Professional Documents

Culture Documents

Course Specifications ACCT 415

Uploaded by

Maha Alnashwan0 ratings0% found this document useful (0 votes)

2 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageCourse Specifications ACCT 415

Uploaded by

Maha AlnashwanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

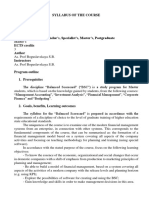

Course Description

Course Title Analysis of Financial Reports Course Code ACCT 415

Program BSBA - Accounting Level 7

Pre-requisites ACCT 318 Credit Hours 3

Course Objective:

This course considers the basics and techniques of financial reports analysis, forecasting, and business

evaluation. In addition, the course considers the basics of fundamental analysis and the role of financial

analysis in investment, credit, and merger decisions. Moreover, the course considers how the Capital

Market works and the characteristics of the Capital Markets.

Course Content:

1. Introduction to Financial Reports.

2. Market Efficiency.

3. Market Indices.

4. Fundamental analysis.

5. Financial Analysis of Financial Position Statement.

6. Financial Analysis of Income Statement.

7. Financial Analysis of Cash Flows Statement

8. Financial Ratios

9. Profitability Analysis

10. Credit Analysis

11. Financial Forecasting

12. Companies Evaluation

Course Learning Outcomes:

1. Explain the need for and limitations of financial statement analysis.

2. Recognize the role of financial analysis in investment, credit, and merger decisions.

3. Apply the basic techniques of financial statement analysis, including financial trends, ratios,

benchmarking, and compression.

4. Analyze major items in financial statements in order to evaluate risk and financial performances of a

business.

5. Communicate effectively and professionally in oral and written forms in analyzing the financial report.

6. Demonstrate self-learning and personal development

7. Demonstrate effective teamwork, leadership, and decision-making skills.

Required Textbooks:

Alsehaly, Mohamed Bin Soltan "Financial Analysis: An Accounting View (205) Accounting Saudi

Association

Assessment Tasks for Students:

• 25 points-Midterm Exam

• 20 points- Group project

• 10 points - Presentation

• 5 points - Homework, Participation

• 40 points Final Exam

You might also like

- Navigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCFrom EverandNavigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCNo ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- PNB Project Report On Financial AnalysisDocument58 pagesPNB Project Report On Financial AnalysisAmbient75% (8)

- Course Code: Course Name: Course Description:: UC-VPAA-COA-SYL-53 September 17, 2012.rev.1Document8 pagesCourse Code: Course Name: Course Description:: UC-VPAA-COA-SYL-53 September 17, 2012.rev.1Annie EinnaNo ratings yet

- Abe ManualDocument320 pagesAbe ManualNicole Taylor100% (2)

- Course Outline AFS Fall 2023Document5 pagesCourse Outline AFS Fall 2023ASIMLIBNo ratings yet

- Course Outline AFS Fall 2023Document5 pagesCourse Outline AFS Fall 2023ASIMLIBNo ratings yet

- Fall2015-Financial Reporting and AnalysisDocument8 pagesFall2015-Financial Reporting and AnalysisASIMLIBNo ratings yet

- MBM 804 Module OutlineDocument6 pagesMBM 804 Module OutlineAutorix InvestmentsNo ratings yet

- 2022-23 - CFRA - IIMC Course Outline - SentDocument10 pages2022-23 - CFRA - IIMC Course Outline - SentAnanya DevNo ratings yet

- Course SyllabusDocument2 pagesCourse SyllabusManpreet ToorNo ratings yet

- ACCT6065 Course SyllabusSpring2021132021Document5 pagesACCT6065 Course SyllabusSpring2021132021Michael PironeNo ratings yet

- Module 1Document13 pagesModule 1Liz PobleteNo ratings yet

- SYLLABUS - Financial Statement AnalysisDocument4 pagesSYLLABUS - Financial Statement AnalysisTâm NhưNo ratings yet

- STI Trisakti Financial Statement Analysis Study PlanDocument24 pagesSTI Trisakti Financial Statement Analysis Study PlanShiel VhyNo ratings yet

- Shikha - Bhatia@imi - Edu: Page 1 of 6Document6 pagesShikha - Bhatia@imi - Edu: Page 1 of 6Daksh AnejaNo ratings yet

- PSA - Financial AccountingDocument684 pagesPSA - Financial Accountingredwan99983% (6)

- MBA Banking Technology course outcomesDocument82 pagesMBA Banking Technology course outcomesSmita SrivastavaNo ratings yet

- Curriculum: Masters in Business Administrat 2020-2022 Term: 1 - Semester Course: MGC1051 - Financial Accounting and AnalysisDocument16 pagesCurriculum: Masters in Business Administrat 2020-2022 Term: 1 - Semester Course: MGC1051 - Financial Accounting and AnalysisAnand BabarNo ratings yet

- PSA - Financial ManagementDocument520 pagesPSA - Financial ManagementArunjit Sutradhar100% (10)

- 511 Ac & Finance For ManagersDocument3 pages511 Ac & Finance For ManagersYonasNo ratings yet

- Accounting and Financial Analysis.Document3 pagesAccounting and Financial Analysis.athirah binti shazaliNo ratings yet

- AFM Course Outline PDFDocument4 pagesAFM Course Outline PDFPrateek saxenaNo ratings yet

- ACC 202 Financial Reporting UpdatesDocument25 pagesACC 202 Financial Reporting UpdatesherueuxNo ratings yet

- RPS Akuntansi Menengah IIDocument18 pagesRPS Akuntansi Menengah IIAnyaaNo ratings yet

