Professional Documents

Culture Documents

Tbchap 014 TCDNNC

Uploaded by

An Trần Thị HảiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tbchap 014 TCDNNC

Uploaded by

An Trần Thị HảiCopyright:

Available Formats

lOMoARcPSD|10169457

TBChap 014 - TCDNNC

Tài chính doanh nghiệp (Trường Đại học Kinh tế Thành phố Hồ Chí Minh)

Studocu is not sponsored or endorsed by any college or university

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

Chapter 14

Efficient Capital Markets and Behavioral Challenges

Multiple Choice Questions

1. An efficient capital market is one in which:

A. brokerage commissions are

zero.

B. taxes are

irrelevant.

C. securities always offer a positive rate of return to

investors.

D. security prices are guaranteed by the U.S. Securities and Exchange Commission

to be fair.

E. security prices reflect available

information.

2. The notion that actual capital markets, such as the NYSE, are fairly priced is called

the:

A. Efficient Markets Hypothesis

(EMH).

B. Law of One

Price.

C. Open Markets

Theorem.

D. Laissez-Faire

Axiom.

E. Monopoly Pricing

Theorem.

3. The hypothesis that market prices reflect all available information of every kind is

called _____ form efficiency.

A. ope

n

B. stron

g

C. semistron

g

D. wea

k

E. stabl

e

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

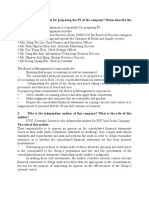

lOMoARcPSD|10169457

4. The hypothesis that market prices reflect all publicly available information is called

_____ form efficiency.

A. ope

n

B. stron

g

C. semistro

ng

D. wea

k

E. stabl

e

5. The hypothesis that market prices reflect all historical information is called _____ form

efficiency.

A. ope

n

B. stron

g

C. semistron

g

D. wea

k

E. stabl

e

6. In an efficient market, the price of a security will:

A. always rise immediately upon the release of new information with no further price

adjustments related to that information.

B. react to new information over a two-day period after which time no further price

adjustments related to that information will occur.

C. rise sharply when new information is first released and then decline to a new stable

level by the following day.

D. react immediately to new information with no further price adjustments

related to that information.

E. be slow to react for the first few hours after new information is released allowing

time for that information to be reviewed and analyzed.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

7. If the financial markets are efficient, then investors should expect their investments in

those markets to:

A. earn extraordinary returns on a routine

basis.

B. generally have positive net present

values.

C. generally have zero net present

values.

D. produce arbitrage opportunities on a routine

basis.

E. produce negative returns on a routine

basis.

8. Which one of the following statements is correct concerning market efficiency?

A. Real asset markets are more efficient than financial

markets.

B. If a market is efficient, arbitrage opportunities should be

common.

C. In an efficient market, some market participants will have an advantage

over others.

D. A firm will generally receive a fair price when it sells

shares of stock.

E. New information will gradually be reflected in a stock's price to avoid any sudden

change in the price of the stock.

9. According to the efficient market hypothesis, financial markets fluctuate daily because

they:

A. are

inefficient.

B. slowly react to new

information.

C. are continually reacting to new

information.

D. offer tremendous arbitrage

opportunities.

E. only reflect historical

information.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

10. Insider trading does not offer any advantages if the financial markets are:

A. weak form

efficient.

B. semiweak form

efficient.

C. semistrong form

efficient.

D. strong form

efficient.

E. inefficien

t.

11. According to theory, studying historical prices in order to identify mispriced stocks will

not work in markets that are _____ efficient.

I. weak form

II. semistrong form

III. strong form

A. I

only

B. II

only

C. I and II

only

D. II and III

only

E. I, II, and

III

12. Which of the following tend to reinforce the argument that the financial markets are

efficient?

I. Information spreads rapidly in today's world.

II. There is tremendous competition in the financial markets.

III. Market prices continually fluctuate.

IV. Market prices react suddenly to unexpected news announcements.

A. I and III

only

B. II and IV

only

C. I, II, and III

only

D. II, III, and IV

only

E. I, II, III, and

IV

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

13. If you excel in analyzing the future outlook of firms, you would prefer that the financial

markets be ____ form efficient so that you can have an advantage in the marketplace.

A. wea

k

B. semiwea

k

C. semistron

g

D. stron

g

E. perfec

t

14. Your best friend works in the finance office of the Delta Corporation. You are aware

that this friend trades Delta stock based on information he overhears in the office. You

know that this information is not known to the general public. Your friend continually

brags to you about the profits he earns trading Delta stock. Based on this information,

you would tend to argue that the financial markets are at best _____ form efficient.

A. wea

k

B. semiwea

k

C. semistro

ng

D. stron

g

E. perfec

t

15. The U.S. Securities and Exchange Commission periodically charges individuals for

insider trading and claims those individuals have made unfair profits. Based on this

fact, you would tend to argue that the financial markets are at best _____ form

efficient.

A. wea

k

B. semiwea

k

C. semistron

g

D. stron

g

E. perfec

t

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

16. Individuals that continually monitor the financial markets seeking mispriced

securities:

A. tend to make substantial profits on a daily

basis.

B. tend to make the markets more

efficient.

C. are never able to find a security that is temporarily

mispriced.

D. are always quite successful using only well-known public information as their basis

of evaluation.

E. are always quite successful using only historical price information as their basis of

evaluation.

17. Efficient capital markets are financial markets:

A. in which current market prices reflect available

information.

B. in which current market prices reflect the present value of

securities.

C. in which there is no excess profit from using available

information.

D. All of

these.

E. None of

these.

18. If the efficient market hypothesis holds, investors should expect:

A. to earn only a normal

return.

B. to receive a fair price for their

securities.

C. to always be able to pick stocks that will outperform the market

averages.

D. Both to earn only a normal return; and to receive a fair price for

their securities.

E. Both to receive a fair price for their securities; and to always be able to pick stocks

that will outperform the market averages.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

19. Financial managers can create value through financing decisions that:

A. reduce costs or increase

subsidies.

B. increase the product

prices.

C. create a new

security.

D. Both reduce costs or increase subsidies; and increase the product

prices.

E. Both reduce costs or increase subsidies; and create a

new security.

20. In an efficient market when a firm makes an announcement of a new product or

product enhancement with superior technology providing positive NPV, the price of

the stock will:

A. rise gradually over the next few

days.

B. decline gradually over the next few

days.

C. rise on the same day to the new

price.

D. stay at the same price, with no net

effect.

E. drop on the same day to the new

price.

21. An investor discovers that for a certain group of stocks, large positive price changes

are always followed by large negative price changes. This finding is a violation of the:

A. moderate form of the efficient market

hypothesis.

B. semistrong form of the efficient market

hypothesis.

C. strong form of the efficient market

hypothesis.

D. weak form of the efficient market

hypothesis.

E. None of

these.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

22. Which of the following would be indicative of inefficient markets?

A. Overreaction and

reversion

B. Delayed

response

C. Immediate and accurate

response

D. Both Overreaction and reversion; and Delayed

response

E. Both Overreaction and reversion; and Immediate and accurate

response

23. When the stock price follows a random walk, the price today is said to be equal to the

prior period price plus the expected return for the period with any remaining

difference to the actual return due to:

A. a predictable amount based on the past

prices.

B. a component based on new information unrelated to

past prices.

C. the security's

risk.

D. the risk free

rate.

E. None of

these.

24. Which form of the efficient market hypothesis implies that security prices reflect only

information contained in past prices?

A. Weak

form

B. Semistrong

form

C. Strong

form

D. Hard

form

E. Past

form

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

25. If the weak form of efficient markets holds, then:

A. technical analysis is

useless.

B. stock prices reflect all information contained in past

prices.

C. stock prices follow a random

walk.

D. All of

these.

E. None of

these.

26. Under the concept of an efficient market, a random walk in stock prices means that:

A. there is no driving force behind price

changes.

B. technical analysts can predict future price movements to earn excess

returns.

C. the unexplained portion of price change in one period is unrelated to the

unexplained portion of price change in any other period.

D. the unexplained portion of price change in one period that cannot be explained by

expected return can only be explained by the unexplained portion of price change

in a prior period.

E. None of

these.

Random walk theory suggest that pas movement of stock price can not be

used to prdeict it's future movement. Such changes in price are totally

unrelated and independent. Thus it states that in lon run all methods of

predicting price movement of stock are useless since stock price takes a

random and unpredictable path

27. A semistrong form efficient market is distinct from a weak form efficient market by:

A. incorporating only random movements in the

price.

B. incorporating all publicly available information in

the price.

C. incorporating inside information in the

price.

D. All of

these.

E. None of

these.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

28. If a market is strong form efficient, it also implies that:

A. semistrong form efficiency

holds.

B. weak form efficiency

holds.

C. one cannot earn abnormal returns with inside

information.

D. Both semistrong form efficiency holds; and one cannot earn abnormal returns with

inside information.

E. semistrong form efficiency holds; and weak form efficiency holds; and one

cannot earn abnormal returns with inside information.

29. An investor discovers that predictions about weather patterns published years in

advance and found in the Farmer's Almanac are amazingly accurate. In fact, these

predictions enable the investor to predict the health of the farm economy and

therefore certain security prices. This finding is a violation of the:

A. moderate form of the efficient market

hypothesis.

B. semistrong form of the efficient market

hypothesis.

C. strong form of the efficient market

hypothesis.

D. weak form of the efficient market

hypothesis.

E. None of

these.

30. A lawyer works for a firm that advises corporate firms planning to sue other

corporations for antitrust damages. He finds that he can "beat the market" by short-

selling the stock of the firm that will be sued. This finding is a violation of the:

A. moderate form of the efficient market

hypothesis.

