Professional Documents

Culture Documents

Assignment - DCM1103 - Fundamentals of Acccounting I

Uploaded by

taniya thakur0 ratings0% found this document useful (0 votes)

171 views3 pagesOriginal Title

Assignment_DCM1103_Fundamentals of Acccounting I

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

171 views3 pagesAssignment - DCM1103 - Fundamentals of Acccounting I

Uploaded by

taniya thakurCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

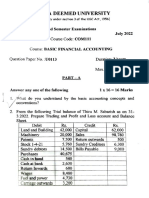

Directorate of Online Education

ASSIGNMENT

SESSION AUG - 2023

PROGRAM BACHELOR OF COMMERCE (BCOM)

SEMESTER I

COURSE CODE & NAME DCM1103 – FUNDAMENTALS OF ACCOUNTING I

CREDITS 4

NUMBER OF ASSIGNMENTS & 02

MARKS 30 Marks each

Note: Answer all questions. Kindly note that answers for 10 marks questions and for 05 marks questions should be approximately of 400 - 450 words and

200 – 250 words respectively.

Assignment Set – 1 Marks Total

Q.No

Questions Marks

Ananth is a trader dealing in textiles. For the following transactions, pass journal entries 5 10

for the month of January, 2018.

Jan.

1 Commenced business with cash ₹. 70,000

2 Purchased goods from X and Co. on credit ₹. 30,000

1. 3 Cash deposited into bank ₹. 40,000.

4 Bought a building from L and Co. on credit ₹.95,000

5 Cash withdrawn from bank for office use ₹.5,000

a) Explain “Full Disclosure Principle” of accounting. 2.5 +

b) Briefly explain about matching concept. 2.5

2. a. Explain the different types of cash book. 5 10

b. Find out credit sales from the following information: 5

Particular ₹

Debtors on 1st January 2018 40,000

Directorate of Online Education

Cash received from debtors 1,00,000

Discount allowed 5,000

Sales returns 2,000

Debtors on 31st December 2018 60,000

Explain the accounting concepts and conventions. 10 10

3.

Q. Assignment Set – 2 Mark Total

No Questions s Marks

4. XYZ Ltd. maintains a current account with the Syndicate Bank of India. As on 31st March 10 10

2006, the bank column of its cashbook showed a debit balance of Rs.20,000. However, the

bank statement showed a different balance on that date. The following are the reasons for such

a difference:

1. Cheque deposited but not yet credited by the bank 3,000

2. Cheque issued but not yet presented 2,000

3. Bank charges 3,000

4. Cheques received by the bank directly 7,000

5. Insurance premium paid by the bank as per standing instructions not yet intimated

2,000

Prepare bank reconciliation statement and find out the balance as per the bank statement

5 Define Depreciation. 3+3 10

State the Causes of depreciation +4

Justify why to record the depreciation.

6. Given below are the balances extracted from the books of Nagarajan as on 31st March, 2016. 10 10

Particulars Rs. Particulars Rs.

Purchases 10,000 Sales 15,100

Wages 600 Commission received 1,900

Directorate of Online Education

Freight inwards 750 Rent received 600

Advertisement 500 Creditors 2,400

Carriage outwards 400 Capital 5,000

Cash 1,200

Machinery 8,000

Debtors 2,250

Bills receivable 300

Stock on 1st January, 2016 1,000

25,000 25,000

Prepare the trading and profit and loss account for the year ended 31st March, 2016 and the

balance sheet as on that date after adjusting the following:

(a) Commission received in advance Rs. 400

(b) Advertisement paid in advance Rs. 150

(c) Wages outstanding Rs. 200

(d) Closing stock on 31st March 2016, Rs. 2,100

You might also like

- Accounts Mock_29178435Document6 pagesAccounts Mock_29178435mopibam555No ratings yet

- Acc Mba Int - 1 Dec 2022Document3 pagesAcc Mba Int - 1 Dec 2022Hema LathaNo ratings yet

- Amity MBA 1 ST Sem ASODL AccountingDocument12 pagesAmity MBA 1 ST Sem ASODL AccountingBhavna Jain67% (9)

- Accounting principles checklist for Allama Iqbal Open UniversityDocument4 pagesAccounting principles checklist for Allama Iqbal Open Universityilyas muhammadNo ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- Sem 2 - End Sem PapersDocument23 pagesSem 2 - End Sem Paperslalith sasankaNo ratings yet

- 13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Document15 pages13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Rakesh MaliNo ratings yet

- Statistics Exam Questions on Sampling, Time Series, Index NumbersDocument99 pagesStatistics Exam Questions on Sampling, Time Series, Index NumbersJohanna LiNo ratings yet

- Nov - 19 - Question and AnswersDocument15 pagesNov - 19 - Question and AnswersVidhi AgrawalNo ratings yet

- Accounts - Full Test 1Document6 pagesAccounts - Full Test 1Shushaanth SanthoshNo ratings yet

- 11-Acc PP1Document11 pages11-Acc PP1adityatiwari122006No ratings yet

- CA-Foundation Accounts Full Syllabus Test For Dec 2023 StudentsDocument4 pagesCA-Foundation Accounts Full Syllabus Test For Dec 2023 Studentsbabu.bhiwadiNo ratings yet

- Unsolved Paper Part IDocument107 pagesUnsolved Paper Part IAdnan KazmiNo ratings yet

- Ednovate CAF Accounts UT 1 QDocument3 pagesEdnovate CAF Accounts UT 1 QROCKYNo ratings yet

- 11 QP Final (2021-22)Document4 pages11 QP Final (2021-22)Flick OPNo ratings yet

- Allama Iqbals accounting checklistDocument5 pagesAllama Iqbals accounting checklistAkhbar-ul- AkhyarNo ratings yet

- ISC Accounts 11Document2 pagesISC Accounts 11Sriyaa SunkuNo ratings yet

- Accountancy Master Test 4 PDFDocument5 pagesAccountancy Master Test 4 PDFRaghav PrajapatiNo ratings yet

- Class Test – Financial Statements with AdjustmentsDocument2 pagesClass Test – Financial Statements with Adjustmentssara VermaNo ratings yet

- Question Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given BelowDocument16 pagesQuestion Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given BelowRaveendra KJNo ratings yet

- Advanced AccountsDocument3 pagesAdvanced AccountsArun SankarNo ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- Basic Principle of AccountingDocument3 pagesBasic Principle of Accounting22ba045No ratings yet

- Topic Wise Test Accounting From Incomplete RecordsDocument4 pagesTopic Wise Test Accounting From Incomplete RecordsChinmay GokhaleNo ratings yet

- Bbfa1103 Assigment Question 2023Document13 pagesBbfa1103 Assigment Question 2023Bdq ArrogantNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument3 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- XI Acc 3Document4 pagesXI Acc 3Bhumika ShaldarNo ratings yet

- (CBCS) (Repeaters) Commerce Paper - 3.5: Accounting For Specialised InstitutionsDocument4 pages(CBCS) (Repeaters) Commerce Paper - 3.5: Accounting For Specialised InstitutionsSanaullah M SultanpurNo ratings yet

- 5627Document8 pages5627MS 7No ratings yet

- Class Xi Acc QPDocument7 pagesClass Xi Acc QP8201ayushNo ratings yet

- 1e710c6f-4b3e-4b03-943f-11430d867f0e-Document30 pages1e710c6f-4b3e-4b03-943f-11430d867f0e-angela antoniaNo ratings yet

- Class XI Practice PaperDocument4 pagesClass XI Practice PaperAyush MathiyanNo ratings yet

- Sanskriti School Dr. S. Radhakrishnan Marg New DelhiDocument7 pagesSanskriti School Dr. S. Radhakrishnan Marg New DelhiAVNEET XII-CNo ratings yet

- Bcom 3 Sem Corporate Accounting 1 21100518 Mar 2021Document5 pagesBcom 3 Sem Corporate Accounting 1 21100518 Mar 2021abin.com22No ratings yet

- Mock-Iv AccountsDocument6 pagesMock-Iv AccountsAnsh UdainiaNo ratings yet

- Class 11 Acc FinalDocument3 pagesClass 11 Acc Finalmnmehta1990No ratings yet

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- Time: 3 Hours Total Marks: 100: Printed Pages: 03 Sub Code: KMB103 Paper Id: 270103 Roll NoDocument4 pagesTime: 3 Hours Total Marks: 100: Printed Pages: 03 Sub Code: KMB103 Paper Id: 270103 Roll NoAbhishek ChaubeyNo ratings yet

- Accounting for Managers: MBA course MMPC-004 assignmentDocument3 pagesAccounting for Managers: MBA course MMPC-004 assignmentMishra FamilyNo ratings yet

- RE Exam FA Sem I MFM MMM MHRDMDocument4 pagesRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGNo ratings yet

- Class 11 Final MTSSDocument7 pagesClass 11 Final MTSSPranshu AgarwalNo ratings yet

- Acc May 2023-Past YearDocument7 pagesAcc May 2023-Past Yearcandywy0719No ratings yet

- Accounting For Managers Trimester 1 Mba Ktu 2016Document3 pagesAccounting For Managers Trimester 1 Mba Ktu 2016Mekhajith MohanNo ratings yet

- Mca Accounts Model QuestionDocument2 pagesMca Accounts Model QuestionAnonymous 1ClGHbiT0JNo ratings yet

- Solution 5Document29 pagesSolution 5HariNo ratings yet

- Accounting for Partnership Admission & DissolutionDocument5 pagesAccounting for Partnership Admission & DissolutionPranit PanditNo ratings yet

- Mca Accounts Model QuestionDocument2 pagesMca Accounts Model QuestionAnonymous 1ClGHbiT0JNo ratings yet

- 3562 Question PaperDocument3 pages3562 Question PaperKimberly MataruseNo ratings yet

- Corporate Accounting Ii-1Document4 pagesCorporate Accounting Ii-1ARAVIND V KNo ratings yet

- 5 6305198873144984587 PDFDocument112 pages5 6305198873144984587 PDFNbut ddgfNo ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingVinithaNo ratings yet

- UntitledDocument269 pagesUntitledvijaypeketiNo ratings yet

- 4 CO4CRT11 - Corporate Accounting II (T) (1)Document5 pages4 CO4CRT11 - Corporate Accounting II (T) (1)emildaraisonNo ratings yet

- 1.2 Managerial AccountingDocument4 pages1.2 Managerial AccountingAshik PaulNo ratings yet

- CA Inter Accounts Q MTP 1 Nov 2022Document7 pagesCA Inter Accounts Q MTP 1 Nov 2022smartshivenduNo ratings yet

- SP - XI - AccountancyDocument3 pagesSP - XI - AccountancyPriyankadevi PrabuNo ratings yet

- Accountancy QP 1 (A) 2023Document5 pagesAccountancy QP 1 (A) 2023mohammedsubhan6651No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- University Grants Commission (UGC) - NET IndiaDocument3 pagesUniversity Grants Commission (UGC) - NET Indiataniya thakurNo ratings yet

- Assignment - DCM1101 - BCom - Set1 and 2 - Aug-Sep - 2023Document3 pagesAssignment - DCM1101 - BCom - Set1 and 2 - Aug-Sep - 2023taniya thakurNo ratings yet

- MA Sample Paper 22 UnsolvedDocument9 pagesMA Sample Paper 22 Unsolvedtaniya thakurNo ratings yet

- ComtoDocument6 pagesComtosignacc362No ratings yet

- Assignment - DCM1101 - BCom - Set1 and 2 - Aug-Sep - 2023Document3 pagesAssignment - DCM1101 - BCom - Set1 and 2 - Aug-Sep - 2023taniya thakurNo ratings yet

- SR No Fee Head Fees : Fee Schedule For Portfolio Investment Scheme - Nri CustomersDocument2 pagesSR No Fee Head Fees : Fee Schedule For Portfolio Investment Scheme - Nri CustomersDesikanNo ratings yet

- The Most Recent Balance Sheet For The Armadillo Dog BiscuitDocument1 pageThe Most Recent Balance Sheet For The Armadillo Dog BiscuitAmit PandeyNo ratings yet

- Application For Margin Money Loan To S.S.I. Units Promoted by Non-Resident Keralites From The Government of Kerala PDFDocument6 pagesApplication For Margin Money Loan To S.S.I. Units Promoted by Non-Resident Keralites From The Government of Kerala PDFdasuyaNo ratings yet

- Act 110 Activity 4 (Answe Sheet - Dimalawang)Document2 pagesAct 110 Activity 4 (Answe Sheet - Dimalawang)Norkan DimalawangNo ratings yet

- Imp Key Indicators of RRBs 2013Document6 pagesImp Key Indicators of RRBs 2013Pankaj SharmaNo ratings yet

- What Is Wirecard?: How Did The Wirecard Scandal Unfold?Document3 pagesWhat Is Wirecard?: How Did The Wirecard Scandal Unfold?Umar AliNo ratings yet

- Cashflow Projection TemplateDocument1 pageCashflow Projection TemplatePAMAJANo ratings yet

- Receivable FinancingDocument5 pagesReceivable FinancingAphol Joyce MortelNo ratings yet

- CertificateDocument4 pagesCertificateMilap NaiduNo ratings yet

- RTP Accounting CA Foundation May 18Document35 pagesRTP Accounting CA Foundation May 18kanishk bahetiNo ratings yet

- Receivables 3,936,400 3,320,000: Balance Sheet Items 2018 2017Document4 pagesReceivables 3,936,400 3,320,000: Balance Sheet Items 2018 2017CulitaBogdanNo ratings yet

- Securities and Exchange Commission v. Bridge Premium Finance, Michael J. Turnock and William P. Sullivan IIDocument33 pagesSecurities and Exchange Commission v. Bridge Premium Finance, Michael J. Turnock and William P. Sullivan IIMichael_Lee_RobertsNo ratings yet

- Doupnik 6e Chap011 PPT Accessible GM OutputDocument55 pagesDoupnik 6e Chap011 PPT Accessible GM Outputhasan jabrNo ratings yet

- Wells Technical Institute (WTI), A School Owned by Tristana Wells, Provides Training To Individuals Who Pay Tuition Directly To The School. Part 2Document2 pagesWells Technical Institute (WTI), A School Owned by Tristana Wells, Provides Training To Individuals Who Pay Tuition Directly To The School. Part 2Fanny SosrosandjojoNo ratings yet

- Assignment 4 - Financial Accounting - February 11Document4 pagesAssignment 4 - Financial Accounting - February 11Ednalyn PascualNo ratings yet

- Merchant Request Letter Direct Debit Mandate FormDocument1 pageMerchant Request Letter Direct Debit Mandate FormStena NadishaniNo ratings yet

- Down Dog Corporation Statement of Affairs June 30, 2014 Book Value AssetsDocument11 pagesDown Dog Corporation Statement of Affairs June 30, 2014 Book Value AssetsEirolNo ratings yet

- Renewal of Your Optima Restore Individual Insurance PolicyDocument3 pagesRenewal of Your Optima Restore Individual Insurance Policypriyank singhNo ratings yet

- Bank lending policies procedures factors determining loan growth mixDocument14 pagesBank lending policies procedures factors determining loan growth mixNadia VirkNo ratings yet

- Investment in AssociateDocument26 pagesInvestment in AssociateJay-L TanNo ratings yet

- EstatementDocument7 pagesEstatementdennisNo ratings yet

- CHAPTER 11 - Franchise Accounting Solutions To Problems Problem 11 - 1Document6 pagesCHAPTER 11 - Franchise Accounting Solutions To Problems Problem 11 - 1Maurice AgbayaniNo ratings yet

- Chap - 1 IAS 37 Provisions and ContingenciesDocument12 pagesChap - 1 IAS 37 Provisions and ContingenciesSandyNo ratings yet

- Black Book Project FinalDocument106 pagesBlack Book Project Finalsanjaysharma1779No ratings yet

- 2nd Year Principles of Accounting Guess Paper 2023 Zahid NotesDocument5 pages2nd Year Principles of Accounting Guess Paper 2023 Zahid Notesashfaq4985No ratings yet

- Managing Cash and Bank AccountsDocument15 pagesManaging Cash and Bank AccountsFalola Feyisola Richard100% (1)

- Role of Technology in Digital Payments by BanksDocument30 pagesRole of Technology in Digital Payments by Bankspreeti magdumNo ratings yet

- Risk Management: Atty. Fernando S. PeñarroyoDocument48 pagesRisk Management: Atty. Fernando S. PeñarroyoEmmanuel CaguimbalNo ratings yet

- Fist Assurance Company LTDDocument30 pagesFist Assurance Company LTDThomas domingo100% (1)

- Auditing Internal Controls and Audit Risk ModelDocument3 pagesAuditing Internal Controls and Audit Risk ModelMichael Tom BucalonNo ratings yet