Professional Documents

Culture Documents

Macro CH 9

Uploaded by

Mishti GhoshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Macro CH 9

Uploaded by

Mishti GhoshCopyright:

Available Formats

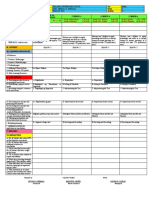

CHAPTER -15- PROBLEM OF EXCESS DEMAND AND DEFICIT DEMAND

MULTIPLE CHOICE QUESTIONS

Question Question Content

No

Q1 If income equilibrium level in the economy is determined at the level before full

employment, it is known as the state of:

a) Deficit Demand

(b) Surplus Demand

(c) Partial Demand

(d) None of these

Q2 What are the characteristics of Deficit Demand?

(a) Aggregate Demand falls short of Aggregate Demand required at full employment

(b) Aggregate Demand remains short of Aggregate Supply required of full

employment level

(c) Both (a) and (b)

(d) None of above

Q3 The gap by which actual aggregate demand exceeds the aggregate

demand required to establish full employment equilibrium is known as___________.

a) Deficit demand

b) Deflationary gap

c) Inflation gap

d) Excess demand

Q4 _____________refers to the situation when aggregate supply falls short of aggregate

demand corresponding to full employment level of output in economy.

a) Deficit demand

b) Excess demand

c) Inflationary gap

d) Deflationary gap

Q5 Deficit demand indicates

a) Under employment equilibrium

b) Over full employment equilibrium

c) Full employment equilibrium

d) None of these

Q6 Monetary policy is the policy of __________ to control money supply and credit in the

economy

a) Central government

b) Central bank

c) Both (A) &(B)

d) None of these

Q7 During excess demand central bank _____________the margin requirement

a) Decrease

b) Increase

1|Page 8 October 2021,ZIET BHUBANESWAR

c) Removes

d) Does not change

Q8 Which of the following is not the reason for excess demand?

a) Fall in the propensity to consume

b) Reduction in taxes

c) Increase in investment

d) Deficit financing

Q9 Which of the following is true?

(a) Employment level declines due to decrease in demand

(b) Price level falls due to Deficit demand in the country

(c) Production level falls Deficit demand

(d) All the above

Q10 The ‘difference between the Aggregate Demand at above full employment and

Aggregate Supply at full employment is known as:

(a) Inflationary Gap

(b) Deflationary Gap

(c) Both (a) and (b)

(d) None of the above

Q11 Which of the following is a reason for surplus demand?

(a) Increase in Public Expenditure

(b) Increase in Money Supply

(c) Fall in Taxes

(d) All the above

Q12 In the situation of the deflationary gap:

(a)Output decreases

(b)Prices decreases

(c) Employment decreases

(d) All of these

Q13 Which of the following causes the trade cycle?

(a) Deflationary Conditions

(b) Inflationary Conditions

(c)Both (a) and (b)

(d) None of these

Q14 Which one is the corrective measure for Deficit Demand?

(a) Fiscal Measures

(b) Monetary Measures

(c) Both (a) & (b)

(d) None of the above

Q15 Which measure is included in Fiscal Measures?

(a)Public Expenditure

(b)Taxation

(c)Public Debt

(d) All of these

Q16 ____________ = AD > AS, corresponding to the full employment level of output or

2|Page 8 October 2021,ZIET BHUBANESWAR

income.

(a) Deficit demand

(b) Excess demand

(c) Deflationary gap

(d) None of the above

Q17 Which one is the reason for deciding Deficit demand conditions?

(a) Fall in the money supply in the country

(b) Fall in investment demand as a result of rising in bank rate

(c) Fall in disposable income and consumer demand due to increase in taxes

(d) All the above

Q18 Deflationary Gap does not shows the measurement of:

(a) Deficit Demand

(b) Surplus Demand

(c) Full Employment

(d) None of these

Q19 Which monetary measure is not to be adopted in correcting Inflationary

(a) Increase in Bank Rate

(b) Buying of Securities in Open Market

(c) Increase in Cash Reserve Ratio

(d) All the above

Q20 In Keynesian economics, the state of Deficit Demand is called as:

(a) Full Employment Equilibrium

(b) Under Full Employment Equilibrium

(c) Both (a) and (b)

(d) None of the above

Q21 What is the impact of deficit demand on production and employment?

(a) Increase

(b) Decrease

(c) Remains constant

(d) None of them

Q22 Name the situation under which aggregate demand falls short of aggregate Supply at

full employment level.

(a) Excess demand

(b) Excess supply

(c) Inflationary gap

(d) None of them

Q23 The ‘difference between the Aggregate Demand at above full employment and

Aggregate Demand at full employment is known as:

(a) Inflationary Gap or Deficit demand

(b) Deflationary Gap or Deficit demand

(c)Neither(a) nor (b)

(d) None of the above

Q24 The fiscal policy measures that control decrease aggregate demand, and thus, control

the problem of excess demand are:

3|Page 8 October 2021,ZIET BHUBANESWAR

(a) Increasing the level of government expenditure.

(fa) Increasing the amount of taxes.

(c) A mix of reducing government expenditure and increasing tax rates

(d) All of them

Q25 The monetary policy measures that control decrease aggregate demand, and thus,

control the problem of excess demand are:

(a) Increase in the bank rate.

(b) Sale of government securities in the open market by the central bank.

(c) Decreasing CRR and SLR.

(d) None of them

Q26 The fiscal policy measures that can increase aggregate demand and thus, control the

problem of Deficit demand are:

(a) Increasing the level of government expenditure.

(b) Reduction in the level of taxes.

(c) A mix of increasing government expenditure and decreasing the rate of taxes

(d) All of them

Q27 Which of the following statements is true?

(a) Employment level declines due to decrease in demand

(b) Price level falls due to Deficit demand in the country

(c) Production level falls Deficit demand

(d) All the above

Q28 Inflationary gap refers to the situation of

a) AD < AS

b) AD > AS

c) AD=AS

d) AD=0

Q29 From following, which is not a cause of excess demand

a) Increase in consumption expenditure

b) Increase in investment expenditure

c) Increase in exports

d) Increase in government income

Q30 Involuntary unemployment refers to the situation

a) When people choose to do work, but jobs are unavailable

b) When people choose to remain unemployed, even when jobs are available

c) When people are not getting work, even when they are willing to work at the

existing wage rate.

d) When people get less income than to their capability

Q31 What is the fiscal measure of correcting deficit demand?

a) Increase in public debt

b) Decrease in public expenditure

c) Decrease in taxes

d) None of the above

Q32 Which is the measure of correcting excess demand?

a) Deficit financing

4|Page 8 October 2021,ZIET BHUBANESWAR

b) Reduction in taxes

c) Increase in public expenditure

d) Increase in public debt

Q33 Policy related to revenue and expenditure of the government is

a) Monetary policy

b) Fiscal policy

c) Foreign trade policy

d) Moral suasion

Q34 Component of fiscal policy

a) Bank rate

b) Margin requirement

c) Moral suasion

d) Tax

Q35 Deficit demand leads to

a) Deflation

b) Fall in output

c) Fall in employment

d) All of these

Q36 Qualitative measures to control money supply:

a) Moral suasion

b) Bank rate

c) Repo rate

d) None of these

Q37 Inflationary gap:

a) raises the level of output

b) does not impact the level of output

c) raises the general price level

d) both b and c

Q38 Full employment equilibrium refers to a situation of:

a) AD=AS(with fuller utilisation of resources)

b) Zero unemployment

c) Both a and b

d) None of these

Q39 Frictional unemployment occurs due to:

a) immobility of labour

b) lack of production capacity

c) low wage rate

d) change in production technique

Q40 Deficit or excess demand can be corrected through:

a) fiscal policy

b) monetary policy

c) both a and b

d) none of these

Q41 Wage-price spiral is a consequence of:

5|Page 8 October 2021,ZIET BHUBANESWAR

a) inflationary gap

b) deflationary gap

c) stagflation

d) both a and c

Q42 By increasing the tax burden on the households, the government intends to:

a) correct the situation of Deficit demand

b) correct the situation of inflationary gap

c) correct the situation of excess demand

d) both b and c

Q43 What is a fiscal measure of correcting Deficit demand?

