Professional Documents

Culture Documents

Kotak Requirement

Kotak Requirement

Uploaded by

navneet.singh0 ratings0% found this document useful (0 votes)

8 views3 pagesThe document describes two zero-balance accounts from Kotak Bank - the Kotak 811 Zero Balance Account and the Kotak 811 Lite Account. Both accounts can be opened through Kotak's mobile app or website without any minimum balance requirement. The Zero Balance Account provides full banking services like online transactions, bill payments, and investments. The Lite Account provides basic services with limitations and caps on transactions. Key differences between the accounts include fees, debit cards, credit limits and available features. The document also lists reasons an account may be automatically opened as a Lite Account instead of a Zero Balance Account.

Original Description:

Original Title

Kotak Requirement (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document describes two zero-balance accounts from Kotak Bank - the Kotak 811 Zero Balance Account and the Kotak 811 Lite Account. Both accounts can be opened through Kotak's mobile app or website without any minimum balance requirement. The Zero Balance Account provides full banking services like online transactions, bill payments, and investments. The Lite Account provides basic services with limitations and caps on transactions. Key differences between the accounts include fees, debit cards, credit limits and available features. The document also lists reasons an account may be automatically opened as a Lite Account instead of a Zero Balance Account.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views3 pagesKotak Requirement

Kotak Requirement

Uploaded by

navneet.singhThe document describes two zero-balance accounts from Kotak Bank - the Kotak 811 Zero Balance Account and the Kotak 811 Lite Account. Both accounts can be opened through Kotak's mobile app or website without any minimum balance requirement. The Zero Balance Account provides full banking services like online transactions, bill payments, and investments. The Lite Account provides basic services with limitations and caps on transactions. Key differences between the accounts include fees, debit cards, credit limits and available features. The document also lists reasons an account may be automatically opened as a Lite Account instead of a Zero Balance Account.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

1.

Kotak 811 Zero Balance

Account:

- This account allows customers to open an

account with zero balance requirements.

- It can be opened through the Kotak 811 mobile

app or the bank's website.

- It provides various banking services, including online transactions, bill payments, fund

transfers, and mobile recharges.

- Customers can use the account for saving and

investment purposes.

- Some additional features may include virtual debit cards, access to Net Banking, and

e-statements.

2. Kotak 811 Lite Account:

- Similar to the Kotak 811 Zero Balance Account, the Kotak 811 Lite Account is also a zero

balance account.

- It can be opened through the Kotak 811 mobile

app or the bank's website.

- It provides basic banking services such as fund transfers, bill payments, and mobile

recharges.

- The account may have certain limitations compared to a regular savings account, such as a

cap on the monthly transaction limit.

- Some additional features may include a virtual debit card and access to Net Banking

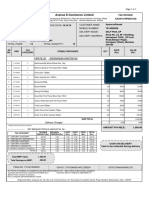

ariants Kotak 0 Balance Kotak 811 lite

How to Open Install 811 App/Website Install 811 App/Website

AMB requirement (Rs.) Zero Zero

Physical Debit Card Rs. 299 p.a. (inclusive of taxes) NA

Virtual Debit Card Free NA

Type Mobile/Website Mobile/Website

Rs. 5,000 in a calendar month & Rs.

Cumulative credits allowed Rs. 2,00,000 in an F.Y 1,20,000 in an F.Y

Online transactions IMPS & NEFT Free Outward Funds transfer not available

Cheques NA NA

Validity from the date of opening 12 months 12 months

Interest paid 4%* NA

Features Deposits Cash

Cheques Yes No

Withdrawal Cash No

Cheque No No

Reasons why it goes to lite account

1. Mobile number not linked with Aadhaar

2. Aadhar pincode nor serviceable

3. Journey mobile number and Aadhar mobile

number different

4. If we suspect any fraud in terms of IP,

location, device, etc

5. Journey pincode and Aadhar Pincode

different

You might also like

- NVBVB Bin List ScribdDocument2 pagesNVBVB Bin List ScribdPunchMade67% (3)

