Professional Documents

Culture Documents

Adani Bs Merged

Uploaded by

RishabhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adani Bs Merged

Uploaded by

RishabhCopyright:

Available Formats

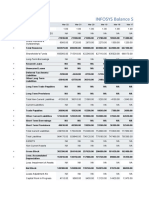

Financial Statement Analysis

Ticker: ADE IN Equity Periodicity: Annuals Currency: INR Note: Years shown on the report are Fiscal Years Company: Adani Enterprises Ltd

Filing: Most Recent Consolidation Basis: Consolidated Data

Standardized

Restated:2014 A Restated:2015 A Restated:2016 A Restated:2017 A Restated:2018 A Restated:2019 A Original:2020 A Original:2021 A Original:2022 A Original:2023 A

For the period ending 2014-3-31 2015-3-31 2016-3-31 2017-3-31 2018-3-31 2019-3-31 2020-3-31 2021-3-31 2022-3-31 2023-3-31

Total Assets

+ Cash, Cash 38,654.10 42,419.40 11,343.30 14,692.40 15,322.30 14,045.60 28,697.70 12,260.90 39,788.80 55,386.90

Equivalents & STI

+ Cash & Cash 37,211.20 36,510.40 11,033.00 13,724.80 14,605.40 14,017.40 28,148.10 11,965.80 39,158.60 53,736.90

Equivalents

+ ST Investments 1,442.90 5,909.00 310.30 967.60 716.90 28.20 549.60 295.10 630.20 1,650.00

+ Accounts & Notes 101,125.30 153,191.50 101,874.60 127,417.50 120,987.70 143,070.30 131,465.30 119,826.50 137,121.90 125,528.80

Receiv

+ Accounts 101,125.30 153,191.50 101,874.60 127,417.50 120,987.70 143,070.30 131,465.30 119,826.50 137,121.90 125,528.80

Receivable, Net

+ Notes Receivable, 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Net

+ Unbilled Revenues 2,145.60 2,494.40 830.60 1,256.20 4,009.80 4,556.40 5,914.50 7,632.90

+ Inventories 39,240.70 40,816.80 12,997.80 16,519.00 23,425.60 26,688.20 25,623.70 17,570.40 67,882.80 69,180.50

+ Raw Materials 12,879.40 17,110.30 0.70 1,768.10 1,938.90 800.90 964.40 1,458.80 2,399.10 1,109.80

+ Work In Process 0.00 0.00 0.00 0.00 872.00 443.40 2,375.70 2,957.70 5,010.80 4,690.30

+ Finished Goods 19,996.90 16,197.90 8,324.20 8,278.50 19,824.10 24,595.00 21,402.00 12,336.20 58,478.70 62,070.80

+ Other Inventory 6,364.40 7,508.60 4,672.90 6,472.40 790.60 848.90 881.60 817.70 1,994.20 1,309.60

+ Other ST Assets 89,995.00 90,823.90 85,005.50 60,463.50 193,997.60 46,219.80 52,032.70 45,418.90 58,745.90 113,488.20

+ Prepaid Expenses 11,600.90 9,750.30 12,781.20 14,918.70 7,901.70 9,389.20 10,094.20 8,452.60 19,191.50 22,773.10

+ Derivative & 0.00 1.20 97.90 249.10 65.70 1,156.90 40.90 32.80 3,094.40

Hedging Assets

+ Assets Held-for- 133,742.50 0.00 0.00 0.00 1,000.00

Sale

+ Misc ST Assets 78,394.10 81,073.60 72,223.10 45,446.90 52,104.30 36,764.90 40,781.60 36,925.40 39,521.60 86,620.70

Total Current Assets 269,015.10 327,251.60 213,366.80 221,586.80 354,563.80 231,280.10 241,829.20 199,633.10 309,453.90 371,217.30

+ Property, Plant & 808,509.30 851,756.90 147,672.20 180,314.20 127,109.40 115,325.30 137,097.50 143,651.50 403,854.90 675,572.10

Equip, Net

+ Property, Plant & 890,450.30 976,453.10 150,654.70 189,058.30 139,352.30 128,475.90 154,643.10 162,895.10 434,656.50 722,700.50

Equip

- Accumulated 81,941.00 124,696.20 2,982.50 8,744.10 12,242.90 13,150.60 17,545.60 19,243.60 30,801.60 47,128.40

Depreciation

+ LT Investments & 1,441.00 1,532.10 192.30 9,873.60 28,099.00 28,849.90 28,434.00 86,724.40 104,657.20 107,222.20

Receivables

+ LT Investments 1,441.00 1,532.10 192.30 9,873.60 28,099.00 28,849.90 28,434.00 86,724.40 104,657.20 107,222.20

+ Other LT Assets 103,572.00 128,045.10 56,329.60 65,119.50 55,174.90 49,906.50 61,622.90 86,419.60 199,635.90 260,866.60

+ Total Intangible 33,013.70 53,913.70 34,485.40 33,680.50 33,701.10 32,525.00 41,134.40 52,979.20 132,817.00 70,229.00

Assets

+ Goodwill 926.10 20,170.90 803.80 796.60 796.60 542.20 1,391.30 1,519.70 3,009.20 8,871.60

+ Other Intangible 32,087.60 33,742.80 33,681.60 32,883.90 32,904.50 31,982.80 39,743.10 51,459.50 129,807.80 61,357.40

Assets

+ Prepaid Expense 157.30 255.90 45.10 2,685.20 2,184.10 4,437.60 3,941.70

+ Deferred Tax 1,518.20 1,403.80 4,050.40 4,876.30 3,170.50 3,493.10 2,727.70 765.40 1,738.30 2,093.40

Assets

+ Derivative & 0.00

Hedging Assets

+ Investments in 0.00 0.00 7,250.10 9,335.70 0.00 0.00 0.00 0.00 0.00

Affiliates

+ Misc LT Assets 69,040.10 72,727.60 10,386.40 16,971.10 18,303.30 13,843.30 15,075.60 30,490.90 60,643.00 184,602.50

Total Noncurrent 913,522.30 981,334.10 204,194.10 255,307.30 210,383.30 194,081.70 227,154.40 316,795.50 708,148.00 1,043,660.90

Assets

Total Assets 1,182,537.40 1,308,585.70 417,560.90 476,894.10 564,947.10 425,361.80 468,983.60 516,428.60 1,017,601.90 1,414,878.20

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 12/01/2023 03:53:03 1

Financial Statement Analysis

Ticker: ADE IN Equity Periodicity: Annuals Currency: INR Note: Years shown on the report are Fiscal Years Company: Adani Enterprises Ltd

