Professional Documents

Culture Documents

NOTICE

NOTICE

Uploaded by

Salman AhmedOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NOTICE

NOTICE

Uploaded by

Salman AhmedCopyright:

Available Formats

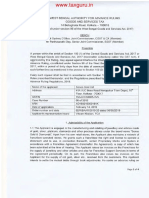

182(2) (Notice to impose penalty u/s 182 for contravention of any of the provisions of the IT Ordinance,

2001)

Name: ROBINA JAVED Registration No 1110114239312

Address: KHANDAR KHAN KHEL, MOHALLAH GHANI Tax Year : 2021

KHEL, AZEEM KALA DISTRICT, Bannu Bannu Period : 01-Jul-2020 - 30-Jun-2021

Medium : Online

Contact No: 00923313058000 Due Date : 10-Oct-2022

Document Date 30-Sep-2022

As per CPR No IT2021040801011159000 dated 08/04/2021, you have purchased immovable property

worth Rs. 17,700,000/-. Under the provision of section 75A of the Income Tax Ordinance 2001, no person

shall purchase immovable property having a fair market value greater than 5 million rupees otherwise

than by a cross cheque drawn on a bank or through cross demand draft or cross pay order or any other

cross banking instrument showing transfer of amount from one bank account to another bank account.

Thus, the property purchased by you as above is greater than 5 million. Please provide documentary

evidence regarding the payment made through the banking channel, otherwise, a penalty proceeding

under section 182(1) Sr. No. 21 of the Income Tax Ordinance, 2001 will be initiated against you, which is

at the rate of 5% of the purchased immovable properties.

Purchased amount of property Rs. 17,700,000/-

Penalty u/s 182(2) @ 5% Rs. 885,000/-

Compliance may be made on or before 10/10/2022.

Sabz Ali Khan

Assistant / Deputy Commissioner

Inland Revenue, Unit-41, Range-I, Zone-D.I. Khan

Assistant / Deputy Commissioner- D.I.K

Zone

Page 1 of 1 Printed on Date: Mon, 3 Oct 2022 14:42:21

Assistant / Deputy Commissioner- D.I.K Zone

You might also like

- HOME LOAN INTEREST CERTIFICATE For FY 2021-22Document1 pageHOME LOAN INTEREST CERTIFICATE For FY 2021-22Harish Ghorpade100% (4)

- Employment Claims without a Lawyer: A Handbook for Litigants in Person, Revised 2nd editionFrom EverandEmployment Claims without a Lawyer: A Handbook for Litigants in Person, Revised 2nd editionNo ratings yet

- Order 3362544Document3 pagesOrder 3362544hamza awanNo ratings yet

- Akbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanDocument1 pageAkbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanSaad KhanNo ratings yet

- Tax Collector Correspondence3362544Document1 pageTax Collector Correspondence3362544hamza awanNo ratings yet

- Tax Collector Correspondence3450120204197Document1 pageTax Collector Correspondence3450120204197Muhammad MustafaNo ratings yet

- Adjudicaton Order EpcgDocument3 pagesAdjudicaton Order Epcgdsouzaraymond78No ratings yet

- FCRA-Renewal CertificateDocument2 pagesFCRA-Renewal CertificateWomen & Child Welfare Society0% (1)

- Tendernotice 1Document25 pagesTendernotice 1Das & Co.No ratings yet

- Conveyancing Project WorkDocument3 pagesConveyancing Project WorkBenjamin Brian NgongaNo ratings yet

- Itr Deadline Extended ITR Filing, Tax Audit Report Deadlines For FY 2020-21 Extended by CBDT - The Economic TimesDocument1 pageItr Deadline Extended ITR Filing, Tax Audit Report Deadlines For FY 2020-21 Extended by CBDT - The Economic TimesVittal TalwarNo ratings yet

- Tax Collector Correspondence3362544Document1 pageTax Collector Correspondence3362544hamza awanNo ratings yet

