Professional Documents

Culture Documents

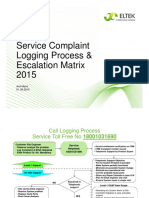

Cam Sna NTR

Uploaded by

Lisno SetiawanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cam Sna NTR

Uploaded by

Lisno SetiawanCopyright:

Available Formats

2

The Joint Sustainable Development Goals (SDG) Fund is an innovative instrument The Local Transformative Finance team at UNCDF helps countries tackle the triple challenge of

to incentivize the transformative policy shifts and stimulate the strategic improving human well-being, maintaining environmental sustainability, and accommodating rapid

investments required to get the world back on track to meet the SDGs. The UN urbanisation. They do this by acting as the UN Subnational Financing Hub and a hybrid development

Secretary-General sees the Joint SDG Fund as a key part of the reform of the UN’s finance institution (DFI) that works with UN Agencies to address the sustainable development financing

development work by providing the “muscle” for a new generation of Resident gaps faced by cities and local governments.

Coordinators (RCs) and UN Country Teams (UNCTs) to really accelerate SDG

implementation.

To date it has funded 101 joint programs focused on integrated social protection

or SDG finance, it has stimulated over 1,000+ partnerships working together Building blocks for a financial ecosystem that works for cities

alongside the UN to support the SDGs and it has tested over 200 innovative

solutions to accelerate the 2030 Agenda.

Building on the policy agenda put forwards by the Malaga Coalition under the impulsion of UNCDF

,UCLG and FMDV and further fleshed out in the UNCDF 2022 publication “Local Government Finance

The Joint SDG Fund is a multi-partner trust fund. This means contributions it is Development Finance”, the Local Transformative Finance team at UNCDF works on the building

receives are not entity-specific, but aim to support broader UN system-level blocks of a financial ecosystem for local infrastructure finance.

functions. In this way, it differs from restrictive earmarked funding which can fuel

competition and hamper cooperation among UN entities. This type of pooled

funding used by multi-partners trust funds, like the Joint SDG Fund is widely

considered ‘multilateralism-friendly’ – and is much more suitable for the

integrated support at scale essential for achieving the 2030 Agenda. Flexibility in

reallocating funds has also proven critical for rapid responses to the COVID-19

Expansion of Development of Strengthening of Local

pandemic. Local Government Finance Local Capital Markets Climate Finance Mechanisms

The UN Capital Development Fund makes public and private finance work for Repurposing of local Unlocking financing from Repurposing of local

government domestic and international government

the poor in the world’s 47 least developed countries (LDCs). finance is a vehicle to accelerate financing institutions to finance is a vehicle to accelerate

environmentally sustainable strengthen local infrastructure environmentally sustainable

and inclusive development. and expand local economies and inclusive development.

UNCDF offers “last mile” finance models that unlock public and private

resources, especially at the domestic level, to reduce poverty and support local

economic development.

UNCDF’s financing models work through three channels: (1) inclusive digital

economies, which connects individuals, households, and small businesses with

financial eco-systems that catalyze participation in the local economy, and

provide tools to climb out of poverty and manage financial lives; (2) local

development finance, which capacitates localities through fiscal Expansion of Implementation of the Rio

Local Fiscal Space Conventions and the New Urban

decentralization, innovative municipal finance, and structured project finance Agenda

to drive local economic expansion and sustainable development; and (3) Rebuild local fiscal space, accelerate

investment finance, which provides catalytic non financial structuring, de- national economic recovery and restore Rebuild local fiscal space, accelerate

trust in public institutions, all of which are national economic recovery and restore

risking, and capital deployment to drive SDG impact and domestic resource core responsibilities of both central and trust in public institutions, all of which are

mobilization local governments. core responsibilities of both central and

local governments.

DISCLAIMER

The designations employed and the presentation of material on the maps and graphs contained in this publication do not

imply the expression of any opinion whatsoever on the part of UNCDF or the Secretariat of the United Nations or any of its

affiliated organisations or its Member States concerning the legal status of any country, territory, city or area or its

authorities, or concerning the delimitation of its frontiers or boundaries.

UNCDF - Local Transformative Finance UNCDF - Local Transformative Finance

4 Contents Introduction 1

Introduction 1

Fiscal decentralisation and effective In addition, it is noted that in the last

The Sub National Governance Architecture 2 budgeting for sub-national administrations three years, as more NTR items have been

(SNAs) is central to the next phase of transferred to the SNAs, it has been the

Legislative Mapping 4

decentralisation reform in Cambodia. CP, not the DMK nor the Commune/

Outline of a Strategic Framework for SNA NTR 5 According to the National Program on Sangkat (CS) level, that was given more

Democratic Development (NP-SNDD) attention. This rationale being that within

SNA NTR System Description 6 Phase 2 – 2021-2030 (NP2), “SNAs need the SNA architecture only the CP levels

more budget resources to contribute to have appropriate personnel, the requisite

SNA NTR Performance 7

local service delivery and development.” finance and the effective and efficient

SNA NTR System Management for SNAs 10 operational management capacity further

Currently, SNA revenues (sourced both exacerbating the already significant

Visioning an Efficient SNA NTR System 11 from own source revenue and national vertical imbalances.

transfers) are insufficient to cover the cost

Strategic Approach 12

of fully implementing their mandated However, at the CP levels there as been

Example Policy Framework for SNA NTR System 13 functions. This issue is particularly acute at an increase of the administrations reliance

the district, municipality, and khan (DMK) on their own source revenue to cover their

Introduction 13 level where new functions, structures, and operation and development activities.

systems have been transferred and

Challenges 14

established but remain to be sufficiently The RGC Medium Revenue

Primary Actions 15 financed. Mobilisation Strategy (RMS) 2019-2023,

placed greater attention on improving

Revenue from State Assets 16 The current budget allocations do not national tax revenues1 (RGC, 2019) In

reflect fully the mandates of the different recent years, more emphasis has been

Challenges 17

levels of SNAs and, as part of the reform placed on the development of the NTR

Primary Actions 18 the new accountabilities that are being systems especially after the adoption of

placed on to the SNAs as a result of the Law on NTR in 2022. Unlike the tax

Revenues from Other Sources 19 legislative and functional upgrades. The policy and administration, the emerging

current system of allocations that have not reform agenda on NTR, has explicitly

Challenges 20

considered the policy impacts of the recognised the roles of SNA, and thus

Primary Actions 21 decentralisation process that includes more consistent and complementary to

legislative driven responsibilities coupled the NP2 reform agenda.).

Upgrading Institutional Capacity and Competence 22 with extended mandates created through

functional transfers has created persistent To support the broader decentralisation

Challenges 23

imbalance both vertically and horizontally. reform, the NP2 envisions and plans for

Primary Actions 24 the development of Strategic Framework

The share of own-source revenue with for SNA NTR.

the SNA budgets has been very minimal,

especially for the DMK level. This can be

Authors attributed to the DMK having been given

Paul A Martin, Regional Advisor UNCDF

limited authority to collect only a small

Dr Kimchoeun Pak., UNCDF Consultant

June 2023, Bangkok, Thailand amount of non-tax revenue (NTR). 1

Reference: RGC. "Revenue Mobilization Strategy 2019-

2023." General Dept Tax Cambodia, 8 May 2019, (Link)

UNCDF - Local Transformative Finance UNCDF - Local Transformative Finance

2 The Sub National Governance Architecture

3

A three tiered system of sub-national The promulgation of the 2008 Law on The Organic Law entitles each SNA to Such allocation bias is due, in the main,

governance is applied in Cambodia and the Management of CP and DMK receive appropriate fiscal and human to the associated higher concentration of

consists of representative institutions Administrations (referred to as the Organic resources in order to perform its core government assets, civil servants and

that are established through direct and Law) established a legal framework for administrative and development functions. government contract employees within

indirect elections (figure 1) indirectly elected councils for DMK and CP The SNAs, especially below DMK level are the capital, when compared to the

administrations. The development of the highly dependent on IGFTs with limited provinces.

figure 1: Cambodia System of Governance

councils and the establishment of a second capacity to generate nor manage their own

IGFT, the DMK Fund has provided a focus of source revenues. With few revenue Given that SNA NTRs are in the main

the last 10 years of the sub national sources being generated by the SNAs , the generated through the One Stop Window

decentralisation reform initiative. revenues that are assigned to SNAs are (OSW) or One Stop Office (OSO)

highly skewed toward Phnom Penh. Population distributions must reflect on

The SNAs are all assigned two types of the ability of the SNAs to generate NTRs.

function (i) permissive and (ii) obligatory

being defined as; The horizontal imbalances of the budget As illustrated, near to 70 per cent of the

allocations between the Capital and the population reside in only 10 provinces.

• Permissive - two forms of permissive rest of the country is significant. Between Further, the top five populated provinces

function exist; (i) functions that have 2011 and 2021, on average, the Capital of account for 53 per cent of the total

been transferred to the SNAs by the Phnom Penh’s annual budget accounts for population. The largest population.

The highest level of the sub national line ministries and (ii) functions that fall about 55 per cent of total SNA budget. In concentration is Phnom Penh where 15

governance system are the provinces, under the general mandate of the SNA 2011, it stood at about 45 per cent and per cent of the population live. Given this

with Phnom Penh being treated with a • Obligatory - these are functions that from there steadily increased to almost 60 it is essential that informed research is

special designation - “the capital”. The are defined by law, regulations the per cent in 2020 but dropped back to applied to set individual provincial targets

lowest level are the Communes and latter including royal decree sub- slightly above 50 per cent. for SNA NTR streams.

Sangkats (CS) serving rural and urban decree or other legal instruments

constituents respectively. The CS are issued by line ministries and the

established by the 2001 Law on the National Committee for Democratic

Management of Commune / Sangkat Development.

Administration and consist of

democratically elected councils and an

figure 2: Population Distribution by Province (2019 census)

administration unit. Sub-decree #285 (2014),

The CS were developed and supported defines a permissive function to

during the initial stages of the those initiated by a SNA that: (i) that

decentralisation process and were the does not fall under mandate of an

first sub national administrations to have

line ministry or national institution,

or (ii) those that fall under the

a specific purposefully established a inter- mandate of an existing line ministry

governmental fiscal transfer (IGFT) or national institution but which the

mechanism developed and tested (The line ministry or the national

C/S Fund) that aimed to improved service institution has no objection to the

delivery whilst simultaneously SNA choosing to implement them.

developing capacity within the local

administration.

UNCDF - Local Transformative Finance UNCDF - Local Transformative Finance

4 Legislative Mapping Outline of a Strategic Framework for SNA NTR

5

The legal framework for managing Third, because NTR are still managed The draft outline for a Strategic For each, an expected overall outcome

Cambodia's NTR system is made up of a by sectors, sectoral laws and inter- Framework for SNA NTR is structured as for the whole period of the NP2 (2021-

mix of various legal instruments. ministerial Prakas on sectoral services are follows: 203O) is identified, followed by specific

also critically relevant. As of 2022, there outputs and priority activities to be

First, those include the Law on NTR are 103 of such inter-ministerial Prakas. • Section 2: Overall situation of the achieved and implemented in the two

(2022) and Sub-decree No. 72 (2018) on SNA NTR Implementation Plan Phases (IP5). The

the Management of Non-Tax Revenue. The relevant legislation for SNA NTRs • Section 3: Goals, outcome, output, first IP5 (IP5-I) covers the period from

These two documents define different (tabulated below) illustrates a complex and approaches 2022 to 2025, and the second (IP5-II) from

types of NTR as well as the roles, environment of potential overlapping • Section 4: Revenue from public 2026 to 2030.

responsibilities, key mechanisms, and legislation, Prakas and ministry level service fees

administrative tasks relating to NTR instructions. In total there are 114 • Section 5: Revenue from state assets These outcomes, outputs, and priority

management and collection. legislative instructions relevant to the SAN • Section 6: Revenue from other activities are also summarised in the

NTRs. sources, and Result Framework in the annex section.

Second, for SNA, key legal documents • Section 7: SNA NTR modernisation

include the Law on SNA Financial Regime Although the draft circular to update the and capacity building

and Property (2011) and other legal management of the revenues from OWSO The draft guidance framework for

documents, especially those relating to at CP and Districts is expected to improve For each area of intervention, specific the upgrade of the SNA NTR is

provided as a policy advisory

the service delivery by the One Window the legislative base a clear repeal to outcomes, outputs and priority activities

document and does not constitute

Service Unit (OWSU) at CP level and the reduce the multitude of documents is are identified. Those areas include (i) the a policy framework, strategy, or

One Window Service Office (OWSO) at required to promote a more effective revenue from public service fees, (ii) regulatory document. All data,

the DMK level. management of the SNA NTR. revenue from state assets, (iii) revenue assumptions and suggestions

from other sources, and (iv) SNA NTR provided are developed as a

upgrading and capacity building. technical assistance to the MEF.

Common & Cross Sector Year

Law on non-tax revenue 2022

Law on SNA financial regime and property 2021

table 1:legislation & Circulars for SNA NTR

Sub-decree No. 72 on non-tax revenue 2018

Sub-decree No. 18 on OWSO at SNA 2017

Sub-decree No. 25 on the revenue management at OWSO at CP 2020

Prakas No. 272 on the use of receipt for revenue 2011

Prakas No. 242 on geographical area codes 2015

Prakas No. 1890 on petty revenue management for national and SNA 2015

Prakas No. 1195 on the procedures on the management of non-tax debt 2022

Circular No. 010 on incentive sharing from service fees 2014

Circular on the management of the revenue from OWSO at CP and Districts Draft

Sectorial

Inter-ministerial Prakas on sectoral services/ non-tax revenue (there are 103) Various

UNCDF - Local Transformative Finance UNCDF - Local Transformative Finance

6 SNA NTR System Description 6

There are five types of NTR in With its General Department of Non-

Cambodia (including at SNAs) which need Tax Revenue and State Property playing

to be managed according to the existing leading roles, MEF also play active roles in

rules and regulations. According to the drafting new rules and regulations,

Law on NTR and Sub-decree No. 72, those maintaining records on NTR, following up

five types include on NTR arrears, and identifying new

sources of NTR.

table 2: S NTR Streams

Non Tax Revenue Stream

1 revenue from public service fees The SNAs are considered as

2 revenue from state asset implementing agencies directly managing

3 revenue from state-owned enterprise (SOE) and collecting NTR in their localities. They

4 revenue from fines and penalties, perform various tasks throughout the

5 revenue from other sources. whole management cycle, starting from

planning and forecasting NTR, directly

managing, collecting, following up on NTR

All of the five types of NTR are arrears, and preparing regular reports to

applicable to SNAs, although with different MEF, through the Provincial Department of

degrees of authority and capability. Economy and Finance (PDEF). In this

arrangement, PDEF acts on behalf of the

In managing and collecting NTR, SNAs MEF in overseeing the public financial

need perform various tasks, including management aspects of SNAs in each

province.

• planning and forecasting of NTRs; As a part of NTR management

• the use of the non-tax revenue modernisation, the Government has used

management information system two digital management systems.

(NRMIS) to process and record

transactions; collection and payment • The Non-Tax Revenue Management

of NTRs into the single treasury Information System (NRMIS) and

account (TSA); • The State Property Registration and

• monitoring, evaluation, auditing, and Management Information System

inspection; and (SARMIS).

• follow-up and writing off non-tax

revenue debts, reward and The NRMIS is given more attention,

punishment for compliance and although it is closely related to the

performance, among others. SARMIS, especially concerning revenue

from state assets.

SNA NTR management and collection

involve a range of stakeholders. Their roles

and responsibilities are provided in the

Law on NTR and Sub-decree No. 72. MEF

is the central agency whose main role is to

monitor and evaluate the management

and collection of NTR, including those

performed by SNAs.

