Professional Documents

Culture Documents

EOU Compliances Requirements

Uploaded by

dasharathdhage0 ratings0% found this document useful (0 votes)

5 views1 pageThis document lists 17 documents and statements required to verify statutory compliance for an Export Oriented Unit (EOU), including the application for establishment, import and export documentation, sales reports, destruction records, bond documents, and quarterly performance reports that must be filed with regulatory authorities.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document lists 17 documents and statements required to verify statutory compliance for an Export Oriented Unit (EOU), including the application for establishment, import and export documentation, sales reports, destruction records, bond documents, and quarterly performance reports that must be filed with regulatory authorities.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageEOU Compliances Requirements

Uploaded by

dasharathdhageThis document lists 17 documents and statements required to verify statutory compliance for an Export Oriented Unit (EOU), including the application for establishment, import and export documentation, sales reports, destruction records, bond documents, and quarterly performance reports that must be filed with regulatory authorities.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

Documents / Statements required for verifying the statutory compliance of EOU:

1. Application for establishment of EOU

2. Letter of Permission (LOP) issued by Development Commissioner

3. Letter of Undertaking with the Development Commissioner

4. License for Private Bonded Warehouse

5. Excise Registration Certificate

6. List of Approved Sub- Contractors

7. ER-2 filed with the Excise Department

8. QPR/APR filed with the DC SEEPZ

9. CIF Value of Imports / FOB value of Exports for the year

10. B-17 Bond / Bank Guarantee

11. Details of Import of RM / Capital Goods during the year

12. Calculation of NFE

13. Details of sales made in DTA by the EOU with the supporting documents

14. Details of sale of rejections made by EOU during the year

15. Details of destruction of scrap by EOU during the year with the supporting documents

16. Reconciliation Statements of:

CT-3 v/s ARE-3

Procurement Certificate v/s Re-Warehousing Certificate

ARE–1 v/s Proof of Export.

Re-Warehousing Certificates to submitted within 3 months from date of Import.

Proof of Export to be submitted within 6 months from the date of removal of goods from

warehouse for Exports.

17. Quarterly Performance Reports for the quarter ended June’05 and September’05.

You might also like

- Sec RequirementsDocument5 pagesSec RequirementsJM Manicap-OtomanNo ratings yet

- Sec Registration RequirementsDocument16 pagesSec Registration RequirementsBona Carmela BienNo ratings yet

- Sec RegDocument19 pagesSec RegseandagsNo ratings yet

- Registration of Partnerships and CorporationsDocument6 pagesRegistration of Partnerships and CorporationsPaolo LimNo ratings yet

- EXP From For Export BD CircularDocument9 pagesEXP From For Export BD CircularMohammad Lutfor Rahaman KhanNo ratings yet

- ANF 4 I: (Please See Guidelines (Given at The End) Before Filling The Application)Document4 pagesANF 4 I: (Please See Guidelines (Given at The End) Before Filling The Application)akashaggarwal88No ratings yet

- BOC AMO Import Accreditation 2016Document5 pagesBOC AMO Import Accreditation 2016Maureen SonidoNo ratings yet

- Direct Client & Broker AgreementDocument55 pagesDirect Client & Broker Agreementdoanthanh88No ratings yet

- Guide To Selling A PropertyDocument5 pagesGuide To Selling A PropertyGrace AboundsNo ratings yet

- Application For Redemption / No Bond CertificateDocument4 pagesApplication For Redemption / No Bond Certificateakashaggarwal88100% (1)

- Circular On Registration and Guidelines For CRES 2021-24 DT 27 Feb 2021-24 1 Mar 2021 Updated On 22 MarDocument9 pagesCircular On Registration and Guidelines For CRES 2021-24 DT 27 Feb 2021-24 1 Mar 2021 Updated On 22 MarMarlinNo ratings yet

- I. Preparation: The Proper and Complete ProcessDocument6 pagesI. Preparation: The Proper and Complete ProcessRyan OdioNo ratings yet

- State Bank Form e Part 1 PDFDocument2 pagesState Bank Form e Part 1 PDFfaizan009No ratings yet

- Association of Insurers and ReinsurersDocument28 pagesAssociation of Insurers and ReinsurersRush YuviencoNo ratings yet

- AC - CIF Procedure CHINA PORT - SINGAPORE PORTDocument2 pagesAC - CIF Procedure CHINA PORT - SINGAPORE PORTfedor.cherenkov99No ratings yet

- Trading Account Opening FormDocument13 pagesTrading Account Opening FormmcxnsebseNo ratings yet

- Sec Registration RequirementsDocument25 pagesSec Registration Requirementsmay .No ratings yet

- Anf 4fDocument4 pagesAnf 4fAjaiKumarNo ratings yet

- ANF-2D Application Format For Seeking Policy/Procedure Relaxation in Terms of para 2.58 of FTPDocument4 pagesANF-2D Application Format For Seeking Policy/Procedure Relaxation in Terms of para 2.58 of FTPUtkarsh KhandelwalNo ratings yet

- Checklist For Home Loan - Plot LoanDocument3 pagesChecklist For Home Loan - Plot LoanNishant RoyNo ratings yet

- Requirement SEC RegistrationDocument14 pagesRequirement SEC RegistrationbrownboomerangNo ratings yet

- Bullion 191113Document4 pagesBullion 191113hari ramNo ratings yet

- Documentary Requirements of Registration 2012 PDFDocument20 pagesDocumentary Requirements of Registration 2012 PDFRj RamosNo ratings yet