- Amended - Sale Agreement Ascra Eunia LuyeraDocument8 pagesAmended - Sale Agreement Ascra Eunia LuyeraayquikomsivNo ratings yet

- ExempDocument1 pageExempFiaz Ahmed LoneNo ratings yet

- 7 Republic v. Taganito HPAL Nickel Corp. G.R. No. 259024 Notice September 28 2022Document6 pages7 Republic v. Taganito HPAL Nickel Corp. G.R. No. 259024 Notice September 28 2022Princess FaithNo ratings yet

- BPI vs. CIRDocument6 pagesBPI vs. CIRlouryNo ratings yet

- Indian Overseas Bank KRIBHCO Branch Sector-1, NOIDA, U P-201 301Document3 pagesIndian Overseas Bank KRIBHCO Branch Sector-1, NOIDA, U P-201 301Jayaprakash M PNo ratings yet

- Ward No. 03, Sial Colony, Fatehpur Road, Chowk Azam, Layyah Layyah Participatory Welfare Services (PWS)Document1 pageWard No. 03, Sial Colony, Fatehpur Road, Chowk Azam, Layyah Layyah Participatory Welfare Services (PWS)Shadnan Bin RashidNo ratings yet

- CASE ANALYSIS of Shankarlal Agarwalla V SBIDocument7 pagesCASE ANALYSIS of Shankarlal Agarwalla V SBIMrunali RajNo ratings yet

- Registration CertificateDocument2 pagesRegistration CertificateArjun BhattaNo ratings yet

- No 77 Deutsche Bank AG Manila Branch V CommisionerDocument2 pagesNo 77 Deutsche Bank AG Manila Branch V CommisionerAJ QuimNo ratings yet

- Reliance Call NoticeDocument6 pagesReliance Call NoticeBharatNo ratings yet

- Akbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanDocument1 pageAkbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanSaad KhanNo ratings yet

- Tax Collector Correspondence4230197783175Document5 pagesTax Collector Correspondence4230197783175AbdulRaheem solangiNo ratings yet

- Valid For: DD/Cash/Fund Transfer (Isure Pay) Icici Bank LTD Bank Copy New Okhla Industrial Development AuthorityDocument5 pagesValid For: DD/Cash/Fund Transfer (Isure Pay) Icici Bank LTD Bank Copy New Okhla Industrial Development AuthoritySagar SehgalNo ratings yet

- Aminabad Road, Near Grand Palace Marriage Hall, Tehsil & District, Sialkot Sialkot Qamar ZamanDocument1 pageAminabad Road, Near Grand Palace Marriage Hall, Tehsil & District, Sialkot Sialkot Qamar ZamanSalman LatifNo ratings yet

- Tax Collector Correspondence3630204090545Document1 pageTax Collector Correspondence3630204090545Muhammad Ayan MalikNo ratings yet

- Jwalamala JewellersDocument9 pagesJwalamala Jewellersbharath289No ratings yet

- E Auction 012 ND Call 20212022Document5 pagesE Auction 012 ND Call 20212022saherunnesa7No ratings yet

- Tax Collector Correspondence3630268163398Document1 pageTax Collector Correspondence3630268163398Muhammad Ayan MalikNo ratings yet

- 2023 - APL - AHEPC8919M - Deficiency Letter - 1058141649 (1) - 22112023Document2 pages2023 - APL - AHEPC8919M - Deficiency Letter - 1058141649 (1) - 22112023RiaZ MoHamMaDNo ratings yet

- Tax Collector Correspondence3362544Document1 pageTax Collector Correspondence3362544hamza awanNo ratings yet

- Board Decision Regarding The Company BargainSafe Invest LTDDocument1 pageBoard Decision Regarding The Company BargainSafe Invest LTDJulia GraceNo ratings yet

- SafariDocument1 pageSafarimaryamshaz710No ratings yet

- Land-Ports-Authority-Of-India (1) - 1682022102349856Document14 pagesLand-Ports-Authority-Of-India (1) - 1682022102349856Corman LimitedNo ratings yet