UNCDF - Local Transformative Finance UNCDF - Local Transformative Finance

Photo Credit: Alexandre Brondin, www.unsplash.com

7 SNA NTR Performance 8

NTR accounts for only a small fraction In essence, the performance of NTRs Comparing the SNA NTR performance However, since 2020, its share reduced

of total state revenues, both at the from 2011 to 2019 increased 2 fold from as a percentage of total national non-tax drastically to only about 10%.The vertical

national and SNA level. At the national US$ 264 million to US$ 820 million. revenue, the SNA NTRs accounted for imbalance of NTR performance is

level, NTR has increased in absolute Growth in NTR receipts was cut short due around 2 per cent in the period from 2017 captured in figure 6.

amounts but dropped in terms of to the pandemic (2020 and 2021) and fell to 2019 but increased sharply in 2020 and

contribution to almost half between 2011 by US$ 350 million to US$ 460 million 2021 to over 10 per cent (figure 5) As is illustrated, a large imbalance

and 2021 as a percentage of the total which is comparable NTR performance between CP and DMK exists, with the

recurrent revenue (from a high of 19 per recorded between 2015 and 2016 (figure The data underpins the change of the DMK having a far lower planned NTR than

cent in 2012 to only 9 per cent in 2021 4) governments policy focus towards fiscal the CP level.

(figure 3). decentralisation.

figure 6: SNA NTR Performance Ratios

figure 5: SNA NTR Performance

figure 4: NTR Growth Profile

figure 3: Tax Base by Flows

The decline in contribution has been As illustrated non positive YoY growth The sharp increase was due to the The ratio between CP and DMK NTRs was

due enlarge to improved national revenue has been seen in 2013, 2015 and 2020 to delegation of large administrative service fairly constant up to 2020 at approximately

collections which have positively 2022. Based on historical data it can be fees from line departments to OWSU at 1.6:1. A sharp increase in 2020 and 2021

increased by 44 per cent between 2011 anticipated that actual NTRs have the CP level in 2020. While the transfer is seen was witnessed where the ration exceeded

and 2021. However, as illustrated all potential to reach beyond US$ 1,000 as progress for decentralisation reform, it 8:1. The ratio between CP and DMK NTRs

contributions remained flat during 2020 million per year. However, the return to has resulted in the fiscal space imbalance are tabulated below

and 2021 as a result of the pandemic. such levels will be enlarge dependent between CP and DMK to be even more

table 2: S NTR Streams

upon external trade factors. Opportunity pronounced. From 2017 to 2019, as the

Year DMK / CP Ratio

Customs derived revenue contributions does present itself to further expand the data shows (figure 3), DMK's non-tax 2017 1:1.622

has shown little change over the same SNA NTR through new forms of climate revenue accounted for around 30% of 2018 1:2.296

time period. Accounting for 50 per cent of charges as fines or issue of local carbon total SNA non-tax revenue. 2019 1:2.414

total revenues, with a drop off to 45 per permits for the special economic and 2020 1:6.947

cent being accounted during the industrial zones. 2021 1:8.659

pandemic

UNCDF - Local Transformative Finance UNCDF - Local Transformative Finance

9 SNA NTR System Management for SNAs 10

Horizontal imbalances are also Presently, the primary source of NTR The management of SNAs follows a While differing by types of NTR, some

significant (figure 7). Similar to tax among SNAs comes from fees charged at cycle which includes the following tasks: overall challenges are noted for the SNA-

revenue, non-tax revenue at the sub the one window service unit (OWSU) and NTR governance systems. Those include:

national levels is dominated by Phnom the one window service office (OWSO). • Planning and forecasting: SNAs

Penh's share. From 2011 to 2021, the data Additionally, in the capital and some include in their annual budget plan the • The legal and policy frameworks

shows Phnom Penh accounts for roughly provinces revenues from state assets are forecast of NTR for each type and which needs to be improved in terms

50 per cent of all SNA NTR. The other significant. classify them according to the of coherence and consistency,

provinces that have larger NTRs being economic classification of budget, especially between those on NTR

Sihanoukville, Kandal, and Siem Reap. This Over half of the revenues collected are • Collection of NTR: SNAs follow policy and those on decentralisation,

horizontal imbalance is mainly due to the generated through fees. They accounted various rules and regulations when • The current NTR functions can be

fact that a large part of the SNA NTR for 55 per cent of all NTRs collected at the implementing the actual NTR further decentralised (both through

comes from public administrative service CP level in 2019 and all NTRs collected at collection, recording, and reporting. To assignment and delegation) to

fees, which correlate closely and positively the DMK level. The limited collection of ensure effectiveness, the CP appropriate levels of SNAs, taking into

with the level of economic activities in state assets is due to internal administrations have been using the account their respective mandates for

each locality. weaknesses related to shared or a NRMIS and SARMIS in their service delivery and local

common information management implementation, development,

system and a lack of clear authority to • Payment into national budget: SNAs • The management and collection of

collect revenues from sources under their pay the collected NTR into the Single SNA NTR which can be made more

figure 7: SNA NTR Horizontal Imbalances

control. Treasury System (TSA) either in cash effective, efficient, and in line with due

or via banking systems by following PFM process,

A medium-term goal of the RGC should relevant rules on petty revenue • Modernisation of SNA NTR

be to develop and implement clearer management. The NRMIS has been management and collections which

guidelines for SNA on collecting NTR from used to facilitate this task. can be strengthened especially with

state assets that are located within the • Recording and reporting: SNAs the use of the NRMIS and other e-

territory of the SNAs. This feature need be prepare and submit monthly, governance solutions, and

a component of a broader process to quarterly, semi-annual and annual • Human resource management and

clarify the extent to which SNAs have reports on NTR implementation to the capacity building which need to be

authority over their own-source revenues. MEF via the PDEF. At the end of each enhanced, trained, and continuously

. year, they also review their NTR supported to allow for clear

performance to inform the planning accountability lines and effective SNA

for the following year. The NRMIS has NTR management and collection.

also been used to aid the recording

and planning process, and

• Following up on NTR arrears: SNAs

keep track of NTR arrears and conduct

necessary follow-ups. Where

necessary, audit and inspections can

be conducted on the management of

NTR for specific SNAs.

UNCDF - Local Transformative Finance UNCDF - Local Transformative Finance

11 Visioning an Efficient SNA NTR System Strategic Approach 12

The proposed VISION of the SNA NTR Per the NP2 (Component 4) and the To achieve the outcome and outputs, • Emphasise the roles of NTR as a

strategic framework needs to align with Blueprint on NTR, the overall expected the Strategic Framework for SNA NTR policy tool for local service delivery

the NP2 (2022) and the Blueprint on NTR outcome of this Strategic Framework on provides the following approaches: and local development: A more

(Upcoming). SNA NTR is to focus on the SNAs effective NTR system is instrumental

capacities and competence to effectively • Ensure reform coordination and not only for revenue generation but also

A more effective, efficient, and manage the SNA NTR. legal framework coherence: SNA as an enabler for better service delivery

decentralized NTR management NTR need be implemented and for local people and businesses. Linked

and collection by SNAs so that SNAs have predictable, adequate strengthened through an effective to the above NTRs are to act as non-

they can better implement their budget resources aligned with coordinated whole of government discretionary revenue stream for the

mandate and functions while mandates and policy priorities and

contributing to the national allocated with the flexibility to approach that compliments the relevant SNAs and not be subject to fiscal

revenue mobilization effort, respond to local situation and reform agendas (public financial pooling at central level.

macro-economic stability, and needs that are determined in the management and decentralisation). • NTRs within the Sub National

improved and equitable service development plans, investment • Promotion of the effectiveness and Jurisdictions: T he “ownership” of all

delivery for local citizens and programs, and budget strategic efficiency of NTR management and NTRs need be clearly articulated to

businesses.' plans of the SNAs. collection: NTR management and assure accountability and the

