Professional Documents

Culture Documents

Elhard Shallo 4601 Logan Way Acworth Ga 30101: Wage and Tax Employee Reference Copy Statement

Elhard Shallo 4601 Logan Way Acworth Ga 30101: Wage and Tax Employee Reference Copy Statement

Uploaded by

elhard shalloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Elhard Shallo 4601 Logan Way Acworth Ga 30101: Wage and Tax Employee Reference Copy Statement

Elhard Shallo 4601 Logan Way Acworth Ga 30101: Wage and Tax Employee Reference Copy Statement

Uploaded by

elhard shalloCopyright:

Available Formats

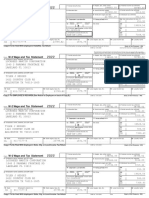

2022 W-2 and EARNINGS SUMMARY

Employee Reference Copy

This blue section is your Earnings Summary which provides more detailed

Wage and Tax

W-2 Statement

Copy C for employee’s records.

2022

OMB No. 1545-0008

information on the generation of your W-2 statement. The reverse side

includes instructions and other general information.

d Control number Dept. Corp. Employer use only

641390 NCN2/BFA BR0009 T EIC 7738

c Employer’s name, address, and ZIP code

LASERSHIP INC

8401 GREENSBORO DRIVE

MCLEAN VA 22102

1. Your Gross Pay was adjusted as follows to produce your W-2 Statement.

Batch #01803

Wages, Tips, other Social Security Medicare GA. State Wages,

e/f Employee’s name, address, and ZIP code Compensation Wages Wages Tips, Etc.

Box 1 of W-2 Box 3 of W-2 Box 5 of W-2 Box 16 of W-2

ELHARD SHALLO

4601 LOGAN WAY Gross Pay 247.50 247.50 247.50 247.50

ACWORTH GA 30101 Reported W-2 Wages 247.50 247.50 247.50 247.50

b Employer’s FED ID number a Employee’s SSA number

54-2015092 XXX-XX-7558

1 Wages, tips, other comp. 2 Federal income tax withheld

247.50

3 Social security wages 4 Social security tax withheld

247.50 15.35

5 Medicare wages and tips 6 Medicare tax withheld

247.50 3.59

7 Social security tips 8 Allocated tips

9 10 Dependent care benefits 2. Employee Name and Address.

11 Nonqualified plans 12a See instructions for box 12

12b

ELHARD SHALLO

14 Other

12c 4601 LOGAN WAY

12d ACWORTH GA 30101

13 Stat emp. Ret. plan 3rd party sick pay

15 State Employer’s state ID no. 16 State wages, tips, etc.

GA 2139395-BY 247.50

17 State income tax 18 Local wages, tips, etc.

.50

19 Local income tax 20 Locality name ¤ 2022 ADP, Inc.

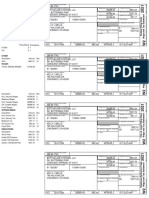

1 Wages, tips, other comp. 2 Federal income tax withheld 1 Wages, tips, other comp. 2 Federal income tax withheld 1 Wages, tips, other comp. 2 Federal income tax withheld

247.50 247.50 247.50

3 Social security wages 4 Social security tax withheld 3 Social security wages 4 Social security tax withheld 3 Social security wages 4 Social security tax withheld

247.50 15.35 247.50 15.35 247.50 15.35

5 Medicare wages and tips 6 Medicare tax withheld 5 Medicare wages and tips 6 Medicare tax withheld 5 Medicare wages and tips 6 Medicare tax withheld

247.50 3.59 247.50 3.59 247.50 3.59

d Control number Dept. Corp. Employer use only d Control number Dept. Corp. Employer use only d Control number Dept. Corp. Employer use only

641390 NCN2/BFA BR0009 T EIC 7738 641390 NCN2/BFA BR0009 T EIC 7738 641390 NCN2/BFA BR0009 T EIC 7738

c Employer’s name, address, and ZIP code c Employer’s name, address, and ZIP code c Employer’s name, address, and ZIP code

LASERSHIP INC LASERSHIP INC LASERSHIP INC

8401 GREENSBORO DRIVE 8401 GREENSBORO DRIVE 8401 GREENSBORO DRIVE

MCLEAN VA 22102 MCLEAN VA 22102 MCLEAN VA 22102

b Employer’s FED ID number a Employee’s SSA number b Employer’s FED ID number a Employee’s SSA number b Employer’s FED ID number a Employee’s SSA number