(a) Increase in public expenditure and decrease in taxes

(b) Decrease in public debt

(c) Deficit financing

(d) All of these

Q44 An increase in aggregate demand of equilibrium level of income and employment

causes an increase in:

(a) Employment

(b) Production

(c) Income

(d) All of these

Q45 In Keynesian economics, the state of Deficit Demand is called as:

(a) Full Employment Equilibrium

(b) Under Full Employment Equilibrium

(c) Both (a) and (b)

(d) None of the above

Q46 Which one is the reason for Deficit Demand condition?

(a) Fall in the money supply in the country

(b) Fall in investment demand as a result of rising in bank rate

(c) Fall in disposable income and consumer demand due to increase in taxes

(d) All the above

Q47 With which component of Monetary Policy, Central Bank tries to attain economic

stability in the country?

(a) Supply of Money

(b) Interest Rate

(c) Availability of Money

(d) All of these

Q48 How the excess money from the economy can be arrested and Excess Demand can be

corrected?

(a) Reduction in Bank Rate

(b) Selling Securities in Open Market

(c) Reducing Cash Reserve Ratio

(d) All the above

Q49 The reverse repo rate is decreased so that commercial banks will create more credit,

because

6|Page 8 October 2021,ZIET BHUBANESWAR

a) The banks will be discouraged to deposit more surplus money with the RBI

b) Banks will decrease the interest rate for the public

c) The commercial banks will maintain less liquidity with themselves

d) None of the above

Q50 Excess Demand may rise due to

a) Increase in exports

b) Increase in imports

c) Increase in consumption expenditure

d) Increase in taxation

Q51 If economies need to control recession like most of the euro zone nations, which of

the following will be most appropriate?

(a)reducing repo rate

(b)reducing CRR

(c)both (a)&(b)

(d) neither (a) nor (b)

Q52 To correct Excess demand, RBI must _______ the margin requirement.

(a)increase

(b)decrease

(c)not change

(d)remove

Q53 Which of the following can be used to correct deflationary gap under monetary

policy?

(a)increase taxation

(b)increase in cost of credit

(c)cut in the government expenditure

(d)none of the above

Q54 Which of the following can be a reason for Excess Demand?

(a)reduction in investment

(b)increase in imports

(c)decrease in exports

(d)rise in propensity to consume

Q55 In Economics the problem of unemployment is the problem of _______

(a)Voluntary unemployment

(b)involuntary unemployment

(c)both (a) & (b)

(d)Seasonal unemployment

Q56 Full employment implies absence of:

a) Voluntary unemployment

b) Involuntary unemployment

c) Unemployment

d) None of these

Q57 In a situation of Deficit demand at the full employment level of income:

a) AD=AS

b) AD>AS

7|Page 8 October 2021,ZIET BHUBANESWAR

c) AD<AS

d) None of these

Q58 Excess demand refers to a situation when:

a) AD>AS (corresponding to full employment)

b) AD>AS (corresponding to full employment)

c) Unsold stocks tend to increase

d) None of these

Q59 Which of the following does not lead to fall in AD?

a) Fall in private consumption expenditure

b) Fall in exports

c) Fall in imports

d) Fall in government expenditure

Q60 Revenue and expenditure policy of the government to correct the situations of excess

and Deficit demand is known as:

a) Monetary policy

b) Fiscal policy

c) Both (A) and (B)

d) None of these

Q61 Which of the following components of fiscal policy can be used to correct Deficit

demand?

a) Increase in government expenditure

b) Cut in tax rates

c) Cut in public borrowing

d) All of these

Q62 Which of the following components of monetary policy can be used to correct excess

demand?

a) Increase in SLR

b) Increase in CRR

c) Increase in margin requirement

d) All of these

Q63 To correct the situation of deflationary gap, the central bank:

a) Increases margin requirement

b) Decreases margin requirement

c) Increases cash reserve ratio

d) Both (A) and (B)

Q64 Which of the following leads to increase in AD?

(A) Fall in imports

(B) Increase in investment expenditure

(C) Increase in government expenditure

(D) All of these

Q65 A situation when AS=AD along with fuller utilisation of resources in the economy is

called

8|Page 8 October 2021,ZIET BHUBANESWAR

a) Underemployment equilibrium

b) Full employment equilibrium

c) Equilibrium without excess capacity

d) Both B and C

Q66 In case of under employment equilibrium

a) AS=AD

b) There is excess capacity in the economy

c) Resources are not fully utilised

d) All of these.

Q67 Full employment:

a) It consistent with a natural rate of unemployment

b) Is a situation of zero unemployment

c) Occurs when demand for labour force is equal to supply of labour force

d) Both A and C.

Q68 Problem of unemployment refers to:

a) The problem of voluntary unemployment

b) The problem of involuntary unemployment

c) Neither A nor B

d) Both A and B.

Q69 Deficit demand leads to:

a) Deflationary gap

b) Excess capacity

c) Low level of employment

d) All of these.

Q70 Planned AD is short of its full employment level in a situation of:

a) Excess demand

b) Inflationary gap

c) Deficit demand

d) None of these.

Q71 Inflationary gap is measured as:

a) ADE+ADF

b) ADE-ADF

c) ADE×ADF

d) ADE÷ADF

(Here ADE= aggregate demand beyond full employment; ADF= aggregate demand at

full employment).

Q72 Aggregate demand falls owing to:

a) Increase in exports

b) Increase in consumption expenditure

c) Increase in imports

d) Both A and C

Q73 Fiscal policy refers to:

a) Revenue and expenditure policy of the government

b) Budgetary policy of the government

9|Page 8 October 2021,ZIET BHUBANESWAR

c) Both A and B

d) Neither A nor B

Q74 The policy which corrects the situations of excess deficit demand by regulating

interest rate and availability of credit in the economy is called :

a) Fiscal policy

b) Monetary policy

c) Budgetary policy

d) All of these

Q75 In order to correct the situation of excess demand:

a) Cost of credit it is raised

b) Availability of credit is raised

c) Availability of credit is reduced to

d) Both A and C

Q76 Which of the following can be used to correct inflationary gap:

a) Increases in taxation

b) But in the cost of credit

c) Cut in government expenditure

d) Both A and C

Q77 Which of the following can be used to correct deflationary gap:

a) Increase in bank rate

b) Increase in CRR

c) Reduction in SLR

d) Increase in margin requirement.

Q78 Excess demand leads to:

(a) Inflationary gap

(b) Rise in prices

(c) Rise in employment level

(d) Both (a) and (b)

Q79 Which of the following leads to an increase in AD?