Statement Example - Vision Statement Example - Outcome collection by SNAs should be effectiveness of collection and

strengthened in line with the due utilisation of NTRs. The NTR legal

The objective of the Strategic The corresponding output statement for process of public financial framework needs to specify if pooling

Framework on SNA-NTR is required to consideration is presented as a system management to contribute to the at the provincial level is a requisite of

support the national decentralisation wide enhancement. The output establishes Government's overall revenue that individual SNAs are able to retain

policy (IP5, phases I and II). an increase in NTRs as a key indicator. mobilisation efforts and utilise existing the NTR revenues

financial information and budget control • Adoption of discretionary or non

Provide clear expected outcomes, An improved SNA NTR governance systems. discretionary expenditure of NTRs:

outputs, and priority activities for system that is established on a • Focus on institutional development The NTR legal framework needs to

the IP5-I and IP5-II clear and coherent legal base that

and local civil service competency clarify and set out the expenditure

is accompanied with an

Statement Example - Objective institutional framework, from enhancement: In line with the conditions of the NTR resource flows.

which more NTR based functions Government's policy on digital Additionally, NTRs can be utilised for

This is to ensure a more effective, can be transferred to the Government, SNA NTR management specific local government expenditure

appropriate level of SNA. This will

efficient, and decentralised management increase the amounts of NTRs and collection will be systematically and classifications as within the COA and

by SNAs over different types of NTR items. collected, calibrate the SNAs and increasingly implemented through the budget law, thereby linking directly NTR

It covers key aspects, including legal and further promulgate modern application of institutionally connected expenditure to provide, enhance and

institutional framework, management and management and information digital technology (e.g., NRMIS, maintain basic local government

systems that assures transparency.

collection, modernisation and capacity SARMIS, e-payment), together with services.

building. Statement Example - Output improved human resource • Adopt the learning-by-doing

management and capacity building. experimental approach: To ensure

• Accelerate decentralisation and continuous improvement, the SNA

accountability of NTR management NTR governance system will be

and collection: More authority to be improved through rapid feedback,

entrusted to the SNAs to manage and period assessment, and adjustments,

collect NTR in alignment to the PFMP, all embodying the spirit of learning by

the new financial law and with the NP2, doing approach.

that latter that may include the possible

identification of new NTR categories.

UNCDF - Local Transformative Finance UNCDF - Local Transformative Finance

Photo Credit: Humphrey Muleba, www.unsplash.com

15 Example Policy Framework for SNA NTR System

Introduction

13

NTRs generated from public services The management and collection of

are by far the major contribution of NTR public service fees need to follow inter-

system for SNAs. Two forms of public ministerial Prakas. This being applicable to

service fees are considered: line ministries, other state agencies and

SNAs. As of the end of 2021, there were

• administrative fees that are sales of 103 of such Prakas in force, providing legal

services associated with a regulatory basis for the collection of fees for 5,151

function of the Government (e.g., services. For the SNAs, the provision of

license); and administrative services and the collection

• end-user fees for provided services. of fees are currently done through OWSU

at the CP level and the OWSO at the DMK

Conceptually, NTRs collected as end level. The service standard and procedures

user fees or charges for public services are at the OWSU and OWSO are provided by

considered as a policy tool and a means MOI's Prakas.

to generate state revenues. Accordingly,

when a user fee is considered, several key The provision of administrative services

policy and management issues need to be by SNAs can be performed in two forms.

considered, including its policy-related

objective, as well as the legal, institutional, • first; is as their own function. In this

and public financial management case, the implementation shall follow

arrangements. the inter-ministerial Prakas between

MEF and MOI. The council of each

According to the Law on NTR and Sub- SNA also has the authority to

decree No. 72, revenue from public determine fee level based on the

services is classified into the following five reality of people livelihood and

sub-types: development of each locality.

• second is as their delegated

• Revenue from public services in the functions from the national level. In

general administrative sector, this case, the implementation shall

• Revenue from public services in follow inter-ministerial Prakas

national defence, security and public between the delegating ministries

order sector, and agencies and the MEF.

• Revenue from public services in the

social affairs sector,

• Revenue from public services in the

economic sector, and

• Revenue from public services by

SNAs.

UNCDF - Local Transformative Finance UNCDF - Local Transformative Finance

Photo Credit: Sam Sokkolinmony, www.unsplash.com

14 Challenges Primary Actions

15

The SNAs need to plan and execute • Appropriateness of certain services: The output for the primary actions for • Clarify financing options to finance

NTR collections from service fees as a Some local government services, the SNA NTR is newly transferred functions (e.g.,

part of their annual budgeting process. The especially related to permits need solid waste management, local

implementation shall comply with the key revision in terms of the perspectives of A more effective and efficient NTR transport, entertainment, education,

laws and regulations. The administrative local citizens and business. Examples system that is decentralized to health) from user fees.

tasks involve include the required manual verification allow SNAs to create new fiscal • To conduct the regulatory review

space to fully implement their

and legalisation of various documents on the current administrative

mandates whilst contributing to the

• the forecasting of NTR for each fiscal (i.e., high school certificates) and the national revenue mobilization services provided by the OWSU,

year, licensing requirements and conditions policy and strategy. In doing so, OWSO and other parts of SNAs to

• the delivery of services, and the for micro and small businesses which macroeconomic stability will be assess their appropriateness as not

collection of associated fees and might act as a hindrance rather than a maintained and the quality and only NTR tool but policy inventions to

• paid fees transferred into the promotion of people's livelihood and quantity of equitable and promote people's livelihood and local

sustainable public services

Government Treasury Single Account. local businesses. business development.

enhanced.

• Management and collection: A few

To incentivise SNA and line department key points are noted:

officials involved in the service delivery The following research and policy The following research and policy

process, some specific incentive sharing ▪ there is still no technical guidance actions need be considered in the short actions need be considered in the short to

schemes have been implemented. In the on how to improve the accuracy of term to align to IP5-I (2022-2025). The medium term to align to IP5-II (2026-2030),

last few years, SNAs have also NTR forecast which has led to high inter-ministerial IP5-1 sets out the short

implemented the NRMIS to ensure discrepancy between planned and term policy actions related to SNA NTRs

improved service delivery and a transparent actual NTR performance; • To finalise the services and fees

NTR management and collection process. ▪ while there are currently over • To review the current management provided and collected by SNAs

5,000 services, many of them and collection of public service fees (based on the regulatory review study

While much progress has been made, have been virtually inactive and at the OWSU and OWSO, including conducted in IP5-I above).

several challenges require more attention, some have had their fees waived the use of NRMIS and e-payment, • To continue improving the legal

including: or charged to a very low rate, • To identify the possible framework and reform

▪ it is not sure to what extent the harmonisation and synchronisation coordination, especially between the

• Concise Legal framework: There are current incentive sharing between the NRMIS and the MIS that national level and SNAs, to ensure

currently many rules and regulations, arrangements have motivated MOI set up for OWSU and OWSO, more effective management and

some of which are not consistent with those staff members directly • To identify additional NTR sub- collection of SNA NTR,

one another, especially between the involved in the service delivery streams to be transferred from line • To continue to decentralise the NTR

various inter-ministerial Prakas on NTR process at the OWSU/OWSO, and ministries to OWSU and OWSO in system to an appropriate level of

on the one hand and those relating to ▪ while the NRMIS has been very accordance with the recent SNAs and identify new NTR sources

decentralisation on the other, instrumental in managing NTR decentralisation reform policy and the to increase SNA's own source

• NTR Institutional framework: There from service fees, there are transfer of functions to the DMK level, revenues,

remains room for improvement in various technical issues to be • To clarify the arrangements to • To fully promulgate the use of

terms of the de-concentration, addressed and further refined allow SNAs more administrative NRMIS, e-payment, and other digital

delegation, and assignment of NTRs (e.g., its coding systems by types jurisdiction related to the setting and solutions to public service delivery

between the national level and the of fees). management of fees or charges for and NTR management and collection

different tiers of SNAs. Similarly, the NTR within a value determined by at SNA,

roles and authorities of SNAs in setting relevant regulations. • To introduce and test a model for

the fee list and the allocation of forecasting NTR revenue from public

revenues are still to be clarified to make service fees.

them consistent with the NTR policy.