54-2015092 XXX-XX-7558 54-2015092 XXX-XX-7558 54-2015092 XXX-XX-7558

7 Social security tips 8 Allocated tips 7 Social security tips 8 Allocated tips 7 Social security tips 8 Allocated tips

9 10 Dependent care benefits 9 10 Dependent care benefits 9 10 Dependent care benefits

11 Nonqualified plans 12a See instructions for box 12 11 Nonqualified plans 12a

12 11 Nonqualified plans 12a

14 Other 12b 14 Other 12b 14 Other 12b

12c 12c 12c

12d 12d 12d

13 Stat emp. Ret. plan 3rd party sick pay 13 Stat emp. Ret. plan 3rd party sick pay 13 Stat emp. Ret. plan 3rd party sick pay

e/f Employee’s name, address and ZIP code e/f Employee’s name, address and ZIP code e/f Employee’s name, address and ZIP code

ELHARD SHALLO ELHARD SHALLO ELHARD SHALLO

4601 LOGAN WAY 4601 LOGAN WAY 4601 LOGAN WAY

ACWORTH GA 30101 ACWORTH GA 30101 ACWORTH GA 30101

15 State Employer’s state ID no. 16 State wages, tips, etc. 15 State Employer’s state ID no. 16 State wages, tips, etc. 15 State Employer’s state ID no. 16 State wages, tips, etc.

GA 2139395-BY 247.50 GA 2139395-BY 247.50 GA 2139395-BY 247.50

17 State income tax 18 Local wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 17 State income tax 18 Local wages, tips, etc.

.50 .50 .50

19 Local income tax 20 Locality name 19 Local income tax 20 Locality name 19 Local income tax 20 Locality name

Federal Filing Copy GA.State Reference Copy GA.State Filing Copy

Wage and Tax Wage and Tax Wage and Tax

W-2 Statement

Copy B to be filed with employee’s

OMB

2022 No. 1545-0008

Federal Income Tax Return.

W-2 Statement 2022

OMB No. 1545-0008

Copy 2 to be filed with employee’s State Income Tax Return.

W-2 Statement OMB

2022

Copy 2 to be filed with employee’s State Income Tax Return.

No. 1545-0008

Instructions for Employee However, if you were at least age 50 in 2022, your employer may T—Adoption benefits (not included in box 1). Complete Form 8839, Qualified

have allowed an additional deferral of up to $6,500 ($3,000 for section Adoption Expenses, to figure any taxable and nontaxable amounts.

Box 1. Enter this amount on the wages line of your tax return. 401(k)(11) and 408(p) SIMPLE plans). This additional deferral amount V—Income from exercise of nonstatutory stock option(s) (included in

Box 2. Enter this amount on the federal income tax withheld line of is not subject to the overall limit on elective deferrals. For code G, the boxes 1, 3 (up to the social security wage base), and 5). See Pub. 525,

your tax return. limit on elective deferrals may be higher for the last 3 years before you Taxable and Nontaxable Income, for reporting requirements.

Box 5. You may be required to report this amount on Form 8959, reach retirement age. Contact your plan administrator for more W—Employer contributions (including amounts the employee elected to

Additional Medicare Tax. See the Form 1040 instructions to information. Amounts in excess of the overall elective deferral limit must contribute using a section 125 (cafeteria) plan) to your health savings

determine if you are required to complete Form 8959. be included in income. See the Form 1040 instructions. account. Report on Form 8889, Health Savings Accounts (HSAs).

Box 6. This amount includes the 1.45% Medicare Tax withheld on all Note: If a year follows code D through H, S, Y, AA, BB, or EE, you Y—Deferrals under a section 409A nonqualified deferred compensation plan

Medicare wages and tips shown in box 5, as well as the 0.9% made a make-up pension contribution for a prior year(s) when you were Z—Income under a nonqualified deferred compensation plan that fails to

Additional Medicare Tax on any of those Medicare wages and tips in military service. To figure whether you made excess deferrals, satisfy section 409A. This amount is also included in box 1. It is subject

above $200,000. consider these amounts for the year shown, not the current year. If no to an additional 20% tax plus interest. See the Form 1040 instructions.

