Professional Documents

Culture Documents

Dividend, Acc & Audit Summary by Swapnil Patni Sir

Uploaded by

samsungkalra01Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dividend, Acc & Audit Summary by Swapnil Patni Sir

Uploaded by

samsungkalra01Copyright:

Available Formats

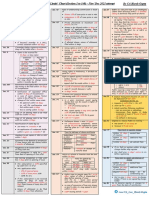

Chapter 8 : Declaration & Payment of Dividend

ni

Selection 123 Dividend shall be deposited in separate scheduled bank A/c within 5 days from declaration

t

Max. Dividend out of reserves in case of inadequate profits

Pa

1) Dividend ≤ Average of last 3 years’ dividend rate

2) Amount drawn ≤ 10% (PSC + FR)

3) Losses set-off against amount drawn

a

4) Balance of reserves ≥ 15% PSC

it

Max. interim dividend in case of loss in previous quarter

Section 124

nk

Average of last 3 years’ dividend rate

Dividend to be paid within 30 days

If remaining unclaimed, transfer to Unclaimed Div. A/c within 7 days

A

If not transferred, transfer with interest @ 12% p.a.

If transferred, upload statement within 90 days

CA

Transfer to IEPF after 7 years

Section 127 If dividend is not paid to the shareholder within 30 days, pay along with 18% p.a. interest

CA ANKITA PATNI PAGE | 55

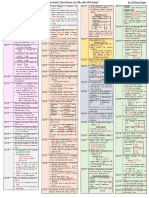

Chapter 9 : Accounts of Companies

ni

Section128 Books of A/c to be preserved for 8 years Can be kept at any place in India, after givingnotice to RoC

t

within 7 days

Pa

Section129 Copy of periodical financial statements to be filed within 30 days

Section 130 Accounts can be re-opened for 8 FYs

a

Section 131 Voluntary revision of financials is allowed for max. 3 FYs

it

Section135 CSR applicable to companies having

nk

Net Worth ≥ 500 cr; or

Turnover ≥ 1,000 cr; or

A

Net Profits ≥ 5 cr, in the preceding FY

Section 136 Annual Report is circulated 21 days before the GM

14 days in case of Sec. 8 Co. Shorter period if consent of

CA

Co. having S/C Majority in + Number ≥ 95% TVP

Any other Co. ≥ 95% TVP

CA ANKITA PATNI PAGE | 56

Section 137 Annual report is filed with RoC within 30 days of AGM or adjourned AGM or else the last due

date of AGM

ni

OPC to file within 180 days from end of FY

XBRL filing mandatory for – Listed + their Indian subs.

t

a) Co. with PSC ≥ 5 cr

Pa

b) Co. with turnover ≥ 100 cr

c) Co. covered under Ind-AS

Listed Co. or

a

Public Co. having o NW > 1 cr; and Turnover > 10 cr

it

Section 138 Internal Audit applicable on Listed Co. and either of following :

nk O/s Deposit

Public

≥ 25 cr

Private

-

A

PSC ≥ 50 cr -

Borrowings > 100 cr > 100 cr

CA

Turnover ≥200 cr ≥200 cr

CA ANKITA PATNI PAGE | 57

Chapter 10 : Audit & Auditors

ni

Section 139

t

Pa

a

it

nk

A

CA

CA ANKITA PATNI PAGE | 58

Casual Vacancy

t ni

Pa

a

it

nk

A

CA

CA ANKITA PATNI PAGE | 59

Section 140 Removal of Auditor :

t ni

Pa

a

it

nk

Resignation : Auditor shall give notice within 30 days

A

NCLT changed auditor : Cannot be appointed as auditor for 5 years

Section 141 Auditor disqualified

Person, Relative or Partner holds security or interest in CASH or co subsidiary

CA

But Relative may hold security in Co. of FV ≤ 1 lakh

Further if > 1 lakh, relative may take corrective action in 60 days

Person, Relative or Partner indebted for ≥ 5 lakh in CASH or Co-subsidiary

CA ANKITA PATNI PAGE | 60

Person, Relative or Partner has given Guarantee or security for ≥ 1 lakh to CASH or Co-subsidiary

Audit of > 20 Co. [Exclusion – OPC, Dormant, Small & Pvt Co. + PSC < 100 cr]

Section 143 Fraud < 1cr = Auditor to report to Board within 2 days

ni

Fraud ≥ 1 cr = Auditor to seek reply of Board within 45 days, then report to CG within 15 days

