8 pagesContract For Credit Restoration Servanon-716426100% (3)

- Asia Amalgamated Holdings Corporation Financials - RobotDoughDocument6 pagesAsia Amalgamated Holdings Corporation Financials - RobotDoughKeith LameraNo ratings yet

- Lecture Credit and Collection Chapter 1Document7 pagesLecture Credit and Collection Chapter 1Celso I. MendozaNo ratings yet

- Microsoft Excel Sheet For Calculating EMI (Equated Monthly Installment) (TYPE 1)Document31 pagesMicrosoft Excel Sheet For Calculating EMI (Equated Monthly Installment) (TYPE 1)Vikas Acharya100% (1)

- The Third World Crisis System of Public Debt Management in The PhilippinesDocument22 pagesThe Third World Crisis System of Public Debt Management in The PhilippinesKenneth Delos SantosNo ratings yet

- Chapter 5 CGTMSEDocument17 pagesChapter 5 CGTMSEMikeNo ratings yet

- Ys%, XLD M Dka S%L Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaDocument5 pagesYs%, XLD M Dka S%L Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaKajarathan SubramaniamNo ratings yet

- IPSAS 14 - Events After The Reporting PeriodDocument12 pagesIPSAS 14 - Events After The Reporting PeriodAida MohammedNo ratings yet

- (Duff & Phelps Credit Rating Co) DCR's Criteria For Rating Cash Flow CDOsDocument16 pages(Duff & Phelps Credit Rating Co) DCR's Criteria For Rating Cash Flow CDOsanuragNo ratings yet

- Mortgage Under Transfer of Property Act 1882Document3 pagesMortgage Under Transfer of Property Act 188218212 NEELESH CHANDRANo ratings yet

- Ong V Roban Lending CorporationDocument2 pagesOng V Roban Lending CorporationEM RGNo ratings yet

- Chapter Four Lecture Notes On Business MathematicsDocument24 pagesChapter Four Lecture Notes On Business MathematicsErmias Guragaw100% (3)

- Mortgage Letter 2010-14Document3 pagesMortgage Letter 2010-14YuriNo ratings yet

- ExercisesDocument16 pagesExercisesyenNo ratings yet

- Penyelesaian Wanprestasi Dalam Perjanjian Pinjam Meminjam UangDocument4 pagesPenyelesaian Wanprestasi Dalam Perjanjian Pinjam Meminjam UangBrayen KorneliusNo ratings yet

- ProvisionDocument6 pagesProvisionsayedrushdiNo ratings yet

- Chart of AccountDocument24 pagesChart of AccountHenok Teka DestaNo ratings yet

- HW - Case 8-2 Pp. 240-241Document4 pagesHW - Case 8-2 Pp. 240-241rajo_onglaoNo ratings yet

- Siochi Fishery Inc. V BPIDocument2 pagesSiochi Fishery Inc. V BPIapbuera50% (2)

- 2023 Week 4Document36 pages2023 Week 4Joshua OnckerNo ratings yet

- Factoring of Accounts ReceivableDocument2 pagesFactoring of Accounts ReceivableCloudKielGuiangNo ratings yet

- IBC PPT (Objectives and Grounds)Document3 pagesIBC PPT (Objectives and Grounds)Ameya Gawhane100% (1)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseFrom EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseNo ratings yet

- Legal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersFrom EverandLegal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersRating: 5 out of 5 stars5/5 (1)

- How to Win Your Case In Traffic Court Without a LawyerFrom EverandHow to Win Your Case In Traffic Court Without a LawyerRating: 4 out of 5 stars4/5 (5)

- Contract Law for Serious Entrepreneurs: Know What the Attorneys KnowFrom EverandContract Law for Serious Entrepreneurs: Know What the Attorneys KnowRating: 1 out of 5 stars1/5 (1)

- The Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterFrom EverandThe Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterNo ratings yet

- Legal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreFrom EverandLegal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreRating: 3.5 out of 5 stars3.5/5 (2)

- Law of Contract Made Simple for LaymenFrom EverandLaw of Contract Made Simple for LaymenRating: 4.5 out of 5 stars4.5/5 (9)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- Digital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetFrom EverandDigital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetNo ratings yet

- How to Win Your Case in Small Claims Court Without a LawyerFrom EverandHow to Win Your Case in Small Claims Court Without a LawyerRating: 5 out of 5 stars5/5 (1)

- Contracts: The Essential Business Desk ReferenceFrom EverandContracts: The Essential Business Desk ReferenceRating: 4 out of 5 stars4/5 (15)

- What Are You Laughing At?: How to Write Humor for Screenplays, Stories, and MoreFrom EverandWhat Are You Laughing At?: How to Write Humor for Screenplays, Stories, and MoreRating: 4 out of 5 stars4/5 (2)

- The Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityFrom EverandThe Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityNo ratings yet