Professional Documents

Culture Documents

Website Disclosure Effective

Uploaded by

Himanshu Milan0 ratings0% found this document useful (0 votes)

13 views3 pagesThe document outlines interest rates for various deposit products offered by Unity Small Finance Bank, including fixed deposits, savings accounts, and bulk deposits. It provides interest rates for different deposit tenures ranging from 7 days to over 10 years for retail and corporate customers. Key details like premature withdrawal terms, eligibility criteria and conditions are also specified. The rates are effective from November 2022 and subject to change without prior notice.

Original Description:

Jjghhju

Original Title

Website_disclosure_Effective_

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines interest rates for various deposit products offered by Unity Small Finance Bank, including fixed deposits, savings accounts, and bulk deposits. It provides interest rates for different deposit tenures ranging from 7 days to over 10 years for retail and corporate customers. Key details like premature withdrawal terms, eligibility criteria and conditions are also specified. The rates are effective from November 2022 and subject to change without prior notice.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views3 pagesWebsite Disclosure Effective

Uploaded by

Himanshu MilanThe document outlines interest rates for various deposit products offered by Unity Small Finance Bank, including fixed deposits, savings accounts, and bulk deposits. It provides interest rates for different deposit tenures ranging from 7 days to over 10 years for retail and corporate customers. Key details like premature withdrawal terms, eligibility criteria and conditions are also specified. The rates are effective from November 2022 and subject to change without prior notice.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

A.

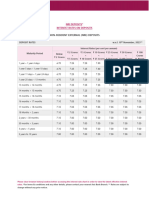

FIXED DEPOSIT RATE: Retail Investors

The deposit interest rate stands revised from 21st November, 2022 as follows:

General FD Rates Senior Citizen FD Rates

Tenure

% p.a. % p.a.

7-14 Days 4.50% 4.50%

15-45 Days 4.75% 4.75%

46-60 Days 5.25% 5.75%

61-90 Days 5.50% 6.00%

91-180 Days 5.75% 6.25%

181 Days 8.50% 9.00%

182 Days – 364 Days 6.75% 7.25%

365 Days(1 Year) 7.35% 7.85%

1Year 1 day 7.35% 7.85%

>1Year 1 day - 500 days 7.35% 7.85%

501 Days 8.50% 9.00%

502 Days - 18 M 7.35% 7.85%

>18 M -2 Year 7.40% 7.90%

>2 Year -3 Year 7.65% 8.15%

>3 Year – 5Year 7.65% 8.15%

>5 Year – 10 Year 7.00% 7.50%

Note:

1. For terms & conditions and any other detail, please contact Unity SFB branch officials.

2. Interest rates are subject to change without prior notice.

3. For premature withdrawal of fixed deposit, interest rate payable would be corresponding FD

rate minus 1.00% for the tenor for which the deposit has actually run.

B. SAVING DEPOSIT RATE : Retail Investors

The Saving deposit interest rate stands revised from January 22, 2022 as follows

Tenure Rates (%)

Upto 1 lakh 6.00%

>1 lakh-5 lakh

>5 lakh -50 lakh

7.00%

>50 lakh – 10 cr.

>10 cr.

Unity Small Finance Bank Limited (CIN: U65990DL2021PLC385568)

Registered Office: 40, Basant Lok, Vasant Vihar, New Delhi – 110 057. Tel No: 011- 4741 4100

Corporate Office: Centrum House, CST Road, Vidyanagari Marg, Kalina, Santacruz (E), Mumbai – 400 098.

Tel No: 022- 4215 9068

C. CALLABLE BULK DEPOSIT RATES (%.p.a.) : w.e.f 15th November, 2022

>=Rs 2 crs Rs 5 crs to Rs 50 crs to Rs 100 crs

Rs 10 crs to < Rs 25 crs to

Tenure to < Rs 5 < Rs 10 < Rs 100 and

Rs 25 crs < Rs 50 crs

crs crs crs Above

7-14 Days 5.00% 5.00% 5.00% 5.00% 5.00% 5.00%

15-45 Days 5.10% 5.10% 5.10% 5.10% 5.10% 5.10%

46-60 Days 5.30% 5.30% 5.30% 5.30% 5.30% 5.30%

61-90 Days 5.70% 5.70% 5.70% 5.70% 5.70% 5.70%

91-180 Days 6.00% 6.00% 6.00% 6.75% 6.75% 6.75%

181 – 364 Days 6.75% 6.75% 6.75% 7.50% 7.50% 7.50%

365 Days(1 Year) 7.50% 7.50% 7.50% 7.50% 7.50% 7.50%

>1Year – 18 M 7.50% 7.50% 7.50% 8.00% 8.00% 8.00%

>18 M -2 Year 7.50% 7.50% 7.50% 7.50% 7.50% 7.50%

>2 Year -3 Year 7.75% 7.75% 7.75% 7.75% 7.75% 7.75%

>3 Year – 5Year 7.55% 7.55% 7.55% 7.55% 7.55% 7.55%

>5 Year – 10 Year 7.00% 7.00% 7.00% 7.00% 7.00% 7.00%

Terms & conditions:

1. For premature withdrawal of fixed deposit, interest rate payable would be corresponding FD

rate minus 1.00% for the tenor for which the deposit has actually run.

2. We hereby propose to offer 1% more over Card Rates to Unity SFB employees.

3. Senior citizen to receive 50 bps more for callable bulk deposits

4. Quote will be valid only if AML and KYC documents are provided and cleared by the

compliance department.

5. Product is only available in INR currency

6. Interest on these deposits will be calculated on quarterly compounding basis for deposits with

tenor 6 months and above.

7. Overdraft is permitted against callable deposits

8. Auto renewal is permitted

D. Non-Callable Bulk Deposit Rates (% p.a.): w.e.f 15th November, 2022

>=Rs 2 crs Rs 50 crs to

Rs 5 crs to Rs 10 crs to Rs 25 crs to Rs 100 crs

Tenure to < Rs 5 < Rs 100

< Rs 10 crs < Rs 25 crs < Rs 50 crs and Above

crs crs

7-14 Days 5.00% 5.00% 5.00% 5.00% 5.00% 5.00%

15-45 Days 5.10% 5.10% 5.10% 5.10% 5.10% 5.10%

46-60 Days 5.30% 5.30% 5.30% 5.30% 5.30% 5.30%

61-90 Days 6.10% 6.10% 6.10% 6.10% 6.10% 6.10%

91-180 Days 6.25% 6.25% 6.25% 6.85% 6.85% 6.85%

Unity Small Finance Bank Limited (CIN: U65990DL2021PLC385568)

Registered Office: 40, Basant Lok, Vasant Vihar, New Delhi – 110 057. Tel No: 011- 4741 4100

Corporate Office: Centrum House, CST Road, Vidyanagari Marg, Kalina, Santacruz (E), Mumbai – 400 098.

Tel No: 022- 4215 9068

181 – 364 Days 6.85% 6.85% 6.85% 7.60% 7.60% 7.60%

365 Days(1 Year) 7.60% 7.60% 7.60% 7.60% 7.60% 7.60%

>1Year – 18 M 7.60% 7.60% 7.60% 8.10% 8.10% 8.10%

>18 M -2 Year 7.60% 7.60% 7.60% 7.60% 7.60% 7.60%

>2 Year -3 Year 7.85% 7.85% 7.85% 7.85% 7.85% 7.85%

>3 Year – 5Year 7.65% 7.65% 7.65% 7.65% 7.65% 7.65%

>5 Year – 10 Year 7.25% 7.25% 7.25% 7.25% 7.25% 7.25%

Terms & conditions:

1. Tenor 7 days to 10 years and for deposits above Rs 2 crores

2. Premature withdrawal will not be permitted

3. Non-callable deposits are not offered to senior citizen due to urgency of requirement.

4. Interest on these deposits will be calculated on quarterly compounding basis for deposits with

tenor 6 months and above.

5. Overdraft is permitted against non-callable deposits

6. Quote will be valid only if AML and KYC documents are provided and cleared by the

compliance department.

7. Product is only available in INR currency

8. Auto renewal is not permitted

9. Customers will be required to sign a term sheet describing the terms and conditions of the

product

10. Premature withdrawal only allowed as exception in cases of bankruptcy/winding up,

directions by court/regulators or operational errors with the approval of Head financial

Markets and CRO

11. In case of such withdrawals, customer will be eligible for the rate of interest as applicable to

premature closure of term deposits ie. Interest rate shall be 1.00% below the rate applicable

for the period the deposit has remained with the bank, or 1.00% below the contracted rate,

whichever is lower. Such penal rate may be waived in terms of extant policy on setting of

interest rates for liabilities.

Unity Small Finance Bank Limited (CIN: U65990DL2021PLC385568)

Registered Office: 40, Basant Lok, Vasant Vihar, New Delhi – 110 057. Tel No: 011- 4741 4100

Corporate Office: Centrum House, CST Road, Vidyanagari Marg, Kalina, Santacruz (E), Mumbai – 400 098.

Tel No: 022- 4215 9068

You might also like

- Website Disclosure Effective 05 Apr 2024Document4 pagesWebsite Disclosure Effective 05 Apr 2024Ab CdNo ratings yet

- Tel No: 022-4215 9068Document3 pagesTel No: 022-4215 9068mamatha niranjanNo ratings yet

- Website Disclosure Effective 30 Nov 2023Document3 pagesWebsite Disclosure Effective 30 Nov 2023bggbggNo ratings yet

- Website Disclosure Effective 03 Feb 2024Document3 pagesWebsite Disclosure Effective 03 Feb 2024abhishek sharmaNo ratings yet

- Website Disclosure Effective 02nd May 2023Document3 pagesWebsite Disclosure Effective 02nd May 2023Prathamesh PatikNo ratings yet

- FD Interest Rates - Check Latest Fixed Deposit Interest Rates Online - ICICI BankDocument1 pageFD Interest Rates - Check Latest Fixed Deposit Interest Rates Online - ICICI BankdhruvNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssasi 'sNo ratings yet

- Interest Rates On Deposits Above Rs 2 Crs Wef 09082023Document5 pagesInterest Rates On Deposits Above Rs 2 Crs Wef 09082023Mohammed Eidrees RazaNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssaurav katarukaNo ratings yet

- Interest Rate RetailDocument6 pagesInterest Rate RetailYashaswi SharmaNo ratings yet

- Interest RatesDocument5 pagesInterest Ratesagupta_16No ratings yet

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Document3 pagesAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakNo ratings yet

- Card Rates For Domestic, NRE & NRO Deposits Less Than INR 1 CroreDocument4 pagesCard Rates For Domestic, NRE & NRO Deposits Less Than INR 1 Croreraghuveer11No ratings yet

- Interest Rate RetailDocument6 pagesInterest Rate RetailRavie S DhamaNo ratings yet

- FD Rate Card - Oct 2022Document2 pagesFD Rate Card - Oct 2022Deepak SuyalNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsY_AZNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsD SunilNo ratings yet

- Interest Rates Standard Chartered IndiaDocument4 pagesInterest Rates Standard Chartered IndiaBinuNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsRaghav sharmaNo ratings yet

- Interest Rates On INR Deposit: Tenor FD With Pre Closure (%) FD W/o Pre Closure (%) FD With Pre Closure (%)Document1 pageInterest Rates On INR Deposit: Tenor FD With Pre Closure (%) FD W/o Pre Closure (%) FD With Pre Closure (%)CA Sandeep ChhuganiNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsIndranil Roy ChoudhuriNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsspshekarNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsV NaveenNo ratings yet

- Interest Rates On Deposits - Domestic, NRE, NRO - Rs. 2 Crore and AboveDocument5 pagesInterest Rates On Deposits - Domestic, NRE, NRO - Rs. 2 Crore and AboveParasjkohli6659No ratings yet

- Interest Rate Idfc BankDocument4 pagesInterest Rate Idfc BankDesikanNo ratings yet

- Interest Rates On Domestic Fixed Deposit and Recurring DepositDocument1 pageInterest Rates On Domestic Fixed Deposit and Recurring DepositMuditNo ratings yet

- Rights of BusinessDocument2 pagesRights of BusinessHimanshu MilanNo ratings yet

- IDFC Bank Interest RateDocument6 pagesIDFC Bank Interest RateA BNo ratings yet

- Interest Rates On Deposits - Domestic, NRE, NRO - Rs. 2 Crore and AboveDocument5 pagesInterest Rates On Deposits - Domestic, NRE, NRO - Rs. 2 Crore and AboveParasjkohli6659No ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsAkhilesh VijayaKumarNo ratings yet

- FD Leaflet - A5 - 13 Dec 23Document2 pagesFD Leaflet - A5 - 13 Dec 23Shaily SinhaNo ratings yet