- Checklist Transfer TitleDocument2 pagesChecklist Transfer TitleDon CorleoneNo ratings yet

- New Regular Contractor'S License Application: Checklist of Requirements (FOR SOLE PROPRIETORSHIP) RemarksDocument26 pagesNew Regular Contractor'S License Application: Checklist of Requirements (FOR SOLE PROPRIETORSHIP) RemarksEjay EmpleoNo ratings yet

- EOU Write UpDocument5 pagesEOU Write Upsrajan7309No ratings yet

- Documentary Requirements: Lending Company - Head OfficeDocument2 pagesDocumentary Requirements: Lending Company - Head Officesheshe gamiaoNo ratings yet

- Export LicenseDocument3 pagesExport LicenseRoshaniNo ratings yet

- BIR Cuts Requirements For Brokers and Importers' ClearancesDocument4 pagesBIR Cuts Requirements For Brokers and Importers' ClearancesPortCallsNo ratings yet

- Loi / Icpo Buyer Profile CIS Ncnd/Imfpa: Proc E DU RE C I F, A SWP: + + + + + +Document2 pagesLoi / Icpo Buyer Profile CIS Ncnd/Imfpa: Proc E DU RE C I F, A SWP: + + + + + +Yrvis100% (1)

- Fob Procedures Tank To Tank 1 RotterdamDocument1 pageFob Procedures Tank To Tank 1 Rotterdamsergioavilacortes24No ratings yet

- Check List To Purchase A CompanyDocument4 pagesCheck List To Purchase A Companyuttamjain22No ratings yet

- ANF 5B LIC - NoDocument5 pagesANF 5B LIC - Nosuman_gourh100% (2)

- Fob Procedures Tank To Tank RotterdamDocument1 pageFob Procedures Tank To Tank Rotterdamsergioavilacortes24No ratings yet

- Form ANF 2M For Ornamental Fish Import License - Firstbusiness - in PDFDocument3 pagesForm ANF 2M For Ornamental Fish Import License - Firstbusiness - in PDFFirstBusiness.inNo ratings yet

- No Dues CertificateDocument4 pagesNo Dues CertificateMahesh PittalaNo ratings yet

- A1 For Import Goods PaymentsDocument3 pagesA1 For Import Goods PaymentskollarajasekharNo ratings yet

- Presentation FrancaisDocument6 pagesPresentation FrancaiskamilinhasousasilvaNo ratings yet

- List of Requirements Prior Turn inDocument1 pageList of Requirements Prior Turn indavid durianNo ratings yet

- New Regular Contractor's LicenseDocument27 pagesNew Regular Contractor's LicenseAdmin BicoreNo ratings yet

- 1Document3 pages1jerry.msgrdcNo ratings yet

- SEC Amendment - Increase in Authorized CapitalDocument4 pagesSEC Amendment - Increase in Authorized CapitalGerryNo ratings yet

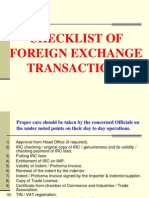

- Check List of Foreign Exchange Transaction in BankDocument20 pagesCheck List of Foreign Exchange Transaction in BankMohammad RokunuzzamanNo ratings yet

- 2020LCFC Lending-Companies Documentary-RequirementsDocument1 page2020LCFC Lending-Companies Documentary-Requirementsmcsyjongtian.picazoNo ratings yet

- 2017documentary Requirements Lending Company Head OfficeDocument1 page2017documentary Requirements Lending Company Head OfficeLawrence PiNo ratings yet

- Pcab Application - SOLE - PROP - CSC BUILDERSDocument27 pagesPcab Application - SOLE - PROP - CSC BUILDERSRamilArtatesNo ratings yet

- Appendix - 5B Certificate of Chartered Accountant/ Cost Accountant/Company Secretary (For Issue of Epcg Authorisation)Document2 pagesAppendix - 5B Certificate of Chartered Accountant/ Cost Accountant/Company Secretary (For Issue of Epcg Authorisation)RD TaxNo ratings yet

- Soft Corporate Offer - En590 - Fob RotterdamDocument3 pagesSoft Corporate Offer - En590 - Fob RotterdamAdnan IsmailNo ratings yet

- PCAB LicenseDocument8 pagesPCAB LicenseJaypee OrtizNo ratings yet

- New Regular Contractor's License (SOLE - PROP) - 11192018Document27 pagesNew Regular Contractor's License (SOLE - PROP) - 11192018aileen manzanoNo ratings yet

- New Regular Contractor'S License Application: Checklist of Requirements (FOR SOLE PROPRIETORSHIP) RemarksDocument27 pagesNew Regular Contractor'S License Application: Checklist of Requirements (FOR SOLE PROPRIETORSHIP) RemarksShen LucinarioNo ratings yet

- New Regular Contractor's License (SOLE - PROP) - 11192018Document27 pagesNew Regular Contractor's License (SOLE - PROP) - 11192018JasonNo ratings yet

- New Regular Contractor's License (SOLE - PROP) - 11192018Document27 pagesNew Regular Contractor's License (SOLE - PROP) - 11192018Francisco TaquioNo ratings yet

- Ste 2020Document27 pagesSte 2020DBS Builders, Inc.No ratings yet

- PCAB (Philippine Contractor Assosiation BoardDocument27 pagesPCAB (Philippine Contractor Assosiation BoardBhyeong HoNo ratings yet

- Form E PDFDocument2 pagesForm E PDFakNo ratings yet

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16From EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet