Professional Documents

Culture Documents

Interest Rates For Fixed Deposits

Uploaded by

saurav katarukaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Interest Rates For Fixed Deposits

Uploaded by

saurav katarukaCopyright:

Available Formats

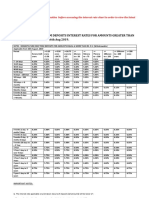

Interest Rates for Retail Fixed Deposits for Domestic/NRO/NRE

Customers

Interest Rates for Retail Fixed Deposits for Domestic / NRO / NRE Customers:

Effective from 01stAugust2023

Regular FD Interest Senior Citizen FD

Tenure

Rate (p.a.) Interest Rate (p.a.)

7-14 Days 3.75% 4.25%

15-60 Days 4.25% 4.75%

61-90 Days 5.00% 5.50%

91-180 Days 6.25% 6.75%

181-364 Days 7.00% 7.50%

365 Days 7.25% 7.75%

366 - 499 Days 8.50% 9.00%

501– 730 Days 8.50% 9.00%

> 2 Years - 3 Years(1095 Days) 7.35% 7.85%

> 3 Year - < 5 Years 7.25% 7.75%

5 Years(1825 Days) 7.25% 7.75%

> 5 Years - 10 Years 7.25% 7.75%

500 Days 8.50% 9.00%

Terms and Conditions:

1. The interest is computed based on the actual number of days in a year i.e. 365 days for a non- leap

year and 366 days for a leap year. The tenor of Deposit is calculated in number of days.

2. The above card rates are applicable to deposits less than INR 2 Crore.

3. Minimum tenure for NRE fixed deposits is 1 year and no interest rate is payable for deposits

prematurely withdrawn within the period of 1 year from the date of the deposit.

4. Only Resident Indian Senior Citizens (of 60 years and above age) are eligible for the above

mentioned Senior Citizen Interest rate specified. The special rates are applicable only for Resident

deposits.

5. Interest earned on NRO fixed deposits are taxable as per applicable rates according to Income Tax

Act 1961 as amended from time-to-time.

6. In case of NRE deposit no interest will be paid if the NRE Deposit is liquidated before the completion

of 1 year from the date of booking.

7. The maximum amount is INR 1.5 Lakhs for Tax Saver FD.

8. Sr. Citizen Preferential rate is applicable for Tax Saver FD. The lock-in period for Tax Saver FD shall

be 5 Years (1825 Days) and no premature withdrawal will be allowed during lock-in period.

9. In case of premature withdrawal of the deposit, interest will not be paid at the originally contracted

rate. In such cases interest will be paid at the applicable rate of interest for the duration which the

deposit is maintained with us minus premature withdrawal penal rate as follows:

a. Fixed Deposit less than INR 200 Lakhs –0.5%

b. Fixed Deposits greater than or equal to INR 200 Lakhs - 1%

10. For all Non-Cumulative Fixed Deposits, interest is calculated on Simple interest basis. Interest

payouts are as per financial year: Monthly Interest payouts will be on 1st of every month, Quarterly

Interest payouts will be on the 1st of every quarter, Half-yearly payouts will be on 1st October & 1st

April and Annual interest payouts will be on 1st April irrespective of the date of booking.

11. In case of premature withdrawal of fixed deposit: The Interest rate applicable for premature closure

will be lower of the rate for the original /contracted tenure for which the deposit has been booked

OR the rate as prevailing on the date of deposit for the tenure for which the of deposit has been in

force with the Bank.

12. Rates are subject to change from time to time without prior notice.

Interest Rates for Fixed Deposit Plus

Interest Rates for FD Plus: (For Fixed Deposits with No Premature Withdrawal facility):

Effective from 12th August 2023

2 Crores - >5 Crores - >25 Crores >50

Tenure < 2 Crores

5 Crores 25 Crores - 50 Crores Crores

7-14 Days 3.00% 3.05% 3.05% 3.05% 3.05%

15-60 Days 4.25% 4.30% 4.30% 4.30% 4.30%

61-90 Days 5.00% 5.05% 5.05% 5.05% 5.05%

91-180 Days 7.00% 6.80% 6.80% 6.80% 6.80%

181-364 Days 7.75% 7.55% 7.55% 7.55% 7.55%

365 Days 8.00% 7.80% 7.80% 7.80% 7.80%

> 1 Year - 2 Years(730 Days) 8.25% 8.05% 8.05% 8.05% 8.05%

> 2 Years - 3 Years(1095 Days) 8.50% 8.30% 8.30% 8.30% 8.30%

> 3 Year - < 5 Years 7.25% 7.30% 7.30% 7.30% 7.30%

5 Years(1825 Days) - 10 Years 6.50% 6.30% 6.30% 6.30% 6.30%

Terms and Conditions:

1. The above rate is applicable for Fixed Deposits above INR 15 Lakhs only.

2. The interest is computed based on the actual number of days in a year i.e. 365 days for a non- leap

year and 366 days for a leap year. The tenor of Deposit is calculated in number of days.

