Professional Documents

Culture Documents

Compensation Table

Uploaded by

Joy Villaruel0 ratings0% found this document useful (0 votes)

9 views1 pageThe document contains a compensation table that lists various positions, monthly salaries, employee deductions for SSS, Pag-ibig, Philhealth and taxes, net pay, and 13 months' pay. It also details that salaries will be given in cash bi-monthly on the 15th and 30th along with pay slips noting any additions or deductions. Computation of salaries is based on daily attendance records, while tardiness is deducted based on hourly rates and minutes late, and absences are deducted as hourly rates times 8 hours times days absent.

Original Description:

Original Title

COMPENSATION TABLE

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains a compensation table that lists various positions, monthly salaries, employee deductions for SSS, Pag-ibig, Philhealth and taxes, net pay, and 13 months' pay. It also details that salaries will be given in cash bi-monthly on the 15th and 30th along with pay slips noting any additions or deductions. Computation of salaries is based on daily attendance records, while tardiness is deducted based on hourly rates and minutes late, and absences are deducted as hourly rates times 8 hours times days absent.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageCompensation Table

Uploaded by

Joy VillaruelThe document contains a compensation table that lists various positions, monthly salaries, employee deductions for SSS, Pag-ibig, Philhealth and taxes, net pay, and 13 months' pay. It also details that salaries will be given in cash bi-monthly on the 15th and 30th along with pay slips noting any additions or deductions. Computation of salaries is based on daily attendance records, while tardiness is deducted based on hourly rates and minutes late, and absences are deducted as hourly rates times 8 hours times days absent.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

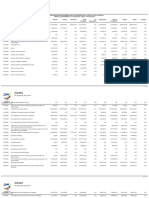

COMPENSATION TABLE

Position Monthly Employee Deduction Net Pay 13 months’ Pay

Salary

SSS Pag- Philhealth Taxable

big (2%) Income

Manager 40,000.00 900.00 150.00 800.00 2,738.40 34,911.60 40,000.00

Cook 30,000.00 900.00 150.00 600.00 1,056.30 26,818.70 30,000.00

Sales Staff 20,000.00 900.00 150.00 400.00 0 18,550.00 20,000.00

Barista 20,000.00 900.00 150.00 400.00 0 18,550.00 20,000.00

Waiter Staff 18,000.00 810.00 150.00 360.00 0 16,685.00 18,000.00

Cleaning 15,000.00 675.00 150.00 300.00 0 13,887.50 15,000.00

Staff

Kitchen 18,000.00 810.00 150.00 360.00 0 16,685.00 18,000.00

Assistant

Delivery 20,000.00 900.00 150.00 400.00 0 18,550.00 20,000.00

Personnel

Salaries will be given every 15th and 30th day of the month in cash rather than bank transfer in

order to ensure that the employees are compensated on time. The pay slip will be given together with

their salaries for transparency. Any additions such as overtime pay, along with deductions from tax,

tardiness, and absences will be noted in the pay slip.

The computation of their salaries will be based on their days of work attendance from the Daily

Time Record.

Computation of Tardiness and Absences:

Late deduction = (Hourly rate x total nos. of hours)

Late deduction = (Hourly rate /60 minutes) x total nos. of minutes late

Absences deduction = (Hourly rate x 8 hours x total nos. of days absent)

You might also like

- Makauno Co.: Semi-Monthly Payroll August 1-15, 2020Document11 pagesMakauno Co.: Semi-Monthly Payroll August 1-15, 2020Chincel G. ANINo ratings yet

- Sify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113Document1 pageSify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113JOOOOONo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Payslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)praveen kumarNo ratings yet

- UntitledDocument13 pagesUntitledAnne GuamosNo ratings yet

- April2018 PDFDocument1 pageApril2018 PDFomkassNo ratings yet

- March 2019Document1 pageMarch 2019Anonymous 2uvubjzzNo ratings yet

- June Salry PDFDocument1 pageJune Salry PDFomkassNo ratings yet

- May Salary PDFDocument1 pageMay Salary PDFomkassNo ratings yet

- SalarySlip - (1001) - 6 - 2019 (1) - MergedDocument18 pagesSalarySlip - (1001) - 6 - 2019 (1) - MergedLaavanyah ManimaranNo ratings yet

- SSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077Document29 pagesSSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077samNo ratings yet

- Payslip 2019 2020 5 2380 SVATANTRADocument1 pagePayslip 2019 2020 5 2380 SVATANTRAsunil.srfcNo ratings yet

- Payroll AccountingDocument26 pagesPayroll AccountingShean VasilićNo ratings yet

- Salary ScheduleDocument3 pagesSalary ScheduleNikka AnastacioNo ratings yet

- Payroll FresnozaDocument3 pagesPayroll FresnozaAna Marie FresnozaNo ratings yet

- Rosas Payroll CalculatorDocument15 pagesRosas Payroll Calculatoracctg2012No ratings yet

- Payroll Accounting & Other Selected TransactionDocument29 pagesPayroll Accounting & Other Selected TransactionParamorfsNo ratings yet

- Rate Gross Annual Pay Daily Monthly Monthly Basic PayDocument8 pagesRate Gross Annual Pay Daily Monthly Monthly Basic PayNiña PacoNo ratings yet

- Calculo IrDocument5 pagesCalculo IrLesbia Reyes MontesNo ratings yet

- Schedule 28 - PAYROLL Employer's Contribution Employee's ContributionDocument1 pageSchedule 28 - PAYROLL Employer's Contribution Employee's ContributionHaideBrocalesNo ratings yet