Section 148 Cost Records

t

Specified goods + service + Overall turnover ≥ 35 cr

Pa

Cost Audit

a

it

nk

A

Cost auditor appointed within 180 days of commencement of FY

Appointed till earlier of 180 days of closure of FY or submission of report

CA

Casual vacancy filled by Board within 30 days

Cost auditor to submit report within 180 days from closure of FY

Co. shall intimate everything to CG within 30 days

CA ANKITA PATNI PAGE | 61

You might also like

- O Level Commerce Through Questions and AnswersDocument30 pagesO Level Commerce Through Questions and AnswersBradley Muganyi100% (3)

- CA Inter Corporate & Other Laws Chart Book With Index FinalDocument237 pagesCA Inter Corporate & Other Laws Chart Book With Index Finalpari maheshwari100% (3)

- Company Law Limits - Nov 2021Document3 pagesCompany Law Limits - Nov 2021Udaykiran BheemaganiNo ratings yet

- Company Law Last Day Revision Notes CA InterDocument2 pagesCompany Law Last Day Revision Notes CA InterGANESH KUNJAPPA POOJARI100% (1)

- 422 - Summary by Harsh Gupta - Part 1Document9 pages422 - Summary by Harsh Gupta - Part 1Kumar Swamy0% (3)

- Limits Chart - May 2023Document2 pagesLimits Chart - May 2023KingNo ratings yet

- Preweek Handouts RoqueDocument25 pagesPreweek Handouts Roquecynthia reyesNo ratings yet

- Haritha Resume - DXCDocument3 pagesHaritha Resume - DXCNethra C.S.NNo ratings yet

- Guidelines On Identifying Beneficial OwnershipDocument14 pagesGuidelines On Identifying Beneficial OwnershipRSNo ratings yet

- Int'l Shoe Co. V State of Washington (Minimal Contacts & Jurisdiction)Document2 pagesInt'l Shoe Co. V State of Washington (Minimal Contacts & Jurisdiction)asklaw1No ratings yet

- Corazon: A Clinic Record Management System For PUNP TayugDocument6 pagesCorazon: A Clinic Record Management System For PUNP TayugJames Reden Salagubang CerezoNo ratings yet

- Inter Law QB (3) - 304-309 PDFDocument6 pagesInter Law QB (3) - 304-309 PDFShreyans JainNo ratings yet

- Limits Chart For Nov 2023Document2 pagesLimits Chart For Nov 2023aaryanmallick161No ratings yet

- Limits Chart - Companies Law - May 2024Document2 pagesLimits Chart - Companies Law - May 2024karanbharda2005No ratings yet

- Company Law Limits - May 21Document2 pagesCompany Law Limits - May 21Nupur Singla100% (1)

- Important LimitsDocument5 pagesImportant LimitsRaghav BangaNo ratings yet

- 5 6273750783301256946Document2 pages5 6273750783301256946Partibha GehlotNo ratings yet

- (Cpar2016) AP-8007 (Audit of Receivables)Document4 pages(Cpar2016) AP-8007 (Audit of Receivables)Dawson Dela CruzNo ratings yet

- d67c833b-8ce2-48db-9fcd-109eeb0eda8eDocument32 pagesd67c833b-8ce2-48db-9fcd-109eeb0eda8ePULKIT MURARKANo ratings yet

- SummaryDocument2 pagesSummaryDeviline MichelleNo ratings yet

- Handbook On Sales U8Document41 pagesHandbook On Sales U8shaik ameer100% (3)

- Limits ChartsDocument6 pagesLimits ChartsveenamadhurimeduriNo ratings yet

- Compilation Due Dates & Limits - Two PageDocument2 pagesCompilation Due Dates & Limits - Two Pageruby mathiasNo ratings yet

- No. Ans - A Ans. B Ans. C Ans. D AnsDocument3 pagesNo. Ans - A Ans. B Ans. C Ans. D AnsHayes MartinNo ratings yet

- CL2020 103Document3 pagesCL2020 103Jamm LiriosNo ratings yet

- Chapter 8Document14 pagesChapter 8Rachit AgarwalNo ratings yet

- CCP102Document23 pagesCCP102api-3849444No ratings yet

- Preweek Practical Accounting 1Document24 pagesPreweek Practical Accounting 1alellieNo ratings yet

- Advance Audit and Professional Ethics Amendment NotesDocument38 pagesAdvance Audit and Professional Ethics Amendment NotesSnehaNo ratings yet