- ACCA FAB Tutor Toolkit Tutor Guidance (2019-20)Document7 pagesACCA FAB Tutor Toolkit Tutor Guidance (2019-20)Vimala RavishankarNo ratings yet

- ACCT 221-Corporate Financial Reporting-Atifa Dar-Waqar AliDocument6 pagesACCT 221-Corporate Financial Reporting-Atifa Dar-Waqar AliDanyalSamiNo ratings yet

- Financial Statement Analysis First LectureDocument17 pagesFinancial Statement Analysis First LectureDavid Obuobi Offei KwadwoNo ratings yet

- ELEMENTS OF BOOK-KEEPING II EditedDocument150 pagesELEMENTS OF BOOK-KEEPING II EditedGifty Asuquo100% (1)

- Online - Accounting and Financial ManagementDocument2 pagesOnline - Accounting and Financial ManagementPranav KompallyNo ratings yet

- IIM Bangalore Financial Accounting course outlineDocument3 pagesIIM Bangalore Financial Accounting course outlineSmriti AggarwalNo ratings yet

- AE13 - Financial Reporting and AnalysisDocument5 pagesAE13 - Financial Reporting and AnalysisMa. Liza MagatNo ratings yet

- Bachelor of Science in Accountancy Saint PaulDocument16 pagesBachelor of Science in Accountancy Saint PaulJeremias PerezNo ratings yet

- Accounting Course Latest Outcomes From HCTDocument19 pagesAccounting Course Latest Outcomes From HCTPavan Kumar MylavaramNo ratings yet

- Table of Contents, Lecture ManualDocument6 pagesTable of Contents, Lecture Manualhayat binbogNo ratings yet

- Advanced Financial Accounting and Reporting Course OutlineDocument3 pagesAdvanced Financial Accounting and Reporting Course Outlineselman AregaNo ratings yet

- H11FM RebrandDocument9 pagesH11FM Rebrandrajbhandarisamyukta03No ratings yet

- ACCT201 Corporate Reporting & Financial Analysis: Course Outline 2018/2019 Term 1Document4 pagesACCT201 Corporate Reporting & Financial Analysis: Course Outline 2018/2019 Term 1Hohoho134No ratings yet

- Financial Accounting and AnalysisDocument2 pagesFinancial Accounting and AnalysisDavinder BhawaniNo ratings yet

- Ic 46 Book General Insurance Accounts Preparation and Regulation of InvestmentDocument823 pagesIc 46 Book General Insurance Accounts Preparation and Regulation of InvestmentDr. S100% (1)

- Course Title: Advanced Financial Management Course Code: MBA 5061 Credit Hour: 2 Ects: 5 Course DescriptionDocument3 pagesCourse Title: Advanced Financial Management Course Code: MBA 5061 Credit Hour: 2 Ects: 5 Course DescriptionAbdu MohammedNo ratings yet

- Balanced Scorecard SyllabusDocument4 pagesBalanced Scorecard SyllabushecfermeNo ratings yet

- Advance Financial Management and Cost AccountingDocument3 pagesAdvance Financial Management and Cost AccountingAMIT08006No ratings yet

- ACCT 100-Principles of Financial Accounting - Fall 2018-19Document7 pagesACCT 100-Principles of Financial Accounting - Fall 2018-19Qudsia AbbasNo ratings yet

- EMBA Fundamental Analysis (Nissim) SP2016Document6 pagesEMBA Fundamental Analysis (Nissim) SP2016darwin12No ratings yet

- Final Paper20 Revised Business ValuationDocument698 pagesFinal Paper20 Revised Business ValuationSukumar100% (5)

- Course CF PDFDocument5 pagesCourse CF PDFSIDDHARTH SETHI-DM 21DM198No ratings yet

- Financial Statement Analysis: Standard Course OutlineDocument6 pagesFinancial Statement Analysis: Standard Course OutlineMahmoud ZizoNo ratings yet

- MBA Weekend Fall 2020 Financial Management CourseDocument2 pagesMBA Weekend Fall 2020 Financial Management CourseominNo ratings yet

- Acct 462 ComDocument265 pagesAcct 462 ComdemolaojaomoNo ratings yet

- FL087-Accounting Concepts and Principles Study ManualDocument216 pagesFL087-Accounting Concepts and Principles Study ManualBi Log100% (4)

- L6 LG Financial Accounting Dec11Document14 pagesL6 LG Financial Accounting Dec11IamThe BossNo ratings yet

- Managerial Accounting Insights for Decision MakingDocument0 pagesManagerial Accounting Insights for Decision MakingMichael YuNo ratings yet

- Unit 02 Conceptual FrameworkDocument17 pagesUnit 02 Conceptual FrameworkNixsan MenaNo ratings yet

- IIM Bangalore Financial Accounting course outlineDocument4 pagesIIM Bangalore Financial Accounting course outlineShabir AhmedNo ratings yet

- 1520245287Document3 pages1520245287merrylyn vivianNo ratings yet

- FM108 Prelim HandoutsDocument8 pagesFM108 Prelim HandoutsKarl Dennis TiansayNo ratings yet

- Syllabus - Principles of Accounting I (ACCT2200-01 & 06 - Spring 2021Document10 pagesSyllabus - Principles of Accounting I (ACCT2200-01 & 06 - Spring 2021SYED HUSSAINNo ratings yet

- Financial Accounting PDFDocument684 pagesFinancial Accounting PDFImtiaz Rashid91% (11)