Box 8. This amount is not included in box 1, 3, 5, or 7. For year is shown, the contributions are for the current year. AA—Designated Roth contributions under a section 401(k) plan

information on how to report tips on your tax return, see the Form A—Uncollected social security or RRTA tax on tips. Include this tax on BB—Designated Roth contributions under a section 403(b) plan

1040 instructions. Form 1040 or 1040-SR. See the Form 1040 instructions.

DD—Cost of employer-sponsored health coverage. The amount

You must file Form 4137, Social Security and Medicare Tax on B—Uncollected Medicare tax on tips. Include this tax on Form 1040 or reported with code DD is not taxable.

Unreported Tip Income, with your income tax return to report at least 1040-SR. See the Form 1040 instructions.

EE—Designated Roth contributions under a governmental section

the allocated tip amount unless you can prove with adequate records C—Taxable cost of group-term life insurance over $50,000 (included in 457(b) plan. This amount does not apply to contributions under a

that you received a smaller amount. If you have records that show boxes 1, 3 (up to the social security wage base), and 5) tax-exempt organization section 457(b) plan.

the actual amount of tips you received, report that amount even if it D—Elective deferrals to a section 401(k) cash or deferred arrangement.

is more or less than the allocated tips. Use Form 4137 to figure the FF—Permitted benefits under a qualified small employer health

Also includes deferrals under a SIMPLE retirement account that is part reimbursement arrangement

social security and Medicare tax owed on tips you didn’t report to of a section 401(k) arrangement.

your employer. Enter this amount on the wages line of your tax GG—Income from qualified equity grants under section 83(i)

return. By filing Form 4137, your social security tips will be credited E—Elective deferrals under a section 403(b) salary reduction agreement HH—Aggregate deferrals under section 83(i) elections as of the close

to your social security record (used to figure your benefits). F—Elective deferrals under a section 408(k)(6) salary reduction SEP of the calendar year

Box 10. This amount includes the total dependent care benefits that G—Elective deferrals and employer contributions (including nonelective Box 13. If the “Retirement plan” box is checked, special limits may apply

your employer paid to you or incurred on your behalf (including deferrals) to a section 457(b) deferred compensation plan to the amount of traditional IRA contributions you may deduct. See Pub.

amounts from a section 125 (cafeteria) plan). Any amount over your H—Elective deferrals to a section 501(c)(18)(D) tax-exempt 590-A, Contributions to Individual Retirement Arrangements (IRAs).

employer’s plan limit is also included in box 1. See Form 2441. organization plan. See the Form 1040 instructions for how to deduct. Box 14. Employers may use this box to report information such as

Box 11. This amount is (a) reported in box 1 if it is a distribution J—Nontaxable sick pay (information only, not included in box 1, 3, or 5) state disability insurance taxes withheld, union dues, uniform payments,

made to you from a nonqualified deferred compensation or K—20% excise tax on excess golden parachute payments. See the health insurance premiums deducted, nontaxable income, educational

nongovernmental section 457(b) plan, or (b) included in box 3 and/or Form 1040 instructions. assistance payments, or a member of the clergy’s parsonage allowance

box 5 if it is a prior year deferral under a nonqualified or section and utilities. Railroad employers use this box to report railroad

457(b) plan that became taxable for social security and Medicare L—Substantiated employee business expense reimbursements retirement (RRTA) compensation, Tier 1 tax, Tier 2 tax, Medicare tax,

taxes this year because there is no longer a substantial risk of (nontaxable) and Additional Medicare Tax. Include tips reported by the employee to

forfeiture of your right to the deferred amount. This box shouldn’t be M—Uncollected social security or RRTA tax on taxable cost of the employer in railroad retirement (RRTA) compensation.

used if you had a deferral and a distribution in the same calendar group-term life insurance over $50,000 (former employees only). See Note: Keep Copy C of Form W-2 for at least 3 years after the due date

year. If you made a deferral and received a distribution in the same the Form 1040 instructions. for filing your income tax return. However, to help protect your social

calendar year, and you are or will be age 62 by the end of the N—Uncollected Medicare tax on taxable cost of group-term life security benefits, keep Copy C until you begin receiving social

calendar year, your employer should file Form SSA-131, Employer insurance over $50,000 (former employees only). See the Form 1040 security benefits, just in case there is a question about your work

Report of Special Wage Payments, with the Social Security instructions. record and/or earnings in a particular year.