- I Sem B.com Financial Accounting I 2011 12 BatchDocument8 pagesI Sem B.com Financial Accounting I 2011 12 Batchlion kingNo ratings yet

- Kapi & Clarke: Chartered AccountantsDocument2 pagesKapi & Clarke: Chartered AccountantsNiño Jay Mortiz BandicoNo ratings yet

- Ca Final Nov23 AmendmentsDocument31 pagesCa Final Nov23 Amendmentsswati dubeyNo ratings yet

- Audit Querysheet Format Combined 01-04-2023Document13 pagesAudit Querysheet Format Combined 01-04-2023Tushar AmruskarNo ratings yet

- CA FINAL - Question Bank - Nov 2019 KALPESH CLASSES PDFDocument1,093 pagesCA FINAL - Question Bank - Nov 2019 KALPESH CLASSES PDFparameshwaraNo ratings yet

- Pa 06Document2 pagesPa 06Amutha NagaratnamNo ratings yet

- Bank Audit Sheet ImpDocument3 pagesBank Audit Sheet ImpPULKIT MURARKANo ratings yet

- Types of AssessmentDocument9 pagesTypes of AssessmentRasel AshrafulNo ratings yet

- Disabled Access Credit: General InstructionsDocument2 pagesDisabled Access Credit: General InstructionsIRSNo ratings yet

- DT - Statutory UpdatesDocument6 pagesDT - Statutory UpdatesFtjjhfdNo ratings yet

- Credit Sassion PL PolicyDocument2 pagesCredit Sassion PL PolicyVishal BawaneNo ratings yet

- LimitsDocument9 pagesLimitsNehaNo ratings yet

- DGA Global - Union Budget Analysis - Income TaxDocument16 pagesDGA Global - Union Budget Analysis - Income TaxshwetaNo ratings yet

- Depreciation & Audit of Financial Statements For FY 2014-15 Depreciation & Audit of Financial Statements For FY 2014-15Document62 pagesDepreciation & Audit of Financial Statements For FY 2014-15 Depreciation & Audit of Financial Statements For FY 2014-15Abhishek YadavNo ratings yet

- Moodle Solutions - Ch09Document26 pagesMoodle Solutions - Ch09singhworks.yegNo ratings yet

- Company Audit SumarryDocument4 pagesCompany Audit SumarryAkshra MahajanNo ratings yet

- Satish Pradhan Dnyanasadhana College: Department of BMS Sample MCQ Questions Subject: Indirect TaxDocument5 pagesSatish Pradhan Dnyanasadhana College: Department of BMS Sample MCQ Questions Subject: Indirect TaxSallu SaleemNo ratings yet

- Intermediate Accounting - Impairment of Assets (Pas 36)Document4 pagesIntermediate Accounting - Impairment of Assets (Pas 36)22100629No ratings yet

- RevisionDocument335 pagesRevisionnagababuNo ratings yet

- US Internal Revenue Service: f8830 - 1996Document2 pagesUS Internal Revenue Service: f8830 - 1996IRSNo ratings yet

- US Internal Revenue Service: f8830 - 1993Document2 pagesUS Internal Revenue Service: f8830 - 1993IRSNo ratings yet

- IT II AnswerDocument4 pagesIT II AnswerChandhini RNo ratings yet

- Ca Final LMR - May 2019 PDFDocument335 pagesCa Final LMR - May 2019 PDFDharmesh BohraNo ratings yet

- 8.special Tax Rates of Companies & MATDocument22 pages8.special Tax Rates of Companies & MATMuthu nayagamNo ratings yet

- Net Business IncomeDocument21 pagesNet Business IncomedonawajNo ratings yet

- ASPIRE10.01.2022Document16 pagesASPIRE10.01.2022tushar nathNo ratings yet

- Module 2b Allowance For Bad DebtsDocument14 pagesModule 2b Allowance For Bad DebtsChen HaoNo ratings yet

- Reviewer TaxrevDocument7 pagesReviewer Taxrevlaw.school20240000No ratings yet

- Council General Guidelines, 2008 & DISCIPLINARY MECHANISM NotesDocument3 pagesCouncil General Guidelines, 2008 & DISCIPLINARY MECHANISM NotesVrinda KNo ratings yet

- Annual Declaration of Income Tax For IndividualsDocument3 pagesAnnual Declaration of Income Tax For IndividualsAnna Dominique Gevaña MarmolNo ratings yet