Filing: Most Recent Consolidation Basis: Consolidated Data

Restated:2014 A Restated:2015 A Restated:2016 A Restated:2017 A Restated:2018 A Restated:2019 A Original:2020 A Original:2021 A Original:2022 A Original:2023 A

For the period ending 2014-3-31 2015-3-31 2016-3-31 2017-3-31 2018-3-31 2019-3-31 2020-3-31 2021-3-31 2022-3-31 2023-3-31

Liabilities &

Shareholders' Equity

+ Payables & 88,762.20 103,831.80 64,444.50 91,959.10 86,052.30 123,978.50 122,521.70 132,988.80 202,853.90 326,531.20

Accruals

+ Accounts Payable 88,762.20 103,831.80 51,943.20 76,545.10 85,490.00 119,887.30 118,136.60 117,563.40 176,478.20 285,468.50

+ Accrued Taxes 396.10 325.90 402.40 383.00 495.20 242.90 1,676.60 1,014.90

+ Interest & 1,107.80 1,030.10 1,275.30 1,288.90 2,940.00 2,191.80 8,081.00

Dividends Payable

+ Other Payables & 10,997.40 14,058.00 159.90 2,432.90 2,601.00 12,242.50 22,507.30 31,966.80

Accruals

+ ST Debt 153,948.10 194,132.00 121,603.10 116,723.90 133,637.10 82,509.80 89,221.70 64,904.30 202,839.80 70,258.80

+ ST Borrowings 153,948.10 194,132.00 110,059.90 106,798.80 125,993.80 69,591.40 81,368.40 57,700.10 193,721.00 42,418.50

+ ST Lease 0.00 0.00 0.00 0.00 0.00 0.00 186.80 125.30 636.40 12,962.90

Liabilities

+ ST Finance 0.00 0.00 0.00 0.00 0.00 0.00

Leases

+ Current Portion of 11,543.20 9,925.10 7,643.30 12,918.40 7,666.50 7,078.90 8,482.40 14,877.40

LT Debt

+ Other ST Liabilities 124,442.50 130,786.50 13,665.20 13,586.80 123,306.00 18,604.60 21,145.40 16,937.80 32,804.10 51,240.50

+ Deferred Revenue 0.00 0.00 0.00 0.00 0.00 0.00

+ Derivatives & 0.00 801.50 2,188.40 25.30 1,628.30 13.30 372.00 419.80 856.80

Hedging

+ Misc ST Liabilities 124,442.50 130,786.50 12,863.70 11,398.40 123,280.70 16,976.30 21,132.10 16,565.80 32,384.30 50,383.70

Total Current Liabilities 367,152.80 428,750.30 199,712.80 222,269.80 342,995.40 225,092.90 232,888.80 214,830.90 438,497.80 448,030.50

+ LT Debt 495,842.30 554,867.60 70,090.40 91,733.20 42,729.80 29,922.20 39,480.80 96,864.10 213,200.50 461,745.80

+ LT Borrowings 495,842.30 554,867.60 70,090.40 91,733.20 42,729.80 29,922.20 35,158.10 95,233.00 208,034.30 325,900.30

+ LT Lease 0.00 0.00 0.00 0.00 0.00 0.00 4,322.70 1,631.10 5,166.20 135,845.50

Liabilities

+ LT Finance 0.00 0.00 0.00 0.00 0.00 0.00

Leases

+ Other LT Liabilities 37,163.90 26,671.20 13,129.30 15,908.90 20,551.60 18,909.60 14,514.60 15,633.50 96,619.90 126,201.40

+ Accrued Liabilities 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

+ Pension Liabilities 0.00 0.00 278.90 378.70 461.30 433.40 558.80 691.30 1,351.40 1,955.90

+ Deferred Revenue 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

+ Deferred Tax 7,997.50 10,048.30 767.10 779.30 893.70 0.00 233.00 261.40 26,062.70 29,799.10

Liabilities

+ Derivatives & 0.00

Hedging

+ Misc LT Liabilities 29,166.40 16,622.90 12,083.30 14,750.90 19,196.60 18,476.20 13,722.80 14,680.80 69,205.80 94,446.40

Total Noncurrent 533,006.20 581,538.80 83,219.70 107,642.10 63,281.40 48,831.80 53,995.40 112,497.60 309,820.40 587,947.20

Liabilities

Total Liabilities 900,159.00 1,010,289.10 282,932.50 329,911.90 406,276.80 273,924.70 286,884.20 327,328.50 748,318.20 1,035,977.70

+ Preferred Equity 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

and Hybrid Capital

+ Share Capital & 1,099.80 1,099.80 10,926.20 10,926.20 10,926.20 10,926.20 10,926.20 10,926.20 26,278.30 103,278.30

APIC

+ Common Stock 1,099.80 1,099.80 1,099.80 1,099.80 1,099.80 1,099.80 1,099.80 1,140.00

+ Additional Paid in 9,826.40 9,826.40 9,826.40 9,826.40 9,826.40 9,826.40 25,178.50 102,138.30

Capital

- Treasury Stock 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

+ Retained Earnings 0.00 0.00 99,597.50 109,308.10 116,205.80 108,592.90 117,838.00 126,790.70 132,224.50 155,857.30

+ Other Equity 236,472.10 256,178.30 23,252.40 21,125.40 23,759.70 28,040.30 40,701.50 33,868.80 64,062.30 71,374.50

Equity Before Minority 237,571.90 257,278.10 133,776.10 141,359.70 150,891.70 147,559.40 169,465.70 171,585.70 222,565.10 330,510.10

Interest

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 12/01/2023 03:53:03 2

Financial Statement Analysis

Ticker: ADE IN Equity Periodicity: Annuals Currency: INR Note: Years shown on the report are Fiscal Years Company: Adani Enterprises Ltd

Filing: Most Recent Consolidation Basis: Consolidated Data

Restated:2014 A Restated:2015 A Restated:2016 A Restated:2017 A Restated:2018 A Restated:2019 A Original:2020 A Original:2021 A Original:2022 A Original:2023 A

For the period ending 2014-3-31 2015-3-31 2016-3-31 2017-3-31 2018-3-31 2019-3-31 2020-3-31 2021-3-31 2022-3-31 2023-3-31

+ Minority/Non 44,806.50 41,018.50 852.30 5,622.50 7,778.60 3,877.70 12,633.70 17,514.40 46,718.60 48,390.40

Controlling Interest

Total Equity 282,378.40 298,296.60 134,628.40 146,982.20 158,670.30 151,437.10 182,099.40 189,100.10 269,283.70 378,900.50

Total Liabilities & 1,182,537.40 1,308,585.70 417,560.90 476,894.10 564,947.10 425,361.80 468,983.60 516,428.60 1,017,601.90 1,414,878.20