(a) Fall in imports

(b) Increase in investment expenditure

(c) Increase in govt.expenditure

(d) All of these

Q80 If the level of AD is to be raised(upward shift in AD curve) there should be:

(a) Increase in autonomous investment

(b) Increase in autonomous consumption expenditure

(c) Both (a) and (b)

(d) None of these

Q81 Deficit demand refers to a situation when

(a) AD>AS (corresponding to full employment)

(b) AD<AS (corresponding to full employment)

(c) Unsold stocks tend to increase

(d) None of these

Q82 Which of the following components of fiscal policy can be used to correct Deficit

10 | P a g e 8 October 2021,ZIET BHUBANESWAR

demand…

(a) Increase in govt.expenditure

(b) Cut in tax rates

(c) Cut in public borrowing

(d) All of these

Q83 Which of the following components of monetary policy can be used to correct excess

demand?

(a) Increase in bank rate

(b) Increase in CRR

(c) Increase in marginal requirement

(d) All of these

Q84 Deflationary gap is measured as :

(a) AD of full employment - Planned AD corresponding to underemployment

(b) AD of full employment + Planned AD corresponding to underemployment

(c) AD of full employment / Planned AD corresponding to underemployment

(d) None of these

Q85 Structural unemployment occurs due to:

(a) Change in technology

(b) When factors other than labour are in shortage

(c) Both (a) and (b)

(d) None of these

Q86 To correct the situation of excess demand, RBI uses…

(a) Cheap monetary policy

(b) Dear monetary policy

(c) Both (a) and (b)

(d) None of these

Q87 Which of the following is considered as a component of monetary policy?

(a) Taxes

(b) Government expenditure

(c) CRR and SLR

(d) None of these

11 | P a g e 8 October 2021,ZIET BHUBANESWAR

ANSWER

Question No Answer

Q1 (a) Deficit Demand

Q2

(C) Both (a) and (b)

Q3 (C)Inflationary gap

Q4 a) Deficit demand

Q5

(a) Under employment equilibrium

Q6 (b) Central bank

Q7 (B) Increase

Q8 (a) Fall in the propensity to consume

Q9 (d) All the above

Q10 (a) Inflationary gap

Q11 (d) All the above

Q12 (d) All of these

Q13 (c) both a & b

Q14 (c) both a & b

Q15 (d) All of these

Q16 (b) Excess demand

Q17 (d) All the above

Q18 (b) Surplus Demand

Q19 (b) Buying of Securities in Open Market

Q20 (b) Under Full Employment Equilibrium

Q21 (b) Decrease

Q22 (b) Excess supply

Q23 (d) None of the above

Q24 (a) Increasing the level of government expenditure.

Q25 (c) Decreasing CRR and SLR.

Q26 (d) All of them

Q27 (d) All the above

Q28 b) AD > AS

Q29 d. Increase in government income

Q30 c) When people are not getting work,even when they are

willing to work at the existing wage rate

Q31 c) Decrease in taxes

Q32 d)Increase in public debt

Q33 b) Fiscal policy

Q34 d. Tax

Q35 d) All of these

Q36 a. Moral suasion

Q37 d) both b and c

12 | P a g e 8 October 2021,ZIET BHUBANESWAR

Q38 a) AD=AS(with fuller utilisation of resources

Q39 a)immobility of labour

Q40 c) both a and b

Q41 a) inflationary gap

Q42 d) both b and c

Q43 (d) All of these

Q44 (d) All of these

Q45 (b) Under Full Employment Equilibrium

Q46 (d) All the above

Q47 (d) All of these

Q48 (b) Selling Securities in Open Market

Q49 (a)The banks will be discouraged to deposit more surplus

money with the RBI

Q50 (a) Increase in exports

Q51 (c)both (a)&(b)

Q52 (a)increase

Q53 (d)none of the above

Q54 (d)rise in propensity to consume

Q55 (c)both (a) & (b)

Q56 (b)

Q57 (c)

Q58 (a)

Q59 (c)

Q60 (b)

Q61 (d)

Q62 (d)

Q63 (b)

Q64 (d)

Q65 d

Q66 d

Q67 d

Q68 b

Q69 d

Q70 b

Q71 b

Q72 c

Q73 c

Q74 b

Q75 d

Q76 d

Q77 c

Q78 (d)

13 | P a g e 8 October 2021,ZIET BHUBANESWAR

Q79 (d)

Q80 (c)

Q81 (b)

Q82 (d)

Q83 (d)

Q84 (a)

Q85 (c)

Q86 (b)

Q87 (c)

PREPIRED BY : PGT ECONOMICS OF BHUBANESWAR, GUWAHATI,

KOLKATA, RANCHI, SILCHAR AND TINSIKIA REGION.

VETTED BY : SILCHAR REGION

14 | P a g e 8 October 2021,ZIET BHUBANESWAR

CHAPTER -15- PROBLEM OF EXCESS DEMAND AND DEFICIT DEMAND

CASE STUDY BASED QUESTIONS

CBQ NO Question Content

Q1 CASE STUDY:

Jobs are back, income is not: Workers take lower-paying jobs ; still suffer salary cuts, November

24,2020

More than half the households in India have suffered a fall in their incomes during the lockdown,

compared to a Year ago, and a very large proportion has seen no increase. The Indian economy is

recovering, listed companies are making huge profits, the employment rate is rising; but, The

common people are still struggling with stagnant household incomes.

According to the Centre for Monitoring Indian Economy (CMIE). Now, India is nearly eight months

into the lockdown with several relaxations in the movement of goods and delivery of services,

and many fast frequency indicators have reported a smart recovery, but the recovery in

household incomes is very slow.

i) . Due to deficit financing there will be _________ in the economy. (excess demand/ deficient

demand)

ii) . _______is not a component of aggregate demand in two-sector economy.

(import, net exports , export)

iii) . Deficient Demand indicates _________ full employment equilibrium. (over/under)

iv) . Minimum level of expenditure is dependent on the level of income in the economy. ( true or

false)

Q2 CASE STUDY:

Read the following news report and answer Questions the following on the basis of the same :

The Reserve Bank of India (RBI), cut Repo Rate to 4.4%, the lowest in at least 15 years. Also, it

reduced the Cash Reserve Ratio (CRR) maintained by the banks for the first time in over seven

years. CRR for all banks was cut by 100 basis points to release ` 1.37 lakh crores across the

banking system. RBI governor Dr. Shaktikanta Das predicted a big global recession and said India

will not be immune. It all depends how India responds to the situation. Aggregate demand may

weaken and ease core inflation. The Economic Times; March 27th, 2020

1. Cut in Repo rate by RBI is likely to............... (Increase/decrease) the demand for goods and

services in the economy. (choose the correct alternative)

2. Decrease in Cash Reserve Ratio will lead to................. (choose the correct alternative)

(i) fall in aggregate demand

(ii) rise in aggregate demand

(iii) no change in aggregate demand

(iv) fall in general price level

3.. The difference by which actual Aggregate Demand exceeds the Aggregate Demand, required

to establish full employment equilibrium is known as... .............(inflationary gap/deflationary

gap). (choose the correct alternative)

4.. The impact of ‘Excess Demand’ under Keynesian theory of income and employment, in an

economy are : (choose the correct alternative)

(i) decrease in income, output, employment and general price level

(ii) decrease in nominal income, but no change in real output

(iii) increase in income, output, employment and general price level

(iv) No change in output/employment but increase in general price level.