- SPECIALIZEDDocument4 pagesSPECIALIZEDBuenaventura, Elijah B.No ratings yet

- US Internal Revenue Service: f8830 - 1992Document2 pagesUS Internal Revenue Service: f8830 - 1992IRSNo ratings yet

- Crimecheck VariablesDocument7 pagesCrimecheck VariablesRahul JhaNo ratings yet

- Handout Fin Man 2307Document6 pagesHandout Fin Man 2307Renz NgohoNo ratings yet

- Bahasa InggrisDocument7 pagesBahasa InggrisSma Plus Margawati OfficialNo ratings yet

- NETSOL Centralized Cash Dividend Register 31-05-2019 (W) (V8)Document16 pagesNETSOL Centralized Cash Dividend Register 31-05-2019 (W) (V8)Umair IdreesNo ratings yet

- Form Tr.P.A. See Rule 73 (5) (Ii) Application For Transfer of A Permit/countersignatureDocument1 pageForm Tr.P.A. See Rule 73 (5) (Ii) Application For Transfer of A Permit/countersignatureMPSNo ratings yet

- Food-Report Statistics PDFDocument162 pagesFood-Report Statistics PDFТатьяна КасимоваNo ratings yet

- The Importance of Record Keeping PDFDocument2 pagesThe Importance of Record Keeping PDFDavid EdemNo ratings yet

- Opening Doors Protecting Filipino Child WorkersDocument246 pagesOpening Doors Protecting Filipino Child WorkerskasamahumanrightsNo ratings yet

- Motilal Oswal FinancialDocument393 pagesMotilal Oswal FinancialReTHINK INDIANo ratings yet

- Ch. 6 Introduction To Islamic Microeconomics (Fitri Yani Jalil)Document30 pagesCh. 6 Introduction To Islamic Microeconomics (Fitri Yani Jalil)FitriNo ratings yet

- Amazon: Introduction, Background, History & GoodsDocument3 pagesAmazon: Introduction, Background, History & GoodsNguyễn Hoàng TrườngNo ratings yet

- Polo S. Pantaleon vs. American Express International, Inc. G.R. No. 174269Document5 pagesPolo S. Pantaleon vs. American Express International, Inc. G.R. No. 174269robdeqNo ratings yet

- Human Resource Management 751 v1Document313 pagesHuman Resource Management 751 v1Aniff Jenita AJNo ratings yet

- Allied Engineering & Services (PVT.) LTDDocument2 pagesAllied Engineering & Services (PVT.) LTDmuhammad omerNo ratings yet

- Annamalai University: Directorate of Distance EducationDocument449 pagesAnnamalai University: Directorate of Distance EducationKing AdvNo ratings yet

- The Transport and Logistics ClusterDocument33 pagesThe Transport and Logistics Clusterisam mahmoudNo ratings yet

- L040 Manager Structure AttachmentDocument1 pageL040 Manager Structure AttachmentBlakk SkrollzNo ratings yet

- Ajayi, Onikoyi, Babalola & Lateef 2021Document14 pagesAjayi, Onikoyi, Babalola & Lateef 2021Saheed Lateef AdemolaNo ratings yet

- Salonee Chitlangia CVDocument2 pagesSalonee Chitlangia CVRajeev TiwaryNo ratings yet

- Lecture 4 - Project Management IDocument3 pagesLecture 4 - Project Management IcliffNo ratings yet

- Components of A Business PlanDocument3 pagesComponents of A Business Plancandy lollipoNo ratings yet

- Bài tập về nhà Reading chuyên ngànhDocument2 pagesBài tập về nhà Reading chuyên ngànhLê Thủy TiênNo ratings yet

- Borders Group Inc. - S Final Chapter - How A Bookstore Giant FailedDocument80 pagesBorders Group Inc. - S Final Chapter - How A Bookstore Giant FailedRonaldo ConventoNo ratings yet

- Indemnity Bond /: (To Be Printed On A Plain A4 Paper) (Document2 pagesIndemnity Bond /: (To Be Printed On A Plain A4 Paper) (VasanthNo ratings yet

- AFM PPT FinalDocument45 pagesAFM PPT Final0nilNo ratings yet

- Metro HR PoliciesDocument15 pagesMetro HR PoliciesSadeeq KhanNo ratings yet

- (Department/Agency/GOCC) : Annex B Implementation Strategy and Phasing of Devolution Transition ActivitiesDocument3 pages(Department/Agency/GOCC) : Annex B Implementation Strategy and Phasing of Devolution Transition Activitiesmp dcNo ratings yet