Equity

Reference Items

Accounting Standard IN GAAP IN GAAP IN GAAP IN GAAP IN GAAP IN GAAP IN GAAP IN GAAP IN GAAP IN GAAP

Shares Outstanding 1,099.81 1,099.81 1,099.81 1,099.81 1,099.81 1,099.81 1,099.81 1,099.81 1,099.81 1,140.00

Number of Treasury 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Shares

Pension Obligations 0.00 278.90 378.70 461.30 433.40 558.80 691.30 1,351.40 1,955.90

Future Minimum 1,153.50 894.90 371.40 269.00 756.80 657.90 13,306.00

Operating Lease

Obligations

Capital Leases - Total 0.00 0.00 0.00 0.00 0.00 0.00

Percent Of Foreign 22.67 20.75 18.24 18.70 20.81 19.41 20.48 20.74 20.42 25.70

Ownership

Number Of 37,629.00 49,364.00 100,927.00 81,677.00 74,533.00 83,070.00 81,620.00 151,802.00 226,071.00 761,044.00

Shareholders

Options Granted 0.00 0.00 0.00 0.00 0.00 0.00 0.00

During Period

Options Outstanding at 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Period End

Net Debt 611,136.30 706,580.20 180,350.20 193,764.70 161,044.60 98,386.40 100,004.80 149,507.50 376,251.50 476,617.70

Net Debt to Equity 216.42 236.87 133.96 131.83 101.50 64.97 54.92 79.06 139.72 125.79

Tangible Common 17.80 16.21 25.92 24.30 22.06 29.28 29.99 25.59 10.14 19.36

Equity Ratio

Current Ratio 0.73 0.76 1.07 1.00 1.03 1.03 1.04 0.93 0.71 0.83

Cash Conversion 28.69 24.07 60.91 57.06 56.50 37.12 16.70 -5.67 9.10 -22.30

Cycle

Number of Employees 1,518.00 1,614.00 877.00 2,042.00 790.00 1,155.00 2,140.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 12/01/2023 03:53:03 3

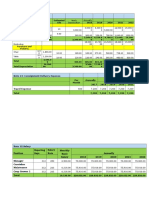

Financial Statement Analysis

Ticker: ADE IN Equity Periodicity: Annuals Currency: INR Note: Years shown on the report are Fiscal Years Company: Adani Enterprises Ltd

Filing: Most Recent Consolidation Basis: Consolidated Data

BBG Adj Highlights

Restated:2015 A Restated:2016 A Restated:2017 A Restated:2018 A Restated:2019 A Original:2020 A Original:2021 A Original:2022 A Original:2023 A Current/LTM

For the period ending 2015-3-31 2016-3-31 2017-3-31 2018-3-31 2019-3-31 2020-3-31 2021-3-31 2022-3-31 2023-3-31 2023-9-30

Market Capitalization 676,768.13 81,165.98 119,384.38 172,010.30 161,397.13 151,333.87 1,134,069.17 2,215,842.36 1,995,514.96 2,704,082.66

- Cash & Equivalents 42,419.40 11,343.30 14,692.40 15,322.30 14,045.60 28,697.70 12,260.90 39,788.80 55,386.90 84,126.50

+ Preferred & Other 41,018.50 852.30 5,622.50 7,778.60 3,877.70 12,633.70 17,514.40 46,718.60 48,390.40 50,685.40

+ Total Debt 748,999.60 191,693.50 208,457.10 176,366.90 112,432.00 128,702.50 161,768.40 416,040.30 532,004.60 571,446.40

Enterprise Value 1,424,366.83 262,368.48 318,771.58 340,833.50 263,661.23 263,972.37 1,301,091.07 2,638,812.46 2,520,523.06 3,242,087.96

Revenue, Adj 643,979.20 337,862.80 365,227.10 357,533.90 402,104.20 432,971.10 394,429.50 693,043.60 1,368,258.80 1,059,140.60

Growth %, YoY 16.94 -47.54 8.10 -2.11 12.47 7.68 -8.90 75.71 97.43 -13.64

Gross Profit, Adj

Margin %

EBITDA, Adj 185,383.80 28,240.10 33,430.10 38,419.60 39,874.30 34,306.30 38,175.60 57,397.10 119,896.50 103,495.40

Margin % 28.79 8.36 9.15 10.75 9.92 7.92 9.68 8.28 8.76 9.77

Net Income, Adj 18,967.78 10,239.61 9,763.43 8,870.55 7,010.08 10,800.49 9,193.85 7,744.04 24,612.08 24,442.90

Margin % 2.95 3.03 2.67 2.48 1.74 2.49 2.33 1.12 1.80 2.31

EPS, Adj 17.25 9.31 8.88 8.07 6.37 9.82 8.36 7.04 21.68 21.44

Growth %, YoY -11.59 -46.02 -4.65 -9.15 -20.97 54.07 -14.88 -15.77 207.83 95.32

Cash from Operations 14,796.80 45,499.40 -1,517.10 17,677.80 21,999.00 13,804.80 32,038.10 -3,945.60 148,924.20

Capital Expenditures -95,574.20 -59,201.40 -41,671.20 -73,050.00 -17,723.20 -29,011.60 -41,389.80 -116,474.80 -147,247.20 -114,985.70

Free Cash Flow -80,777.40 -13,702.00 -43,188.30 -55,372.20 4,275.80 -15,206.80 -9,351.70 -120,420.40 1,677.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 12/01/2023 03:53:03 1

Financial Statement Analysis

Ticker: ADE IN Equity Periodicity: Annuals Currency: INR Note: Years shown on the report are Fiscal Years Company: Adani Enterprises Ltd

Filing: Most Recent Consolidation Basis: Consolidated Data

Standardized

Restated:2015 A Restated:2016 A Restated:2017 A Restated:2018 A Restated:2019 A Original:2020 A Original:2021 A Original:2022 A Original:2023 A Current/LTM

For the period ending 2015-3-31 2016-3-31 2017-3-31 2018-3-31 2019-3-31 2020-3-31 2021-3-31 2022-3-31 2023-3-31 2023-9-30

Cash from Operating

Activities

+ Net Income 19,480.50 10,107.20 9,877.40 7,572.50 7,171.40 11,381.70 9,226.40 7,765.60 24,729.40 24,442.90

+ Depreciation & 35,218.60 3,144.50 6,400.00 13,575.60 10,872.50 6,017.90 6,165.80 12,477.80 24,361.40 29,584.70

Amortization

+ Non-Cash Items -7,547.80 -3,428.50 -4,294.90 -1,459.60 -11,564.10 1,016.40 -1,857.90 1,132.70 26,276.90