1|Page 8 October 2021,ZIET BHUBANESWAR

Q3 Read the passage given below and answer the following questions

When an economy undergoes a deflationary Shock, the implications can be both positive and

negative for consumers and businesses. There is a big difference between the terms disinflation

and deflation, which we will first go over before getting into the causes and effects of deflationary

shocks, and how these shocks can affect the economy, consumers and businesses. Disinflation

usually occurs during a period of recession and manifests itself by slowing down the rate at which

prices increase; this occurs as a result of a decrease in consumer sales. If the inflation rate drops

to a lower level than before, technically that difference is disinflation. Deflation, on the other

hand, can be thought as the opposite of inflation, or as negative inflation, and it occurs when the

supply of goods or services rises faster than the supply of money.

i. ………….. (Central bank/Commercial bank) help to correct the situation of deflationary shock in a

country through its credit control policy.

ii. Which of the following steps should be taken by the Central Bank to boost demand in the

economy during the deflationary gap?

A. Decrease tax rate

B. Deficit financing

C. Decrease legal reserve requirements

D. Increase foreign exchange reserve

iii. Which of the following statements stands true during the deflationary gap?

A. Actual output falls short of potential output

B. Potential output falls short of actual output

C. Actual demand is less than expected demand

D. Expected demand is less than actual demand

iv. What will be the impact on money supply during the deflationary gap?

A. Decrease

B. Increase

C. Remain constant

D. Can't be predicted

Q4 India’s wholesale inflation accelerated for the third consecutive month and firmed up to an eight-

month high of 1.48% in October, driven by manufactured items, data released by the commerce

and industry ministry showed on 16 Nov. The WPI had increased 1.32% in September, The annual

rate of inflation based on the WPI Food Index, which comprises ‘food articles’ from the primary

articles group and ‘food product’ from the manufactured products group, decreased to 5.78% in

October from 6.92% in September. The government also revised the wholesale inflation for

August to 0.41% from 0.16% earlier.

Food inflation cooled to 6.37% in October from 8.17% in September, led by decline in meat, egg

and fish inflation that slowed to 1.65% in October from 4.15% the previous month.

Inflation in vegetables and potatoes was 25.23% and 107.70% respectively.

In the manufactured products category, inflation was 2.12% compared with 1.61% in September.

i, India’s wholesale inflation accelerated for the third consecutive month in October 2020, driven

by ________item(food/manufactured).

ii. Increase in core inflation implies improvement in _______(demand/supply) condition after

covid 19 related lockdown was lifted.

iii. Inflation is a situation of excess demand i.e., when aggregate demand is in excess of aggregate

2|Page 8 October 2021,ZIET BHUBANESWAR

supply corresponding to ______.

a. under full employment

b. over full employment

c. full employment

d. none of these

iv. Inflationary gap causes ________.

a. no change in the level of output

b. no change in the level of employment

c. rise in general price level

d. all of these

Q5 CASE STUDY:

Amidst indications of an economic slowdown in the beginning of year 2020 came the challenge of

CoronaPandemic in Feb-Mar 2020, forcing the Government to impose a strict lock down leading

to near cessation of Major economic activities across all sectors. The Finance Minister on 13th,

14th, 15thMay’20 announced an Economic package of ₹20 Lakh Crore for revival of Indian

economy. Government of India’s ₹20 lakh crore ‘AatmaNirbhar Bharat’ package which aimed at

reviving the economy, includes major fiscal measures like free food for the poor, direct cash

transfer, money for rural job guarantee scheme, MGNREGA and credit guarantees to MSMEs.RBI

has also taken steps to slash lending rates and add more liquidity into the markets.

1. Indicate the impact of the economic package on AD:

(a) Fall in Aggregate Demand

(b) Rise in Aggregate Demand

(c) Rise in general Price level

(d) No change in Aggregate Demand

2. To induce liquidity RBI must have:

(a) Increased Cash Reserve Ratio

(b) Reduced Repo Rate

(c) Increased Reverse Repo Rate

(d) Kept Statutory liquidity Ratio constant

3. The likely impact of “Deficit Demand” under income and employment theory, in an economy

are:

(a) Decrease in income, output, employment and general price level

(b) Decrease in nominal income, but no change in real output

(c) Increase in income, output, employment and general price level

(d) No change in output/ employment but increase in general price level

4. The nature of fiscal policy undertaken by the government is _________ and Monetary Policy is

________ in its nature.

(a) Expansionary, Expansionary

(b) Expansionary, Contractionary

(c) Contractionary, Expansionary

(d) Contractionary, Contractionary

Q6 Case Study :

Monetary and fiscal instruments are the key to combat the problems of excess and deficient

demand. Fiscal instruments relate to revenue and expenditure policy of the government.

Monetary instruments relate to the regulation of money supply in the economy. To combat

excess demand, the government needs to curb its expenditure and raise its revenue. On the

3|Page 8 October 2021,ZIET BHUBANESWAR

monetary front, it needs to pursue a Dear Money Policy, making availability of credit tougher than

before and shrinking the credit creation capacity of the commercial banks. On the other hand, to

combat deficient demand, expenditure needs to be stimulated while revenue needs to be cured.

On the monetary front, Cheap Money Policy needs to be pursued, facilitating easy availability of

credit and enhancing credit creation capacity of the commercial banks.

Based on case study given above, answer the following questions:

1: Who issues monetary policy to control aggregate demand:

(A) Central bank

(B) Government

(C) Commercial bank

(D) None of these

2: Which is monetary instrument to combat the problems of excess and deficient demand:

(A) CCR

(B) SLR

(C) Bank rate

(D) All of above

3: Which is fiscal instrument to combat the problems of excess and deficient demand:

(A) Public revenue

(B) Public expenditure

(C) Public debt

(D) All of above

4: Cause of Deficient Aggregate Demand:

(A) Reduction in private consumption expenditure

(B) Reduction in government expenditure

(C) Decline in exports

(D) All of these

Q7 Case Study :

Along with the weakening of global economic activity, inflation the world over also remained

muted in 2019.Inflation softened in advanced and emerging economies reflecting a slack in

consumer demand. From the supply side, lower energy prices in 2019 also contributed to

softening of inflation. In India, inflation slightly, lower energy prices in rose to 4.1per cent in April-

December 2019, after a sharp decline from 5.9per cent in 2014 to 3.4 per cent in 2018.

Based on case study given above, answer the following questions:

1: Due to weakening of global economic activity, level of aggregate demand in the economy:

(A) increases

(B) decreases

(C) fluctuate

(D) constant

2: The impact of above situation under Keynesian theory of income and employment, in an

economy is:

(A) Decrease in income, output and employment.

(B) Decrease in nominal income, but no change in real output.

(C) Increase in income, output and employment.

(D) No change in output and employment but increase in general price level.

3: Decrease in government expenditure is required to combat:

(A) inflation

(B) deflation

4|Page 8 October 2021,ZIET BHUBANESWAR

(c) unemployment

(D) poverty

4: Inflation leads to:

(A) unemployment

(B) wage-price spiral

(c) both (A) and (B)

(D) none of these

Q8 Deflationary gap When there is involuntary unemployment in the economy, there is a short fall in

Aggregate Demand from the level required to maintain a full employment equilibrium. This short

fall is termed as deflationary gap.

EF is deflationary gap

Read above passage and give the answer of following questions:

1.. Explain the behavior of consumption with increased in income?

2. Why aggregate demand is short when involuntary unemployment in the economy.

Q9 In the present COVID-19

19 times, many economists have raised their concerns that Indian economy

may have to face

ace a deflationary situation, due to reduced economic activities in the country.

Suppose you are a member of the high powered committee constituted by the Reserve Bank of

India (RBI).