B. semistrong form of the efficient market

hypothesis.

C. strong form of the efficient market

hypothesis.

D. weak form of the efficient market

hypothesis.

E. None of

these.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

31. An investor discovers that stock prices change drastically as a result of certain events.

This finding is a violation of the:

A. moderate form of the efficient market

hypothesis.

B. semistrong form of the efficient market

hypothesis.

C. strong form of the efficient market

hypothesis.

D. weak form of the efficient market

hypothesis.

E. None of

these.

32. The semistrong form of the efficient market hypothesis states that:

A. all information is reflected in the price of

securities.

B. security prices reflect all publicly available

information.

C. future prices are

predictable.

D. Both all information is reflected in the price of securities; and future prices are

predictable.

E. None of

these.

33. The market price of a stock moves or fluctuates daily. This fluctuation is:

A. inconsistent with the semistrong efficient market hypothesis because prices should

be stable.

B. inconsistent with the weak form efficient market hypothesis because all past

information should be priced in.

C. consistent with the semistrong form of the efficient market hypothesis

because as new information arrives daily prices will adjust to it.

D. consistent with the strong form because prices are controlled by

insiders.

E. None of

these.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

34. An investor who picks a portfolio by throwing darts at the financial pages:

A. believes that efficient markets will protect the portfolio from harm as all

information is priced.

B. believes that riskier portfolios earn the same as less risky

portfolios.

C. does so because stock prices do not matter; only cash flow generated

matters.

D. Both believes that efficient markets will protect the portfolio from harm as all

information is priced; and does so because stock prices do not matter; and only

cash flow generated matters.

E. Both believes that riskier portfolios earn the same as less risky portfolios; and does

so because stock prices do not matter; and only cash flow generated matters.

35. Suppose that firms with unexpectedly high earnings earn abnormally high returns for

several months after the announcement. This would be evidence of:

A. efficient markets in the weak

form.

B. inefficient markets in the weak

form.

C. efficient markets in the semistrong

form.

D. inefficient markets in the

semistrong form.

E. inefficient markets in the strong

form.

36. Which of the following is not true about serial correlation?

A. It measures the correlation between the current return on a security and

the current return on another security.

B. It involves only one

security.

C. Positive serial correlation indicates a tendency for

continuation.

D. Negative serial correlation indicates a tendency toward

reversal.

E. Significant positive or negative serial correlation coefficients are indicative of

market inefficiency in the weak form.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

37. Which of the following is true?

A. A random walk for stock price changes is inconsistent with observed patterns in

price changes.

B. If the stock market follows a random walk, price changes should be highly

correlated.

C. If the stock market is weak form efficient, then stock prices follow a

random walk.

D. All of

these.

E. Both If the stock market follows a random walk, price changes should be highly

correlated; and If the stock market is weak form efficient, then stock prices follow a

random walk.

38. Event studies attempt to measure:

A. the influence of information released to the market on returns in days surrounding

its announcement.

B. if the market is at least semistrong form

efficient.

C. whether there is a significant reaction to public

announcements.

D. All of

these.

E. None of

these.

39. The abnormal return in an event study is described as:

A. the return earned on the day of announcement for the

stock.

B. the excess return earned on the day of announcement for

the stock.

C. the total return earned for the investment holding

period.

D. All of

these.

E. None of

these.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

40. Evidence on stock prices finds that the sudden death of a chief executive officer

causes stock prices to fall and the sudden death of an active founding chief executive

officer causes stock price to rise. This contrary evidence happens because:

A. markets are inefficient and unsure of the real value of the

events.

B. death is inevitable and market prices are

random.

C. things simply

happen.

D. the value of the founding executive was a negative

to the firm.

E. None of

these.

41. Studies of the performance of professionally managed mutual funds find that these

funds:

A. do not outperform a market index. Assuming mutual fund managers rely primarily

on public information, this finding refutes the semistrong form of the efficient

market hypothesis.

B. do not outperform a market index. Assuming mutual fund managers rely

primarily on public information, this finding supports the semistrong form

of the efficient market hypothesis.

C. outperform a market index. Assuming mutual fund managers rely primarily on

public information, this finding refutes the semistrong form of the efficient market

hypothesis.

D. outperform a market index. Assuming mutual fund managers rely primarily on

public information, this finding supports the semistrong form of the efficient market

hypothesis.

E. Both outperform a market index. Assuming mutual fund managers rely primarily on

public information, this finding refutes the semistrong form of the efficient market

hypothesis; and outperform a market index. Assuming mutual fund managers rely

primarily on public information, this finding supports the semistrong form of the

efficient market hypothesis.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

42. Which of the following statements is true?

A. In efficient markets, a stock's price should change with the arrival of new

information.

B. Average stock returns are higher in January than other

months.

C. Studies by Fama and French and others find that returns of high book to market

stocks (actual price that is recorded [book value] is higher than the market

evaluation – show that it is undervalued are much higher than low book to market

value stocks to be consistent with the efficient market hypothesis.

undervalue will give you higher returns compared to overvalued stocks When you find out

something is cheap, will buy; demand will increase, hence this will push the price of it and

provide you higher returns

D. All of

these.

E. None of

these.

43. Which of the following is true?

A. Most empirical evidence is consistent with strong form

efficiency.

B. Most empirical evidence is inconsistent with weak form

efficiency.

C. Strong form market efficiency is not supported by the empirical

evidence.

D. Both Most empirical evidence is consistent with strong form efficiency; and Strong

form market efficiency is not supported by the empirical evidence.

E. Both Most empirical evidence is inconsistent with weak form efficiency;

and Strong form market efficiency is not supported by the empirical

evidence.

44. In examining the issue of whether the choice of accounting methods affects stock

prices, studies have found that:

A. accounting depreciation methods can significantly affect stock

prices.

B. switching depreciation methods can significantly affect stock

prices.

C. accounting changes that increase accounting earnings also increases stock

prices.

D. accounting changes can affect stock prices if the company were either to

withhold information or provide incorrect information.

E. All of

these.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

45. Market efficiency says:

A. prices may not reflect underlying

value.

B. a good financial manager can time stock

sales.

C. managers may profitably speculate in foreign

currency.

D. managers cannot boost stock prices through creative

accounting.

E. None of

these.

46. The abnormal returns for initial public offerings over longer time periods seem to call

market efficiency into question because:

A. the average returns at announcement are large and positive while the

long-term results are much lower than the returns for seasoned equity

offerings.

B. the average returns at announcement are small and negative while the long-term

results are much lower than the returns for seasoned equity offerings.

C. the average returns at announcement are zero while the long-term results are

much higher than the returns for seasoned equity offerings.

D. the average returns at announcement are large and positive while the long-term

results are much higher than the returns for seasoned equity offerings.

E. the average returns at announcement are insignificant while the long-term results

are much lower than the returns for seasoned equity offerings.

47. An example of financially irrational behavior is:

A. gambling in Las

Vegas.

B. when a firm announces an increase in earnings and the stock price enjoys three

days of large abnormal returns.

C. when a firm announces an increase in earnings and the stock price enjoys an

immediate surge in value which is captured in one day.

D. Both gambling in Las Vegas; and when a firm announces an increase in

earnings and the stock price enjoys three days of large abnormal returns.

E. Both gambling in Las Vegas; and when a firm announces an increase in earnings

and the stock price enjoys an immediate surge in value which is captured in one

day.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

48. Ritter's study of Initial Public Offerings (IPOs) showed that the post offering stock

performance was:

A. less than the control group by about 2% in the five years

following the IPO.

B. incorrectly priced at issuance because over the next five years the abnormal

returns were greater than zero on average.

C. immaterial to the pricing of the IPO because future market performance is unknown

at issuance.

D. equal across IPOs, irrespective of risk or which year they were

issued.

E. All of

these.

Ritter's study of Initial Public Offerings (IPOs) showed that the post offering

stock performance was less than the control group by about 2% in the five

years following the IPO.

49. If the securities market is efficient, an investor need only throw darts at the stock

pages to pick securities and be just as well off.

A. This is true because there are no differences in risk and

return.

B. This is true because in an efficient stock market prices do not

fluctuate.

C. This is false because professional portfolio managers prefer to generate

commissions by active trading.

D. This is false because investors may not hold a desirable risk-return

combination in their portfolio.

E. This is false because the markets are controlled by the institutional

investors.

50 Financial managers must be cognizant of market efficiency because:

.

A. manipulating earnings by accounting changes does not fool the

market.

B. timing security sales is futile because without private information the current price

reflects all known information.

C. there is limited price pressure from any large sale of stock depressing prices only

momentarily before recovering to prior levels.

D. All of

these.

E. None of

these.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

51. Event studies have been used to examine:

A. IPOs, SEOs, and other equity

issuances.

B. changes in

earnings.

C. mergers and

acquisitions.

D. most financial

events.

E. All of

these.

52. If the market is weak form efficient:

A. semistrong form efficiency

holds.

B. strong form efficiency must

hold.

C. semistrong form efficiency may

hold.

D. markets are not weak form

efficient.

E. None of

these.

53. In order to create value from capital budgeting decisions, the firm is likely to:

A. locate an unsatisfied demand for a particular product or

service.

B. create a barrier to make it more difficult for other firms to

compete.

C. produce products or services at a lower cost than the

competition.

D. locate an unsatisfied demand for a particular product or service and produce

products or services at a lower cost than the competition.

E. locate an unsatisfied demand for a particular product or service; create a

barrier to make it more difficult for other firms to compete; and produce

products or services at a lower cost than the competition.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

54. Valuable financing opportunities can be created by:

A. fooling

investors.