- Foreclosure 1709265119955Document3 pagesForeclosure 1709265119955n17mahey09No ratings yet

- Foreclosure Letter - 20 - 49 - 45Document3 pagesForeclosure Letter - 20 - 49 - 45Suman KumarNo ratings yet

- Foreclosure LetterDocument3 pagesForeclosure Letterprem.sNo ratings yet

- Panduan Pendaftaran myIOU Coaching 1on1Document30 pagesPanduan Pendaftaran myIOU Coaching 1on1Mohamad HishamNo ratings yet

- ForeclosureDocument3 pagesForeclosuremohammadafreed223No ratings yet

- Faqs Rbi Guideline On e MandateDocument3 pagesFaqs Rbi Guideline On e MandatePraveen Kumar TNo ratings yet

- Payzapp FaqDocument26 pagesPayzapp Faq231340No ratings yet

- Payzapp FaqDocument26 pagesPayzapp FaqGurvinder SinghNo ratings yet

- Foreclosure Letter - 15 - 57 - 44Document3 pagesForeclosure Letter - 15 - 57 - 44amirshahi2019No ratings yet

- Au Digital Savings AccountDocument5 pagesAu Digital Savings AccountQuaint ZoneNo ratings yet

- 408DPFJK048583 Foreclosure LetterDocument3 pages408DPFJK048583 Foreclosure Lettergmcpdbyv5fNo ratings yet

- No DueeeDocument2 pagesNo Dueeeमराठी मावळाNo ratings yet

- Digital Banking Booklet Ver 1Document32 pagesDigital Banking Booklet Ver 1Anugat JenaNo ratings yet

- Repayment Schedule - 17 - 52 - 09Document3 pagesRepayment Schedule - 17 - 52 - 09Shailendra SharmaNo ratings yet

- 4i0remio542983 NocDocument2 pages4i0remio542983 NocS. ShekharNo ratings yet

- IM Fastpay App User GuideDocument16 pagesIM Fastpay App User GuideEDGAR OGLEETEONo ratings yet

- Arvind 190101010048 State Bank of India. What Is Online SBI ?Document2 pagesArvind 190101010048 State Bank of India. What Is Online SBI ?arvind singhalNo ratings yet

- Application Form Account Opening08062021072437Document4 pagesApplication Form Account Opening08062021072437Sandeep SinghNo ratings yet

- No Dues Certificate - 20!53!53Document2 pagesNo Dues Certificate - 20!53!53krishan chaturvediNo ratings yet

- Noc 1712482198552Document2 pagesNoc 1712482198552Jawed FaruqiNo ratings yet

- Foreclosure 16-17-18Document3 pagesForeclosure 16-17-18Mizzba NisarNo ratings yet

- Open Zero Balance Savings Account Online - Kotak 811Document124 pagesOpen Zero Balance Savings Account Online - Kotak 811ANUJ SINGH100% (1)

- 4080CDJL956903 Foreclosure LetterDocument3 pages4080CDJL956903 Foreclosure LetterJanakiram TammineniNo ratings yet

- Statement of AccountDocument3 pagesStatement of Accountsonychoudhury9No ratings yet

- Foreclosure Letter - 20 - 26 - 19Document3 pagesForeclosure Letter - 20 - 26 - 19Santhosh AnantharamanNo ratings yet

- Veteran Data SolutionsDocument8 pagesVeteran Data SolutionsalharamislamicfoundationNo ratings yet

- No Dues Certificate - 19 - 47 - 18Document2 pagesNo Dues Certificate - 19 - 47 - 18chenchu kuppaswamyNo ratings yet

- Application Form Account Opening26042022011150Document4 pagesApplication Form Account Opening26042022011150Pinkey KumariNo ratings yet

- Application Development Requirement Doc BOCWB 04.06.22Document8 pagesApplication Development Requirement Doc BOCWB 04.06.22Ashish MishraNo ratings yet

- (I) Acct OpeningDocument21 pages(I) Acct OpeningKalaivaniRavisundarNo ratings yet

- Shopify Service Application Form: Particulars of SalespersonDocument3 pagesShopify Service Application Form: Particulars of SalespersonRrohit SawneyNo ratings yet

- Screenshot 2024-02-15 at 3.58.55 PMDocument3 pagesScreenshot 2024-02-15 at 3.58.55 PMaamir.k1473No ratings yet

- No Dues Certificate.Document2 pagesNo Dues Certificate.amritpal22366No ratings yet

- Foreclosure 1709301771975Document3 pagesForeclosure 1709301771975mangeshkacNo ratings yet

- Know Your Rupay Debit CardDocument9 pagesKnow Your Rupay Debit Cardwps gccNo ratings yet

- 6L6RCDFQ600309 LoanNOCcertificateDocument2 pages6L6RCDFQ600309 LoanNOCcertificateatmakurirajesh30No ratings yet

- AspireDocument11 pagesAspirebalaji balaNo ratings yet

- Noc BajajDocument2 pagesNoc BajajSowvik BanerjeeNo ratings yet

- Online - Salary Account Opening - AadhaarDocument4 pagesOnline - Salary Account Opening - AadhaarVarun R NairNo ratings yet

- Foreclosure N94RDPIS170530Document3 pagesForeclosure N94RDPIS170530kalyanhazarika004No ratings yet

- 418ecfjh318344 NocDocument2 pages418ecfjh318344 Nocvishalbhatt2981994No ratings yet

- No Dues CertificateDocument2 pagesNo Dues CertificateSatyajit BanerjeeNo ratings yet

- No Dues Certificate - 20 - 15 - 34Document2 pagesNo Dues Certificate - 20 - 15 - 34Aditya JoshiNo ratings yet

- No Dues Certificate - 1714920071353Document2 pagesNo Dues Certificate - 1714920071353dragongaming1258No ratings yet

- PL88005492417Document25 pagesPL88005492417a64588502No ratings yet

- BDO Online and Mobile Banking Step by Step Sign Up - With OTP Generator - CompDocument37 pagesBDO Online and Mobile Banking Step by Step Sign Up - With OTP Generator - CompJenilynNo ratings yet

- No Dues Certificate - DivakararaoDocument2 pagesNo Dues Certificate - DivakararaoAbhi RamNo ratings yet

- User ManualDocument23 pagesUser ManualMeDDevil03No ratings yet

- Applicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsDocument4 pagesApplicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsRahul Biswas100% (1)

- Prepaid Cards & Money Management App Money NetworkDocument1 pagePrepaid Cards & Money Management App Money NetworkAdrian Gutierrez sanchezNo ratings yet

- Applicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsDocument4 pagesApplicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsDhineshkumar SNo ratings yet

- 60qddeku075984 RPSDocument3 pages60qddeku075984 RPSsm194752No ratings yet

- Interbank GIRO (IBG) : Transaction FeesDocument4 pagesInterbank GIRO (IBG) : Transaction FeesHafizAceNo ratings yet

- Mobile Cashier Flyer EngDocument4 pagesMobile Cashier Flyer EngAyaz Ahmed KhanNo ratings yet

- Wear N Pay Guide FinalDocument26 pagesWear N Pay Guide FinalShrimoy Kumar DasNo ratings yet

- HLB Faq en PDFDocument26 pagesHLB Faq en PDFMohd AzhariNo ratings yet

- FAQ Mobile BankingDocument5 pagesFAQ Mobile BankingAshif RejaNo ratings yet

- Application Form Account Opening10012021105918Document4 pagesApplication Form Account Opening10012021105918RISHIV SINGHNo ratings yet

- Nps For Nris: Opening of Accounts Through EnpsDocument23 pagesNps For Nris: Opening of Accounts Through Enpshs_zakir3519No ratings yet

- App Development For Beginners: Secrets to Success Selling Apps on the App StoreFrom EverandApp Development For Beginners: Secrets to Success Selling Apps on the App StoreRating: 3.5 out of 5 stars3.5/5 (10)

- Handbook On Blocked Credit Under GSTDocument128 pagesHandbook On Blocked Credit Under GSTkaaryafacilitiesNo ratings yet