1. You have suggested that as the supervisor of commercial banks, .....

................

........... (restriction/release)

of the money supply be ensured, by the Reserve Bank of India (RBI).

(Choose the correct alternative)

Q10 The Reserve Bank of India (RBI), cut Repo Rate to 4.4%, the lowest in at least 15 years. Also, it

reduced the Cash Reserve Ratio (CRR) maintained by the banks for the first time in over seven

years. CRR for all banks was cut by 100 basis points to release ₹ 1.37 lakh crores across the

banking system. RBI governor Dr. Shaktikanta Das predicted a big global recession and said India

will not be immune. It all depends how India responds to the situation. Aggregate demand may

weaken and ease core inflation. The Economic Times; March 27th, 2020

1. Cut in Repo rate by RBI is likely to……….. (Increase/decrease) the demand for goods and

5|Page 8 October 2021,ZIET BHUBANESWAR

services in the economy. (choose the correct alternative)

2. Decrease in Cash Reserve Ratio will lead to…...........… (choose the correct alternative)

(a) fall in aggregate demand (b)rise in aggregate demand (c)no change in aggregate demand (d).

fall in general price level

3.The difference by which actual Aggregate Demand exceeds the Aggregate Demand, required to

establish full employment equilibrium is known as……….………(inflationary gap/deflationary gap).

(choose the correct alternative)

4.The impact of “Excess Demand” under Keynesian theory of income and employment, in an

economy are: (choose the correct alternative)

(a). decrease in income, output, employment and general price level

(b). decrease in nominal income, but no change in real output

(c). increase in income, output, employment and general price level

(d). no change in output/employment but increase in general price level.

5.There are two measures-fiscal measures and --------- that may be taken by the Government of

India to correct the situation of deficient demand.(fill in the blanks)

6. To combat with disastrous impact of Covid-19, Government had announced many stimulus

packages to revive economy. This measure will fall under ------policy.

Fiscal policy/monetary policy (choose the correct alternative)

ANSWER

CBQ NO Answer

Q1 i) Excess demand

ii) Net exports

iii) Under full employment

iv)False.

Q2 1. increase

2. (iii) rise in aggregate demand

3. Inflationary gap

4. (iv) No change in output/employment but increase in general price level.

Q3 i. Central bank

ii. C. Decrease legal reserve requirements

iii. C. Actual demand is less than expected demand

iv. A. Decrease

Q4 i. manufactured

ii. demand

iii. c) full employment

iv. d) all of these

Q5 1. Rise in Aggregate Demand

2. Reduced Repo Rate

3. Decrease in income, output, employment and general price level

4. Expansionary, Expansionary

6|Page 8 October 2021,ZIET BHUBANESWAR

Q6 1 (A)

2 (D)

3 (D)

4 (D)

Q7 1 (B)

2 (A)

3 (A)

4 (B)

Q8 1. When increase in income consumption also increase but speed of increase in

consumption is less than the speed of increase in income.

2. Because in this situation some factor of production unemployed. Factor of

production not fully utilised due to involuntary unemployment.

Q9 Ans. Release

Q10 1. Increase

2. (b)

3. Inflationary gap

4. (c)

5. Monetary measures

6. Fiscal policy

PREPIRED BY : PGT ECONOMICS OF BHUBANESWAR, GUWAHATI,

KOLKATA, RANCHI, SILCHAR AND TINSIKIA REGION.

VETTED BY : SILCHAR REGION

7|Page 8 October 2021,ZIET BHUBANESWAR

CHAPTER -15- PROBLEM OF EXCESS DEMAND AND DEFICIT DEMAND

TRUE AND FALSE QUESTIONS

Question Question Content

No

Q1 Monetary policy is related to the revenue and expenditure policy of the government.

A.TRUE

B.FALSE

Q2 When there is excess demand, the rate of taxation is to be reduced.

A.TRUE

B.FALSE

Q3 When there is deficient demand, public expenditure is to be generally expanded.

A.TRUE

B.FALSE

Q4 When there is deficient demand, public expenditure is to be generally contracted.

A.TRUE

B.FALSE

Q5 An increase in the interest rate in the future will reduce the savings.

A.TRUE

B.FALSE

Q6 Low level of investment and employment implies low level of output as the impact is deficient

demand in an economy.

A.TRUE

B.FALSE

Q7 According to Keynes, “Unemployment is the cause of AD < AS.

A.TRUE

B.FALSE

Q8 Decreasing tax is a fiscal measure to deal with the inflationary gap situation in an economy.

(A.TRUE

B.FALSE

Q9 The inflationary gap is the shortfall in AD from the level required to maintain full employment

equilibrium in the economy.

A.TRUE

B.FALSE

Q10 Deflationary gap exists when aggregate demand is greater than aggregate supply at full

employment level.

A.TRUE

B.FALSE

Q11 Excess demand represents over full employment situation.

A.TRUE

B.FALSE

Q12 Unemployment can exist at full employment level.

A.TRUE

B.FALSE

Q13 Deficient demand is inflationary in nature.

A.TRUE

1|Page 8 October 2021,ZIET BHUBANESWAR

B.FALSE

Q14 The government decreases its spending to correct the situation of excess demand.

A.TRUE

B.FALSE

Q15 Aggregate Demand can be increased by selling the securities in the open market.

A.TRUE

B.FALSE

Q16 During deficient demand there is accumulation of inventory in the economy.

A.TRUE

B.FALSE

Q17 Deflationary Gap shows the measurement of Deficit Demand.

A.TRUE

B.FALSE

Q18 Production and employment level increases due to deficient demand.

A.TRUE

B.FALSE

Q19 Full employment equilibrium refers to the situation in the economy when AS=AD along with

fuller utilization of resources.

A.TRUE

B.FALSE

Q20 Natural unemployment is a situation of ‘frictional and structural’ unemployment in the

economy.

A.TRUE

B.FALSE

Q21 Deflationary gap is measured in terms of excess demand.

A.TRUE

B.FALSE

Q22 Higher borrowing by the government from the RBI releases greater liquidity in the economy.

A.TRUE

B.FALSE

Q23 Monetary policy is also called budgetary policy of the government.

A.TRUE

B.FALSE

Q24 Problem of unemployment is the problem of voluntary unemployment

A.TRUE

B.FALSE

Q25 AD is in excess while there is excess capacity in the economy

A.TRUE

B.FALSE

Q26 Monetary policy is pursued by the central bank of a country

A.TRUE

B.FALSE

Q27 Due to excess demand the market value of goods and services tends to decline

A.TRUE

B.FALSE

Q28 Full employment does not mean a situation of zero unemployment

A.TRUE

B.FALSE

2|Page 8 October 2021,ZIET BHUBANESWAR

Q29 Government should adopt balanced budget policy when economy is very close to full

employment. (

A.TRUE

B.FALSE

Q30 Deflationary gap can be corrected by increasing the level of AD.

A.TRUE

B.FALSE

Q31 CRR should be raised to combat the deflationary gap.

A.TRUE

B.FALSE

Q32 Bank rate should be lowered in a situation of inflationary gap.

A.TRUE

B.FALSE

Q33 AD is deficient when there is excess capacity in the economy.