B. reducing costs or increasing

subsidies.

C. the creation of a new

security.

D. fooling investors and reducing costs or increasing

subsidies.

E. fooling investors; reducing costs or increasing subsidies; and the creation of a new

security.

55. The following time period(s) is/are consistent with the bubble theory:

A. the stock market crash of

1929.

B. the stock market crash of

1972.

C. the stock market crash of

1987.

D. the stock market crash of 1929 and the stock market

crash of 1987.

E. the stock market crash of 1929; the stock market crash of 1972; and the stock

market crash of 1987.

56. In the five years after the offering, ______ underperform matched control groups.

A. initial public

offerings

B. seasoned equity

offerings

C. bond

offerings

D. initial public offerings and seasoned equity

offerings

E. initial public offerings; seasoned equity offerings; and bond

offerings

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

57. In the three years prior to a forced departure of management, stock prices, adjusted

for market performance, on average will:

A. decline about

20%.

B. decline about

40%.

C. decline about

60%.

D. remain

stable.

E. increase about

20%.

58. If it takes 10 days for a stock price to correctly respond an event, it might be due to

A. overreactio

n.

B. under

reaction.

C. efficient

markets.

D. overreaction and under

reaction.

E. under reaction and efficient

markets.

59. Strong form market efficiency

A. accurately reflects all information, both public and

private.

B. only accurately reflects private

information.

C. reflects only public

information.

D. implies weak form market

inefficiency.

E. implies semi-strong form market

inefficiency.

Strong form efficiency refers to a market where share prices fully and fairly reflect not only all

publicly available information and all past information, but also all private information (insider

information) as well. In such a market, it is not possible to make abnormal gains by studying any

kind of information. Since it is always possible to make abnormal gains by using insider information

(even if governments have made this illegal), even well-developed capital markets cannot be

described as strong form efficient. However, investors and analysts are often accurate in their

estimates of what is happening inside companies and financial management theory considers well-

developed capital markets to be highly efficient.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

60. The average serial correlation, which indicates if there is a relationship between

yesterday's return and today's return for the 100 largest companies is

A. positive, and

large.

B. not possible to

calculate.

C. zero

.

D. positive, but

small.

E. negative, but

small.

Essay Questions

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

61. Define the three forms of market efficiency.

The Three Basic Forms of the EMH

The efficient market hypothesis assumes that markets are efficient.

However, the efficient market hypothesis (EMH) can be categorized into

three basic levels:

1. Weak-Form EMH

The weak-form EMH implies that the market is efficient, reflecting all

market information. This hypothesis assumes that the rates of return on

the market should be independent; past rates of return have no effect on

future rates. Given this assumption, rules such as the ones traders use

to buy or sell a stock, are invalid.

2. Semi-Strong EMH

The semi-strong form EMH implies that the market is efficient, reflecting

all publicly available information. This hypothesis assumes that stocks

adjust quickly to absorb new information. The semi-strong form EMH

also incorporates the weak-form hypothesis. Given the assumption that

stock prices reflect all new available information and investors purchase

stocks after this information is released, an investor cannot benefit over

and above the market by trading on new information.

3. Strong-Form EMH

The strong-form EMH implies that the market is efficient: it reflects all

information both public and private, building and incorporating the weak-

form EMH and the semi-strong form EMH. Given the assumption that

stock prices reflect all information (public as well as private) no investor

would be able to profit above the average investor even if he was given

new information.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

62.

Explain why it is that in an efficient market, investments have an expected NPV of

zero.

(1): In an efficient market all investments have an expected NPV of zero

because information is impounded in prices and hence investors will be

expected to earn a normal rate of return. It should be noted an efficient

market is one in which investors will be expected to earn only a rate of

return that will be just enough to compensate for the risk borne by the

investor. The difference between actual price and expected price will

also be zero.

(2): Yes, your cousin’s performance is a violation of market efficiency.

This is because market efficiency is earmarked by the degree to which

market prices reflect all available, relevant information. In other words if

the market is efficient then all information is (and should be) incorporated

into stock prices and so beating the market is not possible. As current

prices reflect all available and relevant information the possibility of

beating the market does not exist in an efficient market.

(3): The risk that often accompanies the behavioral concept of familiarity

is the risk of building a sub-optimal portfolio and the risk of ignoring other

viable options that can be added to portfolio diversification. It should be

noted that familiarity bias can occur when an investor has a preference

for a familiar investment. This is despite the fact that there are other

viable investment options available.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

63. Do you think the lessons from capital market history will hold for each year in the

future?

That is, as an example, if you buy small stocks will your investment always

outperform

U.S. Treasury bonds?

64. Suppose your cousin invests in the stock market and doubles her money in a single

year while the market, on average, earned a return of only about 15%. Is your cousin's

performance a violation of market efficiency?

No, an efficient market does not prevent investors from earning a return

above the average market return. It is completely possible for investors

to beat the market at times. Therefore your cousin's performance is not a

violation of market efficiency. However, if this happens on a consistent

basis, there would certainly be some doubt cast on the market efficiency.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

65.

Why should a financial decision maker such as a corporate treasurer or CFO be

concerned with market efficiency?

Financial decision-maker such as corporate treasurer or CFO must be

concerned with market efficiency because they must protect a

company's value from the financial risks it faces from its business

activities.

Market efficiency refers to how well current prices reflect all available,

relevant information about the actual value of the underlying assets.

A truly efficient market eliminates the possibility of beating the market,

because any information available to any trader is already incorporated

into the market price.

For examples of market efficiency arise when perceived market

anomalies become widely known and then subsequently disappear. For

instance, it was once the case that when a stock was added to

an index such as the S&P 500 for the first time, there would be a large

boost to that share's price simply because it became part of the index

and not because of any new change in the company's fundamentals.

This index effect anomaly became widely reported and known, and has

since largely disappeared as a result. This means that as information

increases, markets become more efficient and anomalies are reduced.

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

lOMoARcPSD|10169457

Downloaded by Anh ?inh (dspanh.1410@gmail.com)

You might also like

- Efficient Capital Markets and Behavioral Challenges: Multiple Choice QuestionsDocument16 pagesEfficient Capital Markets and Behavioral Challenges: Multiple Choice QuestionsCông Long NguyễnNo ratings yet

- Fundamentals of Investments Valuation and Management Jordan 7th Edition Test Bank Full DownloadDocument57 pagesFundamentals of Investments Valuation and Management Jordan 7th Edition Test Bank Full Downloadwilliamunderwoodfkpiwrjbgz100% (36)

- Chap013 PDFDocument35 pagesChap013 PDFym5c2324No ratings yet

- Sample Test Chap04Document9 pagesSample Test Chap04Niamul HasanNo ratings yet

- CH 13Document9 pagesCH 13portia16100% (1)

- Questions. 1. Scarcity: A. Exists... : Question: Microeconomics Multiple Choice Questions. Please Answer All TheDocument14 pagesQuestions. 1. Scarcity: A. Exists... : Question: Microeconomics Multiple Choice Questions. Please Answer All TheRubina Hannure100% (1)

- Test Bank For Investments Analysis and Management 14th Edition Charles P Jones Gerald R Jensen 2 Full DownloadDocument10 pagesTest Bank For Investments Analysis and Management 14th Edition Charles P Jones Gerald R Jensen 2 Full Downloadandrewwilsoncziqfwxgks100% (21)

- 60 Câu (Có Đáp Án) - Ôn Tập PTCKDocument13 pages60 Câu (Có Đáp Án) - Ôn Tập PTCKvanpth20404cNo ratings yet

- MCQ EfficiencyDocument7 pagesMCQ EfficiencyBatoul ShokorNo ratings yet

- Test Bank For Investments Analysis and Behavior 1st Edition HirscheyDocument22 pagesTest Bank For Investments Analysis and Behavior 1st Edition HirscheySarahRiverakizb100% (32)

- Chapter 12 Market EfficiencyDocument17 pagesChapter 12 Market EfficiencymoatazNo ratings yet

- Economics Questions From H.ODocument27 pagesEconomics Questions From H.Oamanuel KifluNo ratings yet

- Tutorial 5 QuestionsDocument4 pagesTutorial 5 QuestionsĐỗ Minh HuyềnNo ratings yet

- Emh McqsDocument15 pagesEmh McqsTumaini JM100% (1)

- 16BSP422-Jan2017 - Outline AnswersDocument9 pages16BSP422-Jan2017 - Outline AnswersalexwilliamduffNo ratings yet

- Chap011 Text Bank (1) SolutionDocument23 pagesChap011 Text Bank (1) SolutionMuhammad HanafiNo ratings yet

- Test Bank Chapter 11 Investment BodieDocument37 pagesTest Bank Chapter 11 Investment BodieTami DoanNo ratings yet

- Equity QuestionsDocument9 pagesEquity QuestionsDuyên HànNo ratings yet

- 2021 Wassce Economics Theory SolutionDocument9 pages2021 Wassce Economics Theory SolutionBernard ChrillynNo ratings yet

- MCQ 4Document27 pagesMCQ 4Rishad kNo ratings yet

- Gordon Growth Model 2. Efficient Market Hypothesis: Are FormedDocument4 pagesGordon Growth Model 2. Efficient Market Hypothesis: Are FormedLinh KellyNo ratings yet

- MAS 7 Exercises For UploadDocument9 pagesMAS 7 Exercises For UploadChristine Joy Duterte RemorozaNo ratings yet

- 70 724ef94aDocument56 pages70 724ef94adecentyNo ratings yet

- Valuation Method ExamsDocument75 pagesValuation Method ExamsRhejean Lozano100% (2)