- GSTR3B PDFDocument48 pagesGSTR3B PDFmalhar develkarNo ratings yet

- BillDocument10 pagesBillArun PriyaNo ratings yet

- VAT Booklet F.Y.2012-13Document20 pagesVAT Booklet F.Y.2012-13ankur2706No ratings yet

- Drill: A. P100,000 C. P130,000Document2 pagesDrill: A. P100,000 C. P130,000Glen JavellanaNo ratings yet

- Tax Invoice: Sara Web SolutionsDocument1 pageTax Invoice: Sara Web SolutionsYasha Poptani AggarwalNo ratings yet

- InvoiceDocument1 pageInvoicebadalnayak0259No ratings yet

- East West UniversityDocument4 pagesEast West UniversityMD Minhazur RahmanNo ratings yet

- CO 8000020836, B000672 - STANDARD FORMS & TUBES, Delivery - 00001 - STANDARD FORMS & TUBES, Buyer's Ref 300519Document1 pageCO 8000020836, B000672 - STANDARD FORMS & TUBES, Delivery - 00001 - STANDARD FORMS & TUBES, Buyer's Ref 300519ashishvaidNo ratings yet

- PEZA - Fiscal Incentives PDFDocument8 pagesPEZA - Fiscal Incentives PDFfloricelNo ratings yet

- Gmail - MyBB ReceiptDocument1 pageGmail - MyBB ReceiptZamri Rahmat SikumbangNo ratings yet

- 5 6307432105815048770Document192 pages5 6307432105815048770Nkume IreneNo ratings yet

- Negotiable Instruments Act NotesDocument14 pagesNegotiable Instruments Act Notesshashank guptaNo ratings yet

- Wa0001.Document1 pageWa0001.Georgina W. RuschNo ratings yet

- Mastercard Rules PDFDocument353 pagesMastercard Rules PDFSamir MadanNo ratings yet

- Invoice Dmart 5813766 PDFDocument1 pageInvoice Dmart 5813766 PDFApoorva PareekNo ratings yet

- FIN623 Midterm Subjective By:::: Usman Attari: Rules To Prevent Double Derivation and Double Deductions: Section 73Document10 pagesFIN623 Midterm Subjective By:::: Usman Attari: Rules To Prevent Double Derivation and Double Deductions: Section 73SunitaNo ratings yet

- Notification FinalDocument4 pagesNotification FinalBrahmanand DasreNo ratings yet

- Bank TransferDocument1 pageBank TransferRichard RicardoNo ratings yet

- Renewal Premium Receipt: This Receipt Is Subject To Realisation of Cheque AmountDocument1 pageRenewal Premium Receipt: This Receipt Is Subject To Realisation of Cheque AmountSurya GoudNo ratings yet

- When and Where To FileDocument3 pagesWhen and Where To FileJessRowelJulianNo ratings yet

- GA Tax GuideDocument46 pagesGA Tax Guidedamilano1No ratings yet

- Consolidated Mines vs. CTADocument2 pagesConsolidated Mines vs. CTAJam ZaldivarNo ratings yet

- RR 6-2009 - Withholding by Top 20,000 CorpsDocument6 pagesRR 6-2009 - Withholding by Top 20,000 CorpsKarina PulidoNo ratings yet

- Salary - APRIL2022 2Document1 pageSalary - APRIL2022 2katihariNo ratings yet

- Direct Taxation - WorkBook - Question and Answers - CMA IntermediateDocument187 pagesDirect Taxation - WorkBook - Question and Answers - CMA IntermediateUdaya VelagapudiNo ratings yet

- Computation With Dumping Duty (R.A 8752)Document11 pagesComputation With Dumping Duty (R.A 8752)Mariel BoncatoNo ratings yet

- CIR VS. Fortune TobaccoDocument8 pagesCIR VS. Fortune TobaccoMichelle Jude TinioNo ratings yet

- Answer Key To Quiz 1 INCOME TAXDocument2 pagesAnswer Key To Quiz 1 INCOME TAXMhico MateoNo ratings yet