- Interest Rates On Deposits Above Rs 2 Crs Wef 15092022Document5 pagesInterest Rates On Deposits Above Rs 2 Crs Wef 15092022Manish bishnoiNo ratings yet

- Revision of Interest Rate On Fixed Deposit Wef February 28 2019Document1 pageRevision of Interest Rate On Fixed Deposit Wef February 28 2019sg06No ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailRavi KumarNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailShanawaz KhanNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailAlok GoyalNo ratings yet

- Dri 2024014Document2 pagesDri 2024014detix97225No ratings yet

- Nre FD New RateDocument5 pagesNre FD New RateMidhunRameshThuvasseryNo ratings yet

- UntitledDocument1 pageUntitledഓൺലൈൻ ആങ്ങളNo ratings yet

- RevisionInterestRates CircularDocument5 pagesRevisionInterestRates CircularPrashantGuptaNo ratings yet

- Nri Fixed Deposits FCNR Deposits 14 November 23Document2 pagesNri Fixed Deposits FCNR Deposits 14 November 23shivamkatare0No ratings yet

- Interest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument3 pagesInterest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresHemant KhanNo ratings yet

- RevisionInterestRates CircularDocument4 pagesRevisionInterestRates CircularNishantNo ratings yet

- HDFC RatesDocument4 pagesHDFC RatesdesikanttNo ratings yet

- Interest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument4 pagesInterest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 Croresgolagani praveenkumarNo ratings yet

- BankingDocument4 pagesBankingBhavin GhoniyaNo ratings yet

- Interest Rates - Savings, NREFCNR Fixed Deposits & Home Loan Rates DBS Bank IndiaDocument1 pageInterest Rates - Savings, NREFCNR Fixed Deposits & Home Loan Rates DBS Bank IndiaVASANTHNo ratings yet

- RevisionInterestRates CircularDocument5 pagesRevisionInterestRates CircularK NkNo ratings yet

- Yes Bank Interest ChargesDocument3 pagesYes Bank Interest ChargessaiaviNo ratings yet

- Sweep Deposit Interest RatesDocument1 pageSweep Deposit Interest RatesReyansh MishraNo ratings yet

- Tenor Previous Interest Rate P.A. (%) Revised Interest Rate P.A. (%) (W.e.f. 18.12.2012)Document8 pagesTenor Previous Interest Rate P.A. (%) Revised Interest Rate P.A. (%) (W.e.f. 18.12.2012)Holly SmithNo ratings yet

- Interest Rates On Domestic Fixed Deposits and Recurring DepositsDocument1 pageInterest Rates On Domestic Fixed Deposits and Recurring Depositsavnish singhNo ratings yet

- FD RatesDocument3 pagesFD Rates22satendraNo ratings yet

- Roi04082015 PDFDocument1 pageRoi04082015 PDFTanmay YadavNo ratings yet

- Interest Rates On Deposits 02 11 2023Document4 pagesInterest Rates On Deposits 02 11 2023ashishNo ratings yet

- Domestic Fixed Deposit RateDocument2 pagesDomestic Fixed Deposit RateKarthikeyan GovindarajanNo ratings yet

- Interest Rates On Deposits & Advances: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument4 pagesInterest Rates On Deposits & Advances: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresSumanyuSoodNo ratings yet

- Fixed Deposit Plus Rates W e F May 2023Document1 pageFixed Deposit Plus Rates W e F May 2023saurav katarukaNo ratings yet

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- New Ambuja Anu23Document49 pagesNew Ambuja Anu23Himanshu MilanNo ratings yet

- Current Affairs 19th July, 2019Document156 pagesCurrent Affairs 19th July, 2019Himanshu MilanNo ratings yet

- Ravi Prakash TPR FinalDocument12 pagesRavi Prakash TPR FinalHimanshu MilanNo ratings yet

- The Effect of Marketing Research in Product Planning ProcessDocument94 pagesThe Effect of Marketing Research in Product Planning ProcessHimanshu MilanNo ratings yet

- Photo UploadDocument2 pagesPhoto UploadHimanshu MilanNo ratings yet

- Internship Report Juliana ShingakiDocument100 pagesInternship Report Juliana ShingakiHimanshu MilanNo ratings yet

- Rights of BusinessDocument2 pagesRights of BusinessHimanshu MilanNo ratings yet