A.TRUE

B.FALSE

ANSWER

Question Answer

No

Q1 False

Q2 False

Q3 True

Q4 False

Q5 False

Q6 True

Q7 True

Q8 False

Q9 False

Q10 False

Q11 True

Q12 True

Q13 False

Q14 True

Q15 False

Q16 True

Q17 True

Q18 False

Q19 True

Q20 True

Q21 False

Q22 True

Q23 False

3|Page 8 October 2021,ZIET BHUBANESWAR

Q24 False

Q25 False

Q26 True

Q27 False

Q28 True

Q29 True

Q30 True

Q31 True

Q32 False

Q33 True

PREPIRED BY : PGT ECONOMICS OF BHUBANESWAR, GUWAHATI,

KOLKATA, RANCHI, SILCHAR AND TINSIKIA REGION.

VETTED BY : SILCHAR REGION

4|Page 8 October 2021,ZIET BHUBANESWAR

CHAPTER -15- PROBLEM OF EXCESS DEMAND AND DEFICIT DEMAND

ASSERTION- REASON QUESTIONS

Question Question Content

No

Q1 Assertion (A): Inflationary gap is the result of excess demand.

Reasoning(R): When aggregate demand is more than aggregate supply, inflationary gap is

occurred.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q2 Assertion (A): Due to excess demand, employment increases in the economy.

Reasoning(R): Output level increases in the economy due to excess demand.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q3 Assertion (A): Bank rate increases in order to control excess demand.

Reasoning(R): Bank rate helps to control the money supply in the economy.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q4 Assertion (A): Monetary measures are adopted by the central bank to control deficient demand.

Reasoning(R): Fiscal measures are adopted by the government through budget to control excess

demand.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q5 Assertion (A): RBI is the apex bank in the country.

Reasoning(R): Commercial banks want to maximize their profits.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

1|Page 8 October 2021,ZIET BHUBANESWAR

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q6 Assertion: Fiscal policy and monetary policy are contradictory to each other.

Reason: Fiscal policy and monetary policy are complementary to each other. Both the policies

simultaneously target to stabilize the economy.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q7 Assertion: There is underemployment of resources in the economy during Deficient Demand

situations.

Reason: To correct the excess demand situation, Govt. must cut down unproductive expenditure.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q8 Assertion: In a situation of excess demand at the full employment level, there is inflation in the

economy.

Reason: At the full employment level, even if there is more demand for goods and service, the

output cannot be increased.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q9 Assertion: Reduction in taxation can correct the problem of deficient demand.

Reason: Reduction in taxation leaves the people with more disposable income.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q10 Assertion: Deficient demand causes inflation and full employment.

Reason: when the actual AD falls short of the AS at full employment, the output produced in the

economy cannot be sold.

2|Page 8 October 2021,ZIET BHUBANESWAR

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q11 Assertion (A) During deflationary gap, actual aggregate demand is more than potential aggregate

demand to maintain full employment.

Reason(R) Recession in an economy leads to fall in demand as compared with supply.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q12 Assertion (A) Deflationary gaps reflects presence of unemployment in an economy.

Reason(R) Full employment doesn't ensure zero unemployment during a period of time.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q13 Assertion (A) Excess demand refers to the situation when aggregate demand is in excess of

aggregate supply corresponding to full employment in the economy i.e., AD >AS, corresponding to

full employment.

Reason(R) To correct inflationary gap, Bank rate, Repo rate, Reverse Repo rate and legal reserve

ratio is increased by the Central Bank to reduce supply of money so that purchasing power of

people can be curtailed and inflationary gap can be controlled.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q14 Assertion (A) Fiscal policy refers to the budgetary policy of the government with a view to correct

the situation of excess demand or deficient demand.

Reason(R) Government uses low Bank rate to control excess supply of money.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

3|Page 8 October 2021,ZIET BHUBANESWAR

(d) Assertion (A) is false but Reason (R) is true.

Q15 Assertion (A) Deficient demand leads to fall in output.

Reason(R) Due to fall in investment and employment in the economy, the output also tends to fall.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q16 Assertion: In a situation of excess demand at the full employment level, there is inflation in the

economy.

Reason: At the full employment level, even if there is more demand for goods and service, the

output cannot be increased.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q17 Assertion (A): General price level tends to rise in a situation of inflationary gap.

Reason (R): Excess demand implies pressure of demand on the existing resource.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q18 Assertion (A): Wage-price spiral is the consequence of deficient demand.

Reason (R): In this situation, wages catch prices and prices catch wages

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q19 Assertion (A): Underemployment equilibrium indicates excess capacity in the economy.

Reason (R): Aggregate demand is less than what is needed for full employment of the factors.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

4|Page 8 October 2021,ZIET BHUBANESWAR

Q20 Assertion (A): CRR should be raised to combat inflationary gap.

Reason (R): CRR is controlled by commercial bank.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q21 Assertion (A): Bank rate should be lowered in a situation of inflationary gap.

Reason (R): Bank rate is controlled by central bank.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q22 Assertion (A): Deflationary gap can be corrected by increasing the level of aggregate demand.

Reason (R): it is the deficiency of aggregate demand that causes deflationary gap.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q23 Assertion (A) inflationary pressure takes place when the economy is in full employment.

Reason (R) due to the rise in demand and rigid supply, price of the goods tends to rise

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q24 Assertion (A) if aggregate demand exceeds aggregate supply income rises.

Reason (R) excess of aggregate demand will reduce planned inventory and firm would tend to

increase the employment and output.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q25 Assertion (A) the point at which consumption intersect the 45 degree line, APS is zero

Reason (R) it happens because at this point consumption is equal to income and saving is zero.

5|Page 8 October 2021,ZIET BHUBANESWAR

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q26 Assertion (A) full employment implies zero unemployment where nobody is ever unemployed in

the economy

Reason (R) there is always some minimum level of unemployment for natural unemployment or

voluntary unemployment.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q27 Assertion (A) increase in public expenditure will improve AD.

Reason (R) Public expenditure incurred by government will increase the money supply in the heads

of public.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q28 ASSERTION (A):

Inflationary pressure takes place when the economy is in full employment.

REASONING (R):

Due to the rise in demand and rigid supply, price of the goods tends to rise.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q29 ASSERTION (A):

In a situation of deficient demand, there is underemployment in the economy.

REASONING (R):

Excess demand raises the real value of the output. Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

6|Page 8 October 2021,ZIET BHUBANESWAR

(d) Assertion (A) is false but Reason (R) is true.

Q30 ASSERTION (A):

Tax increases by state governments during recessions often reduce the expansionary impact of

fiscal policy by the central government.

REASONING (R):

Tax increases lead to decrease in disposable income due to which consumption expenditure in the

economy falls. Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q31 ASSERTION (A):

Increase in public expenditure will improve AD.

REASONING (R):

Public expenditure incurred by government will increase the money supply in the hands of public.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

Q32 ASSERTION (A):

During deficient demand, central bank advises the commercial banks to advance loan at easy

terms in order to minimize the condition of deficient demand in the country.

REASONING (R):

Recently the Reserve Bank of India has announced the policy of Demonetization in order to reduce

the excess demand and to absorb the excess and unauthorized money from the market.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of

Assertion (A)

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of

Assertion (A)

(c) Assertion (A) is true but Reason (R) is false.

(d) Assertion (A) is false but Reason (R) is true.

7|Page 8 October 2021,ZIET BHUBANESWAR

ANSWER

Question No Answer

Q1 (a) Both Assertion and reason are true and reason is the correct explanation of the

assertion.

Q2 (b) Assertion and reason both are true but reason is not the correct explanation of

assertion.

Q3 (a) Both Assertion and reason are true and reason is the correct explanation of the

assertion.

Q4 (b) Assertion and reason both are true but reason is not the correct explanation of

assertion.