+ Other Non-Cash -7,547.80 -3,428.50 -4,294.90 -1,459.60 -11,564.10 1,016.40 -1,857.90 1,132.70 26,276.90

Adj

+ Chg in Non-Cash -32,354.50 35,676.20 -13,499.60 -2,697.90 14,089.40 -4,611.20 18,503.80 -25,321.70 73,556.50

Work Cap

+ (Inc) Dec in Accts -52,508.80

Receiv

+ (Inc) Dec in -1,648.40 -1,331.30 -3,521.20 -7,131.20 -3,692.30 1,725.90 3,434.20 -50,237.90 -1,297.70

Inventories

+ Inc (Dec) in Other 21,802.70 37,007.50 -9,978.40 4,433.30 17,781.70 -6,337.10 15,069.60 24,916.20 74,854.20

+ Net Cash From Disc 0.00 0.00 0.00 687.20 1,429.80 0.00 0.00 0.00 0.00

Ops

Cash from Operating 14,796.80 45,499.40 -1,517.10 17,677.80 21,999.00 13,804.80 32,038.10 -3,945.60 148,924.20

Activities

Cash from Investing

Activities

+ Change in Fixed & -91,523.00 -58,900.20 -41,469.30 -72,940.20 -17,652.30 -27,215.00 -33,589.90 -116,456.10 -146,548.00

Intang

+ Disp in Fixed & 4,051.20 301.20 201.90 109.80 70.90 1,796.60 7,799.90 18.70 699.20

Intang

+ Disp of Fixed Prod 4,051.20 301.20 201.90 109.80 70.90 1,796.60 7,799.90 18.70 699.20

Assets

+ Disp of Intangible 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Assets

+ Acq of Fixed & -95,574.20 -59,201.40 -41,671.20 -73,050.00 -17,723.20 -29,011.60 -41,389.80 -116,474.80 -147,247.20

Intang

+ Acq of Fixed Prod -95,574.20 -59,201.40 -41,671.20 -73,050.00 -17,723.20 -29,011.60 -41,389.80 -116,474.80 -147,247.20

Assets

+ Acq of Intangible 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Assets

+ Net Change in LT 0.00 0.00 0.00 0.00 0.00 0.00 3,023.20 888.20 0.00

Investment

+ Dec in LT 0.00 0.00 0.00 0.00 0.00 0.00 3,023.20 888.20 0.00

Investment

+ Inc in LT 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Investment

+ Net Cash From Acq -42,043.00 -472.50 -728.10 0.00 12,695.20 0.00 0.00 -14,842.60 -9,136.90

& Div

+ Cash from 0.00 453.00 0.00 0.00 12,695.20 0.00 0.00 0.00 0.00

Divestitures

+ Cash for Acq of -42,043.00 -523.50 0.00 0.00 0.00 0.00 0.00 -14,842.60 -9,136.90

Subs

+ Cash for JVs 0.00 -402.00 -728.10 0.00 0.00 0.00 0.00 0.00 0.00

+ Other Investing 7,070.80 26,856.60 23,360.50 -9,638.40 18,258.20 -605.50 -51,677.00 -52,673.60 -19,000.10

Activities

+ Net Cash From Disc 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Ops

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 12/01/2023 03:53:03 1

Financial Statement Analysis

Ticker: ADE IN Equity Periodicity: Annuals Currency: INR Note: Years shown on the report are Fiscal Years Company: Adani Enterprises Ltd

Filing: Most Recent Consolidation Basis: Consolidated Data

Restated:2015 A Restated:2016 A Restated:2017 A Restated:2018 A Restated:2019 A Original:2020 A Original:2021 A Original:2022 A Original:2023 A Current/LTM

For the period ending 2015-3-31 2016-3-31 2017-3-31 2018-3-31 2019-3-31 2020-3-31 2021-3-31 2022-3-31 2023-3-31 2023-9-30

Cash from Investing -126,495.20 -32,516.10 -18,836.90 -82,578.60 13,301.10 -27,820.50 -82,243.70 -183,084.10 -174,685.00

Activities

Cash from Financing

Activities

+ Dividends Paid -1,460.00 -2,084.50 0.00 -529.50 -530.30 -1,856.30 0.00 -1,099.80 -1,140.00

+ Cash From 115,367.30 -17,460.80 17,195.80 65,854.40 -46,045.50 11,395.20 44,052.40 184,963.40 -48,103.40

(Repayment) Debt

+ Cash From 40,183.90 -29,775.60 -3,261.10 30,868.30 -56,332.60 11,613.40 -13,371.50 54,960.90 -151,368.40

(Repay) ST Debt

+ Cash From LT 262,784.20 47,719.30 42,664.40 119,821.30 30,314.70 32,740.80 75,200.60 133,775.20 303,385.40

Debt

+ Repayments of LT -187,600.80 -35,404.50 -22,207.50 -84,835.20 -20,027.60 -32,959.00 -17,776.70 -3,772.70 -200,120.40

Debt

+ Cash (Repurchase) 0.10 0.00 5,393.90 1,005.90 269.80 636.00 0.00 0.00 77,000.00

of Equity

+ Increase in Capital 0.10 0.00 5,393.90 1,005.90 269.80 636.00 0.00 0.00 77,000.00

Stock

+ Decrease in 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Capital Stock

+ Other Financing -45.00 0.00 374.40 2,124.90 780.10 2,937.70 -1,349.50 1,159.30 -6,307.30

Activities

+ Net Cash From Disc 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Ops

Cash from Financing 113,862.40 -19,545.30 22,964.10 68,455.70 -45,525.90 13,112.60 42,702.90 185,022.90 21,449.30

Activities

Effect of Foreign 2,957.50 4,949.90 -2,309.00 576.20 5,870.00 12,411.20 -7,082.70 4,467.60 14,012.50

Exchange Rates

Net Changes in Cash 5,121.50 -1,612.10 301.10 4,131.10 -4,355.80 11,508.10 -14,585.40 2,460.80 9,701.00

Cash Paid for Taxes 8,337.70 2,305.10 2,195.00 2,501.00 2,109.10 2,671.30 1,121.80 2,046.70 9,099.70

Cash Paid for Interest 79,410.00 14,935.20 15,805.90 17,260.00 16,058.20 15,321.60 12,117.00 26,008.70 33,424.50

Reference Items

EBITDA 185,339.70 28,071.90 33,311.50 37,477.90 33,160.90 34,205.50 38,169.60 57,393.10 119,896.50 103,495.40

Trailing 12M EBITDA 28.78 8.31 9.12 10.48 8.25 7.90 9.68 8.28 8.76 9.77

Margin

Interest Received 8,719.80 7,542.90 6,510.30 5,469.90 4,762.50 4,590.60 3,219.90 8,209.70 6,083.40

