Professional Documents

Culture Documents

Diff CA Vs FA

Uploaded by

ks2699100Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Diff CA Vs FA

Uploaded by

ks2699100Copyright:

Available Formats

1.

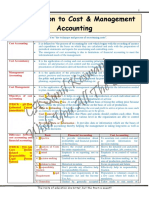

18 COST ACCOUNTING

Distinction between Financial Accounting and CoRs

Accounting

Basis Financial Accounting Cost Accounting

Toascertain profit or loss and To provide information to

1.Objective financial position of the the management for

business. proper planning, control

and decision making

relating to costs.

2. Scope It covers both operating and It covers only operating

non-operating activities. activities.

3. Unit of Only transactions which can |Along with money value,

non-monetary units like

Measurement be measured in monetary

terms are recorded.

No of Units/ Hours etc.

are also recorded.

4. Format of reports Reports are prepared in Formáts of Cost Audit

of registered accordance with the formats report are provided under

Companies provided in Schedule ll ofrespective Cost Records

and Audit 2019.

Companies Act , 2013.

Reports are meant only

5. User groups Reports are prepared mainly for use by internal

for external users for their management for proper

decision making. ThÍse planning control and|

reports are published. decision making. These

reports are not published.

6. Control It is used only for recording It uses techniques for

data and provides reports controlling costs like

without attaching any inventory control,

budgetary control and

importance to control. standard costing etc.

7. Periodicity of Financial statements are Cost Accounting is

reporting prepared normally at the end| prepared for management

of the financial year. depending upon their

requirements i.e. hourty.

daily, weekly, monthly.

quarterly or on a yearly

basis.

INTRODUCTION 1.19

Basis Financial Accounting Cost Accounting

8. Unit of study Financial Accounting regards Under Cost Accounting a

the overall entity as a unit of comprehensive analysis is

study i.e. it follows a macrol done for various segments

approach. of the organisation such

as product wise,

department wise, function

wise, prOcess wise etc. It

followsa micro approach.

9. Classification Classification of revenue and| While preparing cost

of revenue and expenses are done as per sheet, clear and distinct

expenses the guidelines provided in classification of various

Schedule of the types of costs is done

Companies Act, 2013. under some rational basis.

10. Statutory Financial accounting is It is voluntary except in

requirements obligatory under Companies case of certain industries

Act and Income Tax Act. where it is mandatory to

maintain cost acCOunts

under Companies Act.

recorded on a

Costs are recorded on anl Costs are

11. Types of aggregate basisin financiall unit basis in cost

costs accounts.

accounts.

on historical

12. Basis of It is based on historical costs. It is based

Preparation costs as well as on pre

determined estimated

COsts.

at cost

13. Valuation of Stock is valued At Cost orl Stock is valued

Net Realisable Value, price.

stock

whichever is lower.

14.Information on Efficiencies of workers/Plant Cost Accounts provide

& Machinery etc. cannot be information on the

Efficiency efficiencies of workers,

reflected in Financiall

Plant & Machinery,

Accounting.

product lines or divisions.

You might also like

- Dmgt202 Cost and Management AccountingDocument269 pagesDmgt202 Cost and Management AccountingRoaster 2100% (2)

- Difference Between Cost Accounting and Financial AccountingDocument3 pagesDifference Between Cost Accounting and Financial AccountingabdulrehmanNo ratings yet

- Cost AccountingDocument201 pagesCost AccountingMikhil Pranay Singh100% (4)

- L2 Management AccountingDocument23 pagesL2 Management Accountingvidisha sharmaNo ratings yet

- Cost SheetDocument14 pagesCost Sheettanbir singhNo ratings yet

- Introduction to Cost Accounting BasicsDocument24 pagesIntroduction to Cost Accounting BasicsAnushka Chouhan100% (3)

- Cost AccountingDocument19 pagesCost AccountingJoseph Anbarasu89% (9)

- Cost Accounting-Task No. 1Document11 pagesCost Accounting-Task No. 1Aguilar Desirie P.No ratings yet

- Cost AccountingDocument117 pagesCost AccountingSIKANDARR GAMING YTNo ratings yet

- Summary Theory - Costing PDFDocument66 pagesSummary Theory - Costing PDFartizutshiNo ratings yet

- Sma Anwer KeyDocument9 pagesSma Anwer Keysrinivas kanakalaNo ratings yet

- Unit 1Document134 pagesUnit 1Laxmi Rajput100% (3)

- Difference Between FA, CA - MADocument9 pagesDifference Between FA, CA - MARishabh MehtaNo ratings yet

- Ca - Unit 1Document22 pagesCa - Unit 1SHANMUGHA SHETTY S SNo ratings yet

- Marginal & Variable Costs ExplainedDocument10 pagesMarginal & Variable Costs ExplainedMohammad Adil ChoudharyNo ratings yet

- Cost Accountancy Summary - 2019Document68 pagesCost Accountancy Summary - 2019K BNo ratings yet

- Basic Concepts in Accounting: AbstractDocument7 pagesBasic Concepts in Accounting: AbstractinChristVeluz AgeasNo ratings yet