UNCDF - Local Transformative Finance UNCDF - Local Transformative Finance

16 Example Policy Framework for SNA NTR System

Revenue from State Assets

16

Non-tax revenues from state property However, for the medium and long-

covers a wide range of sub-types. In term, there are key governance and public

general, it involves legal contracts financial management issues relating to

between the state and private actors for state property management that need to

the use of state-owned assets for be addressed, both at the overall system

commercial gain. According to the NTR and for specific revenue items.

Law and sub-decree No. 72, NTR from

state property includes the revenue from: NTR from state assets has been a

Sales and exchange of private state minor source of income for SNAs but is

property, expected to increase from 2022. Data

from 2020 reveal that the revenues from

• Lease of state property, state assets accounted for about 6 per

• The concession from public services, cent of accumulative SNA NTR, or about

• Royalty on natural resource 0.4% of SNA total budget. It is notated

extraction, and that all NTR collected from state assets

• Other revenues as stipulated in collected came from the CP level, and

contracts and agreements. virtually none for DMK and CS. However,

starting from 2022, the Government has

Each sub-category of NTR provides a plans to further allocate more NTR from

range of detailed revenue sources but state assets to SNA, including:

whose definitions are stated in only broad

terms. Their specific definitions and • 100% of revenue from fishery

further categorisations that aligns to concession (with an estimated

national and international standards are amount of 2,650 KR Million),

expected to be determined through • 50% of revenue from the lease of

additional law, sub-decree or Prakas. Many state property of CP line departments

of the revenue items have already been and CP administrations (about 2,744

implemented, but a few (such as royalty KR Million)

from oil and gas) are relatively new. • 30% of revenue from land concession

(about 6,075 KR Million),

The untapped potential for NTR from • 30% of revenue from forestry and

state property is significant, but so are its penalty (about 6,027 KR Million), and

governance and management challenges. • 50% of royalty related to construction

At both the national and sub-national level, materials (about 42,914 KR Million).

there is a shared understanding that

additional state property revenue can be

collected if the system and its

management can be improved. This is why

specific management reform measures

have been identified in the RMS II with a

focus on revenue items such as

concession from land, forestry, and mining

concession.

UNCDF - Local Transformative Finance UNCDF - Local Transformative Finance

Photo Credit: Paul Szewczyk, www.unsplash.com

17 Challenges Primary Actions

18

SNAs plan and execute NTR from state including within and between national The output for the primary actions for • To assess the progress to guide the

assets as a part of their annual budgeting and sub-national levels. This has led to NTR revenue optimisation from state reform of SNA NTR from state

process. The implementation complies poor forecasting, management, and assets assets so that it is well coordinated

with the key laws and regulations on SNA collection of NTR from state assets. It and complementary to the broader

and NTR (as listed in the previous section is also noted that the use of digital e- A more effective and efficient NTR reform of SNA state asset

system that is decentralized to

on the legal framework), relevant legal payment has also been low compared management.

allow SNAs to generate new fiscal

documents on state asset management, to the other types of NTR. flows from State Assets that are

and the provisions as stated in the • Transfer of NTR from state assets to accumulated on their territories to The following research and policy

contracts, agreements, and licenses SNAs: The planned transfer of more fully implement their mandates actions need be considered in the short to

relating to the lease of state assets, NTR from state assets to SNAs is in whilst contributing to the national medium term to align to IP5-II (2026-2030).

concession, etc. The NRMIS has been its infancy, As the process is revenue mobilization policy and

strategy. In doing so, new fiscal

used to manage and collect SNA NTR developed further various • To implement the work plan

space will be created for improved

from state assets at SNAs. implementation challenges will equitable and sustainable public developed in IP5-II and to

emerge and need be responded to. As services. continuously improve its performance

While much progress has been made, this is a new competence area, through the establishment of Key

several key challenges need to be trainings and coaching that enables Performance Indicators (KPIs)

addressed including: SNAs to learn by doing is critical. In The following research and policy • Complete a detailed research based

addition, the NTR from state assets actions need be considered in the short forecasting model to establish

• Simplification of the legal needs to be closely linked with the term to align to IP5-I (2022-2025). The revenue baselines for SNA NTRs by

framework: There are currently a overall SNA asset management and inter-ministerial IP5-1 sets out the short province and DMK level

number of laws and sub-decrees with asset transfer. term policy actions related to SNA NTRs • Develop a complete set of SNA NTR

relevance to SNA-NTR from state • The national role out and use of collection targets based on above

assets. Those include the Law on SNA NRMIS: It is required SNAs enter all • To improve the implementation of mentioned research and the

Financial Regime (2011), the Law on items of NTR from state assets into the recently transferred NTR from associated province specific territorial

State Asset Management (2022), Sub- the NRMIS. However, the limited data state assets by identifying specific social economic conditions and

decree No. 66 and a range of leasing quality (mentioned earlier) almost areas for improvement through a rapid environments.

contracts, agreements, and licensing. means data gaps in the NRMIS, which feedback loop and systematic • Seamlessly coordinate and

Anecdotes suggest there are possibly in turn limits its usefulness as a tool assessment, complement the implementation of

some major inconsistencies among for managing and recording revenue. • To determine enhanced the NTR associated with state assets

these legal instruments, although arrangements for the management to the SNA state asset management

their extent and specifics need to be and collection of SNA NTR from reform.

further determined, state assets and including the use of

• Quality and timely data needed for NRMIS, based on the feedback (and/or

effective management: The current assessment), including the use of

data on asset leasing, concession, and NRMIS,

licensing is still limited, a situation that • To continue the process of

has been compounded by the limited transferring more NTR streams that

data sharing across relevant agencies, emanate from state assets to the

appropriate level of SNAs in line with

the overall decentralisation reform and

the functional transfer to the DMK

level, and

UNCDF - Local Transformative Finance UNCDF - Local Transformative Finance

19 Example Policy Framework for SNA NTR System

Revenues from Other Sources

19

Revenues from the other types of NTR What is known, however, is that this

identify with three specific streams and revenue needs to be planned and

include; executed as a part of the annual budgeting

process, with the NRMIS also put in use.

• revenue received as dividends from

state-owned enterprises (SOEs), The current legal and policy framework

• fines and penalties does not reference the possibility of SNAs

• and the flows that are designated as establishing and operating an SOE on their

"other" forms of revenue under the territory. This need be considered a policy

Law on NTR and Sub-decree No. 72. gap, as it does not correspond to the

needs for local service delivery and higher

Even at the national level, these three levels of devolution associated to of

NTR items account for only about 7% decentralised governance as rapid

(taking the year 2019 as a case), with the urbanisations in Cambodia are being

SOE dividend accounting for more than experienced.

70% of the total. In terms of regular

framework and management, while some Since the government has been

information is known about the SOE allocating more authority and

dividend and penalty and fines, very little accountability to the SNAs, not only on

data and information is available on the service delivery the issue of the territorial

'other' forms of revenue. operations of SOEs need be researched.

Currently, the relevance of SNAs NTRs A SOE that is operating on the territory

to the revenues collected from SOE of an SNA should contribute to

dividends, penalties and fines is minimal.

This being due to the fact that the SNAs • the provision of better services, that it

have no role nor accountability for the will ultimately benefit from,

SOEs. In general the SOEs are affiliated to • the broader local infrastructure

the national organs of government and development agenda and

security apparatus. • in reasoning fiscal space for the

socio-economic development of the

As with the penalty and fine, it is known territory.

that there are currently more than 1,000

different forms of fines and penalties that As previously mentioned earlier, NTR

the Government can collect, and the collections from fines and penalties that

biggest revenue so far has been from can be retained within the SNA territory

traffic offences. However, the information provides a new potential area for policy

on the roles of SNAs on this matter is development.

limited and needs to be understood on a

case-by-case basis (e.g., fine and penalty

on specific offences).