Net Cash Paid for 42,043.00 523.50 14,842.60 9,136.90

Acquisitions

Free Cash Flow -80,777.40 -13,702.00 -43,188.30 -55,372.20 4,275.80 -15,206.80 -9,351.70 -120,420.40 1,677.00

Free Cash Flow to -28,245.37 -3,139.68 -35,027.80 -47,776.10 12,456.06 -8,050.30 -1,246.69 -110,633.24 22,090.75

Firm

Free Cash Flow to 38,641.10 -30,861.60 -25,790.60 10,592.00 -41,698.80 -2,015.00 42,500.60 64,561.70 -45,727.20

Equity

Free Cash Flow per -73.45 -12.46 -39.27 -50.35 3.89 -13.83 -8.50 -109.49 1.48

Basic Share

Price to Free Cash 37.75 1,185.22 1,605.73

Flow

Cash Flow to Net 0.76 4.50 -0.15 2.33 3.07 1.21 3.47 -0.51 6.02

Income

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 12/01/2023 03:53:03 2

Financial Statement Analysis

Ticker: ADE IN Equity Periodicity: Annuals Currency: INR Note: Years shown on the report are Fiscal Years Company: Adani Enterprises Ltd

Filing: Most Recent Consolidation Basis: Consolidated Data

BBG Adjusted

Restated:2015 A Restated:2016 A Restated:2017 A Restated:2018 A Restated:2019 A Original:2020 A Original:2021 A Original:2022 A Original:2023 A Current/LTM

For the period ending 2015-3-31 2016-3-31 2017-3-31 2018-3-31 2019-3-31 2020-3-31 2021-3-31 2022-3-31 2023-3-31 2023-9-30

Revenue 643,979.20 337,862.80 365,227.10 357,533.90 402,104.20 432,971.10 394,429.50 693,043.60 1,368,258.80 1,059,140.60

+ Sales & Services 643,979.20 337,862.80 365,227.10 357,533.90 402,104.20 432,971.10 394,429.50 693,043.60 1,368,258.80 1,059,140.60

Revenue

+ Other Operating 1,839.60 1,455.50 855.90 1,705.30 1,682.40 1,054.50 941.80 1,158.20 1,518.80

Income

- Operating Expenses 495,653.60 314,222.70 339,052.90 334,395.20 374,784.80 405,737.20 363,361.50 649,282.50 1,274,242.50 985,229.90

+ Selling & 5,325.70 1,667.30 1,088.80 2,870.20 1,669.10 1,478.00 5,522.40

Marketing

+ Research & 0.00 0.00 0.00 0.00 0.00 0.00

Development

+ Depreciation & 70,437.20 3,144.50 3,154.60 6,639.20 10,872.50 4,720.60 5,371.40 14,563.20 26,148.80 29,584.70

Amortization

+ Prov For Doubtful 44.90 -143.30 214.60 75.80 300.20 986.60 93.20 865.60 -415.30

Accts

+ Other Operating 419,845.80 309,554.20 334,594.90 327,680.20 363,612.10 397,159.80 356,227.80 632,375.70 1,242,986.60 955,645.20

Expense

Operating Income 150,165.20 25,095.60 27,030.10 24,844.00 29,001.80 28,288.40 32,009.80 44,919.30 95,535.10 73,910.70

(Loss)

- Non-Operating 124,315.40 14,335.30 16,570.50 17,917.30 24,256.00 17,895.40 21,196.60 35,429.60 63,203.70 35,743.10

(Income) Loss

+ Interest Expense, 54,173.40 3,664.50 4,463.00 4,993.70 8,582.40 4,822.50 7,479.00 11,904.40 21,651.90

Net

+ Interest Expense 60,884.80 11,404.20 10,774.40 10,199.50 13,472.90 10,065.10 11,793.60 19,601.30 30,033.70

- Interest Income 6,711.40 7,739.70 6,311.40 5,205.80 4,890.50 5,242.60 4,314.60 7,696.90 8,381.80

+ Other Investment -170.50 -1,771.60 -37.80 -44.00 -27.70 -0.20 -0.40 -0.60 -0.70

(Inc) Loss

+ Foreign Exch 11,694.30 2,718.80 528.60 -777.10 -1,055.70 -3,635.20 -2,251.00 3,494.50 3,370.40

(Gain) Loss

+ (Income) Loss 0.00 0.00 0.00 0.00 0.00

from Affiliates

+ Other Non-Op 58,618.20 9,723.60 11,616.70 13,744.70 16,757.00 16,708.30 15,969.00 20,031.30 38,182.10 33,951.30

(Income) Loss

Pretax Income (Loss), 25,849.80 10,760.30 10,459.60 6,926.70 4,745.80 10,393.00 10,813.20 9,489.70 32,331.40 38,167.60

Adjusted

- Abnormal Losses -784.10 202.50 -717.10 2,534.50 1,066.40 -830.30 -46.50 -30.80 -167.60 0.00

(Gains)

+ Abnormal -182.90 -359.20 -401.20 -63.30 -287.30 -0.90

Derivatives

+ Disposal of Assets -160.70 6.50 92.40 23.70 2.00 -425.40 -27.30 -11.70 -18.20

+ Asset Write-Down 896.40 6,708.00

+ Gain/Loss on Sale/ -131.00 -43.50

Acquisition of Business

+ Sale of -446.30 -63.10 -138.80 -167.40 -265.40 -117.60 -18.30 -19.10 -105.90

Investments

+ Unrealized

Investments

+ Other Abnormal 5.80 749.30 -269.50 1,845.10 -5,378.20

Items

Pretax Income (Loss), 26,633.90 10,557.80 11,176.70 4,392.20 3,679.40 11,223.30 10,859.70 9,520.50 32,499.00 38,167.60

GAAP

- Income Tax 3,653.90 779.40 2,711.50 1,121.10 1,445.40 3,243.30 3,396.50 4,766.80 10,409.60 13,460.70

Expense (Benefit)

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 12/01/2023 03:53:03 1

Financial Statement Analysis

Ticker: ADE IN Equity Periodicity: Annuals Currency: INR Note: Years shown on the report are Fiscal Years Company: Adani Enterprises Ltd

Filing: Most Recent Consolidation Basis: Consolidated Data

Restated:2015 A Restated:2016 A Restated:2017 A Restated:2018 A Restated:2019 A Original:2020 A Original:2021 A Original:2022 A Original:2023 A Current/LTM

For the period ending 2015-3-31 2016-3-31 2017-3-31 2018-3-31 2019-3-31 2020-3-31 2021-3-31 2022-3-31 2023-3-31 2023-9-30

+ Current Income 1,408.40 1,575.50 1,830.70 1,130.90 1,675.50 2,413.80 1,226.60 3,914.10 7,698.10 10,597.50