Administration and give you a copy. P—Excludable moving expense reimbursements paid directly to a

Box 12. The following list explains the codes shown in box 12. You member of the U.S. Armed Forces (not included in box 1, 3, or 5)

may need this information to complete your tax return. Elective Q—Nontaxable combat pay. See the Form 1040 instructions for details

deferrals (codes D, E, F, and S) and designated Roth contributions on reporting this amount.

(codes AA, BB, and EE) under all plans are generally limited to a R—Employer contributions to your Archer MSA. Report on Form 8853,

total of $20,500 ($14,000 if you only have SIMPLE plans; $23,500 Archer MSAs and Long-Term Care Insurance Contracts.

for section 403(b) plans if you qualify for the 15-year rule explained

in Pub. 571). Deferrals under code G are limited to $20,500. S—Employee salary reduction contributions under a section 408(p)

Deferrals under code H are limited to $7,000. SIMPLE plan (not included in box 1)

Department of the Treasury - Internal Revenue Service

NOTE: THESE ARE SUBSTITUTE WAGE AND TAX STATEMENTS AND ARE ACCEPTABLE FOR FILING WITH YOUR FEDERAL, STATE AND LOCAL/CITY INCOME TAX RETURNS.

This information is being furnished to the Internal

Revenue Service. If you are required to file a tax Notice to Employee

return, a negligence penalty or other sanction may

be imposed on you if this income is taxable and Do you have to file? Refer to the Form 1040 instructions Corrections. If your name, SSN, or address is incorrect,

you fail to report it. correct Copies B, C, and 2 and ask your employer to

to determine if you are required to file a tax return. Even if

you don’t have to file a tax return, you may be eligible for correct your employment record. Be sure to ask the

IMPORTANT NOTE:

a refund if box 2 shows an amount or if you are eligible for employer to file Form W-2c, Corrected Wage and Tax

In order to insure efficient processing,

any credit. Statement, with the SSA to correct any name, SSN, or

attach this W-2 to your tax return like this

money amount error reported to the SSA on Form W-2. Be

(following agency instructions): Earned income credit (EIC). You may be able to take the

sure to get your copies of Form W-2c from your employer

EIC for 2022 if your adjusted gross income (AGI) is less

for all corrections made so you may file them with your tax

than a certain amount. The amount of the credit is based

return. If your name and SSN are correct but aren’t the

on income and family size. Workers without children could

same as shown on your social security card, you should

qualify for a smaller credit. You and any qualifying children

ask for a new card that displays your correct name at any

must have valid social security numbers (SSNs). You can’t

SSA office or by calling 800-772-1213. You may also visit

take the EIC if your investment income is more than the

the SSA website at www.SSA.gov.

TAX RETURN specified amount for 2022 or if income is earned for

services provided while you were an inmate at a penal Cost of employer-sponsored health coverage (if such

institution. For 2022 income limits and more information, cost is provided by the employer). The reporting in box

visit www.irs.gov/EITC. See also Pub. 596, Earned Income 12, using code DD, of the cost of employer-sponsored

THIS Credit. Any EIC that is more than your tax liability is health coverage is for your information only. The amount

OTHER refunded to you, but only if you file a tax return. reported with code DD is not taxable.

FORM

W-2’S Credit for excess taxes. If you had more than one

W-2 Employee’s social security number (SSN). For your

protection, this form may show only the last four digits of employer in 2022 and more than $9,114 in social

your SSN. However, your employer has reported your security and/or Tier 1 railroad retirement (RRTA) taxes

complete SSN to the IRS and the Social Security were withheld, you may be able to claim a credit for the

Administration (SSA). excess against your federal income tax. See the Form

1040 instructions. If you had more than one railroad

Clergy and religious workers. If you aren’t subject to employer and more than $5,350.80 in Tier 2 RRTA tax

social security and Medicare taxes, see Pub. 517, Social was withheld, you may be able to claim a refund on

Security and Other Information for Members of the Clergy Form 843. See the Instructions for Form 843.

and Religious Workers.

Department of the Treasury - Internal Revenue Service Department of the Treasury - Internal Revenue Service Department of the Treasury - Internal Revenue Service

You might also like

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnmaliktaimoorsurahNo ratings yet

- Statement For 2021Document2 pagesStatement For 2021seguins0% (1)

- Taxes Made Simple Income Taxes Explained in 100 Pages or Less (Mike Piper) PDFDocument131 pagesTaxes Made Simple Income Taxes Explained in 100 Pages or Less (Mike Piper) PDFRiley Escobar0% (1)

- Notice To Employee: WWW - Irs.gov/efileDocument2 pagesNotice To Employee: WWW - Irs.gov/efileRODRIGO GRIJALBA CABREJOSNo ratings yet

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Document2 pagesSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNo ratings yet

- Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691 Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691Document2 pagesSebastian Desmond PO BOX 1717 West Sacramento Ca 95691 Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691Deborah Beth DarlingNo ratings yet

- Think Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Document1 pageThink Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Humayon MalekNo ratings yet

- 9YWwhh55h5384810244629010109102 PDFDocument2 pages9YWwhh55h5384810244629010109102 PDFDave Yerznkyan100% (1)

- 20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeDocument2 pages20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeWillie Davis0% (1)

- Camilla Herrera W-2 2022Document1 pageCamilla Herrera W-2 2022Camila HerreraNo ratings yet

- Return Postage Guaranteed: Employee Reference Copy Wage and Tax StatementDocument2 pagesReturn Postage Guaranteed: Employee Reference Copy Wage and Tax StatementEvelin De NunezNo ratings yet

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceDocument2 pagesW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceJunk BoxNo ratings yet

- 2022 TaxReturn-1Document7 pages2022 TaxReturn-1Hengki Yono100% (3)

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturntabithaNo ratings yet

- PPDocument2 pagesPPSNG RYKNo ratings yet

- TGDocument2 pagesTGpr995No ratings yet

- Wage and Tax Statement: Copy C-For Employee'S RecordsDocument1 pageWage and Tax Statement: Copy C-For Employee'S RecordslidiaNo ratings yet

- TaxForms PDFDocument2 pagesTaxForms PDFLMN214100% (1)

- W2 FinalDocument1 pageW2 FinalWaqar Hussain100% (1)

- Ajax PDFDocument2 pagesAjax PDFGeorge AndoneNo ratings yet

- Maria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 07712Document2 pagesMaria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 0771216baezmcNo ratings yet

- Wage and Tax Employee Reference Copy Statement: Gross Pay Other Cafe 125Document2 pagesWage and Tax Employee Reference Copy Statement: Gross Pay Other Cafe 125rachel sanchezNo ratings yet

- W2 W2taxdocument 2023Document3 pagesW2 W2taxdocument 2023sywwvpdnp7No ratings yet

- AjaxDocument2 pagesAjaxaccount.enquiry6770No ratings yet

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- Anil Gupta 2021 w2Document2 pagesAnil Gupta 2021 w2Kawljeet Singh KohliNo ratings yet

- W2 PreviewDocument1 pageW2 Previewmrs merle westonNo ratings yet

- TWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772Document2 pagesTWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772sana shahidNo ratings yet

- 20212Document2 pages20212carriemccabeNo ratings yet

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptDocument2 pagesKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1No ratings yet

- Print PreviewDocument4 pagesPrint PreviewDerrin Lee100% (1)

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- IRS Form W2Document1 pageIRS Form W2nurulamin00023No ratings yet

- Filename PDFDocument3 pagesFilename PDFIvette PizarroNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document4 pagesWage and Tax Statement: OMB No. 1545-0008jgoldson235No ratings yet

- W 2Document3 pagesW 2Bar ChenNo ratings yet

- 623 Cce 3 BD 2 FB 0Document1 page623 Cce 3 BD 2 FB 0mondol miaNo ratings yet

- form-w2-Ramona-Crawford 2Document9 pagesform-w2-Ramona-Crawford 2Nicole CarutherNo ratings yet

- Ralston Medina W2Document2 pagesRalston Medina W2bussinesl las100% (1)

- 0ZB43 0ZB44 1837 20200101 W2Report W2Report 001Document2 pages0ZB43 0ZB44 1837 20200101 W2Report W2Report 001Ian CabanillasNo ratings yet

- Matthew Wozniak W2 2021 W2 202233131923Document3 pagesMatthew Wozniak W2 2021 W2 202233131923MwNo ratings yet

- 2021 w2Document1 page2021 w2Candy ValentineNo ratings yet

- W-2 Wage and Tax Statement: I I I IDocument1 pageW-2 Wage and Tax Statement: I I I Imichelle analieNo ratings yet

- Omb No. 1545-0008 Omb No. 1545-0008Document2 pagesOmb No. 1545-0008 Omb No. 1545-0008Luke NyeNo ratings yet

- Square 2022 W-2Document2 pagesSquare 2022 W-2Zane CardinalNo ratings yet

- STF 2023-03-20 1679339081483Document4 pagesSTF 2023-03-20 1679339081483ayogboloNo ratings yet

- 2022 46-1240832 XXX-XX-8976 1410.00: CORRECTED (If Checked)Document2 pages2022 46-1240832 XXX-XX-8976 1410.00: CORRECTED (If Checked)Minerva BetancourtNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document7 pagesWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINANo ratings yet

- Ioana w2 PDFDocument1 pageIoana w2 PDFBlueberry13KissesNo ratings yet

- Tax Return 2021Document4 pagesTax Return 2021Adam Clifton100% (4)

- Reissued Statement Reissued Statement: OMB No. 1545-0008 OMB No. 1545-0008Document1 pageReissued Statement Reissued Statement: OMB No. 1545-0008 OMB No. 1545-0008Sadiki LuhandeNo ratings yet

- FTF 2023-03-20 1679339077907Document15 pagesFTF 2023-03-20 1679339077907ayogbolo100% (1)

- PDF DocumentDocument1 pagePDF DocumentAngelo DiloneNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Return7cf42b5d98No ratings yet

- w-2 2019 Form - LOUISA - BOKACHEVADocument1 pagew-2 2019 Form - LOUISA - BOKACHEVAKeller Brown JnrNo ratings yet

- 2018 Xiaohe Huang Tax ReturnDocument48 pages2018 Xiaohe Huang Tax ReturnKaren Xie100% (2)

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09rose ownes100% (2)

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocument3 pagesWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atcofi kenteNo ratings yet

- W2 & Earnings: Kelly L WellsDocument5 pagesW2 & Earnings: Kelly L Wellshala100% (1)

- Procoleman, Tia: Tia Coleman 820 Fotis DR Unit 2 Dekalb, Il 60115Document2 pagesProcoleman, Tia: Tia Coleman 820 Fotis DR Unit 2 Dekalb, Il 60115Myt WovenNo ratings yet

- 5 MTihh 4271 H 1914120242901191102202Document2 pages5 MTihh 4271 H 1914120242901191102202elena.69.mxNo ratings yet

- Timothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052Document2 pagesTimothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052TJ JanssenNo ratings yet

- Update Now: Dear CustomerDocument1 pageUpdate Now: Dear CustomerHengki YonoNo ratings yet

- Loan Agreement PDFDocument9 pagesLoan Agreement PDFHengki YonoNo ratings yet

- Dixo2460 19i FCDocument32 pagesDixo2460 19i FCHengki Yono100% (1)

- CaseID #175864Document1 pageCaseID #175864Hengki YonoNo ratings yet

- C.Lund Employment AppDocument3 pagesC.Lund Employment AppHengki YonoNo ratings yet

- Keith Maydak v. Seafirst, 108 F.3d 338, 1st Cir. (1997)Document3 pagesKeith Maydak v. Seafirst, 108 F.3d 338, 1st Cir. (1997)Scribd Government DocsNo ratings yet

- Secretary of Justice vs. Lantion 343 Scra 377Document1 pageSecretary of Justice vs. Lantion 343 Scra 377Georgette V. SalinasNo ratings yet

- Loloee Request To Seal DocumentsDocument4 pagesLoloee Request To Seal DocumentsKristin LamNo ratings yet

- Reyna v. Ledezma, 10th Cir. (2011)Document4 pagesReyna v. Ledezma, 10th Cir. (2011)Scribd Government DocsNo ratings yet

- Contador - Julgado Sobre o EB2-NIWDocument4 pagesContador - Julgado Sobre o EB2-NIWmceliargNo ratings yet

- King v. Corrections Corporation of America Et Al - Document No. 11Document2 pagesKing v. Corrections Corporation of America Et Al - Document No. 11Justia.comNo ratings yet

- DeFunis V OdegaardDocument1 pageDeFunis V OdegaardDennis SalemNo ratings yet

- UnpublishedDocument5 pagesUnpublishedScribd Government DocsNo ratings yet

- Coulthrust v. Wells, 10th Cir. (2007)Document5 pagesCoulthrust v. Wells, 10th Cir. (2007)Scribd Government DocsNo ratings yet

- Novak v. Overture Services, Inc. Et Al - Document No. 65Document1 pageNovak v. Overture Services, Inc. Et Al - Document No. 65Justia.comNo ratings yet

- Lascona Land Co., Inc. vs. CIR, G.R. No. 171251, March 5, 2012 DoctrineDocument1 pageLascona Land Co., Inc. vs. CIR, G.R. No. 171251, March 5, 2012 DoctrineHoreb FelixNo ratings yet

- Texas Trading & Milling Corp. v. Federal Republic of NigeriaDocument2 pagesTexas Trading & Milling Corp. v. Federal Republic of NigeriacrlstinaaaNo ratings yet

- United States v. Ward, 4th Cir. (2002)Document3 pagesUnited States v. Ward, 4th Cir. (2002)Scribd Government DocsNo ratings yet

- Nixon v. Crim - Document No. 7Document4 pagesNixon v. Crim - Document No. 7Justia.comNo ratings yet

- Ray Marshall, Secretary of Labor, Etc. v. Erin Food Services, Inc., D/B/A Burger King, and David W. Murray, 672 F.2d 229, 1st Cir. (1982)Document4 pagesRay Marshall, Secretary of Labor, Etc. v. Erin Food Services, Inc., D/B/A Burger King, and David W. Murray, 672 F.2d 229, 1st Cir. (1982)Scribd Government DocsNo ratings yet

- Antipolo V ZapantaDocument1 pageAntipolo V ZapantaEsp BsbNo ratings yet

- PC Statement Jorge CarvalhoDocument2 pagesPC Statement Jorge CarvalhoIan FroebNo ratings yet

- United States Court of Appeals, Third CircuitDocument12 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Dollree Mapp V Ohio Case SummaryDocument3 pagesDollree Mapp V Ohio Case SummaryPATRICK OTIATONo ratings yet

- Federal Judge Rules Against University of Nebraska Lincoln InstructorDocument46 pagesFederal Judge Rules Against University of Nebraska Lincoln InstructorThe College Fix100% (1)

- Hugo E. Ribadeneira, Cross-Appellee v. Director of Taxation, Department of Revenue, State of Kansas, 161 F.3d 18, 10th Cir. (1998)Document3 pagesHugo E. Ribadeneira, Cross-Appellee v. Director of Taxation, Department of Revenue, State of Kansas, 161 F.3d 18, 10th Cir. (1998)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument2 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- United States v. Garfield Campbell, 4th Cir. (2012)Document4 pagesUnited States v. Garfield Campbell, 4th Cir. (2012)Scribd Government DocsNo ratings yet

- Assignment 8 Tejaswi Rupakula Campbellsville University Cyber Law Bruce SingletonDocument3 pagesAssignment 8 Tejaswi Rupakula Campbellsville University Cyber Law Bruce SingletonKashyap ChintuNo ratings yet

- Guillermo Napoleon Lopez Order For Emergency SuspensionDocument2 pagesGuillermo Napoleon Lopez Order For Emergency SuspensionThe Straw BuyerNo ratings yet

- Filed: Patrick FisherDocument4 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Notice of Appeal in The TJ HS Admissions CaseDocument2 pagesNotice of Appeal in The TJ HS Admissions CaseABC7NewsNo ratings yet

- United States v. Chewey, 10th Cir. (2002)Document3 pagesUnited States v. Chewey, 10th Cir. (2002)Scribd Government DocsNo ratings yet

- Kesha AppealDocument5 pagesKesha AppealMarkAReaganNo ratings yet