- Chapter 2 (Investment)Document20 pagesChapter 2 (Investment)Elen LimNo ratings yet

- Infolink Uiversity College Dilla Campus Department of Accountig & FinanceDocument4 pagesInfolink Uiversity College Dilla Campus Department of Accountig & FinanceKanbiro OrkaidoNo ratings yet

- Chap 011Document33 pagesChap 011ducacapupuNo ratings yet

- Tutorial Solutions6-1Document7 pagesTutorial Solutions6-1Yilin YANGNo ratings yet

- Equity QUIZDocument8 pagesEquity QUIZSaYeD SeeDooNo ratings yet

- FIMA 40023 Security Analysis MidtermDocument14 pagesFIMA 40023 Security Analysis MidtermNila FranciaNo ratings yet

- QUIZ (17.10.2016) : Gestão Financeira IiDocument2 pagesQUIZ (17.10.2016) : Gestão Financeira IiRafael RochaNo ratings yet

- FINMARKETS - Prelim ExamDocument7 pagesFINMARKETS - Prelim ExamArmalyn CangqueNo ratings yet

- Tut 5 FMTDocument3 pagesTut 5 FMTNguyễn Thùy Linh 1TC-20ACNNo ratings yet

- Eco MidDocument14 pagesEco Midbeshahashenafe20No ratings yet

- Econ 11 Exercise Set No. 1Document3 pagesEcon 11 Exercise Set No. 1orangemonkey2014No ratings yet

- FGM OBJESSAY CompiledDocument20 pagesFGM OBJESSAY CompiledPatience AkpanNo ratings yet

- Building Warehousing CompetitivenessDocument18 pagesBuilding Warehousing CompetitivenesspenelopegerhardNo ratings yet

- Financial Institution & Investment Management - Final ExamDocument5 pagesFinancial Institution & Investment Management - Final Exambereket nigussie100% (4)

- Business Economics and Financial Analysis Course File: Deshmukhi, HyderabadDocument14 pagesBusiness Economics and Financial Analysis Course File: Deshmukhi, HyderabadDeepthi YadavNo ratings yet

- 17BSP422-Jan2018 Outline AnswersDocument7 pages17BSP422-Jan2018 Outline AnswersalexwilliamduffNo ratings yet

- 15BSP422-Jan2016 Outline AnswersDocument7 pages15BSP422-Jan2016 Outline AnswersalexwilliamduffNo ratings yet

- FM19 - PrelimQ1 Chap 1 & 2Document7 pagesFM19 - PrelimQ1 Chap 1 & 2sarahbeeNo ratings yet

- Ramon Magsaysay Memorial Colleges-Marbel Inc Accounting Education Program Purok Waling-Waling, Arellano Street, Zone II, Koronadal CityDocument3 pagesRamon Magsaysay Memorial Colleges-Marbel Inc Accounting Education Program Purok Waling-Waling, Arellano Street, Zone II, Koronadal Cityalajar opticalNo ratings yet

- Answers - Market EfficiencyDocument4 pagesAnswers - Market Efficiencymanar.boulaabaNo ratings yet

- Final Exam Study QuestionsDocument14 pagesFinal Exam Study QuestionsSaid DávilaNo ratings yet

- Chương 14Document21 pagesChương 14Như Quỳnh ÂuNo ratings yet

- N7Document13 pagesN7Hứa Trí TínNo ratings yet

- FIN203 Tutorial 1 QDocument4 pagesFIN203 Tutorial 1 Q黄于绮100% (1)

- FinMar Reviewer - Multiple ChoicesDocument34 pagesFinMar Reviewer - Multiple ChoicesdmangiginNo ratings yet

- 0304 - Ec 1Document30 pages0304 - Ec 1haryhunter100% (3)

- Financial Institutions Instruments and Markets 8th Edition Viney Test BankDocument58 pagesFinancial Institutions Instruments and Markets 8th Edition Viney Test Bankluyendonnasxs7100% (28)

- Investments Canadian 7th Edition Bodie Test BankDocument38 pagesInvestments Canadian 7th Edition Bodie Test Bankemareategui100% (16)

- Practice Test 3Document6 pagesPractice Test 3garu1991No ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet

- The Big Long: Using Stops to Profit More and Reduce Risk in the Long-Term UptrendFrom EverandThe Big Long: Using Stops to Profit More and Reduce Risk in the Long-Term UptrendNo ratings yet

- KTTCDocument2 pagesKTTCAn Trần Thị HảiNo ratings yet

- Multinational Financial Management 7 Edition: Alan Shapiro J.Wiley & SonsDocument36 pagesMultinational Financial Management 7 Edition: Alan Shapiro J.Wiley & SonsMayank GuptaNo ratings yet