- Cost Accounting Study MaterialDocument188 pagesCost Accounting Study Materialpdd801852No ratings yet

- Lecture Notes OnDocument36 pagesLecture Notes OnNaresh GuduruNo ratings yet

- Branches of Accounting and Users of Accounting InformationDocument5 pagesBranches of Accounting and Users of Accounting InformationSirvie FersifaeNo ratings yet

- Cost SheetDocument59 pagesCost SheetVIKAS BHANVRANo ratings yet

- Cost Accounting Unit 1Document45 pagesCost Accounting Unit 1Akhilesh SatyadevanNo ratings yet

- Definition of Cost and CostingDocument6 pagesDefinition of Cost and CostingNahidul Islam IUNo ratings yet

- Ch01 Introduction To Cost AccountingDocument5 pagesCh01 Introduction To Cost AccountingRenelyn FiloteoNo ratings yet

- DBM Employee Sourcing NotesDocument91 pagesDBM Employee Sourcing Notesjxmzeey420No ratings yet

- Introduction To Cost Accounting: Lecture NoteDocument49 pagesIntroduction To Cost Accounting: Lecture NoteSaciid Xaji AxmedNo ratings yet

- SMA Lecture Notes E2Document99 pagesSMA Lecture Notes E2Zill-e-huda hashmiNo ratings yet

- Cost Accounting - (Al Jamia Arts and Science College, Poopalam)Document23 pagesCost Accounting - (Al Jamia Arts and Science College, Poopalam)Sibin Sibi100% (1)

- AccountsDocument13 pagesAccountsFake AccountNo ratings yet

- Introduction To Cost Accounting Module 1Document49 pagesIntroduction To Cost Accounting Module 1Godliving J LyimoNo ratings yet

- Cost AccountingDocument52 pagesCost Accountingd. CNo ratings yet

- Pert 1Document21 pagesPert 1ALDA FADILA DAMAYANTINo ratings yet

- Introduction To Cost Accounting - Topic 1Document36 pagesIntroduction To Cost Accounting - Topic 1Zairinawati ErinNo ratings yet

- 462 1Document10 pages462 1M Noaman AkbarNo ratings yet

- Gian Jyoti Institute of Management and Technology, Mohali Assignment No-2 Academic Session January-May 202Document6 pagesGian Jyoti Institute of Management and Technology, Mohali Assignment No-2 Academic Session January-May 202Isha aggarwalNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingTofael MajumderNo ratings yet

- Accounting 202Document8 pagesAccounting 202Gortex MeNo ratings yet

- Stock Valuation and Inventory ValuationDocument49 pagesStock Valuation and Inventory ValuationYu ya WyneNo ratings yet

- Overview of Cost AccountingDocument21 pagesOverview of Cost AccountingVinayNo ratings yet

- Introduction to Cost Accounting ObjectivesDocument18 pagesIntroduction to Cost Accounting ObjectivesDecery BardenasNo ratings yet

- Lesson 2 - Cost Accounting Cycle Part 1Document39 pagesLesson 2 - Cost Accounting Cycle Part 1Mama MiyaNo ratings yet

- Cost AccountingDocument19 pagesCost AccountingAysayah JeanNo ratings yet

- Chapter 4 (Acc)Document25 pagesChapter 4 (Acc)shafNo ratings yet

- 1.1 Intro To SCM and Management AccountingDocument6 pages1.1 Intro To SCM and Management AccountingXyril MañagoNo ratings yet

- Cost & Management Accounting FundamentalsDocument77 pagesCost & Management Accounting FundamentalsDhanaperumal VarulaNo ratings yet

- Revenue-ExpensesDocument3 pagesRevenue-ExpensesJullianneBalaseNo ratings yet

- Conceptual FoundationDocument20 pagesConceptual FoundationSuman Samal MagarNo ratings yet

- Cost AccountingDocument10 pagesCost AccountingFarhani Sam RacmanNo ratings yet

- Cost AccountingDocument14 pagesCost Accountingshazilramzan111No ratings yet

- Unit 4 Costing and Decision MakingDocument43 pagesUnit 4 Costing and Decision MakingYash BhushanNo ratings yet

- Accountingdefinition: Financial Accounting Accounting Accounting Accounting Accounting InstallationDocument5 pagesAccountingdefinition: Financial Accounting Accounting Accounting Accounting Accounting InstallationRahul Kumar RajakNo ratings yet

- CostaccDocument6 pagesCostaccKassandra Mari LucesNo ratings yet

- Cost Accounting AssignmentDocument15 pagesCost Accounting AssignmentDirector Telecom DoTNo ratings yet

- Unit-1 Introduction Cost AccountingDocument23 pagesUnit-1 Introduction Cost AccountingShylaja NagNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingSumit BainNo ratings yet

- Cost Accountancy SyllabusDocument67 pagesCost Accountancy SyllabusDhananjay SinghNo ratings yet

- ENTR 20083 - Module 1Document6 pagesENTR 20083 - Module 1Mar Jonathan FloresNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet