Professional Documents

Culture Documents

RATIO

Uploaded by

Jing Jing Romero0 ratings0% found this document useful (0 votes)

7 views5 pagesIn 2020, RLC's gross profit margin, net profit margin, average collection period, and inventory turnover decreased compared to 2019, indicating less efficient operations. However, the current ratio and acid test ratio increased, showing RLC had sufficient short-term assets to cover current liabilities. The decreases were largely due to the impacts of the COVID-19 pandemic through reduced business activities from lockdowns and travel restrictions.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIn 2020, RLC's gross profit margin, net profit margin, average collection period, and inventory turnover decreased compared to 2019, indicating less efficient operations. However, the current ratio and acid test ratio increased, showing RLC had sufficient short-term assets to cover current liabilities. The decreases were largely due to the impacts of the COVID-19 pandemic through reduced business activities from lockdowns and travel restrictions.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views5 pagesRATIO

Uploaded by

Jing Jing RomeroIn 2020, RLC's gross profit margin, net profit margin, average collection period, and inventory turnover decreased compared to 2019, indicating less efficient operations. However, the current ratio and acid test ratio increased, showing RLC had sufficient short-term assets to cover current liabilities. The decreases were largely due to the impacts of the COVID-19 pandemic through reduced business activities from lockdowns and travel restrictions.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

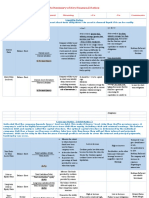

Let’s look at the financial health of RLC in the year 2020 as compared to the previous year.

RATIO DESCRIPTION REMARKS

GROSS PROFIT MARGIN - measures how BAD

Total Revenue/Sales x 100 efficiently a company

uses its materials and Decreased by 6%

Cost of Goods

labor to produce and - While there was a 2B increase in the real estate sales, gross revenue went down by

sell products

profitably

6% in 2020. Attributable mainly in the big drop in Amusement Income from 2.1B in

- it shows how 2019 to 200M in 2020

efficiently a company - On account of the community quarantines and restricted travel, the RLC’s hotels and

can produce and sell

its products

resorts segment continues to be adversely affected due to significant decrease in

- A higher ratio is number of guests, reduced room rates, limited operations – so all of which have

usually preferred, as significantly impacted the revenues of RLC

this would indicate

that the company is

selling inventory for a

higher profit.

Ideal:

NET PROFIT MARGIN - assess if a company's BAD

Net Income x 100 management is

generating enough Decreased by 8%

Total Revenue/Sales

profit from its sales

and whether

operating costs

- A higher profit

margin is always

desirable since it

means the company

generates more

profits from its sales.

Ideal:

CURRENT RATIO - The current ratio is a GOOD

_Current assets_ liquidity ratio that

measures a Increased by 12%

Current liabilities

company's ability to - On the contrary, the global pandemic made no significant impact on the current

pay short-term

obligations or those

ratio of RLC.

due within one year - The lower current liabilities (which was mainly caused by lower income tax payable

- The current for 2020 from 1B to 100M) can be sufficiently covered by RLC’s current assets which

ratio measures a

company's ability to

consists of interests earned from cash in banks and short-term investments, rental

pay current, or short- receivables, among others

term, liabilities (debts

and payables) with its

current, or short-

term, assets, such as

cash, inventory,

and receivables

without relying on

the sale of inventory

or on obtaining

additional financing.

- A current ratio that is

in line with the

industry average or

slightly higher is

generally considered

acceptable. A current

ratio that is lower

than the industry

average may indicate

a higher risk of

distress or default.

Similarly, if a

company has a very

high current ratio

compared to its peer

group, it indicates

that management

may not be using its

assets efficiently.

Ideal:

ACID TEST - liquidity ratio that GOOD

Current assets – Inventory measures how

sufficient a Increased by 21%

Current liabilities

company’s short- - Looking at RLC liquidity ratio, we have sufficient short-term assets to cover our

term assets are to

cover its current

current liabilities

liabilities. In other

words, the acid-test

ratio is a measure of

how well a company

can satisfy its short-

term (current)

financial obligations.

- The higher the ratio,

the better the

company’s liquidity

and overall financial

health

- However, it’s

important to note

that an extremely

high quick ratio (for

example, a ratio of

10) is not considered

favorable, as it may

indicate that the

company has excess

cash that is not being

wisely put to use

growing its business.

Ideal:

AVERAGE COLLECTION - is a measure of how BAD

PERIOD many days it takes a

firm, on average, to Increased by 133.88 days

Accounts receivable

(Ave. sales / 365)

collects its - It can be recalled that as part of the govt measures to mitigate the economic effects

receivables.

- It indicates the

of the global pandemic, Bayanihan I and 2 provided for, among others, a 30 and 60-

efficiency of the day grace period, respectively, for all loans without incurring interest, penalties and

collection process other charges. The financial reliefs extended by RLC to its borrowers/debtors may

and the lower it is the

shorter the cash cycle

have contributed to the increase in the average collection period of its accounts

of the business is, receivables.

which has a positive

impact on its

profitability.

Ideal:

INVENTORY TURNOVER - measures how BAD

Cost of Goods Sold efficiently inventory is

managed. Decreased by 7%

Inventory

- higher turnover rates - RLC Inventories composed of real estate inventories sold in normal operating cycles

reduce storage and

other holding costs

(which excludes land held for future development and investment properties)

- Low turnover implies - Group experienced limited selling activities that resulted to lower sales in 2020 ergo a

that a company’s decrease in the movement of its inventory

sales are poor, it is

carrying too much

inventory, or

experiencing poor

inventory

management. Unsold

inventory can face

significant risks from

fluctuating market

prices and

obsolescence.

Ideal:

RETURN ON COMMON - return that common BAD

EQUITY (ROCE) equity investors

receive on their Decreased by 4%

investment. - Result of lower net income

- used by some

investors to assess

the likelihood and

size of dividends that

the company may pay

out in the future.

- A high ROCE indicates

the company is

generating high

profits from its equity

investments, thus

making dividend

payouts more likely.

Ideal:

RETURN ON TOTAL ASSETS - indicator of how BAD

(ROTA) effectively a company

is using its assets to Decreased by 2%

Net Income

Total Assets

generate earnings - result of lower net income but higher assets as there was limited movement on

- used to determine

which companies are

RLCs assets in 2020

reporting the most

efficient use of their

assets as compared

with their earnings.

Ideal:

GROSS INCOME - Gross income is the BAD

total amount you

earn Decreased by 17%

NET INCOME - net income is your BAD

actual business profit

after expenses and Decreased by 39%

allowable deductions

are taken out.

Overall, RLC’s resilient diversified portfolio gave it a Net Income of Php5.26 billion for 2020 which is 39% lower than the previous years

but we are very positive that with RLC’s several projects in the pipeline, we will have better financial performance in the coming years.

You might also like

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisGina FabunanNo ratings yet

- FABM2 - Q1 - V2a Page 102 114Document12 pagesFABM2 - Q1 - V2a Page 102 114Kate thilyNo ratings yet

- Current Ratio: Current Assets ÷ Current LiabilitiesDocument3 pagesCurrent Ratio: Current Assets ÷ Current LiabilitiesPatricia Bawiin †No ratings yet

- Key Financial Ratios (VIP)Document10 pagesKey Financial Ratios (VIP)Ahmed HeshamNo ratings yet

- b100 Activity 9 5Document2 pagesb100 Activity 9 5Zuhaira IsrarNo ratings yet

- Ratios Analysis Notes and Questions NewDocument7 pagesRatios Analysis Notes and Questions NewAnthony OtiatoNo ratings yet

- Accounts Specific Project 1Document28 pagesAccounts Specific Project 1sakshi pandey100% (1)

- Project of Financial Reporting AnalysisDocument29 pagesProject of Financial Reporting AnalysisAhmad Mujtaba PhambraNo ratings yet