Tax

+ Deferred Income 2,245.50 -796.10 880.80 -9.80 -230.10 829.50 2,169.90 852.70 2,711.50 2,863.20

Tax

- (Income) Loss from -219.90 -1,175.30 -2,194.80 -1,917.30 -2,419.90 -2,994.40 -3,123.30 -2,126.60 -601.40

Affiliates

Income (Loss) from 22,980.00 9,998.30 9,640.50 5,465.90 4,151.30 10,399.90 10,457.60 7,877.00 24,216.00 25,308.30

Cont Ops

- Net Extraordinary 0.00 0.00 388.00 -476.10 -907.80 0.00 0.00 0.00 0.00 0.00

Losses (Gains)

+ Discontinued 0.00 0.00 388.00 -476.10 -907.80 0.00 0.00 0.00 0.00 0.00

Operations

+ XO & Accounting 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Changes

Income (Loss) Incl. MI 22,980.00 9,998.30 9,252.50 5,942.00 5,059.10 10,399.90 10,457.60 7,877.00 24,216.00 25,308.30

- Minority Interest 3,499.50 -108.90 -624.90 -1,630.50 -2,112.30 -981.80 1,231.20 111.40 -513.40 865.40

Net Income, GAAP 19,480.50 10,107.20 9,877.40 7,572.50 7,171.40 11,381.70 9,226.40 7,765.60 24,729.40 24,442.90

- Preferred Dividends 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

- Other Adjustments 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Net Income Avail to 19,480.50 10,107.20 9,877.40 7,572.50 7,171.40 11,381.70 9,226.40 7,765.60 24,729.40 24,442.90

Common, GAAP

Net Income Avail to 18,967.78 10,239.61 9,763.43 8,870.55 7,010.08 10,800.49 9,193.85 7,744.04 24,612.08 24,442.90

Common, Adj

Net Abnormal Losses -512.72 132.41 -501.97 1,774.15 746.48 -581.21 -32.55 -21.56 -117.32 0.00

(Gains)

Net Extraordinary 0.00 0.00 388.00 -476.10 -907.80 0.00 0.00 0.00 0.00 0.00

Losses (Gains)

Basic Weighted Avg 1,099.81 1,099.81 1,099.81 1,099.81 1,099.80 1,099.81 1,099.81 1,099.81 1,135.49 1,140.00

Shares

Basic EPS, GAAP 17.71 9.19 8.98 6.89 6.52 10.35 8.39 7.06 21.78 21.44

Basic EPS from Cont 17.71 9.19 9.33 6.45 5.69 10.35 8.39 7.06 21.78 21.44

Ops, GAAP

Basic EPS from Cont 17.25 9.31 8.88 8.07 6.37 9.82 8.36 7.04 21.68 21.44

Ops, Adjusted

Diluted Weighted Avg 1,099.81 1,099.81 1,099.81 1,099.81 1,099.80 1,099.81 1,099.81 1,099.81 1,135.49 1,140.00

Shares

Diluted EPS, GAAP 17.71 9.19 8.98 6.89 6.52 10.35 8.39 7.06 21.78 21.44

Diluted EPS from Cont 17.71 9.19 9.33 6.45 5.69 10.35 8.39 7.06 21.78 21.44

Ops, GAAP

Diluted EPS from Cont 17.25 9.31 8.88 8.07 6.37 9.82 8.36 7.04 21.68 21.44

Ops, Adjusted

Reference Items

Accounting Standard IN GAAP IN GAAP IN GAAP IN GAAP IN GAAP IN GAAP IN GAAP IN GAAP IN GAAP

EBITDA 185,383.80 28,240.10 33,430.10 38,419.60 39,874.30 34,306.30 38,175.60 57,397.10 119,896.50 103,495.40

EBITDA Margin 28.79 8.36 9.15 10.75 9.92 7.92 9.68 8.28 8.76 9.77

(T12M)

EBITA 150,165.20 25,462.10 30,667.50 31,780.40 29,001.80 30,022.90 33,738.00 44,948.30 96,725.90

EBIT 150,165.20 25,095.60 27,030.10 24,844.00 29,001.80 28,288.40 32,009.80 44,919.30 95,535.10 73,910.70

Operating Margin 23.32 7.43 7.40 6.95 7.21 6.53 8.12 6.48 6.98 6.98

Profit Margin 2.95 3.03 2.67 2.48 1.74 2.49 2.33 1.12 1.80 2.31

Sales per Employee 240,597,562.58 221,520,384.14 458,499,657.92 212,032,859.94 499,277,848.10 600,037,748.92 639,373,271.03

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 12/01/2023 03:53:03 2

Financial Statement Analysis

Ticker: ADE IN Equity Periodicity: Annuals Currency: INR Note: Years shown on the report are Fiscal Years Company: Adani Enterprises Ltd

Filing: Most Recent Consolidation Basis: Consolidated Data

Restated:2015 A Restated:2016 A Restated:2017 A Restated:2018 A Restated:2019 A Original:2020 A Original:2021 A Original:2022 A Original:2023 A Current/LTM

For the period ending 2015-3-31 2016-3-31 2017-3-31 2018-3-31 2019-3-31 2020-3-31 2021-3-31 2022-3-31 2023-3-31 2023-9-30

Dividends per Share 1.40 0.40 0.40 0.40 0.40 1.40 1.00 1.00 1.00

Total Cash Common 1,539.73 439.92 439.92 439.92 439.92 1,539.73 1,099.81 1,099.81 1,140.00

Dividends

Personnel Expenses 11,503.60 5,279.20 5,106.70 5,683.10 6,564.00 6,824.80 8,293.10 11,805.60 18,773.30 20,819.70

Export Sales 0.00

Depreciation Expense 35,218.60 2,778.00 2,762.60 6,639.20 10,872.50 4,283.40 4,437.60 12,448.80 23,170.60

Rental Expense 628.30 351.20 504.10 199.10 269.40 219.30 126.50 567.10

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 12/01/2023 03:53:03 3

CORPORATE FINANCE

CASE STUDY ON: Ratio Analysis of Company for the last

five years : 2018-19 to 2022-23

Company Name: Adani Enterprises Ltd

Submitted By:

Name- Rishabh Thakur

Roll No- 23WU0202230

Submitted to:

Dr. Nikhil

( Assosiate Professor Finance)

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Adani CFDocument2 pagesAdani CFRishabhNo ratings yet

- Hindustan Unilever LTD.: Cash Flow Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. MillionDocument2 pagesHindustan Unilever LTD.: Cash Flow Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. Millionandrew garfieldNo ratings yet