UNCDF - Local Transformative Finance UNCDF - Local Transformative Finance

Photo Credit: Paul Szewczyk, www.unsplash.com

20 Challenges Primary Actions

21

Anecdotes suggest that SNA collection The output statement for the primary The following research and policy

and retention of NTRs might face many actions for NTR revenue optimisation from actions need be considered in the short to

challenges in terms of; other sources; medium term to align to IP5-II (2026-2030).

• The legal framework, A more effective and efficient NTR

system that is decentralized to

• The division of roles and • To continue improving the

allow SNAs to generate new fiscal

responsibilities among different flows from other sources (fines, management and collection of SNA

stakeholders (both within and between penalties and SOE generated NTR from fines and penalties through

national and sub-national levels), dividends) to fully implement their a systematic and evolutionary approach

• The appropriateness and practicality mandates whilst contributing to the to inform a gradual expansion to the

of the many fines and penalties in national revenue mobilization collection of more designations of

policy and strategy. In doing so,

force, penalties and fines that can be

new fiscal space will be created for

• The higher financial costs that will be improved equitable and sustainable administered by the local governments

incurred related the SNAs undertaking public services. • To conduct a feasibility study to

planning, collection, and recording of examine regional and DMK

the fines. ownership and management of the

The following research and policy of SNA NTRs in the context of SOE

A more thorough understanding of actions need be considered in the short ownership and or Local Government

these aspects is needed to inform more term to align to IP5-I (2022-2025). The Enterprises management. The feasibility

coherent policy options moving forward. inter-ministerial IP5-1 sets out the short study needs to examine the issues of

term policy actions related to SNA NTRs increased fiscal space, positive socio-

economic impacts and the underlying

• To conduct an assessment on and factors of agglomeration CP

make policy recommendations for administrations set up and perform as

the management and collection of technical guardians of autonomous

SNA NTR from fines and penalties. agencies overseeing local development

The assessment need examine the and service delivery issues such as solid

overall legal and institutional framework waste management, parking, etc.

down to specific tasks involved.

• Generate an evidence informed

policy framework on the improved

arrangement for the management

and collection of SNA NTR from

fines and penalties. Innovative fines

and penalties specifically for SNAs

(e.g.fines and penalties relating to solid

waste management issues, parking,

etc.) need be identified and included

within the SNA NTR.s The policy

framework needs to consider the

retention of SNA NTRs within the

associated territory as a mechanism for

creating fiscal space.

UNCDF - Local Transformative Finance UNCDF - Local Transformative Finance

22 Example Policy Framework for SNA NTR System

Upgrading Institutional Capacity and Competence

22

Digitalisation is at the core of the Human resource management and

upgrade and upscale of NTR management capacity building is essential to support

and collection process in Cambodia. the development and deepening of SNA

Digital solutions have been introduced in NTR management and collection

accordance with the policy guidance improvement. As mentioned it is only at

provided in the Digital Economy and the provincial level that NTRs are being

Society Policy Framework (2021-2035), the collected in full, with the DMKs, in some

RMS II and the NP2. cases, being responsible for OWSU,

OWSO. For some key growth areas for the

The expectation is that the applications SNAs in terms of NTRs such as revenues

of digital technologies will make the public from state assets and other such as fines

administration systems more effective in and charges only the CP level is functional

delivering public service delivery as well with the DMK not undertaking such

as in collecting the associated revenues. revenue collections.

For NTR, among the most important

digital initiatives is the adoption and Therefore policy to enact the expansion

upscaling of the NRMIS and SARMIS. The of the mandate of the DMK level in the

NRMIS is given more attention, although it context of NTRs and also to increase

is closely related to the SARMIS, staffing to support NTR implementation is

especially concerning revenue from state required to be completed in the short

assets. term.

The NRMIS operates online (both on a To date, the MEF has played a leading

computer and smartphone) and covers key role providing training and technical

management functions over non-tax support to line ministries and SNAs on

revenue. This includes maintaining and NTR management and NRMIS in

recording data, recording, and tracking of particular. The capacity building has been

non-tax debts, revenue allocation, done mainly in collaboration the Economic

incentive sharing, issuance of payment and Finance Institute (EFI), with support

vouchers, report generation, and storing of from the PFMRP, but with only limited

data (i.e., standard fees by types of coordination with MOI and NASLA.

services, rent contracts, licenses, etc.).

The NRMIS, unlike the Financial

Management Information System (FMIS),

was developed in-house by MEF and

rolled out methodically to 23 central line

ministries and 18 provincial line

departments of central LMs, plus selected

CP administrations. E-payments have also

been implemented in 23 central line

ministries and agencies and in the step-by-

step roll-out to SNAs.

UNCDF - Local Transformative Finance UNCDF - Local Transformative Finance

Photo Credit: Office of the Civil Service Commission of the Kingdom of Thailand (OCSC), https://www.ocsc.go.th

23 Challenges Primary Actions

24

Several key challenges need to be • ICT infrastructure for NRMIS The output statement for the primary • To enhance horizontal integration of

addressed in the future; implementation at the SNA level is actions for the upgrade of institutional the SNA NTR system across also line

still underdeveloped and thus capacity and competence NTR revenue ministries that includes data sharing

• Legal framework: Currently, the requires more investment from the optimisation from other sources; relating to various types of SNA NTR

NRMIS and e-Payment are Government. that need to be integrated into the

implemented based on a MEF Circular. • The NRMIS (MEF) is yet to be Adequate institutional capacity and NRMIS,

A higher legal instrument is needed to connected and synchronised with competence to support the • To introduce standard report

ensure a more forceful legal basis for the MOI's MIS for OWSU and deployment of nationwide digital formats that can be generated from

information and payment system

further expansion and compliance OWSO is a particular technical NRMIS and that meet the regular

for administration, management

throughout the Government, problem that needs to be addressed and the collection of SNA NTR that reporting requirements on SNA NTR,

• NRMIS System roll-out is an early • Staffing levels at the SNA and is synchronized with other • To review and improve the

stage of SNA roll-out, with DMK and especially at the DMK level need to management information systems classification of SNA NTR to ensure

CS remaining to be included in the be reconciled. It is suggested that and the budget. consistencies both within and

process. additional new staff at SNA need to be between the NRMIS and the various

• Key NRMIS functions are either recruited, trained, to enable the SNA The following research and policy rules and regulations,

missing or only partially automated DMK levels to manage NTRs. At the actions need be considered in the short • To assess and recommend specific

(e.g., a reminder of NTR arrears). PDEF, there is also a need to appoint term to align to IP5-I (2022-2025). The measures on how to ensure the

• The NTR classifications and the use and train an official to be specifically in inter-ministerial IP5-1 sets out the short complementarity and consistency

of coding are still not consistent charge of NTR. term policy actions related to SNA NTRs between the NRMIS and SARMIS.

between the NRMIS, the legal

classification (i.e. the five types), and • To develop and approve a policy The following research and policy

the economic classification of the framework to further scale up the actions need be considered in the short to

budget. implementation of NRMIS and e- medium term to align to IP5-II (2026-2030).

• The formats of generated NTR payment at SNAs, including the DMK

reports from the system remain and later on the CS level. Coordination • The continuous improvement of

inconsistent with the regular paper- between MEF, NCDD-S, and MOI is human resources, systems and

based report formats, critical for the development and processes to fully implement the

• Coordination and information implementation of the plan, NRMIS, e-payment, and meeting new

sharing remains an issue. The • To promulgate necessary rules and higher revenue targets for SNA NTRs

NRMIS is useful only to the extent of regulations needed to strengthen the • Implementation of a civil service

how well the data is shared and keyed legal basis for the expansion and wide capacity building program for

in by the relevant agencies into the strengthening of the NRMIS SNA NTRs and their management.

system. Currently, the governance of implementation, • The continuous update of the

critical data on service fees, licensing, • To appoint and build the capacity of NRMIS system to reflect the progress

contracts, and agreements is still officials in charge of SNA NTR both of NTR decentralisation to various

fragmented and not well-updated and at SNAs and the PDEF, while putting in levels of SNAs,

shared among relevant ministries and place a technical support mechanism • Policy pathways developed to

SNAs. and process (e.g., help desks, ensure synchronisation between the

management task teams for NRMIS and other relevant SNA MIS

mentoring and coaching relating to NTR.