Q5 (b) Assertion and reason both are true but reason is not the correct explanation of

assertion.

Q6 (d) Assertion is false, reason is true.

Q7 (b) Assertion and reason both are true but reason is not the correct explanation of

assertion.

Q8 (a) Both Assertion and reason are true and reason is the correct explanation of the

assertion.

Q9 (a) Both Assertion and reason are true and reason is the correct explanation of the

assertion

Q10 (d) Assertion is false, reason is true.

Q11 (b) Assertion and reason both are true but reason is not the correct explanation of

assertion.

Q12 (b) Assertion and reason both are true but reason is not the correct explanation of

assertion.

Q13 (b) Assertion and reason both are true but reason is not the correct explanation of

assertion.

Q14 (a) Both Assertion and reason are true and reason is the correct explanation of the

assertion.

Q15 (c) Assertion (A) is true but Reason (R) is false.

Q16 (a) Both Assertion and reason are true and reason is the correct explanation of the

assertion.

Q17 (a) Both Assertion and reason are true and reason is the correct explanation of the

assertion.

Q18 (d) Assertion is false, reason is true.

Q19 (a) Both Assertion and reason are true and reason is the correct explanation of the

assertion.

Q20 (d) Assertion is false, reason is true.

Q21 (d) Assertion is false, reason is true.

Q22 (a) Both Assertion and reason are true and reason is the correct explanation of the

assertion.

Q23 (d) Assertion is false, reason is true.

Q24 (a) Both Assertion and reason are true and reason is the correct explanation of the

assertion.

Q25 (a) Both Assertion and reason are true and reason is the correct explanation of the

assertion.

Q26 (d) Assertion is false, reason is true.

8|Page 8 October 2021,ZIET BHUBANESWAR

Q27 (a) Both Assertion and reason are true and reason is the correct explanation of the

assertion.

Q28 (d) Assertion is false, reason is true.

Q29 (c) Assertion (A) is true but Reason (R) is false.

Q30 (a) Both Assertion and reason are true and reason is the correct explanation of the

assertion.

Q31 (a) Both Assertion and reason are true and reason is the correct explanation of the

assertion.

Q32 (b) Assertion and reason both are true but reason is not the correct explanation of

assertion.

PREPIRED BY : PGT ECONOMICS OF BHUBANESWAR, GUWAHATI,

KOLKATA, RANCHI, SILCHAR AND TINSIKIA REGION.

VETTED BY : SILCHAR REGION

9|Page 8 October 2021,ZIET BHUBANESWAR

You might also like

- Economics & Statistics Questions For Entrance: Page 1 of 26Document26 pagesEconomics & Statistics Questions For Entrance: Page 1 of 26Suryansh jain100% (1)

- Macro Economics MCQ'SDocument19 pagesMacro Economics MCQ'SGuruKPO93% (40)

- ECONOMY 700 MCQs With Explanatory Notes PDFDocument234 pagesECONOMY 700 MCQs With Explanatory Notes PDFvarunNo ratings yet

- Focus 2011 WiringDocument139 pagesFocus 2011 Wiringphalksturm100% (1)

- Final Exam Sample QuestionsDocument11 pagesFinal Exam Sample Questionsecobalas7100% (1)

- 2021 Abbotsleigh Economics Trial (Marking Guide)Document22 pages2021 Abbotsleigh Economics Trial (Marking Guide)lg019 workNo ratings yet

- Aura and Chakra 3Document88 pagesAura and Chakra 3Theodore Yiannopoulos100% (2)

- Module 5 Developing Mission, Vision, and ValuesDocument25 pagesModule 5 Developing Mission, Vision, and ValuesMatthew ScarellaNo ratings yet

- Spec 2008 - Unit 2 - Paper 1Document11 pagesSpec 2008 - Unit 2 - Paper 1capeeconomics83% (12)

- Econ 101 Test #2Document10 pagesEcon 101 Test #2overloaduser_10No ratings yet

- MCQs With Solution For ECONS (Macro)Document38 pagesMCQs With Solution For ECONS (Macro)DzifahManteau100% (1)

- PMP Lite Mock Exam 2 QuestionsDocument16 pagesPMP Lite Mock Exam 2 QuestionsJobin John100% (1)

- Lesson-Exemplar-Template - ActivityDocument9 pagesLesson-Exemplar-Template - ActivityFrank Enciso Tronco100% (4)

- National Income MCQDocument23 pagesNational Income MCQishaanrox64No ratings yet

- Chap 011Document26 pagesChap 011Himanshu DhamijaNo ratings yet

- 203 Sample Midterm3 AnswersDocument13 pages203 Sample Midterm3 AnswersMarilyne JinNo ratings yet

- A5E43455517 6 76 - MANUAL - SITOP Manager - en USDocument252 pagesA5E43455517 6 76 - MANUAL - SITOP Manager - en USdasdNo ratings yet

- Macro CH 10Document31 pagesMacro CH 10Tanisha TibrewalNo ratings yet

- May 2024 Chaptr 7 Unit 4 Fiscal Policy PDFDocument12 pagesMay 2024 Chaptr 7 Unit 4 Fiscal Policy PDFsathyashreekadhamNo ratings yet

- XII 90 MCQs For PracticeDocument12 pagesXII 90 MCQs For PracticeGirish SinghalNo ratings yet

- AS and AS MCQ CUET - 8979858 - 2022 - 07 - 09 - 12 - 28Document7 pagesAS and AS MCQ CUET - 8979858 - 2022 - 07 - 09 - 12 - 28Harshit SainiNo ratings yet

- PMAC Practice Exam 2022Document5 pagesPMAC Practice Exam 2022bison3216No ratings yet

- Govt BudgetDocument9 pagesGovt BudgetShreya PushkarnaNo ratings yet

- Business Economics MCQDocument14 pagesBusiness Economics MCQPriti ParmarNo ratings yet

- GS Economy Module 1 - MCQsDocument13 pagesGS Economy Module 1 - MCQsAnup KumarNo ratings yet

- Chandan Eco Inflation Eng 1Document3 pagesChandan Eco Inflation Eng 1Raju KumarNo ratings yet

- SYBBI - SAMPLE QUESTIONS - EVEN 2021 (MERGED PDF) - MinDocument71 pagesSYBBI - SAMPLE QUESTIONS - EVEN 2021 (MERGED PDF) - Minketan karmoreNo ratings yet

- PMAC Practice Exam 2022 Suggested SolsDocument9 pagesPMAC Practice Exam 2022 Suggested Solsbison3216No ratings yet

- MCQs Inflation Business Cycle - EditedDocument5 pagesMCQs Inflation Business Cycle - EditedSadia IlyasNo ratings yet

- Practice Questions EE BranchDocument4 pagesPractice Questions EE Branch2K19/EE/116 ISH MISHRANo ratings yet

- Tayabur Rahman - Final - AutumnDocument10 pagesTayabur Rahman - Final - AutumnTayabur RahmanNo ratings yet

- CDS Pyq EconomyDocument12 pagesCDS Pyq EconomypriyaqueenshrmaNo ratings yet

- ECON 201 12/9/2003 Prof. Gordon: Final ExamDocument23 pagesECON 201 12/9/2003 Prof. Gordon: Final ExamManicks VelanNo ratings yet

- Multiple Choice QuestionsDocument6 pagesMultiple Choice QuestionsKago MakoNo ratings yet

- Rise University Campus: (Personal Information) (For Office Use Only)Document4 pagesRise University Campus: (Personal Information) (For Office Use Only)Muhammad junaid qureshiNo ratings yet