- TCSDocument150 pagesTCSlaxmi joshiNo ratings yet

- Adjusted Trial BalanceDocument24 pagesAdjusted Trial BalanceakseldNo ratings yet

- Profit & Loss - Maruti Suzuki India LTD.: PrintDocument5 pagesProfit & Loss - Maruti Suzuki India LTD.: PrintPushkar VermaNo ratings yet

- Standardized: Restated:2018 A Original:2019 A Original:2020 A Original:2021 A Original:2022 ADocument2 pagesStandardized: Restated:2018 A Original:2019 A Original:2020 A Original:2021 A Original:2022 AMaria Pia Rivas LozadaNo ratings yet

- Balance SheetDocument11 pagesBalance SheetPrachi VermaNo ratings yet

- Pasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Document6 pagesPasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Aljon DagalaNo ratings yet

- Company Finance Profit & Loss Consolidated (Rs in CRS.)Document4 pagesCompany Finance Profit & Loss Consolidated (Rs in CRS.)rohanNo ratings yet

- Financial Statements of WiproDocument2 pagesFinancial Statements of WiproPraveen Reddy100% (1)

- Hind Adhesives BBG AdjustedDocument2 pagesHind Adhesives BBG Adjustedgraheeth26No ratings yet

- Company Finance Balance Sheet Consolidated (Rs in CRS.)Document11 pagesCompany Finance Balance Sheet Consolidated (Rs in CRS.)Chirag GugnaniNo ratings yet

- Coca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)Document7 pagesCoca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)sarthak mendiratta100% (1)

- 9S-2B Corporation Forecasted Income StatementDocument5 pages9S-2B Corporation Forecasted Income StatementFlora Fil GutierrezNo ratings yet

- EstandarizadoDocument3 pagesEstandarizadoEnriqueNo ratings yet

- Value Forecasting 13 04 23Document10 pagesValue Forecasting 13 04 23Dani MagarzoNo ratings yet

- Infosys Ltd. Vs Computer Software: Assets Summary (Industry Benchmark) : Annualised: Mar 2015 - Mar 2017: Rs. MillionDocument2 pagesInfosys Ltd. Vs Computer Software: Assets Summary (Industry Benchmark) : Annualised: Mar 2015 - Mar 2017: Rs. MillionZia AhmadNo ratings yet

- Balance Sheet of Wipro: Print/Copy To ExcelDocument17 pagesBalance Sheet of Wipro: Print/Copy To ExcelRekha RaoNo ratings yet

- INFOSYS Balance Sheet & Profit & Loss: Descript ION Mar-22 Mar-21 Mar-20 Mar-19 Mar-18 Mar-17Document7 pagesINFOSYS Balance Sheet & Profit & Loss: Descript ION Mar-22 Mar-21 Mar-20 Mar-19 Mar-18 Mar-17Nishita KanabarNo ratings yet

- Profit & Loss Account of Reliance Industries - in Rs. Cr.Document9 pagesProfit & Loss Account of Reliance Industries - in Rs. Cr.Mansi DeokarNo ratings yet

- Caso Coca-Cola Plantilla CursantesDocument11 pagesCaso Coca-Cola Plantilla CursantesJuan PabloNo ratings yet

- Balance Sheet WiproDocument2 pagesBalance Sheet WiproSai SunilNo ratings yet

- Caso N.4 Hampton Machine Tool Company - III ParcialDocument6 pagesCaso N.4 Hampton Machine Tool Company - III ParcialJonathan MonjeNo ratings yet

- DR Reddys Laboratories: PrintDocument5 pagesDR Reddys Laboratories: PrintSiddharth VermaNo ratings yet

- IncomeStatement Q12 2Document3 pagesIncomeStatement Q12 2adavidmontoyaNo ratings yet

- Profit and Loss WiproDocument2 pagesProfit and Loss WiproSai SunilNo ratings yet

- Company Info - Print Financials 1Document2 pagesCompany Info - Print Financials 1Shown Shaji JosephNo ratings yet

- Maruti Suzuki India Balance Sheet - Maruti Suzuki India LTD Balance Sheet, Financial StatementDocument1 pageMaruti Suzuki India Balance Sheet - Maruti Suzuki India LTD Balance Sheet, Financial StatementPriyanka GodhaNo ratings yet

- XLS EngDocument7 pagesXLS Engmariaj.hernandezNo ratings yet

- Company Finance Balance Sheet (Rs in CRS.)Document13 pagesCompany Finance Balance Sheet (Rs in CRS.)Dinesh SharmaNo ratings yet

- Excel Case Lady MDocument10 pagesExcel Case Lady MSayan BiswasNo ratings yet

- Taller 3 - Inventario PEPSDocument3 pagesTaller 3 - Inventario PEPSJawyidi GomezNo ratings yet

- Tata Steel LTD.: Executive Summary: Mar 2012 - Mar 2021: Non-Annualised: Rs. MillionDocument11 pagesTata Steel LTD.: Executive Summary: Mar 2012 - Mar 2021: Non-Annualised: Rs. MillionForam SukhadiaNo ratings yet

- 11 - Eshaan Chhagotra - Maruti Suzuki Ltd.Document8 pages11 - Eshaan Chhagotra - Maruti Suzuki Ltd.rajat_singlaNo ratings yet

- Maruti Suzuki India LTD.: Balance Sheet (Standalone)Document5 pagesMaruti Suzuki India LTD.: Balance Sheet (Standalone)Denish VekariyaNo ratings yet

- Profit Loss - 12month ComparisonDocument2 pagesProfit Loss - 12month ComparisonIbrahim SyedNo ratings yet

- Solved - Trinity Electro Case - Class WorkDocument5 pagesSolved - Trinity Electro Case - Class WorkPrarthuTandon0% (1)

- Balance Sheet of Tech MahindraDocument3 pagesBalance Sheet of Tech MahindraPRAVEEN KUMAR M 18MBR070No ratings yet

- Biocon Balance SheetDocument5 pagesBiocon Balance SheetSweety RoyNo ratings yet

- Consolidated Balance Sheet: Wipro TCS InfosysDocument4 pagesConsolidated Balance Sheet: Wipro TCS Infosysvineel kumarNo ratings yet

- 10 Column Heavy BombersDocument3 pages10 Column Heavy BombersVince Ferdinand Pajanustan100% (1)

- Balancee SheetDocument2 pagesBalancee SheetKarthik KarthikNo ratings yet

- Company Finance Balance Sheet Consolidated (Rs in CRS.)Document3 pagesCompany Finance Balance Sheet Consolidated (Rs in CRS.)rohanNo ratings yet

- Coca-Cola Working-From Sagar - PGPFIN StudentDocument23 pagesCoca-Cola Working-From Sagar - PGPFIN StudentAshutosh TulsyanNo ratings yet