- Key Financial Ratios (M.N) FinialDocument10 pagesKey Financial Ratios (M.N) FinialYousab KaldasNo ratings yet

- Risco - Ro: Financial Rating - CuiDocument9 pagesRisco - Ro: Financial Rating - CuiAmine DiabyNo ratings yet

- Ratios Analysis Notes AND ONE SOLVED QUIZDocument6 pagesRatios Analysis Notes AND ONE SOLVED QUIZDaisy Wangui100% (1)

- Financial Statements AnalysisDocument6 pagesFinancial Statements Analysisangelika dijamcoNo ratings yet

- Week 7 Formula SheetDocument1 pageWeek 7 Formula SheetHarsahej MokhaNo ratings yet

- Financial RatiosDocument9 pagesFinancial RatiosTariq qandeelNo ratings yet

- Formula Financial RatioDocument4 pagesFormula Financial RatioRubiatul Adawiah Zainal AriffinNo ratings yet

- FAR ReviewerDocument1 pageFAR ReviewerAllyson Charissa AnsayNo ratings yet

- Anh-Nguyen s3814738 Assignment-3B ACCT2105-1Document23 pagesAnh-Nguyen s3814738 Assignment-3B ACCT2105-1Chu Ngoc AnhNo ratings yet

- Anh-Nguyen s3814738 Assignment-3B ACCT2105-1Document23 pagesAnh-Nguyen s3814738 Assignment-3B ACCT2105-1Chu Ngoc AnhNo ratings yet

- Ratio Analysis: It Is Concerned With The Calculation ofDocument19 pagesRatio Analysis: It Is Concerned With The Calculation ofsajithNo ratings yet

- Ratio Analysis - FACDocument4 pagesRatio Analysis - FACPravallika NadakuditiNo ratings yet

- Financial RatiosDocument3 pagesFinancial RatiosluudieulinhNo ratings yet

- 6.financial RatiosDocument13 pages6.financial RatiosYousab KaldasNo ratings yet

- UntitledDocument21 pagesUntitledPravin AmirthNo ratings yet

- Liquidity Only.: Ex Payable AmountDocument12 pagesLiquidity Only.: Ex Payable AmountPranshu SahasrabuddheNo ratings yet

- Ratio Analysis of Timken India: Sr. No. Ratio Formula Years InterpretationDocument4 pagesRatio Analysis of Timken India: Sr. No. Ratio Formula Years InterpretationSachin WahaneNo ratings yet

- UntitledDocument18 pagesUntitledPravin AmirthNo ratings yet

- Ratio Name Interpretation Interpretation Current RatioDocument4 pagesRatio Name Interpretation Interpretation Current Ratiotamanna rashid shime0% (1)

- Ratio Made EasyDocument8 pagesRatio Made Easytlahabaig26No ratings yet

- Financial Ratio AnalysisDocument5 pagesFinancial Ratio AnalysisPhuoc TruongNo ratings yet

- IGCSE Business Studies: Financial Information and Decisions: Study Online atDocument2 pagesIGCSE Business Studies: Financial Information and Decisions: Study Online atDefa RoseNo ratings yet

- UntitledDocument17 pagesUntitledPravin AmirthNo ratings yet

- Financial Analysis of Vantage LTD and Dunhop LTDDocument23 pagesFinancial Analysis of Vantage LTD and Dunhop LTDAJ MNo ratings yet

- Ratios: Interpreting Financial StatementsDocument3 pagesRatios: Interpreting Financial StatementsMr RizviNo ratings yet

- Financial RatiosDocument13 pagesFinancial Ratiosakash ThakurNo ratings yet

- 3 Working Capital and Current Assets ManagementDocument8 pages3 Working Capital and Current Assets ManagementJamaica DavidNo ratings yet

- Faraz Ahmad B-21 Ratio AnalysisDocument5 pagesFaraz Ahmad B-21 Ratio Analysissayali bangaleNo ratings yet

- Manajemen Strategis - Pertemuan 4Document18 pagesManajemen Strategis - Pertemuan 4Ferdian PratamaNo ratings yet

- 1 Financial Statements AnalysisDocument5 pages1 Financial Statements AnalysisMark Lawrence YusiNo ratings yet

- Topic 3 Internal Environment - 2023 For StudentsDocument63 pagesTopic 3 Internal Environment - 2023 For StudentsDuc Tao ManhNo ratings yet

- 1 Financial Statements AnalysisDocument6 pages1 Financial Statements AnalysisJamaica DavidNo ratings yet

- Dmart AccountsDocument18 pagesDmart AccountsDrishti KataraNo ratings yet

- Compute and Interpret Liquidity RatiosDocument3 pagesCompute and Interpret Liquidity RatiosANKITA SHENDRENo ratings yet

- f3 Fin RatioDocument5 pagesf3 Fin RatioErza Scarlet ÜNo ratings yet

- Stock Investing Mastermind - Zebra Learn-119Document2 pagesStock Investing Mastermind - Zebra Learn-119RGNitinDevaNo ratings yet

- Financial Ratios and Analysis of Tata Motors: Research PaperDocument15 pagesFinancial Ratios and Analysis of Tata Motors: Research PaperMCOM 2050 MAMGAIN RAHUL PRASADNo ratings yet

- White & Gold Corporate Sleek Clean Modern Annual Report PDFDocument4 pagesWhite & Gold Corporate Sleek Clean Modern Annual Report PDFEdsyll BriNo ratings yet

- Ratio Analysis: Submitted in Partial Towards The Degree ofDocument17 pagesRatio Analysis: Submitted in Partial Towards The Degree ofWhite HatNo ratings yet

- Activity RatiosDocument4 pagesActivity RatiosndmudhosiNo ratings yet

- Significance of Financial Management Planning For Small and Medium EnterpriseDocument8 pagesSignificance of Financial Management Planning For Small and Medium EnterpriseSyed MuneemNo ratings yet

- Week 02 - Ratios - SDocument6 pagesWeek 02 - Ratios - STeresa ManNo ratings yet

- Finman22 Working Capital Management B5Document5 pagesFinman22 Working Capital Management B5Anacristina PincaNo ratings yet

- 1 Financial Statements AnalysisDocument5 pages1 Financial Statements AnalysisMariel BalanditanNo ratings yet

- Ratio Analysis TechinqueDocument11 pagesRatio Analysis TechinqueWilliamLawnsonsNo ratings yet

- Ratio Report Excel Template Copy El - Copy 2Document21 pagesRatio Report Excel Template Copy El - Copy 2api-736389893No ratings yet

- Business Math ReviewerDocument3 pagesBusiness Math ReviewerYngvild ArrNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument29 pagesAnalysis and Interpretation of Financial StatementsJessiEsquivelNo ratings yet

- Post Graduate Programme in ManagementDocument5 pagesPost Graduate Programme in ManagementSaranya VsNo ratings yet

- Two Financial RatiosDocument9 pagesTwo Financial RatiosWONG ZI QINGNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Chap 18Document37 pagesChap 18Ethel K. EastmanNo ratings yet

- Downpayments Customizing GuideDocument17 pagesDownpayments Customizing Guidearvind pandhareNo ratings yet

- ACCTG 105 Midterm - Quiz No. 01 - Statement of Changes in Equity, Cash Flows, and Notes To FS (Answers)Document3 pagesACCTG 105 Midterm - Quiz No. 01 - Statement of Changes in Equity, Cash Flows, and Notes To FS (Answers)Lucas BantilingNo ratings yet

- Chemalite BDocument12 pagesChemalite BTatsat Pandey100% (2)

- Chapter 13 Financial Management by CabreraDocument25 pagesChapter 13 Financial Management by CabreraLars FriasNo ratings yet

- Category 1 MessagesDocument17 pagesCategory 1 MessagesSun City TVNo ratings yet

- Dessertation Report On NBFCDocument65 pagesDessertation Report On NBFCHarsh ChaudharyNo ratings yet

- Triple - M-Trading - SARAYDocument10 pagesTriple - M-Trading - SARAYLaiza Cristella SarayNo ratings yet

- Security Lending Vs Repo RateDocument2 pagesSecurity Lending Vs Repo RatePrateek GoyalNo ratings yet

- Make and Grow Money The Right Way (Free Sample)Document12 pagesMake and Grow Money The Right Way (Free Sample)Ankit ChawlaNo ratings yet

- Partnership Resolution FormatDocument2 pagesPartnership Resolution FormatKristine Almonte TaboraNo ratings yet

- CHP 1 - Introduction To Merchant BankingDocument44 pagesCHP 1 - Introduction To Merchant BankingFalguni MathewsNo ratings yet

- RuPay Cards Offer PDFDocument24 pagesRuPay Cards Offer PDFmirunmanishNo ratings yet

- Mba f09 01 Security Analysis Portfolio Management Syllabus PDFDocument3 pagesMba f09 01 Security Analysis Portfolio Management Syllabus PDFPrabhjot KaurNo ratings yet

- HA 222 Finance Practice Prob Chap 7Document6 pagesHA 222 Finance Practice Prob Chap 7Ben Kramer50% (2)

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Document1 pageHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971NEELESH GARGNo ratings yet

- Banking Frauds: Ca .Kranthi Kumar Kedari-Fca .Disa (Icai) Certified in FAFPDocument55 pagesBanking Frauds: Ca .Kranthi Kumar Kedari-Fca .Disa (Icai) Certified in FAFPgmech100% (1)

- Live Weekly Class 1 - COMM121Document14 pagesLive Weekly Class 1 - COMM121harshit guptaNo ratings yet

- Salome Kirimi CVDocument3 pagesSalome Kirimi CVsalome kirimiNo ratings yet

- Financial Education Workbook-VII - ComprDocument44 pagesFinancial Education Workbook-VII - ComprShubh JainNo ratings yet

- SWIFT Operations Mr. KunduDocument58 pagesSWIFT Operations Mr. KunduLokesh MahajanNo ratings yet

- Edev 311: Economic Development: Session 5: The Basic Tools of FinanceDocument16 pagesEdev 311: Economic Development: Session 5: The Basic Tools of FinanceCarlNo ratings yet

- PBCOM Vs Basic PolyprintersDocument3 pagesPBCOM Vs Basic PolyprintersKylie Kaur Manalon Dado100% (1)

- Date Transaction Description Amount (In RS.) : Card No: 5459 64XX XXXX 7221 AAN: 0001011170001967229Document2 pagesDate Transaction Description Amount (In RS.) : Card No: 5459 64XX XXXX 7221 AAN: 0001011170001967229credit cardNo ratings yet

- Invoice - Seasky International Business Travel Gde0902Document1 pageInvoice - Seasky International Business Travel Gde0902Hank ZhouNo ratings yet

- Note On Precedent TransactionsDocument2 pagesNote On Precedent TransactionsTamim HasanNo ratings yet

- Syllabus 3310 MasterDocument39 pagesSyllabus 3310 MasterRaju SharmaNo ratings yet

- The iBAS in BangladeshDocument23 pagesThe iBAS in BangladeshInternational Consortium on Governmental Financial Management100% (1)

- Core Banking Solutions: Andhra Pradesh Grameena Vikas Bank Head Office, WarangalDocument8 pagesCore Banking Solutions: Andhra Pradesh Grameena Vikas Bank Head Office, WarangalleenardniNo ratings yet

- Cost of Machine Cash Add Sales Tax Add Shipping Cost Add Insurance in Transit Add Installation Cost Total Cost of The MachineDocument22 pagesCost of Machine Cash Add Sales Tax Add Shipping Cost Add Insurance in Transit Add Installation Cost Total Cost of The MachineMohsin HassanNo ratings yet