- SituationsDocument8 pagesSituationsAn Trần Thị HảiNo ratings yet

- IAChap001 2 ADocument16 pagesIAChap001 2 AAn Trần Thị HảiNo ratings yet

- A Practical Guide To Price Action Tradingdocx PDF FreeDocument36 pagesA Practical Guide To Price Action Tradingdocx PDF Freekhatodarapolicestation100% (1)

- Basis Technical AnalysisDocument92 pagesBasis Technical Analysisrahulsheth_cal2159No ratings yet

- Candlestick Charts - ExplanationDocument15 pagesCandlestick Charts - Explanationpangm100% (1)

- Reg - Book Nyte13 Low PDFDocument16 pagesReg - Book Nyte13 Low PDFpankaj thakurNo ratings yet

- The 1 Hour Trade Make Money With One Simple Strategy, One Hour Daily PDFDocument107 pagesThe 1 Hour Trade Make Money With One Simple Strategy, One Hour Daily PDFSoma Shekar100% (4)

- Technicalanalysis Astudyonselectedstocks 120105030453 Phpapp02Document76 pagesTechnicalanalysis Astudyonselectedstocks 120105030453 Phpapp02Ankita DoddamaniNo ratings yet

- Inner Circle Trader - TPDS 2Document3 pagesInner Circle Trader - TPDS 2Sonja Moran83% (6)

- Japanese Candlestick Charting TechniquesDocument45 pagesJapanese Candlestick Charting TechniquesSau Gio SauNo ratings yet

- TD Rei PDFDocument12 pagesTD Rei PDFzameerp73No ratings yet

- Volume Zone OscillatorDocument15 pagesVolume Zone OscillatorRoberto Rossi100% (1)

- How Much Interest Is Your Broker Paying You?: Pays Up To 3.83% On Idle Cash in Your Brokerage AccountDocument11 pagesHow Much Interest Is Your Broker Paying You?: Pays Up To 3.83% On Idle Cash in Your Brokerage AccountRenéNo ratings yet

- Document From AdityaDocument6 pagesDocument From AdityaDevansh ChauhanNo ratings yet

- Using Candlestick Charts To Trade ForexDocument13 pagesUsing Candlestick Charts To Trade ForexRishaal MahadhoNo ratings yet

- 3.about This Course - Welcome To The Course - Fundamentals of Technical Analysis - EdxDocument4 pages3.about This Course - Welcome To The Course - Fundamentals of Technical Analysis - EdxHitesh LNo ratings yet

- FINANCE - A Study On Fundamental & Technical Analysis of SectorDocument114 pagesFINANCE - A Study On Fundamental & Technical Analysis of SectorNikita DhomkarNo ratings yet

- Ashish Bandooni: Rofessional XperienceDocument2 pagesAshish Bandooni: Rofessional Xperienceanon_907856858No ratings yet

- Chris Dennistoun Catalogue 2012Document11 pagesChris Dennistoun Catalogue 2012blandibloodNo ratings yet

- Guppy Trend Trading 1Document50 pagesGuppy Trend Trading 1Supachai Tangsitchanakul86% (7)

- Starkoff Andrew. Volume Analysis How To Receive Advantages in Trading DEMO 1.2 PDFDocument36 pagesStarkoff Andrew. Volume Analysis How To Receive Advantages in Trading DEMO 1.2 PDFJetzayn Casas67% (3)

- Candlesticks BookDocument14 pagesCandlesticks BookLoose100% (1)

- TD Apr97Document6 pagesTD Apr97husserl01100% (1)

- CandleSticks DiagramDocument39 pagesCandleSticks Diagramberaatanu88% (25)

- FTI Teaching (Updated)Document129 pagesFTI Teaching (Updated)bonasNo ratings yet

- The Handbook of Technical Analysis Test Bank The Practitioners Comprehensive Guide To Technical Anal 191214043625Document7 pagesThe Handbook of Technical Analysis Test Bank The Practitioners Comprehensive Guide To Technical Anal 191214043625Mahmoud Habak25% (4)

- Laundry T Theory Introduction 1997Document12 pagesLaundry T Theory Introduction 1997Longterm YeungNo ratings yet

- Chapter 7 - Test BankDocument93 pagesChapter 7 - Test Bankjoess100% (1)

- Getting Started in Currency Trading: Way of The Turtle Trend Following Mastering Trading Stress Currency KingsDocument1 pageGetting Started in Currency Trading: Way of The Turtle Trend Following Mastering Trading Stress Currency KingssabenasuhaimiNo ratings yet

- Excel Integration With Velocity 2.0 (RT + Historical) - TrueData™ Velocity 2.0Document10 pagesExcel Integration With Velocity 2.0 (RT + Historical) - TrueData™ Velocity 2.0screen1 recordNo ratings yet

- Day 1 Crypto Technical Analysis ModuleDocument16 pagesDay 1 Crypto Technical Analysis ModuleTomNo ratings yet

- The 3 Best Technical Indicators On EarthDocument11 pagesThe 3 Best Technical Indicators On Earthpabloorellana8No ratings yet