- Bharti Airtel: PrintDocument1 pageBharti Airtel: Printvivek singhNo ratings yet

- Data Moneycontrol - Com - Company Info - Print FinancialsDocument2 pagesData Moneycontrol - Com - Company Info - Print FinancialsshreyasNo ratings yet

- Tech Mahindra LTD: Profit & LossDocument5 pagesTech Mahindra LTD: Profit & LossJay ReddyNo ratings yet

- Joonktollee Tea BBG AdjustedDocument2 pagesJoonktollee Tea BBG Adjustedgraheeth26No ratings yet

- BoschDocument8 pagesBoschPreethi LoganathanNo ratings yet

- Standardized: Financial Statement AnalysisDocument18 pagesStandardized: Financial Statement AnalysisnainNo ratings yet

- Balance Sheet of MsDocument2 pagesBalance Sheet of Mspraansuchaudhary713No ratings yet

- Tedros Genene Bakery Income Statement For The Year 2013 - 2018Document30 pagesTedros Genene Bakery Income Statement For The Year 2013 - 2018Samuel GirmaNo ratings yet

- Planilla Mov. TierrasDocument51 pagesPlanilla Mov. TierrasJhon Rolando Kuiro PumayalliNo ratings yet

- Company Financial StatementDocument2 pagesCompany Financial Statementinvinciblesid8950% (2)

- Bai Tap 3-SolutionDocument3 pagesBai Tap 3-SolutionMạnh hưng LêNo ratings yet

- Note 15 DepreciationDocument7 pagesNote 15 DepreciationJerica DacanayNo ratings yet

- Maruti-SuzukiDocument20 pagesMaruti-Suzukihena02071% (7)

- Q. Balance Sheet and Income Statement of Maruti Suzuki. (Please Refer To The Solution Below Balance Sheet.)Document5 pagesQ. Balance Sheet and Income Statement of Maruti Suzuki. (Please Refer To The Solution Below Balance Sheet.)Aaditya PokhrelNo ratings yet

- 230831 Case 2 AfternoonDocument1 page230831 Case 2 AfternoonRishabhNo ratings yet

- 23WU0202230_Q1Document2 pages23WU0202230_Q1RishabhNo ratings yet

- CASE REPORT ON BMVSS - Changing Lives .Document5 pagesCASE REPORT ON BMVSS - Changing Lives .RishabhNo ratings yet

- Capstone Project OutlineDocument3 pagesCapstone Project OutlineRishabhNo ratings yet

- Chapter 5Document12 pagesChapter 5RishabhNo ratings yet

- First Page Esg Rishabh PDFDocument1 pageFirst Page Esg Rishabh PDFRishabhNo ratings yet

- B2B MarketplaceDocument22 pagesB2B Marketplacevinod3511No ratings yet

- EMEA Marketing Director in London UK Resume Martin NorthendDocument3 pagesEMEA Marketing Director in London UK Resume Martin NorthendMartinNorthendNo ratings yet

- IFRS Trainer ProfileDocument7 pagesIFRS Trainer ProfileRafay IkramNo ratings yet

- Newinc 2023-11-03Document10 pagesNewinc 2023-11-03B HamzaNo ratings yet

- Benefits For The Buying Company: 1. Vendor Managed Inventory (Vmi)Document10 pagesBenefits For The Buying Company: 1. Vendor Managed Inventory (Vmi)raish alamNo ratings yet

- Tutorial 8 QsDocument9 pagesTutorial 8 QsDylan Rabin PereiraNo ratings yet

- Hul Sales and DistrubutionDocument23 pagesHul Sales and DistrubutionKrishna Praveen PuliNo ratings yet

- Financial Analysis of Infosys Technologies LTD.: Executive SummaryDocument47 pagesFinancial Analysis of Infosys Technologies LTD.: Executive SummaryAnuka GanbaatarNo ratings yet

- Financial Disclosures Checklist: General InstructionsDocument35 pagesFinancial Disclosures Checklist: General InstructionsPaulineBiroselNo ratings yet

- Working Capital Management SlidesDocument25 pagesWorking Capital Management SlidesFirdaus LasnangNo ratings yet

- Lesson 7 EBBADocument132 pagesLesson 7 EBBAThao Thu VuongNo ratings yet

- ISC Economics XI XIIDocument8 pagesISC Economics XI XIIDev KhariNo ratings yet

- Kailey Barrett: Kbar400Document10 pagesKailey Barrett: Kbar400klee28No ratings yet

- Altius Case QuestionDocument3 pagesAltius Case QuestionRais Umair AhmedNo ratings yet

- PQY Dec 22Document25 pagesPQY Dec 22SAM and CoNo ratings yet

- UOB Company Update AKRA 12 Jul 2023Document5 pagesUOB Company Update AKRA 12 Jul 2023botoy26No ratings yet

- Cashflow AnalysisDocument19 pagesCashflow Analysisgl101No ratings yet

- KP Unlocking-Global-Success-Insights-And-Strategies-For-Indian-Fashion-Designers - 652ac88eDocument73 pagesKP Unlocking-Global-Success-Insights-And-Strategies-For-Indian-Fashion-Designers - 652ac88egskprasadgskNo ratings yet

- 5.1 Consumer Protection WorksheetDocument1 page5.1 Consumer Protection WorksheetTiffany KolbertNo ratings yet

- Amc Case StudyDocument2 pagesAmc Case StudyAishwarya SundararajNo ratings yet

- Ecommerce Analytics Guide 2019Document93 pagesEcommerce Analytics Guide 2019ace187No ratings yet

- 7 P'sDocument3 pages7 P'sGlenda ValerosoNo ratings yet

- Introduction To Inventory ManagementDocument71 pagesIntroduction To Inventory ManagementJane LobNo ratings yet

- Forex Bermuda Trading Strategy SystemDocument20 pagesForex Bermuda Trading Strategy SystemMichael Selim75% (8)

- Break-Even Analysis - LinearDocument2 pagesBreak-Even Analysis - LinearJoshua MarianoNo ratings yet

- BUS687 Week 3 JournalDocument4 pagesBUS687 Week 3 JournalRose BachNo ratings yet

- Comparatie IFRS HGBDocument5 pagesComparatie IFRS HGBValentin BurcaNo ratings yet

- Theme1 StarbucksCoffe CaseStudyDocument2 pagesTheme1 StarbucksCoffe CaseStudyYannis A. PollalisNo ratings yet

- 23A ECON 1194 Assignment 2Document2 pages23A ECON 1194 Assignment 2Nhu NgocNo ratings yet

- Sales Operations PlanningDocument28 pagesSales Operations PlanningHoang PhuNo ratings yet