UNCDF - Local Transformative Finance UNCDF - Local Transformative Finance

Non Tax Revenue for Sub National Administrations

of Cambodia

Sample Activity Plan

The assocaited work plan covers

the short and merdiumk term

actions that allign to the IP5

Phase I and Phase 2 and provides

a sample for discusison only

SNA NTR System Upgrade - Sample Work Plan Aligned to IP5

Specific outputs Priority activities for IP5-I (2022-2025) Priority activities for IP5-I (2026-2030)

1) Revenue from public service fees: A more effective, 1. To review and improve on the current management and collection of public service fees at the OWSU • To review the list of services and fees provided and collected by SNAs (based on the regulatory review study

efficient, and decentralised NTR from public service fees and OWSO, including the use of NRMIS and e-payment, conducted in IP5-I above).

implemented by SNAs so that they can better implement 2. To review and identify the possible connection and synchronisation between the NRMIS and the MIS • To continue improving the legal framework and reform coordination, especially between the national level and

their mandate and functions while contributing to the that MOI set up for OWSU and OWSO, SNAs, to ensure more effective management and collection of SNA NTR,

national revenue mobilisation effort, macro-economic 3. To identify more NTR from line ministries to OWSU and OWSO in accordance with the recent • To continue more decentralisation of NTR to an appropriate level of SNAs and identify new NTR sources to

stability, and improved and equitable service delivery for decentralisation reform policy and the transfer of functions to the DMK level, increase SNA's own source revenues,

local citizens and businesses 4. To review and study the possibility of transferring specific NTR items from OWSU to OWSO in • To continue improving the use of NRMIS, e-payment, and other digital solutions to public service delivery and

accordance with the recent decentralisation reform policy and the transfer of functions to the DMK NTR management and collection at SNA,

level, • To introduce and test a model for forecasting NTR revenue from public service fees.

5. To clarify the arrangements to allow SNAs more power over the setting of fees or charges for NTR

within a value determined by relevant regulations.

6. To study options to finance newly transferred functions (e.g., solid waste management, local transport,

entertainment, education, health) from user fees.

7. To conduct the regulatory review on the current administrative services provided by the OWSU, OWSO

and other parts of SNAs to assess their appropriateness as not only NTR tool but policy inventions to

promote people's livelihood and local business development.

2) Revenue from state assets: A more effective, efficient, 1. To improve the implementation of the recently transferred NTR from state assets by identifying specific • To implement the work plan developed in IP5-II and to continuously improve, using the learning-by-doing

and decentralised NTR from state assets implemented by areas for improvement through a rapid feedback loop and systematic assessment (if needed), approach, the SNA NTR from state asset in ways that are closely coordinated and complementary to the SNA

SNAs so that they can better implement their mandate and 2. Based on the feedback (and/or assessment), to identify and put in place an improved arrangement for state asset management reform.

functions while contributing to the national revenue the management and collection of SNA NTR from state assets, including the use of NRMIS,

mobilisation effort, macro-economic stability, and 3. To continue transferring more NTR from state assets from the national level to the appropriate level of

improved and equitable service delivery for local citizens SNAs in line with the overall decentralisation reform and the functional transfer to the DMK level,

and businesses 4. To assess the progress and develop a work plan to guide the reform of SNA NTR from state assets so

that it is well coordinated and complementary to the broader reform of SNA state asset management.

3) Revenues from other sources: A more effective, 1. To conduct an assessment on and recommend how the management and collection of SNA NTR from • To continue improving the management and collection of SNA NTR from fines and penalties through a learning-

efficient, and decentralised NTR from other sources fines and penalties can be improved. The assessment and recommendations should be comprehensive, by-doing approach to inform a gradual expansion to more types of penalties and fines,

(including fines and penalties, SOE dividend) implemented covering the overall legal and institutional framework down to specific tasks involved. • To conduct a feasibility of having CP administrations set up and perform as technical guardians of autonomous

by SNAs so that they can better implement their mandate 2. Based on the recommendations, develop and implement an improved arrangement for the agencies overseeing local development and service delivery issues such as solid waste management, parking,

and functions while contributing to the national revenue management and collection of SNA NTR from fines and penalties, possibly for specific pilots (e.g., fines etc.

mobilisation effort, macro-economic stability, and and penalties relating to solid waste management issues, parking, etc.).

improved and equitable service delivery for local citizens

and businesses

4) Modernisation and capacity building: A digital system 1. To develop and implement a plan to further scale up the implementation of NRMIS and e-payment at • To continue improving the implementation of the NRMIS, e-payment, and building capacity of relevant staff

for supporting the management and collection of various SNAs, including the DMK and later on the CS level. Coordination between MEF, NCDD-S, and MOI is members at SNAs and the PDEF,

types of SNA NTR which is effective, user-friendly, and critical for the development and implementation of the plan, • To continue updating the NRMIS system to reflect the progress of NTR decentralisation to various levels of

well synchronised with other MIS relevant to SNA NTRs, 2. To review and adopt necessary rules and regulations needed to strengthen the legal basis for the SNAs,

and functioned by capable and accountable officials expansion and strengthening of the NRMIS implementation, • To assess and recommend the ways to ensure synchronisation between the NRMIS and other relevant SNA MIS

3. To appoint and build the capacity of officials in charge of SNA NTR both at SNAs and the PDEF, while relating to NTR.

putting in place a technical support mechanism and process (e.g., help desks, telegram groups,

mentoring and coaching arrangements),

4. To improve the inclusion and sharing of data relating to various types of SNA NTR that need to be

integrated into the NRMIS,

5. To develop and adopt standard report formats that can be generated from NRMIS and meet the regular

reporting requirements on SNA NTR,

6. To review and improve the classification of SNA NTR to ensure consistencies both within and between

the NRMIS and the various rules and regulations,

7. To assess and recommend specific measures on how to ensure the complementarity and consistency

between the NRMIS and SARMIS.

You might also like

- Regional Revitalization Partnership Program 2022Document28 pagesRegional Revitalization Partnership Program 2022MarianNo ratings yet

- Standard Procedure For Hotel Sales Team Incentives PlanDocument2 pagesStandard Procedure For Hotel Sales Team Incentives PlanImee S. Yu0% (1)

- UN-Habitat's Human Library Conference ReportDocument126 pagesUN-Habitat's Human Library Conference ReportUnited Nations Human Settlements Programme (UN-HABITAT)100% (1)

- Impact of Climate FinanceDocument4 pagesImpact of Climate FinancesumithNo ratings yet

- Promoting Local Economic Development Through Strategic Planning:The Local Economic Development (LED) SeriesDocument222 pagesPromoting Local Economic Development Through Strategic Planning:The Local Economic Development (LED) SeriesUnited Nations Human Settlements Programme (UN-HABITAT)No ratings yet

- Pelatihan Awareness Integrated Management System Qhse: Based OnDocument77 pagesPelatihan Awareness Integrated Management System Qhse: Based OnAchmad FiqriNo ratings yet

- CS Form No. 212 Attachment - Work Experience SheetDocument1 pageCS Form No. 212 Attachment - Work Experience SheetNoel Ephraim AntiguaNo ratings yet

- Very Good ReportDocument60 pagesVery Good ReportMomin IqbalNo ratings yet

- UNDG UNDAF Companion Pieces 5 Funding To FinancingDocument14 pagesUNDG UNDAF Companion Pieces 5 Funding To FinancingMauricio Javier Gaitán FuentesNo ratings yet

- Stronger PartnershipDocument25 pagesStronger PartnershipJoe DouillyNo ratings yet