3. For the “FD with no Premature withdrawal / FD Plus Product”

a. Auto Renewal facility is not available

b. Pre-mature withdrawal of the deposit is not allowed before the expiry of the term, except in

case of death of the account holder or on order from statutory and/or regulatory authority.

4. For all Non-Cumulative Fixed Deposits, interest is calculated on Simple interest basis. Interest payouts

Are as per financial year: Monthly Interest payouts will be on 1st of every month, Quarterly Interest

payouts will be on the 1st of every quarter, Half-yearly payouts will be on 1st October & 1st April and

Annual interest payouts will be on 1st April irrespective of the date of booking.

5. In case of premature withdrawal of fixed deposit, the Interest rate applicable for premature closure

Will be lower of the rate for the original /contracted tenure for which the deposit has been booked

OR the rate as prevailing on the date of deposit for the tenure for which the of deposit has been in

force with the Bank.

6. Rates are subject to change from time to time without prior notice.

You might also like

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsV NaveenNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsY_AZNo ratings yet

- Fixed Deposit Interest RatesDocument2 pagesFixed Deposit Interest Ratessasi 'sNo ratings yet

- FD Interest RatesDocument2 pagesFD Interest RatesHimanshu MilanNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsD SunilNo ratings yet

- Latest Fixed Deposit Interest RatesDocument2 pagesLatest Fixed Deposit Interest RatesRaghav sharmaNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsIndranil Roy ChoudhuriNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsspshekarNo ratings yet

- Interest Rates on Deposits & Advances at IDFC FIRST BankDocument4 pagesInterest Rates on Deposits & Advances at IDFC FIRST BankRavi KumarNo ratings yet

- Interest Rate RetailDocument6 pagesInterest Rate RetailRavie S DhamaNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsAkhilesh VijayaKumarNo ratings yet

- Interest rates on deposits and loansDocument4 pagesInterest rates on deposits and loansShanawaz KhanNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailAlok GoyalNo ratings yet

- Interest Rates On Deposits Above Rs 2 Crs Wef 09082023Document5 pagesInterest Rates On Deposits Above Rs 2 Crs Wef 09082023Mohammed Eidrees RazaNo ratings yet

- Interest RatesDocument5 pagesInterest Ratesagupta_16No ratings yet

- Interest Rates On Deposits & Advances: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument4 pagesInterest Rates On Deposits & Advances: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresSumanyuSoodNo ratings yet

- Interest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument4 pagesInterest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 Croresgolagani praveenkumarNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailRajender Singh DeepakNo ratings yet

- Interest Rates On Deposits 02 11 2023Document4 pagesInterest Rates On Deposits 02 11 2023ashishNo ratings yet

- Interest Rates on Large DepositsDocument5 pagesInterest Rates on Large DepositsManish bishnoiNo ratings yet

- IDFC Bank Interest RateDocument6 pagesIDFC Bank Interest RateA BNo ratings yet

- Interest Rates On Deposits 01 03 2023Document4 pagesInterest Rates On Deposits 01 03 2023Shashank ChandraNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailManvith B YNo ratings yet

- Interest Rate Idfc BankDocument4 pagesInterest Rate Idfc BankDesikanNo ratings yet

- Changes to interest rates on Fixed Deposits and Savings AccountsDocument5 pagesChanges to interest rates on Fixed Deposits and Savings AccountsK NkNo ratings yet

- Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument4 pagesCard Rates For Domestic, NRE & NRO Deposits Less Than INR 2 Croressatyajit_manna_2No ratings yet

- Interest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument3 pagesInterest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresHemant KhanNo ratings yet

- Interest rates on deposits and savings accountsDocument4 pagesInterest rates on deposits and savings accountsraghuveer11No ratings yet

- Website Disclosure Effective 30 Nov 2023Document3 pagesWebsite Disclosure Effective 30 Nov 2023bggbggNo ratings yet

- RevisionInterestRates CircularDocument5 pagesRevisionInterestRates CircularPrashantGuptaNo ratings yet

- Interest Rates On Deposits - Domestic, NRE, NRO - Rs. 2 Crore and AboveDocument5 pagesInterest Rates On Deposits - Domestic, NRE, NRO - Rs. 2 Crore and AboveParasjkohli6659No ratings yet

- Fixed Deposit Plus Rates W e F May 2023Document1 pageFixed Deposit Plus Rates W e F May 2023saurav katarukaNo ratings yet

- Fixed Deposit Plus Rates W e F October 30 2023 WebsiteDocument1 pageFixed Deposit Plus Rates W e F October 30 2023 Websitekushboog019No ratings yet

- FD Leaflet - A5 - 13 Dec 23Document2 pagesFD Leaflet - A5 - 13 Dec 23Shaily SinhaNo ratings yet

- Interest Rate RetailDocument6 pagesInterest Rate RetailYashaswi SharmaNo ratings yet

- Fixed Deposit Plus Rates W e F August 21 2023Document1 pageFixed Deposit Plus Rates W e F August 21 2023BhupinderNo ratings yet

- website-disclosure-effective-05-apr-2024 (1)Document4 pageswebsite-disclosure-effective-05-apr-2024 (1)Ab CdNo ratings yet

- UntitledDocument1 pageUntitledഓൺലൈൻ ആങ്ങളNo ratings yet

- Interest Rates On Domestic Fixed Deposit and Recurring DepositDocument1 pageInterest Rates On Domestic Fixed Deposit and Recurring DepositMuditNo ratings yet

- Fixed Deposit Rates W e F February 27 2023 WebsiteDocument1 pageFixed Deposit Rates W e F February 27 2023 WebsiteAman singhNo ratings yet

- Interest Rates On Deposits - Domestic, NRE, NRO - Rs. 2 Crore and AboveDocument5 pagesInterest Rates On Deposits - Domestic, NRE, NRO - Rs. 2 Crore and AboveParasjkohli6659No ratings yet

- FD Interest Rates - Check Latest Fixed Deposit Interest Rates Online - ICICI BankDocument1 pageFD Interest Rates - Check Latest Fixed Deposit Interest Rates Online - ICICI BankdhruvNo ratings yet

- Fixed Deposit Rates Wef August 21 2023 WebsiteDocument1 pageFixed Deposit Rates Wef August 21 2023 WebsiteSudhanshuNo ratings yet

- Website Disclosure Effective 03 Feb 2024Document3 pagesWebsite Disclosure Effective 03 Feb 2024abhishek sharmaNo ratings yet

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Document3 pagesAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakNo ratings yet

- Domestic Fixed Deposits and Recurring Deposits Interest RatesDocument1 pageDomestic Fixed Deposits and Recurring Deposits Interest Ratesavnish singhNo ratings yet

- Fixed Deposit As On October19,2020 Website UpdateDocument1 pageFixed Deposit As On October19,2020 Website UpdateSusovan DasNo ratings yet

- Website Disclosure EffectiveDocument3 pagesWebsite Disclosure EffectiveHimanshu MilanNo ratings yet

- FD Rate Card - Oct 2022Document2 pagesFD Rate Card - Oct 2022Deepak SuyalNo ratings yet

- RevisionInterestRates CircularDocument4 pagesRevisionInterestRates CircularNishantNo ratings yet

- Screenshot 2023-07-02 at 11.14.42 PMDocument6 pagesScreenshot 2023-07-02 at 11.14.42 PMUttam JaiswalNo ratings yet

- Interest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankDocument1 pageInterest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankSusovan DasNo ratings yet

- Website Disclosure Effective 02nd May 2023Document3 pagesWebsite Disclosure Effective 02nd May 2023Prathamesh PatikNo ratings yet

- Fixed Deposit Rates November 21 2022Document1 pageFixed Deposit Rates November 21 2022haha heeeNo ratings yet

- Interest Rates - Savings, NREFCNR Fixed Deposits & Home Loan Rates DBS Bank IndiaDocument1 pageInterest Rates - Savings, NREFCNR Fixed Deposits & Home Loan Rates DBS Bank IndiaVASANTHNo ratings yet

- HDFC RatesDocument4 pagesHDFC RatesdesikanttNo ratings yet

- Tel No: 022-4215 9068Document3 pagesTel No: 022-4215 9068mamatha niranjanNo ratings yet

- Revision of Interest Rate On Fixed Deposit Wef February 28 2019Document1 pageRevision of Interest Rate On Fixed Deposit Wef February 28 2019sg06No ratings yet