- ECO FINAL MCQ's (Chapter #11) JAN 2024Document4 pagesECO FINAL MCQ's (Chapter #11) JAN 2024ajwazubair846No ratings yet

- Ad As Without AnsDocument5 pagesAd As Without AnsnomanNo ratings yet

- Midterm Two Springl 2012Document6 pagesMidterm Two Springl 2012Zahra Ahmed AlfarajNo ratings yet

- 5.3 InflationDocument7 pages5.3 Inflationyiming peiNo ratings yet

- 4 Caf 2 Ief Autumn 2019Document4 pages4 Caf 2 Ief Autumn 2019Shaheer MalikNo ratings yet

- Demo Quiz - 1Document10 pagesDemo Quiz - 1Rohit GuptaNo ratings yet

- Chapters 8,11 & 12Document9 pagesChapters 8,11 & 12gg ggNo ratings yet

- Revision 2Document54 pagesRevision 2Aman KumarNo ratings yet

- Mock Test - Mid-Term - 28102023Document6 pagesMock Test - Mid-Term - 28102023dlphuonganhhhhNo ratings yet

- Which of The Following Is Not The Feature of Business Cycle? (A) Business Cycle Follow Perfectly Timed CycleDocument5 pagesWhich of The Following Is Not The Feature of Business Cycle? (A) Business Cycle Follow Perfectly Timed CycleMohammad Waris RahmanNo ratings yet

- Ravenswood 2014 Economics TrialsDocument23 pagesRavenswood 2014 Economics TrialssquishyapplyNo ratings yet

- Macroeconomics Canadian 8th Edition Sayre Test BankDocument40 pagesMacroeconomics Canadian 8th Edition Sayre Test Bankjerryholdengewmqtspaj100% (33)

- 1311 - As-Ad HW (Ans)Document6 pages1311 - As-Ad HW (Ans)Haifa Al-humayydNo ratings yet

- EconomicDocument32 pagesEconomicSeyiNo ratings yet

- Concept Classes: Economics Paper - 3Document23 pagesConcept Classes: Economics Paper - 3Kunal SardanaNo ratings yet

- Rank Order Paper 1Document11 pagesRank Order Paper 1ਅਸ਼ਨਾNo ratings yet

- 2015 HSC EconomicsDocument28 pages2015 HSC EconomicsKelvin ChenNo ratings yet

- Fall Macro 2016-3.tst PDFDocument7 pagesFall Macro 2016-3.tst PDFctyre34No ratings yet

- Untitled12 PDFDocument27 pagesUntitled12 PDFErsin TukenmezNo ratings yet

- ECO1102, Practice 2nd MT (With Answers), CH 11-13Document8 pagesECO1102, Practice 2nd MT (With Answers), CH 11-13Faris BarkawiNo ratings yet

- Sample Paper EconomicsDocument4 pagesSample Paper EconomicsmananNo ratings yet

- Paper 4 Dec. 22Document15 pagesPaper 4 Dec. 2220 Mayank SatijaNo ratings yet

- Knox 2020 Economics Trials & SolutionsDocument55 pagesKnox 2020 Economics Trials & SolutionsAlecNo ratings yet

- CB2402 Week 3 Part 1Document4 pagesCB2402 Week 3 Part 1RoyChungNo ratings yet

- Assignment 1 - KTEE203.1Document11 pagesAssignment 1 - KTEE203.1Hà ChiếnNo ratings yet

- Test Bank For Macroeconomics 6th Canadian Edition AbelDocument21 pagesTest Bank For Macroeconomics 6th Canadian Edition Abelangelawigginsktdiaqbpry100% (24)

- CA Foundation MTP 2020 Paper 4 QuesDocument15 pagesCA Foundation MTP 2020 Paper 4 QuesKanchan AggarwalNo ratings yet

- CA Foundation MTP 2020 Paper 4 QuesDocument15 pagesCA Foundation MTP 2020 Paper 4 QuesKanchan AggarwalNo ratings yet

- Unilag Past QuestionDocument12 pagesUnilag Past QuestionTemitayoNo ratings yet

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- Information We Collect: Information You Provide UsDocument4 pagesInformation We Collect: Information You Provide UsAlex CapurroNo ratings yet

- DLL Q3 Week 4 Day5 WWDocument3 pagesDLL Q3 Week 4 Day5 WWCecilia Guevarra DumlaoNo ratings yet

- Christmas Book 2004Document98 pagesChristmas Book 2004Ron BarnettNo ratings yet

- SMAW WeldingDocument37 pagesSMAW Weldingvishwas salunkheNo ratings yet

- Centering On Mentoring: A Training Program For Mentors and MenteesDocument21 pagesCentering On Mentoring: A Training Program For Mentors and MenteesMahendran MahendranNo ratings yet

- AVK EngineeringDocument48 pagesAVK EngineeringOzan BegdeNo ratings yet

- How Could Auto Manufacturer Use Transportation To Increase The Efficiency of Supply Chain?Document25 pagesHow Could Auto Manufacturer Use Transportation To Increase The Efficiency of Supply Chain?guddianushaNo ratings yet

- Activity 1 CONDUCTING AN INTERVIEW WITH AN OFWDocument5 pagesActivity 1 CONDUCTING AN INTERVIEW WITH AN OFWSammuel De BelenNo ratings yet

- Teachers Beliefs About Multilingualism and A Multilingual Pedagogical ApproachDocument19 pagesTeachers Beliefs About Multilingualism and A Multilingual Pedagogical ApproachKhalid S. H, Ph.DNo ratings yet

- CoveringlettersDocument45 pagesCoveringlettersbeautygirl3310No ratings yet

- Radiological SignDocument3 pagesRadiological SignMuhammad BilalNo ratings yet

- Selected Objective Question On Introduction To Computers With Answer Set 5Document27 pagesSelected Objective Question On Introduction To Computers With Answer Set 5Ankit JainNo ratings yet

- Hsep-05 - Communication, Participation & ConsultationDocument6 pagesHsep-05 - Communication, Participation & ConsultationScha AffinNo ratings yet

- Forest Botany For Forestry StudentsDocument39 pagesForest Botany For Forestry StudentsMadan ThapaNo ratings yet

- VungleDocument14 pagesVunglegaurdevNo ratings yet

- Google Maps Places Scraper 19 Jul 2022Document16 pagesGoogle Maps Places Scraper 19 Jul 2022K. SanjuNo ratings yet

- Theories of MotivationDocument8 pagesTheories of MotivationIrtaqa RazaNo ratings yet

- Access To Health Records Application Form v2Document2 pagesAccess To Health Records Application Form v2Georgie SNo ratings yet

- Imaginefx How To Draw and Paint Anatomy Volume 2Document116 pagesImaginefx How To Draw and Paint Anatomy Volume 2tofupastaNo ratings yet

- MTH 212 OdeDocument18 pagesMTH 212 OdeJames ojochegbNo ratings yet

- Ar. Laurie BakerDocument21 pagesAr. Laurie BakerHardutt Purohit100% (1)

- Sumande - Field Work No.8 - Azimuth Traverse Using Theodolite and TapeDocument10 pagesSumande - Field Work No.8 - Azimuth Traverse Using Theodolite and TapeCedrix SumandeNo ratings yet

- TPG Alstom - Distance RelayDocument7 pagesTPG Alstom - Distance RelayFranz Erwin Gabriel FuentesNo ratings yet

- SrsDocument13 pagesSrsSantoshkumar ShaliNo ratings yet