- Legal Notice Ni ActDocument5 pagesLegal Notice Ni ActSurbhi GuptaNo ratings yet

- Circular 14 2022Document3 pagesCircular 14 2022shantXNo ratings yet

- J 2023 SCC OnLine ITAT 550 Dhruvba2046 Hpnluacin 20231209 110237 1 12Document12 pagesJ 2023 SCC OnLine ITAT 550 Dhruvba2046 Hpnluacin 20231209 110237 1 12Dhruv ThakurNo ratings yet

- Intimation of Demand NoteDocument1 pageIntimation of Demand NoteRishabh jainNo ratings yet

- Enforce PAymentDocument1 pageEnforce PAymentJebs KwanNo ratings yet

- In Re Senco Gold LTD GST AAR West BangalDocument4 pagesIn Re Senco Gold LTD GST AAR West Bangalkinnar2013No ratings yet

- Certificate of Collection or Deduction of Tax: (See Rule 42 of Income Tax Ordinance 2001) :: Withholding AgentDocument11 pagesCertificate of Collection or Deduction of Tax: (See Rule 42 of Income Tax Ordinance 2001) :: Withholding AgentAR RahmanNo ratings yet

- AAACP7770R - Issue Letter - 1038164359 (1) - 28122021Document2 pagesAAACP7770R - Issue Letter - 1038164359 (1) - 28122021lovish tyagiNo ratings yet

- Tax Collector Correspondence4210107211917Document2 pagesTax Collector Correspondence4210107211917Amsal Asif Kasbati0% (1)

- NT 391ewbDocument1 pageNT 391ewbkishan panchalNo ratings yet

- Idt QDocument10 pagesIdt QriyaNo ratings yet

- Notice of Dishonor and Demand Letter For PaymentDocument1 pageNotice of Dishonor and Demand Letter For PaymentCarlo ItaoNo ratings yet

- IN30267933627262Document2 pagesIN30267933627262CLANCY GAMING COMUNITYNo ratings yet

- Manpowergroup Services India PVT LTD Vs Commissioner of Income TaxDocument6 pagesManpowergroup Services India PVT LTD Vs Commissioner of Income Taxtry testNo ratings yet

- Compliance Calendar NovDocument23 pagesCompliance Calendar NovDsp VarmaNo ratings yet

- E Auction Process Document1Document30 pagesE Auction Process Document1Vinod RahejaNo ratings yet

- Payment Details: Email: Investor - Relations@pidilite - Co.inDocument2 pagesPayment Details: Email: Investor - Relations@pidilite - Co.inOpenText DataNo ratings yet

- AACCK3258R - Demand Notice Us 156 - 1052866885 (1) - 16052023Document1 pageAACCK3258R - Demand Notice Us 156 - 1052866885 (1) - 16052023Hitesh DhingraNo ratings yet

- IDFC LoanDocument6 pagesIDFC Loansharmashubham170295No ratings yet

- ChallanDocument2 pagesChallanRajib GhoshNo ratings yet

- Bid Notice Abstract: Invitation To Bid (ITB)Document3 pagesBid Notice Abstract: Invitation To Bid (ITB)John Rheynor MayoNo ratings yet

- Monday, April 4, 2022: The Pre-EMI Interest Received From To Is Rs. 0Document1 pageMonday, April 4, 2022: The Pre-EMI Interest Received From To Is Rs. 0raghu I0% (1)

- 2022 23 0251 - BLDocument2 pages2022 23 0251 - BLAccount Branch RewariNo ratings yet

- Before The Commissioner Inland Revenue (Appeal-Iii) KarachiDocument6 pagesBefore The Commissioner Inland Revenue (Appeal-Iii) Karachiiqbal sheikhNo ratings yet

- R.C. NO. 635 - 2018 BOI Vs MAGIC OPTICALSDocument3 pagesR.C. NO. 635 - 2018 BOI Vs MAGIC OPTICALSAbhishek BarwalNo ratings yet