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

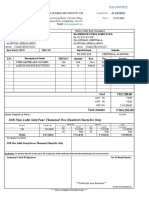

- Nudhana Industries-2126-03 Sep 22Document1 pageNudhana Industries-2126-03 Sep 22Dhanapal 11No ratings yet

- CREATE Zalamea Briefing + RRsDocument76 pagesCREATE Zalamea Briefing + RRsGerryNo ratings yet

- Finals Handout TaxDocument3 pagesFinals Handout TaxFlorenz AmbasNo ratings yet

- Tax Invoice: Product Description Qty Gross A Mount Discount Taxable V Alue Igst TotalDocument3 pagesTax Invoice: Product Description Qty Gross A Mount Discount Taxable V Alue Igst TotalANIL KUMARNo ratings yet

- DownloadDocument1 pageDownloadJitaram SamalNo ratings yet

- Education Authority PunjabDocument1 pageEducation Authority PunjabMuhammad JamilNo ratings yet

- Assignment ON Tax Calculation: Calculated byDocument4 pagesAssignment ON Tax Calculation: Calculated byAkanksha Sinha MBA20100% (2)

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountAbhi ShNo ratings yet

- Declaration for Non-Deduction of TDS u/s 194CDocument1 pageDeclaration for Non-Deduction of TDS u/s 194CPreethi Venkataraman100% (2)

- Mohitmittal Dot 1505@yahoo DotinDocument1 pageMohitmittal Dot 1505@yahoo DotinPawan GuptaNo ratings yet

- Deloitte Tax InvoiceDocument2 pagesDeloitte Tax InvoiceSunny PandeyNo ratings yet

- Invoice 18 EmiratesDocument1 pageInvoice 18 Emiratessiva manikandanNo ratings yet

- Cash Budget PracticeDocument4 pagesCash Budget PracticeSavana AndiraNo ratings yet

- GST ASMT Form Dispute ReplyDocument2 pagesGST ASMT Form Dispute ReplyStock PsychologistNo ratings yet

- Ch. 14 Chattels Principal Private Residence Exemption NotesDocument4 pagesCh. 14 Chattels Principal Private Residence Exemption NotesGhanshyam RabadiaNo ratings yet

- SUBA (Detailed) - Gutierrez v. CIRDocument3 pagesSUBA (Detailed) - Gutierrez v. CIRPaul Joshua SubaNo ratings yet

- Pradeep Kumar Bobbili - Dec'17 - PayslipDocument1 pagePradeep Kumar Bobbili - Dec'17 - PayslipraaghuNo ratings yet

- South Western Federal Taxation 2017 Individual Income Taxes 40th Edition Hoffman Solutions ManualDocument38 pagesSouth Western Federal Taxation 2017 Individual Income Taxes 40th Edition Hoffman Solutions Manualriaozgas3023100% (15)

- Pay Slip 1Document4 pagesPay Slip 1api-3810267No ratings yet

- JBM PayslipDocument1 pageJBM PayslipROHIT RANJAN100% (1)

- Nov2019 60013470 PDFDocument1 pageNov2019 60013470 PDFParvinder SinghNo ratings yet

- Q000686a 2019917 8550 0003598919Document1 pageQ000686a 2019917 8550 0003598919Thirangana WeerasingheNo ratings yet

- W2 & Earnings: Emma MimsDocument1 pageW2 & Earnings: Emma MimsIsaiah MimsNo ratings yet

- Property Tax Revision - NoticeDocument1 pageProperty Tax Revision - NoticeBenedict DavidNo ratings yet

- Tax Invoice: Total 1Document5 pagesTax Invoice: Total 1abhinay marellaNo ratings yet

- Solved Stan Rented An Office Building To Clay For 3 000 PerDocument1 pageSolved Stan Rented An Office Building To Clay For 3 000 PerAnbu jaromiaNo ratings yet

- Prentice Halls Federal Taxation 2014 Comprehensive Rupert 27th Edition Solutions ManualDocument30 pagesPrentice Halls Federal Taxation 2014 Comprehensive Rupert 27th Edition Solutions ManualJosephWoodsdbjt100% (44)

- PPF Account Opening Form1Document3 pagesPPF Account Opening Form1apurv429No ratings yet

- Form No. 2E Naya Saral Naya Saral Its - 2E: (See Second Proviso To Rule 12 (1) (B) (Iii) )Document2 pagesForm No. 2E Naya Saral Naya Saral Its - 2E: (See Second Proviso To Rule 12 (1) (B) (Iii) )NeethinathanNo ratings yet