- Financing: Local and Regional GovernmentsDocument20 pagesFinancing: Local and Regional GovernmentsArnaldo GonzalezNo ratings yet

- Solutions To Attract ODA Investment Into The Southeastern Economic Region of VietnamDocument7 pagesSolutions To Attract ODA Investment Into The Southeastern Economic Region of VietnamQuỳnh HươngNo ratings yet

- UNDP Funding Compendium 2020Document20 pagesUNDP Funding Compendium 2020Necla ZerenNo ratings yet

- Ifc Ar21Document117 pagesIfc Ar21Tom BaetensNo ratings yet

- Regional Observatorio Framework PaperDocument12 pagesRegional Observatorio Framework Papermayang azurinNo ratings yet

- Poverty Reduction and MDGSDocument7 pagesPoverty Reduction and MDGSGreatNo ratings yet

- Oda NNNDocument7 pagesOda NNNHà MyyNo ratings yet

- Nanwani - SDGs and The Role of International Financial Institutions - 2019Document16 pagesNanwani - SDGs and The Role of International Financial Institutions - 2019PABLO RAFFAELLINo ratings yet

- Financing For Development in COVID-19 by United NationsDocument131 pagesFinancing For Development in COVID-19 by United NationsSuborna BaruaNo ratings yet

- Economic and Political Weekly Economic and Political WeeklyDocument10 pagesEconomic and Political Weekly Economic and Political WeeklyMig TigNo ratings yet

- Opinion: Strengthening Demand: A Framework For Financing Sustainable DevelopmentDocument6 pagesOpinion: Strengthening Demand: A Framework For Financing Sustainable DevelopmentpijNo ratings yet

- Giz2022 de Resilient Cities Action Package 2021 (ReCAP21)Document24 pagesGiz2022 de Resilient Cities Action Package 2021 (ReCAP21)MK DmrklNo ratings yet

- A Review of International Development in SWM - IsWA Globalisation Task Foroce - September 2014 FINALDocument48 pagesA Review of International Development in SWM - IsWA Globalisation Task Foroce - September 2014 FINALw3n123No ratings yet

- Global Climate Finance ArchitectureDocument4 pagesGlobal Climate Finance ArchitectureHans SechserNo ratings yet

- Supporting Sustainable Development Afd Offer To SeoDocument9 pagesSupporting Sustainable Development Afd Offer To SeoKristina Wulan YulianiNo ratings yet

- Philippines: Asian Development Bank Member Fact SheetDocument4 pagesPhilippines: Asian Development Bank Member Fact SheetPaulNo ratings yet

- FS 2017 DMC - Philippines PDFDocument4 pagesFS 2017 DMC - Philippines PDFWildom RosarioNo ratings yet

- 2016 IATF Chapter1 PDFDocument24 pages2016 IATF Chapter1 PDFUkash AbrahimNo ratings yet

- Slum Upgrading: by Nora Sticzay and Larissa Koch, Wageningen University and Research CentreDocument8 pagesSlum Upgrading: by Nora Sticzay and Larissa Koch, Wageningen University and Research CentreZeinab NadeemNo ratings yet

- Philippines: Asian Development Bank Member Fact SheetDocument4 pagesPhilippines: Asian Development Bank Member Fact SheetShekinah CastrosantoNo ratings yet

- Scaling Up Investment For Sustainable Urban Infrastructure: A Guide To National and Subnational ReformDocument47 pagesScaling Up Investment For Sustainable Urban Infrastructure: A Guide To National and Subnational ReformSyed Zaki Ali AsgharNo ratings yet

- NDB Annual Report 2017Document100 pagesNDB Annual Report 2017Alexey KosarevNo ratings yet

- Unit 7 PDFDocument20 pagesUnit 7 PDFvamsiNo ratings yet

- From Billions To Trillions:: MDB Contributions To Financing For DevelopmentDocument6 pagesFrom Billions To Trillions:: MDB Contributions To Financing For DevelopmentpavloneNo ratings yet

- Bahan Bacaan Wajib DesentralisasiDocument14 pagesBahan Bacaan Wajib DesentralisasiアンディNo ratings yet

- دور ميزانية البلدية في تمويل التنمية المحلية دراسة حالة بلدية عين تسرة - برج بوعريريج - للفترة 2014-2019.Document23 pagesدور ميزانية البلدية في تمويل التنمية المحلية دراسة حالة بلدية عين تسرة - برج بوعريريج - للفترة 2014-2019.Amara Moniur MenaouarNo ratings yet

- Nsfi 2022 2028Document43 pagesNsfi 2022 2028Kay ZeeNo ratings yet

- Convergence Report Best Practices For Donor Governments Engaging in Blended FinanceDocument34 pagesConvergence Report Best Practices For Donor Governments Engaging in Blended Financelezi.upeleNo ratings yet

- 3resource Mobilization - PDF StrategiesDocument16 pages3resource Mobilization - PDF StrategiesHasrat AliNo ratings yet

- Strengthening Public Financial-2015Document5 pagesStrengthening Public Financial-2015Anns NasirNo ratings yet

- DC2017-0009 Maximizing 8-19Document14 pagesDC2017-0009 Maximizing 8-19Jeyjo d'BestNo ratings yet

- Mobilising Institutional Investors For Financing Sustainable Development FinalDocument63 pagesMobilising Institutional Investors For Financing Sustainable Development Finalmostafayman009No ratings yet

- Results Based Management-Idf 2021Document19 pagesResults Based Management-Idf 2021hugues kouassiNo ratings yet

- The Un Millennium Project: A Practical Plan To Achieve The MdgsDocument3 pagesThe Un Millennium Project: A Practical Plan To Achieve The MdgsArjita SaxenaNo ratings yet

- Pad350 Final TestDocument12 pagesPad350 Final TestYoon Ae RiNo ratings yet

- Economic - Report For StudentsDocument128 pagesEconomic - Report For StudentsDiptiranjan PandaNo ratings yet

- Development Investments: A Response To Global ChallengesDocument36 pagesDevelopment Investments: A Response To Global ChallengesLostorageAceNo ratings yet

- FSFSCI-2.4 SUSTENTABILIDAD-Partnerships For Sustainable Development Analyzing The Challenges-Basil UgochukwuDocument11 pagesFSFSCI-2.4 SUSTENTABILIDAD-Partnerships For Sustainable Development Analyzing The Challenges-Basil UgochukwuNorman AlburquerqueNo ratings yet

- Financing Urban SpecialDocument3 pagesFinancing Urban Specialjacm_zarNo ratings yet

- OECD WP Humanitarian Financing CrisisDocument34 pagesOECD WP Humanitarian Financing CrisisTintea MihneaNo ratings yet

- Principles For Action: Centre For Entrepreneurship, Smes, Local Development and TourismDocument39 pagesPrinciples For Action: Centre For Entrepreneurship, Smes, Local Development and TourismMLGNo ratings yet

- Development Finance Assessment & Integrated Financing Solutions BriefDocument28 pagesDevelopment Finance Assessment & Integrated Financing Solutions BriefMinsannNo ratings yet

- 19 Oct RFA Community of Practice - FHDocument14 pages19 Oct RFA Community of Practice - FHSanchita GhoshNo ratings yet

- Case Study Indonesia Infrastructure FinanceDocument2 pagesCase Study Indonesia Infrastructure FinanceMimi OlshopeNo ratings yet

- Bernardus Djonoputro JDCN Policy DiscussionDocument10 pagesBernardus Djonoputro JDCN Policy DiscussionTigaes SurvetamaNo ratings yet

- BUDGETINGDocument34 pagesBUDGETINGmiadjafar463No ratings yet

- PartnershipsDocument2 pagesPartnershipsJuan Carlos Mendoza RevillaNo ratings yet

- APUF8-Constituency Assemblies Concept Note - LG Ao 20oct2023Document5 pagesAPUF8-Constituency Assemblies Concept Note - LG Ao 20oct2023M Kali Hamzah SiregarNo ratings yet