- PAYSLIPDocument1 pagePAYSLIPsandeepNo ratings yet

- Achas, Ashley - Chapter 2 Assignment 1Document8 pagesAchas, Ashley - Chapter 2 Assignment 1Gwen Stefani DaugdaugNo ratings yet

- RandomDocument80 pagesRandomAngel Lalezka CablingNo ratings yet

- Partnership OperationsDocument9 pagesPartnership OperationsJay Mark Marcial JosolNo ratings yet

- Palbot's Barber Shop Income Statement For The Year EndedDocument21 pagesPalbot's Barber Shop Income Statement For The Year EndedCocoy Llamas HernandezNo ratings yet

- H61M VG4Document10 pagesH61M VG4Eliezer SarmientoNo ratings yet

- Payslip 2018 2019 3 2380 SVATANTRADocument1 pagePayslip 2018 2019 3 2380 SVATANTRAsunil.srfcNo ratings yet

- SamplePayroll Processing and Withholding Tax On CompensationDocument2 pagesSamplePayroll Processing and Withholding Tax On CompensationReinalyn De VeraNo ratings yet

- Individual Income TaxationDocument8 pagesIndividual Income TaxationMarirose Sheena DomingoNo ratings yet

- Business-Plan Final WorksheetDocument43 pagesBusiness-Plan Final WorksheetKrishia Belacsi BajanaNo ratings yet

- ProposalDocument6 pagesProposaldavida rustonNo ratings yet

- Arindam 2023Document1 pageArindam 2023Anupam DasNo ratings yet

- Calculo Rta 5ta 2020Document12 pagesCalculo Rta 5ta 2020CARLOS DANIEL ARELLANO SOLANONo ratings yet

- SULITASDocument3 pagesSULITASAlvin LuisaNo ratings yet

- CINSP Salary Adjustments 2016-2019Document2 pagesCINSP Salary Adjustments 2016-2019Rowena FelloganNo ratings yet

- Ea 14Document4 pagesEa 14Nicole BatoyNo ratings yet

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahNo ratings yet

- Part 2 CalculationDocument5 pagesPart 2 CalculationAríesNo ratings yet

- Principles of Taxation Solution # 3: Ans: 1 Year 1 Description Rs. Rs. Basic SalaryDocument7 pagesPrinciples of Taxation Solution # 3: Ans: 1 Year 1 Description Rs. Rs. Basic SalaryWarriach WarriachNo ratings yet

- Sample Exam - 2018 Answer KeyDocument23 pagesSample Exam - 2018 Answer KeyCharity Lumactod AlangcasNo ratings yet

- Projected Revenues & ExpensesDocument23 pagesProjected Revenues & Expenseslagria jeanNo ratings yet

- Accrued Liabilities: Problem 3-1 (AICPA Adapted)Document15 pagesAccrued Liabilities: Problem 3-1 (AICPA Adapted)Nila FranciaNo ratings yet

- Gross Profit For The Year 2021-2023Document6 pagesGross Profit For The Year 2021-2023Beverly DatuNo ratings yet

- Flexible Budget Healthy Hospital STDNTDocument4 pagesFlexible Budget Healthy Hospital STDNTFalguni ShomeNo ratings yet

- Rincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2015Document2 pagesRincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2015mashudiNo ratings yet

- Harry Carryout StoresDocument2 pagesHarry Carryout StoresDaniel John LegaspiNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- Financial Status of TSP Model: IncomeDocument4 pagesFinancial Status of TSP Model: Incomeaquash16scribdNo ratings yet

- PPH 21 (Income Tax) Calculation - Gross Up Method: IdentitasDocument2 pagesPPH 21 (Income Tax) Calculation - Gross Up Method: IdentitasDahliana MansyahNo ratings yet

- Compensation Income - (250,000 - 400,000) : Dazai OsamuDocument5 pagesCompensation Income - (250,000 - 400,000) : Dazai OsamuGideon Tangan Ines Jr.No ratings yet

- Section Vi: Financial A. Financial ForecastDocument4 pagesSection Vi: Financial A. Financial ForecastYna mae BonsolNo ratings yet

- Division of ProfitsDocument55 pagesDivision of ProfitsMichole chin MallariNo ratings yet

- Little Master Auto Components PVT LTD Address: Plot No: 3 & 6 WMDC Industrial Area, Ambethan Road ChakanDocument4 pagesLittle Master Auto Components PVT LTD Address: Plot No: 3 & 6 WMDC Industrial Area, Ambethan Road ChakanYogesh DeshmukhNo ratings yet

- Proposed Budget of SHARAN: For The Year 2019Document3 pagesProposed Budget of SHARAN: For The Year 2019GREEN COMPUTERNo ratings yet

- Book 1Document7 pagesBook 1kamal royNo ratings yet

- Social Security System: Collection List Summary For The Month of June 2018Document2 pagesSocial Security System: Collection List Summary For The Month of June 2018Anonymous yIFv8NHHnNo ratings yet

- Social Security System: Collection List Summary For The Month of July 2018Document2 pagesSocial Security System: Collection List Summary For The Month of July 2018Haponesa NinzNo ratings yet

- Income Taxation Answer ExamDocument5 pagesIncome Taxation Answer Examyezaquera100% (1)

- Cost of Revenue Operating Expenses Research & Development Sales, General and Admin Add Income/expense ItemsDocument1 pageCost of Revenue Operating Expenses Research & Development Sales, General and Admin Add Income/expense ItemsMerlene CastilloNo ratings yet